3D printing mutual fund etf

Total 3D-Printing Index - ETF Tracker

ETFs Tracking Other Mutual Funds

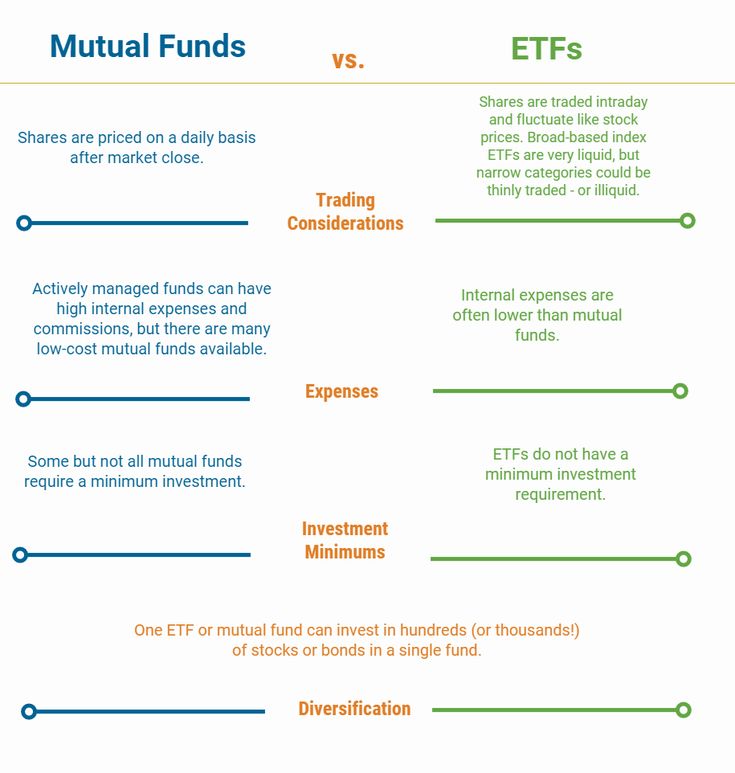

Mutual Fund to ETF Converter Tool

- Overview

- Returns

- Fund Flows

- Expenses

- Dividends

- Holdings

- Taxes

- Technicals

- Analysis

- Realtime Ratings

ETFs Tracking The Total 3D-Printing Index – ETF List

ETFs tracking the Total 3D-Printing Index are presented in the following table.

ETFs Tracking The Total 3D-Printing Index – ETF Returns

The following table presents historical return data for ETFs tracking the Total 3D-Printing Index.

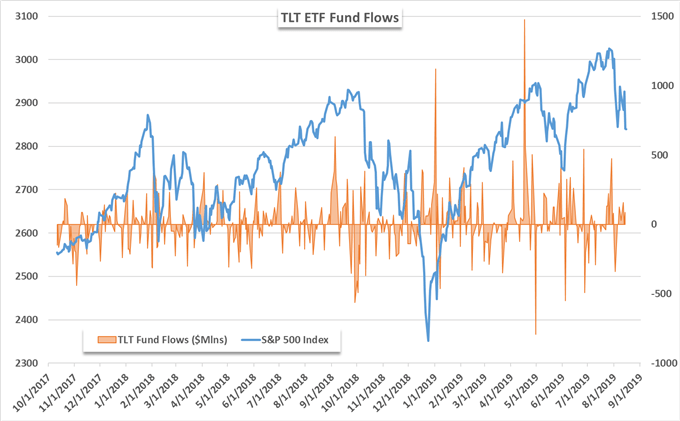

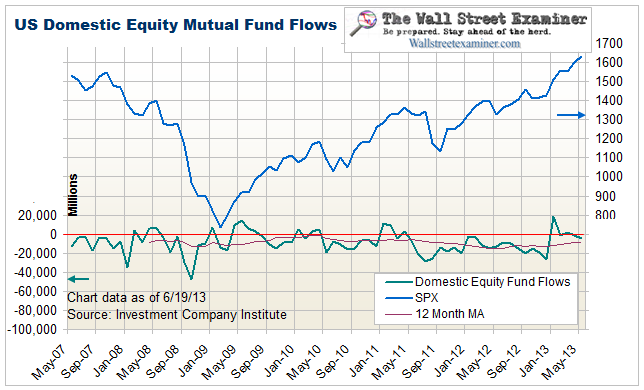

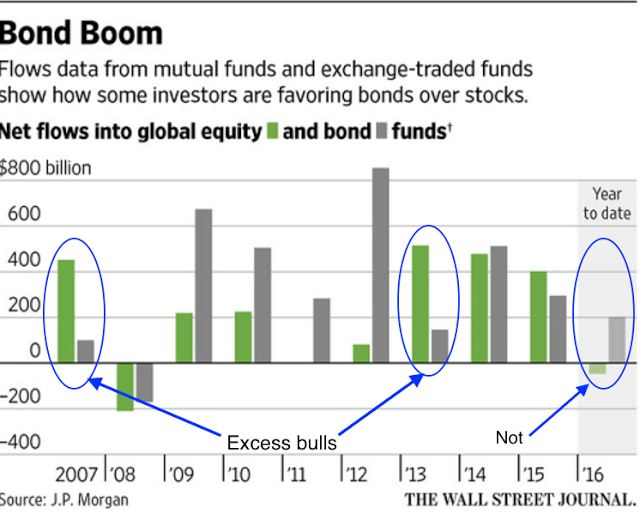

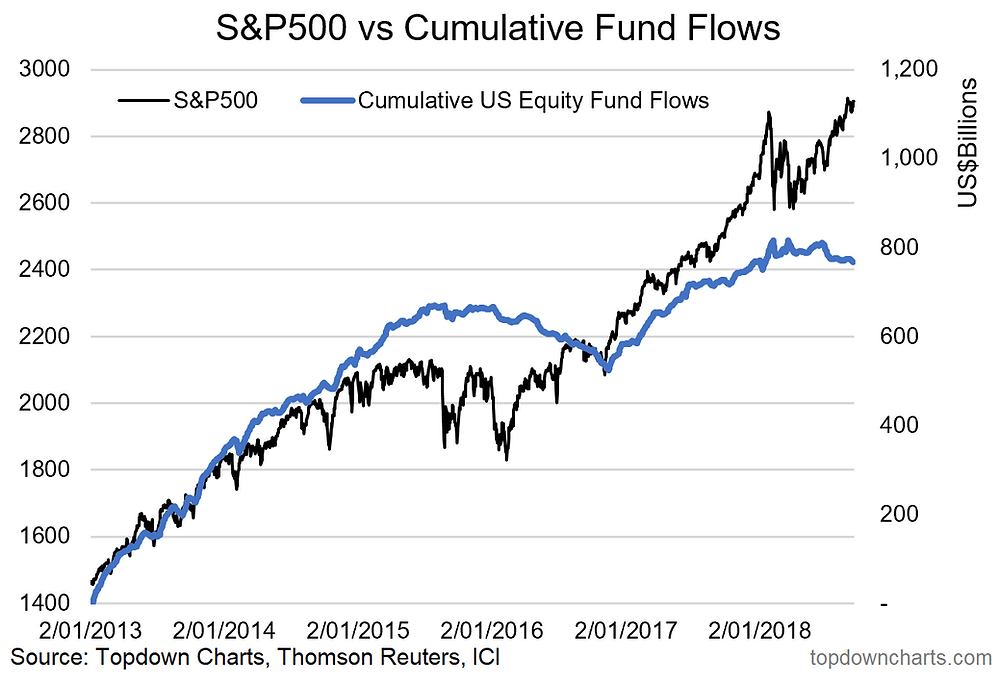

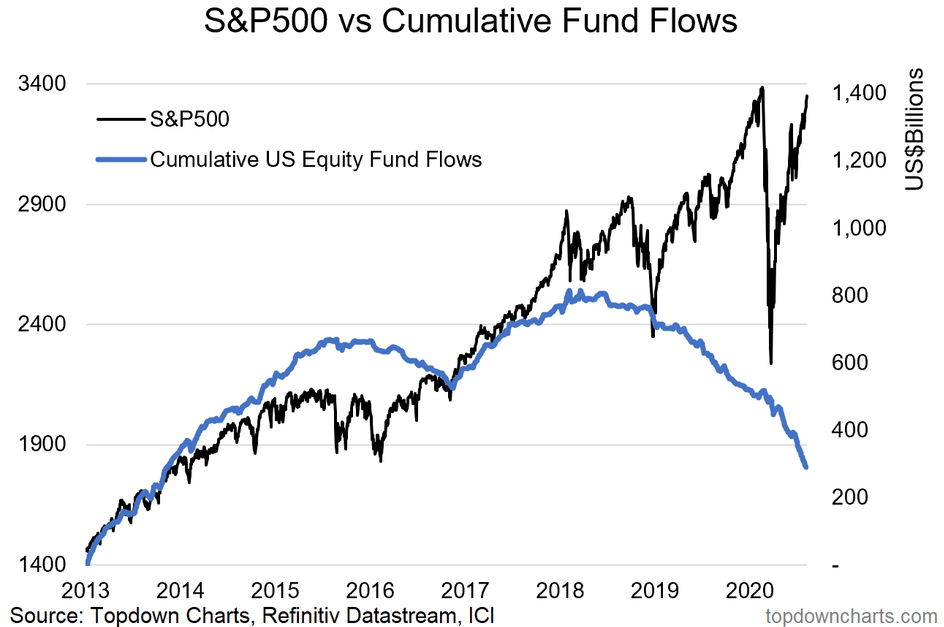

ETFs Tracking The Total 3D-Printing Index – ETF Fund Flow

The table below includes fund flow data for all U.S. listed Highland Capital Management ETFs. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

Fund Flows in millions of U.S. Dollars.

ETFs Tracking The Total 3D-Printing Index – ETF Expenses

The following table presents expense information for ETFs tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Dividends

The following table presents dividend information for ETFs tracking the Total 3D-Printing Index, including yield and dividend date.

ETFs Tracking The Total 3D-Printing Index – ETF Holdings

The following table presents holdings data for all ETFs tracking the Total 3D-Printing Index. For more detailed holdings data for an ETF click the ‘View’ link in the right column.

ETFs Tracking The Total 3D-Printing Index – ETF Tax Rates

The following table presents sortable tax data for ETFs currently tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Technicals

The following table presents certain technical indicators for ETFs tracking the Total 3D-Printing Index. To see complete technical metrics click the ‘View’ link in the right column.

ETFs Tracking The Total 3D-Printing Index – ETF Analysis

The following table presents links to in-depth analysis for ETFs tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Realtime Ratings

The following table presents a proprietary ETF Database rating for ETFs tracking the Total 3D-Printing Index.

Total 3D-Printing Index - ETF Tracker

| Symbol | ETF Name | Asset Class | Total Assets* | YTD | Avg Volume | Previous Closing Price | 1-Day Change | Overall Rating | 1 Week | 1 Month | 1 Year | 3 Year | 5 Year | YTD FF | 1 Week FF | 4 Week FF | 1 Year FF | 3 Year FF | 5 Year FF | ETF Database | Inception | ER | Commission Free | Annual Dividend Rate | Dividend Date | Dividend | Annual Dividend Yield % | P/E Ratio | Beta | # of Holdings | % In Top 10 | Complete | ST Cap Gain Rate | LT Cap Gain Rate | Tax Form | Lower Bollinger | Upper Bollinger | Support 1 | Resistance 1 | RSI | Advanced | Fact Sheet | ETF Holdings | Chart | ETF Home Page | Head-To-Head | Liquidity Rating | Expenses Rating | Returns Rating | Volatility Rating | Dividend Rating | Concentration Rating |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PRNT | 3D Printing ETF | Equity | $178,515 | 5. 8% 8% | 22,192.0 | $21.67 | 1.26% | 5.9% | 1.5% | -33.0% | -5.4% | -14.6% | Technology Equities | 2016-07-19 | 0.66% | N/A | $0.00 | 2019-12-27 | $0.02 | 0.00% | 39.1 | 1.30 | 58 | 43.4% | View | 40% | 20% | 1099 | $19. 50 50 | $22.25 | N/A | N/A | 55.81 | View | View | View | View | View | View | B+ | B- |

Sort By:

- Overview

- Returns

- Fund Flows

- Expenses

- Dividends

- Holdings

- Taxes

- Technicals

- Analysis

- Realtime Ratings

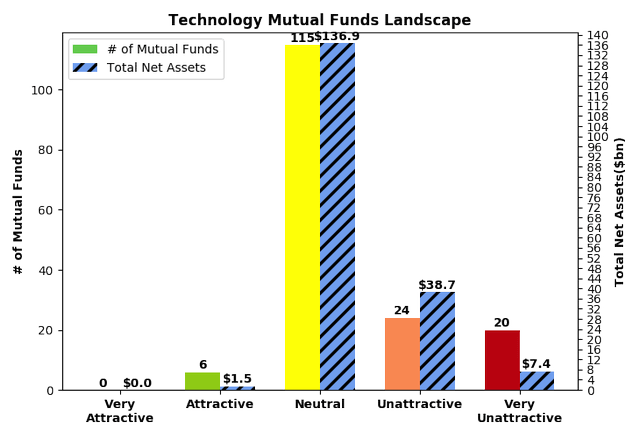

ETFs Tracking Other Technology Equities

ETF Database staff has allocated each ETF in the ETF database, as well as each index, to a single ‘best-fit’ ETF Database Category. Other ETFs in the Technology Equities ETF Database Category are presented in the following table.

Other ETFs in the Technology Equities ETF Database Category are presented in the following table.

* Assets in thousands of U.S. Dollars. Assets and Average Volume as of 2023-01-10 15:16:04 -0500

ETFs Tracking Other Technology Equities

Historical return data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Fund flow information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Expense information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Dividend information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Holdings data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Tax Rate data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Technical information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Links to analysis of other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Links to a proprietary ETF Database rating for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

| Symbol | ETF Name | Asset Class | Total Assets* | YTD | Avg Volume | Previous Closing Price | 1-Day Change | Overall Rating | 1 Week | 1 Month | 1 Year | 3 Year | 5 Year | YTD FF | 1 Week FF | 4 Week FF | 1 Year FF | 3 Year FF | 5 Year FF | ETF Database | Inception | ER | Commission Free | Annual Dividend Rate | Dividend Date | Dividend | Annual Dividend Yield % | P/E Ratio | Beta | # of Holdings | % In Top 10 | Complete | ST Cap Gain Rate | LT Cap Gain Rate | Tax Form | Lower Bollinger | Upper Bollinger | Support 1 | Resistance 1 | RSI | Advanced | Fact Sheet | ETF Holdings | Chart | ETF Home Page | Head-To-Head | Liquidity Rating | Expenses Rating | Returns Rating | Volatility Rating | Dividend Rating | Concentration Rating |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VGT | Vanguard Information Technology ETF | Equity | $39,266,900 | 2. 1% 1% | 767,428.0 | $326.15 | 0.65% | 3.1% | -2.5% | -24.4% | 32.4% | 99.6% | Technology Equities | 2004-01-26 | 0.10% | Vanguard | $2.79 | 2021-09-29 | $0.89 | 0.63% | 32.8 | 1.08 | 374 | 58.8% | View | 40% | 20% | 1099 | $304. 39 39 | $343.60 | $322.79 | $328.00 | 50.07 | View | View | View | View | View | View | A | A | |||||||||||

| XLK | Technology Select Sector SPDR Fund | Equity | $38,246,300 | 2.0% | 7,072,928.0 | $126.96 | 0.62% | 3.0% | -2. 7% 7% | -22.8% | 38.3% | 102.5% | Technology Equities | 1998-12-16 | 0.10% | N/A | $1.10 | 2021-09-20 | $0.27 | 0.67% | 27.5 | 1.04 | 78 | 66.5% | View | 40% | 20% | 1099 | $118.69 | $133.96 | $125.72 | $127. 68 68 | 49.90 | View | View | View | View | View | View | A+ | A | |||||||||||

| IYW | iShares U.S. Technology ETF | Equity | $7,822,070 | 2.0% | 931,794.0 | $76.01 | 0.70% | 2.8% | -2.5% | -29.8% | 27.7% | 84.8% | Technology Equities | 2000-05-15 | 0. 39% 39% | N/A | $0.32 | 2021-09-24 | $0.07 | 0.29% | 39.3 | 1.06 | 142 | 61.1% | View | 40% | 20% | 1099 | $70.94 | $80.17 | $75.23 | $76.40 | 49.64 | View | View | View | View | View | View | A | A- | |||||||||||

| SMH | VanEck Semiconductor ETF | Equity | $6,717,330 | 8. 0% 0% | 4,367,939.0 | $219.09 | 1.30% | 8.8% | 0.7% | -25.5% | 55.6% | 125.9% | Technology Equities | 2000-05-05 | 0.35% | N/A | $1.50 | 2020-12-21 | $1.50 | 0.50% | 28.2 | 1.17 | 25 | 59.4% | View | 40% | 20% | 1099 | $193. 83 83 | $224.92 | N/A | N/A | 56.77 | View | View | View | View | View | View | A | A | |||||||||||

| SOXX | iShares Semiconductor ETF | Equity | $6,182,910 | 7.8% | 1,147,164.0 | $375.16 | 1.29% | 8.9% | 0.5% | -27. 2% 2% | 51.7% | 121.7% | Technology Equities | 2001-07-10 | 0.35% | N/A | $3.17 | 2021-09-24 | $1.16 | 0.61% | 32.7 | 1.17 | 31 | 57.2% | View | 40% | 20% | 1099 | $331.41 | $386.15 | $369.67 | $378.16 | 56. 22 22 | View | View | View | View | View | View | A | A- | |||||||||||

| FTEC | Fidelity MSCI Information Technology Index ETF | Equity | $4,935,430 | 2.1% | 179,573.0 | $96.47 | 0.64% | 3.0% | -2.5% | -24.4% | 32.5% | 94.4% | Technology Equities | 2013-10-21 | 0. 08% 08% | Fidelity | $0.79 | 2021-09-17 | $0.20 | 0.60% | 31.7 | 1.08 | 365 | 58.3% | View | 40% | 20% | 1099 | $90.07 | $101.63 | $95.65 | $96.89 | 50.02 | View | View | View | View | View | View | A- | A+ | |||||||||||

| CIBR | First Trust NASDAQ Cybersecurity ETF | Equity | $4,395,860 | -1. 6% 6% | 673,505.0 | $38.11 | 0.03% | -1.0% | -4.0% | -23.1% | 24.8% | 64.9% | Technology Equities | 2015-07-07 | 0.60% | N/A | $0.06 | 2021-06-24 | $0.03 | 0.11% | 28.0 | 1.02 | 39 | 46.9% | View | 40% | 20% | 1099 | $36. 80 80 | $40.71 | $37.73 | $38.35 | 44.79 | View | View | View | View | View | View | A | B- | |||||||||||

| IGV | iShares Expanded Tech-Software Sector ETF | Equity | $4,259,680 | 1.2% | 1,329,295.0 | $259.06 | 0.10% | 1.0% | -0. 1% 1% | -29.2% | 6.6% | 61.2% | Technology Equities | 2001-07-10 | 0.40% | N/A | $0.00 | 2020-06-15 | $0.07 | 0.00% | 50.1 | 0.99 | 121 | 57.2% | View | 40% | 20% | 1099 | $245.74 | $268.74 | $256.80 | $260. 60 60 | 50.23 | View | View | View | View | View | View | A | A- | |||||||||||

| IXN | iShares Global Tech ETF | Equity | $2,698,650 | 3.1% | 340,305.0 | $46.23 | 0.54% | 3.9% | -2.0% | -24.2% | 30.2% | 80.2% | Technology Equities | 2001-11-12 | 0. 40% 40% | N/A | $1.13 | 2021-06-10 | $0.20 | 1.82% | 38.5 | 1.03 | 132 | 57.2% | View | 40% | 20% | 1099 | $42.96 | $48.34 | N/A | N/A | 51.54 | View | View | View | View | View | View | A | A- | |||||||||||

| SKYY | First Trust Cloud Computing ETF | Equity | $2,512,980 | 0. | 432,087.0 | $57.94 | 1.10% | 0.7% | -3.3% | -41.0% | -7.3% | 25.6% | Technology Equities | 2011-07-05 | 0.60% | N/A | $0.18 | 2021-09-23 | $0.04 | 0.15% | N/A | 0.97 | 68 | 36.2% | View | 40% | 20% | 1099 | $53. 99 99 | $62.29 | $57.16 | $58.33 | 46.96 | View | View | View | View | View | View | A | B | |||||||||||

| Click Here to Join to ETF Database Pro for 14 Days Free, Export This Data & So Much More | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Content continues below advertisement

NewLoading Articles...

3D Printing ETF: Long-Term Bet On A Megatrend (BATS:PRNT)

Oct. 29, 2021 9:38 PM ET3D Printing ETF (PRNT)DM, DDD, CLLKF, CFMS, SLGRF14 Comments

Main Street Investor

3. 95K Followers

95K Followers

Summary

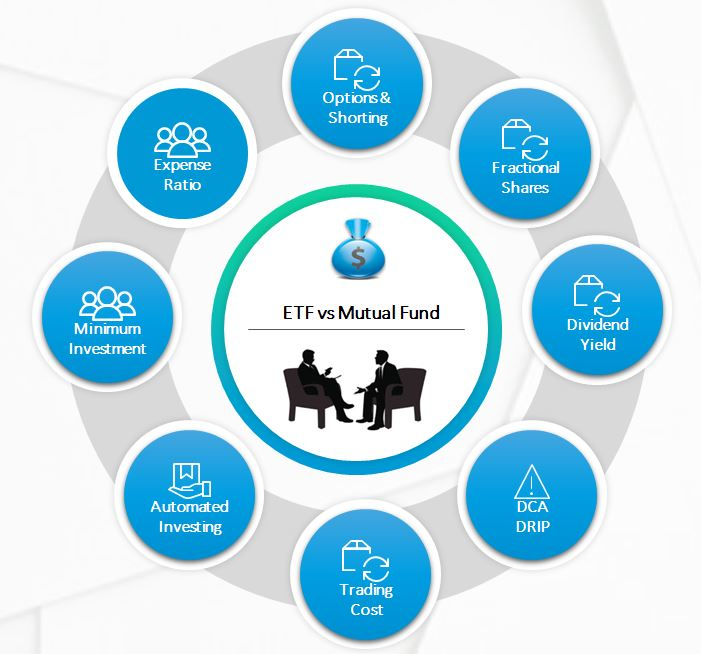

- ARK's printing ETF offers exposure to the 3D printing industry while diversifying individual risk to investors.

- The ETF successfully rotates along the most promising companies engaging in the 3D printing industry.

- While the ETF is trading below all-time highs reached earlier this year, the ETF still outperformed the broader market.

- Looking for more investing ideas like this one? Get them exclusively at Blue Ocean Investing. Learn More »

izusek/E+ via Getty Images

Overview

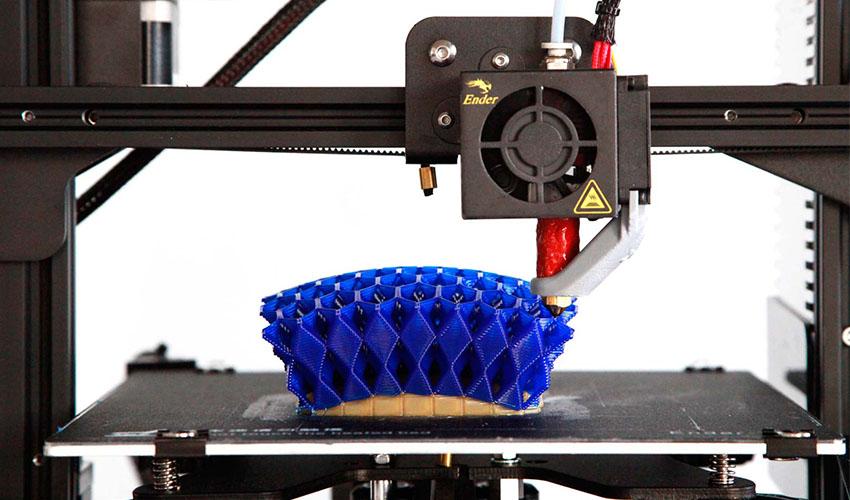

3D Printing ETF (BATS:PRNT) offers an attractive investment opportunity to capitalize on the massive growth of 3D printing in the future. The technology, which has been characterized as a 'hobby' for long, is used increasingly for commercial use and is underestimated in terms of applications. In this regard, 3D printing is being adopted in nearly every significant industry, ranging from the private sector to health, manufacturing, education and more. The market for 3D solutions is growing quickly, therefore the ETF offers a chance to capture growth while diversifying individual risk.

In this regard, 3D printing is being adopted in nearly every significant industry, ranging from the private sector to health, manufacturing, education and more. The market for 3D solutions is growing quickly, therefore the ETF offers a chance to capture growth while diversifying individual risk.

Source: ETF.com

The ETF focuses specifically on 3D printing, including physical printers, hardware, software, printing centers, and materials. Within each category, the selected securities are given equal weight. The top 10 holdings of PRNT ETF account for 50%, while it includes 52 holdings in total. Roughly 66% of the holdings are American companies, while the remaining are well diversified across Europe.

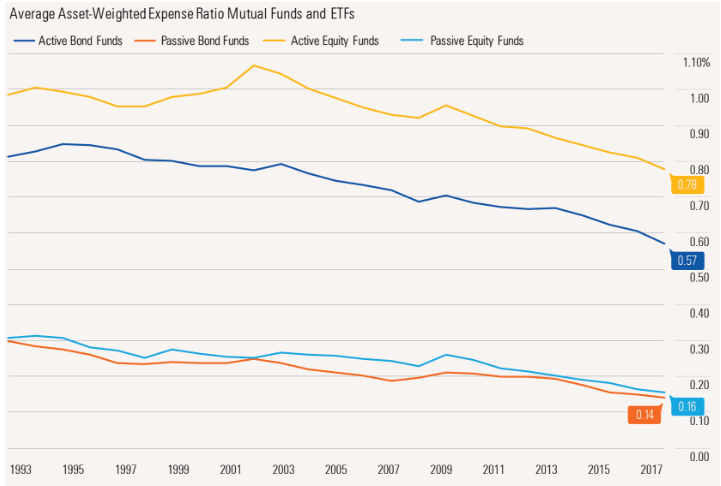

The ETF is rebalanced quarterly and has an average expense ratio of 0.66%, representing the cost of an initial investment. That said, Cathie Woods' ARK fund has gained significant traction at the end of 2020, as innovation technologies surged. However, after trading sideways for some time, the question remains as to whether the ETF can break out once more.

Holdings

Source: Ark Funds

ExOne Co. (NASDAQ:XONE): Being the largest holding of the ETF, the firm develops, manufactures, and markets three-dimensional (3D) printing machines, 3D printed and other products, materials, and services to industrial customers in the United States, Germany, and Japan. It directly sells 3D printing machines as well as indirect applications, including components and tools for 3D printing. Although shares are still down roughly 65% from all-time highs, the stock is trading 120% higher year-over-year.

3D Systems Corp. (NYSE:DDD): Headquartered in the U.S., the company offers 3D printers, such as stereolithography, selective laser sintering, direct metal printing, multi-jet printing, and color jet printers that transform digital data input generated by 3D design software, computer-aided design software, or other 3D design tools into printed parts. The stock has surged over 372% YoY as sales jumped 44% last quarter.

BICO Group (OTCPK:CLLKF): The Swedish bio convergence startup designs and supplies technologies and services to enhance biology research by commercializing bioprinting through artificial intelligence, robotics, multi-omics, and diagnostics. The company is in an ultra growth stage, as sales surged nearly 500% last quarter to $38 million. As a result, Stockholm-listed shares are up 147% YoY.

Conformis Inc. (NASDAQ:CFMS): The medical company develops and manufactures joint replacement implants through the use of 3D printing technologies. It markets and sells its products to orthopedic surgeons, hospitals, and other medical facilities in the United States, Argentina, Europe, the Middle East, and Australia. Trading at just $1.2, Conformis shares have been surging 72% over the last year.

SLM Solutions (OTC:SLGRF): The German-based company engages in the development, production, marketing, and sale of machines and peripheral equipment for selective laser melting. These machines operate based on 3D technology and serve the aerospace, mechanical engineering, tool construction, and automotive industries. The stock is up roughly 100% year-over-year.

These machines operate based on 3D technology and serve the aerospace, mechanical engineering, tool construction, and automotive industries. The stock is up roughly 100% year-over-year.

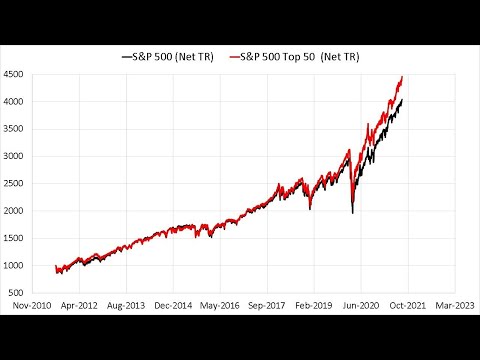

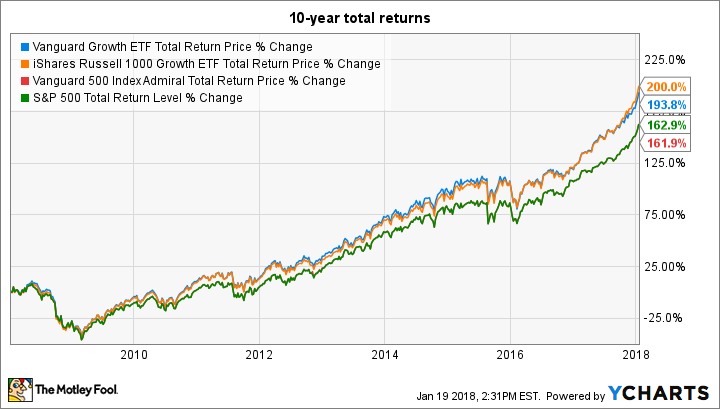

Data by YCharts

As briefly mentioned earlier, the ETF jumped sharply in early 2021, as the underlying stocks benefited from a momentum-driven rally in the technology market. However, after giving up some gains, the ETF has mostly traded sideways, which can be tied back to an overall rotation from growth to value stocks, after rising inflation and the reopening of the economy have made investors more cautious of technology solutions. Still, the ETF has returned 50% to investors, outperforming the broader technology market, which has gained only 35%. It has also outperformed its 'parent ETF' ARK Innovation ETF, which bundles future technologies including Genomics, Internet, Artificial Intelligence, and 3D Printing.

Defiance Quantum ETF (QTUM) has slightly outperformed the ETF, although the ETF rather concentrates on machine learning such as quantum computers and semiconductors. This is also reflected in its holdings including Analog Devices, AMD, and Ambarella. As a result of the semiconductor shortage, the ETF performed slightly better.

This is also reflected in its holdings including Analog Devices, AMD, and Ambarella. As a result of the semiconductor shortage, the ETF performed slightly better.

Attractive Valuation-Even Now

Data by YCharts

Despite the massive rally in 3D stocks, valuations remain attractive concerning the growth potential. In this regard, most 3D printing stocks in PRNT trade below 10x EV to Sales, indicating general undervaluation, IMO. HP Inc. (NYSE:HPQ) especially catches my attention, yet it should be noted that the market cap stands at $35 billion; thus, it may not be as volatile to the upside as other stocks such as Conformis, which is worth around only $220 million.

On the other hand, Bico Group and Straumann Holdings appear more pricey at 42 times Price to Sales and 17 times Price to Sales, although it should be noted that they also hold strong growth rates. Thus, from a valuation standpoint, PRNT remains attractive, although higher valuations than in past years could lead to short to mid-term weakness in the ETF's performance.

Moreover, if we compare these valuations to the main ARKK Innovation ETF, the individual holdings appear reasonably priced when accounting for growth rates and future growth aspects. While almost no securities trade above 20 times sales, the opposite can be said about ARRK's holdings, although margins and growth rates in the fund tend to be higher.

Risks

Despite the enormous opportunity of investing in a quickly-growing industry through a diversified portfolio, various risks should be considered. The commercial 3D printing industry is still relatively new and thus nowhere near saturation. It is still unclear which companies will win the race of 3D printing in the future and many new startups should arise in the next few decades.

Therefore, it is not guaranteed that PRNT ETF will include all these winners and miss out. Also, the ETF performed well in 2020 due to a broad rally in the stock market, and more specifically in Tech stocks. However, when a bear market occurs, the ETF will likely fall proportionally more, as its underlying volatility is higher.

Takeaways

3D Printing ETF is an attractive bundled fund, which deserves more attention from growth-focused investors. The 3D printing industry has more useful applications than most would imagine. The ETF offers exposure to an ultra-growing multibillion-dollar industry, including the most promising companies in the space. Unsurprisingly, investors have been rewarded mightily, as the ETF outperformed the broader market and competing ETFs. Even after an impressive surge of 3D printing stocks, valuations remain attractive, considering the industry's massive potential.

On the other hand, investors have a reason to stay cautious: While the ETF benefitted from a pandemic-induced rally among tech stocks, a higher return converts into higher risk. Thus, if the current bull market fades (or turns into a bear market), performance will reverse quickly. Either way, 3D Printing ETF remains an attractive investment opportunity and is among the only diversified ETFs concentrating solely on 3D printing.

Blue Ocean Investing focuses on finding the next big disruptors that can multiply many times over the long run. We consistently screen and research the most innovative businesses that enjoy gigantic competitive advantages and may be discounted by the market. With a membership you will gain access to:

- Portfolio and Watchlist

- Deep-dive investment research

- 24/7 Live-Chat

- Upcoming IPOs

- An interactive investment community

Get your free 14-day trial now!

This article was written by

Main Street Investor

3.95K Followers

I am a 22 year old investor with a Bachelors degree in Finance and Business. My investing strategy is focused on finding the best opportunities from every sector: value or growth - there is value in everything. For all my investment decisions I undertake extensive research, collecting relevant data, charts and graphs for the given company. The three most crucial ratios for my analysis are margins, CAGR revenue growth and marketing spend as a % of revenue. These measures are all based on 2024 estimates in order to evaluate the given moat of a company/stock. Therefore, all my investments are long-term, with the exception of large fluctuations in the fundamentals of an investment or drastic valuation changes. I hope that I am able to share some of my investment opinions with you and look forward to learning more in the process! Best regards

The three most crucial ratios for my analysis are margins, CAGR revenue growth and marketing spend as a % of revenue. These measures are all based on 2024 estimates in order to evaluate the given moat of a company/stock. Therefore, all my investments are long-term, with the exception of large fluctuations in the fundamentals of an investment or drastic valuation changes. I hope that I am able to share some of my investment opinions with you and look forward to learning more in the process! Best regards

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Comments (14)Recommended For You

To ensure this doesn’t happen in the future, please enable Javascript and cookies in your browser.

Is this happening to you frequently? Please report it on our feedback forum.

If you have an ad-blocker enabled you may be blocked from proceeding. Please disable your ad-blocker and refresh.

Top 10 Most Unusual ETFs

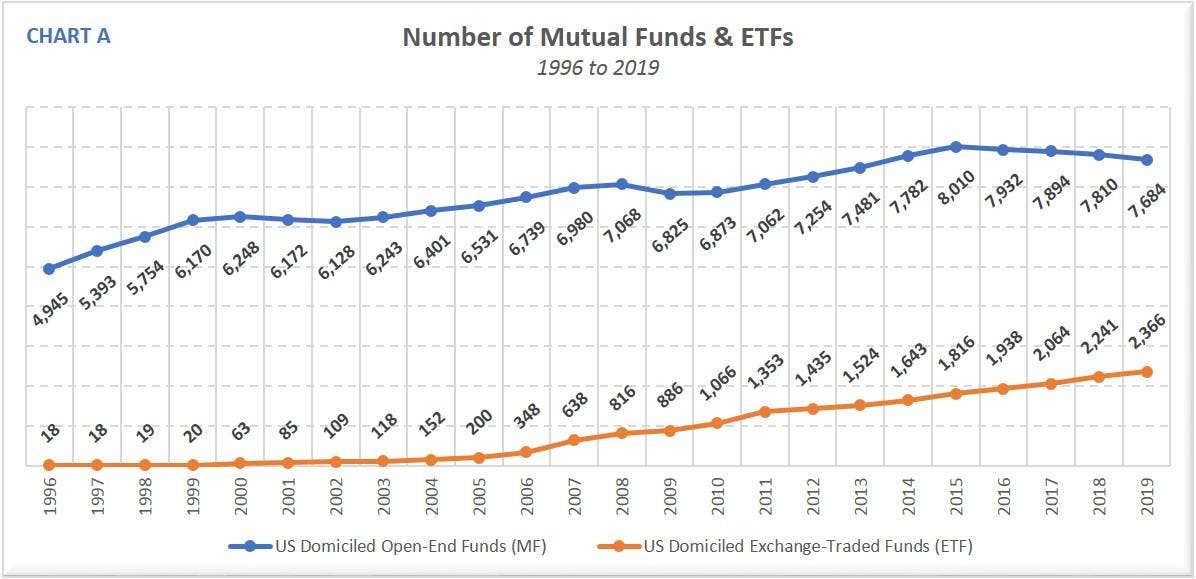

In recent years, Wall Street has been dominated by ETF papers - exchange-traded funds.

In total, about 5,000 such securities are traded in the world, of which about 1,800 are in the US market.

In the US market, you can bet on almost any asset with an ETF: the broad stock market index, indices of individual countries or regions, various industries, commodities, and bonds.

Can focus on individual ideas. Some of the ideas are highly specialized and unusual. Some are related to revolutionary technologies, others are just weird. Such unusual papers will be discussed in today's review. nine0005

PureFunds Drone Economy Strategy ETF (IFLY)

Drones (drones) can be used for a variety of purposes, including the delivery of goods, scientific research, education, surveillance of various territories, including military and agricultural facilities.

IFLY covers the various companies in the drone and drone solution ecosystem, including manufacturers and suppliers. We are talking about solutions in agriculture, construction, oil production, public services, etc. The fund is based on 47 securities. 53% of assets are in the US, including Boeing and GoPro. nine0005

ROBO Global Robotics & Automation Index ETF (ROBO)

Robots are on the rise. They are being used in increasingly sophisticated fields, including surgery. In 2013, Google acquired 8 robot businesses. Meanwhile, Apple intends to spend $10.5 billion on robots and other mechanisms to produce iPhones and iPads.

ROBO covers various companies in the ecosystem of robots and solutions related to them, including artificial intelligence. In total, ETFs include 89securities from 14 countries, both developed and emerging. Geographically, 40% of investments are in the United States.

Global X Lithium & Battery Tech ETF (LIT)

Lithium is heavily used in modern technologies, including the production of electric vehicles. The ETF is based on shares of 34 lithium and lithium battery manufacturers. Largest investment - FMC Corp. and Albemarle with about 16% portfolio shares.

The ETF is based on shares of 34 lithium and lithium battery manufacturers. Largest investment - FMC Corp. and Albemarle with about 16% portfolio shares.

ETFMG Video Game Tech ETF (GAMR)

Fund focused on the fast growing video game segment. More than 60% of ETF assets belong to software developers for the gaming industry. The portfolio also includes securities of enterprises from related areas - manufacturers of game consoles, semiconductors, etc. There are 58 investments in total, including Nintendo, Electronic Arts and Activision Blizzard. nine0005

The Obesity ETF (SLIM)

The fund helps to earn on human weaknesses, namely overeating. The population of the Earth is rapidly gaining weight, and especially unfortunate people are not even allowed on planes. ETFs include stocks of those companies that help in the fight against excess weight. About 80% of investments are in the healthcare segment.

First of all, these are biotech and pharmaceutical enterprises that produce drugs for the treatment of obesity and related diseases (diabetes, high blood pressure, etc. ). In addition, there are shares of companies offering weight loss programs, nutritional supplements and plus size clothing. The portfolio includes such well-known names as Herbalife and Weight Watchers. nine0005

). In addition, there are shares of companies offering weight loss programs, nutritional supplements and plus size clothing. The portfolio includes such well-known names as Herbalife and Weight Watchers. nine0005

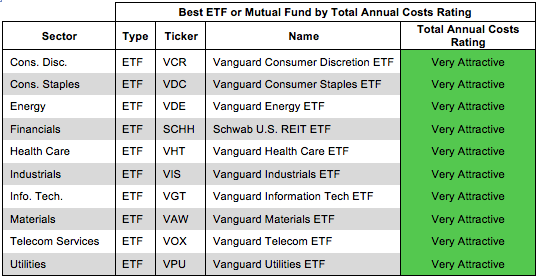

3D Printing ETF (PRNT)

Tracks the Total 3D Printing Index, which is based on stocks of companies involved in the 3D printing industry. The fund's portfolio includes 47 investments from the US, other developed markets and Taiwan with an average capitalization of $3.4 billion, including 3D Systems, HP Inc. and Stratasys. These enterprises produce devices, software and materials for 3D printing.

Global X Millennials Thematic ETF (MILN)

Stocks for those who want to capitalize on Millennial consumer preferences and trends associated with this generation. "Millenials" or "Generation Y" is commonly referred to as people born in 1980-1990s Now they are about 30 years old.

Before us is a kind of demographic fund, which includes stocks from a wide range of categories - social networks, entertainment, food, clothing, etc. 75 securities in total. The largest assets of the Global X Millennials Thematic ETF are such fashion brands as Netflix, Amazon, Nike (the share of each in the portfolio is about 3.5-4.5%).

75 securities in total. The largest assets of the Global X Millennials Thematic ETF are such fashion brands as Netflix, Amazon, Nike (the share of each in the portfolio is about 3.5-4.5%).

Buzz US Sentiment Leaders ETF (BUZ)

The fund's strategy is based on selecting the most popular stocks, according to social networks, and determining the sentiment for these securities. As a result, 75 securities with the highest rating are selected. The approach is a reflection of the growing popularity of social media, which now almost rule the world, shaping consumer sentiment. nine0005

The portfolio is rebalanced every month based on the most recent social media trends. Compared to more conservative ETFs, these changes are fairly frequent. Now the fund has invested most actively in Microsoft, Apple and Nutanix (about 3% of the portfolio for each security).

iPath Bloomberg Livestock Subindex Total Return ETN (COW)

As the name suggests, the fund invests in livestock as a commodity asset. In fact, investments are limited to beef and pork. COW is a good play on inflationary expectations, since meat prices are the most susceptible to changes when inflationary pressures arise. nine0005

In fact, investments are limited to beef and pork. COW is a good play on inflationary expectations, since meat prices are the most susceptible to changes when inflationary pressures arise. nine0005

AI Powered Equity ETF (AIEQ)

The fund uses artificial intelligence (AI) technology to manage a portfolio that primarily consists of U.S. securities. The process of making investment decisions uses its own quantitative model (EquBot Model), running on the Watson platform from IBM. At the moment, the largest investments of the fund are S&P Global Inc., Alphabet, NVIDIA and Amazon (each has over 3% share in the portfolio).

Exotic ETFs are exposed to less liquidity and lack of transparency for some fund investors. In addition, there are specific product risks, so in such cases, diversification is not so obvious. Funds with such assets require careful preliminary analysis.

Oksana Kholodenko,

international market expert BCS Broker

Why are ETFs from Katie Wood popular?

After 2020, the name of the 66-year-old founder of the investment company ARK Invest, Katherine (Kathy) Wood, became known to many investors around the world. The reason is that one of her funds, ARK Innovation (ARKK), has delivered a fantastic 152% return in a year and added more than $10 billion to assets under management. We tell you what is remarkable about Katie Wood's strategy. nine0005

The reason is that one of her funds, ARK Innovation (ARKK), has delivered a fantastic 152% return in a year and added more than $10 billion to assets under management. We tell you what is remarkable about Katie Wood's strategy. nine0005

What is Kathy Wood's strategy based on

Kathy Wood (and ARK Invest, respectively) focuses on thematic strategies that focus on long-term megatrends. Funds mainly acquire shares of technology companies from the field of “disruptive innovations”, which significantly change the patterns of consumption, the functioning of individual industries and enterprises. This sector includes robotics, 3D printing, artificial intelligence, blockchain technology and genomics. nine0005

ARK Invest buys companies, regardless of their capitalization, geographic and sectoral affiliation, as well as profitability. The most important aspect is how much the technology that the company develops will be able to change the daily routine of things in the future, no matter what stage of development this technology is at. Stocks of this type of company (growth stocks), although they have a huge potential for growth in price (if they manage to realize their plans), are much more volatile and are suitable for investors with either a long investment horizon or a high risk tolerance. This type of investment can generate phenomenal returns under certain market conditions, and at the same time suffer significantly during a correction. nine0005

Stocks of this type of company (growth stocks), although they have a huge potential for growth in price (if they manage to realize their plans), are much more volatile and are suitable for investors with either a long investment horizon or a high risk tolerance. This type of investment can generate phenomenal returns under certain market conditions, and at the same time suffer significantly during a correction. nine0005

When choosing a team of analysts, Wood also takes an unorthodox approach. When other Wall Street investment firms hire analysts with financial backgrounds or MBAs, Cathy's team is largely comprised of experts from various non-financial industries who are encouraged to "think outside the box and focus on the long term."

Openness is another distinguishing feature of ARK Invest funds. The official website states that the company offers completely transparent ETFs - information on the composition and transactions made is available to the general public. Most financial companies do not allow portfolio managers and analysts to use social media to share their research or collect information. Wood has created an open source ecosystem where the team can share research and collaborate with scientists, engineers, doctors, and other experts. nine0005

Wood has created an open source ecosystem where the team can share research and collaborate with scientists, engineers, doctors, and other experts. nine0005

Another interesting feature of funds is the fact that they cannot have cash on their balance sheet. Instead, the fund is acquiring, according to Cathy, "cash-like stocks in innovative companies" such as Apple. “For us, FAANG [Meta (Facebook)*, Apple, Amazon, Netflix, Alphabet (Google)] shares act as protective assets – during periods of volatility, we sell these shares and buy more promising, in our opinion, securities,” shares Wood.

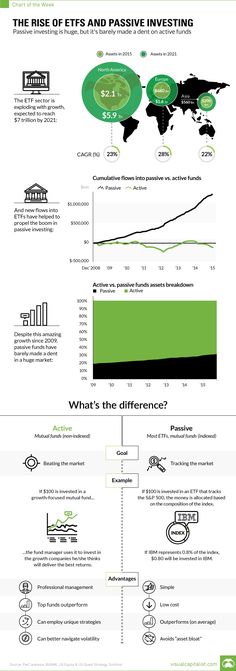

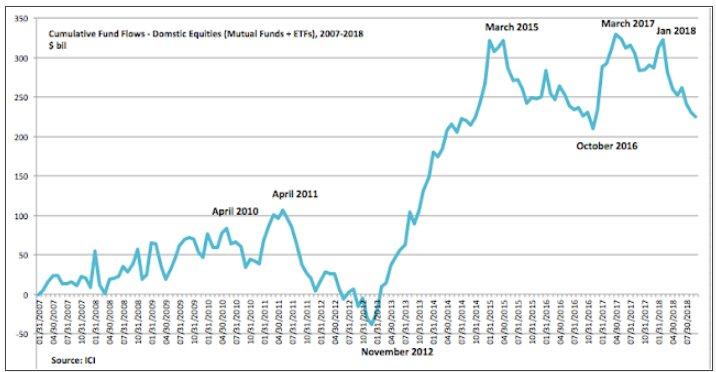

What returns do Kathy Wood's funds show

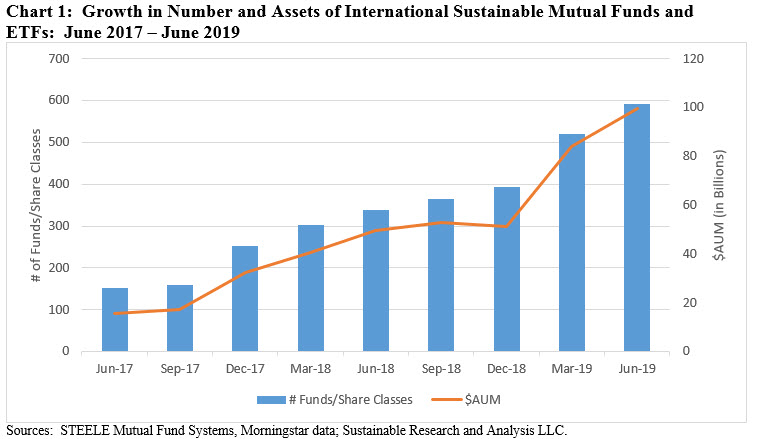

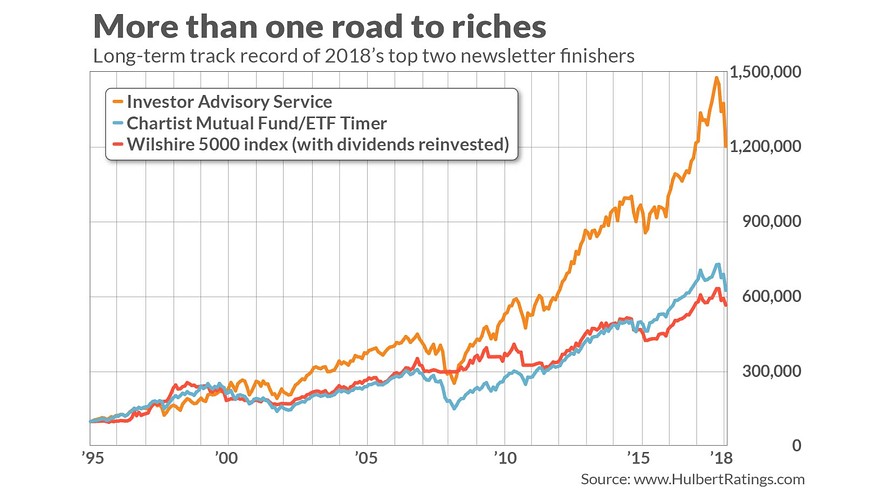

The growth in popularity of ARK Invest and Kathy Wood is primarily due to the returns that the funds (in particular, the aforementioned ARKK) have shown until 2021. The chart below shows the performance of the US Tech Index (NASDAQ-100 Index), the US Broad Market (MSCI US Index), and ARK Invest's flagship ARKK ETF. Yield is calculated from the launch of ARKK (November 2014).

Comparison of ARKK ETF, NASDAQ-100 and MSCI US dynamics

From 2017 to 2022, Kathy Wood's fund outperformed both indexes significantly each year (from launch to peak December 2021, the fund showed a fantastic return of 668% versus 232% of the NASDAQ-100 and 119% of MSCI US returns). The fund's exuberant performance in 2020 can be attributed to the growth in stock prices of the technology sector companies included in the fund's portfolio (in particular, Tesla, Zoom Video Communications Inc., Teladoc Health Inc. and Roku Inc.).

However, from January to July 2022, Katie's fund became an outsider among the analyzed assets. During this period, investors in ARKK lost 52% (versus -21% on NASDAQ and -14% on MSCI US), and from the peak of 2020 - 68%. Due to a significant decline in 2022, the fund began to lose in return to the NASDAQ-100 index and almost equaled the US broad market index. nine0005

How the main fund works Cathy Wood

Katie's willingness to bet on just a few companies is the main reason her funds have outperformed many others - a change in the price of one stock has a greater effect on the return of the entire portfolio, making it potentially more profitable and at the same time much more risky. As a rule, actively managed funds try to reduce the dependence of the fund's performance on the behavior of a few stocks by diversifying the portfolio into hundreds, sometimes thousands of positions. Wood, by contrast, has created rather concentrated funds — for example, according to StockAnalysis, as of August 3, 2022, there are only 34 companies in the portfolio of the flagship ARKK fund: nine0005

As a rule, actively managed funds try to reduce the dependence of the fund's performance on the behavior of a few stocks by diversifying the portfolio into hundreds, sometimes thousands of positions. Wood, by contrast, has created rather concentrated funds — for example, according to StockAnalysis, as of August 3, 2022, there are only 34 companies in the portfolio of the flagship ARKK fund: nine0005

| Company | Weight | Company | Weight |

|---|---|---|---|

| Tesla Inc. | 9.7% | PagerDuty, Inc. | 2.3% |

| Zoom Video Communications, Inc. | 8.7% | Fate Therapeutics, Inc. | 2.3% |

| Roku Inc. | 7.1% nine0142 | Ginkgo Bioworks Holdings Inc. | 2.2% |

| Block, Inc. | 5.1% | Robinhood Markets Inc. | 2. 1% 1% |

| CRISPR Therapeutics AG | 5.0% | Twist Bioscience Corporation | 1.9% |

| Exact Sciences Corporation | 5.0% | Veracyte Inc. | 1.4% |

| Teladoc Health Inc. nine0142 | 4.6% | 10x Genomics, Inc. | 1.4% |

| UiPath Inc. | 4.5% | TuSimple Holdings Inc. | 1.0% |

| Intellia Therapeutics, Inc. | 4.4% | Spotify Technology S.A. | 0.9% |

| Beam Therapeutics Inc. | 4.1% | NVIDIA Corporation | 0.9% |

| Twilio Inc. nine0142 | 3.7% | Pacific Biosciences of California, Inc. | 0.7% |

| Unity Software Inc. | 3.6% | Cerus Corporation | 0.7% |

| Shopify Inc. | 3.5% | 2U Inc. | 0.6% |

| Coinbase Global Inc. | 3.5% | Materialize NV | 0.6% |

| Roblox Corporation nine0142 | 2.8% | Invitae Corporation | 0.4% |

| DraftKings Inc. | 2.7% | Berkeley Lights Inc. | 0.2% |

| Signify Health Inc. | 2.5% | Compugen Ltd. | 0.1% |

Why Cathy Wood Foundations Are Criticized

The growth in popularity of ARK Invest has given rise to the development of the ETF industry as a whole. For example, AXS Investments LLC launched a double-leverage fund on the ARKK (TARK) fund. The same provider previously purchased another fund previously owned by Tuttle Capital Management, the Tuttle Capital Short Innovation ETF (SARK), which bets against ARKK (opens short positions). nine0005

AXS Investments CEO Greg Bassuk said: "We have nothing against Kathy Wood or ARK Invest, and the funds are only launched to give investors the opportunity to go short or longer in disruptive technology companies. " Both funds are actively managed and use derivatives to replicate ARKK's momentum.

" Both funds are actively managed and use derivatives to replicate ARKK's momentum.

Double leveraged ETFs (inverse ETFs) are funds that multiply their return or loss by several times (in the case of double leverage, twice) due to built-in financial leverage. Replication occurs on the basis of derivatives and/or the use of borrowed funds. Inverse ETFs move in the opposite direction of the benchmark, meaning if the benchmark rises 2% on the day, the double leveraged reverse ETF will fall 4%. nine0005

A short position allows you to profit from a falling market. An investor borrows shares from a broker and sells them at the current price, then waits for them to fall, buys them at a reduced cost and returns them to the broker. The difference between the selling and buying price is his income.

Over the past year, the performance of ARK Invest funds has been so low that investors and managers have begun to question whether the previous results were really achieved due to the manager's genius and her progressive approach. Kathy herself replies that the return on her funds can only be judged on a five-year horizon, because the young and unprofitable companies in her portfolio need time to develop. nine0005

Kathy herself replies that the return on her funds can only be judged on a five-year horizon, because the young and unprofitable companies in her portfolio need time to develop. nine0005

Output

An out-of-the-box approach to fundraising, hiring, and a strong marketing strategy based on "explosive technology" has made Katy Wood and her company a symbol of innovation, which has attracted a whole army of fans. Successful market timing also played an important role in this: it was at the end of the second decade of the 21st century that the rapid growth of technology stocks occurred, which ensured the phenomenal growth of ARKK ETF. Nevertheless, ARK Investment funds remain extremely risky due to the high concentration of assets. In 2022, the flagship ARKK ETF lost all its accumulated value and equaled the performance of the broad stock market. The realized risk is a good reminder to investors that active management may not always systematically outperform market benchmarks, especially over a long time horizon.