Investing in 3d printers

Top 3D Printing Stocks for Q4 2022

Table of Contents

Table of Contents

-

Best Value 3D Printing Stocks

-

Fastest Growing 3D Printing Stocks

-

3D Printing Stocks With the Best Performance

SSYS is top for value and performance and NNDM is top for growth

By

Noah Bolton

Full Bio

Noah has about a year of freelance writing experience. He's worked on his investing website dealing with topics such as the stock market and financial advice for beginners.

Learn about our editorial policies

Updated October 06, 2022

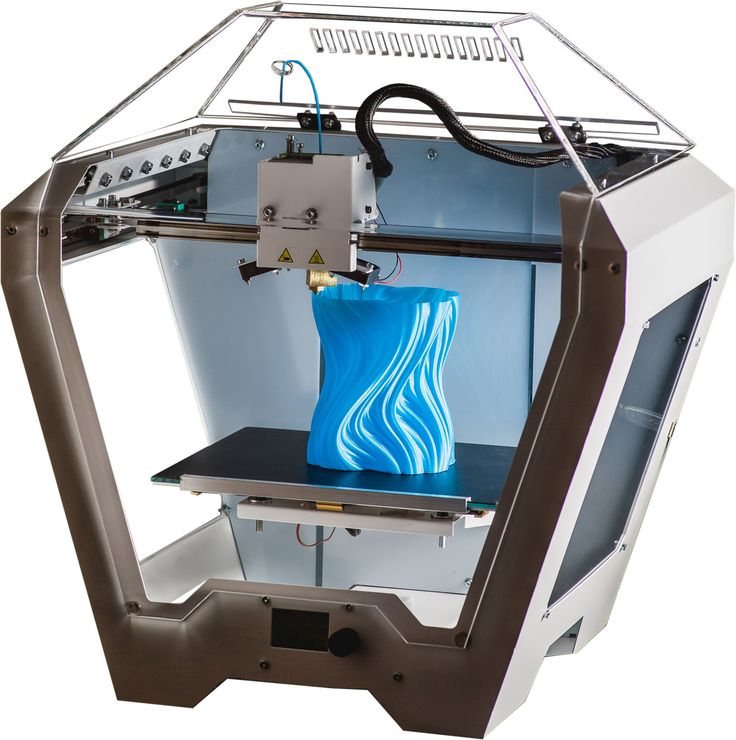

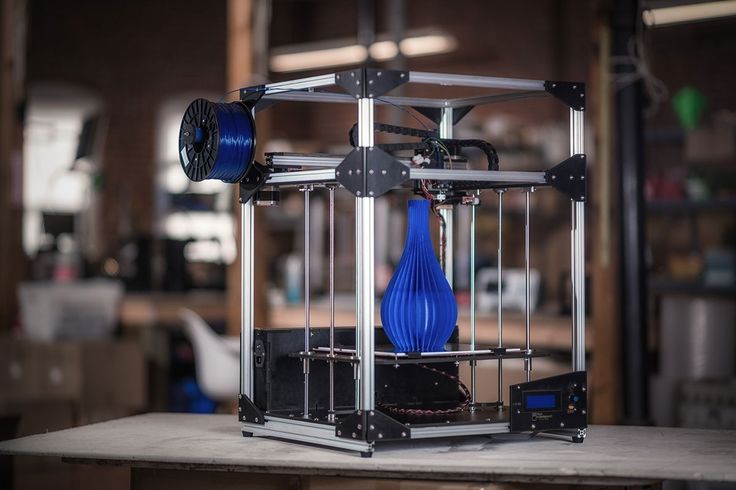

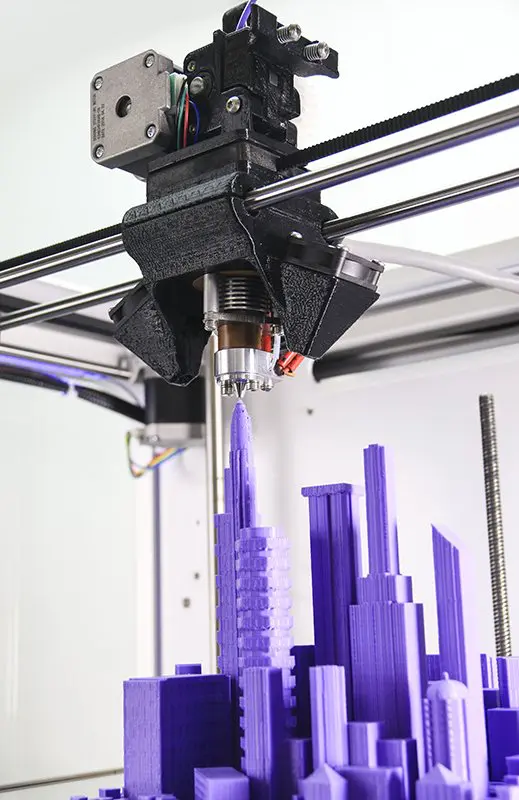

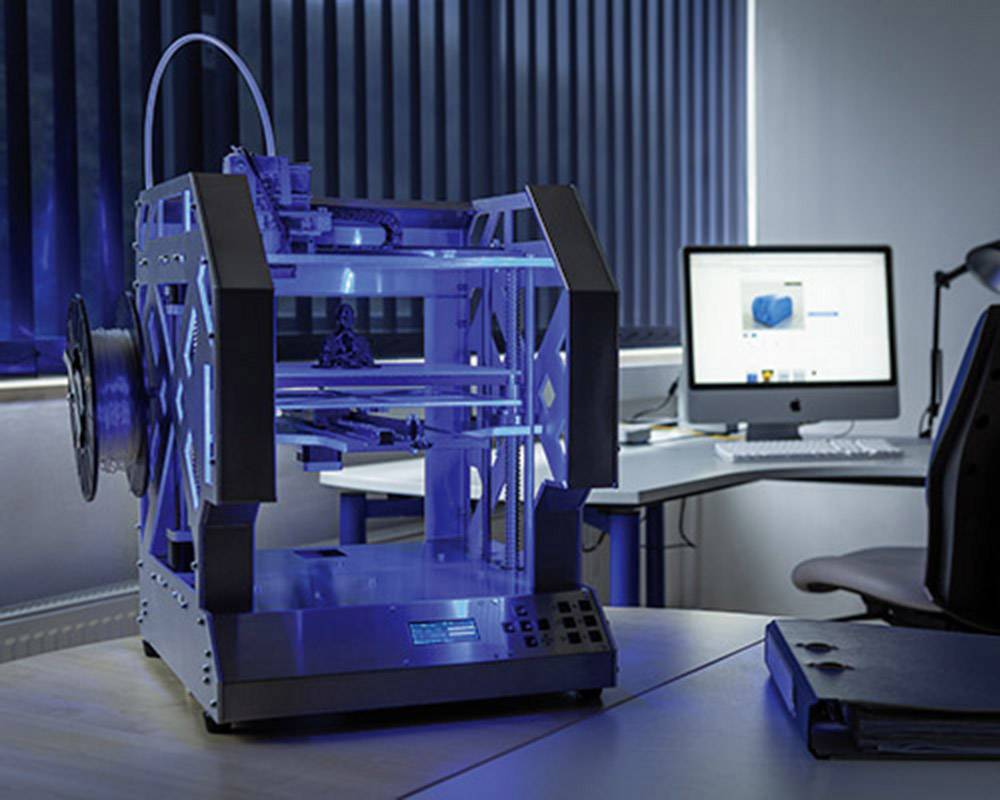

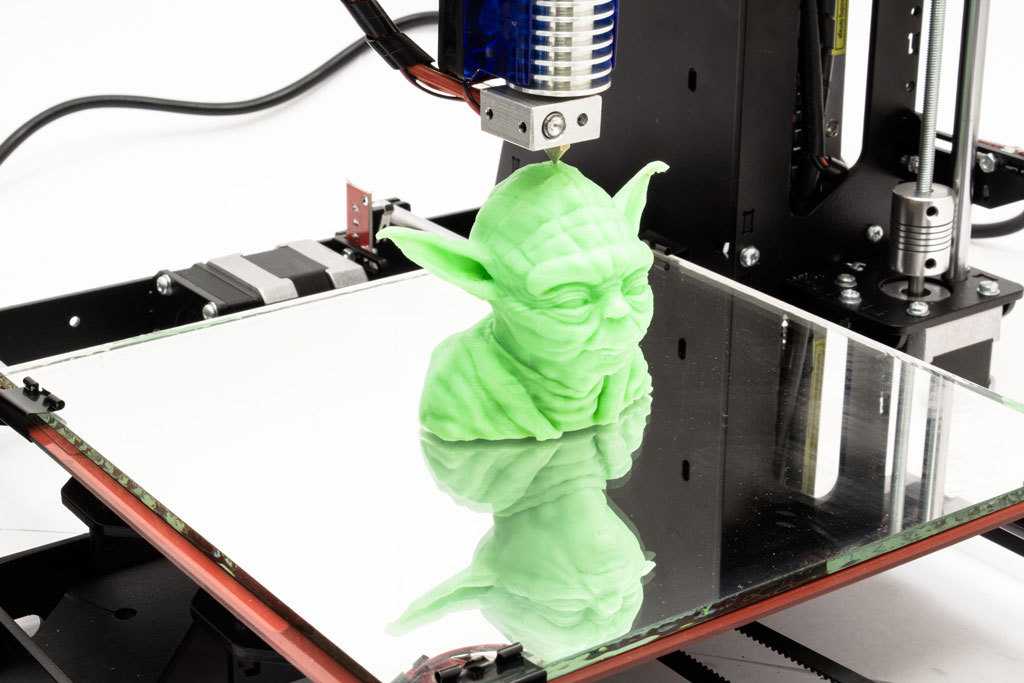

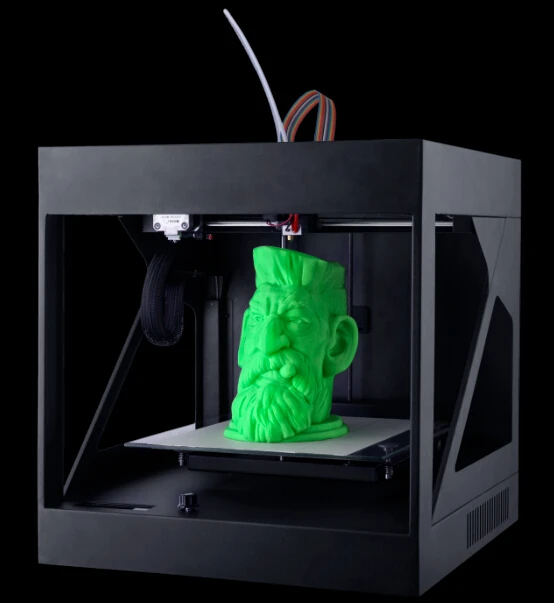

The 3D printing industry is made up of companies that provide products and services capable of manufacturing a range of products. 3D printing, also known as additive manufacturing, creates physical objects from digital designs. The printing process works by laying down thin layers of material in the form of liquid or powdered plastic, metal, or cement, and then fusing the layers together. Though still too slow for mass production, it is a revolutionary technology that has the potential to disrupt the manufacturing logistics and inventory management industries. The 3D printing industry is comprised of only a handful of companies, including players such as Proto Labs Inc., Faro Technologies Inc., and Desktop Metal Inc.

The industry is so young that it has no meaningful benchmark index. But the performance of these stocks can be compared to the broader market as represented by the Russell 1000 Index. These stocks have not performed well. Stratasys Ltd. (SSYS), the best performing 3D printing stock, has dramatically underperformed the Russell 1000, which has provided a total return of -12.5% over the past 12 months. This market performance number and all statistics in the tables below are as of Sept. 20, 2022.

Here are the top three 3D printing stocks with the best value, fastest sales growth, and the best performance.

These are the 3D printing stocks with the lowest 12-month trailing price-to-sales (P/S) ratio. For companies in early stages of development or industries suffering from major shocks, this metric can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

For companies in early stages of development or industries suffering from major shocks, this metric can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

| Best Value 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing P/S Ratio | |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 1.6 |

| 3D Systems Corp. (DDD) | 9.00 | 1.2 | 2.0 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | 2.1 |

Source: YCharts

- Stratasys Ltd.: Stratasys offers 3D printing solutions, such as 3D printers, polymer materials, a software ecosystem, and related parts.

It serves a variety of industries, including aerospace, automotive, consumer products, and healthcare. On Sept. 13, Stratasys completed the merger of its MakerBot subsidiary with Ultimaker, which offers platforms used to make 3-D printers. Ultimaker is backed by NPM Capital. The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%.

It serves a variety of industries, including aerospace, automotive, consumer products, and healthcare. On Sept. 13, Stratasys completed the merger of its MakerBot subsidiary with Ultimaker, which offers platforms used to make 3-D printers. Ultimaker is backed by NPM Capital. The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%. - 3D Systems Corp.: 3D Systems provides 3D printing solutions. The company offers a range of hardware, software, and materials designed for additive manufacturing. Its products and services are used in a variety of industries and sectors, including aerospace, automotive, semiconductor, healthcare, and more.

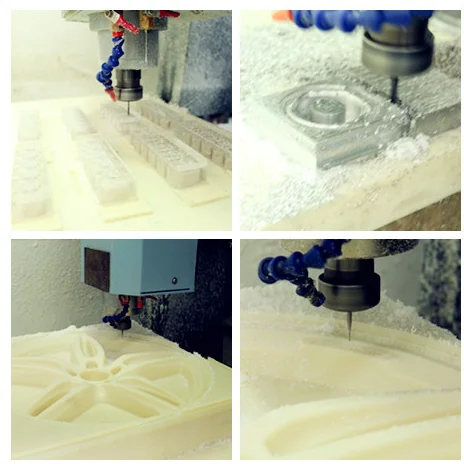

- Proto Labs Inc.: Proto Labs is an e-commerce-based company that provides digital manufacturing services. It offers 3D printing, injection molding, CNC machining, and sheet metal fabrication.

On Aug. 5, Proto Labs announced financial results for Q2 2022, the three-month period ending on June 30, 2022. Net income fell more than 80% to $2.6 million from the prior-year quarter while revenue rose 3.1%.

On Aug. 5, Proto Labs announced financial results for Q2 2022, the three-month period ending on June 30, 2022. Net income fell more than 80% to $2.6 million from the prior-year quarter while revenue rose 3.1%.

These are the 3D printing stocks with the highest YOY sales growth for the most recent quarter. Rising sales can help investors identify companies that are able to grow revenue organically or through other means and find growing companies that have not yet reached profitability. In addition, accounting factors that may not reflect the overall strength of the business can significantly influence earnings per share. However, sales growth can also be potentially misleading about the strength of a business, because growing sales on money-losing businesses can be harmful if the company has no plan to reach profitability.

| Fastest Growing 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | Revenue Growth (%) | |

Nano Dimension Ltd. (NNDM) (NNDM) | 2.45 | 0.6 | 1,270 |

| Desktop Metal Inc. (DM) | 3.07 | 1.0 | 203.9 |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 13.3 |

Source: YCharts

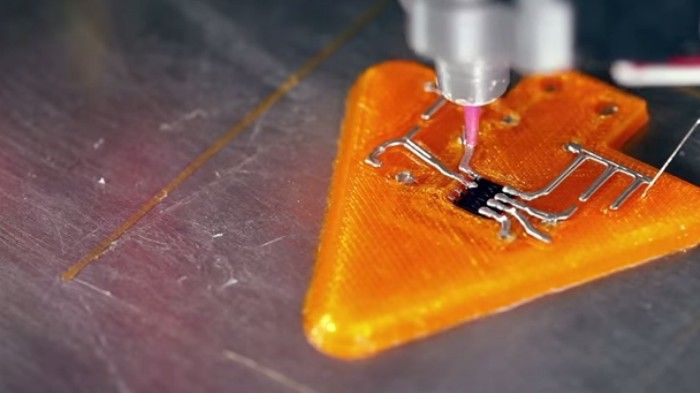

- Nano Dimension Ltd.: Nano Dimension is an Israel-based 3D printing company focused on developing equipment and software for 3D-printed electronics. It develops printers for multilayer printed circuit boards and nanotechnology-based inks. The company serves a range of industries, including consumer electronics, healthcare, aerospace, and automotive. On Sept. 1, Nano Dimension released Q2 2022 results. The company's net loss widened sharply to $40.0 million from a loss of $13.6 million in the same quarter a year earlier even as revenue soared more than 13-fold. The larger second-quarter loss was fueled partly by $10.9 million in non-cash adjustments for depreciation and amortization expenses, and share-based payments.

- Desktop Metal Inc.: Desktop Metal manufactures 3D printers and related equipment used to build complex parts from metal. It also offers 3D printing software. The company serves a range of industries, including automotive, consumer products, education, and heavy industry. On Aug. 08, the company reported Q2 2022 results. Desktop Metals' net loss increase nearly seven-fold to $297.3 million compared to the same quarter a year earlier even as revenue tripled.

- Stratasys Ltd.: See above for company description.

These are the 3D printing stocks that had the smallest declines in total return over the past 12 months out of the companies we looked at.

| 3D Printing Stocks With the Best Performance | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing Total Return (%) | |

Stratasys Ltd. (SSYS) (SSYS) | 15.49 | 1.0 | -34.5 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | -50.6 |

| Materialise NV (MTLS) | 10.95 | 0.6 | -53.9 |

| Russell 1000 | N/A | N/A | -12.5 |

Source: YCharts

- Stratasys Ltd.: See above for company description.

- Proto Labs Inc.: See above for company description.

- Materialise NV: Materialise is a Belgium-based provider of additive manufacturing software and 3D printing services. It serves a range of industries, including healthcare, aerospace, and automotive. On Sept. 7, Materialise completed its acquisition of Identity3D, which makes products that encrypt, distribute, and track digital parts as they move through supply-chains. The value of the deal was not specified in the announcement.

The comments, opinions, and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

YCharts. "Financial Data.

"

"Stratasys Ltd. "Stratasys Completes Merger of MakerBot with Ultimaker."

Proto Labs Inc. "Proto Labs Q2 2022 Earnings Release."

Nano Dimension Ltd. "Earnings Press Release for Q2 2022."

Desktop Metals Inc. " Desktop Metals Second Quarter 2022 Earnings."

Materialise NV. "Materialise Acquires Indenity3D."

Beginner's Guide To Investing In 3D Printing

3D printing has taken off as a futuristic technology that goes beyond just the printing industry. 3D printing is the printing of images, tools, shapes – and houses even – in three dimensional form, whether it is something as simple as a keychain or as useful as a brick to build an entire building.

The 3D printing industry has experienced exponential growth over the last 30 years, and its continued contributions to technological innovations across major industries position it for ongoing growth and considerable investment potential.

Below is an overview of the 3D printing industry and what potential investors need to know.

What is 3D printing?

The idea of 3D printing a bridge – which actually happened in the Netherlands in 2017 and then again in 2021 – might seem like something out of a futuristic sci-fi movie, but the technology has in fact been around since the early ‘80s. Hideo Kodama filed for the first 3D printing patent in 1980, describing the technology as a photopolymer rapid prototyping system using UV light to harden the material.

Since then, the idea has taken off, with 3D printing being used to design intricate small objects to being touted as the future to the manufacturing industry. In its early mass market days, some companies attempted to bring 3D printers into the home. While this proved difficult, 3D printing experienced rapid growth in the 2010s and sales ballooned to $9.3 billion in 2018. In 2021, the industry grew to $10.6 billion, with projections to reach $50.8 billion by 2030, according to 3D printing analysis and market research firm SmarTech Analysis.

- 3D printing technology has been around since the early ‘80s.

- In 2005, Dr. Adrian Bowyer created the self-replicating 3D printer process, allowing for the creation of next-generation 3D printers. Self-replicating printers can make copies of its own parts, effectively cutting down production costs and supply chain blockages.

- The industry is expected to reach over $50 billion in sales by 2030, according to SmarTech Analysis.

- Throughout the world, 2.2 million 3D printers were shipped in 2021 and the shipments are expected to reach 21.5 million units by 2030, according to Grand View Research.

- Global 3D printing sales are forecasted to expand at a compound annual growth rate of 20.8 percent from 2022 to 2030, according to Grand View Research.

- A 12-meter 3D-printed steel bridge was opened in 2021 in Amsterdam, opening the road for the technology in everyday life.

A brief history of 3D printing

3D printing has rapidly evolved since its inception some 40 years ago. Below is a brief overview of its trajectory from hobby to billion dollar industry.

Below is a brief overview of its trajectory from hobby to billion dollar industry.

The first stereolithography apparatus (SLA), or resin printing machine, was created by Charles Hull in 1983. Hull was granted the first patent for a 3D printing machine in 1986 and later co-founded 3D Systems Corporation. The company would go on to sell the first 3D printing SLA machine in 1988 called SLA-1.

The 1990s saw a number of 3D printing technology achievements setting the stage for global use. In 1997, AeroMat produced the first 3D process that allowed for high-powered lasers to fuse powdered titanium alloys, opening the door for the use of 3D manufacturing.

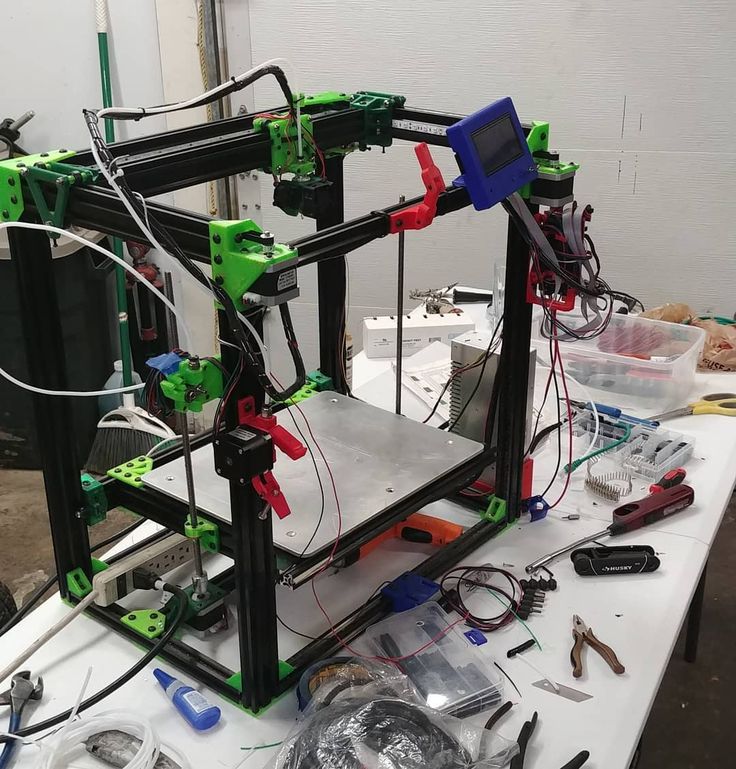

A pivotal moment in the evolution of the manufacturing of 3D printing, Dr. Adrian Bowyer created the self-replicating 3D printer process in 2005, allowing printers to replicate their own parts and helping expand next-generation 3D printers.

3D printing was largely marketed in its early stages for home use, and as a way to supplement or replace at-home printers. London-based 3D printing manufacturing group AMFG says that early visions of 3D home printers were not easily applied for home use. The critical consumer application that would have allowed home 3D printing to take off never truly materialized, and as a result the market lagged for a number of years.

London-based 3D printing manufacturing group AMFG says that early visions of 3D home printers were not easily applied for home use. The critical consumer application that would have allowed home 3D printing to take off never truly materialized, and as a result the market lagged for a number of years.

In the meantime, industrial 3D printing took off and supported a resurgence of the 3D printing market, taking it to new heights for both investors and manufacturers alike.

2009 was a transformative year for the 3D printing business. Micro, a consumer 3D printing company, launched a funding campaign on Kickstarter, becoming the largest-funded 3D printer campaign on the platform. The same year, 3D printing company Makerbot launched do-it-yourself kits to allow consumers to 3D print at home. The company also issued a file library where people could upload their own files and 3D design patterns, becoming the largest online library for 3D printing designs in the world. Stratasys acquired the company for $400 million in 2013.

In a 2015 report, Harvard Business Review stated that numerous big name companies were using 3D printing to aid in production. Among them were General Electric, Lockheed Martin, Boeing, Aurora Flight Sciences, Invisalign and Google. Harvard added that in 2014, sales of industrial 3D printers in the U.S. already accounted for over 30 percent of industrial automation and robotic sales.

3D printing has become an embedded part of industrial technology. The ability to intricately design products that traditional manufacturing cannot, and the revolution of creating such products with materials light enough to be used in 3D technology has spearheaded innovations in manufacturing and supply chain distribution. A recent report by Stratasys explained that part of 3D printing’s expansion is due to the technology’s flexibility. It is reconfigurable, adaptable and “above all else digital,” making it an easy alternative where needed.

(Looking for the best investing apps to get your finances organized and invested? Here are some of the most popular ones to consider. )

)

Top 3D printing companies

| Company | Stock symbol | Market Capitalization | What it does |

| Desktop Metal | DM | $780.7 million | Creates processes for metal 3D printers. |

| Xometry | XMTR | $1.8 billion | Provides on-demand manufacturing services for 3D printing. |

| Markforged | MKFG | $382.4 million | Software interface that allows you to create and print 3D parts. Provides physical printers as well. |

| PTC Inc. | PTC | $13.1 billion | Provides an entire 3D technology suite for manufacturers. |

| 3D Systems | DDD | $1.4 billion | One of the industry’s pioneers. Deals with the production and development of 3D printers. |

| Proto Labs | PRLB | $1.3 billion | Digitally manufactures prototypes and then 3D prints them. |

| Stratasys | SSYS | $1.3 billion | Provides polymer-based 3D solutions. |

Source: YahooFinance. Data as of July 22, 2022.

The 3D Printing ETF

The 3D Printing ETF (PRNT) is managed by investor Cathie Wood’s advisory firm, ARK Invest. The fund tracks around 50 companies in the 3D printing industry spanning hardware, software, scanner, materials and printing centers. Some big name holdings include Microsoft, Autodesk, Xometry and PTC.

The fund tracks a tiered, equal-weighted index.

Annualized returns (as of July 19, 2022): -38.8 percent (1 year), -0.8 percent (3 year) and -2.5 percent (5 year)

Expense ratio: 0.66 percent

| Pros | Cons |

Exposure: Gives investors exposure to many key players in and around the industry, touted by many as having tremendous potential. | Narrowly diversified: The ETF is concentrated in only one overarching industry. |

| Growth: The industry is projected to grow sales rapidly, giving investors an opportunity. | Volatility: As of July 18, 2022, the ETF is down around 38 percent year to date. Investors will need to have tolerance for risk. |

| Firm reputation: Cathie Wood and ARK are known for investing in innovative high-growth sectors of the market. | Still not steady on its feet: The 3D printing industry has grown tremendously, but is still solidifying itself as a developing market. |

| Expense ratio: An expense ratio of 0.66 percent is considered within a reasonable range. | Performance: The fund has negative returns in its 1-, 3- and 5-year periods thus far. |

The fund has wide exposure to the overall 3D printing market, both directly and indirectly. Some of the fund’s holdings, like PTC, deal primarily with 3D technology, whereas another major holdings, Microsoft, has more diversified lines of business.

Some of the fund’s holdings, like PTC, deal primarily with 3D technology, whereas another major holdings, Microsoft, has more diversified lines of business.

For those who think the 3D market is an attractive industry, the ETF could be a useful and not-too-expensive way to invest in it, without having to do the analysis on the individual names.

Industries driving 3D printing adoption

3D printing has become particularly useful in manufacturing of certain industries. The health care, automotive, aerospace and defense industries specifically have been driving the adoption of mass 3D printing.

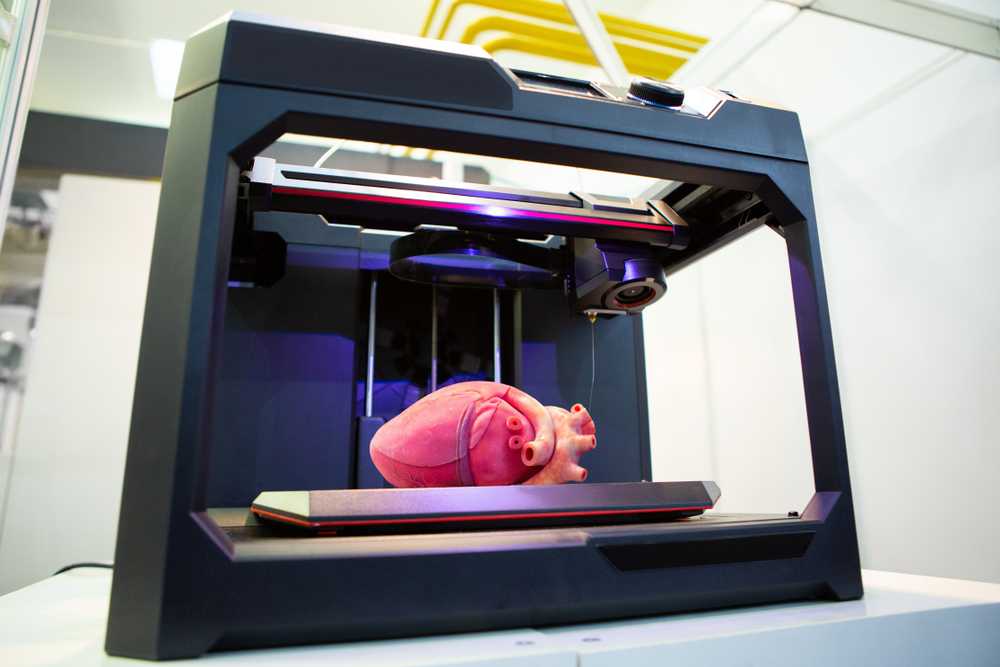

- Health care: 3D printing has truly taken off for health care science. Beyond what might first come to mind when thinking of health care 3D printing like a prosthetic leg or surgical tool, 3D technology has come so far that 3D bioprinting is now used to create living human cells! During the pandemic, 3D-printable open-source PPE equipment was created to help ease the equipment shortage.

The 3D printing health care market was estimated to be $1.04 billion in 2020 and is projected to reach $5.8 billion by 2030, according to Allied Market Research. Increased pressure on hospital systems, larger patient pools and new biomedical applications are key factors driving this growth.

The 3D printing health care market was estimated to be $1.04 billion in 2020 and is projected to reach $5.8 billion by 2030, according to Allied Market Research. Increased pressure on hospital systems, larger patient pools and new biomedical applications are key factors driving this growth. - Automotive: The automotive 3D printing market is forecasted to grow from $2.9 billion in 2022 to $7.9 billion by 2027, according to Markets and Markets, a B2B research firm. The pandemic exposed a need in the industry to decrease development time and a way to cut supply chain disruptions, which 3D printing can help achieve. Additionally, the surge in demand for electric vehicles has increased the demand for lightweight components, easily provided through 3D technology. Large investments by original equipment manufacturers has driven growth in this sector.

- Aerospace: Global aerospace 3D printing markets are expected to grow sales from $1.4 billion in 2020 to $6.

8 billion by 2030, or more than 18 percent annually, according to Allied Market Research. An increase in demand for lightweight airplane components and easier prototyping have driven growth. Although 3D printing can be expensive and the aerospace industry has the added headache of regulatory oversight, industry insiders say they’re committed to developing new supply chains and processes.

8 billion by 2030, or more than 18 percent annually, according to Allied Market Research. An increase in demand for lightweight airplane components and easier prototyping have driven growth. Although 3D printing can be expensive and the aerospace industry has the added headache of regulatory oversight, industry insiders say they’re committed to developing new supply chains and processes. - Defense: Like the aerospace industry, the defense industry is one in which extremely complicated parts are needed in relatively smaller volumes than can be provided by large-scale manufacturers. The 3D military market size is expected to reach $1.7 billion by 2027.

The future of 3D printing

With its many uses and integration into several different major industries, 3D printing is poised to make a significant impact on technology and manufacturing. Experts say that 3D printing will become a mainstream technology for mass production in the near future. Metal 3D printing is also positioned to expand, further allowing the aerospace and defense industries to incorporate the technology into their production.

The potential for applications in the health care industry is also clear. Especially after the pressures the pandemic put on hospitals, 3D printing applications will be a welcome innovation in times of emergency or supply chain disruption.

The skills to use 3D technologies will be a potential hurdle for growth. John Barnes, founder of the Barnes Group Advisors, said in a 2019 interview with AMFG that the “workforce element is really critical right now. There are not enough engineers, managers, executives who truly understand the technology well enough to work and develop a strategy to get what they need to get out of it.”

The Barnes Group launched an online course with Purdue University to provide engineers and others with the knowledge they need for 3D printing software and technology. Increased awareness and education will only propel the already growing niche sector even further.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Investment idea: 3D Systems because 3D printing

Mikhail Gorodilov

makes money on investments

Author profile

expected growth in demand in this area.

Growth potential and duration: 20.5% for 14 months; 54% in 4 years; 11% per year for 15 years.

Why stocks might go up: 3D printing has a great future.

How we act: we take shares now at $32.34.

When creating the material, sources were used that are inaccessible to users from the Russian Federation. We hope you know what to do.

Our thoughts are based on an analysis of the company's business and the personal experience of our investors, but remember: it is not a fact that an investment idea will work as we expect. Everything we write is forecasts and hypotheses, not a call to action. Rely on our thoughts or not - it's up to you.

Rely on our thoughts or not - it's up to you.

And what about the author's forecasts

Research, such as this and this, suggests that the accuracy of target price predictions is low. And this is normal: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

Therefore, we do not try to build complex models. The profit forecast in the article is the author's expectations. We indicate this forecast for reference: as with the investment idea as a whole, readers decide for themselves whether to trust the author and focus on the forecast or not.

We love, appreciate,

Investment edition

How the company earns

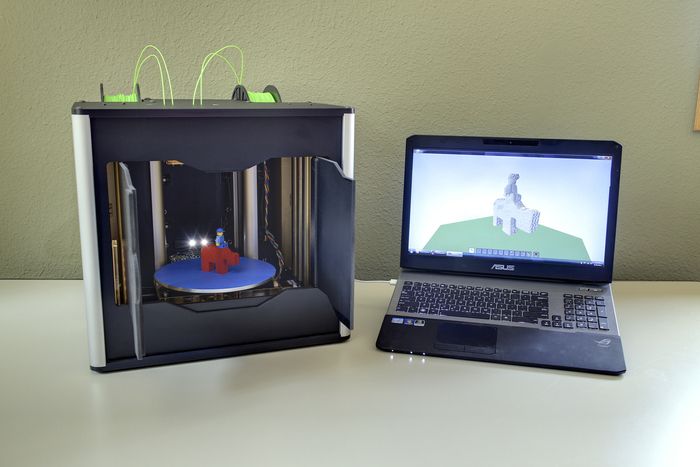

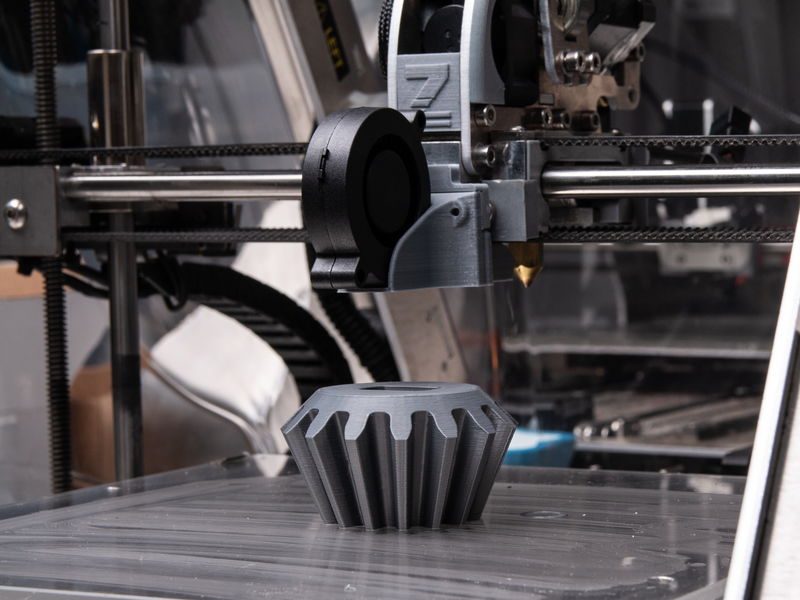

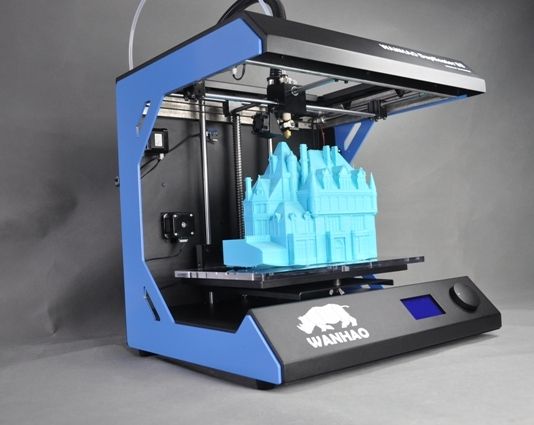

DDD makes 3D printers and provides services in this area. You can see what the company's printers look like on its website, but for the most part, these are printers for the corporate sector.

According to the annual report, the company's revenue is divided into the following segments.

Goods - 61.2%. A variety of printers: for plastic, for metal, for ceramics, and so on. Specialized software for scanning, design and virtual simulations for the medical sector. The segment's gross margin is 31.6% of its revenue.

Services - 38.8%. Technical support and training services for the company's clients. Production services for the company's customers - from prototyping to more complex projects. Specialized services for the medical sector: surgical planning, printing devices and instruments, building anatomical models, and more. The segment's gross margin is 52.7% of its revenue.

The report lacks detail: it would be useful to know what types of printers the company has - ceramic or metal, how much revenue they generate, and what is the structure of revenue by customer type. We know that the company serves clients from almost every possible industry: everyone always needs to print something large.

Company revenue by country and region:

- Americas - 50.25%. The US accounts for 49.47% of the company's total revenue.

- Europe, Middle East and Africa - 38.34%.

- Asia Pacific - 11.41%.

The company is unprofitable.

Revenue and profit for the last 12 months in billions of dollars, total margin as a percentage of revenue. Source: MacrotrendsArguments in favor of the company

Dropped. The company's shares have fallen in price by 41.57% since February of this year: from $55.35 to $32.34. The fall was quite strong and perhaps we can pick up stocks in anticipation of a rebound.

Something about a fast growing market. DDD's target market for 3D printing and related solutions and products is expected to increase from $15 billion in 2021 to $37.2 billion in 2026. More recently, DDD acquired Volumetric Biotechnologies, a biomaterial printing company, perhaps from this, those who believe that soon the missing organs for transplantation can be mass-produced on printers will run into the DDD shares.

The company has not the largest capitalization - 4.05 billion dollars. It is possible that its shares will be easy to pump for retail investors because they read somewhere that "the sector is very promising."

Prose of the market. In general, the company has something to hope for without speculation. In the Proto Labs idea, we have already discussed the good prospects for companies related to R&D and small-scale production due to the expected increase in corporate sector investment around the world in the renewal of fixed assets. And 3D printing is needed primarily for creating prototypes and a small number of parts.

DDD could also benefit from Biden's infrastructure package, which is about to become a reality. This will stimulate the industry and contribute to the demand for DDD solutions: it will increase the wear and tear of the equipment of manufacturing companies and increase their need to invest in the business.

Life has become better. In the latest report, DDD showed progress: the loss ratio of its business is declining - and profit may not be far off. This can attract investors from among banks and funds into shares.

In the latest report, DDD showed progress: the loss ratio of its business is declining - and profit may not be far off. This can attract investors from among banks and funds into shares.

Can buy. DDD has 35 years of additive manufacturing experience with solutions for all industries, from dentistry and surgery to jewelry and high-tech manufacturing. Given all of the above, it may well be bought by some large industrial conglomerate.

What can get in the way

Expensive. The company has a P/S of about 6.55, which is not very low. And if we take into account the unprofitability of the company and the fact that its revenue has not been growing particularly actively in recent years, you can even decide that the company is expensive.

Unprofitable. The company has been on the market for a long time, but it has no profit. Loss will contribute to the volatility of these stocks. Yes, and there is always the possibility of bankruptcy, even taking into account the fact that DDD's accounting is quite accurate: it has enough money to close all urgent debts.

Not all at once. Waves of investor interest in the field of 3D printing periodically give way to disappointment when it suddenly turns out that not every individual user can print their own house yet.

3D printing technology is still quite raw and needs significant improvement: there are problems with a large number of defects, temperature control. So DDD will remain in the position of such a risky startup for some time to come, the technology of which has not yet been fully mastered. This must be understood and accepted in order not to be surprised by the volatility of these stocks.

Hot time puts its test. The company has production and assets around the world, and more than half of its sales are made outside the United States. This means that logistical problems, as well as an increase in the cost of labor and raw materials, will be reflected in its reporting. Well, the permanent threat of a new quarantine must also be taken into account: as the experience of 2020 showed, the DDD business does not respond well to a decrease in industrial activity in the world.

As a result

Shares can be taken now at $32.34. And then there are three options:

- wait until shares are worth $39. I think we will reach this level in the next 14 months;

- wait until the stock is worth $50. Here, you may have to wait 4 years for 3D printing to become widespread;

- hold shares for 15 years to see the company become IBM from the world of 3D printing.

But still, it should be remembered that this idea is very volatile. So don't invest in these stocks unless you're ready for the storm.

3D printing market. Is it time to buy shares? / Habr

In this article I would like to talk about companies, each of which is a "unicorn". Shares of two of the three can already be bought on the New York Stock Exchange. There is a pattern: they were all born in the large Boston metropolitan area. And if Silicon Valley is a Mecca for software startups, then Boston, and especially the Massachusetts Institute of Technology (MIT), is the Medina for manufacturing innovation.

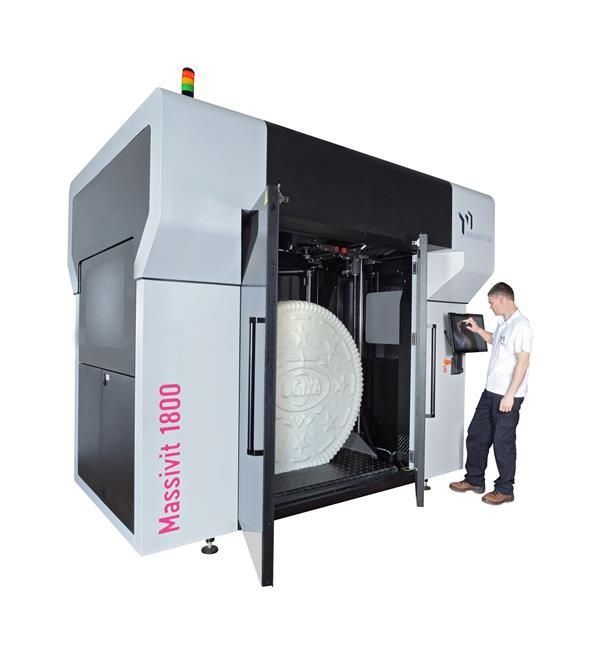

I'll make it clear right away: I won't analyze the entire 3D printing market, but will focus on some of the most notable representatives of the desktop 3D printing segment. But even here everything is very conditional, since in the process of improving technology, products smoothly flow from one category to another, and roughly three main categories can be distinguished: desktop, professional and industrial. So…

In 2011, three American students founded Formlabs in their garage. It was headed by Max Lobowski. Born into a family of engineers - emigrants from Ukraine, from his youth he was interested in robotics and new technologies, attended various specialized additional classes in high school. After earning a bachelor's degree from Cornell University, he went on to graduate school at MIT, where he began designing his desktop 3D printer, which is both powerful and affordable.

Max Lobowski The friends were able to quickly get an angel investment, with which they launched their first product, the Formlabs Form 1 printer, in 2013. On the Kickstarter crowdfunding platform, they managed to raise almost $ 3 million from more than 2,000 bakers from around the world, who were excited about the new product, which promised to make 3D printing accessible to almost everyone. At that time, there were models of printers on the market using the technology of illumination with a laser beam of photopolymer resin (SLA) with a price of 100 thousand dollars, Formlabs offered a printer for 1500 dollars. The company, of course, faced a lot of difficulties in the production of the first batch, but it managed to ship the printers to all buyers. And even though they were far from perfect, this made it possible to attract round A investments in the amount of 19million dollars and return the "angel" money.

On the Kickstarter crowdfunding platform, they managed to raise almost $ 3 million from more than 2,000 bakers from around the world, who were excited about the new product, which promised to make 3D printing accessible to almost everyone. At that time, there were models of printers on the market using the technology of illumination with a laser beam of photopolymer resin (SLA) with a price of 100 thousand dollars, Formlabs offered a printer for 1500 dollars. The company, of course, faced a lot of difficulties in the production of the first batch, but it managed to ship the printers to all buyers. And even though they were far from perfect, this made it possible to attract round A investments in the amount of 19million dollars and return the "angel" money.

The company then continued to improve its product and create an ecosystem like Apple, which includes 3D printers themselves, consumables (resins for various tasks), software for preparing models for printing, and post-processing equipment. In 2019, the company's turnover reached $100 million, in May 2021 it received $150 million in a round of E from the SoftBank Investment Advisers fund, valuing the company at $2 billion. After that, there was talk of an IPO, which would be an absolutely logical step, since investment funds are planning this in the future for 7-10 years, and this period has already come for investors of the first round.

In 2019, the company's turnover reached $100 million, in May 2021 it received $150 million in a round of E from the SoftBank Investment Advisers fund, valuing the company at $2 billion. After that, there was talk of an IPO, which would be an absolutely logical step, since investment funds are planning this in the future for 7-10 years, and this period has already come for investors of the first round.

However, despite high market expectations, Max Lobowski said in an interview with BizJournals that he is in no rush to go public: “We would rather take our time and better prepare to be a great public company… We make more money than all 3D -companies taken together that have gone public with the help of SPAC (a procedure that allows startups to go public by merging with another private company). However, when I look at really large, successful, long-term public projects, which is what we are aiming for, I see that they are on a completely different level in terms of predictability and profitability than we are. ” These are serious words, and apparently the head of the company has reason to pronounce them. Most likely, the forecast of the company's capitalization in the region of 4-6 billion dollars with a successful initial offering, which will make it the largest company in the market, because even the result of the veteran and long-term market leader - 3DSystems as of August 2021 is no more than 3.5 billion. dollars.

” These are serious words, and apparently the head of the company has reason to pronounce them. Most likely, the forecast of the company's capitalization in the region of 4-6 billion dollars with a successful initial offering, which will make it the largest company in the market, because even the result of the veteran and long-term market leader - 3DSystems as of August 2021 is no more than 3.5 billion. dollars.

Unlike the students at Formlabs, Markforged was founded by older guys. However, even here it was not without MIT. MIT alumnus Mark Greg encountered 3D printing while his company was doing a job for the US Navy. Experiments in the field of improving the quality of products led him to the idea of creating a printer that could reinforce the printed model with carbon fiber to make it strong and suitable for use under load.

Employees of the company together with the Metal X printer, Mark Greg is seated to the right of the printer. The company was founded in 2013, and already in 2014 at the Solidworks World exhibition, the startup presented its first product - the Mark One printer, which had two extruders and could reinforce the printed model with nylon, fiberglass and even Kevlar. Later, The Digital Forge, a cloud-based print management platform, was introduced, and already in 2017, MarkForged announced the release of a Metal X desktop metal 3D printer worth $100,000, while competitors' counterparts cost a million. In 2020, the company's turnover amounted to $ 70 million, and the management decided to bring the company to an IPO using SPAC. The company introduced the concept of additive manufacturing 2.0 to potential investors, allowing the production of finished products rather than prototypes, paving the way for 3D printing to the production of goods. The volume of this market is estimated by experts at 13 trillion dollars.

Later, The Digital Forge, a cloud-based print management platform, was introduced, and already in 2017, MarkForged announced the release of a Metal X desktop metal 3D printer worth $100,000, while competitors' counterparts cost a million. In 2020, the company's turnover amounted to $ 70 million, and the management decided to bring the company to an IPO using SPAC. The company introduced the concept of additive manufacturing 2.0 to potential investors, allowing the production of finished products rather than prototypes, paving the way for 3D printing to the production of goods. The volume of this market is estimated by experts at 13 trillion dollars.

Based on the Wholers Report, in 2020 the company predicted the growth of the additive technologies market at an average rate of 27%, which means that in the next 8 years from the current 18 billion dollars, the market will grow to 118 billion in 2029 from 10 multiple growth of own revenue up to 700 million dollars already in 2025.

On July 15, 2021, MarkForged was listed on the New York Stock Exchange under the ticker MKFG. The placement was estimated at 2 billion dollars, but a month later the shares lost a little in price, and the current capitalization is about 1.5 billion dollars. The question remains: is it worth buying shares of a company that plans to be unprofitable for at least another 2 years (the company predicts a turnover of about $100 million this year).

The placement was estimated at 2 billion dollars, but a month later the shares lost a little in price, and the current capitalization is about 1.5 billion dollars. The question remains: is it worth buying shares of a company that plans to be unprofitable for at least another 2 years (the company predicts a turnover of about $100 million this year).

On the one hand, there are enough companies on the market trading at even higher multiples, and on the other hand, 3D printing is not yet such a mature technology that one can be sure of the 100% success of exactly the concept that MarkForged offers. In fact, the company itself considers the emergence of new technologies as one of the risks that could undermine its current technological superiority. In general, investors are now positive about the future of 3D printing. They were impressed by how the technology performed in the first, most difficult months of the pandemic, when production chains were disrupted and many transport arteries stopped working. With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, the coin has two sides, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the market of additive technologies in general.

With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, the coin has two sides, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the market of additive technologies in general.

The last one in my story is DeskTop Metal. Formlabs was created by MIT students, Markforged - MIT graduates, DeskTop Metal was created by experienced entrepreneurs Rick Fulop and Johan Mayerberg, as well as 4 (!) MIT professors. Going to the goal, Rick Fulop founded 6 different companies, also headed an investment fund. Johan Maierberg has been a lead engineer for various companies and became the CTO of DeskTop Metal.

Rick Fulop in front of DeskTop Metal Studio System 9 printers0002 The company's goal was to create an affordable desktop 3D printer that prints metal models. The company immediately became a favorite among investors and attracted investment rounds with enviable constancy. Among her donors were BMW, Ford Motor, Stratasys (a pioneer in the creation of 3D printing technology), SaudiAramco investment fund, General Electric and others. The total valuation in the latest round reached $2.4 billion, with a paltry $26 million turnover in 2019. The funds received were used for R&D and attracting the best engineers and developers to the company. In 2017, a three-component metal printing system based on FDM layer-by-layer printing technology was introduced, followed by burning and baking the final model. The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which can hardly be called a desktop one.

The company immediately became a favorite among investors and attracted investment rounds with enviable constancy. Among her donors were BMW, Ford Motor, Stratasys (a pioneer in the creation of 3D printing technology), SaudiAramco investment fund, General Electric and others. The total valuation in the latest round reached $2.4 billion, with a paltry $26 million turnover in 2019. The funds received were used for R&D and attracting the best engineers and developers to the company. In 2017, a three-component metal printing system based on FDM layer-by-layer printing technology was introduced, followed by burning and baking the final model. The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which can hardly be called a desktop one. The company claims that its Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it.

The company claims that its Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it. The company entered the IPO on December 10, 2020 under the same SPAC scheme and in its presentation for potential investors outlined the following parameters: planned turnover in 2025 - 942 million dollars, reaching operating profit in 2023, and also indicated that , which plans to spend a significant portion of the proceeds on acquisitions of other 3D printing companies.

Capitalization on the New York Stock Exchange at the time of its IPO on December 10 was a fantastic $6 billion. During the placement, $580 million was raised and the company was assigned the laconic ticker DM. Already in February 2021, the shares rose even more, and the company's capitalization exceeded $8 billion. DM has said it will be the first company in 3D printing history to have a capitalization of over $10 billion. Having received huge funds at its disposal, already in January 2021, DM announced the first takeover deal: the German manufacturer of professional photopolymer 3D printers EnvisionTEC (founded in 2002 and is one of the oldest on the market) was bought for $ 300 million. For me, this choice was not obvious, it is difficult to find something in common between DM and EnvisionTEC and it will be difficult to achieve a significant synergistic effect from this transaction. EnvisionTEC has continued to operate under its own brand as a 100% subsidiary of DM and plans to release a number of new models for its key customers - dental clinics and jewelry companies. Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase announced in August of another public company, the American ExOne.

Having received huge funds at its disposal, already in January 2021, DM announced the first takeover deal: the German manufacturer of professional photopolymer 3D printers EnvisionTEC (founded in 2002 and is one of the oldest on the market) was bought for $ 300 million. For me, this choice was not obvious, it is difficult to find something in common between DM and EnvisionTEC and it will be difficult to achieve a significant synergistic effect from this transaction. EnvisionTEC has continued to operate under its own brand as a 100% subsidiary of DM and plans to release a number of new models for its key customers - dental clinics and jewelry companies. Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase announced in August of another public company, the American ExOne. Established in 2005 in Pittsburgh, it specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other and they have already presented a joint portfolio based on the products of both companies, in which one product complements the other.

Established in 2005 in Pittsburgh, it specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other and they have already presented a joint portfolio based on the products of both companies, in which one product complements the other.

It would be logical to assume that DM stock skyrocketed after such high-profile acquisitions, but in reality the opposite happened. Since its peak in February, the shares have fallen 4 times and are now trading at $8 a share, and the capitalization is slightly over $2 billion. Apparently, the first euphoria of investors gave way to a more sober approach to the current results of the company. Perhaps this was influenced by the dissatisfaction of some ExOne shareholders, who considered the sale price of the company unfair and were preparing a class action lawsuit against management in order to block the deal.

Should I buy DM stock now that it has fallen so much, or wait for further decline? I would say that their current level is very comfortable for entry, but, of course, such investments also have a certain risk. This is despite the fact that the company has reported strong first half results, which DM expects to generate over $100 million in revenue this year.

Summing up, I would like to say that a number of stock analysts consider what is happening in the market of additive technologies to be a "renaissance". The market came into motion after the pandemic, which gave everyone hope that the technology was ripe for serious tasks, and that the situation in the industry of 2013-2014 would not repeat itself. Then the technique was still very "raw", but attracted a lot of attention from the press and potential investors. This drove the stocks of market leaders 3DSystems and Stratasys to unknown heights, and then, when there was disappointment in the results of their work, the fall reached 20 times from peak values.