3D printing penny stocks

Top 3D Printing Stocks for Q4 2022

Table of Contents

Table of Contents

-

Best Value 3D Printing Stocks

-

Fastest Growing 3D Printing Stocks

-

3D Printing Stocks With the Best Performance

SSYS is top for value and performance and NNDM is top for growth

By

Noah Bolton

Full Bio

Noah has about a year of freelance writing experience. He's worked on his investing website dealing with topics such as the stock market and financial advice for beginners.

Learn about our editorial policies

Updated October 06, 2022

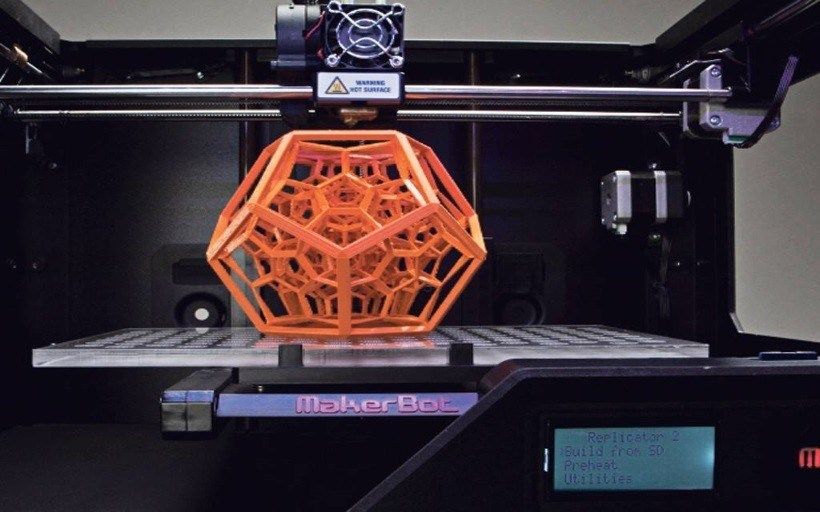

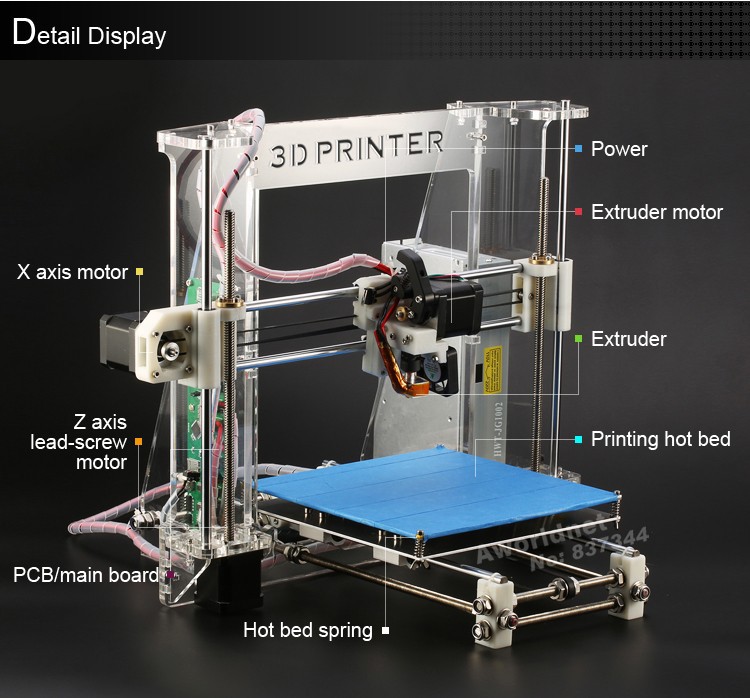

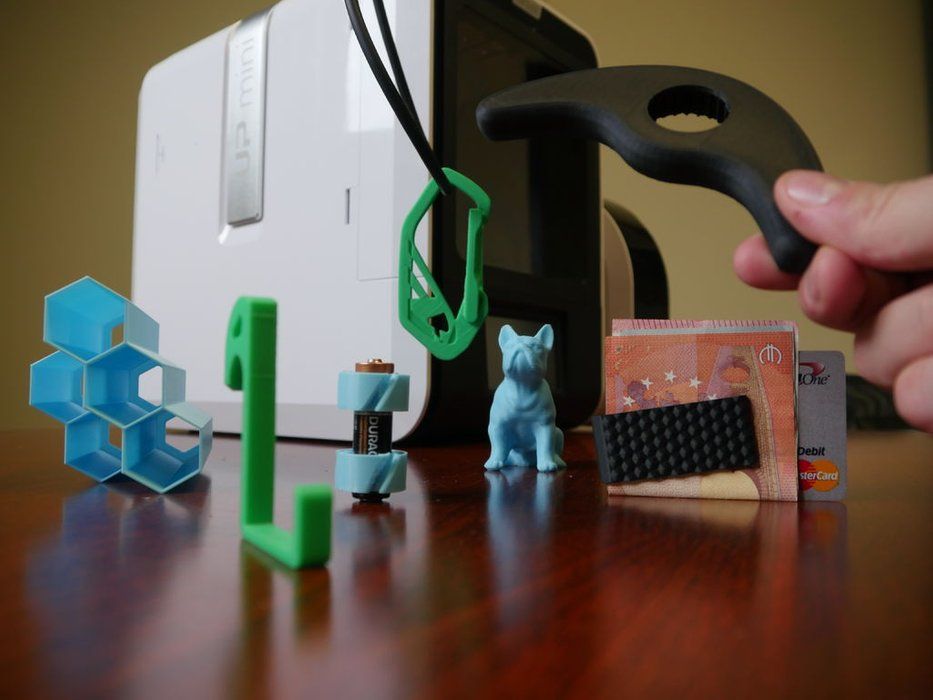

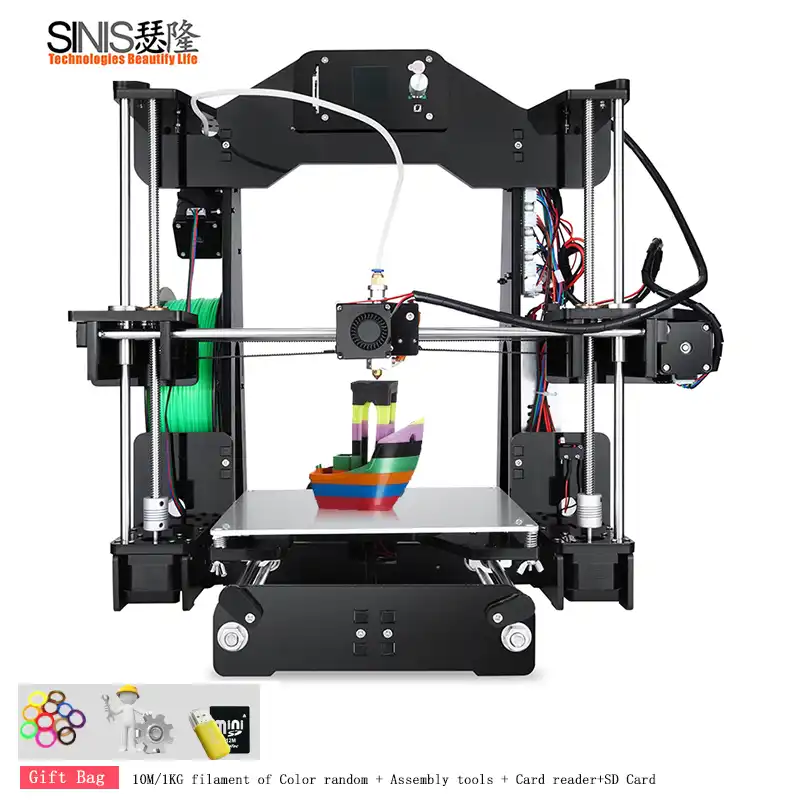

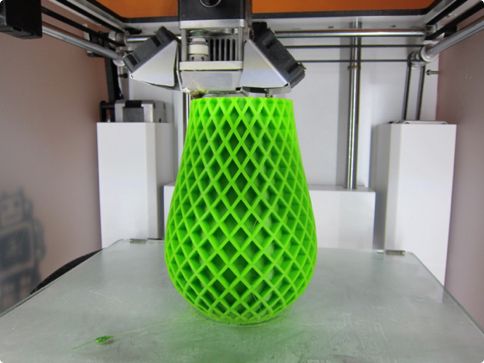

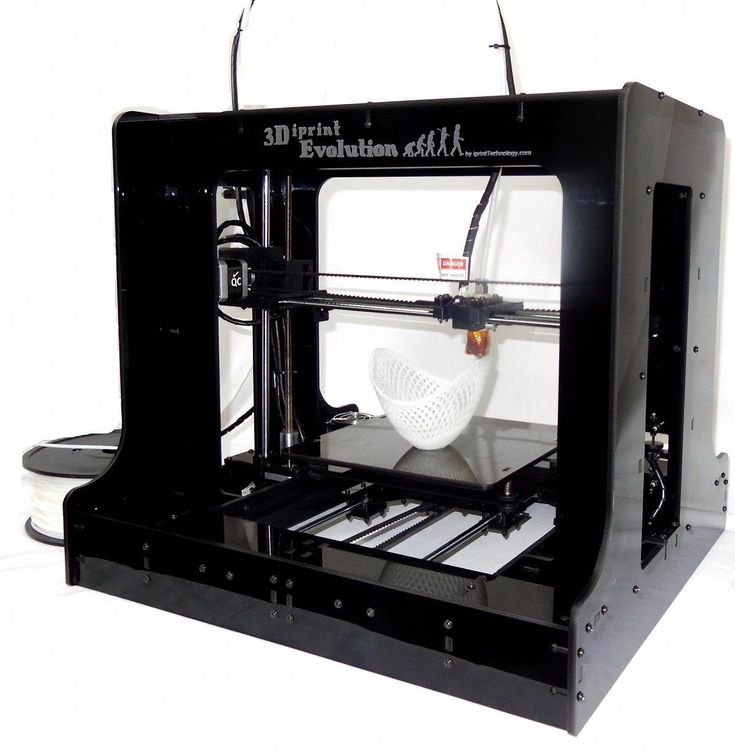

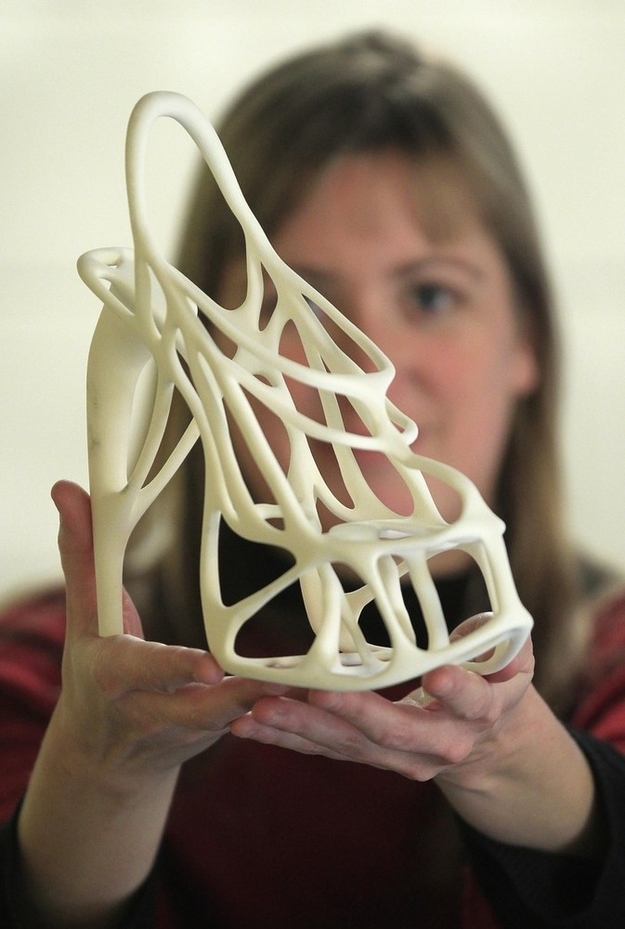

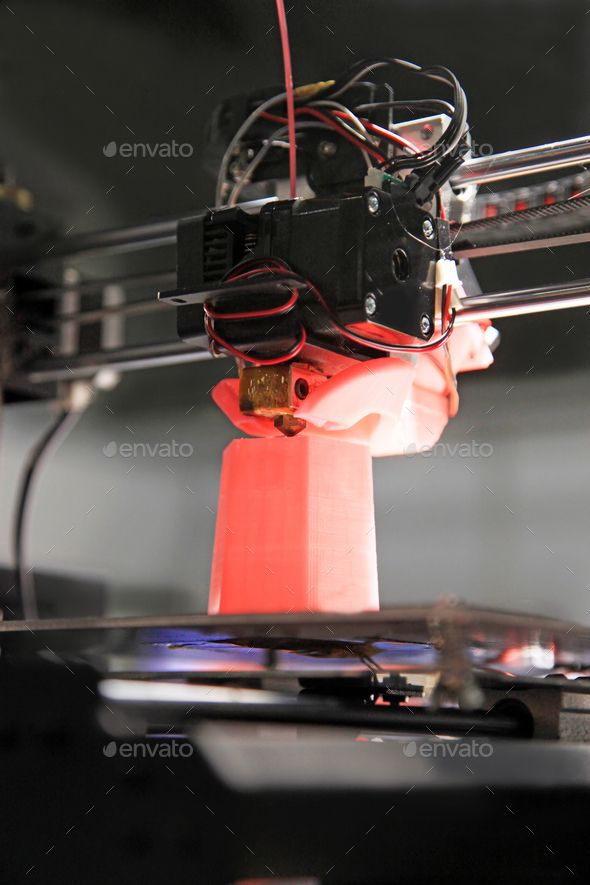

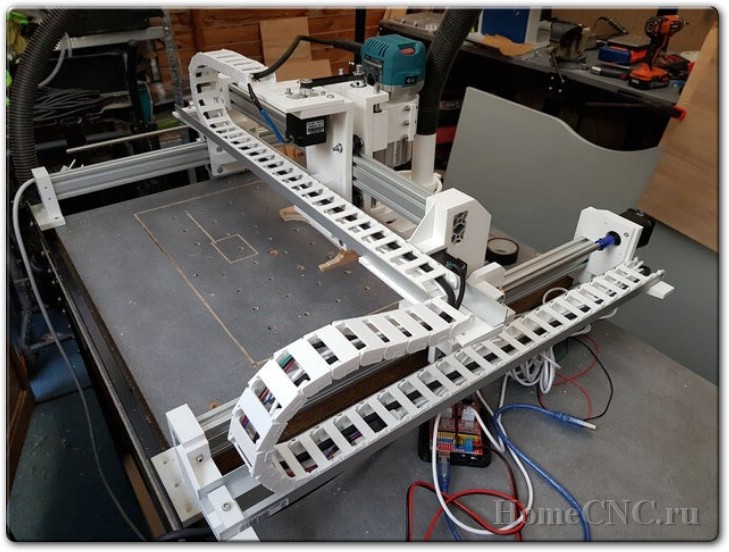

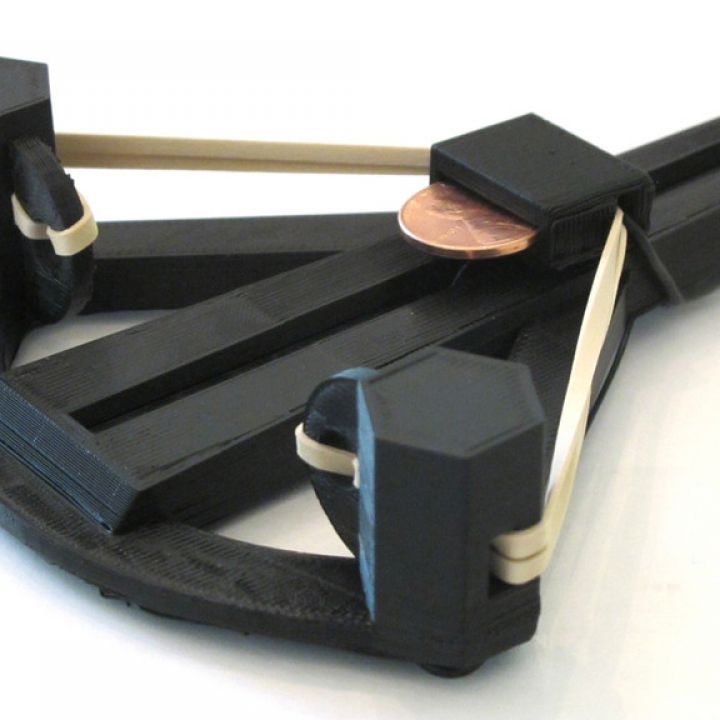

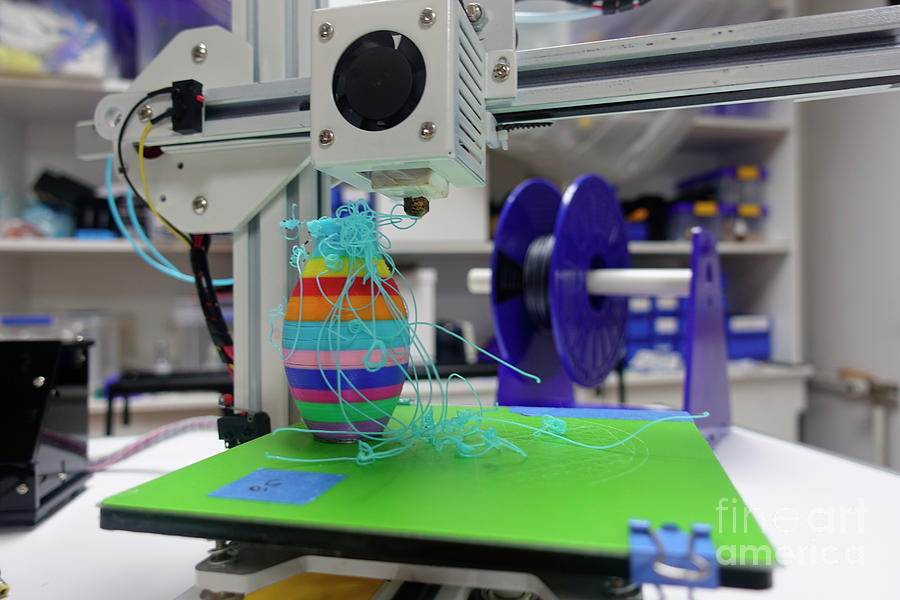

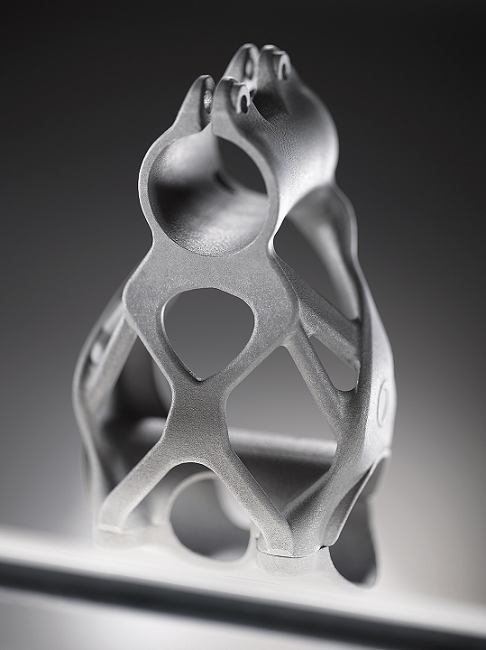

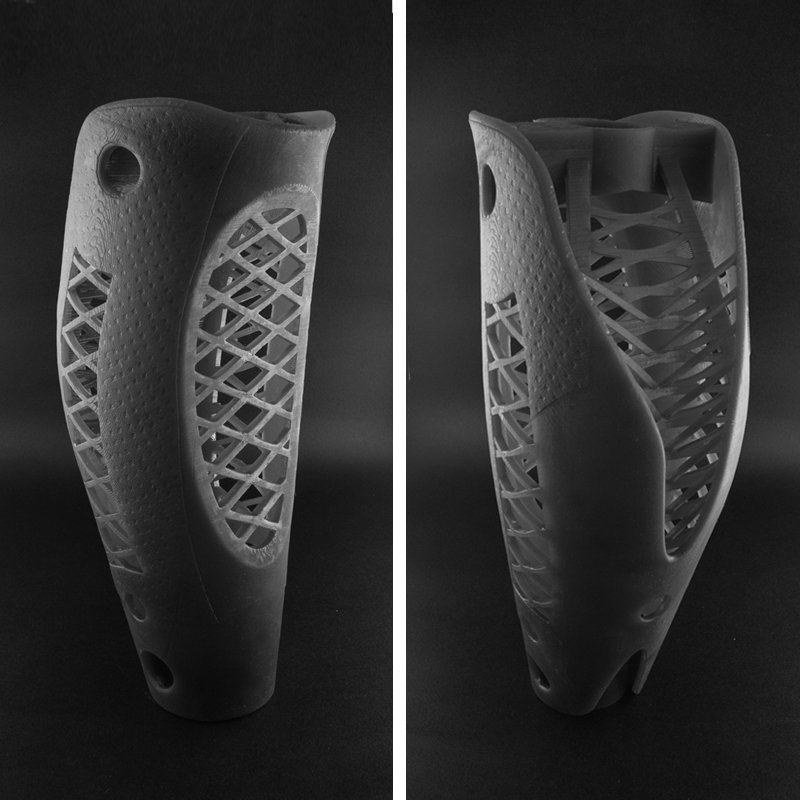

The 3D printing industry is made up of companies that provide products and services capable of manufacturing a range of products. 3D printing, also known as additive manufacturing, creates physical objects from digital designs. The printing process works by laying down thin layers of material in the form of liquid or powdered plastic, metal, or cement, and then fusing the layers together. Though still too slow for mass production, it is a revolutionary technology that has the potential to disrupt the manufacturing logistics and inventory management industries. The 3D printing industry is comprised of only a handful of companies, including players such as Proto Labs Inc., Faro Technologies Inc., and Desktop Metal Inc.

The industry is so young that it has no meaningful benchmark index. But the performance of these stocks can be compared to the broader market as represented by the Russell 1000 Index. These stocks have not performed well. Stratasys Ltd. (SSYS), the best performing 3D printing stock, has dramatically underperformed the Russell 1000, which has provided a total return of -12.5% over the past 12 months. This market performance number and all statistics in the tables below are as of Sept. 20, 2022.

Here are the top three 3D printing stocks with the best value, fastest sales growth, and the best performance.

These are the 3D printing stocks with the lowest 12-month trailing price-to-sales (P/S) ratio. For companies in early stages of development or industries suffering from major shocks, this metric can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

For companies in early stages of development or industries suffering from major shocks, this metric can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

| Best Value 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing P/S Ratio | |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 1.6 |

| 3D Systems Corp. (DDD) | 9.00 | 1.2 | 2.0 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | 2.1 |

Source: YCharts

- Stratasys Ltd.: Stratasys offers 3D printing solutions, such as 3D printers, polymer materials, a software ecosystem, and related parts.

It serves a variety of industries, including aerospace, automotive, consumer products, and healthcare. On Sept. 13, Stratasys completed the merger of its MakerBot subsidiary with Ultimaker, which offers platforms used to make 3-D printers. Ultimaker is backed by NPM Capital. The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%.

It serves a variety of industries, including aerospace, automotive, consumer products, and healthcare. On Sept. 13, Stratasys completed the merger of its MakerBot subsidiary with Ultimaker, which offers platforms used to make 3-D printers. Ultimaker is backed by NPM Capital. The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%. - 3D Systems Corp.: 3D Systems provides 3D printing solutions. The company offers a range of hardware, software, and materials designed for additive manufacturing. Its products and services are used in a variety of industries and sectors, including aerospace, automotive, semiconductor, healthcare, and more.

- Proto Labs Inc.: Proto Labs is an e-commerce-based company that provides digital manufacturing services. It offers 3D printing, injection molding, CNC machining, and sheet metal fabrication.

On Aug. 5, Proto Labs announced financial results for Q2 2022, the three-month period ending on June 30, 2022. Net income fell more than 80% to $2.6 million from the prior-year quarter while revenue rose 3.1%.

On Aug. 5, Proto Labs announced financial results for Q2 2022, the three-month period ending on June 30, 2022. Net income fell more than 80% to $2.6 million from the prior-year quarter while revenue rose 3.1%.

These are the 3D printing stocks with the highest YOY sales growth for the most recent quarter. Rising sales can help investors identify companies that are able to grow revenue organically or through other means and find growing companies that have not yet reached profitability. In addition, accounting factors that may not reflect the overall strength of the business can significantly influence earnings per share. However, sales growth can also be potentially misleading about the strength of a business, because growing sales on money-losing businesses can be harmful if the company has no plan to reach profitability.

| Fastest Growing 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | Revenue Growth (%) | |

Nano Dimension Ltd. (NNDM) (NNDM) | 2.45 | 0.6 | 1,270 |

| Desktop Metal Inc. (DM) | 3.07 | 1.0 | 203.9 |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 13.3 |

Source: YCharts

- Nano Dimension Ltd.: Nano Dimension is an Israel-based 3D printing company focused on developing equipment and software for 3D-printed electronics. It develops printers for multilayer printed circuit boards and nanotechnology-based inks. The company serves a range of industries, including consumer electronics, healthcare, aerospace, and automotive. On Sept. 1, Nano Dimension released Q2 2022 results. The company's net loss widened sharply to $40.0 million from a loss of $13.6 million in the same quarter a year earlier even as revenue soared more than 13-fold. The larger second-quarter loss was fueled partly by $10.9 million in non-cash adjustments for depreciation and amortization expenses, and share-based payments.

- Desktop Metal Inc.: Desktop Metal manufactures 3D printers and related equipment used to build complex parts from metal. It also offers 3D printing software. The company serves a range of industries, including automotive, consumer products, education, and heavy industry. On Aug. 08, the company reported Q2 2022 results. Desktop Metals' net loss increase nearly seven-fold to $297.3 million compared to the same quarter a year earlier even as revenue tripled.

- Stratasys Ltd.: See above for company description.

These are the 3D printing stocks that had the smallest declines in total return over the past 12 months out of the companies we looked at.

| 3D Printing Stocks With the Best Performance | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing Total Return (%) | |

Stratasys Ltd. (SSYS) (SSYS) | 15.49 | 1.0 | -34.5 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | -50.6 |

| Materialise NV (MTLS) | 10.95 | 0.6 | -53.9 |

| Russell 1000 | N/A | N/A | -12.5 |

Source: YCharts

- Stratasys Ltd.: See above for company description.

- Proto Labs Inc.: See above for company description.

- Materialise NV: Materialise is a Belgium-based provider of additive manufacturing software and 3D printing services. It serves a range of industries, including healthcare, aerospace, and automotive. On Sept. 7, Materialise completed its acquisition of Identity3D, which makes products that encrypt, distribute, and track digital parts as they move through supply-chains. The value of the deal was not specified in the announcement.

The comments, opinions, and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

YCharts. "Financial Data.

"

"Stratasys Ltd. "Stratasys Completes Merger of MakerBot with Ultimaker."

Proto Labs Inc. "Proto Labs Q2 2022 Earnings Release."

Nano Dimension Ltd. "Earnings Press Release for Q2 2022."

Desktop Metals Inc. " Desktop Metals Second Quarter 2022 Earnings."

Materialise NV. "Materialise Acquires Indenity3D."

The Stock Dork Stock Ideas, Penny Stocks, Product Reviews

The Stock Dork Stock Ideas, Penny Stocks, Product ReviewsSkip to content

The Stock Dork Has Been Featured On

The Best Stock Ideas, Investor Education and Penny Stocks are on Thestockdork.com

The 9 Best Robinhood Penny Stocks (November 2022)

- By Noah Zelvis

- Aug 29, 2022

The 8 Best Solar Stocks To Buy For November 2022

The 8 Best SPACs To Buy For November 2022 + What Is A SPAC?

The 7 Best Cybersecurity ETFs To Buy For November 2022

The 9 Best Robinhood Stocks Under 10 Dollars To Buy For November 2022

Most Recent Posts

Chaikin Analytics Review (Is Power Gauge Report Legit?)

- By Chris Dios

- Nov 27, 2022

Marc Chaikin’s company has made a name for itself as a sophisticated research publisher. But do its insights and stock research tools really live up...

But do its insights and stock research tools really live up...

Marc Chaikin Predictions and Warnings (2022)

- By Chris Dios

- Nov 26, 2022

Marc Chaikin predicts that a huge market event could be right around the corner in 2022, and he lays out his investment forecast in his...

True Wealth Systems Review (Is Steve Sjuggerud Legit?)

- By Chris Dios

- Nov 24, 2022

Steve Sjuggerud’s proprietary software is turning heads in investment circles. But is it legit? Read my True Wealth Systems review to find out everything you...

Warlock’s World Review (Is Kenny Glick Legit?)

- By Jenna Gleespen

- Nov 23, 2022

Kenny Glick’s new research service is making waves online, and I want to see if his insights check all the boxes. Keep reading for my...

View More

Popular Reviews

Marc Chaikin Predictions and Warnings (2022)

Marc Chaikin predicts that a huge market event could be right around the corner in %currentyear%, and he lays out his investment forecast in his. ..

..

Read More

Motley Fool Rule Breakers Review (2022)

Given the success of Stock Advisor, many want to know if its sister service packs the same punch and hard-hitting market analysis. Check out my...

Read More

Capitalist Exploits Review (Is The Insider Newsletter Legit?)

The Stock Dork is reader supported. We may earn a commission, at no additional cost to you if you buy products or signup for services...

Read More

Motley Fool Review: Is Stock Advisor Worth the Money?

The Stock Dork is reader supported. We may earn a commission, at no additional cost to you if you buy products or signup for services...

Read More

Stock Market Investing

The 6 Best Farmland REITs To Buy Now

The 7 Best Retail REITs To Buy Now

The 5 Best Hotel REITs To Buy Now

The 4 Best Online Slot Developer Stocks

The 5 Best Value Stocks for Inflation November 2022

The 4 Best Penny Stocks Under 25 Cents for November 2022

The 3 Best Value Stocks To Buy For November 2022

The 9 Best Healthcare Penny Stocks To Buy Now

The 9 Best Value Stocks For Long-Term

The 9 Best Mid-Cap Value Stocks To For November 2022

The 7 Best Cannabis Penny Stocks To Buy For November 2022

The 6 Best Small Cap Value Stocks to Buy For November 2022

Stock Market News

- By Jenna Gleespen

- Oct 03, 2022

What Are The Safest Assets To Invest In During A Recession? Experts Explain

By Noah Zelvis

Penny Stocks that Could Explode in November 2022 (Top 8)!

By Chris Dios

5 Dividend Stocks to Buy Now

Two Penny 3D Printing Securities to Look Out For (TKSTF, SGLB)

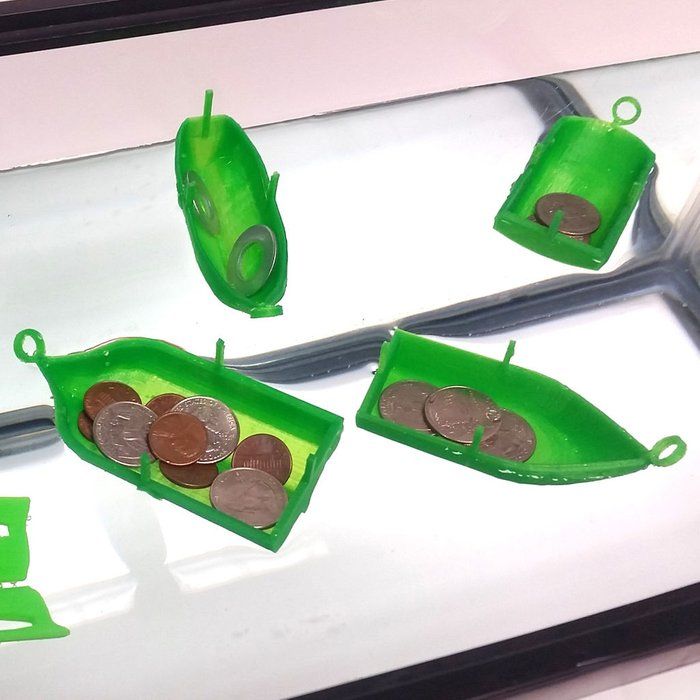

3D printing or additive manufacturing is an exciting and dynamic sector. 3D printing has the ability to change the way products are designed, manufactured, acquired, and purchased. Currently, there are many promotions that focus on 3D printing. For an investor looking for penny stocks in the 3D printing sector, there are fewer choices. Print-related penny holdings include Tinkerine and Sigma Labs, Inc. Penny stocks present many risks, but for an investor looking for a more speculative investment, they can also provide attractive upside potential. (For more on penny stocks in general, see The Lowdown on Penny Stocks.)

3D printing has the ability to change the way products are designed, manufactured, acquired, and purchased. Currently, there are many promotions that focus on 3D printing. For an investor looking for penny stocks in the 3D printing sector, there are fewer choices. Print-related penny holdings include Tinkerine and Sigma Labs, Inc. Penny stocks present many risks, but for an investor looking for a more speculative investment, they can also provide attractive upside potential. (For more on penny stocks in general, see The Lowdown on Penny Stocks.)

Tinkerine

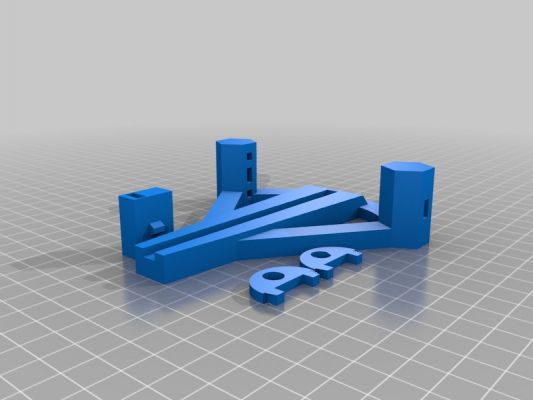

Tinkerine (TKSTF) is based in Canada and trades over the counter (OTC). The firm targets the consumer and educational 3D printing market and sells its Ditto Pro 3D printer, software, filament and accessories. The Ditto Pro 3D printer received positive reviews, particularly from Make magazine: and received the best award for 3D printing at CES Asia.

Tinkerine's Q2 2015 results show strong revenue growth, with Q2 2015 revenue more than triple Q1 2015 from C$108,000 to US$345,000 (financial Tinkerine results are presented in Canadian dollars). Second-quarter revenue was also more than six times higher than 2014's reported second-quarter earnings of C54,603. Despite strong revenue growth, the firm continues to decline. In 2015, Tinkerine recorded a loss of C$340,076 in the second quarter, but this is a trend in a positive direction. The four quarters prior to the second quarter of 2015 had losses greater than C$500,000.

Second-quarter revenue was also more than six times higher than 2014's reported second-quarter earnings of C54,603. Despite strong revenue growth, the firm continues to decline. In 2015, Tinkerine recorded a loss of C$340,076 in the second quarter, but this is a trend in a positive direction. The four quarters prior to the second quarter of 2015 had losses greater than C$500,000.

Net income "src =" // i. Investopedia. com/u53863/tinkerine_chart2. png "style=" display: block; height: 384px; margin-left: auto; margin-right: auto; width=645px; "title="John Linton" />

Tinkerine has shown some positive progress, but investors will have to rely on Tinkerine's ability to continue to raise additional funding until it can operate profitably and generate positive cash flow from operations.

Sigma Labs

Another interesting 3D printing penny stock is Sigma Labs, Inc. (SGLB). Sigma Labs was founded in 2010 and is based in New Mexico. The firm also trades on the over-the-counter market. Sigma Labs sells a quality management system for additive manufacturing that can evaluate the quality of a product in real time as it is produced. Sigma Labs' flagship quality assessment product, PrintRite3D, targets the aerospace industry for parts that are built using an additive.

The firm also trades on the over-the-counter market. Sigma Labs sells a quality management system for additive manufacturing that can evaluate the quality of a product in real time as it is produced. Sigma Labs' flagship quality assessment product, PrintRite3D, targets the aerospace industry for parts that are built using an additive.

Sigma Labs also has a line of products for 3D printing production. The firm recently purchased a state-of-the-art intaglio printer. Assuming Sigma Labs can provide contract services to customers, this product line should immediately boost revenue and bottom line.

Sigma Labs' historical financials show stagnant earnings and net income that has declined over the last two quarters. Investors should exercise caution as the firm failed to generate significant revenue growth. Without a significant increase in revenue or a sharp reduction in costs, the company will not achieve profitability.

There are some developments on the horizon that could start boosting Sigma Labs' revenue. As previously mentioned, Sigma Labs is expanding the manufacturing contract for its metal 3D printers. This product line can add additional revenue and profit. The firm appears to be producing some thrust with their quality assurance production line. Sigma Labs announced that it has entered into an agreement with Honeywell International, Inc. (HON HONHoneywell International Inc145.60+0.44% Created with Highstock 4.2.6) to test Sigma Labs' PrintRite3D. A successful Honeywell test may result in additional purchases from Honeywell and other customers.

As previously mentioned, Sigma Labs is expanding the manufacturing contract for its metal 3D printers. This product line can add additional revenue and profit. The firm appears to be producing some thrust with their quality assurance production line. Sigma Labs announced that it has entered into an agreement with Honeywell International, Inc. (HON HONHoneywell International Inc145.60+0.44% Created with Highstock 4.2.6) to test Sigma Labs' PrintRite3D. A successful Honeywell test may result in additional purchases from Honeywell and other customers.

The Bottom Line

For investors who understand the risks of investing in penny and OTC stocks, these two stocks could be an interesting entry point into the 3D printing sector. Tinkerine showed positive growth in the second quarter of 2015 and has an award-winning product. Sigma Labs is adding additional product lines and has major corporations testing their quality assurance product. The 3D printing sector is competitive and rapidly changing; making once promising companies obsolete and catapulting some firms to large valuations. The risks with Tinkerine and Sigma Labs are high, but the upside could be significant.

The risks with Tinkerine and Sigma Labs are high, but the upside could be significant.

Fundamental analysis of Penny Stocks

Fundamental analysis of Penny Stocks is much more accessible than other securities.

Penny Stocks - shares of companies with a price below $5. Our trader akyushin asked me to talk about the fundamental indicators, which can be used to see the prerequisites for the growth of such stocks. I must say right away that it is better to watch as little as possible below 0.5 or even 1 dollar. There are obstacles to growth. Either the company is on the verge of bankruptcy, or it has a dark forest of problems, in which there are huge losses, or it has just come into being and still does not represent anything.

Pump & Dump

Many advise avoiding "pump and dump" stocks. Now I'll tell you what it is. Penny stocks are usually illiquid and therefore subject to manipulation. A buyer of a large volume of such shares leaks information to the market under the guise of an insider and waits for a non-professional to start buying him back. The off-topic guys are guided by the analysts' excitement about the stock and prefer the stock that traders avoid. Then a large market participant splits up its volume and puts it up for sale under the guise of epic bullshit, which will soon turn from a chrysalis into a butterfly. As interest increases, shares are traded more and more actively, with

The off-topic guys are guided by the analysts' excitement about the stock and prefer the stock that traders avoid. Then a large market participant splits up its volume and puts it up for sale under the guise of epic bullshit, which will soon turn from a chrysalis into a butterfly. As interest increases, shares are traded more and more actively, with manipulator is a real master of his craft, selling evenly enough to keep the line of potential buyers. When he runs out of volumes, novice investors have a ton of shares for ten, and there is no one to sell them to, and they have to lower the price of this product, sometimes bought at exorbitant prices. In these cases, the manipulator is said to be using a "pump and dump" strategy.

Nyse & Nasdaq vs OTC

Contrary to popular belief, we are still looking at securities that are not listed on major US exchanges. These are traded on the over-the-counter market (OTC). When they say that it is better to take companies with a revenue of at least $10 million, we laugh. When trading Penny Stocks, there are no universal criteria. Of course, it is better to take offices that constantly generate cash and increase cash flow, and at the same time avoid firms with a high debt load. There are a lot of prejudices about trading small cap stocks. First of all, because of the lack of transparency of OTC firms compared to other companies traded on the Nyse and Nasdaq. You can’t refuse penny stocks, which are often mentioned in the media and analyst mailing lists, but we try to seize the moment in them from the arrival of volume to the decline. There are only two rules for trading penny stocks. The first is to never invest more than 5% in one stock, and preferably more than 1% of the amount of funds in the portfolio. And the second. Try to choose companies that, from the point of view of other investors, will generate money. Actually, this question should be asked in any transaction, purchase of a subscription to software or analytics. The only disadvantage of OTC compared to Nyse and Nasdaq, in terms of infrastructure, is that a market order may not be executed due to

When trading Penny Stocks, there are no universal criteria. Of course, it is better to take offices that constantly generate cash and increase cash flow, and at the same time avoid firms with a high debt load. There are a lot of prejudices about trading small cap stocks. First of all, because of the lack of transparency of OTC firms compared to other companies traded on the Nyse and Nasdaq. You can’t refuse penny stocks, which are often mentioned in the media and analyst mailing lists, but we try to seize the moment in them from the arrival of volume to the decline. There are only two rules for trading penny stocks. The first is to never invest more than 5% in one stock, and preferably more than 1% of the amount of funds in the portfolio. And the second. Try to choose companies that, from the point of view of other investors, will generate money. Actually, this question should be asked in any transaction, purchase of a subscription to software or analytics. The only disadvantage of OTC compared to Nyse and Nasdaq, in terms of infrastructure, is that a market order may not be executed due to low liquidity of the market the desire of a major player to hold the volume until the price increases, and not to split.

How to trade penny stocks, or where to buy marijuana?

It's better to trade penny stocks the way big market participants do it. Since it is not you who becomes the initiator of the manipulation, then you need to take shares fractionally. For example, instead of buying 10,000 UCMTD papers for $1.05, it would be better to order to buy 5,000 at $1.10 and another 5,000 at $1.00. The average transaction price in this case will be $ 1.10, but it will be more likely to pass. The advantage of weakly traded papers may be greater sectoral diversity. For example, among penny stocks, there are many stocks related to the marijuana trade. Such offices as MJNA, PHOT, CBIS, MWIP, CANV, GRNH are usually popular. You can buy low-liquid securities in the hope of an M&A deal or a lucrative contract. In the US, this makes sense, first of all, in the field of high technology, where sector leaders show good activity, for example, GOOG among search engines (remember, for example, the purchase of NEST) and DDD in the field of 3D printing. At the same time, major events can become a signal not only for buying, but also for selling penny stocks, as was the case with THEGQ after the TWTR IPO.

At the same time, major events can become a signal not only for buying, but also for selling penny stocks, as was the case with THEGQ after the TWTR IPO.

Stock screener penny stocks

OTC stock screeners a dime a dozen:

- otcmarkets com / research / stock-screener

- screener finance yahoo com

- Just in case, you can check the data with the Dailyfinance screener and Market Watch (marketwatch com / tools / stockresearch / screener - 766 shares).

- At superstockscreener com / stock-screener, you can select a stock by return on assets and equity, operating and free cash flow, return on revenue by net and operating income. According to the criterion from 1 to 5 dollars, 808 shares are searched.

- An in depth analysis of the stock can be found at gurufocus com. The screener is paid, but very high quality. There is a price search here. Looking for 2310 shares.

- Best - Google Finance Stock Screener. It is free, searches on the main American sites, including OTC.

From $1 to $5, you get 3,072 shares.

From $1 to $5, you get 3,072 shares.

On information services, including finviz, Yahoo and Google, data on penny stocks are submitted, as a rule, with a big delay. Of course, you can’t catch short-term movements based on such information, so when choosing securities, you also need to read analytical reports and figure out the news for tickers. But at the same time, it is these services that show the generally accepted criteria for evaluating existing companies, so they should not be completely ignored either. *** Fundamental analysis of penny stocks shows that the advantage of Nyse and Nasdaq over OTC is by no means unambiguous. Of course, the compulsive selling of US stocks often artificially gives the impression that they will go up a lot. But the methods of market manipulation are extremely transparent. To create an image of a rising or falling stock under the guise of an insider, which is known only to a select few, information is leaked that controls quotes. Therefore, OTC stocks can be fairly predictable. What events will actually affect Ticker, market participants may not guess. Of course, except for the dividend cutoff, half a month before which it is better not to buy. But the market still, as they say, is happy to be deceived if it can make money on it. The main thing when analyzing Penny Stocks is that we are only interested in a few parameters that we can measure ourselves. So when selecting shares in the screener, I usually set the price (Share Price) from 1 to 5 dollars. Then I choose by ratios, among which are the usual price to earnings (P / E), to book value and to sales, as well as the PEG parameter - price growth to earnings equal to the ratio of P / E to annual income growth per security. Further, you can already select the industry (Industry), securities significantly lower than the highs and / or with increased volatility. As a rule, I take high-tech stocks and do not average into a loss, which is what I wish you. If there are other strategies and setups, welcome to the comments.

What events will actually affect Ticker, market participants may not guess. Of course, except for the dividend cutoff, half a month before which it is better not to buy. But the market still, as they say, is happy to be deceived if it can make money on it. The main thing when analyzing Penny Stocks is that we are only interested in a few parameters that we can measure ourselves. So when selecting shares in the screener, I usually set the price (Share Price) from 1 to 5 dollars. Then I choose by ratios, among which are the usual price to earnings (P / E), to book value and to sales, as well as the PEG parameter - price growth to earnings equal to the ratio of P / E to annual income growth per security. Further, you can already select the industry (Industry), securities significantly lower than the highs and / or with increased volatility. As a rule, I take high-tech stocks and do not average into a loss, which is what I wish you. If there are other strategies and setups, welcome to the comments.