Best 3d printing stocks 2023

Top 3D Printing Stocks in 2023

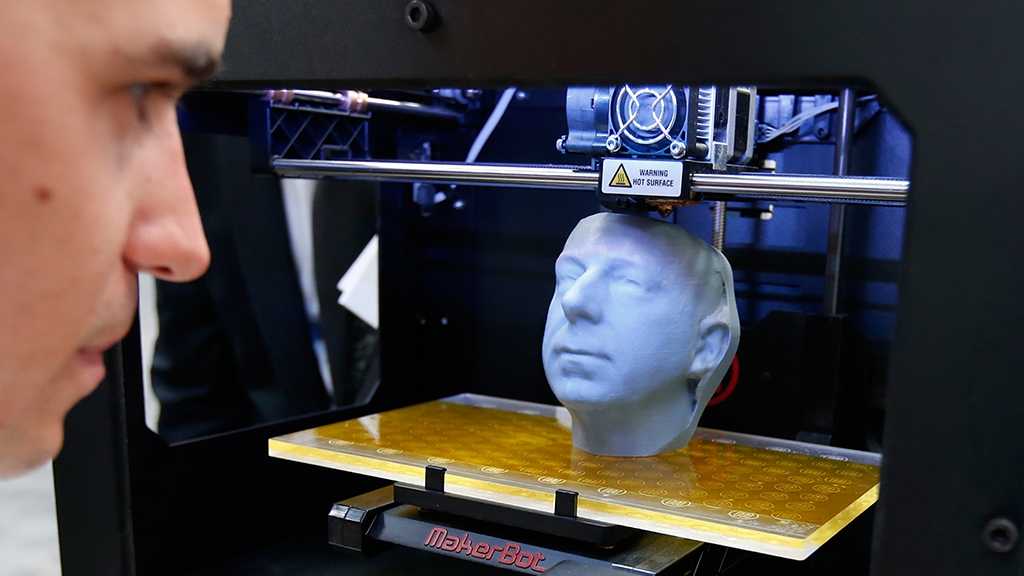

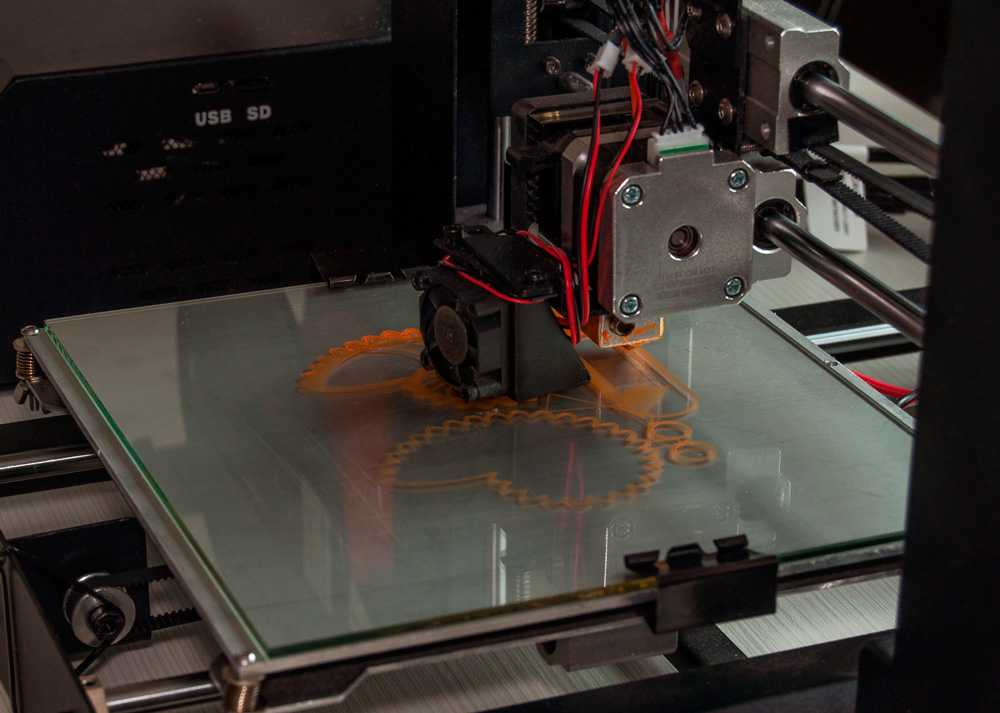

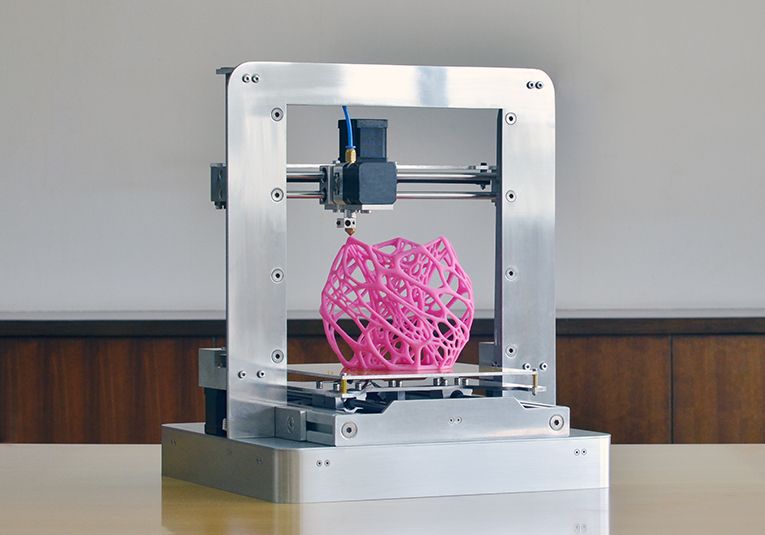

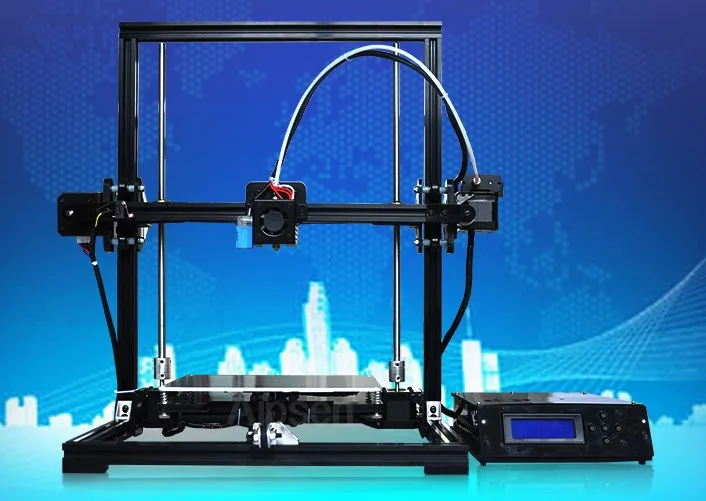

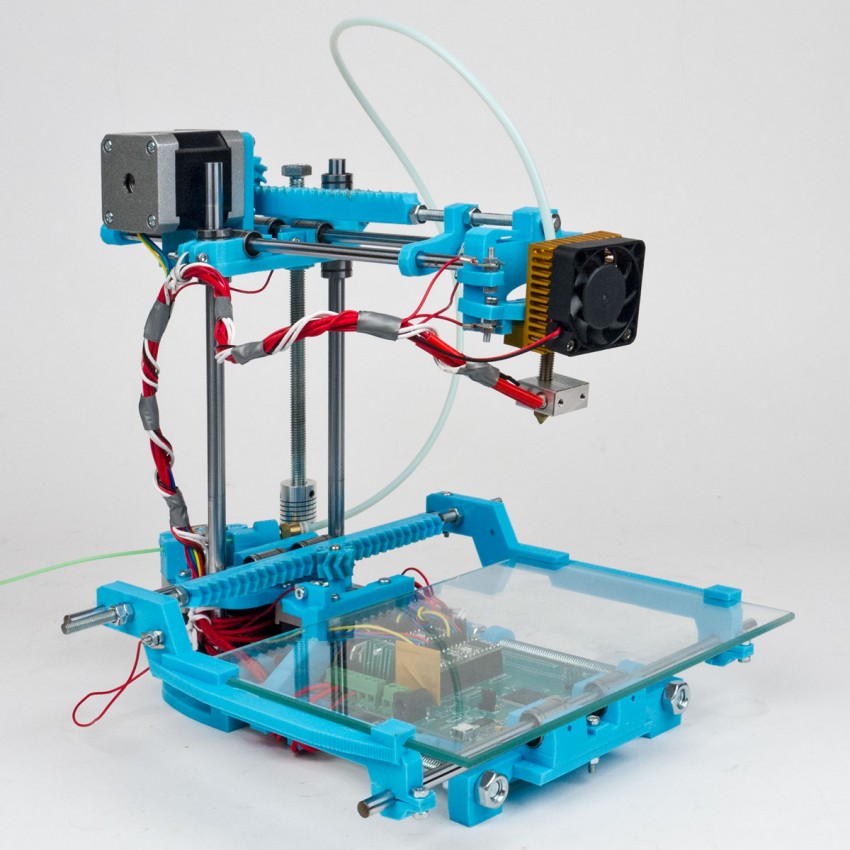

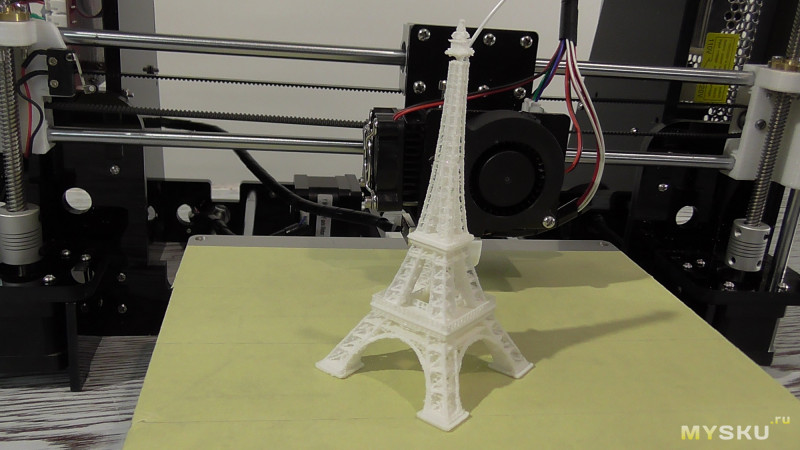

3D printing, also known as additive manufacturing, is a rapidly evolving technology that is quietly revolutionizing the way things are manufactured and processed.

From cars to industrial machinery to food, 3D printing is now being used to create finished products rather than just prototypes. The process saves time and enables small businesses to produce products in-house.

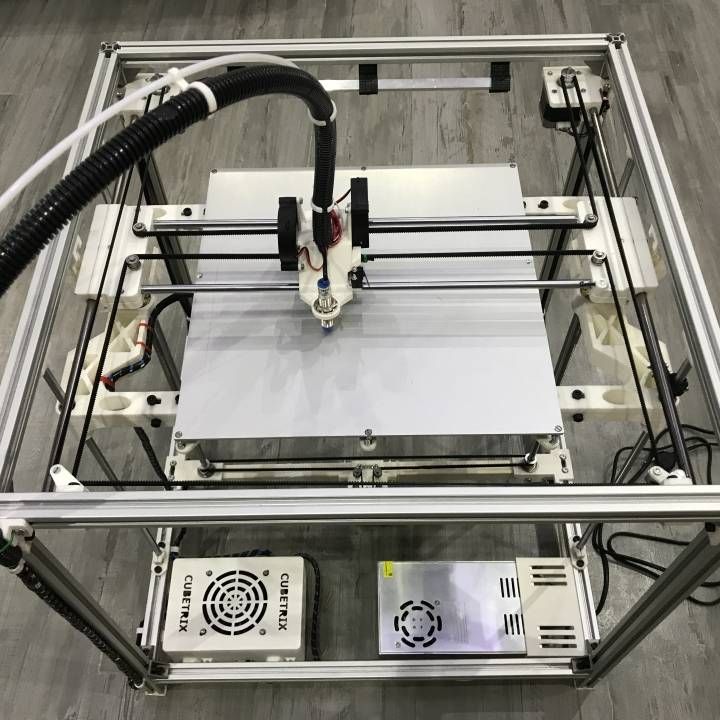

In Iceland, a small manufacturing facility is using 3D printing to produce parts for fish-processing machines. The founder of Curio, Elliði Hreinsson, says that his machines would be difficult or in some cases impossible to produce without 3-D printing.

Hreinsson says that 3-D printing skips all the steps required for conventional manufacturing, from prototyping to casting or injection molding. This not only saves time, but also enables small businesses like Curio to produce all their products in-house.

The use of 3D printing is also on the rise in the automotive industry.

General Motors (NYSE: GM) recently used 3D printing to make 60,000 weatherproof seals for the 2022 Chevy Tahoe, and the forthcoming Cadillac Celestiq will include more than 100 3D-printed parts.

BMW is also making broad use of 3-D printed parts throughout its lineup. Mercury Marine is also producing its newest V12, 600-horsepower outboard motor with 3-D printed molds.

3D printing is not only cost-efficient, but also allows for the creation of complex designs that would be difficult to produce with traditional manufacturing methods.

The use of 3D printing in traditional industries is also on the rise.

Humtown Additive, a family business in Ohio, uses 3D printing with sand to create molds for casting metal parts.

This is a process that has changed little since ancient Egypt, but with the addition of computers, CAD software, and the ability to print complicated shapes, it is now more efficient and cost-effective.

The implications of 3D printing for the shape of global supply chains could be significant.

Traditional manufacturing often requires outsourcing to Asia, adding weeks or months to the time between product design and delivery.

With 3D printing, products can be created in-house, enabling small businesses to compete on a global scale.

Additionally, 3D printing can also be used to create products in remote areas, reducing the need for transportation and logistics.

Investors also point to the fact that 3D printing is a sustainable technology.

It reduces the need for raw materials and the waste produced is minimal. This is because it only uses the material required to create the final product, unlike traditional manufacturing methods that create a lot of waste during the manufacturing process. This not only saves resources but also reduces the environmental impact of manufacturing.

From cars to industrial machinery to food, 3D printing is now being used to create finished products, rather than just prototypes.

The implications of 3D printing for the shape of global supply chains could be significant, as it enables small businesses to compete on a global scale and reduces the need for transportation and logistics.

3D printing is a rapidly evolving technology still in its infancy that investors are increasing paying attention to as it has the potential to change the way the global economy manufactures and processes products in the future.

Many publicly traded 3D printing companies are competing to grab market share. Listed below are the top 3D printing stocks to watch in 2023:

- 3D Systems (NYSE: DDD)

- Protolabs (NYSE: PRLB)

- Desktop Metal (NYSE: DM)

- Stratasys (NASDAQ: SSYS)

- Velo3D (NYSE: VLD)

- Dassault Systemes (OTCMKTS: DASTY)

- Materialise (NASDAQ: MTLS)

- Nano Dimension (NASDAQ: NNDM)

- Faro Technologies (NASDAQ: FARO)

- MarkForged (NYSE: MKFG)

- Shapeways (NYSE: SHPW)

- Voxeljet (NASDAQ: VJET)

- Organovo (NASDAQ: ONVO)

- Sigma Additive Solutions (NASDAQ: SASI)

For a full list of 3D Printing stocks, quote and news visit: https://greenstocknews. com/stocks/3d-printing-stocks

com/stocks/3d-printing-stocks

Five 3D Printing Stocks to Consider in 2023

Image source: Getty Images.

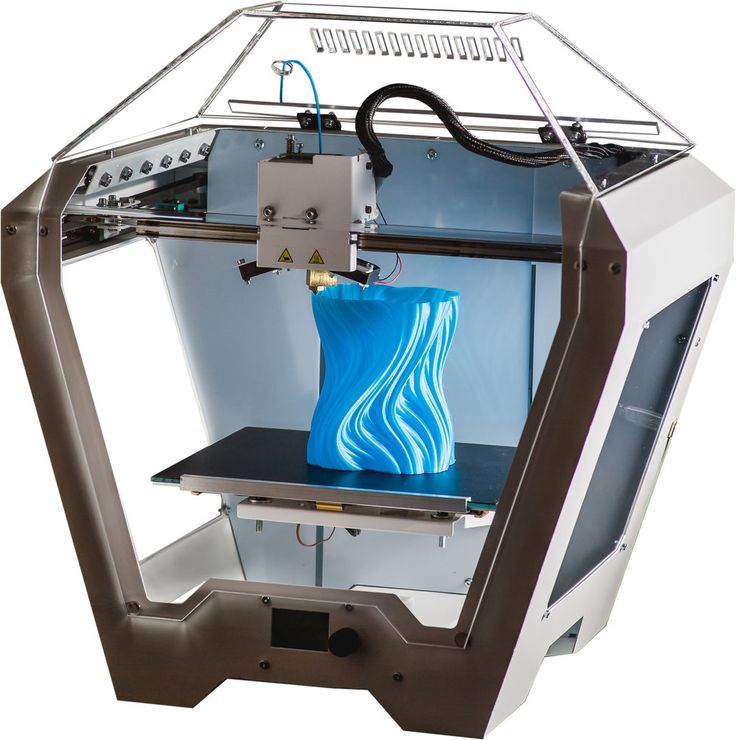

Back in the early 2010s, stocks were booming for 3D printing -- also known as additive manufacturing, a computer-controlled process in which three-dimensional objects are made. But the boom was followed by a bust as many pure-play 3D printing companies didn't immediately deliver on lofty expectations.

Rumors of the manufacturing technology's demise are clearly premature. These days, 3D printing is a high-growth niche that is steadily reshaping the manufacturing and industrial sectors. Some estimates point to a doubling in annual revenue from additive manufacturing between 2022 and 2026. Even growth investor Cathie Wood has launched a fund focused on manufacturing tech, The 3D Printing ETF (NYSEMKT:PRNT), via her company ARK Invest.

Here's what you need to know about 3D printing and additive manufacturing stocks for 2023:

Investing in 3D printing stocks in 2023

The manufacturing of products in all corners of the economy is being revolutionized by 3D printing, from healthcare equipment to metal fabrication to housing construction. It's invading so many sectors that tech giants such as Microsoft (NASDAQ:MSFT), Autodesk (NASDAQ:ADSK), and HP (NYSE:HPQ) have launched products aimed at 3D printing and additive manufacturing. Other engineering and software outfits such as Dassault Systemes (OTC:DASTY), ANSYS (NASDAQ:ANSS), and Trimble (NASDAQ:TRMB) have also gotten involved in 3D printing technology.

It's invading so many sectors that tech giants such as Microsoft (NASDAQ:MSFT), Autodesk (NASDAQ:ADSK), and HP (NYSE:HPQ) have launched products aimed at 3D printing and additive manufacturing. Other engineering and software outfits such as Dassault Systemes (OTC:DASTY), ANSYS (NASDAQ:ANSS), and Trimble (NASDAQ:TRMB) have also gotten involved in 3D printing technology.

Here are five key players to consider for 2023 that are a more focused bet on 3D printing:

| Company | Market Cap | Description |

|---|---|---|

| Desktop Metal (NYSE:DM) | $584.3 million | Recent IPO that focuses on metal fabrication technology. |

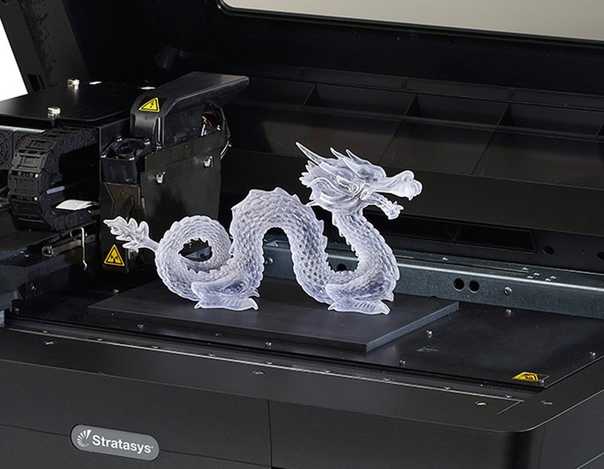

| Stratasys (NASDAQ:SSYS) | $924.3 million | One of the original 3D printing pioneers, with a wide array of printers and supporting design software. |

| Xometry (NASDAQ:XMTR) | $1.3 billion | A manufacturing marketplace, including access to on-demand 3D printing services. |

| 3D Systems (NYSE:DDD) | $1.2 billion | Another original 3D printing pioneer and the largest pure-play stock on 3D printing technology. |

| PTC (NASDAQ:PTC) | $15.4 billion | A manufacturing technology provider with a suite of software and related services for industrial businesses. |

1. Desktop Metal

This company is a recent entry into the 3D printing space after going public via a SPAC at the end of 2020. The stock has been a terrible market underperformer since then, losing three-quarters of its value as of spring 2022. However, Desktop Metal could still be a promising investment for the long term.

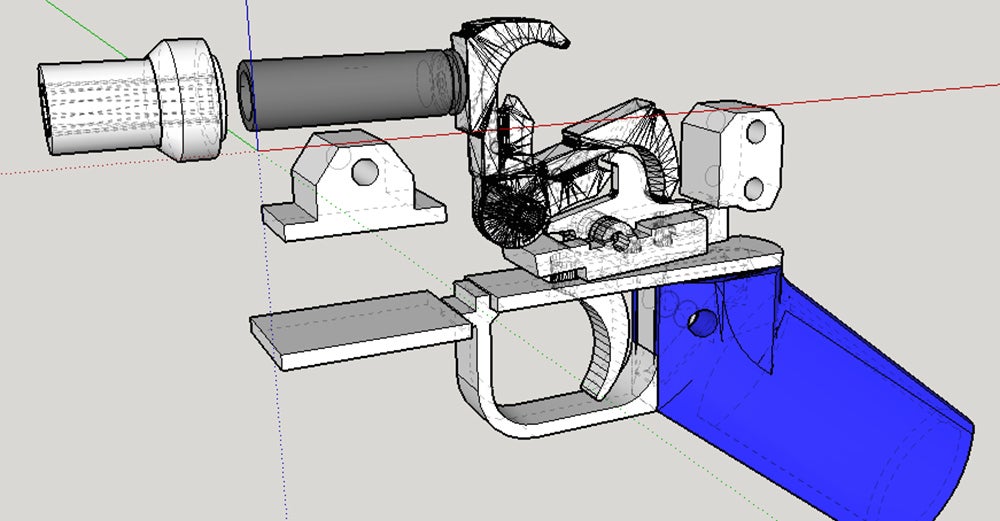

As its name implies, Desktop Metal develops 3D printing hardware and accompanying design software for metal and carbon fiber parts. The company's smaller systems can handle prototyping and one-off parts, and larger printers are production grade-designed for manufacturing facilities. Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

The company's smaller systems can handle prototyping and one-off parts, and larger printers are production grade-designed for manufacturing facilities. Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

Despite a tenuous start as a public company, Desktop Metal was actually increasing revenue at a torrid triple-digit pace in 2021. Gross profit margins are thin, and the company generated a steep net loss, but that should improve over time as the business scales its operation. Desktop Metal also has several hundred million dollars in cash and investments to fund its expansion. It used some of these funds to acquire additive manufacturing peer ExOne at the end of 2021.

2. Stratasys

Stratasys was part of the early 2010s 3D printing stock boom and bust, but its business has endured. Sales took a dip early in the COVID-19 pandemic but are rebounding as the Israel-based company picks up new manufacturing contracts.

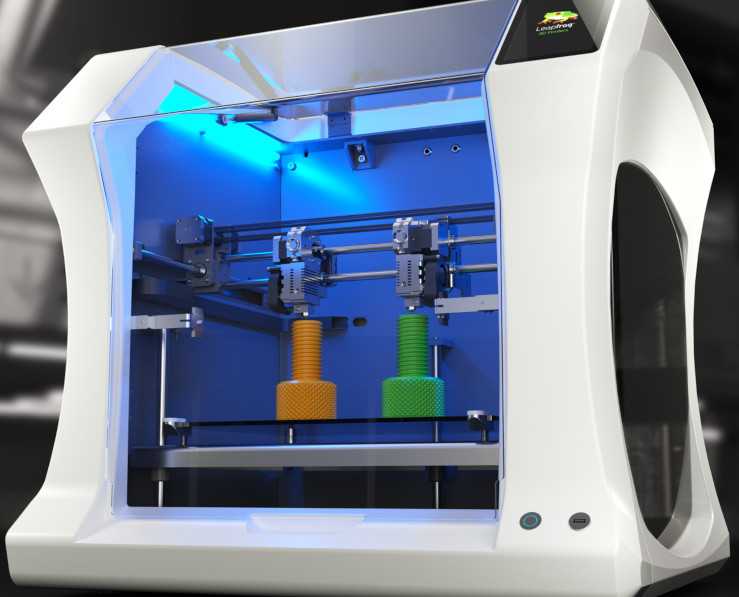

Stratasys serves a diverse set of customers, including aerospace and automotive parts manufacturers, medical and dental companies, and makers of basic consumer products. In addition to a wide array of 3D printer models, Stratasys develops software to help users accelerate the time between design and final printing.

It isn't the highest-growth name on this list, but Stratasys is profitable (on a free cash flow basis) and has more than $500 million in cash and investments on its balance sheet, as well as no debt. Management thinks its payoff from years of research and development into additive manufacturing will accelerate in 2022.

3. Xometry

This is another newcomer to public markets. Xometry completed its initial public offering (IPO) over the summer of 2021, raising almost $350 million in cash in the process. As is often the case with new IPOs, the stock has underperformed since then. It has lost over half of its value from the time it started trading on public markets, but the business itself is rapidly growing.

It has lost over half of its value from the time it started trading on public markets, but the business itself is rapidly growing.

Xometry is a marketplace for on-demand manufacturing of prototyping and mass production. It has a network of more than 5,000 suppliers that companies can call on to meet their fabrication needs. Among the suppliers on the Xometry platform are 3D printing companies, injection molding, and automated machining. The company reported having more than 28,000 active buyers utilizing its platform at the end of 2021.

Although it isn't profitable yet, Xometry's unique approach to the 3D printing and additive manufacturing industry is growing fast. Like other names on this list, it has a sizable war chest of cash and short-term investments that it can spend on research and marketing as it tries to attract more suppliers and buyers to its marketplace.

4. 3D Systems

3D Systems was another early player in the 3D printing industry, and while it suffered through the boom-and-bust period of the early 2010s, its business has held steady for much of the past decade. After a brief dip during the early days of the pandemic, 3D Systems is back in growth mode.

After a brief dip during the early days of the pandemic, 3D Systems is back in growth mode.

The company develops printers and design software for all sorts of materials and industries (medical device makers, dental labs, semiconductor designers, aerospace, and automotive manufacturers). It claims leadership among independent 3D printing companies (as measured by sales). As the 3D printing industry expands in the coming years, 3D Systems thinks it will be able to attract lots of new business with its extensive experience and global reach.

As an established tech outfit in the manufacturing sector, 3D Systems offers investors the prospect of more stable growth, along with profitability. It also has a large net cash position from which it can consolidate its lead in 3D printers and software technology.

5. PTC

By far the largest company on this list, PTC is a longtime technology partner of manufacturing and industrial enterprises. Fast approaching $2 billion in annualized sales and highly profitable, PTC has all the tools needed to digitally transform industrial businesses.

Fast approaching $2 billion in annualized sales and highly profitable, PTC has all the tools needed to digitally transform industrial businesses.

Besides 3D printing computer-aided design software (ANSYS is a peer and software partner that also operates in this space), PTC specializes in augmented reality, industrial IoT (Internet of Things), and product life-cycle management software. Most of its revenue is subscription-based (including its Creo software that enables 3D printing), making for a stable and steadily growing business model that generates ample cash flow. PTC puts spare cash to work developing new products for its partners and makes bolt-on acquisitions of other software companies that enhance its overall portfolio.

As a larger company, PTC won't be the fastest-growing stock in the additive manufacturing and 3D printing space. However, the company has established itself as a leader in industrial technology and should be a primary beneficiary as the production of manufactured goods gets more efficient.

The future of 3D printing

Manufacturing technology is making inroads throughout the global economy by reducing the cost of production and localizing and speeding up the time it takes to deliver customer orders. This is far from mere hype. Nevertheless, as is the case with all technology investments, progress won't go straight up. Expect twists and turns in these stocks as they develop new methods to design and make products.

If you decide to invest, do so in a measured way. Maintain a diversified portfolio, be wary of stocks benefiting from investor over-optimism, and always leave spare cash to invest more when there are inevitable dips. Given enough time -- years and decades -- investing in 3D printing could eventually provide a big payoff.

Related communication stocks topics

Investing in 5G Stocks

As the 5G technology rollout continues, these companies look like winners.

Investing in Top Telecommunications Stocks

Our world is increasingly interconnected, and these companies make it happen.

Investing in Communication Stocks

Communications has a broad definition. These companies are the leaders in the space.

Investing in Top Consumer Discretionary Stocks

When people have a little extra cash, they indulge in offerings from these companies.

Nicholas Rossolillo has positions in Autodesk. The Motley Fool has positions in and recommends Autodesk, HP, and Microsoft. The Motley Fool recommends 3d Systems, Ansys, Dassault Systèmes Se, PTC, and Trimble. The Motley Fool has a disclosure policy.

4 3D printing trends in 2023

Analytics and business

Experts recommend

Author: Viktor Naumov

Author: Viktor Naumov

Year after year, the adoption of additive manufacturing reaches new heights. What can we expect from 2023? Materialize, a leader in the global 3D printing market, offered its forecast based on four key trends that will drive the industry over the next twelve months:

-

the rise of smart, distributed manufacturing;

-

focus on cost reduction;

-

transition from automation of individual processes to complex automation of the workflow;

-

data security and integrity becomes a priority.

By addressing these issues, companies will be able to bring 3D printing to the level of mass production and accelerate the adoption of additive technologies.

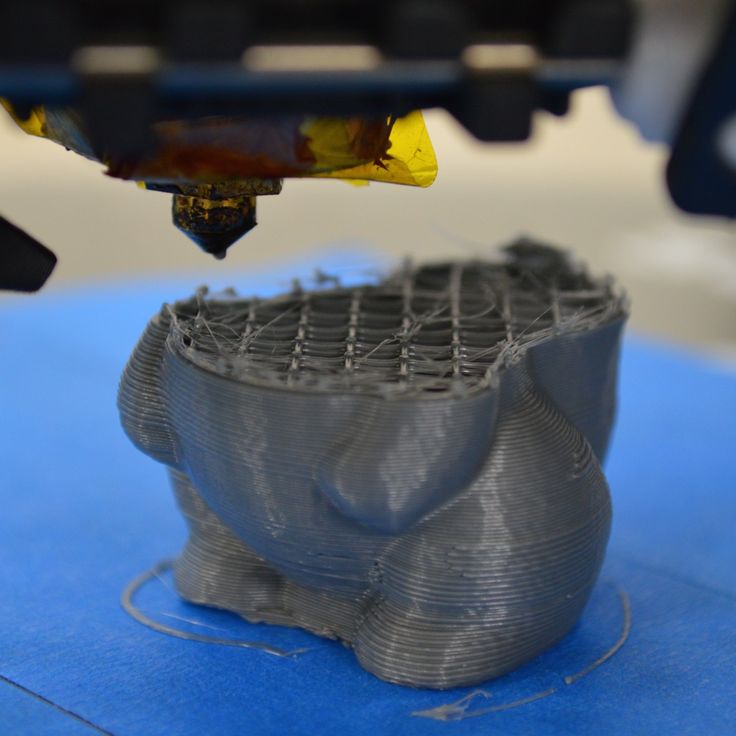

Over the past three decades, 3D printing has established itself as a versatile and flexible tool in the manufacturing arsenal. Being a relatively new technology, it has spent most of this time somewhat isolated from the traditional manufacturing process. But in recent years, the wall between classic manufacturing and 3D printing has begun to disappear. We are starting to see these two separate worlds coming together, and the implications are enormous.

In 2023, the above trends will be the key to overcome the barriers that are still associated with the introduction of technology into industrial production. Addressing these issues will help companies scale up 3D printing to mass production and accelerate the adoption of 3D printing.

Fried Vankran, CEO of Materialize

© Materialise

1.

The rise of smart, distributed manufacturing

The rise of smart, distributed manufacturing Traditionally, production has always been concentrated in one place - usually a factory in another country. This system worked well until it stopped working. Over the past few years, we have seen how the COVID-19 crisis has paralyzed production and disrupted supply chains. We have witnessed an increase in geopolitical tensions and environmental concerns. All this taken together forced manufacturing companies to reconsider their model of centralized production. And with the help of smart digital technologies like 3D printing, manufacturers can move to multiple, smaller sites closer to customers.

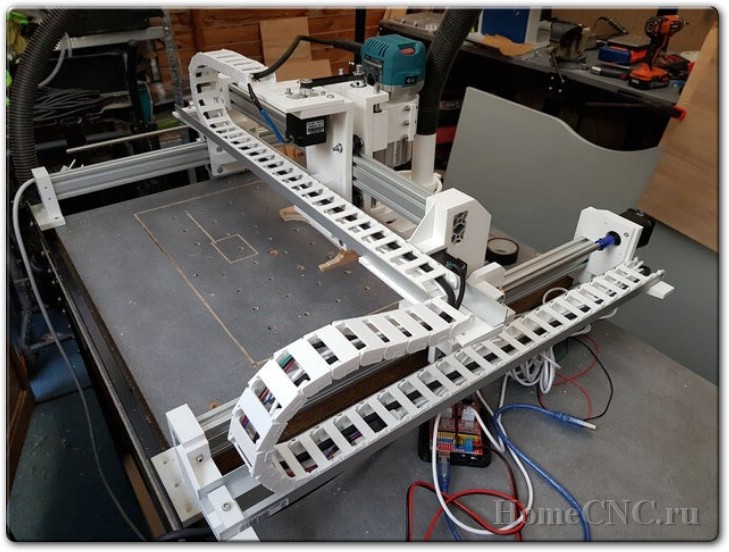

Find the right 3D printer for you

However, many of the recent implementations owe their success to quick decision making in the face of scarce funds, such as reaching out to local 3D printing service providers to produce essential medical devices during the coronavirus pandemic. It can be said that 3D printing has been used as a temporary replacement. But, fortunately, such decisions have sparked new conversations about the future of production.

But, fortunately, such decisions have sparked new conversations about the future of production.

Now we see that many companies are ready to take a more strategic approach. These companies need to carefully consider which applications will deliver the most value in terms of supply chain efficiency or environmental sustainability. And this requires a change in thinking, moving from short-term solutions to the use of additive technologies as a stable method for the production of certified final parts.

A good example is CNH, an agricultural machinery company. During the pandemic, CNH was 3D-printing a vital part that could not be obtained due to COVID-related logistical constraints. The experience has proved useful, and the company is now looking at 3D printing as part of its strategy to manage supply chains in a more cost-effective way.

3D printing at CNH © cnhindustrial.com

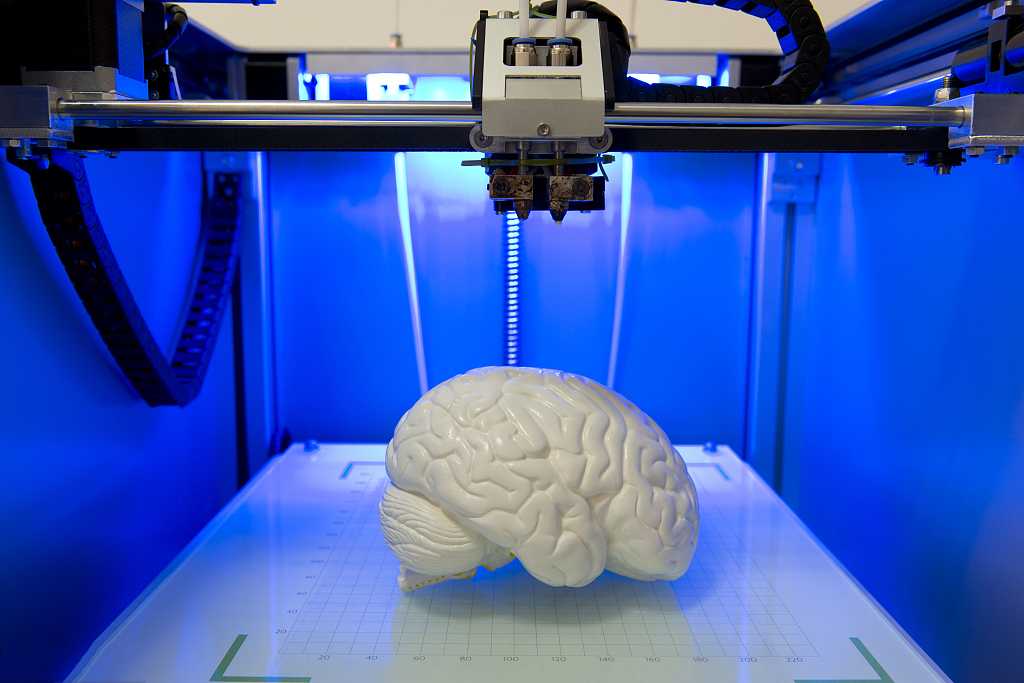

Thus, the potential is real even in such a highly regulated field as medicine. We are seeing hospitals increasingly turning to 3D printing to create medical models and personalized implants in situ, close to patients.

We are seeing hospitals increasingly turning to 3D printing to create medical models and personalized implants in situ, close to patients.

We can say that this is the medical equivalent of a decentralized model of industrial production. Ultimately, we have smart, distributed manufacturing enabled by 3D printing that, when approached strategically, can be a recipe for success rather than an ad hoc response to problems.

Hanne Gielis, Innovation Manager, Mindware

2. Focus on cost reduction

The history of 3D printing is a history of added value. Additive manufacturing allows for design optimization, delivering performance, weight savings, time savings and supply chain savings that traditional manufacturing methods cannot achieve. In many cases, these benefits create opportunities for cost savings that affect overall manufacturing costs, from design to delivery.

Manufacturers planning to scale additive manufacturing to thousands or even millions of parts must ensure that the 3D printing process is efficient, reliable, and repeatable across multiple manufacturing sites.

Peter Lace, Executive Chairman, Materialize

A recent survey showed that the ability to reduce overall manufacturing costs is cited as the most important benefit of 3D printing. But this does not necessarily mean that the additive process itself is cost effective. Rising material and energy prices have only further increased costs.

The cost of 3D printed parts is determined by several factors, including the materials needed, the lead time per part, and the type of printer. There are two really important ways to reduce these costs. The first is more efficient work to increase production capacity. Software plays a big role in this, allowing you to optimize your designs. We can also customize the printing process to make it more efficient and repeatable. The second way is to use tools and improve quality. And you have to pay for quality.

© Materialise

If we take a certified production in the medical or aviation industry, we will see that up to 70 percent of the cost of production is accounted for by quality control. 3D printing continues to transform factory floors as companies increasingly turn to the technology for large-scale production. But to accelerate this adoption, our industry will have to work harder to bring down the cost of 3D printing.

3D printing continues to transform factory floors as companies increasingly turn to the technology for large-scale production. But to accelerate this adoption, our industry will have to work harder to bring down the cost of 3D printing.

Brian Crutchfield, Vice President and General Manager, North America

3. Transition from single process automation to integrated workflow automation

3D printing is a digital manufacturing technology, but it still requires a lot of human intervention. And such skilled workers are becoming increasingly difficult to find. According to a recent study by Materialize, finding the right people with the right knowledge and experience is a major challenge for companies that already use or are considering using 3D printers.

At the same time, scaling industrial additive manufacturing to thousands or millions requires repeatability and stability of the printing process. These two issues have increased the need for automation in recent years. The software allowed us to automate various steps in the 3D printing process, from preparing and editing files to creating supports, optimizing object placement in the build chamber, and even post-processing.

The software allowed us to automate various steps in the 3D printing process, from preparing and editing files to creating supports, optimizing object placement in the build chamber, and even post-processing.

But these are all separate processes. In 3D printing, they follow each other, merging into a complex digital manufacturing process. The promise of large-scale industrial 3D printing requires us to automate not only each individual process, but also the workflows between them. And this is what we call end-to-end workflow automation.

© Materialise

We see the same thing in the medical industry, where complex process automation is needed to cope with the surge in custom 3D solutions. The good news is that opportunities to meet this need are growing with the creation of software platforms that allow manufacturers to customize their own unique 3D printing process.

Isabelle Rombaugh, Director of Global Sales and Business Development Medical

4.

Data security and integrity becomes a priority

Data security and integrity becomes a priority We have already talked about such an important trend as distributed production. Smart digital technologies, including 3D printing, are making it possible to move production to several smaller sites closer to customers. This is a clear sign that the factory of the future will not have a single, central location. This new digital distributed manufacturing environment revolves around one key asset - data, and this data must be protected so that an unscrupulous supplier cannot steal the design and print the product on their own 3D printer.

Of course, data security is important in any kind of manufacturing, be it traditional or smart. In both cases, companies share their unique designs with contractors and suppliers, and they want to know that their design data will remain secure. But in the case of 3D printing, that's not all. Manufacturers planning to scale additive manufacturing to thousands or even millions of parts must optimize and fine-tune their unique printing process to ensure it is efficient, reliable and repeatable across multiple manufacturing sites.

A well-thought-out manufacturing process guarantees the same quality of all 3D printed components, regardless of where they are produced. Creating such a process is a complex and time-consuming task, but it allows companies to stay ahead of the competition. That is why not only the security of data storage, but also their integrity, that is, a close and reliable connection between the project, on the one hand, and production parameters, on the other, becomes a paramount task for companies implementing digital production.

Peter Lace, Executive Chairman

Material provided by Materialize

Article published on 01/20/2023, updated on 01/20/2023

Top 10 3D printing companies listed on the stock exchange

So, we present to your attention the ranking of 3D printing companies in terms of annual turnover.

Stratasys: $750 million

Industry leader Stratasys grew 54% over the past year with sales exceeding $750 million. This is partly driven by demand for the new Object500 Connex3 model, as well as the traditionally popular PolyJet and industrial FDM 3D printers. Another growth driver was the acquisition of other companies such as Solid Concepts and Harvest Technologies (now part of Stratasys Direct Manufacturing). At the same time, the American-Israeli company (which includes, among other things, MakerBot Industries and SolidScape) recorded a net loss of $119 in its financial statements.million. This figure is more than four times higher than last year, which is also due to active acquisitions and investments. The forecast for 2015 is positive, it is expected that the revenue will be $940 million. If Stratasys manages to beat expectations by 6%, it could become the first pure 3D printing company to reach $1 billion in revenue.

This is partly driven by demand for the new Object500 Connex3 model, as well as the traditionally popular PolyJet and industrial FDM 3D printers. Another growth driver was the acquisition of other companies such as Solid Concepts and Harvest Technologies (now part of Stratasys Direct Manufacturing). At the same time, the American-Israeli company (which includes, among other things, MakerBot Industries and SolidScape) recorded a net loss of $119 in its financial statements.million. This figure is more than four times higher than last year, which is also due to active acquisitions and investments. The forecast for 2015 is positive, it is expected that the revenue will be $940 million. If Stratasys manages to beat expectations by 6%, it could become the first pure 3D printing company to reach $1 billion in revenue.

3D Systems: $650 million

Although 3D Systems' revenue grew 27% to a record high, the company still lost the top spot to Stratasys last year. The head of the company, Avi Reichental, said he was not entirely satisfied with how the company realized the potential of its technology portfolio. 3D Systems has some of the most advanced 3D printing technology in the industry, but hasn't shown enough willingness to go mainstream. However, according to 3D Systems financial statements, the company turned out to be in positive territory with a net profit of $1.6 million at the end of the year. Although the forecast for 2015 is generally positive, it is likely that 3D Systems will again be behind Stratasys, with revenues of $850-900 million.

The head of the company, Avi Reichental, said he was not entirely satisfied with how the company realized the potential of its technology portfolio. 3D Systems has some of the most advanced 3D printing technology in the industry, but hasn't shown enough willingness to go mainstream. However, according to 3D Systems financial statements, the company turned out to be in positive territory with a net profit of $1.6 million at the end of the year. Although the forecast for 2015 is generally positive, it is likely that 3D Systems will again be behind Stratasys, with revenues of $850-900 million.

Materialize: $81 million

Materialize is one of Europe's leading 3D printing service providers and a developer of innovative 3D printing software. In 2014, the company's revenue amounted to $81 million, which is 18.4% more than last year. The company's net profit reached $1.8 million, half of what it was in 2013, but still significant. Materialize's core business is the development and sale of 3D printing software (22% of sales) and medical 3D printing services (37%). The industrial segment, including the i.materialise 3D printing service, generated 40% of the company's total revenue. Materialize is expected to grow by 20% next year and reach €100 million in annual turnover.

The industrial segment, including the i.materialise 3D printing service, generated 40% of the company's total revenue. Materialize is expected to grow by 20% next year and reach €100 million in annual turnover.

ExOne: $43.9 million

Last year, ExOne grew by 10% with revenues of approximately $43.9 million. The main contribution to this result was made by the fourth quarter, during which sales increased by 50%. This state of affairs resulted in a gross profit of $10 million, but ExOne's operating costs were $21 million. This was mainly due to investments in the expansion of the company (new production facilities in Russia and Italy), as well as research and development (more than $8 million). In addition, ExOne announced the creation of a new large-scale 3D printer, Exerial.

Arcam: $39 million

Arcam, a Swedish manufacturer of electron beam melting (EBM) systems, recorded revenues of approximately $39 million. Thus, sales grew by 70% in a year, and profits exceeded $6 million. However, it is likely that in the financial markets such results were considered too good to be true. Compared to a record high at the end of 2013, Arcam shares are down more than 70% and are now trading for around $17.

Thus, sales grew by 70% in a year, and profits exceeded $6 million. However, it is likely that in the financial markets such results were considered too good to be true. Compared to a record high at the end of 2013, Arcam shares are down more than 70% and are now trading for around $17.

SLM Solutions: $36 million

Germany's SLM Solutions posted similar results to Arcam, with record earnings of approximately $36 million and 56% growth in 2014. At the same time, the company's shares fell from a record high of €21 to €18. However, SLM Solutions boasts a more stable stock price than most other members of the 3D printing industry. At the moment, for the past period of 2015, SLM Solutions reports an increase in the number of orders twice year-on-year.

Alphaform: $30 million

German company Alphaform offers rapid prototyping services. Alphaform made its first steps in the consumer market as part of the Artshapes project to apply 3D printing to the arts. The company reported record revenue of $30 million in 2014, up 11.6%. While Alphaform lost more than $3 million in the same period, this is a significant improvement from $6.5 million in 2013.

The company reported record revenue of $30 million in 2014, up 11.6%. While Alphaform lost more than $3 million in the same period, this is a significant improvement from $6.5 million in 2013.

voxeljet: $17-18 million

Analysts have criticized the German company voxeljet for not selling enough devices while offering special deals to customers to increase orders. However, it should be taken into account that voxeljet manufactures large industrial equipment, the print volume of which reaches 8 cubic meters - in other words, the company occupies a very specific niche. Estimated revenue for 2014 (updated data will be available at the end of March) is $17-18 million. In addition, according to voxeljet forecasts, the company expects to grow by almost 50% this year.

Organovo: $0

Organovo is the only listed biomaterials 3D printing company. However, most of Organovo's activities are still research and the first commercial product, exVive3D human liver tissue, was released just recently.