3D printing market segments

3D Printing Market Size, Share | Trends & Forecast

2022

3d Printing Market

P

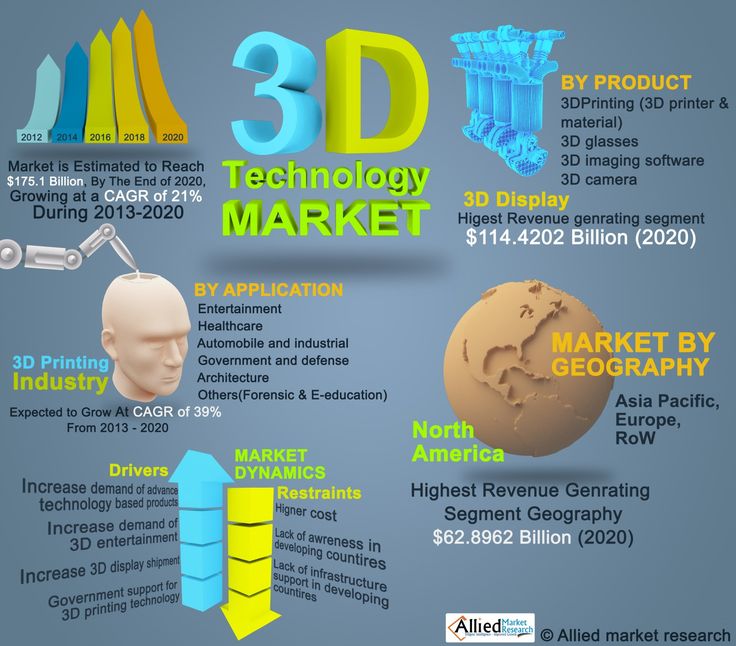

by Technology (Stereolithography (SLA), Selective laser sintering (SLS), Electron beam melting (EBM), Fused deposition modeling (FDM), Laminated object manufacturing (LOM), Others), by Application (Consumer Electronics, Industrial, Aerospace, Automotive, Healthcare, Defense, Education and research, Others): Global Opportunity Analysis and Industry Forecast, 2020-2030

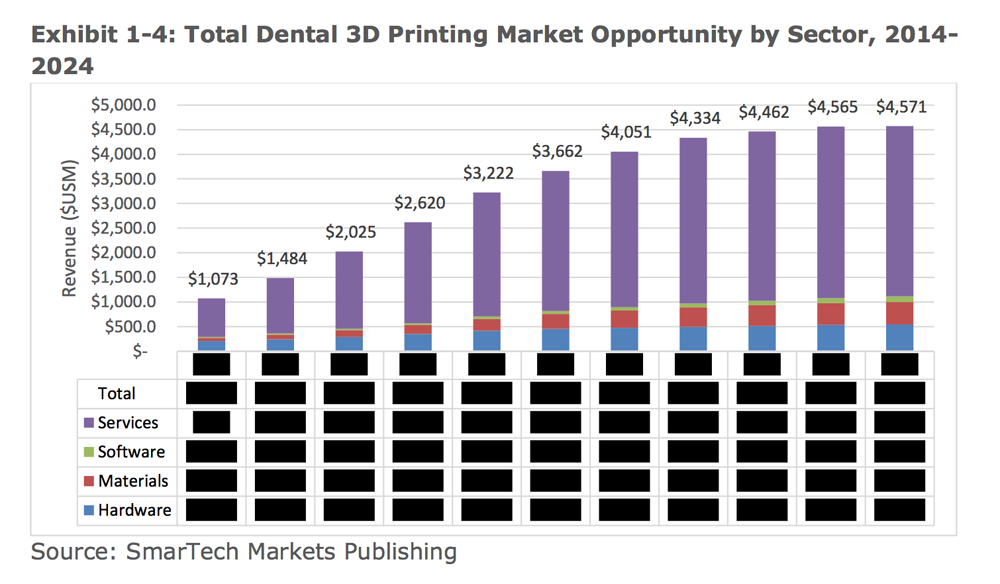

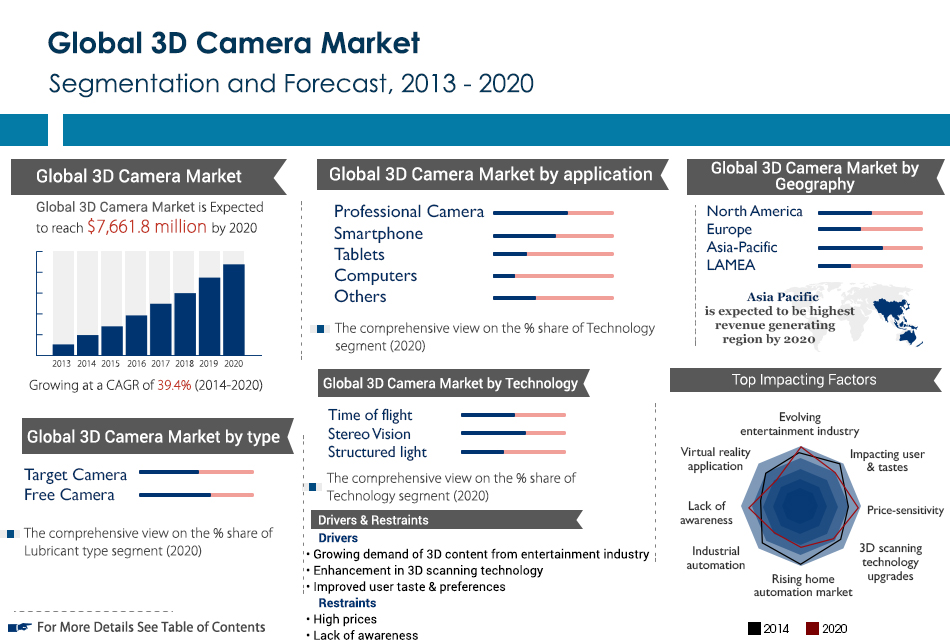

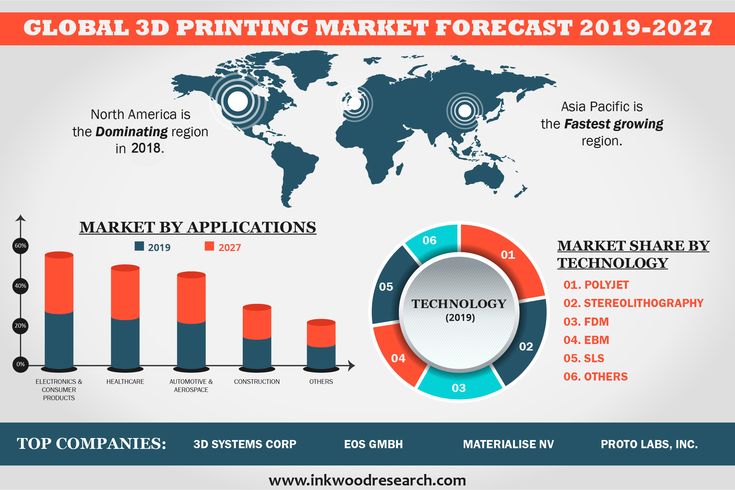

The global 3d printing market was valued at $13.2 billion in 2020 and is projected to reach $94.0 billion by 2030, growing at a CAGR of 22.1% from 2021 to 2030.

3D printing is a manufacturing technique for creating three-dimensional items from a digital file. 3D printing is used to create objects through additive processes of sequential layers of material. Owing to its great precision and economical use of resources. Further, 3D printing solution such as resin 3d printer, 3d printer filament, and 3d printing service has gained popularity in a variety of sectors for the production of bespoke items. Previously, 3D printing was only used for quick prototyping. However, as technology advances and applications expand, 3D printing is increasingly being utilized for functional testing of prototypes under working settings as well as the creation of final goods.

The outbreak of COVID-19 has significantly impacted the growth of the 3D printing solution in 2020, owing to significant impact on prime players operating in the 3D printing supply chain. Countries across the globe have suffered major loss in terms of business and revenue, owing to lockdown and lack of availability of raw material across the world. Production and manufacturing sectors globally have been heavily impacted by the outbreak of the COVID-19 disease, which, in turn, led to economic downfall, thereby declining the growth of the 3D printing market in 2020. However, rise in penetration of 3D printing solutions in healthcare sector during COVID-19 has significantly boosted the market growth during pandemic.

On the contrary, the market was principally hit by several obstacles created amid the COVID-19 pandemic, such as lack of skilled workforce availability and delay or cancelation of projects due to partial or complete lockdown, globally. Furthermore, surge in adoption of smart infrastructure solutions across automotive, retail, and healthcare sectors is expected to strengthen the market growth in 3D printing.

In addition, 3D printing is a part of additive manufacturing and uses similar techniques such as inkjet printer-albeit in three dimensions. Moreover, the 3D printing method has witnessed a surge in demand across the healthcare, defense, and automotive sector owing to the rise in deployment of 3D technology, thereby driving the market growth.

The 3D Printing industry is expected to witness notable growth during the forecast period, owing to a reduction in manufacturing cost and process downtime. Furthermore, government investments in 3D printing projects have driven the growth of the market. Moreover, ease in development in customized products is expected to propel the growth of the 3D Printing market growth during the forecast period.

Moreover, ease in development in customized products is expected to propel the growth of the 3D Printing market growth during the forecast period.

However, lack of standard process control and limited availability & high cost associated with 3D printing materials are some of the prime factors that restrain the market growth. On the contrary, the rise in utilization of 3D printing in healthcare sectors, applications in various industries, and improved manufacturing processes are expected to provide lucrative opportunities for the growth of the market during the forecast period.

The outbreak of COVID-19 has significantly impacted the growth of the 3D printing market outlook in 2020, owing to a significant impact on prime players operating in the 3D printing supply chain. However, the rise in penetration of 3D printing solutions in the healthcare sector during COVID-19 has significantly boosted the market growth during a pandemic. On the contrary, the market was principally hit by several obstacles created amid the COVID-19 pandemic, such as lack of skilled workforce availability and delay or cancelation of projects due to partial or complete lockdown, globally.

Furthermore, the surge in the adoption of smart infrastructure solutions across the automotive, retail, and healthcare sectors is expected to strengthen the 3D printing market size.

Furthermore, the surge in the adoption of smart infrastructure solutions across the automotive, retail, and healthcare sectors is expected to strengthen the 3D printing market size.The 3D Printing market is segmented into technology, applications, and country. Depending on the technology, the market is segregated into stereolithography (SLA), selective laser sintering (SLS), electron beam melting (EBM), Fused deposition modeling (FDM), laminated object manufacturing (LOM), and others. The selective laser sintering (SLS) segment dominated the market, in terms of revenue, in 2020, and is expected to follow the same trend during the forecast period.

3D Printing Market

By Technology

Stereolithography segment influence the market in 2020, and expected to follow the same in future.

Get more information on this report : Request Sample Pages

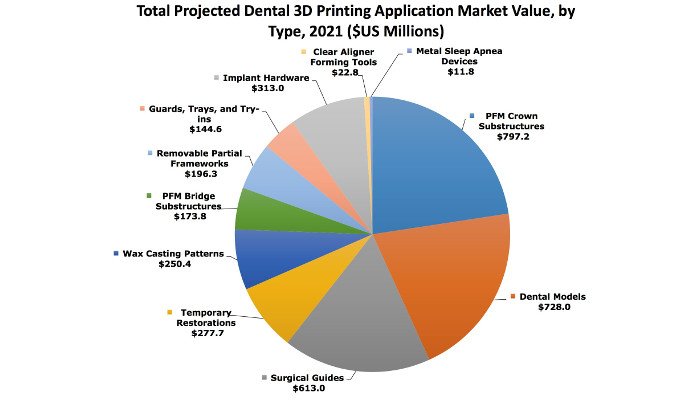

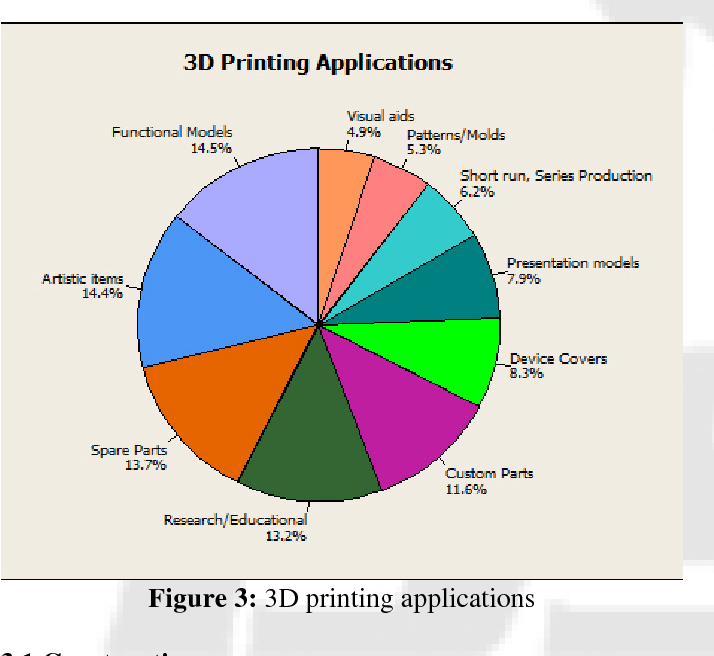

On the basis of application, it is categorized into consumer electronics, industrial, aerospace, automotive, healthcare, defense, education & research, and others. The consumer electronics segment acquired the largest 3D Printing market share in 2020, however, the healthcare segment is expected to grow at a high CAGR from 2021 to 2030.

The consumer electronics segment acquired the largest 3D Printing market share in 2020, however, the healthcare segment is expected to grow at a high CAGR from 2021 to 2030.

3D Printing Market

By Application

Consumer Electronics segment hold domination position in 2020.

Get more information on this report : Request Sample Pages

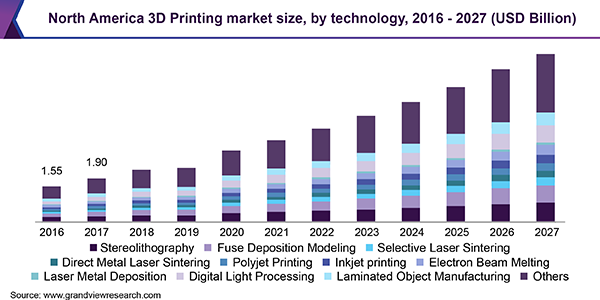

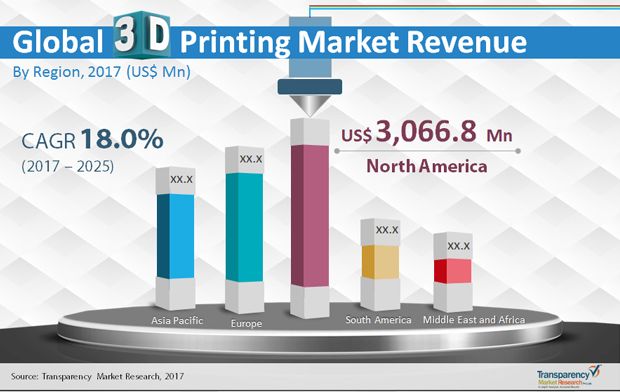

Region-wise, the 3D display market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, and the rest of the Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America, specifically U.S., remains a significant participant in the global 3D printing industry This is attributed to the fact that major organizations and government institutions in the country are intensely putting resources into the technology, which is anticipated to open new avenues for the expansion of the market.

3D Printing Market

By Region

2030

North America

Europe

Asia-pacific

Lamea

North America garner significant market share in 2020.

Get more information on this report : Request Sample Pages

Key Benefits For Stakeholders- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the 3d printing market analysis from 2020 to 2030 to identify the prevailing 3d printing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the 3d printing market forecast segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global 3d printing market trends, key players, market segments, application areas, and market growth strategies.

3D Printing Market Report Highlights

| Aspects | Details |

|---|---|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | 3D Systems Corp., Arcam AB, Stratasys Ltd., Autodesk, Inc., Optomec, Inc, Organovo Holdings, Inc., Protolabs, Voxelijet AG, Hoganas AB, ExOne Company |

Loading Table Of Content...

3D printing is an enhanced process designed to use layers of materials to build 3D equipment or object. Furthermore, 3D printing is intended to enable users to develop a complex shape using less material than traditional manufacturing methods. In addition, the surge in demand for AI, the IoT, and smart infrastructure solutions across the automotive, consumer electronics, and healthcare sectors are expected to drive the growth of the market across North America in the coming years.

The 3D printing market is highly competitive owing to the strong presence of existing vendors. 3D printing vendors who have access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with rise in technological innovations, product extensions, and different strategies adopted by key vendors.

The surge in the adoption of 3D printing in the healthcare sector, owing to the emergence of COVID-19 has significantly boosted the growth of 3D printing solutions. Moreover, prime economies, such as the U.S. and Canada, are planning to develop and deploy next-generation 3D printing solutions across various sectors. For instance, in February 2022, AM-giant 3D Systems Inc. announced the acquisition of pellet extruding machine company Titan Robotics LLC, which is anticipated to provide lucrative opportunities for market growth.

Among the analyzed regions, the U.S.exhibits the highest adoption rate of 3D printing solutions. On the other hand, North America is expected to grow at a faster pace, due to emerging countries, such as Mexico, investing in these technologies.

Globally, various key players and government agencies operating in North America are investing in 3D printing solutions to make them compatible with various industrial platforms. For instance,in2019, according to a report by New Story, a nonprofit organization based in Mexico, announced the development of the world’s first 3D printed community. The NPO has officially revealed the first set of 3D printed homes in Mexico, which is showcasing lucrative growth opportunities for market growth.

The key players profiled in the report include 3D Systems, Arcam AB, Autodesk Inc., Stratasys Ltd., The ExOne Company, Optomec, Inc., Organovo Holdings, Inc., Protolabs, Voxeljit AG, and Hoganas AB.

3D Printing Market Size, Growth

The global 3D printing market size was valued at USD 15. 10 billion in 2021. The market is projected to grow from USD 18.33 billion in 2022 to USD 83.90 billion by 2029, exhibiting a CAGR of 24.3% during the forecast period. Based on our analysis, the global market exhibited an average growth of 20.2% in 2020 as compared to 2019.

10 billion in 2021. The market is projected to grow from USD 18.33 billion in 2022 to USD 83.90 billion by 2029, exhibiting a CAGR of 24.3% during the forecast period. Based on our analysis, the global market exhibited an average growth of 20.2% in 2020 as compared to 2019.

Rapidly increasing digitization, increasing adoption of advanced technologies such as Industry 4.0, smart factories, robotics, machine learning, and others fuel the demand for online 3D printing for simulation purposes. These technologies increase the chances of broader adoption and greater utilization of this technology across industries, including aerospace, automotive, healthcare, among others. For instance,

- Aerospace companies are exploring this 3D printing for manufacturing various hardware parts of their products. For instance, Boeing leverages industrial 3D printing to manufacture the interior parts of its plane, whereas, NASA uses it to build rocket engines and parts of the satellite.

- Automotive industry is expected to show a huge adoption of this technology. Rapid tooling incorporated with additive manufacturing has become the priority of many automotive manufacturers. Customization of the automotive interior is another major application of this technology in the automotive industry.

COVID-19 IMPACT

Supply Chain Disruption and Halts on Production Units Negatively Impact Printing Industry Amid Lockdown

Post outbreak of the COVID-19 crisis, industrial hubs, manufacturing sectors witnessed an immediate supply chain disruption and halts on production. As a result of the fast-spreading pandemic, the overall industrial production across the globe experienced a sharp decline. It was demobilized, reflecting supply chain disruption, and reviving financial market conditions. The crisis forced market players across the globe to reduce their operational expenditure. Fewer operation expenditures restricted the investments of market players in this technology in 2020, impacting the 3D printing market growth.

The temporary closures of the factories in major economies such as China, Southeast Asia, the U.K., Germany, and others have impacted the production plants of the 3D technology industry and operations of suppliers resulting in short-term supply shortages. Manufacturing capacity was observed to be restored to normalized levels by the end of July 2020. The short-term disruptions in supply shortages have resulted in logistics challenges, including delays in delivering services to end-use industries. Such a situation affected the company’s ability to meet the technology demand of the end customers. For instance,

- Stratasys, one of the well-known companies in the market, experienced dip in sales in the early months of COVID-19 pandemic. However, later, the company started rebounding as it picked up new manufacturing contracts.

However, the study conducted by the ‘Society of Manufacturing Engineers’ states that 25% of the manufacturers in the United States plan to change their supply chains in response to the pandemic. The study also found that they prioritize investing in this technology post-COVID-19 out of other technologies such as robotics, 5G, digital security, and artificial intelligence. This shows that the increasing investments of manufacturers in 3D technologies are likely to uplift the growth of the market in the forthcoming years.

The study also found that they prioritize investing in this technology post-COVID-19 out of other technologies such as robotics, 5G, digital security, and artificial intelligence. This shows that the increasing investments of manufacturers in 3D technologies are likely to uplift the growth of the market in the forthcoming years.

LATEST TREND

Request a Free sample to learn more about this report.

Advancement in 3D Hardware and Software is Generating New Revenue Streams for Market Players

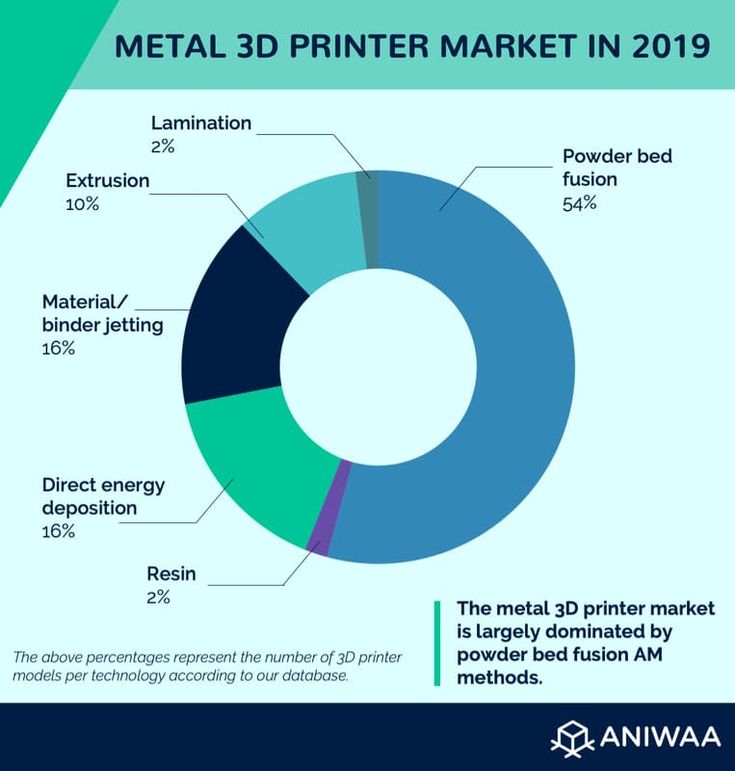

Techno-savvy start-ups and established market players are upgrading and developing new technologies. The advancements in hardware have led to faster and reliable 3D printers for production applications. Polymer printers are one of the most used 3D printers.

- According to a 2019 report by Ernst & Young Global Limited, 72% of the enterprises leveraged polymer additive manufacturing systems, whereas the remaining 49% used metal additive manufacturing systems.

The statistics show that developments in polymer additive manufacturing would create new market opportunities for market players.

The statistics show that developments in polymer additive manufacturing would create new market opportunities for market players.

Fused Filament Fabrication (FFF) and powder bed fusion technologies such as Multi Jet Fusion offered by HP Inc. are expected to be the most preferred industrial 3D technologies by the manufacturers due to their ability of volume manufacturing and high productivity. Similarly, resin-based technologies such as digital light processing (DLP) and Stereolithography (SLA) are more likely to have a growing demand from the dental and consumer goods industry.

Similarly, software developments are gaining pace in the 3D industry driven by the demand to streamline operations. The technology has been extensively used in the manufacturing process, which has surged the need for software that can help manufacturers to increase production volumes and enhance their additive manufacturing processes efficiently.

DRIVING FACTORS

Substantial Investments of Governments and Tech Giants to Foster Market Growth

Many countries across the globe are experiencing massive digital disruptions in advanced manufacturing technologies. The United States is a potential user of 3D technology. In 2018, the United States Department of Defense included this technology as an important capability in their budget. Even tech software giants such as Autodesk, Microsoft, and HP have launched products aimed at additive and 3D printing manufacturing.

The United States is a potential user of 3D technology. In 2018, the United States Department of Defense included this technology as an important capability in their budget. Even tech software giants such as Autodesk, Microsoft, and HP have launched products aimed at additive and 3D printing manufacturing.

Similarly, China is making significant efforts to maintain the competitive index of the manufacturing industry in the global market. Chinese manufacturers foresee this technology as both a risk and opportunity for the Chinese manufacturing economy, and hence they tend to invest in the research and development of this technology.

Whereas India is looking forward to this technology as an opportunity to increase its share in global manufacturing competitiveness. The market in India is supported by active government initiatives such as the ‘Make in India’ Initiative.

Korea has established an independent roadmap for research and development of this technology and provides national support to execute it. The government of Korea is introducing tax incentives and accelerating industry regulatory agreements to encourage the adoption of this technology.

The government of Korea is introducing tax incentives and accelerating industry regulatory agreements to encourage the adoption of this technology.

The U.K. government has developed an independent 3D technology strategy; however, it is witnessing some uncertainties in the U.K. manufacturing sector due to Brexit. Germany is expected to define new strategies for the technology as Germany has a well-established Industry 4.0 infrastructure.

RESTRAINING FACTORS

High Initial Investments to Restrict Market Growth

High initial investments are observed to be the most significant restraint for adoption of this technology. This investment encompasses investment in hardware, software, materials, certification, additive & manufacturing education, and training for the employees. The capital costs and resources required to set up a 3 dimensional system are quite expensive than traditional printing methods.

However, with the introduction of the industrial Desktop 3D printer, the manufacturers are helping the end-customers cut the high initial costs. Desktop printers are easy to use and handle and also are less expensive than the 3 dimensional system.

Desktop printers are easy to use and handle and also are less expensive than the 3 dimensional system.

SEGMENTATION

By Component Analysis

Wider Adoption of the Software to Make Designs of Objects and Parts to Fuel its Growth Rate

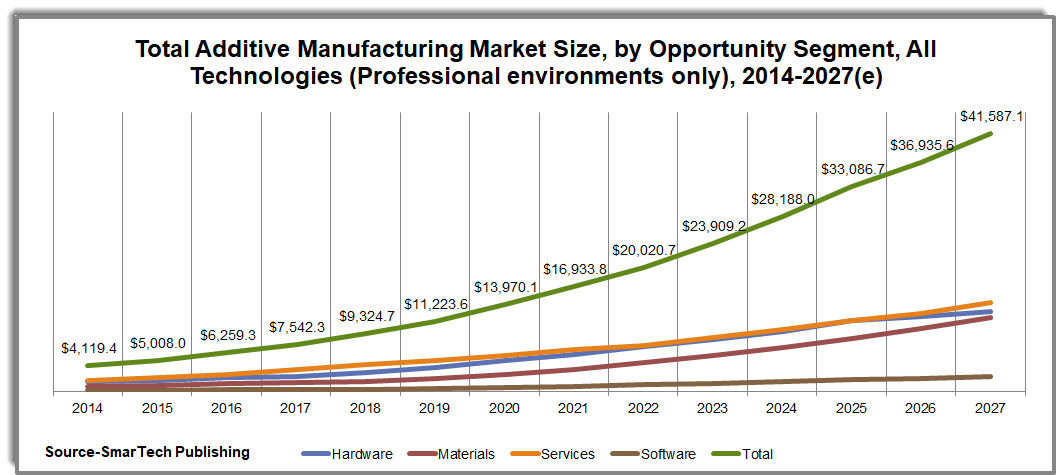

On the basis of component, the market is divided into hardware, software, and services.

Adoption of hardware for manufacturing 3D printed material is maximum and is likely to maintain its dominance during the forecast period. The demand for hardware is increasing as major key players are enhancing their product portfolio and launching new technologies to serve high demand from several industry verticals. Companies are investing in research & development activities, which have a positive impact on the market growth.

The software is expected to grow at a high CAGR during the forecast period. The 3D printing software is widely used in different industry verticals to design the objects and parts to be printed. As manufacturing companies are shifting away from traditional manufacturing methods, the adoption of 3D software has grown to print iterations of different manufacturing parts.

As manufacturing companies are shifting away from traditional manufacturing methods, the adoption of 3D software has grown to print iterations of different manufacturing parts.

By Technology Analysis

Fused Deposition Modeling (FDM) Technology to be at Forefront

Based on technology, the market has been divided into FDM, SLS, SLA, DMLS/SLM, Polyjet, Multi Jet Fusion, DLP, Binder Jetting, EBM, CLIP/CDLP, SDL, and LOM.

Among these, fused Deposition Modeling (FDM) technology captured the maximum share in 2021. The growth of FDM is mainly due to the ease of operation and advantages associated with the technology. FDM technology is highly used in making durable, strong, and dimensionally stable parts.

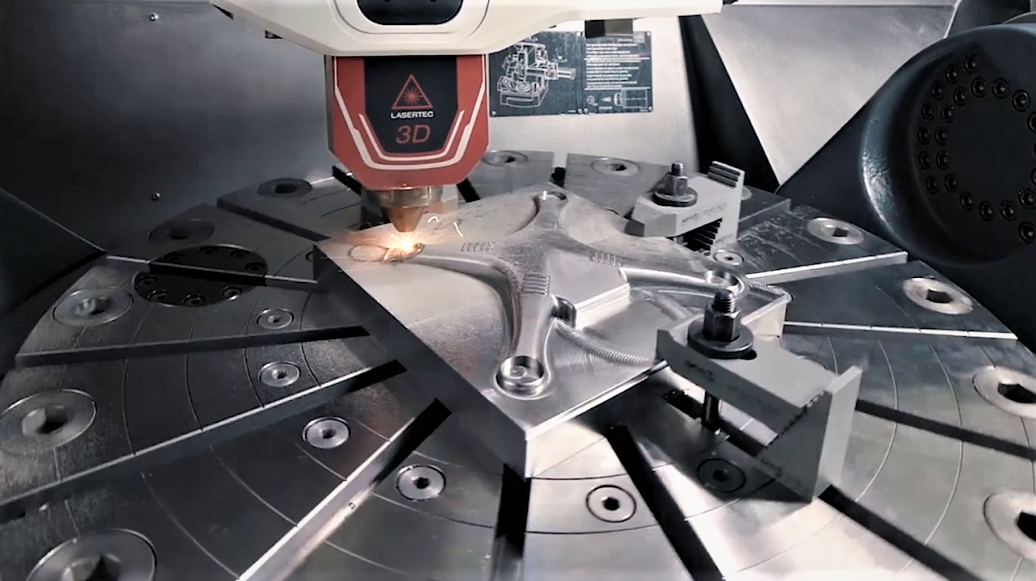

Direct Metal Laser Sintering (DMLS/SLM) technology is expected to grow at a high CAGR during the forecast period. The technology promotes the production of high-quality metal components, which makes them suitable for the manufacturing industry since they enable the creation of complex geometries of metals of extremely small sizes.

Selective Laser Sintering (SLS) is expected to show significant growth in coming years. SLS finds a wide variety of vertical applications, including aerospace, defense, automotive, and others. Polyjet, Multi Jet Fusion, DLP, Binder Jetting, EBM, CLIP/CDLP, SDL, LOM technologies are expected to witness a significant rise in adoption in the upcoming years.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Prototyping to Capture Maximum Market Share Due to its Widespread Acceptance Across Various Vertical Industries

This technology has application in prototyping, production, proof of concept, and others.

Due to widespread acceptance of the prototyping process across various vertical industries, the prototyping represented the largest market share in 2021. Prototyping helps businesses to achieve greater precision and produce consistent end products. This technology helps to manufacture 3 dimensional computer-aided design (CAD) models and prototypes.

The production is expected to witness strong growth during the forecast period. While manufacturers are shifting their traditional manufacturing units toward advanced manufacturing processes, the adoption of this technology to produce complex and low-volume parts is expected to grow during the forecast period.

By End User Analysis

Automotive Industry to Lead Market Owing to its Maximum Use in Producing Prototype Equipment

Automotive, aerospace and defense, healthcare, architecture and construction, consumer products, education, and others are some of the end-users of 3D printing.

The adoption of this technology in the automotive industry is expected to hold a maximum share in 2021. For decades, the automotive industry has been using this technology to produce prototype equipment and small custom products in a short time span. The technology is being widely used for the construction of lightweight components for automobiles and OEMs.

The technology is being widely used for the construction of lightweight components for automobiles and OEMs.

Additive manufacturing has tremendous potential for the aerospace industry, where light, solid, and geometrically complex parts are required — and normally manufactured in limited quantities. Aerospace and defense companies are heavily using this technology to produce lightweight components.

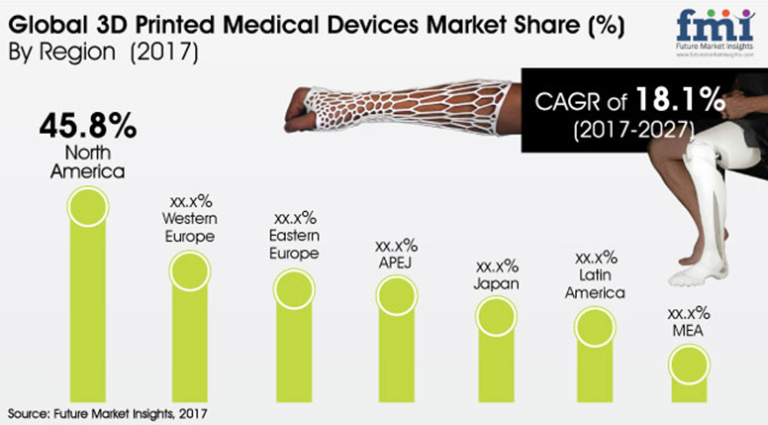

Additive processing in the healthcare industry helps create artificial tissues and muscles that mimic normal human tissues that can be used in substitution operations. These skills are anticipated to lead to vertical acceptance of 3DP in healthcare and the sector's development.

On the other hand, architecture and construction, consumer products, education verticals are anticipated to grow at a significant CAGR during the forecast period.

REGIONAL INSIGHTS

North America 3D Printing Market Size, 2021 (USD Billion)

To get more information on the regional analysis of this market, Request a Free sample

Geographically, the market is divided into five major regions such as North America, South America, Asia Pacific, Europe, and the Middle East & Africa. They are further categorized into countries.

They are further categorized into countries.

Globally, North America accounted for the maximum share in the global market mainly due to rising expenditure on advanced manufacturing technologies by developed countries such as Canada and the U.S. Also, various government agencies, such as the National Aeronautics and Space Administration (NASA), have identified major R&D investments that can greatly contribute to space applications and create new technologies that drive business expansion.

Europe holds the second-highest market share in the global market. The demand for this technology is high among small and medium-sized industries that require high-speed, reliable, and inexpensive prototypes for manufacturing purposes. The regional market is expected to showcase strong growth in the adoption of this technology in the manufacturing and semiconductors industry.

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. An increasing interest in the development of a sustainable 3D printing environment has been backed by APAC manufacturers and the implementation of several policies and legislative proposals by governments in the region. Given the massive government funding for the industry, China is possibly the main force behind adopting this technology in Asia.

Given the massive government funding for the industry, China is possibly the main force behind adopting this technology in Asia.

To know how our report can help streamline your business, Speak to Analyst

The Middle East & Latin America is expected to showcase high growth during the forecast period. The rapid adoption of 3D technology in the region is mainly due to technological advancements and improvements in the manufacturing industry.

KEY INDUSTRY PLAYERS

Companies are Focusing on Partnership and Collaboration Activities for Safer Internet Environment

The prominent players of the market are focusing on offering advanced and innovative solutions catering to the growing needs of industries. These key players are investing in R&D to provide innovative services and materials. They are entering into strategic partnership and collaboration to provide next-generation solutions. These companies are offering consumer-centric solutions to help in boosting business growth. Similarly, the key players are keen on offering a vast range of 3-dimensional materials to grow across every industry application.

Similarly, the key players are keen on offering a vast range of 3-dimensional materials to grow across every industry application.

February 2022 – Imaginarium partnered with Ultimaker to introduce desktop & industrial 3D printer range in the India market. This partnership would help Ultimaker to expand its business in India, where additive manufacturing is anticipated to reach a point of breakthrough in the coming years.

November 2021 – 3D Systems is planning to enhance additive manufacturing innovation through partnerships and launch of products. The company launched new 3-dimensional printing tools and collaborated with the U.K.-based startup Additive Manufacturing Technologies (AMT) to present novel 3-dimensional printing workflows and improve AM software, which is ideal for automotive components.

List of the Key Companies Profiled:

- 3D Systems Corporation (U.S.)

- The ExOne Company (Germany)

- voxeljet AG (Germany)

- Materialise NV (Belgium)

- Made in Space, Inc.

(U.S.)

(U.S.) - Envisiontec, Inc. (Germany)

- Stratasys Ltd. (U.S.)

- HP, Inc. (U.S.)

- General Electric Company (GE Additive) (U.S.)

- Autodesk Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2022 – South Africa’s Department of Science and Innovation (DSI) launched a pilot project to build around 25 houses by utilizing 3D printing technology to combat the shortage of housing in the country.

- March 2022 – 3DGence, a European manufacturer, launched a new industrial FFF machine, INDUSTRY F421, which is well-suited with high performance materials. Additionally, the firm has also introduced AS9100, a new high-temperature filament, which is made using polyether ether ketone (PEEK) and certified for use in defense and aerospace sectors.

REPORT COVERAGE

An Infographic Representation of 3D Printing Market

View Full Infographic

To get information on various segments, share your queries with us

The global 3D printing market research report highlights leading regions across the world to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further offers drivers and restraints, helping the reader gain in-depth knowledge about the market.

Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further offers drivers and restraints, helping the reader gain in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

ATTRIBUTE | DETAILS |

Study Period | 2018-2029 |

Base Year | 2021 |

Estimated Year | 2022 |

Forecast Period | 2022-2029 |

Historical Period | 2018-2020 |

Unit | Value (USD billion) |

Segmentation | By Component, Technology, Application, End-User, and Region |

By Component |

|

By Technology |

|

By Application |

|

By End-User |

|

By Region |

|

Overview of the home 3D printing market - Technology on vc.

ru

ru The market for home 3D printers is one of the fastest growing markets in recent years. If a few years ago such a thing as a “home 3D printer” belonged to the exotic, now such a device is becoming commonplace.

602 views

Varvara Kiseleva

Doctor, marketer, researcher, mother

At the same time, the scope of such printers in everyday life is rapidly expanding. Initially, these printers were acquired mainly by those who were fond of technical modeling. But now the 3D printer works at home for many artists, jewelers, car enthusiasts, cyclists, fishermen, home craftsmen and in general for those who have any hobby. Since the presence of such a device allows not only to save a lot of time that used to be spent looking for spare parts and accessories, but also to quickly produce parts and products of our own design.

This is also facilitated by the constantly decreasing price of printers and consumables, which today already allows you to purchase a device "in reserve", just in case you need to make some broken part of a household appliance or a lost accessory.

Since the existing 3D printing technologies are very diverse, it should be clarified that speaking of the home 3D printer market, we mean printers using FDM (Fused Deposition Modeling) technology, which involves the creation of three-dimensional objects by applying successive layers of thermoplastic plastic that is pressed through in the molten state through a heated nozzle. It was this technology that, due to its simplicity and low cost, was able to quickly conquer the home market.

Today, there are a huge number of materials that are used for 3D printing at home, including special compositions with ceramic, wood filler, as well as metal powder.

The use of such materials makes it possible to obtain products that differ little in appearance and performance from products made of wood, ceramics and metal.

As for the actual plastic, currently more than a dozen varieties are available for household printing with different predominant properties: strength, decorative, various heat resistance. There are also flexible plastics that allow you to print products that resemble rubber products.

There are also flexible plastics that allow you to print products that resemble rubber products.

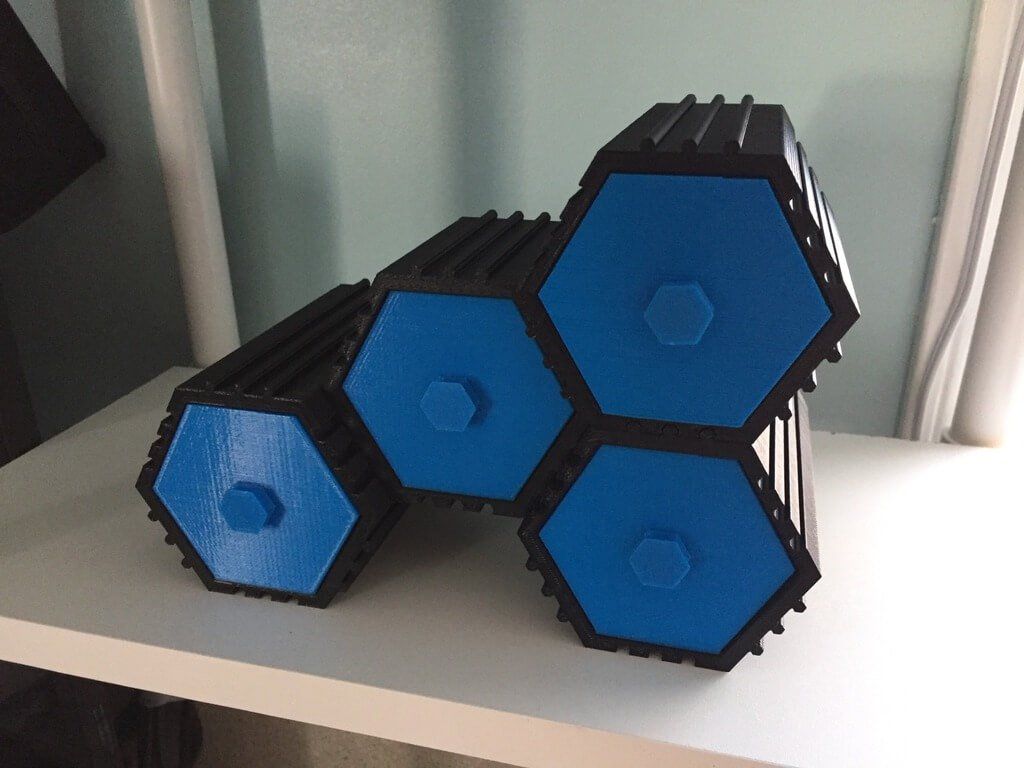

It should be noted that the home printer market is actually divided into two segments: the ready-made printer market, which is operated by a limited number of manufacturers, and the DIY market, which offers kits and kits for self-assembly of printers. The last segment significantly exceeds the first, both in terms of the number of devices sold and in terms of cash turnover, despite the fact that DIY devices are several times cheaper than ready-made factory-assembled printers. Currently, this is perhaps the only market where DIY versions are dominated to such an extent.

There is a certain specificity of the DIY market. Although there is no official standardization here, nevertheless, historically, although unofficial, but rather rigid standards have arisen here in terms of dimensions, interfaces, tolerances and fits, as well as the parameters of signals and connectors of electronic devices, which all new manufacturers that appear on the market are forced to follow. .

.

As a result, in the course of competition between manufacturers of components, the market was divided among a limited number of manufacturers of components for 3D printers. This has led to the fact that the vast majority of DIY kits for self-assembly consist of the same components, and overlap in their composition by 60-80%. The differences between them are in the design features of the implementation.

In fact, the firms that sell these kits are selling their intellectual property to develop a particular design. Competition between manufacturers (since all kits are equipped with the same parts of identical quality) is carried out at the level of service implementation and customer support.

However, the vast majority of DIY printers are clones of the Prusa series with open source modeling software. This series was designed by Czech engineer Josef Průša especially as a DIY model. The open source code, as well as the simplicity of design, allowing for numerous implementation options, combined with low cost, has made Prusa the world's best-selling 3D printer series.

The COVID-19 pandemic has given a major boost to the popularity of 3D printers, as 3D printing enthusiasts created groups that, especially in the early stages of the pandemic, were able to locally print hard-to-find parts, consumable accessories, and medical equipment components in COVID clinics, and which literally saved thousands of lives. This phenomenon received wide publicity in the press and caused a rapid increase in public interest in the possibilities of 3D printing.

Venturi valves for ventilators, 3D printed.

3D printed nasopharyngeal swabs.

Diving mask converted by 3D printing into antique mask

As a result, contrary to forecasts, sales of 3D printers during the epidemic not only did not fall, but even increased. This is especially true for DIY kits ordered by mail.

Market growth during the pandemic and growth forecast until 2024 in billions of US dollars. Data from Wohlers Associates © Statista

This review uses materials and photographs from Wohlers Associates, Research and Markets, Fortune Busness Insights, Technavio, 3dnatives. com.

com.

Thank you for your interest in my article! In my analysis, I tried to highlight all the current features of the 3D printer market.

If you are interested in such posts and are not afraid of large analytical texts, subscribe to my profile, I will share my research.

I will also be grateful for the proposed topics for future publications.

3D printing: an overview of technology, equipment manufacturers and how to invest in the industry

3D printing is one of the modern additive manufacturing technologies. Things and details are literally created layer by layer, while according to the classical scheme they need to be melted or cut using molds.

How does 3D printing work?

Additive technologies include printing and casting (burning, model melting). They use various complex plastics, ceramics, metals, gypsum and biomaterials.

Different technologies are used depending on materials, workpiece dimensions and precision. Familiar to all 3D printing is called "layer-by-layer deposition" and uses a filament - a special plastic. This is a cheap and fast technology, which is mainly used for creating models and prototypes.

Familiar to all 3D printing is called "layer-by-layer deposition" and uses a filament - a special plastic. This is a cheap and fast technology, which is mainly used for creating models and prototypes.

More expensive and sophisticated technologies can create precise and durable parts or finished products from plastics. For this, photopolymers and other plastics are used.

To print from metals, powder alloys are used - standard and unique. With their help, you can create miniature and complex objects. And with the help of plaster, multi-colored models are printed, mainly for decorative purposes.

In general, 3D printing is very promising, it can be used to create almost any part - from auto parts to human organs. In the midst of a pandemic, for example, protective equipment for doctors and parts of ventilators for patients were often produced in this way.

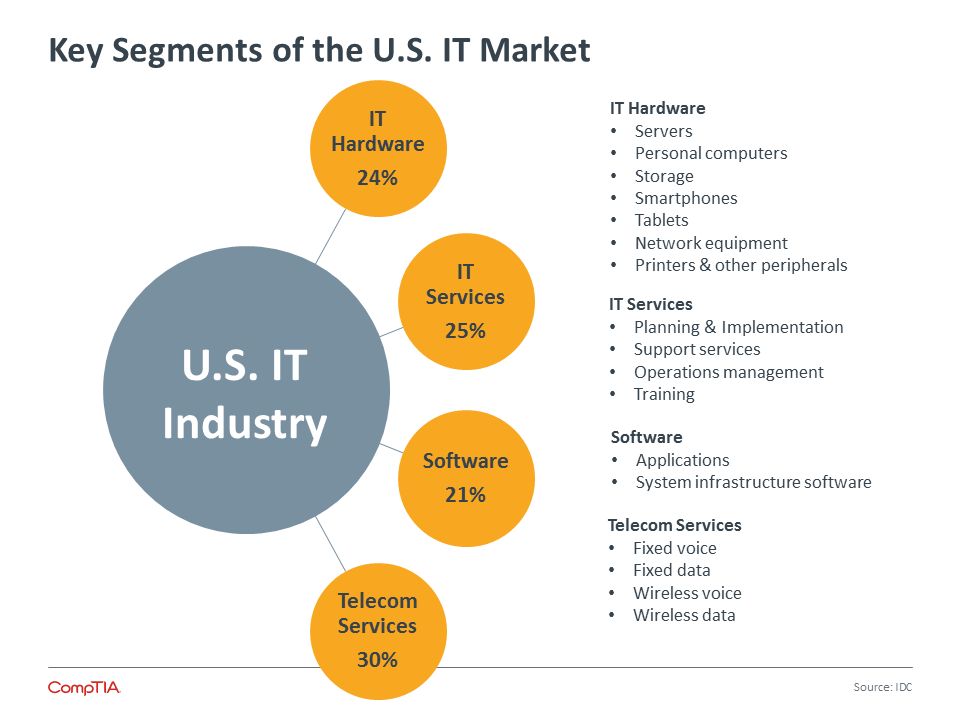

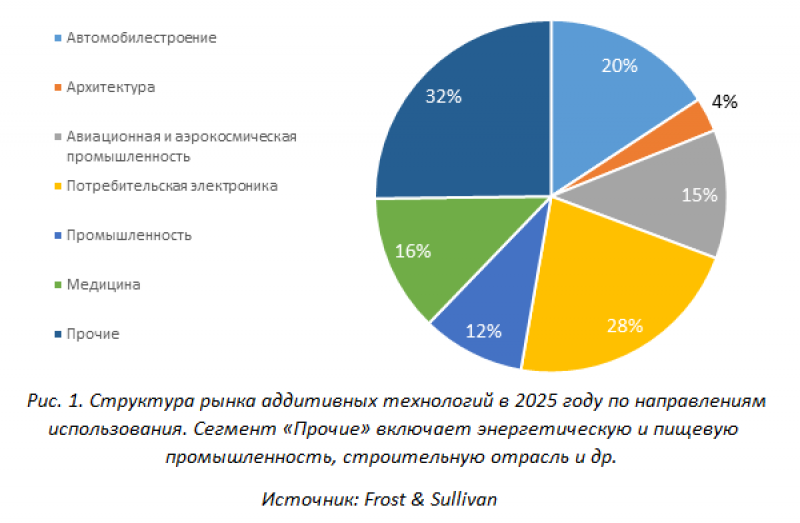

The main segments of the 3D printing market are automotive, aerospace, consumer goods and electronics, and medical. According to Statista, the automotive and manufacturing sectors were the most profitable. But so far, for the most part, 3D printing companies do not work as pipelines, but provide services: the creation of parts, the implementation of technologies, maintenance and support. And the market share for the production of equipment for 3D printing is not yet highly developed, according to Acumen Research.

According to Statista, the automotive and manufacturing sectors were the most profitable. But so far, for the most part, 3D printing companies do not work as pipelines, but provide services: the creation of parts, the implementation of technologies, maintenance and support. And the market share for the production of equipment for 3D printing is not yet highly developed, according to Acumen Research.

Benefits of 3D printing

This production reduces supply chains, reduces costs, production time and waste. Also, production becomes more flexible and can respond to surges in demand, supply disruptions and shortages of workers. The global supply chain crisis of 2020 has exposed the shortcomings of traditional manufacturing, which could accelerate the adoption of 3D printing technologies.

Businesses can also hold less inventory: if needed, they will “print” more for themselves if there is no delivery. This reduces the area of warehouses. You can even place printers closer to customers to reduce delivery times and costs. At the same time, companies are less dependent on suppliers.

At the same time, companies are less dependent on suppliers.

Finally, you can create exactly as many parts as you need, even just one. But a classic production line often involves a minimum volume for work. Therefore, "printers" are often used for prototypes and R&D: it is easier and cheaper to experiment.

What are the prospects for the development of 3D printing technology?

ARK Invest believes that the development of additive technologies is helped by crises: 2000, 2008, 2020, because there are problems in supplies, especially international ones. Companies are thinking about dependence and want to have their own production. The issue arose especially acutely in the midst of a trade war between the United States and China, and the pandemic aggravated the situation.

ARK predicts that the 3D printing market will grow from $16 billion in 2020 to $1.1 trillion in 2030. And according to Statista, the global market will triple from 2020 to 2026.

Which stocks of 3D companies can I buy?

Several shares of companies directly involved in the 3D printing market are available to unqualified investors.

3D systems (DDD)

It is one of the largest companies with 28.4% of the market according to Industry Data Analytics. 3D Systems develops software, equipment and materials, prints to order. The company is focused on healthcare and industry. Its strategy is to move away from installation and support services for customers, focusing on development.

Proto Labs (PRLB)

Primary activity is prototyping and custom manufacturing parts, mainly for medical/healthcare and electronics.

Desktop Metal (DM)

The company develops and sells metal and carbon fiber 3D printing systems and develops its own materials. Since 2021, he has been creating biofibers.

In terms of financial performance, Proto Labs looks more interesting: its revenue is steadily increasing, unlike 3D Systems. And this is important for a company to grow in an innovative market. Proto Labs is also profitable, although net margins have halved in 5 years. But this can be justified by development and expansion costs.

S., Canada, Mexico)

S., Canada, Mexico)  S. (By Application)

S. (By Application)