3D printing exchange traded fund

Total 3D-Printing Index - ETF Tracker

ETFs Tracking Other Mutual Funds

Mutual Fund to ETF Converter Tool

- Overview

- Returns

- Fund Flows

- Expenses

- Dividends

- Holdings

- Taxes

- Technicals

- Analysis

- Realtime Ratings

ETFs Tracking The Total 3D-Printing Index – ETF List

ETFs tracking the Total 3D-Printing Index are presented in the following table.

ETFs Tracking The Total 3D-Printing Index – ETF Returns

The following table presents historical return data for ETFs tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Fund Flow

The table below includes fund flow data for all U.S. listed Highland Capital Management ETFs. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

Fund Flows in millions of U.S. Dollars.

ETFs Tracking The Total 3D-Printing Index – ETF Expenses

The following table presents expense information for ETFs tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Dividends

The following table presents dividend information for ETFs tracking the Total 3D-Printing Index, including yield and dividend date.

ETFs Tracking The Total 3D-Printing Index – ETF Holdings

The following table presents holdings data for all ETFs tracking the Total 3D-Printing Index. For more detailed holdings data for an ETF click the ‘View’ link in the right column.

ETFs Tracking The Total 3D-Printing Index – ETF Tax Rates

The following table presents sortable tax data for ETFs currently tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Technicals

The following table presents certain technical indicators for ETFs tracking the Total 3D-Printing Index. To see complete technical metrics click the ‘View’ link in the right column.

ETFs Tracking The Total 3D-Printing Index – ETF Analysis

The following table presents links to in-depth analysis for ETFs tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Realtime Ratings

The following table presents a proprietary ETF Database rating for ETFs tracking the Total 3D-Printing Index.

Total 3D-Printing Index - ETF Tracker

| Symbol | ETF Name | Asset Class | Total Assets* | YTD | Avg Volume | Previous Closing Price | 1-Day Change | Overall Rating | 1 Week | 1 Month | 1 Year | 3 Year | 5 Year | YTD FF | 1 Week FF | 4 Week FF | 1 Year FF | 3 Year FF | 5 Year FF | ETF Database | Inception | ER | Commission Free | Annual Dividend Rate | Dividend Date | Dividend | Annual Dividend Yield % | P/E Ratio | Beta | # of Holdings | % In Top 10 | Complete | ST Cap Gain Rate | LT Cap Gain Rate | Tax Form | Lower Bollinger | Upper Bollinger | Support 1 | Resistance 1 | RSI | Advanced | Fact Sheet | ETF Holdings | Chart | ETF Home Page | Head-To-Head | Liquidity Rating | Expenses Rating | Returns Rating | Volatility Rating | Dividend Rating | Concentration Rating |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PRNT | 3D Printing ETF | Equity | $175,364 | -41. 1% 1% | 23,942.0 | $20.21 | -1.99% | -4.3% | -4.9% | -41.0% | -9.5% | -17.6% | Technology Equities | 2016-07-19 | 0.66% | N/A | $0.00 | 2019-12-27 | $0.02 | 0.00% | 39.1 | 1.30 | 57 | 43.9% | View | 40% | 20% | 1099 | $19. 96 96 | $22.42 | $19.98 | $20.38 | 42.94 | View | View | View | View | View | View | B+ | B- |

Sort By:

- Overview

- Returns

- Fund Flows

- Expenses

- Dividends

- Holdings

- Taxes

- Technicals

- Analysis

- Realtime Ratings

ETFs Tracking Other Technology Equities

ETF Database staff has allocated each ETF in the ETF database, as well as each index, to a single ‘best-fit’ ETF Database Category. Other ETFs in the Technology Equities ETF Database Category are presented in the following table.

Other ETFs in the Technology Equities ETF Database Category are presented in the following table.

* Assets in thousands of U.S. Dollars. Assets and Average Volume as of 2022-12-22 15:18:01 -0500

ETFs Tracking Other Technology Equities

Historical return data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Fund flow information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Expense information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Dividend information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Holdings data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Tax Rate data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Technical information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Links to analysis of other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Links to a proprietary ETF Database rating for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

| Symbol | ETF Name | Asset Class | Total Assets* | YTD | Avg Volume | Previous Closing Price | 1-Day Change | Overall Rating | 1 Week | 1 Month | 1 Year | 3 Year | 5 Year | YTD FF | 1 Week FF | 4 Week FF | 1 Year FF | 3 Year FF | 5 Year FF | ETF Database | Inception | ER | Commission Free | Annual Dividend Rate | Dividend Date | Dividend | Annual Dividend Yield % | P/E Ratio | Beta | # of Holdings | % In Top 10 | Complete | ST Cap Gain Rate | LT Cap Gain Rate | Tax Form | Lower Bollinger | Upper Bollinger | Support 1 | Resistance 1 | RSI | Advanced | Fact Sheet | ETF Holdings | Chart | ETF Home Page | Head-To-Head | Liquidity Rating | Expenses Rating | Returns Rating | Volatility Rating | Dividend Rating | Concentration Rating |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VGT | Vanguard Information Technology ETF | Equity | $40,507,100 | -29. 8% 8% | 869,557.0 | $319.07 | -2.48% | -3.4% | -4.4% | -29.1% | 34.8% | 101.5% | Technology Equities | 2004-01-26 | 0.10% | Vanguard | $2.79 | 2021-09-29 | $0.89 | 0.63% | 32.8 | 1.08 | 374 | 58.8% | View | 40% | 20% | 1099 | $318. 04 04 | $351.95 | $314.11 | $323.67 | 43.89 | View | View | View | View | View | View | A | A | |||||||||||

| XLK | Technology Select Sector SPDR Fund | Equity | $39,123,400 | -27.7% | 7,594,071.0 | $124.47 | -2.52% | -3.4% | -4. 5% 5% | -26.9% | 41.0% | 104.1% | Technology Equities | 1998-12-16 | 0.10% | N/A | $1.10 | 2021-09-20 | $0.27 | 0.67% | 27.5 | 1.04 | 78 | 67.3% | View | 40% | 20% | 1099 | $124.12 | $137.28 | $122.48 | $126. 35 35 | 44.01 | View | View | View | View | View | View | A+ | A | |||||||||||

| IYW | iShares U.S. Technology ETF | Equity | $8,039,290 | -34.9% | 953,068.0 | $74.37 | -2.76% | -3.5% | -4.4% | -34.5% | 30.6% | 86.2% | Technology Equities | 2000-05-15 | 0. 39% 39% | N/A | $0.32 | 2021-09-24 | $0.07 | 0.29% | 39.3 | 1.06 | 142 | 61.9% | View | 40% | 20% | 1099 | $74.16 | $82.23 | $73.19 | $75.46 | 43.67 | View | View | View | View | View | View | A | A- | |||||||||||

| SMH | VanEck Semiconductor ETF | Equity | $6,840,980 | -33. 4% 4% | 4,594,562.0 | $203.50 | -4.15% | -4.4% | -4.6% | -32.7% | 47.4% | 117.4% | Technology Equities | 2000-05-05 | 0.35% | N/A | $1.50 | 2020-12-21 | $1.50 | 0.50% | 28.2 | 1.17 | 26 | 58.5% | View | 40% | 20% | 1099 | $204. 84 84 | $227.46 | $199.30 | $207.84 | 45.72 | View | View | View | View | View | View | A | A | |||||||||||

| SOXX | iShares Semiconductor ETF | Equity | $6,126,650 | -35.0% | 1,148,011.0 | $348.58 | -4.04% | -4.4% | -4.6% | -34. 1% 1% | 43.0% | 114.1% | Technology Equities | 2001-07-10 | 0.35% | N/A | $3.17 | 2021-09-24 | $1.16 | 0.61% | 32.7 | 1.17 | 32 | 57.2% | View | 40% | 20% | 1099 | $350.61 | $390.72 | $340.96 | $356.49 | 45. 41 41 | View | View | View | View | View | View | A | A- | |||||||||||

| FTEC | Fidelity MSCI Information Technology Index ETF | Equity | $5,059,110 | -29.6% | 182,897.0 | $94.43 | -2.47% | -3.4% | -4.4% | -29.0% | 34.9% | 96.4% | Technology Equities | 2013-10-21 | 0. 08% 08% | Fidelity | $0.79 | 2021-09-17 | $0.20 | 0.60% | 31.7 | 1.08 | 366 | 59.3% | View | 40% | 20% | 1099 | $94.08 | $104.13 | $92.96 | $95.76 | 43.95 | View | View | View | View | View | View | A- | A+ | |||||||||||

| CIBR | First Trust NASDAQ Cybersecurity ETF | Equity | $4,606,190 | -27. 1% 1% | 643,575.0 | $38.46 | -1.51% | -2.7% | -4.3% | -26.2% | 31.2% | 70.9% | Technology Equities | 2015-07-07 | 0.60% | N/A | $0.06 | 2021-06-24 | $0.03 | 0.11% | 28.0 | 1.02 | 39 | 46.2% | View | 40% | 20% | 1099 | $38. 24 24 | $41.89 | $38.03 | $38.77 | 43.43 | View | View | View | View | View | View | A | B- | |||||||||||

| IGV | iShares Expanded Tech-Software Sector ETF | Equity | $4,559,800 | -36.3% | 1,446,682.0 | $253.45 | -1.92% | -2.5% | -2. 0% 0% | -36.2% | 9.0% | 64.1% | Technology Equities | 2001-07-10 | 0.40% | N/A | $0.00 | 2020-06-15 | $0.07 | 0.00% | 50.1 | 0.99 | 121 | 56.6% | View | 40% | 20% | 1099 | $250.37 | $274.22 | $250.18 | $255. 93 93 | 45.13 | View | View | View | View | View | View | A | A- | |||||||||||

| IXN | iShares Global Tech ETF | Equity | $2,804,600 | -29.7% | 325,000.0 | $44.92 | -2.39% | -3.2% | -4.6% | -29.0% | 31.3% | 81.2% | Technology Equities | 2001-11-12 | 0. | N/A | $1.13 | 2021-06-10 | $0.20 | 1.82% | 38.5 | 1.03 | 132 | 57.4% | View | 40% | 20% | 1099 | $44.82 | $49.57 | $44.27 | $45.54 | 44.18 | View | View | View | View | View | View | A | A- | |||||||||||

| SKYY | First Trust Cloud Computing ETF | Equity | $2,635,560 | -45. 1% 1% | 443,378.0 | $57.19 | -2.32% | -4.6% | -4.6% | -45.5% | -4.4% | 27.6% | Technology Equities | 2011-07-05 | 0.60% | N/A | $0.18 | 2021-09-23 | $0.04 | 0.15% | N/A | 0.97 | 68 | 36.7% | View | 40% | 20% | 1099 | $56. 87 87 | $64.01 | $56.29 | $57.85 | 41.92 | View | View | View | View | View | View | A | B | |||||||||||

| Click Here to Join to ETF Database Pro for 14 Days Free, Export This Data & So Much More | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Content continues below advertisement

NewLoading Articles...

5 3D Printing Stocks to Consider in 2022

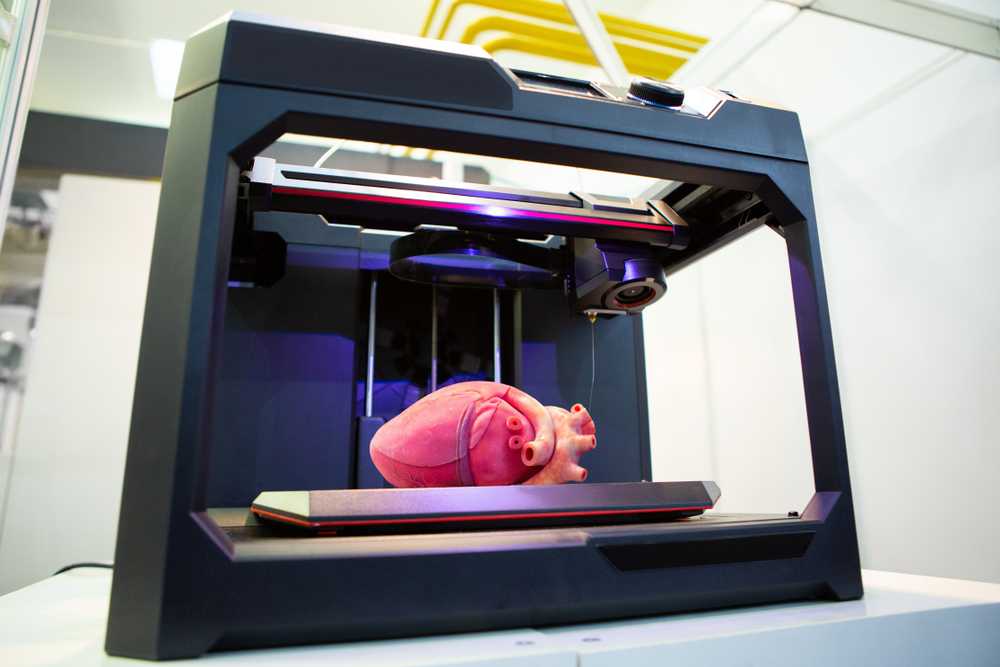

Back in the early 2010s, stocks were booming for 3D printing -- also known as additive manufacturing, a computer-controlled process in which three-dimensional objects are made. But the boom was followed by a bust as many pure-play 3D printing companies didn't immediately deliver on lofty expectations.

But the boom was followed by a bust as many pure-play 3D printing companies didn't immediately deliver on lofty expectations.

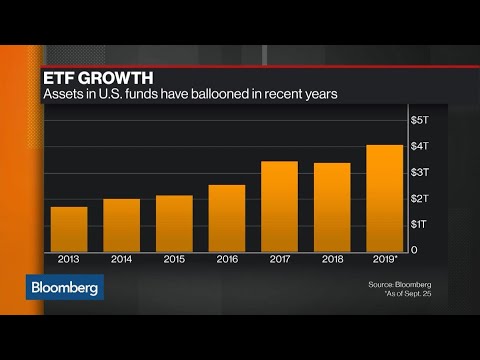

Rumors of the manufacturing technology's demise are clearly premature. These days, 3D printing is a high-growth niche that is steadily reshaping the manufacturing and industrial sectors. Some estimates point to a doubling in annual revenue from additive manufacturing between 2022 and 2026. Even growth investor Cathie Wood has launched a fund focused on manufacturing tech, The 3D Printing ETF (NYSEMKT:PRNT), via her company ARK Invest.

Here's what you need to know about 3D printing and additive manufacturing stocks for 2022:

Image source: Getty Images.

Investing in 3D printing stocks

The manufacturing of products in all corners of the economy is being revolutionized by 3D printing, from healthcare equipment to metal fabrication to housing construction. It's invading so many sectors that tech giants such as Microsoft (NASDAQ:MSFT), Autodesk (NASDAQ:ADSK), and HP (NYSE:HPQ) have launched products aimed at 3D printing and additive manufacturing. Other engineering and software outfits such as Dassault Systemes (OTC:DASTY), ANSYS (NASDAQ:ANSS), and Trimble (NASDAQ:TRMB) have also gotten involved in 3D printing technology.

It's invading so many sectors that tech giants such as Microsoft (NASDAQ:MSFT), Autodesk (NASDAQ:ADSK), and HP (NYSE:HPQ) have launched products aimed at 3D printing and additive manufacturing. Other engineering and software outfits such as Dassault Systemes (OTC:DASTY), ANSYS (NASDAQ:ANSS), and Trimble (NASDAQ:TRMB) have also gotten involved in 3D printing technology.

Here are five key players to consider for 2022 that are a more focused bet on 3D printing:

| Company | Market Cap | Description |

|---|---|---|

| Desktop Metal (NYSE:DM) | $1.3 billion | Recent IPO that focuses on metal fabrication technology. |

| Stratasys (NASDAQ:SSYS) | $1.5 billion | One of the original 3D printing pioneers, with a wide array of printers and supporting design software. |

| Xometry (NASDAQ:XMTR) | $1.9 billion | A manufacturing marketplace, including access to on-demand 3D printing services. |

| 3D Systems (NYSE:DDD) | $1.9 billion | Another original 3D printing pioneer and the largest pure-play stock on 3D printing technology. |

| PTC (NASDAQ:PTC) | $11.7 billion | A manufacturing technology provider with a suite of software and related services for industrial businesses. |

1. Desktop Metal

This company is a recent entry into the 3D printing space after going public via a SPAC at the end of 2020. The stock has been a terrible market underperformer since then, losing three-quarters of its value as of spring 2022. However, Desktop Metal could still be a promising investment for the long term.

As its name implies, Desktop Metal develops 3D printing hardware and accompanying design software for metal and carbon fiber parts. The company's smaller systems can handle prototyping and one-off parts, and larger printers are production grade-designed for manufacturing facilities. Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

The company's smaller systems can handle prototyping and one-off parts, and larger printers are production grade-designed for manufacturing facilities. Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

Despite a tenuous start as a public company, Desktop Metal was actually increasing revenue at a torrid triple-digit pace in 2021. Gross profit margins are thin, and the company generated a steep net loss, but that should improve over time as the business scales its operation. Desktop Metal also has several hundred million dollars in cash and investments to fund its expansion. It used some of these funds to acquire additive manufacturing peer ExOne at the end of 2021.

2. Stratasys

Stratasys was part of the early 2010s 3D printing stock boom and bust, but its business has endured. Sales took a dip early in the COVID-19 pandemic but are rebounding as the Israel-based company picks up new manufacturing contracts.

Stratasys serves a diverse set of customers, including aerospace and automotive parts manufacturers, medical and dental companies, and makers of basic consumer products. In addition to a wide array of 3D printer models, Stratasys develops software to help users accelerate the time between design and final printing.

It isn't the highest-growth name on this list, but Stratasys is profitable (on a free cash flow basis) and has more than $500 million in cash and investments on its balance sheet, as well as no debt. Management thinks its payoff from years of research and development into additive manufacturing will accelerate in 2022.

3. Xometry

This is another newcomer to public markets. Xometry completed its initial public offering (IPO) over the summer of 2021, raising almost $350 million in cash in the process. As is often the case with new IPOs, the stock has underperformed since then. It has lost over half of its value from the time it started trading on public markets, but the business itself is rapidly growing.

It has lost over half of its value from the time it started trading on public markets, but the business itself is rapidly growing.

Xometry is a marketplace for on-demand manufacturing of prototyping and mass production. It has a network of more than 5,000 suppliers that companies can call on to meet their fabrication needs. Among the suppliers on the Xometry platform are 3D printing companies, injection molding, and automated machining. The company reported having more than 28,000 active buyers utilizing its platform at the end of 2021.

Although it isn't profitable yet, Xometry's unique approach to the 3D printing and additive manufacturing industry is growing fast. Like other names on this list, it has a sizable war chest of cash and short-term investments that it can spend on research and marketing as it tries to attract more suppliers and buyers to its marketplace.

4. 3D Systems

3D Systems was another early player in the 3D printing industry, and while it suffered through the boom-and-bust period of the early 2010s, its business has held steady for much of the past decade. After a brief dip during the early days of the pandemic, 3D Systems is back in growth mode.

After a brief dip during the early days of the pandemic, 3D Systems is back in growth mode.

The company develops printers and design software for all sorts of materials and industries (medical device makers, dental labs, semiconductor designers, aerospace, and automotive manufacturers). It claims leadership among independent 3D printing companies (as measured by sales). As the 3D printing industry expands in the coming years, 3D Systems thinks it will be able to attract lots of new business with its extensive experience and global reach.

As an established tech outfit in the manufacturing sector, 3D Systems offers investors the prospect of more stable growth, along with profitability. It also has a large net cash position from which it can consolidate its lead in 3D printers and software technology.

5. PTC

By far the largest company on this list, PTC is a longtime technology partner of manufacturing and industrial enterprises. Fast approaching $2 billion in annualized sales and highly profitable, PTC has all the tools needed to digitally transform industrial businesses.

Fast approaching $2 billion in annualized sales and highly profitable, PTC has all the tools needed to digitally transform industrial businesses.

Besides 3D printing computer-aided design software (ANSYS is a peer and software partner that also operates in this space), PTC specializes in augmented reality, industrial IoT (Internet of Things), and product life-cycle management software. Most of its revenue is subscription-based (including its Creo software that enables 3D printing), making for a stable and steadily growing business model that generates ample cash flow. PTC puts spare cash to work developing new products for its partners and makes bolt-on acquisitions of other software companies that enhance its overall portfolio.

As a larger company, PTC won't be the fastest-growing stock in the additive manufacturing and 3D printing space. However, the company has established itself as a leader in industrial technology and should be a primary beneficiary as the production of manufactured goods gets more efficient.

The future of 3D printing

Manufacturing technology is making inroads throughout the global economy by reducing the cost of production and localizing and speeding up the time it takes to deliver customer orders. This is far from mere hype. Nevertheless, as is the case with all technology investments, progress won't go straight up. Expect twists and turns in these stocks as they develop new methods to design and make products.

If you decide to invest, do so in a measured way. Maintain a diversified portfolio, be wary of stocks benefiting from investor over-optimism, and always leave spare cash to invest more when there are inevitable dips. Given enough time -- years and decades -- investing in 3D printing could eventually provide a big payoff.

Related communication stocks topics

Investing in 5G Stocks

As the 5G technology rollout continues, these companies look like winners.

Investing in Top Telecommunications Stocks

Our world is increasingly interconnected, and these companies make it happen.

Investing in Communication Stocks

Communications has a broad definition. These companies are the leaders in the space.

Investing in Top Consumer Discretionary Stocks

When people have a little extra cash, they indulge in offerings from these companies.

Nicholas Rossolillo has positions in Autodesk and PTC. The Motley Fool has positions in and recommends Autodesk, HP, and Microsoft. The Motley Fool recommends 3D Systems, ANSYS, Dassault Systemes, PTC, and Trimble Inc. The Motley Fool has a disclosure policy.

3D printing market. Is it time to buy shares? / Habr

In this article I would like to talk about companies, each of which is a "unicorn". Shares of two of the three can already be bought on the New York Stock Exchange. There is a pattern: they were all born in the large Boston metropolitan area. And if Silicon Valley is a Mecca for software startups, then Boston, and especially the Massachusetts Institute of Technology (MIT), is the Medina for manufacturing innovation.

And if Silicon Valley is a Mecca for software startups, then Boston, and especially the Massachusetts Institute of Technology (MIT), is the Medina for manufacturing innovation.

I'll make it clear right away: I won't analyze the entire 3D printing market, but will focus on some of the most notable representatives of the desktop 3D printing segment. But even here everything is very conditional, since in the process of improving technology, products smoothly flow from one category to another, and roughly three main categories can be distinguished: desktop, professional and industrial. So…

In 2011, three American students founded Formlabs in their garage. It was headed by Max Lobowski. Born into a family of engineers - emigrants from Ukraine, from his youth he was interested in robotics and new technologies, attended various specialized additional classes in high school. After earning a bachelor's degree from Cornell University, he went on to graduate school at MIT, where he began designing his desktop 3D printer, which is both powerful and affordable. nine0003 Max Lobowski

nine0003 Max Lobowski

The friends were able to quickly get an angel investment, with which they launched their first product, the Formlabs Form 1 printer, in 2013. On the Kickstarter crowdfunding platform, they managed to raise almost $ 3 million from more than 2,000 bakers from around the world, who were excited about the new product, which promised to make 3D printing accessible to almost everyone. At that time, there were models of printers on the market using the technology of illumination with a laser beam of photopolymer resin (SLA) with a price of 100 thousand dollars, Formlabs offered a printer for 1500 dollars. The company, of course, faced a lot of difficulties in the production of the first batch, but it managed to ship the printers to all buyers. And even though they were far from perfect, this made it possible to attract round A investments in the amount of 19million dollars and return the "angel" money.

The company then continued to improve its product and create an ecosystem like Apple, which includes 3D printers themselves, consumables (resins for various tasks), software for preparing models for printing, and post-processing equipment. In 2019, the company's turnover reached $100 million, in May 2021 it received $150 million in a round of E from the SoftBank Investment Advisers fund, valuing the company at $2 billion. After that, there was talk of an IPO, which would be an absolutely logical step, since investment funds are planning this in the future for 7-10 years, and this period has already come for investors of the first round. nine0003

In 2019, the company's turnover reached $100 million, in May 2021 it received $150 million in a round of E from the SoftBank Investment Advisers fund, valuing the company at $2 billion. After that, there was talk of an IPO, which would be an absolutely logical step, since investment funds are planning this in the future for 7-10 years, and this period has already come for investors of the first round. nine0003

However, despite high market expectations, Max Lobowski said in an interview with BizJournals that he is in no rush to go public: “We would rather take our time and better prepare to be a great public company… We make more money than all 3D -companies taken together that have gone public with the help of SPAC (a procedure that allows startups to go public by merging with another private company). However, when I look at really large, successful, long-term public projects, which is what we are aiming for, I see that they are on a completely different level in terms of predictability and profitability than we are. ” These are serious words, and apparently the head of the company has reason to pronounce them. Most likely, the forecast of the company's capitalization in the region of 4-6 billion dollars with a successful initial offering, which will make it the largest company in the market, because even the result of the veteran and long-term market leader - 3DSystems as of August 2021 is no more than 3.5 billion. dollars. nine0003

” These are serious words, and apparently the head of the company has reason to pronounce them. Most likely, the forecast of the company's capitalization in the region of 4-6 billion dollars with a successful initial offering, which will make it the largest company in the market, because even the result of the veteran and long-term market leader - 3DSystems as of August 2021 is no more than 3.5 billion. dollars. nine0003

Unlike the students at Formlabs, Markforged was founded by older guys. However, even here it was not without MIT. MIT alumnus Mark Greg encountered 3D printing while his company was doing a job for the US Navy. Experiments in the field of improving the quality of products led him to the idea of creating a printer that could reinforce the printed model with carbon fiber to make it strong and suitable for use under load.

Employees of the company together with the Metal X printer, Mark Greg is seated to the right of the printer. nine0002 The company was founded in 2013, and already in 2014 at the Solidworks World exhibition, the startup presented its first product - the Mark One printer, which had two extruders and could reinforce the printed model with nylon, fiberglass and even Kevlar. Later, The Digital Forge, a cloud-based print management platform, was introduced, and already in 2017, MarkForged announced the release of a Metal X desktop metal 3D printer worth $100,000, while competitors' counterparts cost a million. In 2020, the company's turnover amounted to $ 70 million, and the management decided to bring the company to an IPO using SPAC. The company introduced the concept of additive manufacturing 2.0 to potential investors, allowing the production of finished products rather than prototypes, paving the way for 3D printing to the production of goods. The volume of this market is estimated by experts at 13 trillion dollars. nine0003

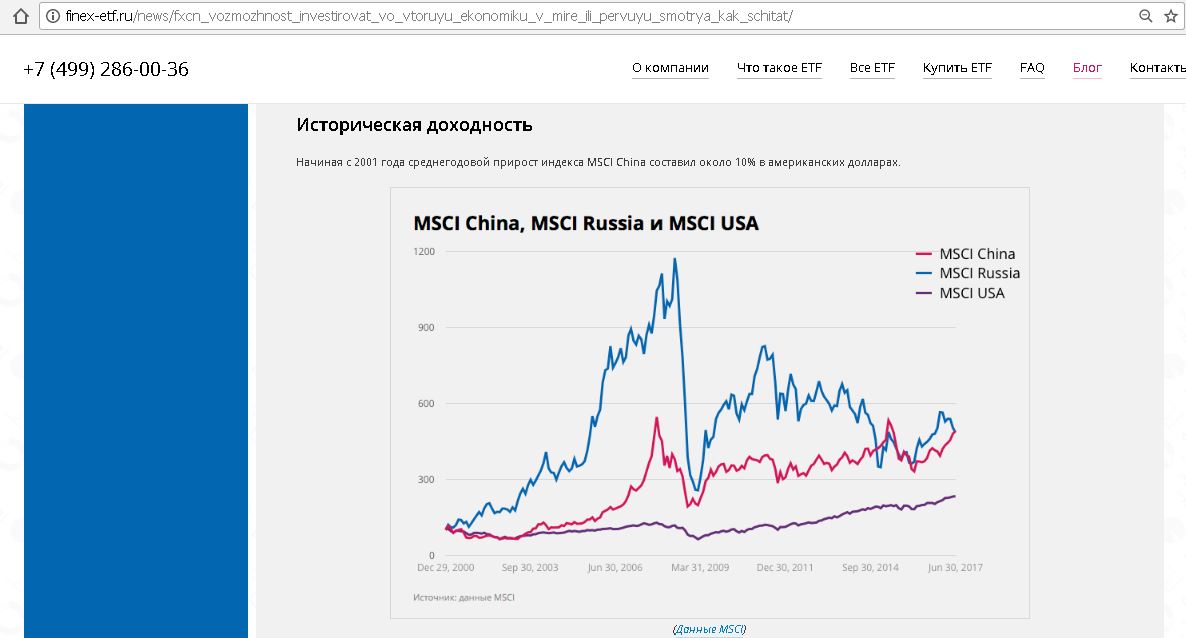

Later, The Digital Forge, a cloud-based print management platform, was introduced, and already in 2017, MarkForged announced the release of a Metal X desktop metal 3D printer worth $100,000, while competitors' counterparts cost a million. In 2020, the company's turnover amounted to $ 70 million, and the management decided to bring the company to an IPO using SPAC. The company introduced the concept of additive manufacturing 2.0 to potential investors, allowing the production of finished products rather than prototypes, paving the way for 3D printing to the production of goods. The volume of this market is estimated by experts at 13 trillion dollars. nine0003 Based on the Wholers Report, in 2020 the company predicted the growth of the additive technologies market at an average rate of 27%, which means that in the next 8 years from the current 18 billion dollars, the market will grow to 118 billion in 2029 from 10 multiple growth of own revenue up to 700 million dollars already in 2025.

On July 15, 2021, MarkForged was listed on the New York Stock Exchange under the ticker MKFG. The placement was estimated at 2 billion dollars, but a month later the shares lost a little in price, and the current capitalization is about 1.5 billion dollars. The question remains: is it worth buying shares of a company that plans to be unprofitable for at least another 2 years (the company predicts a turnover of about $100 million this year). nine0003

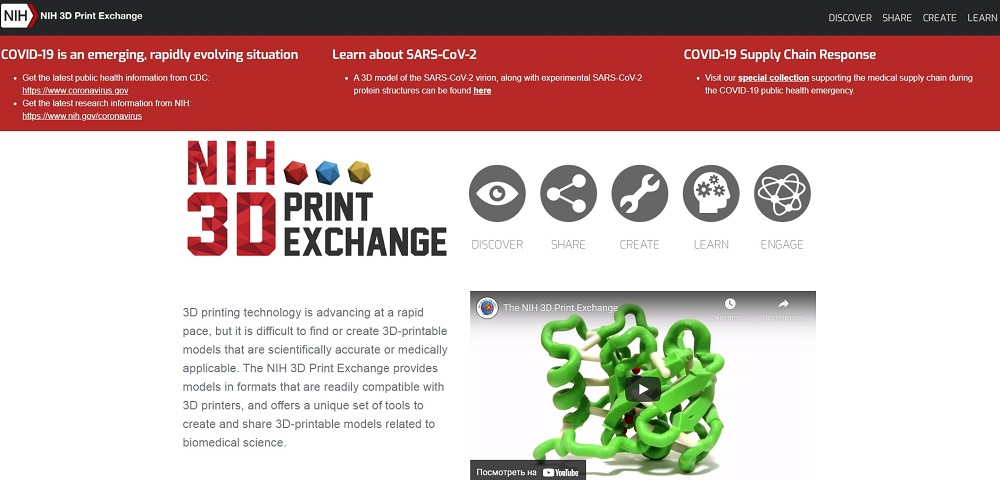

On the one hand, there are enough companies on the market trading at even higher multiples, and on the other hand, 3D printing is not yet such a mature technology that one can be sure of the 100% success of exactly the concept that MarkForged offers. In fact, the company itself considers the emergence of new technologies as one of the risks that could undermine its current technological superiority. In general, investors are now positive about the future of 3D printing. They were impressed by how the technology performed in the first, most difficult months of the pandemic, when production chains were disrupted and many transport arteries stopped working. With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, the coin has two sides, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the market of additive technologies in general. nine0003

With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, the coin has two sides, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the market of additive technologies in general. nine0003

The last one in my story is DeskTop Metal. Formlabs was created by MIT students, Markforged - MIT graduates, DeskTop Metal was created by experienced entrepreneurs Rick Fulop and Johan Mayerberg, as well as 4 (!) MIT professors. Going to the goal, Rick Fulop founded 6 different companies, also headed an investment fund. Johan Maierberg has been a lead engineer for various companies and became the CTO of DeskTop Metal.

Rick Fulop in front of DeskTop Metal Studio System 9 printers0002 The company's goal was to create an affordable desktop 3D printer that prints metal models. The company immediately became a favorite among investors and attracted investment rounds with enviable constancy. Among her donors were BMW, Ford Motor, Stratasys (a pioneer in the creation of 3D printing technology), SaudiAramco investment fund, General Electric and others. The total valuation in the latest round reached $2.4 billion, with a paltry $26 million turnover in 2019. The funds received were used for R&D and attracting the best engineers and developers to the company. In 2017, a three-component metal printing system based on FDM layer-by-layer printing technology was introduced, followed by burning and baking the final model. The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which can hardly be called a desktop one.

The company immediately became a favorite among investors and attracted investment rounds with enviable constancy. Among her donors were BMW, Ford Motor, Stratasys (a pioneer in the creation of 3D printing technology), SaudiAramco investment fund, General Electric and others. The total valuation in the latest round reached $2.4 billion, with a paltry $26 million turnover in 2019. The funds received were used for R&D and attracting the best engineers and developers to the company. In 2017, a three-component metal printing system based on FDM layer-by-layer printing technology was introduced, followed by burning and baking the final model. The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which can hardly be called a desktop one. The company claims that its Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it. nine0003

The company claims that its Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it. nine0003 The company entered the IPO on December 10, 2020 under the same SPAC scheme and in its presentation for potential investors outlined the following parameters: planned turnover in 2025 - 942 million dollars, reaching operating profit in 2023, and also indicated that , which plans to spend a significant portion of the proceeds on acquisitions of other 3D printing companies.

Capitalization on the New York Stock Exchange at the time of its IPO on December 10 was a fantastic $6 billion. During the placement, $580 million was raised and the company was assigned the laconic ticker DM. Already in February 2021, the shares rose even more, and the company's capitalization exceeded $8 billion. DM has said it will be the first company in 3D printing history to have a capitalization of over $10 billion. Having received huge funds at its disposal, already in January 2021, DM announced the first takeover deal: the German manufacturer of professional photopolymer 3D printers EnvisionTEC (founded in 2002 and is one of the oldest on the market) was bought for $ 300 million. For me, this choice was not obvious, it is difficult to find something in common between DM and EnvisionTEC and it will be difficult to achieve a significant synergistic effect from this transaction. EnvisionTEC has continued to operate under its own brand as a 100% subsidiary of DM and plans to release a number of new models for its key customers - dental clinics and jewelry companies. Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase announced in August of another public company, the American ExOne.

Having received huge funds at its disposal, already in January 2021, DM announced the first takeover deal: the German manufacturer of professional photopolymer 3D printers EnvisionTEC (founded in 2002 and is one of the oldest on the market) was bought for $ 300 million. For me, this choice was not obvious, it is difficult to find something in common between DM and EnvisionTEC and it will be difficult to achieve a significant synergistic effect from this transaction. EnvisionTEC has continued to operate under its own brand as a 100% subsidiary of DM and plans to release a number of new models for its key customers - dental clinics and jewelry companies. Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase announced in August of another public company, the American ExOne. Established in 2005 in Pittsburgh, it specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other and they have already presented a joint portfolio based on the products of both companies, in which one product complements the other.

Established in 2005 in Pittsburgh, it specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other and they have already presented a joint portfolio based on the products of both companies, in which one product complements the other.

It would be logical to assume that DM stock skyrocketed after such high-profile acquisitions, but in reality the opposite happened. Since its peak in February, the shares have fallen 4 times and are now trading at $8 a share, and the capitalization is slightly over $2 billion. Apparently, the first euphoria of investors gave way to a more sober approach to the current results of the company. Perhaps this was influenced by the dissatisfaction of some ExOne shareholders, who considered the sale price of the company unfair and were preparing a class action lawsuit against management in order to block the deal. nine0003

nine0003

Should I buy DM stock now that it has fallen so much, or wait for further decline? I would say that their current level is very comfortable for entry, but, of course, such investments also have a certain risk. This is despite the fact that the company has reported strong first half results, which DM expects to generate over $100 million in revenue this year.

Summing up, I would like to say that a number of stock analysts consider what is happening in the market of additive technologies to be a "renaissance". The market came into motion after the pandemic, which gave everyone hope that the technology was ripe for serious tasks, and that the situation in the industry of 2013-2014 would not repeat itself. Then the technique was still very "raw", but attracted a lot of attention from the press and potential investors. This drove the stocks of market leaders 3DSystems and Stratasys to unknown heights, and then, when there was disappointment in the results of their work, the fall reached 20 times from peak values. Startups bought in batches, not really understanding what to do with them later. Most of these deals only made it harder for companies to focus on their core business. I would like to hope that history will be a good lesson for the new giants of the industry. There have already been a number of IPO exits by companies from the 3D printing industry through SPAC this year, with several more large listings planned for the end of the year. And, if you are interested in this sector, stay tuned. nine0003

Startups bought in batches, not really understanding what to do with them later. Most of these deals only made it harder for companies to focus on their core business. I would like to hope that history will be a good lesson for the new giants of the industry. There have already been a number of IPO exits by companies from the 3D printing industry through SPAC this year, with several more large listings planned for the end of the year. And, if you are interested in this sector, stay tuned. nine0003

Alexander Kornveits

Expert in the field of additive technologies and 3D equipment, founder and head of Tsvetnoy Mir

REC Wiki 3D printer and plastic for 3D printing, it remains only to find digital models. Do-it-yourself 3D modeling is interesting, but mastering this skill will take a lot of time. In the meantime, we suggest looking for something interesting on the sites in our selection. nine0003

1. Thingiverse

The largest and most famous platform, Thingiverse is a project of the American company MakerBot, which has made a huge contribution to the development of amateur 3D printers. In recent years, MakerBot has been operating under the wing of Stratasys Corporation and focuses more on the professional segment of the additive market, but this has not affected the work of Thingiverse in any way. The name of the platform is a play on words meaning "The Universe of Things" (Thing + Universe). The site remains the largest repository of exclusively free 3D models with a focus on 3D printing and continues to grow. Thingiverse currently offers over one and a half million 3D models. nine0003

In recent years, MakerBot has been operating under the wing of Stratasys Corporation and focuses more on the professional segment of the additive market, but this has not affected the work of Thingiverse in any way. The name of the platform is a play on words meaning "The Universe of Things" (Thing + Universe). The site remains the largest repository of exclusively free 3D models with a focus on 3D printing and continues to grow. Thingiverse currently offers over one and a half million 3D models. nine0003

Thingiverse website: www.thingiverse.com/

2. Instructables

Instructables is more than just an online warehouse of 3D models. This platform is primarily aimed at do-it-yourselfers, and therefore Instructables hosts not just 3D models, but complex projects - often using electronics, mostly hobby, but often quite serious. Scientists also use the site, posting useful open-source projects like smartphone-based 3D printed microscopes. The main feature of the site is that the projects are accompanied by detailed, step-by-step instructions - hence the name. Of course, additive technologies play an important role in many of the published projects, and the projects themselves are offered free of charge. nine0003

Of course, additive technologies play an important role in many of the published projects, and the projects themselves are offered free of charge. nine0003

Instructables website: www.instructables.com

3. Cults

A popular venue based in France. The platform works in a mixed way, offering both free and paid models. The paid section to a large extent influenced the rich assortment, since any user can make money on their creations. The site takes a commission, but approximately 80% of the cost of each 3D model sold goes into the authors' pocket. If you're not ready to pay for digital models, check out Cults anyway and browse the freebies - there are plenty of them. And don't let the name confuse you, it doesn't smell of any cultists there. Cults is just St. Luc is the opposite, while Saint Luke is considered the patron saint of artists. nine0003

Website: cults3d.com

4. MyMiniFactory

A London-based platform that also offers a mixture of free and paid 3D models. Many of the paid works are posted by professional designers, and the administration often holds competitions among authors. The peculiarity of MyMiniFactory is that this site guarantees quality: the published 3D models are first tested for compatibility with 3D printers, then a trial 3D printing is carried out, and only then the model is placed in the public domain. nine0003

Many of the paid works are posted by professional designers, and the administration often holds competitions among authors. The peculiarity of MyMiniFactory is that this site guarantees quality: the published 3D models are first tested for compatibility with 3D printers, then a trial 3D printing is carried out, and only then the model is placed in the public domain. nine0003

Jonathan Beck

One of the most famous MyMiniFactory-related endeavors is the Scan the World project. The author of this initiative was the British enthusiast Jonathan Beck, who in 2014 committed a major “robbery” of the London Museum. True, Jonathan took out not real exhibits, but about ten thousand photographs, on the basis of which he then recreated the appearance of the exhibits in digital form using photogrammetry. Since then, Beck has had many associates armed with cameras and 3D scanners and regularly adding 3D models of art and historical artifacts from around the world, including from some Russian museums. All models in the Scan the World collection are offered free of charge. nine0003

All models in the Scan the World collection are offered free of charge. nine0003

MyMiniFactory website: www.myminifactory.com

5. Prusa Printers

Strictly speaking, this is not a repository of 3D models as such, but the home site of Prusa Research, an enterprise of Czech engineer Josef Prusa, whose name is familiar to all enthusiasts additive technologies. True, on this site, Josef and his team offer not only 3D printers and consumables of their own production, but also 3D models, and for free. Since this company deals only with additive technologies, all models in the catalog are optimized for 3D printing. The main share of published models falls on the users of the site, and Prusha's team regularly stimulates the authors with various competitions. An interesting feature of this site is that it allows you to publish not only 3D models, but also ready-made machine code. On the one hand, this is good, because users can immediately send a model for 3D printing without fiddling with a slicer. On the other hand, there is always a chance of incompatibility or outright sabotage, so be careful, and if in doubt, just download the STL files and prepare the code yourself. nine0003

On the other hand, there is always a chance of incompatibility or outright sabotage, so be careful, and if in doubt, just download the STL files and prepare the code yourself. nine0003

Prusa Printers website: www.prusa3d.com

6. Pinshape

Another collection of 3D models, this time of Canadian origin. The first version of the site did not last long, only a couple of years, but immediately after the closure, the well-known American manufacturer of stereolithographic 3D printers Formlabs bought the resource. The platform continues to work to this day and contains tens of thousands of projects. Like most similar platforms, Pinshape offers both paid and free 3D models, and anyone can submit work. nine0003

Pinshape website: pinshape.com

7. YouMagine

Another project under the corporate umbrella. This site was founded by one of the co-founders of the Dutch company Ultimaker, which in turn is well known for a whole series of successful FDM 3D printers. Although this is not the largest resource (only about twenty thousand projects), it has two pluses. Firstly, only free 3D models are offered here. Secondly, the site is structured in such a way that it is easier for designers to improve their own and other people's work, collaborate and receive feedback. As a result, you can find a lot of serious projects here, such as OpenBionics 3D printed prostheses, but there is also enough entertainment content. nine0003

Although this is not the largest resource (only about twenty thousand projects), it has two pluses. Firstly, only free 3D models are offered here. Secondly, the site is structured in such a way that it is easier for designers to improve their own and other people's work, collaborate and receive feedback. As a result, you can find a lot of serious projects here, such as OpenBionics 3D printed prostheses, but there is also enough entertainment content. nine0003

YouMagine website: www.youmagine.com

8. CGTrader

This Lithuanian site initially had nothing to do with 3D printing, being a platform for the exchange of graphic models for computer games, virtual reality and the like. However, with the growing popularity of additive technologies, a specialized section appeared on CGTrader for publishing 3D models with polygonal meshes optimized for 3D printing. There are not so many models for 3D printing, only about thirteen thousand, in addition, this resource is focused on paid content, although there are also free offers. On the other hand, this site is popular among professional designers, so you can find very interesting and high-quality work here. nine0003

On the other hand, this site is popular among professional designers, so you can find very interesting and high-quality work here. nine0003

CGTrader website: www.cgtrader.com

9. Sketchfab

Sketchfab, a Franco-American marketplace, is similar to CGTrader in that it publishes models for computer games, virtual reality, and 3D printing, as well as in terms of an abundance of professional work. With 3D printable models, things are a little more complicated: although there are many free models on the site, those optimized for 3D printing are in the paid section. On the other hand, nothing prevents you from downloading free options and using third-party mesh repair programs for 3D printing, such as Meshmixer or Netfabb. nine0003

Sketchfab website: sketchfab.com

10. 3Dtoday

Russian website and main portal for Russian-speaking 3D printing enthusiasts. 3Dtoday is designed as an all-in-one platform with user blogs, catalogs and a marketplace, as well as a collection of 3D models categorized into different categories.