Number of 3d printers

Three Areas Holding Back The $10.6B 3D Printing Industry

Market research firm SmarTech Analysis recently released its data for the additive manufacturing (AM) industry. It determined that, in 2021, the 3D printing sector reached $10.6 billion in revenue, excluding the revenues associated with hardware maintenance contracts and post-processing equipment. The firm further projects that AM is expected to grow to over $50 billion by 2030.

The 3D printing industry is projected to reach over $50 billion by 2030, according to one market ... [+] research firm.

Image courtesy of SmarTech Analysis.This growth is closely pinned to the trend that large manufacturers will increasingly use the technology for mass production. However, in order for AM to reach wide-scale adoption, it will need to advance significantly in three crucial and interrelated areas: throughput, factory integration, and quality control. Fortunately for the industry, these are all also issues that are being actively addressed.

3D Printing Throughput

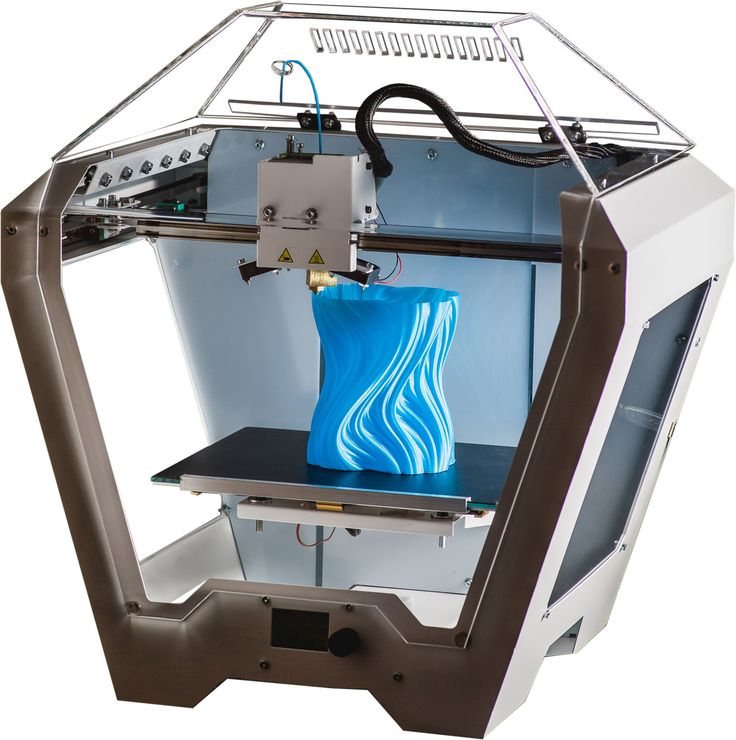

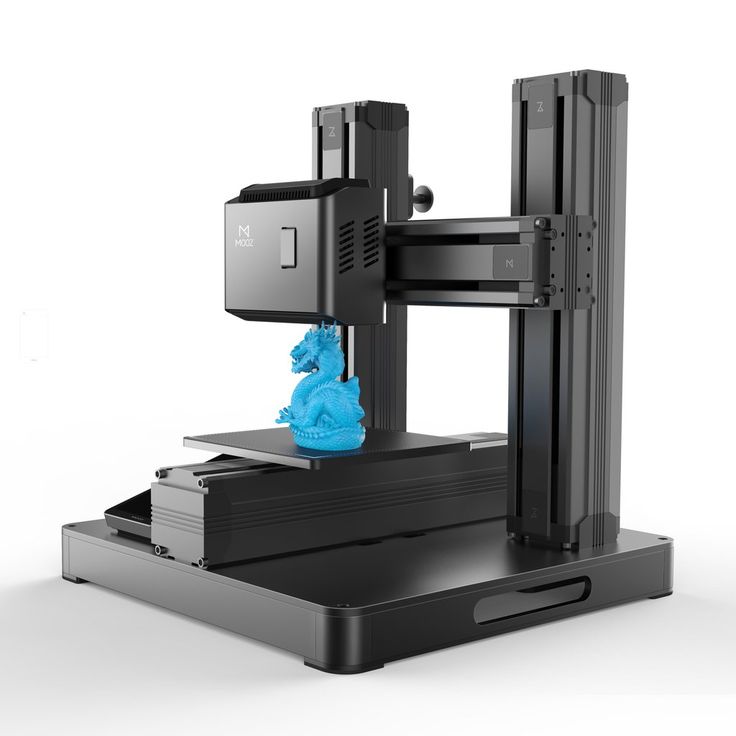

Due to its roots as a prototyping technology, 3D printing was never designed with mass production in mind. Instead, its ability to create complex shapes has been limited to one-off parts or small batch manufacturing. For that reason, firms across the 3D printing industry have been working to develop systems that can make many parts as rapidly as possible, a concept known as throughput.

Among the leaders in this regard is HP, which spent years researching the technology before finally unveiling technologies capable of rapid production both in plastics and metals. The 2D printing giant has ported its expertise in inkjet printheads over to 3D printing with a technology called Multi Jet Fusion (MJF). MJF is already being used to produce large batches of polymer parts for everything from eyewear to grocery bots.

Legor Group in Italy is using HP Metal Jet to 3D print functional stainless steel accessories for ... [+] the jewelry and fashion markets.

MORE FROMFORBES ADVISOR

This is just the beginning for the company, which is now rolling out its Metal Jet technology. A form of what is called “metal binder jetting,” Metal Jet deposits a liquid binder onto metal powder, creating a component that must then be sintered in a furnace. Customers as large as Volkswagen are investing in the technology with a plan to mass produce up to 100,000 metal components annually for consumer vehicles.

However, HP isn’t the only company in this quickly evolving space. A widely publicized startup called Desktop Metal is working to speed up metal binder jetting. GE, too, is working on its own version of the technology. Altogether, these companies are ushering in an era in which low-cost metal powders can be used to 3D print large numbers of parts in a single job, potentially changing the cost structure for metal 3D printing altogether.

This means that they will be taking on the established leaders in metal 3D printing, which typically rely on zapping high powered laser beams at expensive metal powders. These companies are working on increasing throughput, as well, by adding up to 12 lasers to their machines.

These companies are working on increasing throughput, as well, by adding up to 12 lasers to their machines.

3D Printing Factories

While a fleet of 3D printers may be capable of manufacturing at volume, that doesn’t mean that they’ll necessarily fit into an existing factory operation. In large part, this is due to the fact that they lack mass production-level software.

Now, a handful of startups have emerged to take on the challenge of developing AM-specific software for manufacturing execution systems (MES). These tools make it possible to both manage a fleet of 3D printers and connect them to a company’s existing production software. They typically aid in the entire order-to-fabrication workflow. This means order quoting and tracking, print file preparation, print job monitoring and data collection, printer fleet queuing, quality control, and shipping.

MES software necessarily connects to a business’s existing software tools. This includes product lifecycle management (PLM), enterprise resource planning (ERP), and general IT software. While PLM might include a company’s preferred 3D modeling software, ERP will be made up of everything from payroll programs to tools for tracking overall finances.

While PLM might include a company’s preferred 3D modeling software, ERP will be made up of everything from payroll programs to tools for tracking overall finances.

MES platforms are now working to take all of the software that a manufacturer might already be working with and inserting 3D printing into the mix. However, they’re not just limiting themselves to AM. Many MES developers are looking to connect with other production equipment, such as CNC machines. Then, with the help of machine learning, the entire workflow can be improved automatically as data from each order and each machine job feeds back into the work cycle. Artificial intelligence is significantly adding to the capabilities of MES software.

3D Printing Quality Control

Perhaps the biggest obstacle to widespread AM adoption is quality control. This is because, with additive, each part is distinct. Every point on the build platform may be slightly different and even the slightest variation in a printing parameter may change the microstructure of the printed object.

In turn, an object printed at one angle will not be the same as one printed at another. And, because parts are built up layer by layer, it is difficult to validate the internal geometries of an item once printing is complete. As a result, the only true way to assure the quality of a printed object is with a CT scan, typically a cost-prohibitive method for inspecting multitudes of parts.

Fortunately, not only are newer CT scanning systems with lower price tags coming onto the market, but there are other tools that are being used to ensure the quality of printed parts. Among them is computer simulation. Companies like ANSYS have developed software that can anticipate any defects that occur during the printing process and compensate for them. Hexagon is taking this one step further by predicting issues at the microscopic level.

Meanwhile, firms like Sigma Labs and Additive Assurance have created hardware to monitor the build chambers of metal 3D printers to detect errors. Increasingly, these tools will enable active feedback so that the machines can quickly correct issues during the print process. When connected with MES software and 3D printing simulation, the equipment can learn from past errors and address them before they even happen in the future.

Increasingly, these tools will enable active feedback so that the machines can quickly correct issues during the print process. When connected with MES software and 3D printing simulation, the equipment can learn from past errors and address them before they even happen in the future.

Altogether, these areas are advancing at incredible rates, in large part because manufacturers see the value in being able to produce objects from digital files on demand. As companies as large as Ford, GE, and Siemens look to 3D printing to produce quality end parts, they are driving the entire additive market to bend to their needs. To reach a whopping $50 billion by the end of the decade, the 3D printing industry has to be capable of making millions of parts for those customers.

Reasons Why 3D Printing is Reaching Mainstream

Cutting-edge technology developments, evolving value chains and market innovations are pushing 3D printing into the mainstream arena according to the latest exclusive research from Smithers

According to the new Smithers report The Future of Global 3D Printing to 2027 this market is set for explosive growth over the next decade. It will rise from $5.8 billion in 2016 to $55.8 billion by 2027, an aggressive annual growth rate of 23.0%. The 3D printing market is beginning to transition into a maturing business environment and has earnt an important position as a design and prototyping tool, and in the production of complex tooling and moulds.

It will rise from $5.8 billion in 2016 to $55.8 billion by 2027, an aggressive annual growth rate of 23.0%. The 3D printing market is beginning to transition into a maturing business environment and has earnt an important position as a design and prototyping tool, and in the production of complex tooling and moulds.

The market continues to experience substantial success among hobbyists and home users, dominating the number of 3D printers delivered in 2016 (233,000 printers versus 63,000 units in industrial/commercial applications), and in the total number of 3D printers installed. However, the combined value of the industrial/commercial sectors is overwhelmingly larger ($5.4 billion versus $0.4 billion in 2016), due to the much higher cost of industrial/commercial 3D print hardware, higher raw materials costs and larger spending on services.

Evolution of printer and materials technologies

The most common 3D printing raw materials are the commodity thermoplastic polymers:

- Acrylonitrile butadiene styrene (ABS)

- Polylactic acid (PLA)

- Polyethylene terephthalate glycol-modified (PETG).

These materials, made in huge quantities by the global chemicals and plastics industry, are readily available, relatively inexpensive, and easy to handle and process in fused filament fabrication (FFF) 3D printing equipment.

Currently, the most readily available metallic raw materials are aluminium and bronze powders, selected grades of maraging steel and of stainless steels, a few aluminium alloys, cobalt-chromium compounds and a limited number of titanium alloys. Private industry and independent research agencies are investing substantial R&D resources to expand the envelope of metals for 3D printing.

The pace of raw materials development for 3D printing will accelerate dramatically over the coming years. Raw materials for 3D printing will become more uniform and of a higher, more reliable quality. These materials will be generally more accessible and affordable, and improvements in materials formulations and processing techniques will make them more user friendly.

With the advancing technology and sophistication of the 3D printing marketplace, value chains are evolving to meet the growing and diverging needs of the rapidly developing markets. Currently, most industrial/commercial 3D printing installations function as a stand-alone unit operation, not intimately integrated into the overall manufacturing environment and workflow. For many companies, 3D printing remains something of a lab curiosity, still far from achieving its potential to transform product design and manufacturing processes or, ultimately, the structure of value chains and the marketplace.

Companies with a deep experience of incorporating 3D printing principles into their design and manufacturing workflow – companies like Airbus, Lockheed Martin, and Boeing – are now developing integrated manufacturing systems that seamlessly incorporate 3D printing into the factory environment and workflow.

The industry will likely devise constructive solutions to potential business transformations. While traditional second tier part suppliers and logistics companies may see their business diminish over time, these changes will open up significant opportunities, particularly for contract manufacturing providers.

While traditional second tier part suppliers and logistics companies may see their business diminish over time, these changes will open up significant opportunities, particularly for contract manufacturing providers.

Leadership in the global 3D printing marketplace will continue to reside in North America and Western Europe. Asian companies will manufacture an increasingly large share of 3D printing machines, especially the low-cost, lower capability machines favoured by the hobbyist/DIY segments, and by casual school and commercial users.

Widespread innovation is expected across the forecast period, both in terms of 3D printing technologies and equipment, and in terms of raw materials and end uses. Widespread adoption of 3D printing processes will enable the dramatic transformation of value chains and supplier–customer relationships.

Many of these innovations will address the natural evolutionary pressures that affect any new technology: increases in production speeds, process efficiency and reliability, reductions in machinery and systems costs, and improvements in product quality and uniformity.

Smithers exlusive research reveals the industry can expect:

- 3D printer and process innovations to focus upon progressive improvements and refinements to existing processes, and less upon radical new technologies

- A broadening of the range of commercially important metals and plastics to be made available in forms suitable as 3D printers

- Companies in the industrial and commercial sectors will increasingly view 3D printing as a toolbox of technologies and production techniques to be commercially exploited and integrated.

These changes in the scope and direction of 3D printing innovation will create substantial opportunities for the industry in terms of 3D printing materials and processes, applications and end user development; and in terms of the value chains and relationships across the 3D printing business environment.

The full impact of these technology changes, innovations and evolving supply chains are analysed in-depth in Smithers report The Future of 3D Printing to 2027.

Overview of the home 3D printing market - Technology on vc.ru

The market for home 3D printers is one of the fastest growing markets in recent years. If a few years ago such a thing as a “home 3D printer” belonged to the exotic, now such a device is becoming commonplace.

588 views

Varvara Kiseleva

Doctor, marketer, researcher, mother

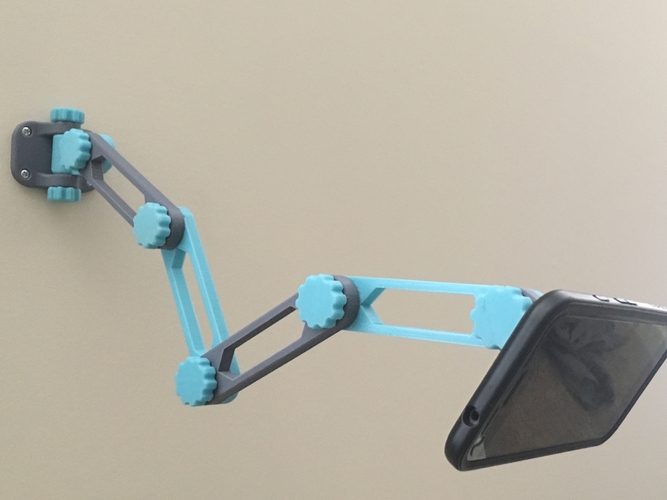

At the same time, the scope of such printers in everyday life is rapidly expanding. Initially, these printers were acquired mainly by those who were fond of technical modeling. But now the 3D printer works at home for many artists, jewelers, car enthusiasts, cyclists, fishermen, home craftsmen and in general for those who have any hobby. Since the presence of such a device allows not only to save a lot of time that used to be spent looking for spare parts and accessories, but also to quickly produce parts and products of our own design.

This is also facilitated by the constantly decreasing price of printers and consumables, which today already allows you to purchase a device "in reserve", just in case you need to make some broken part of a household appliance or a lost accessory.

Since the existing 3D printing technologies are very diverse, it should be clarified that speaking of the home 3D printer market, we mean printers using FDM (Fused Deposition Modeling) technology, which involves the creation of three-dimensional objects by applying successive layers of thermoplastic plastic that is pressed through in the molten state through a heated nozzle. It was this technology that, due to its simplicity and low cost, was able to quickly conquer the home market.

Today, there are a huge number of materials that are used for 3D printing at home, including special compositions with ceramic, wood filler, as well as metal powder.

The use of such materials makes it possible to obtain products that differ little in appearance and performance from products made of wood, ceramics and metal.

As for the actual plastic, currently more than a dozen varieties are available for household printing with different predominant properties: strength, decorative, various heat resistance. There are also flexible plastics that allow you to print products that resemble rubber products.

There are also flexible plastics that allow you to print products that resemble rubber products.

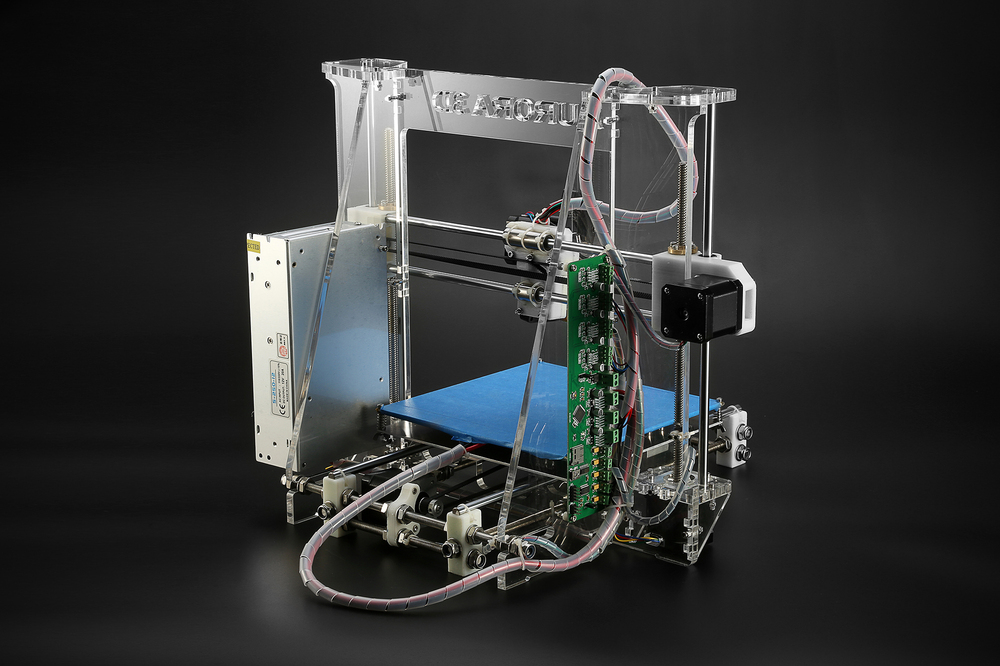

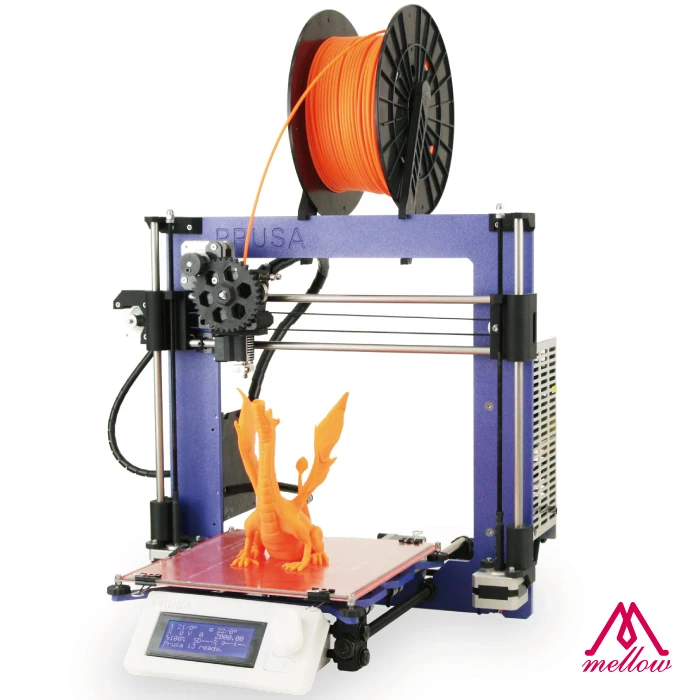

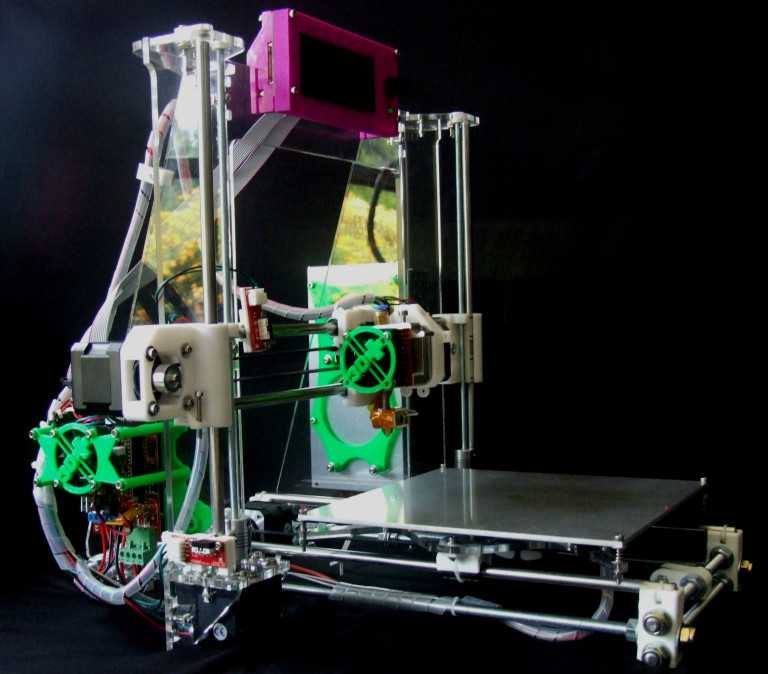

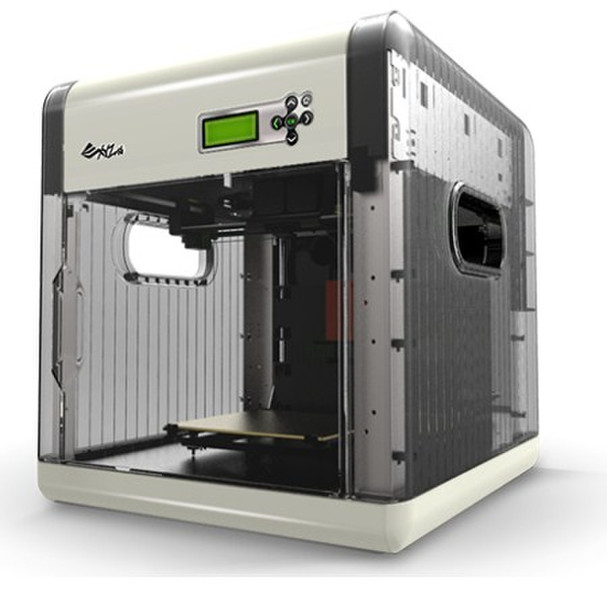

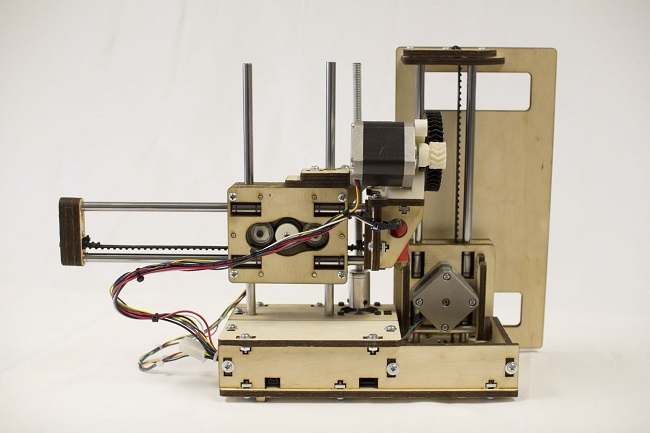

It should be noted that the home printer market is actually divided into two segments: the ready-made printer market, which is operated by a limited number of manufacturers, and the DIY market, which offers kits and kits for self-assembly of printers. The last segment significantly exceeds the first, both in terms of the number of devices sold and in terms of cash turnover, despite the fact that DIY devices are several times cheaper than ready-made factory-assembled printers. Currently, this is perhaps the only market where DIY versions are dominated to such an extent.

There is a certain specificity of the DIY market. Although there is no official standardization here, nevertheless, historically, although unofficial, but rather rigid standards have arisen here in terms of dimensions, interfaces, tolerances and fits, as well as the parameters of signals and connectors of electronic devices, which all new manufacturers that appear on the market are forced to follow. .

.

As a result, in the course of competition between manufacturers of components, the market was divided among a limited number of manufacturers of components for 3D printers. This has led to the fact that the vast majority of DIY kits for self-assembly consist of the same components, and overlap in their composition by 60-80%. The differences between them are in the design features of the implementation.

In fact, the firms that sell these kits are selling their intellectual property to develop a particular design. Competition between manufacturers (since all kits are equipped with the same parts of identical quality) is carried out at the level of service implementation and customer support.

However, the vast majority of DIY printers are clones of the Prusa series with open source modeling software. This series was designed by Czech engineer Josef Průša especially as a DIY model. The open source code, as well as the simplicity of design, allowing for numerous implementation options, combined with low cost, has made Prusa the world's best-selling 3D printer series.

The COVID-19 pandemic has given a major boost to the popularity of 3D printers, as 3D printing enthusiasts created groups that, especially in the early stages of the pandemic, were able to locally print hard-to-find parts, consumable accessories, and medical equipment components in COVID clinics, and which literally saved thousands of lives. This phenomenon received wide publicity in the press and caused a rapid increase in public interest in the possibilities of 3D printing.

Venturi valves for ventilators, 3D printed.

3D printed nasopharyngeal swabs.

Diving mask converted by 3D printing into antique mask

As a result, contrary to forecasts, sales of 3D printers during the epidemic not only did not fall, but even increased. This is especially true for DIY kits ordered by mail.

Market growth during the pandemic and growth forecast until 2024 in billions of US dollars. Data from Wohlers Associates © Statista

This review uses materials and photographs from Wohlers Associates, Research and Markets, Fortune Busness Insights, Technavio, 3dnatives. com.

com.

Thank you for your interest in my article! In my analysis, I tried to highlight all the current features of the 3D printer market.

If you are interested in such posts and are not afraid of large analytical texts, subscribe to my profile, I will share my research.

I will also be grateful for the proposed topics for future publications.

3D printing market overview in 2020

Analytics and business

Experts recommend

Author: Andrey Kombarov

Author: Andrey Kombarov

Additive Manufacturing Trends | Application of 3D printing | A look at additive technologies | Business Strategies for 3D Printing | Overview of the 3D printing industry over the past 6 years | Key Findings

The future of additive manufacturing starts with understanding the goals and expectations of 3D printing users around the world. This was the reason for the launch of an ambitious research project by the French company Sculpteo - the annual State of 3D Printing report. Today it is one of the most authoritative and comprehensive sources of information about the real situation and prospects of the industry.

Today it is one of the most authoritative and comprehensive sources of information about the real situation and prospects of the industry.

This year, 1,600 respondents from 71 countries took part in the Sculpteo survey. According to the report, a growing number of companies are realizing the possibilities of additive manufacturing, increasing investments and demonstrating undeniable confidence in the future of professional use of 3D printing.

This material offers a complete overview of the world of additive manufacturing and will help you develop the right business strategy.

In the blog , the State of the 3D Printing Market 2020 is published in abbreviated form. You can download the full version for free in our virtual library:

Additive Manufacturing Trends

Materials

- New and available materials.

- Improving the quality and stability of budget additive technologies.

- Improving post-processing technologies to obtain parts with the highest quality surface.

- 3D printing from multiple materials at once.

Environmental sustainability

- Biodegradable materials and materials of biological origin.

- Manufactured on demand and on site to reduce transport and environmental costs.

- Application of 3D printing to meet the challenges of renewable energy and energy efficiency.

Technology Development

- Improved usability of software and printers

- Mass Production: Printing and 3D Scanning Speed

- Generative design

Availability

- Reducing the cost of 3D printers and materials (metals, photopolymers).

- Low post-processing costs.

- Sharing projects and tools.

iQB Technologies experts recommend articles:

3D printing as a full-fledged manufacturing technology in the context of the COVID-19 pandemic

2020 results and forecasts: the 3D printing market will grow by 25% annually

Application of 3D printing

The possibilities of 3D printing are growing every day, and with them the scope of its application is expanding. Gradually, companies begin to feel more confident in relation to 3D technologies. 68% of respondents are looking to use additive manufacturing to solve more problems, and 44% of are going to introduce new 3D printing technologies. Most professionals outsource SLS and Jet Fusion printing, as well as metal 3D printing, so they do not need to maintain their own equipment, and this will encourage them to test new technologies.

Gradually, companies begin to feel more confident in relation to 3D technologies. 68% of respondents are looking to use additive manufacturing to solve more problems, and 44% of are going to introduce new 3D printing technologies. Most professionals outsource SLS and Jet Fusion printing, as well as metal 3D printing, so they do not need to maintain their own equipment, and this will encourage them to test new technologies.

So what are the most popular 3D printing and post-processing technologies? Let's find out!

We emphasize once again that production volumes using 3D printing continue to grow. We are seeing this growth in research and development and education, which is in line with the increased demand for new materials and technologies in the market.

Click image to enlarge

The use of photopolymers is increasing through both internal and external services, while for metal 3D printing, most users outsource.

Design, testing and prototyping remain the main tasks solved with the help of 3D printing.

Stability and quality control remain a major concern for users seeking to scale up the use of 3D printing.

Most users use SLS, Jet Fusion and metal 3D printing technologies through outsourcing without purchasing equipment.

3D printing users are interested in exploring new applications, technologies and materials.

Typically, 3D printing is used in conjunction with traditional manufacturing methods such as laser cutting, CNC machining, and injection molding.

A look at additive technologies

What do respondents think about 3D printing technologies? In this section, we will look at the main benefits of 3D printing for users and their companies. How exactly does it optimize production processes?

66% of respondents use 3D printing to create parts with complex geometries. Survey participants cite the reduction in iterations, lead times and costs as the most important benefits of this technology.

In this section, we will also look at the future of the additive industry and the factors driving its growth and business adoption. What needs to be done to accelerate the adoption of 3D technologies? Now we'll find out.

As technology and materials become more accessible, the cost savings of 3D printing become clear to more and more users. Many also cite time savings due to reduced iterations and lead times as a benefit.

Set-up costs and lack of knowledge are seen as the main limiting factors for the adoption of 3D printing.

The role of 3D printing in business and manufacturing continues to grow.

New materials and reliable technologies are in demand for more than 55% industries.

3D Printing Business Strategies

Additive manufacturing is a huge competitive advantage. With some significant benefits of 3D printing, such as reduced lead times and speed of innovation, the vast majority of respondents view 3D printing as a significant improvement for their business.

As for money, investment in additive technologies is growing every year. Most of these users will increase their investments in 2020! It can also be seen that the vast majority of those surveyed have been using 3D printing for several years and plan to invest more in this technology in the near future. The business world believes in the promise of additive manufacturing.

Let's watch how 3D printing becomes a real asset for companies, helping them develop their business strategy!

63% of see a significant or dramatic impact on sales. Reduced lead times and speed of innovation are the most important success metrics for 3D printing.

Nearly 60% of consider 3D printing one of their strengths compared to the competition.

65% of companies plan to increase their investment in 3D printing in 2020.

The integration of 3D printing into manufacturing processes continues to increase: 74% of actively use 3D printing in their companies.

Overview of the 3D printing industry over the past 6 years

The Sculpteo report offers a look at the analysis of the state of the 3D printing industry for each year since 2015. How has the use of 3D printing evolved over the period 2015-2020? Let's look at the answers of the latest polls.

Large-scale production using 3D printing continues to spread, becoming as commonplace as prototyping and testing.

Accelerating development and offering customized products and limited editions remains a major challenge for companies using 3D printing.

The market share of photopolymers continues to increase, showing significant growth over the past two years.

Key Findings

1. Lack of stability is the Achilles' heel of 3D printing

In order for additive technologies to become an integral part of any production, it is necessary to develop equipment and materials that ensure high stability.

- 51% claims to use 3D printing mostly for quality control purposes.

- 62% of believe the 3D printing industry needs more robust technology to grow.

2. 3D printing is gaining ground in certain industries

Many industries are beginning to increase their use of 3D printing as its role in their manufacturing processes becomes more significant. Users are constantly deepening their knowledge and experience in the application of additive technologies.

- 80% of have been using 3D printing in their companies for over 2 years.

- 33% expect up to 50% increase in investment this year, which is a more conservative estimate than in previous years.

3. 3D printing may not be profitable

For wider use of additive technologies, the cost of manufactured parts must be reduced - this will attract more industries and sectors.

- More than 50% of outsource SLS, Jet Fusion, SLM/DMLS and Binder Jetting to offset equipment and service costs.

Learn more