How do i invest in 3d printing technology

Beginner's Guide To Investing In 3D Printing

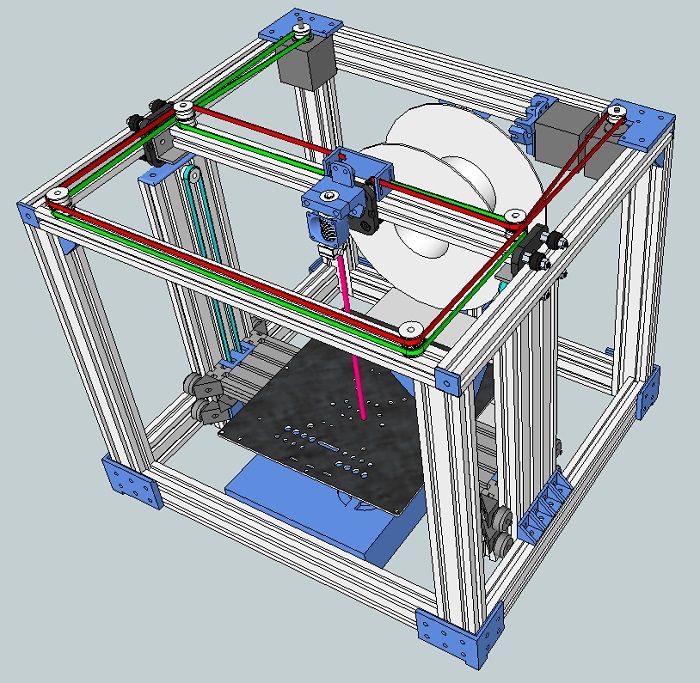

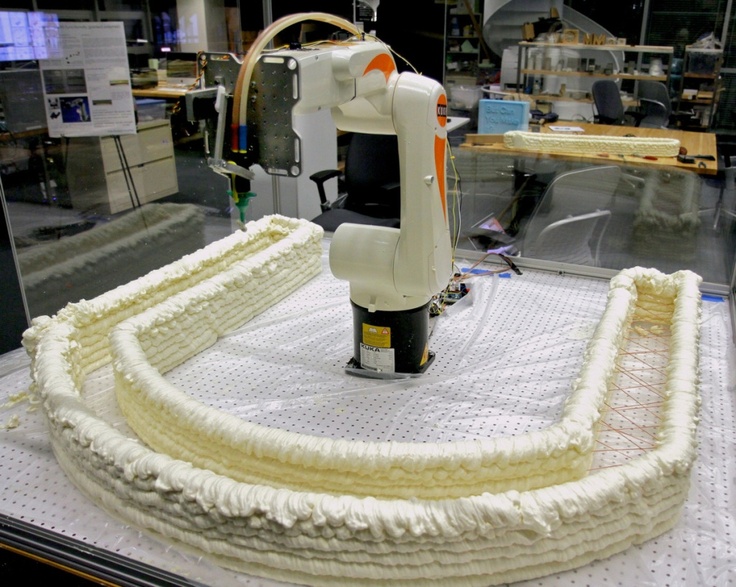

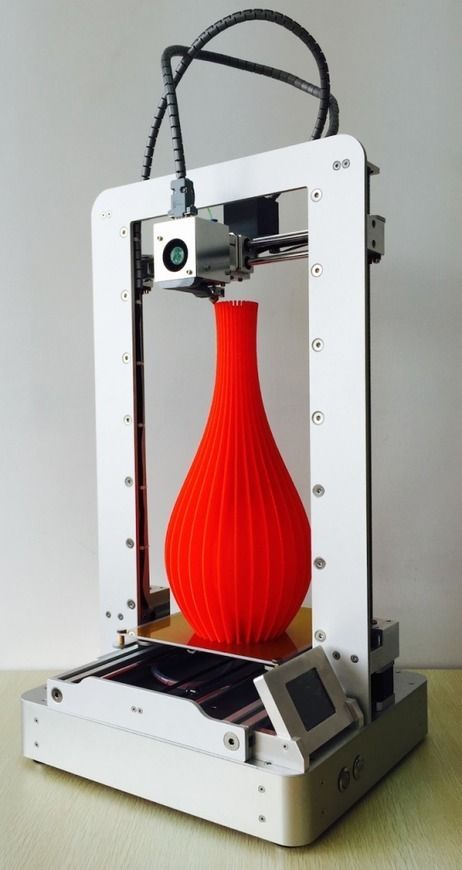

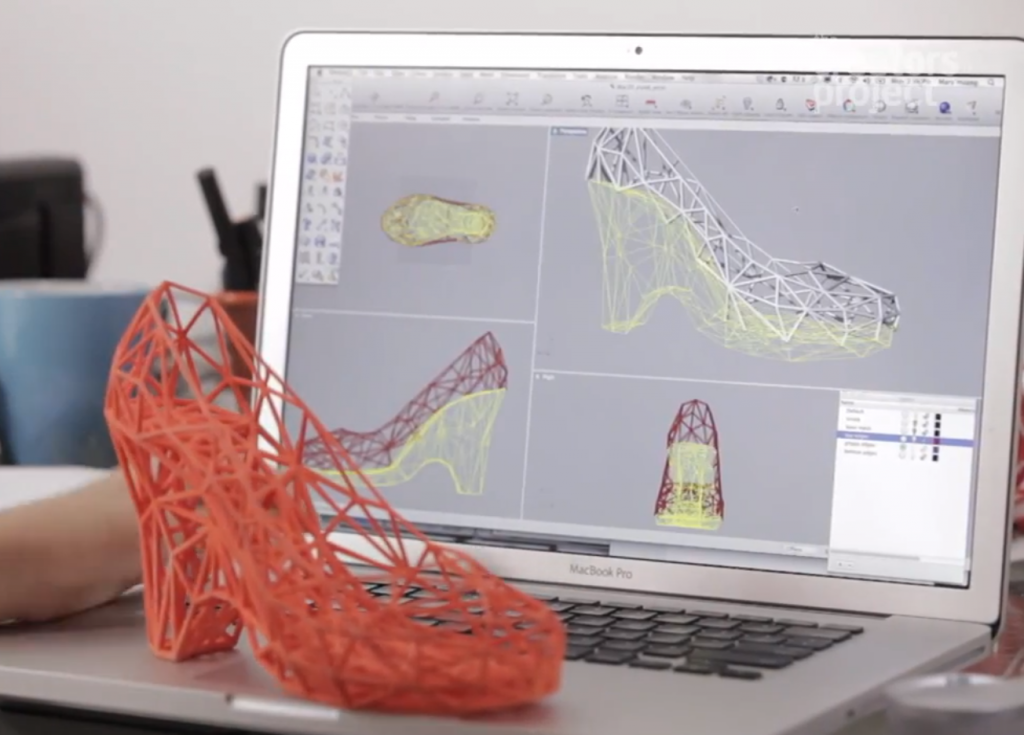

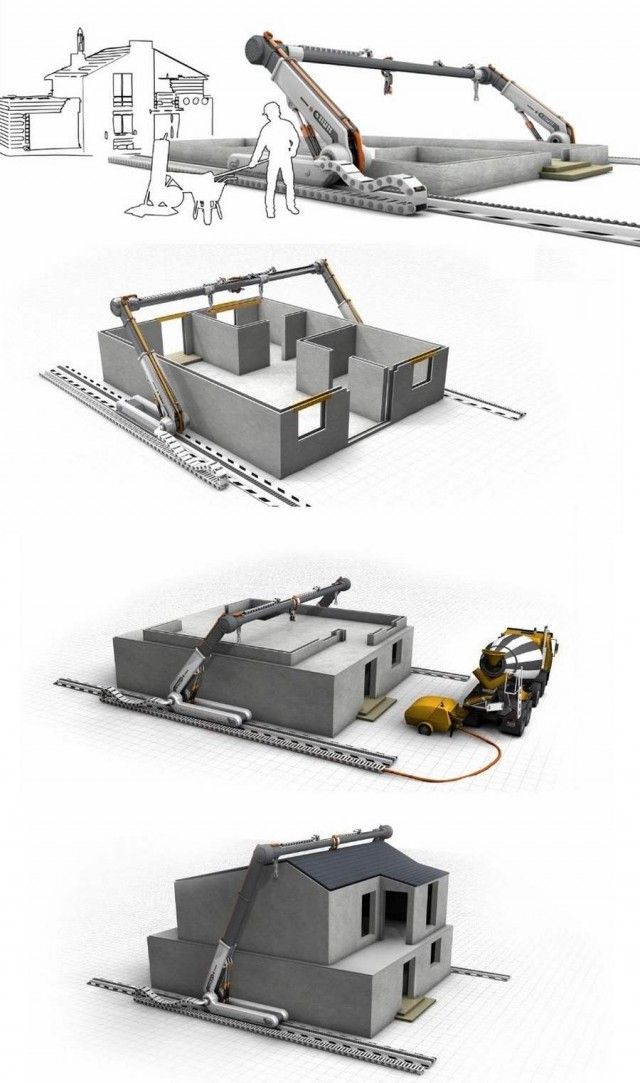

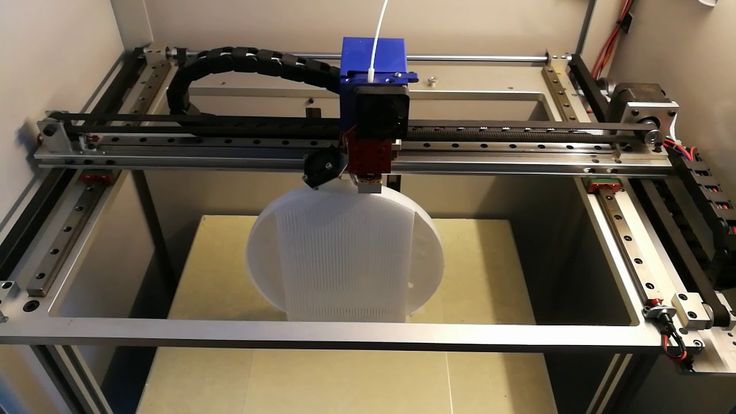

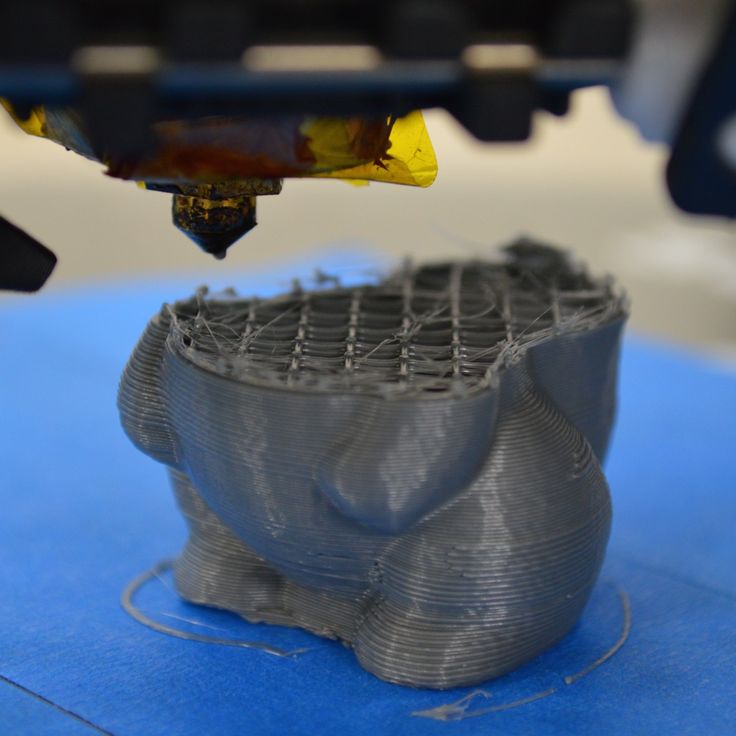

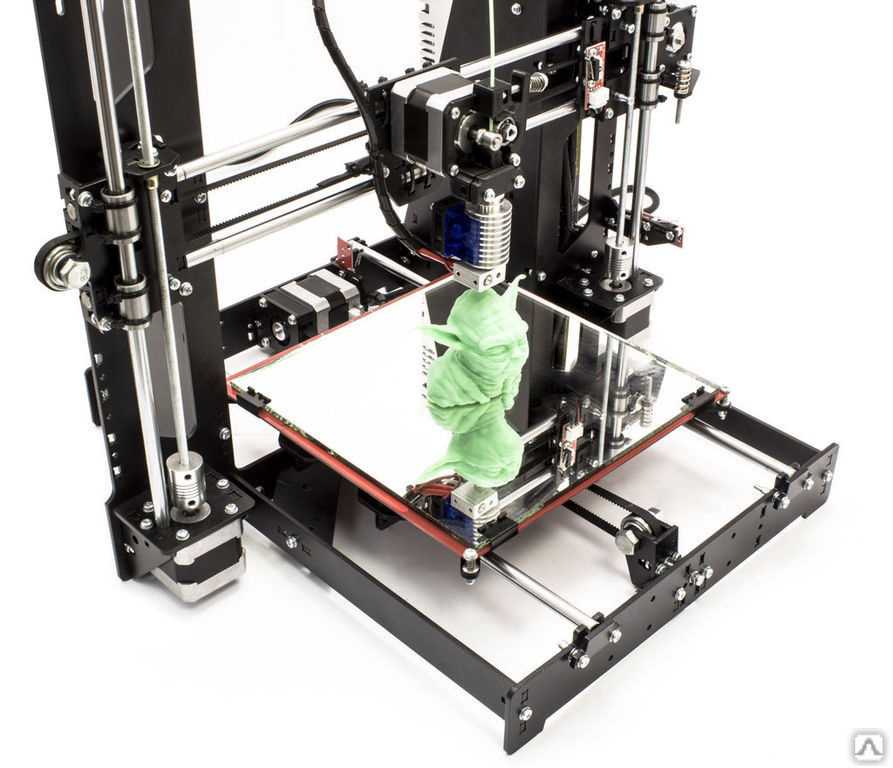

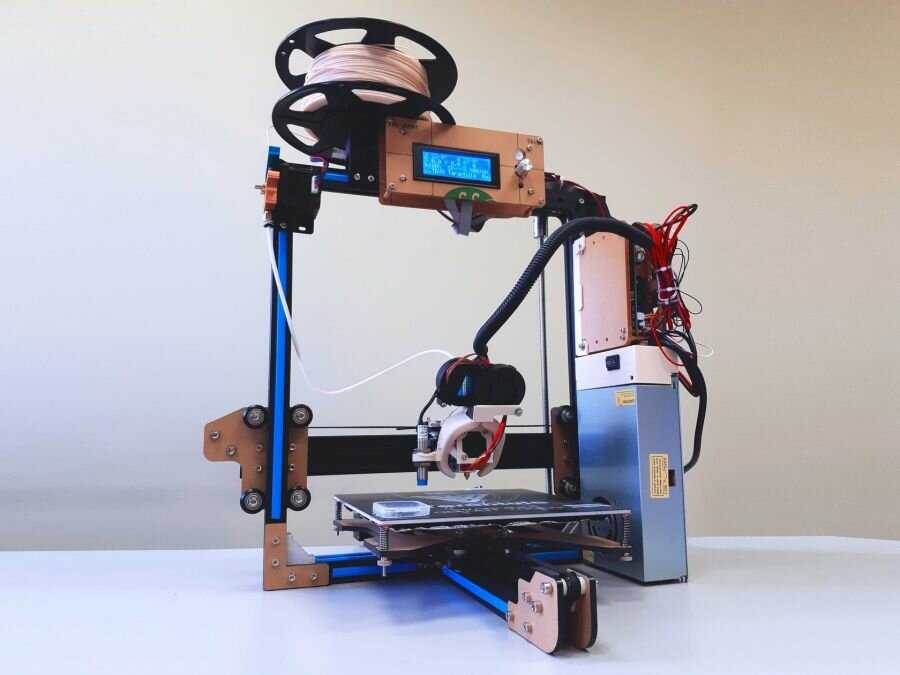

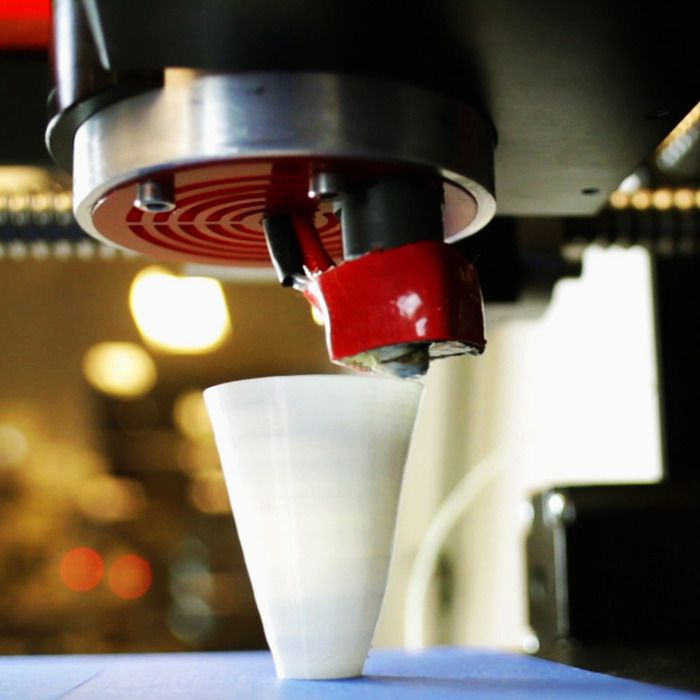

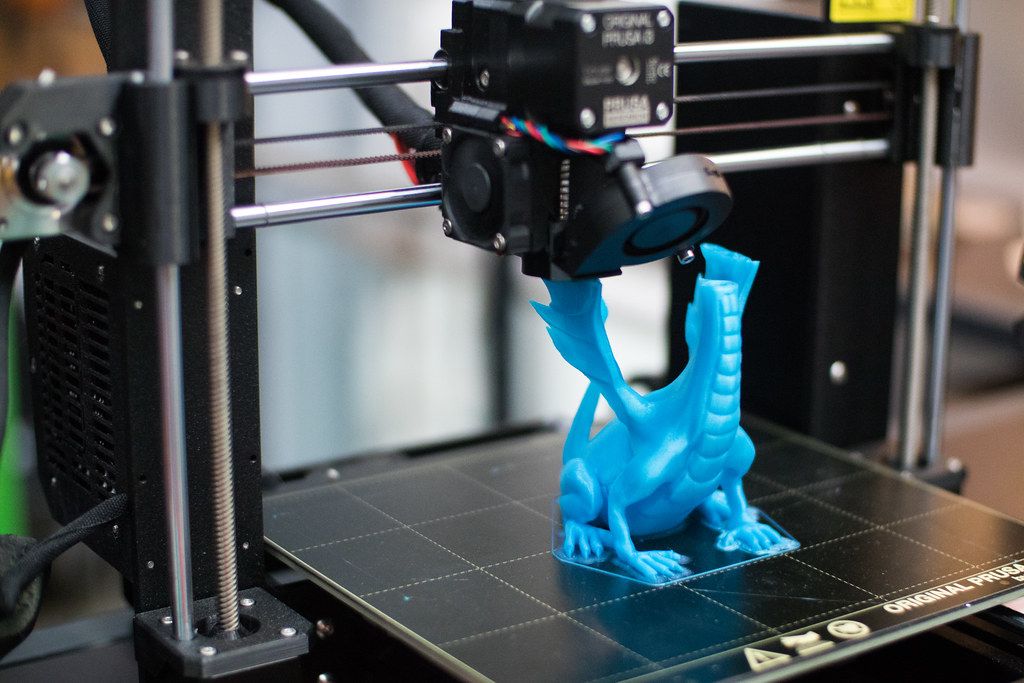

3D printing has taken off as a futuristic technology that goes beyond just the printing industry. 3D printing is the printing of images, tools, shapes – and houses even – in three dimensional form, whether it is something as simple as a keychain or as useful as a brick to build an entire building.

The 3D printing industry has experienced exponential growth over the last 30 years, and its continued contributions to technological innovations across major industries position it for ongoing growth and considerable investment potential.

Below is an overview of the 3D printing industry and what potential investors need to know.

What is 3D printing?

The idea of 3D printing a bridge – which actually happened in the Netherlands in 2017 and then again in 2021 – might seem like something out of a futuristic sci-fi movie, but the technology has in fact been around since the early ‘80s. Hideo Kodama filed for the first 3D printing patent in 1980, describing the technology as a photopolymer rapid prototyping system using UV light to harden the material.

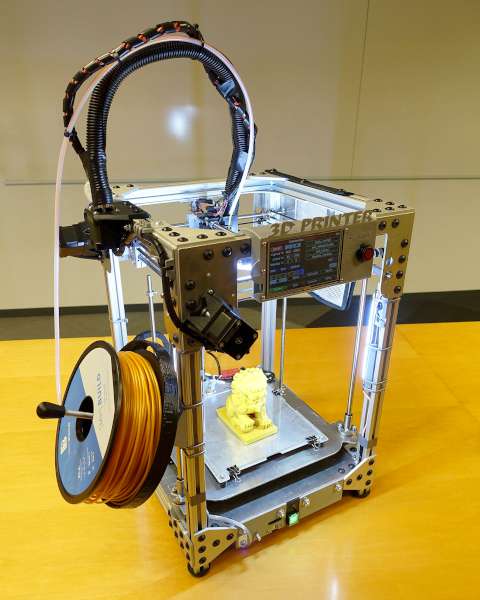

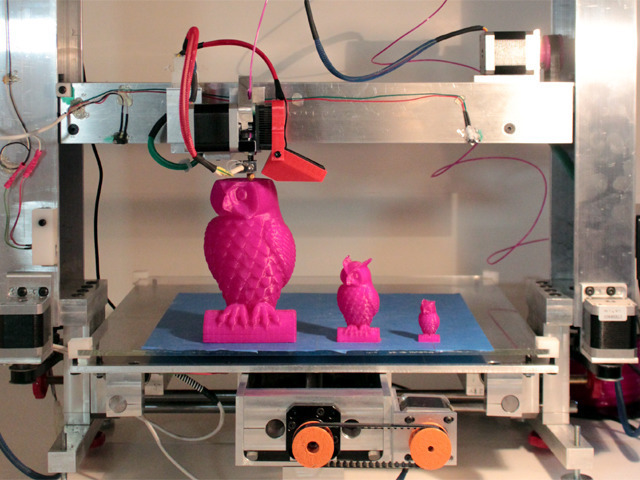

Since then, the idea has taken off, with 3D printing being used to design intricate small objects to being touted as the future to the manufacturing industry. In its early mass market days, some companies attempted to bring 3D printers into the home. While this proved difficult, 3D printing experienced rapid growth in the 2010s and sales ballooned to $9.3 billion in 2018. In 2021, the industry grew to $10.6 billion, with projections to reach $50.8 billion by 2030, according to 3D printing analysis and market research firm SmarTech Analysis.

3D printing key stats:- 3D printing technology has been around since the early ‘80s.

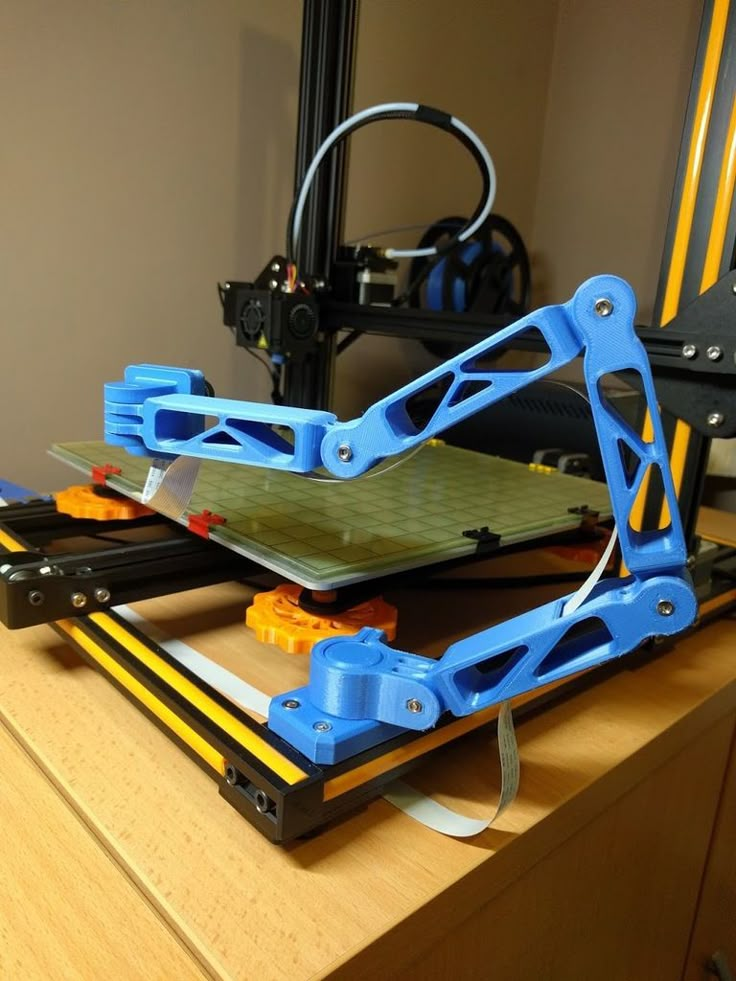

- In 2005, Dr. Adrian Bowyer created the self-replicating 3D printer process, allowing for the creation of next-generation 3D printers. Self-replicating printers can make copies of its own parts, effectively cutting down production costs and supply chain blockages.

- The industry is expected to reach over $50 billion in sales by 2030, according to SmarTech Analysis.

- Throughout the world, 2.2 million 3D printers were shipped in 2021 and the shipments are expected to reach 21.5 million units by 2030, according to Grand View Research.

- Global 3D printing sales are forecasted to expand at a compound annual growth rate of 20.8 percent from 2022 to 2030, according to Grand View Research.

- A 12-meter 3D-printed steel bridge was opened in 2021 in Amsterdam, opening the road for the technology in everyday life.

A brief history of 3D printing

3D printing has rapidly evolved since its inception some 40 years ago. Below is a brief overview of its trajectory from hobby to billion dollar industry.

The first stereolithography apparatus (SLA), or resin printing machine, was created by Charles Hull in 1983. Hull was granted the first patent for a 3D printing machine in 1986 and later co-founded 3D Systems Corporation. The company would go on to sell the first 3D printing SLA machine in 1988 called SLA-1.

The 1990s saw a number of 3D printing technology achievements setting the stage for global use. In 1997, AeroMat produced the first 3D process that allowed for high-powered lasers to fuse powdered titanium alloys, opening the door for the use of 3D manufacturing.

In 1997, AeroMat produced the first 3D process that allowed for high-powered lasers to fuse powdered titanium alloys, opening the door for the use of 3D manufacturing.

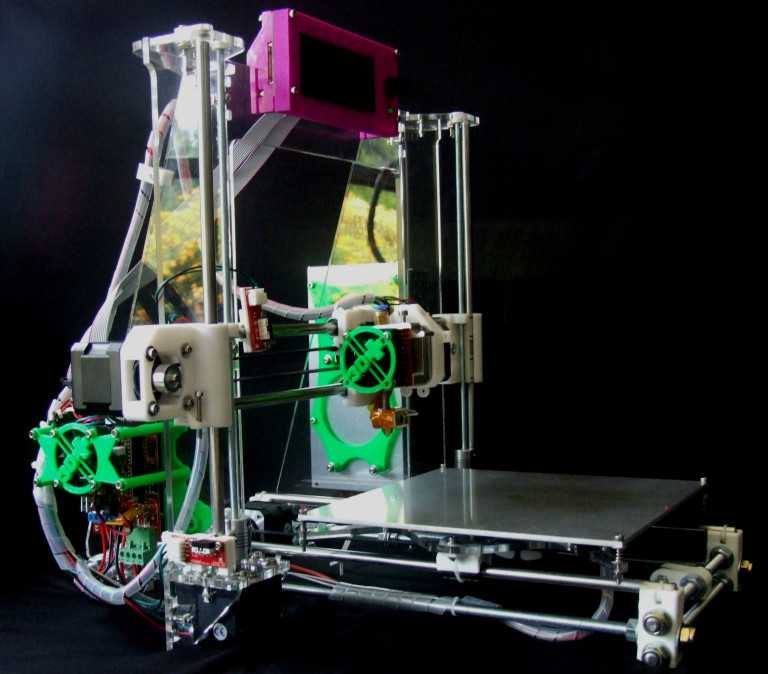

A pivotal moment in the evolution of the manufacturing of 3D printing, Dr. Adrian Bowyer created the self-replicating 3D printer process in 2005, allowing printers to replicate their own parts and helping expand next-generation 3D printers.

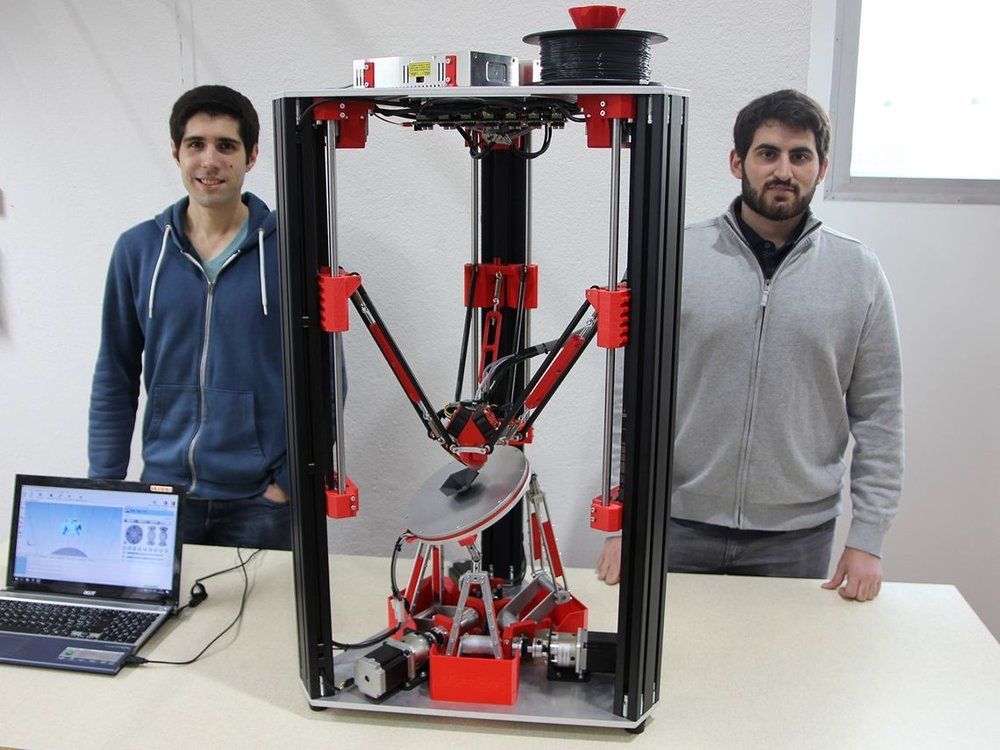

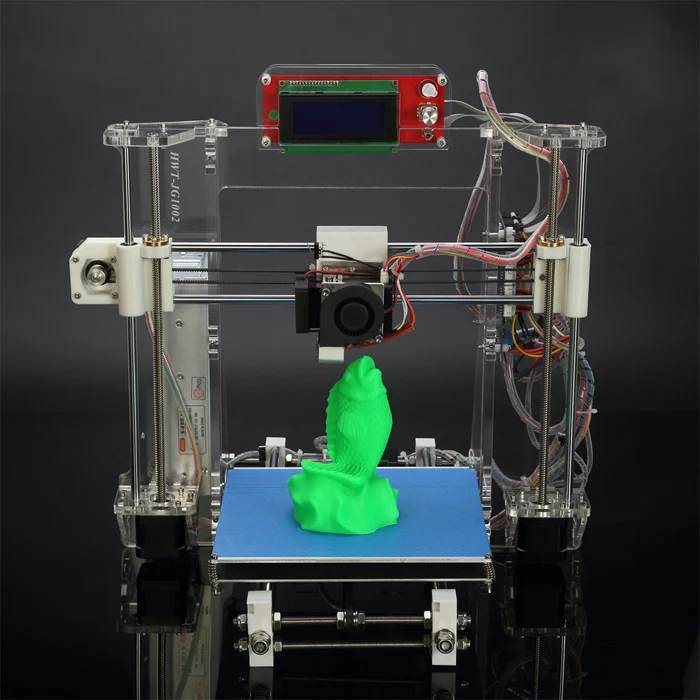

3D printing was largely marketed in its early stages for home use, and as a way to supplement or replace at-home printers. London-based 3D printing manufacturing group AMFG says that early visions of 3D home printers were not easily applied for home use. The critical consumer application that would have allowed home 3D printing to take off never truly materialized, and as a result the market lagged for a number of years.

In the meantime, industrial 3D printing took off and supported a resurgence of the 3D printing market, taking it to new heights for both investors and manufacturers alike.

2009 was a transformative year for the 3D printing business. Micro, a consumer 3D printing company, launched a funding campaign on Kickstarter, becoming the largest-funded 3D printer campaign on the platform. The same year, 3D printing company Makerbot launched do-it-yourself kits to allow consumers to 3D print at home. The company also issued a file library where people could upload their own files and 3D design patterns, becoming the largest online library for 3D printing designs in the world. Stratasys acquired the company for $400 million in 2013.

In a 2015 report, Harvard Business Review stated that numerous big name companies were using 3D printing to aid in production. Among them were General Electric, Lockheed Martin, Boeing, Aurora Flight Sciences, Invisalign and Google. Harvard added that in 2014, sales of industrial 3D printers in the U.S. already accounted for over 30 percent of industrial automation and robotic sales.

3D printing has become an embedded part of industrial technology. The ability to intricately design products that traditional manufacturing cannot, and the revolution of creating such products with materials light enough to be used in 3D technology has spearheaded innovations in manufacturing and supply chain distribution. A recent report by Stratasys explained that part of 3D printing’s expansion is due to the technology’s flexibility. It is reconfigurable, adaptable and “above all else digital,” making it an easy alternative where needed.

The ability to intricately design products that traditional manufacturing cannot, and the revolution of creating such products with materials light enough to be used in 3D technology has spearheaded innovations in manufacturing and supply chain distribution. A recent report by Stratasys explained that part of 3D printing’s expansion is due to the technology’s flexibility. It is reconfigurable, adaptable and “above all else digital,” making it an easy alternative where needed.

(Looking for the best investing apps to get your finances organized and invested? Here are some of the most popular ones to consider.)

Top 3D printing companies

| Company | Stock symbol | Market Capitalization | What it does |

| Desktop Metal | DM | $780.7 million | Creates processes for metal 3D printers. |

| Xometry | XMTR | $1. 8 billion 8 billion | Provides on-demand manufacturing services for 3D printing. |

| Markforged | MKFG | $382.4 million | Software interface that allows you to create and print 3D parts. Provides physical printers as well. |

| PTC Inc. | PTC | $13.1 billion | Provides an entire 3D technology suite for manufacturers. |

| 3D Systems | DDD | $1.4 billion | One of the industry’s pioneers. Deals with the production and development of 3D printers. |

| Proto Labs | PRLB | $1.3 billion | Digitally manufactures prototypes and then 3D prints them. |

| Stratasys | SSYS | $1.3 billion | Provides polymer-based 3D solutions. |

Source: YahooFinance. Data as of July 22, 2022.

The 3D Printing ETF

The 3D Printing ETF (PRNT) is managed by investor Cathie Wood’s advisory firm, ARK Invest. The fund tracks around 50 companies in the 3D printing industry spanning hardware, software, scanner, materials and printing centers. Some big name holdings include Microsoft, Autodesk, Xometry and PTC.

The fund tracks around 50 companies in the 3D printing industry spanning hardware, software, scanner, materials and printing centers. Some big name holdings include Microsoft, Autodesk, Xometry and PTC.

The fund tracks a tiered, equal-weighted index.

Annualized returns (as of July 19, 2022): -38.8 percent (1 year), -0.8 percent (3 year) and -2.5 percent (5 year)

Expense ratio: 0.66 percent

| Pros | Cons |

| Exposure: Gives investors exposure to many key players in and around the industry, touted by many as having tremendous potential. | Narrowly diversified: The ETF is concentrated in only one overarching industry. |

| Growth: The industry is projected to grow sales rapidly, giving investors an opportunity. | Volatility: As of July 18, 2022, the ETF is down around 38 percent year to date. Investors will need to have tolerance for risk. Investors will need to have tolerance for risk. |

| Firm reputation: Cathie Wood and ARK are known for investing in innovative high-growth sectors of the market. | Still not steady on its feet: The 3D printing industry has grown tremendously, but is still solidifying itself as a developing market. |

| Expense ratio: An expense ratio of 0.66 percent is considered within a reasonable range. | Performance: The fund has negative returns in its 1-, 3- and 5-year periods thus far. |

The fund has wide exposure to the overall 3D printing market, both directly and indirectly. Some of the fund’s holdings, like PTC, deal primarily with 3D technology, whereas another major holdings, Microsoft, has more diversified lines of business.

For those who think the 3D market is an attractive industry, the ETF could be a useful and not-too-expensive way to invest in it, without having to do the analysis on the individual names.

Industries driving 3D printing adoption

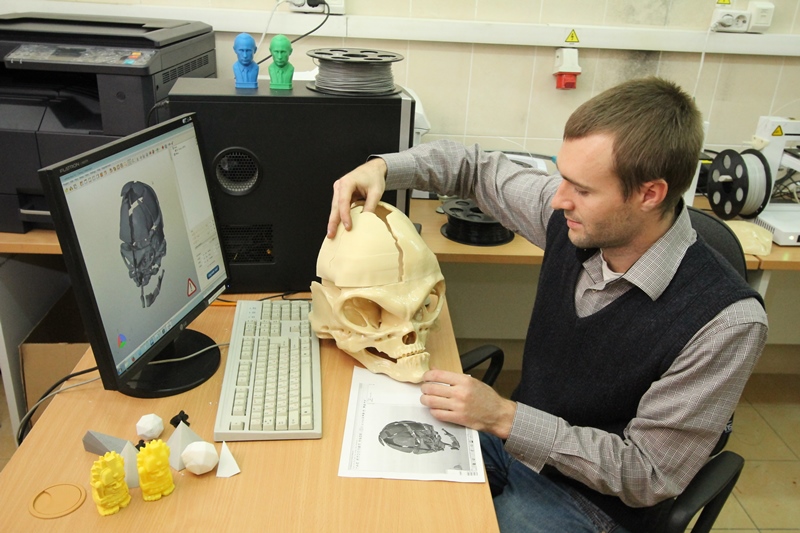

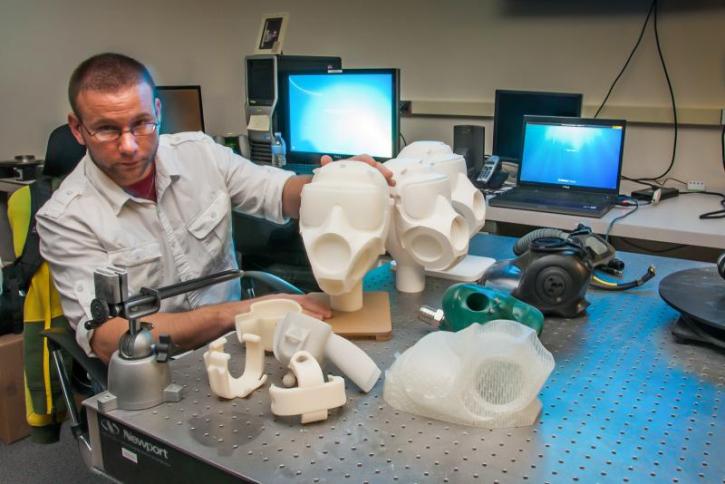

3D printing has become particularly useful in manufacturing of certain industries. The health care, automotive, aerospace and defense industries specifically have been driving the adoption of mass 3D printing.

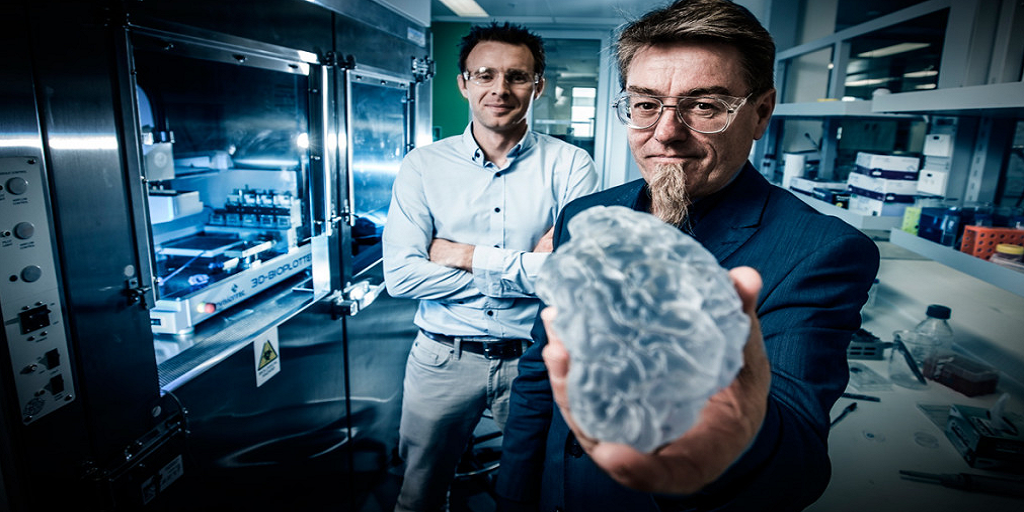

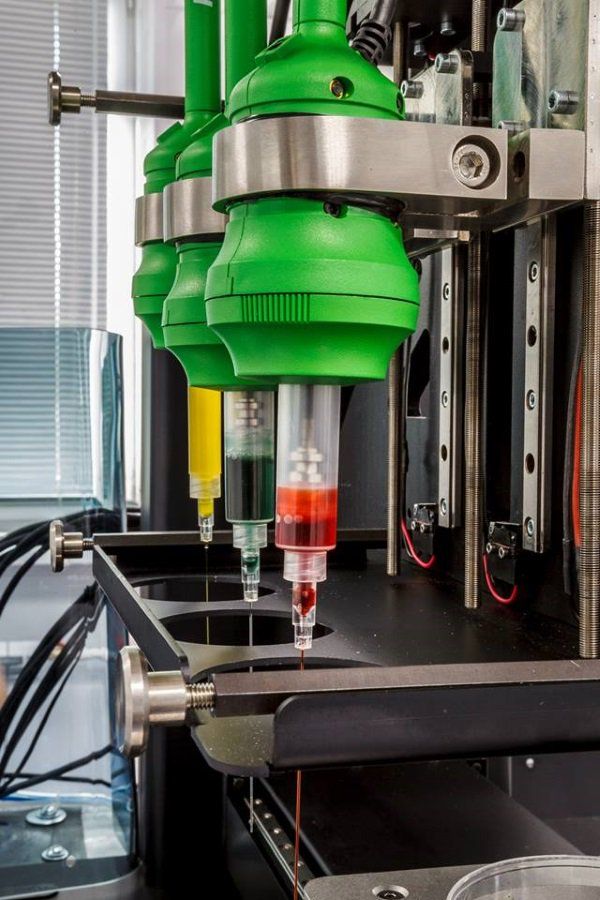

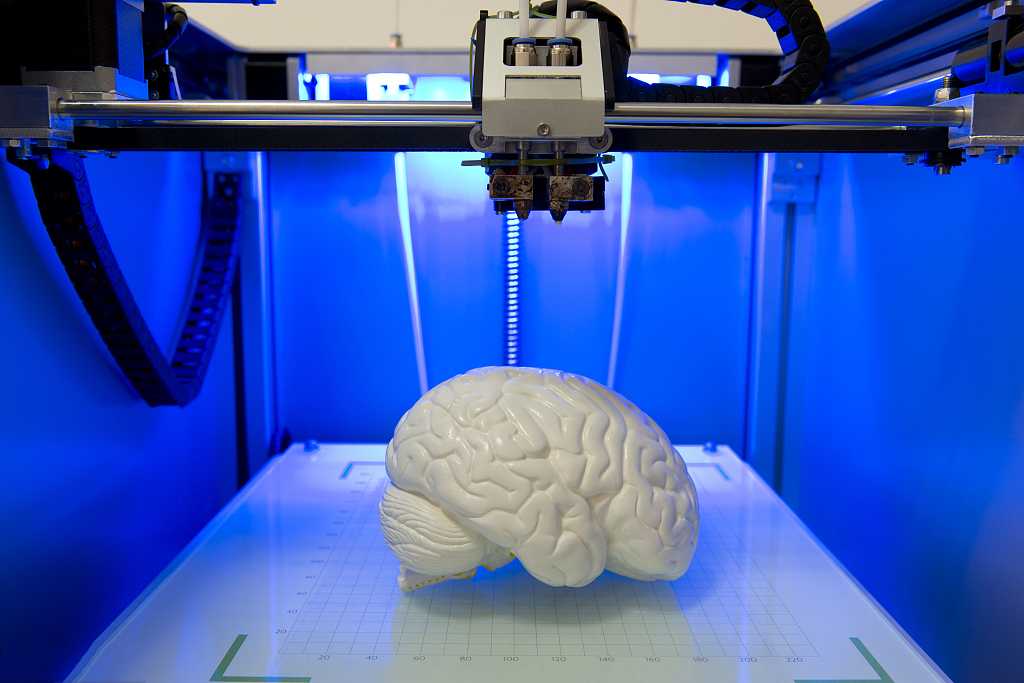

- Health care: 3D printing has truly taken off for health care science. Beyond what might first come to mind when thinking of health care 3D printing like a prosthetic leg or surgical tool, 3D technology has come so far that 3D bioprinting is now used to create living human cells! During the pandemic, 3D-printable open-source PPE equipment was created to help ease the equipment shortage. The 3D printing health care market was estimated to be $1.04 billion in 2020 and is projected to reach $5.8 billion by 2030, according to Allied Market Research. Increased pressure on hospital systems, larger patient pools and new biomedical applications are key factors driving this growth.

- Automotive: The automotive 3D printing market is forecasted to grow from $2.

9 billion in 2022 to $7.9 billion by 2027, according to Markets and Markets, a B2B research firm. The pandemic exposed a need in the industry to decrease development time and a way to cut supply chain disruptions, which 3D printing can help achieve. Additionally, the surge in demand for electric vehicles has increased the demand for lightweight components, easily provided through 3D technology. Large investments by original equipment manufacturers has driven growth in this sector.

9 billion in 2022 to $7.9 billion by 2027, according to Markets and Markets, a B2B research firm. The pandemic exposed a need in the industry to decrease development time and a way to cut supply chain disruptions, which 3D printing can help achieve. Additionally, the surge in demand for electric vehicles has increased the demand for lightweight components, easily provided through 3D technology. Large investments by original equipment manufacturers has driven growth in this sector. - Aerospace: Global aerospace 3D printing markets are expected to grow sales from $1.4 billion in 2020 to $6.8 billion by 2030, or more than 18 percent annually, according to Allied Market Research. An increase in demand for lightweight airplane components and easier prototyping have driven growth. Although 3D printing can be expensive and the aerospace industry has the added headache of regulatory oversight, industry insiders say they’re committed to developing new supply chains and processes.

- Defense: Like the aerospace industry, the defense industry is one in which extremely complicated parts are needed in relatively smaller volumes than can be provided by large-scale manufacturers. The 3D military market size is expected to reach $1.7 billion by 2027.

The future of 3D printing

With its many uses and integration into several different major industries, 3D printing is poised to make a significant impact on technology and manufacturing. Experts say that 3D printing will become a mainstream technology for mass production in the near future. Metal 3D printing is also positioned to expand, further allowing the aerospace and defense industries to incorporate the technology into their production.

The potential for applications in the health care industry is also clear. Especially after the pressures the pandemic put on hospitals, 3D printing applications will be a welcome innovation in times of emergency or supply chain disruption.

The skills to use 3D technologies will be a potential hurdle for growth. John Barnes, founder of the Barnes Group Advisors, said in a 2019 interview with AMFG that the “workforce element is really critical right now. There are not enough engineers, managers, executives who truly understand the technology well enough to work and develop a strategy to get what they need to get out of it.”

The Barnes Group launched an online course with Purdue University to provide engineers and others with the knowledge they need for 3D printing software and technology. Increased awareness and education will only propel the already growing niche sector even further.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Top 3D Printing Stocks for Q4 2022

Table of Contents

Table of Contents

-

Best Value 3D Printing Stocks

-

Fastest Growing 3D Printing Stocks

-

3D Printing Stocks With the Best Performance

SSYS is top for value and performance and NNDM is top for growth

By

Noah Bolton

Full Bio

Noah has about a year of freelance writing experience. He's worked on his investing website dealing with topics such as the stock market and financial advice for beginners.

He's worked on his investing website dealing with topics such as the stock market and financial advice for beginners.

Learn about our editorial policies

Updated October 06, 2022

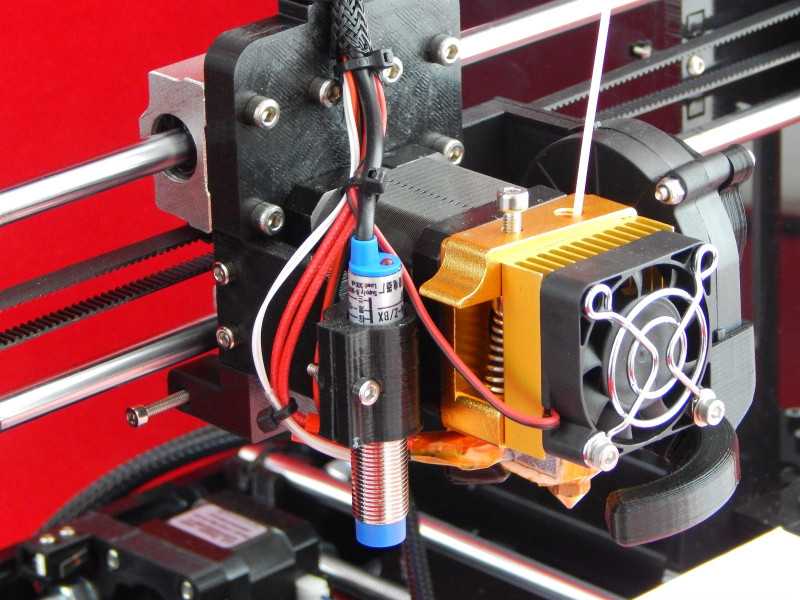

The 3D printing industry is made up of companies that provide products and services capable of manufacturing a range of products. 3D printing, also known as additive manufacturing, creates physical objects from digital designs. The printing process works by laying down thin layers of material in the form of liquid or powdered plastic, metal, or cement, and then fusing the layers together. Though still too slow for mass production, it is a revolutionary technology that has the potential to disrupt the manufacturing logistics and inventory management industries. The 3D printing industry is comprised of only a handful of companies, including players such as Proto Labs Inc., Faro Technologies Inc., and Desktop Metal Inc.

The industry is so young that it has no meaningful benchmark index. But the performance of these stocks can be compared to the broader market as represented by the Russell 1000 Index. These stocks have not performed well. Stratasys Ltd. (SSYS), the best performing 3D printing stock, has dramatically underperformed the Russell 1000, which has provided a total return of -12.5% over the past 12 months. This market performance number and all statistics in the tables below are as of Sept. 20, 2022.

But the performance of these stocks can be compared to the broader market as represented by the Russell 1000 Index. These stocks have not performed well. Stratasys Ltd. (SSYS), the best performing 3D printing stock, has dramatically underperformed the Russell 1000, which has provided a total return of -12.5% over the past 12 months. This market performance number and all statistics in the tables below are as of Sept. 20, 2022.

Here are the top three 3D printing stocks with the best value, fastest sales growth, and the best performance.

These are the 3D printing stocks with the lowest 12-month trailing price-to-sales (P/S) ratio. For companies in early stages of development or industries suffering from major shocks, this metric can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

| Best Value 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing P/S Ratio | |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 1.6 |

| 3D Systems Corp. (DDD) | 9.00 | 1.2 | 2.0 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | 2.1 |

Source: YCharts

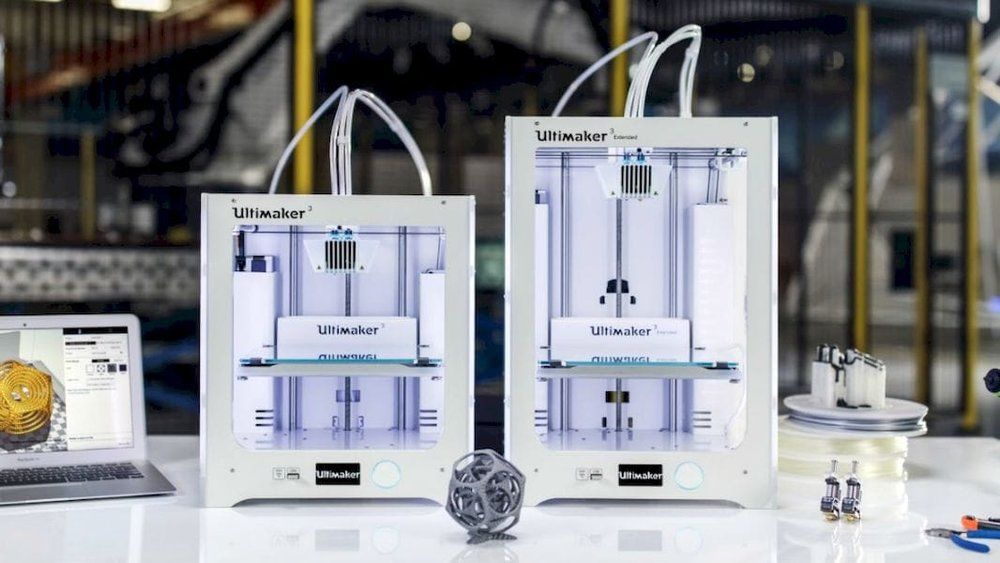

- Stratasys Ltd.: Stratasys offers 3D printing solutions, such as 3D printers, polymer materials, a software ecosystem, and related parts. It serves a variety of industries, including aerospace, automotive, consumer products, and healthcare. On Sept. 13, Stratasys completed the merger of its MakerBot subsidiary with Ultimaker, which offers platforms used to make 3-D printers. Ultimaker is backed by NPM Capital.

The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%.

The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%. - 3D Systems Corp.: 3D Systems provides 3D printing solutions. The company offers a range of hardware, software, and materials designed for additive manufacturing. Its products and services are used in a variety of industries and sectors, including aerospace, automotive, semiconductor, healthcare, and more.

- Proto Labs Inc.: Proto Labs is an e-commerce-based company that provides digital manufacturing services. It offers 3D printing, injection molding, CNC machining, and sheet metal fabrication. On Aug. 5, Proto Labs announced financial results for Q2 2022, the three-month period ending on June 30, 2022. Net income fell more than 80% to $2.6 million from the prior-year quarter while revenue rose 3.1%.

These are the 3D printing stocks with the highest YOY sales growth for the most recent quarter. Rising sales can help investors identify companies that are able to grow revenue organically or through other means and find growing companies that have not yet reached profitability. In addition, accounting factors that may not reflect the overall strength of the business can significantly influence earnings per share. However, sales growth can also be potentially misleading about the strength of a business, because growing sales on money-losing businesses can be harmful if the company has no plan to reach profitability.

Rising sales can help investors identify companies that are able to grow revenue organically or through other means and find growing companies that have not yet reached profitability. In addition, accounting factors that may not reflect the overall strength of the business can significantly influence earnings per share. However, sales growth can also be potentially misleading about the strength of a business, because growing sales on money-losing businesses can be harmful if the company has no plan to reach profitability.

| Fastest Growing 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | Revenue Growth (%) | |

| Nano Dimension Ltd. (NNDM) | 2.45 | 0.6 | 1,270 |

| Desktop Metal Inc. (DM) | 3.07 | 1.0 | 203.9 |

Stratasys Ltd. (SSYS) (SSYS) | 15.49 | 1.0 | 13.3 |

Source: YCharts

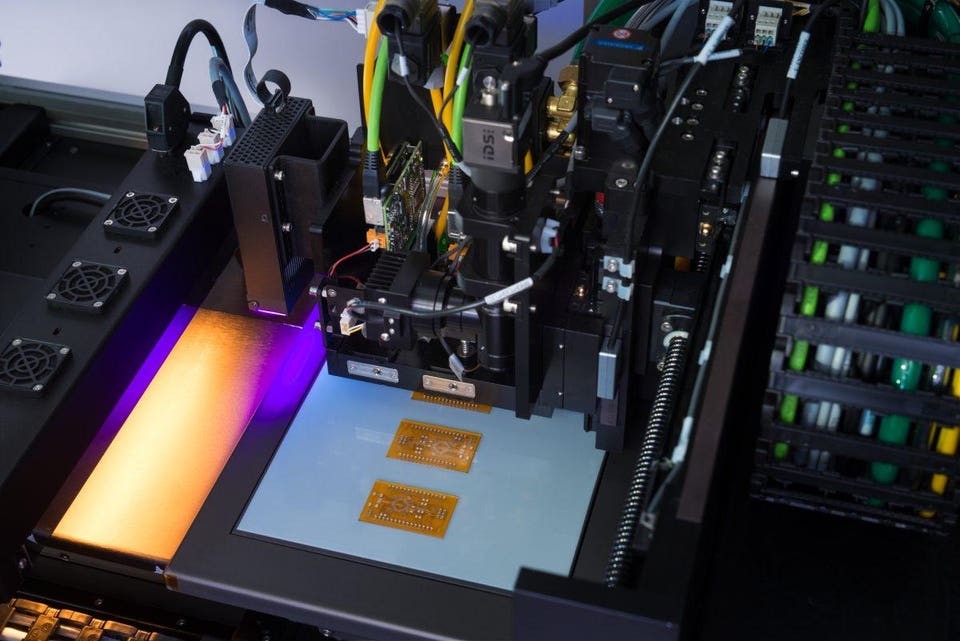

- Nano Dimension Ltd.: Nano Dimension is an Israel-based 3D printing company focused on developing equipment and software for 3D-printed electronics. It develops printers for multilayer printed circuit boards and nanotechnology-based inks. The company serves a range of industries, including consumer electronics, healthcare, aerospace, and automotive. On Sept. 1, Nano Dimension released Q2 2022 results. The company's net loss widened sharply to $40.0 million from a loss of $13.6 million in the same quarter a year earlier even as revenue soared more than 13-fold. The larger second-quarter loss was fueled partly by $10.9 million in non-cash adjustments for depreciation and amortization expenses, and share-based payments.

- Desktop Metal Inc.: Desktop Metal manufactures 3D printers and related equipment used to build complex parts from metal.

It also offers 3D printing software. The company serves a range of industries, including automotive, consumer products, education, and heavy industry. On Aug. 08, the company reported Q2 2022 results. Desktop Metals' net loss increase nearly seven-fold to $297.3 million compared to the same quarter a year earlier even as revenue tripled.

It also offers 3D printing software. The company serves a range of industries, including automotive, consumer products, education, and heavy industry. On Aug. 08, the company reported Q2 2022 results. Desktop Metals' net loss increase nearly seven-fold to $297.3 million compared to the same quarter a year earlier even as revenue tripled. - Stratasys Ltd.: See above for company description.

These are the 3D printing stocks that had the smallest declines in total return over the past 12 months out of the companies we looked at.

| 3D Printing Stocks With the Best Performance | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing Total Return (%) | |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | -34.5 |

| Proto Labs Inc. (PRLB) | 37. 49 49 | 1.0 | -50.6 |

| Materialise NV (MTLS) | 10.95 | 0.6 | -53.9 |

| Russell 1000 | N/A | N/A | -12.5 |

Source: YCharts

- Stratasys Ltd.: See above for company description.

- Proto Labs Inc.: See above for company description.

- Materialise NV: Materialise is a Belgium-based provider of additive manufacturing software and 3D printing services. It serves a range of industries, including healthcare, aerospace, and automotive. On Sept. 7, Materialise completed its acquisition of Identity3D, which makes products that encrypt, distribute, and track digital parts as they move through supply-chains. The value of the deal was not specified in the announcement.

The comments, opinions, and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

YCharts. "Financial Data.

"

"Stratasys Ltd. "Stratasys Completes Merger of MakerBot with Ultimaker."

Proto Labs Inc. "Proto Labs Q2 2022 Earnings Release."

Nano Dimension Ltd. "Earnings Press Release for Q2 2022."

Desktop Metals Inc. " Desktop Metals Second Quarter 2022 Earnings."

Materialise NV. "Materialise Acquires Indenity3D."

additive manufacturing experts forecast / Habr

What is the future of 3D printing? In 2022, the 3D printing industry will celebrate its first decade as an additive manufacturing tool. We look forward to the second and asked 3D printing experts to share their predictions for the development of additive technologies.

Which 3D printing materials will be the most in demand in the future?

What 3D printing materials will thrive in the next decade? Will we see new materials for 3D printing resulting from the discovery of new alloys using artificial intelligence-based computational processes, where the end user can specify the desired characteristics? What about the widespread use of metamaterials - materials with properties that do not occur in nature? How will the issue of sustainability, the growth of production of bio-based polymers or the recycling of waste plastics and metals, the return of resources to a closed economy be considered?

Is there too much hope for 3D printing? Like any cutting edge technology, 3D printing has gone through its fair share of futuristic hype. The hype and fashion trends can be useful tools for attracting funding, but excessive expectations can be detrimental in the long run. Marketers can use fashion trends or provide beautiful concepts, but it's important to understand the end goal you're aiming for.

The hype and fashion trends can be useful tools for attracting funding, but excessive expectations can be detrimental in the long run. Marketers can use fashion trends or provide beautiful concepts, but it's important to understand the end goal you're aiming for.

Can 3D Printing Companies Expect Increased Government Control? Some inventions extend security concerns beyond defense to other verticals such as energy, aerospace, or broader technology markets.

Concerns about the semiconductor market, exemplified by the conflict between China and Taiwan's TSMC, the European chip law announced in Davos, or Intel's $20 billion investment in a "Silicon Center" could herald a new era of protectionism. Export controls and ITAR restrictions are unlikely to be lifted as tensions escalate between Russia and NATO over the conflict in Ukraine. How will the tax on digital goods work and will the current moratorium on customs duties on electronic goods be extended - if it is lifted, how will the market react to smart factories and collaborative business models?

Rising transport costs and confusing supply chains leading to a logistical crisis have contributed to the revaluation of production sites. Does additive manufacturing play a role in reorientation projects by returning production to consuming countries, and will this take the form of the long-advertised distributed production – or will production most likely be relocated but remain concentrated due to economies of scale?

Does additive manufacturing play a role in reorientation projects by returning production to consuming countries, and will this take the form of the long-advertised distributed production – or will production most likely be relocated but remain concentrated due to economies of scale?

Back to the 3D printing industry and how the brand landscape will change in the next decade. Consolidation in the 3D printing sector is on the horizon, fueled by IPOs and SPAC's insane capital injections into the sector. How will this R&D money be used to bring innovation and new 3D printing technology to market, given the short timeframe investors are looking for?

Business leaders must demonstrate quarterly improvement in performance, and the acquisition of innovative equipment plays an important role in profit growth. The 3D printing industry will release an update on 3D printing patents soon.

How can the additive manufacturing market be valued at $12 billion when SPAC activity has exceeded $11 billion over the past 12 months? Is the market capitalization of one company using additive manufacturing three times the value of the 3D printing industry? (Align Technology, NASDAQ: ALGN, market cap: $37. 4 billion vs. 3D Systems, NYSE: DDD, market cap: $2.2 billion).

4 billion vs. 3D Systems, NYSE: DDD, market cap: $2.2 billion).

Market through end users can do some of the work. Demand helps find the most winning technology platforms from a sea of options. As demand for additive manufacturing rises, the growing market can help grow all firms, both new and established, who will have access to a larger pie.

It may seem strange to refer to history in an article about the future, but the mistakes of the past can be instructive and can help chart a safer course of development. 1922 is often referred to as the birth of modernism: workers returning from global conflicts, the great migration underway, workers moving into newly mechanized factories. Artists under the banner of Futurism, led by Marinetti, celebrated the movement and the rapid development of technology, while the Dadaists and the film Modern Times, starring Charlie Chaplin, later opposed it. Wolfe, Elliot, and Joyce took their thinking to a clean slate, experimenting during the Harlem Renaissance, when modernism flourished in literature, music, and other arts, not just in the US, but around the world. Can new design tools and technologies provide a modern renaissance and the realization of creative impulses? How will broader societal trends and macroeconomic forces interact?

Can new design tools and technologies provide a modern renaissance and the realization of creative impulses? How will broader societal trends and macroeconomic forces interact?

Aldous Huxley's novel "Brave New World" not only reflects the social characteristics of that time, but also illustrates the ideas about the application of new technologies. The author expresses the anxieties of that time along with the dangers of scientific futurism. A clumsy selection of elements to draw parallels with the current decade is pleasant entertainment, but it would be a mistake to ignore the malign forces of frenzied speculation, overproduction, and inadequate or absent controls that plunged the subsequent period into a great depression. We will return to this topic later, after additive manufacturing experts present their view of the broader technology landscape that will shape the coming decade. Will NFT-enabled STLs be readily available in the metaverse, and will engineers work on them in augmented reality?

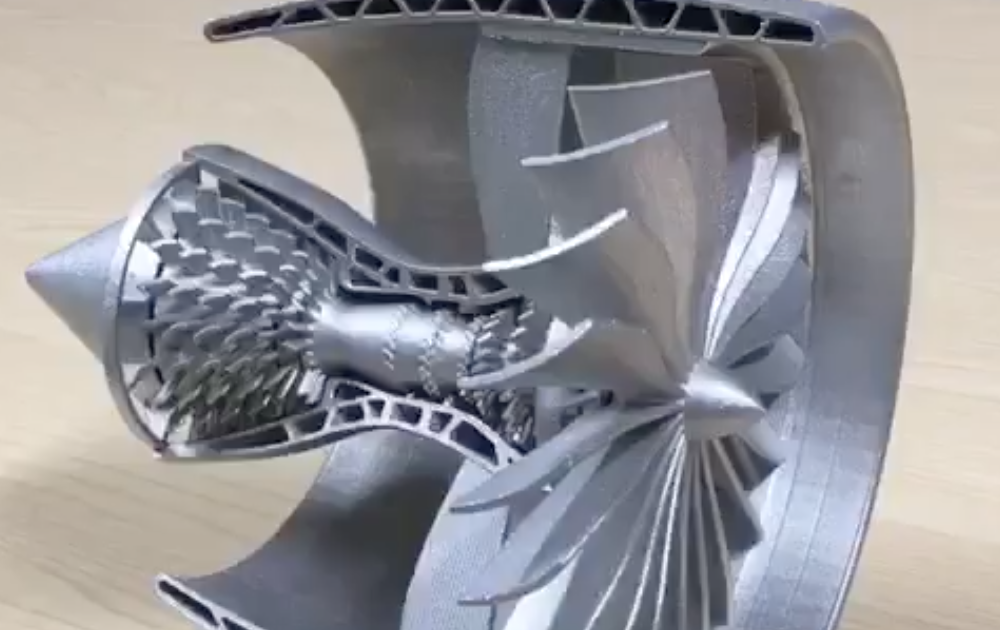

Meltio aerospace disc in 316L. Photo by Michael Petch

Photo by Michael Petch Arno G. Held, Managing Partner, AT Ventures

Over the next 10 years, additive manufacturing is set to take its place as the manufacturing technology that will support the transition to a sustainable and resource efficient civilization. The biggest potential applications are in the design and manufacture of lightweight structural components or electric motors. To do this, industry players must understand the need to work together and overcome the challenges of quality control, cross-platform repeatability, and material recycling together.

Dr. Jeffrey Graves, President & CEO, 3D Systems

I expect mass customization to be a trend not just in 2022 but in the next decade. Many organizations are looking to take advantage of the possibilities of additive manufacturing to produce large numbers of individual parts, but it seems to me that many firms have not yet figured out how to integrate AT (Additive Manufacturing) into their workflows. We are seeing a growing adoption of additive technologies, alongside traditional manufacturing methods. I think we will soon see manufacturers large and small using AT for mass personalization.

We are seeing a growing adoption of additive technologies, alongside traditional manufacturing methods. I think we will soon see manufacturers large and small using AT for mass personalization.

I believe machine learning will play a critical role in facilitating the integration of AT into existing workflows. Additive manufacturing has the potential to offer design flexibility, fast time to market, and efficient supply chains. In order for companies to maintain their competitive position, they need a sound production strategy that allows them to effectively and efficiently integrate AT into the overall production process. As more companies adopt smart manufacturing solutions, I expect they will see how machine learning can enable autonomous manufacturing, which will help increase productivity and increase the ability to inject scalability and agility into processes.

We will see how additive manufacturing can help achieve significant breakthroughs in medicine. AT has already shown excellent results in this industry. Additive technologies have helped provide patient-specific healthcare with unique solutions for surgical planning and medical device design. I am very excited about the next frontier in healthcare, where bioprinting plays an important role. Over the past year, the number of participants in this industry has increased dramatically, whether they are research organizations or private and public companies. We have seen the scope of research expand to include new printing technologies and new materials to help drug discovery, tissue creation and, hopefully, human organ donation in the near future. I believe that we are on the cusp of amazing developments in this field and look forward to discoveries in this industry.

Additive technologies have helped provide patient-specific healthcare with unique solutions for surgical planning and medical device design. I am very excited about the next frontier in healthcare, where bioprinting plays an important role. Over the past year, the number of participants in this industry has increased dramatically, whether they are research organizations or private and public companies. We have seen the scope of research expand to include new printing technologies and new materials to help drug discovery, tissue creation and, hopefully, human organ donation in the near future. I believe that we are on the cusp of amazing developments in this field and look forward to discoveries in this industry.

Avi Reichenthal, co-founder and CEO of Nexa3D

AT will play a key role in reversing global warming through weight reduction, reduced carbon footprint, localized manufacturing, lower energy consumption and reduced waste, and shift to plant-based materials origin.

Over the next decade, AT will become a cost effective and practical tool spanning the entire product lifecycle from concept models to aftermarket parts and everything in between, including the holy grail: mass production.

AT will reach a new level, becoming an effective tool for the manufacture of aircraft, trains, cars and houses, as well as for the creation of atomic structures.

We will get closer to the emergence of the “replicator”, especially in the field of bioprinting.

Christine Mulcherin, General Manager of Powder Products, Nexa3D and President of Women in 3D Printing

Sustainability and the Circular Economy have been hot topics in 2021 and I expect interest will only increase over the course of the decade. Additive manufacturing contributes to the development of the circular economy. In addition to the growing pressure on the environment, the efficient recycling of materials, both plastic and metal, is critical to reducing the cost of commercial-scale printing. The high cost of 3D printing raw materials is arguably one of the biggest obstacles to making AT a true mainstream manufacturing method. And until we can effectively and efficiently reduce or almost eliminate material waste and therefore reduce these costs, actual large-scale printing is likely to remain prohibitively expensive.

The high cost of 3D printing raw materials is arguably one of the biggest obstacles to making AT a true mainstream manufacturing method. And until we can effectively and efficiently reduce or almost eliminate material waste and therefore reduce these costs, actual large-scale printing is likely to remain prohibitively expensive.

Didier Deltorte, President, HP Personalization & 3D Printing

Consumer behavior is undergoing a historic shift. Personalization and stability are becoming benchmarks for brands seeking to stand out in increasingly competitive markets. Traditional product design, manufacturing, and long supply chains do not fit well with these trends. In the coming years, as we continue to improve additive manufacturing solutions, more brands, both small and large, will implement new automated, data-driven, high-performance innovations that are ubiquitous with complex design, ordering, and ordering systems. and logistics. All this allows us to turn both mass personalization and classic production into a scalable reality.

Chris Connery, VP Global Research, CONTEXT

Supply trends have shown time and time again that the industrial 3D printing market is growing with every innovation. Innovation can be realized through a new approach to existing technologies, expansion of the product portfolio by existing players, and by complementing existing technologies or introducing completely new developments to the market. Developments in new categories from both established players and well-funded startups.

End markets are always looking to explore technological advances, trying to find the “silver bullet” technology that will give them a competitive edge. It is expected that just as Carbon's vat polymerization technology or Markforged's material extrusion technology has driven market growth, other vendors are expected to find new enhancements to 7-core AM technologies. Just as we are now seeing Stratasys expand its polymer portfolio to include powder coating, we can expect other manufacturers to independently develop or acquire new technologies and actively bring them to market.

Brian Thompson, Vice President, CAD Division and General Manager, PTC

In the next decade, we expect digital technology to come into full force and become the backbone of smart factories, and additive manufacturing to play a major role in the transformation of integrated industrial manufacturing.

As AT standards continue to evolve and more materials, processes and parts are certified and qualified, more industries will move to end-use mass production. We will see multi-batch printing and consolidation become more ubiquitous.

From a technological standpoint, we also expect big breakthroughs in bioprinting and regenerative medicine, whether it's the creation of complex tissues or the development of drugs.

Cathy Bui, Head of Product Development, Business Engineering, Formlabs

The past two years have shown us just how fragile and important supply chains can be. AT/3DP technology has already helped support and strengthen supply chains, but the next decade will see an even greater role for AT/3DP in supporting traditional manufacturing technologies. In particular, we will see more companies using 3D printing to create consumer-facing parts, make custom manufacturing fixtures, and enable decentralized manufacturing. AT/3DP will never completely replace traditional mass production, but in the next decade we will see this technology take on more and more processes that used to be done by traditional methods.

In particular, we will see more companies using 3D printing to create consumer-facing parts, make custom manufacturing fixtures, and enable decentralized manufacturing. AT/3DP will never completely replace traditional mass production, but in the next decade we will see this technology take on more and more processes that used to be done by traditional methods.

Stephan Kuhr, Founder & CEO, 3YOURMIND

When it comes to manufacturing in 10 years, I envision new collaborative business models powered by digital platforms and technologies around the world. AT/3D will be implemented by all manufacturers not only for prototyping, but, first of all, for mass production. Barriers related to AT knowledge, quality certification, data collection will be removed. These new Industry 5.0 factories will be sustainable, interconnected and digital. Through this, I hope, creativity will become limitless; the production of new forms (additive, hybrid, etc.) will be fully integrated with artificial intelligence, robotics, and digital twins will push us to open the boundaries of IoT. Ultimately, this will show everyone that there are no boundaries! I can't wait to see this!

Ultimately, this will show everyone that there are no boundaries! I can't wait to see this!

Frank Roberts, President, 6K Additive

Technology across the AT supply chain, from materials to machinery to post-processing and software, will greatly add value to organizations, and more will open as we transition to such manufacturing. areas of application.

In terms of materials, we are seeing an ever-expanding range of high-performance metal materials that will allow rockets to fly faster and operate at extreme temperatures that can be used in medicine, which will greatly improve patient care, and allow doctors to perform operations using implants made from exotic materials. Materials from high-entropy alloys will appear, which are in their infancy today. And although new materials will appear, the commitment of manufacturers and consumers of materials to the principles of sustainable development will be no less important than quality and cost factors.

Kai Führer, CEO, enter2net.com

In the future, additive manufacturing will take up an increasing share of the total. A new driving force is the stabilization of supply chains through local and decentralized production. On the way to a sustainable and cost-effective introduction into the manufacturing industry, 3D printing will lose its special status as a new technology "where everything is different" and will be fully integrated into the economic chain, using the concepts of automation and industrial IoT. This assumes that the main issues regarding the cost and qualification of materials, the speed and quality of printing, as well as the integration of AT processes into standard software will be solved, I firmly believe in this.

Joseph Crabtree, CEO and founder of AT&T

As we look forward to the next decade, we look forward to a period of consolidation in the AT industry. Several "traditional" manufacturing companies will start to "play" in the field of AT, and there will be an increase in activity in the field of mergers and acquisitions. We expect the reset of the bloated markets of the last 2 years to lead to consolidation of companies, and only those with viable long-term businesses that are resilient to profitable growth will be able to ride the wave. This will contribute to the eventual growth and expansion of the AT industry and lead to 3D printing becoming "just another manufacturing technology." This will be the final acceptance that we have all been looking for.

We expect the reset of the bloated markets of the last 2 years to lead to consolidation of companies, and only those with viable long-term businesses that are resilient to profitable growth will be able to ride the wave. This will contribute to the eventual growth and expansion of the AT industry and lead to 3D printing becoming "just another manufacturing technology." This will be the final acceptance that we have all been looking for.

Dr. Robert Gmeiner, Cubicure CEO & CTO

The current decade is likely to see a shift away from technology strategies towards an intense focus on measurable value added based on realistic production scenarios.

Vertical markets will be the first to show sustainable examples of AT success. While the mergers will continue, both technologically and in terms of companies, the AT industry is on the rise.

In the past, attention in the field of polymer AT has focused on FDM and powder-based printing processes. However, the largest turnover in the industrial production of AT has always been associated with resin-based 3D printing. The next decade will further reflect this economic fact: Light-curing materials are rapidly becoming polymers that meet the high specifications of many industries. Customized mass production will continue to play an increasing role in patient and consumer related products. At the same time, full-scale additive manufacturing of small and complex parts will see huge growth in industries such as electronics and connectors.

However, the largest turnover in the industrial production of AT has always been associated with resin-based 3D printing. The next decade will further reflect this economic fact: Light-curing materials are rapidly becoming polymers that meet the high specifications of many industries. Customized mass production will continue to play an increasing role in patient and consumer related products. At the same time, full-scale additive manufacturing of small and complex parts will see huge growth in industries such as electronics and connectors.

Flexibility and risk reduction are important to all industries now and will continue to be so in the future.

Deho Hong, Product Manager, nTopology

Over the next decade, mass customization will become the standard in many more areas than today (such as medical devices and high-end sports equipment). As the cost of materials and production of ATs continues to decline, we are likely to see some change in supply chains as locally printed parts become more profitable than those sourced from global manufacturing centers. We will also witness an expansion of the range of materials for AT with the advent of new alloys, polymers and hybrid metamaterials. Advances in additive manufacturing will enable printing with little or no human intervention, and many printers will provide high-tech fabrication, allowing parts to be created from all sides, not just z-layer growth.

We will also witness an expansion of the range of materials for AT with the advent of new alloys, polymers and hybrid metamaterials. Advances in additive manufacturing will enable printing with little or no human intervention, and many printers will provide high-tech fabrication, allowing parts to be created from all sides, not just z-layer growth.

Gil Lavie, Founder & CEO, 3D Alliances

I see two trends in the next decade. The first is accelerating research and development on new AT capabilities, leading to exciting technologies that will provide higher productivity, special materials for specific applications, higher accuracy and repeatability, in other words, better compatibility with real production needs.

2021 has been a big year for many companies that have raised funds/decided to go public with some of the capital focused on developing new products.

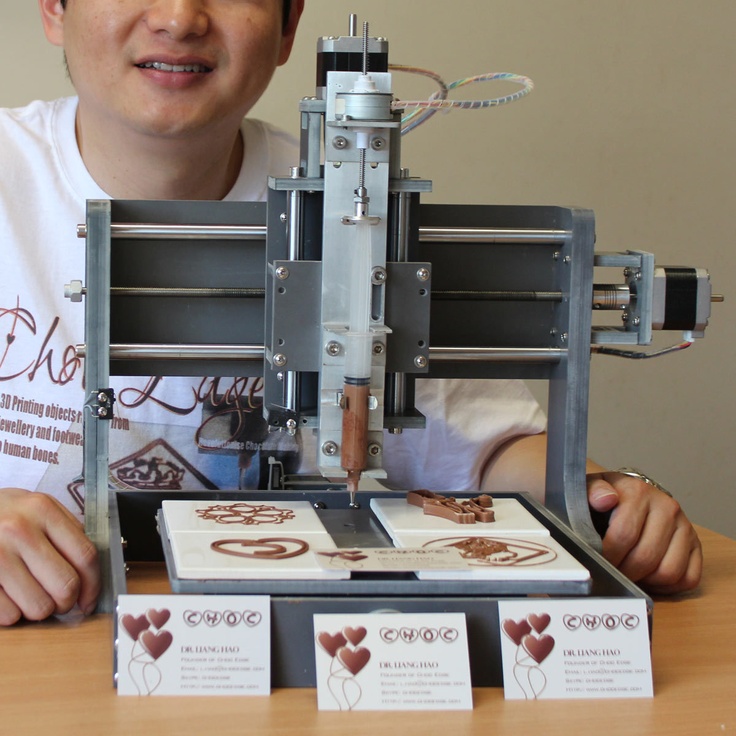

The second trend is the introduction of AT for new applications in non-standard industries such as construction, food, fashion, space and others.

Oliver Smith, Founder, Principal Consultant, Rethink Additive

If the 2010s was the decade of 3D printing coming of age, the 2020s will be the decade of its going public. Over the past 24 months, the industry has been flooded with capital, which has led to a sharp acceleration in the development of new platforms, as well as spurring M&A activity, and there is no sign of a downturn in this trend. I could argue that the renewed investment interest in the technology has been driven by a significant amount of positive press coverage demonstrating how 3D printing can address critical parts shortages and supply chain disruption, but unlike the wave of investment hype 10 years ago, this the second wave is stable, because many 3D printing technologies can be incorporated into manufacturing processes or used to support manufacturing. The next ten years will be an interesting time for technology vendors and investors, as a wave of public offerings lies ahead (several successful private vendors such as Formlabs have already publicly indicated their interest in an IPO), as well as consolidation among new and old vendors through mergers and acquisitions .

Another trend we expect to see in Rethink, due to AT's increased prominence as a result of the pandemic supply disruption, is explosive growth this year and over the decade driven by financial investment in technology providers. 3D printing has again become one of the most mentioned technologies in conversations about the development of the market and the factories of the future. This led to a wave of acquisitions, investments and IPOs. With this influx of capital, we are already seeing accelerated time-to-market for new technologies and platforms, as well as M&A among legacy vendors. With several more successful AT vendors publicly stating their intention to go public, whether through traditional public offerings or SPACs, the M&A and IPO trend should be expected to continue into 2023 and beyond, with not all of them being sustainable.

Mohsen Seifi, Director of Global Additive Manufacturing Programs, Martin White, Head of Additive Manufacturing Programs - European Region, UK, Alexander Liu, Head of Additive Manufacturing Programs - Asia Region, Singapore, and Terry Wahlers, Head of Advisory Services and Market Analysis, ASTM International Center of Excellence for Additive Manufacturing.

Over the next decade, we predict AT will play a vital role in the pursuit of sustainability by supporting the global shift towards cleaner production methods. This trend will help support the economic and environmental goals set by governments around the world. AT methods will continue to be driven by market demand, such as zero-carbon solutions, especially in transport and heavy industry.

In applications, demand will continue to grow for large parts such as titanium blanks in the aerospace industry and large molds that compete with alternative AT methods (powder melting or metal spraying). This will expand the supply chain, reduce the development time for new platforms, and ultimately help reduce the final cost.

Dr. Johannes Homa, CEO of Lithoz

Additive manufacturing is an increasingly common technology. We see companies successfully incorporating this powerful technology into their workflow, complementing existing production methods. We will soon see the creation of geographically independent, yet globally and digitally connected manufacturing sites that can reach simultaneous mass production through the digital capabilities of 3D printing.

We will soon see the creation of geographically independent, yet globally and digitally connected manufacturing sites that can reach simultaneous mass production through the digital capabilities of 3D printing.

In addition, more attention will be paid to quality and reliability in serial production. As more and more companies enter mass production, there will be a need for a higher level of quality and confidence in the efficiency and capabilities of the additive manufacturing process. Therefore, companies in this industry will prioritize making each step as reliable as possible. Finally, as a consequence of the previous point, the level of automation will increase in the industry, eliminating the human factor and making the whole process more efficient and simple for both manufacturers and customers.

Roger Useda, CIM-UPC Director of Technology Transfer and co-founder of BCN3D

I firmly believe that we will finally see mass production using AT technology, and not only for piece or expensive products, but also for series production . To do this, we still have to solve some problems, such as the quality of the primary products and the price of the final part.

To do this, we still have to solve some problems, such as the quality of the primary products and the price of the final part.

Henrique Wonneberger, COO and co-founder, Replique

Applications for AT materials are already on the rise as metallic and high temperature polymers for FDM printing are being developed. Improvements in AT have already led to a shift from prototyping to mainstream manufacturing, but we expect AT to be used in the coming years not only as a replacement for traditional manufacturing, but as a completely new approach to creating a production chain. AT will be integrated into a comprehensive and reliable platform, where the individual steps of 3D printing will be combined into one process, from ordering a part to its delivery to the customer. Advances in AT software have improved quality control and can now predict warp and thermal stress before a part is made, minimizing printing defects and wasted materials. 3D modeling can be used to get the most out of materials, allowing designers to create shapes that would not be possible without 3D printing, develop new products that optimize topology and reduce weight.

Rush Laselle, Senior Director, Additive Manufacturing, Jabil

The next decade in manufacturing will bring major transformations in the digital technologies and applications being implemented in the world's factories. The advent of a more comprehensive digital ecosystem will kick-start the entire additive manufacturing industry, making small-scale manufacturing, including batch sizes of one, truly cost-effective, for more consumer-oriented products. As a result, the democratization of production and localization is expected, which will allow better customer service.

Louis Folgar, EVP Americas, ATT Inc.

The range of resin materials available for 3D printing will be unlimited. Part quality and productivity will increase proportionally. With lessons learned from supply disruptions, 3DP end-use parts will become the only viable choice for many OEMs from the automotive to medical industries. 3DP manufacturers will offer fully automated, end-to-end systems and technology solutions that keep the digital link from design to post-production and control of any 3D printed part.

Philemon Schoffer, co-founder and CEO of Hubs

New types of materials and composites, lower prices and improved post-processing options will make it more viable to integrate 3D printing into production cycles. As technology advances, 3D printing technology is becoming a more competitive alternative to injection molding for low-volume plastic parts.

Even more exciting, modern composite materials, combined with the ability to produce complex geometries, will open up new manufacturing possibilities that could not be realized with traditional technologies (it's already happening!).

Kwang-Ming Lee, Vice President of Carima

AT/3DP technology applications and market size have expanded significantly, but the application of AT/3DP to the production of finished parts in mechanical engineering has not yet reached full maturity.

In other words, in addition to being used for 3D prototyping, education and research and development, many industrial companies are working to use this technology as an alternative to traditional manufacturing methods such as milling and injection molding, but the point is that 3D printing production speed is still a sticking point compared to these methods.:quality(80)/images.vogel.de/vogelonline/bdb/1612700/1612740/original.jpg)

To compete with traditional manufacturing methods, differentiated 3D printing technology needs to be developed and should be pursued in the near future and the AT/3DP market is likely to remain unchanged for the next decade.

To prepare for this development, almost all 3D printer manufacturers are investing a lot of time and money in developing the fastest 3D printing technology, but it is still difficult to achieve both high accuracy and repeatability.

The fact is that we, Carima, as one of the global manufacturers of 3D printers, have developed C-CAT (Carima Continuous Additive Technology), which is the world's fastest 3D printing technology, increasing productivity by at least 20 times compared to existing DLP technology. We successfully demonstrated it at Formnext 2021 and intend to upgrade it and bring new 3D printers with this technology to the market in the next 1-2 years.

C-CAT is the fastest 3D printing technology that allows DLP 3D printers to print 1 cm per minute (60 cm per hour) with high precision and repeatability. Our development team has been able to minimize model output problems at this speed, as well as significantly reduce power consumption. Thanks to this, more stable continuous additive manufacturing is possible with C-CAT.

Our development team has been able to minimize model output problems at this speed, as well as significantly reduce power consumption. Thanks to this, more stable continuous additive manufacturing is possible with C-CAT.

As I mentioned earlier, improving the 3DP workflow and more robust implementation of the technology is absolutely essential to supply some of the existing plastic or rubber parts industries. We plan to lead the era of mass personalization of end products by accelerating the development of a new 3D printer capable of producing various components in industries such as eyewear, footwear, consumer goods, and automotive interior and exterior parts at a print speed of several tens of centimeters per hour.

Carima at Formnext 2021. Photo by Michael PetchAmir Veresh, Founder, eConsulting Ltd.

I am confident that in the second half of the next decade, additive manufacturing will become an important, legitimate (regulated and standards-based) and mainstream manufacturing method. It will improve the way products are produced, as in many cases it will complement traditional methods of production, and for other products it will become the main technology and method of production. Replacing traditional mass production with additive mass production requires an appropriate justification, which may be due to cost, environmental considerations, supply chain, improved functionality, etc. (no need to prioritize between these justifications). It will take time for equipment manufacturers to develop their products in a way that justifies the transition from traditional to additive manufacturing. This will happen as technology improves and education in design for additive manufacturing develops. Many endeavors will fail because of weak justification, but over time more and more applications will benefit from the use of AT.

It will improve the way products are produced, as in many cases it will complement traditional methods of production, and for other products it will become the main technology and method of production. Replacing traditional mass production with additive mass production requires an appropriate justification, which may be due to cost, environmental considerations, supply chain, improved functionality, etc. (no need to prioritize between these justifications). It will take time for equipment manufacturers to develop their products in a way that justifies the transition from traditional to additive manufacturing. This will happen as technology improves and education in design for additive manufacturing develops. Many endeavors will fail because of weak justification, but over time more and more applications will benefit from the use of AT.

Additive manufacturing will be able to use more of the standard industrial materials currently in use. It is possible that some materials developed for additive manufacturing will be approved for use in the manufacture of products.

Additive technologies will enable distributed manufacturing, thereby optimizing supply chains and reducing costs, increasing customer appeal and supporting the well-being of our planet.

Based on current trends, I expect a breakthrough in the mainstream segment to come from the identification of more products with low production volume and a large number of components, which will gradually replace existing (not adapted) mass-produced products. This is an exponential process that will accelerate significantly over time. Additive technologies should solve the problem of storage of spare parts by introducing a comprehensive solution of digital inventories, backed up by distributed local digital production.

Additive manufacturing will become an integral part of the advanced PLM complex, which will be deeply focused on IoT and the fourth industrial revolution.

Jordi Driman, 3D Applications Specialist, Mimaki Europe

I predict that full-color 3D printing will be in demand in the next decade by SMEs as printers like our 3DUJ-2207 become more cost effective and convenient for office space.

Automation is another exciting technology that I think is becoming commonplace throughout the printing sector as hopes for faster delivery times grow and with it the need for 24/7 operation.

Dr. Alvaro Goyanes Goyanes, co-founder and CEO of FabRx

In the next decade, 3D printing will be widely used in hospitals and pharmacies, for the preparation of complex drugs, and for clinical and preclinical research. One of the sources of income for large pharmaceutical companies will be the sale of drug cartridges for the preparation of individual drugs next to patients. This will increase the personalization of drugs, increasing their tolerability and effectiveness, and reducing side effects.

Andreas Langfeld, President EMEA, Stratasys

AT will find its place as a unique and unique manufacturing technology. There will be a general understanding that certain parts must be produced additively due to lot size, the need for customization, the need for on-site production on demand. This standardization of AT as the manufacturing method of choice is seen today in the mobile, aerospace, dental and medical sectors, but it will spread to other verticals and become the new normal for some component manufacturing.

This standardization of AT as the manufacturing method of choice is seen today in the mobile, aerospace, dental and medical sectors, but it will spread to other verticals and become the new normal for some component manufacturing.

André Wegner, CEO, Authentise

New technologies. One thing is clear - the evolution of digital technologies will not stop. We will see not only continuous, incremental improvements to existing technology platforms, but entirely new platforms and technology suites.

Concept based design. Partly to ensure the rapid deployment of new technology platforms and to increase the speed of bringing new ideas to market, we will increasingly rely less on CAD and other design tools to communicate our ideas. Instead, we will focus on semantics that can convey our true intent. This design, in turn, will be used by a variety of software tools, including generative designers, to determine the final shape, influenced by other parameters such as available equipment and materials.

Artificial intelligence in AT. Transposed design means that the results of the last stage of the process (for example, measurements during testing) can influence new versions of designs or change parameters. We get a full-fledged technological complex for the entire production cycle, and not just limit the production technology to specific machines.

Martin Hermatschweiler, CEO of Nanoscribe

People tend to overestimate what they can achieve in 1 year and underestimate what can be achieved in 10 years. 3D microfabrication will be the driving force behind innovation. Size matters - especially on a small scale. And the material matters too. We will see many applications develop, from basic to applied research, until eventually reaching industrial maturity with a steep evolution in technology readiness level (TRL). In particular, startups will identify niches early and develop them. A huge range of materials will emerge and reach industrial levels, whether they be biomaterials such as biocoatings and biodegradable materials or technical materials beyond high-performance polymers, including glass and ceramics.

Multi-material 3D printing concepts will also become industrially applicable. The computational design capabilities and ease of use of two-photon polymerization will shorten the development cycle from sketch to ready-to-use product from years to weeks.

Xavier Martinez Faneca, CEO, BCN3D

Consolidation will play a key role in the coming years. In the coming decade, the 3D printing industry will certainly undergo a complete transformation. Technology will evolve towards high performance solutions, leading to greater autonomy in the hands of end customers. I expect that during this 10 year period AT will be able to truly deliver on the promises that have been made in recent years and become a mainstream manufacturing method.

John Barnes, Managing Director, and Laura Ely, Program Director, The Barnes Group Advisors

AT will become less unusual, perhaps even boring. Boredom is good for batch production, and batch production is good for AT. We will be happy, free, less confused and alone - all at the same time.

We will be happy, free, less confused and alone - all at the same time.

Equipment. More diversification as the industry learns about 3D printing and its techniques.

Materials. Here we see two directions: 1) a deeper understanding of how the material functions in various processes, and 2) the emergence of more advanced polymers that will push the boundaries of performance. (We are seeing a move to higher cost materials, as is the case with metal ATs.)

Digital technologies. Improved software is on the horizon, it will be integrated into the AT workflow and become smarter, perhaps even artificially intelligent. Machine learning will become a standard tool for the industry.

People. As more people learn AT and understand its importance, the gap in practical experience will be minimized, the existing workforce will continue to learn and be supplemented by new graduates of vocational schools and colleges for whom AT is already a tool in the arsenal .

David Iacovelli, Regional Director EMEA, EOS

AT has clear advantages over other production methods in terms of stability. We will see how AT will compete and replace technologies that are widely used today. Additive manufacturing will become the dominant mass production technology. The full automation and digital workflow that is possible with polymer additive manufacturing will replace mass production technologies that require high precision and productivity, while reducing costs. We have our own Fine Detail Resolution technology. But this also applies to other technologies such as Laser ProFusion. They will bring the industry closer to tool-free injection molding.

We will see how AT will compete and replace technologies that are widely used today. Additive manufacturing will become the dominant mass production technology. The full automation and digital workflow that is possible with polymer additive manufacturing will replace mass production technologies that require high precision and productivity, while reducing costs. We have our own Fine Detail Resolution technology. But this also applies to other technologies such as Laser ProFusion. They will bring the industry closer to tool-free injection molding.

The second innovation we anticipate is the industry's shift to digital storage and on-demand production of needed parts. This will enable companies to significantly reduce aftermarket costs and create new businesses focused on providing locally produced parts and services for a variety of consumer and industrial products.

We believe that in the next decade we can expect further market consolidation and the emergence of several major players. In addition, interoperability will be improved, which will lead to increased competition in the market, as it will be much easier for manufacturers to switch from one technology to another and mix competitive technologies depending on their needs.

In addition, interoperability will be improved, which will lead to increased competition in the market, as it will be much easier for manufacturers to switch from one technology to another and mix competitive technologies depending on their needs.

Nora Toure, Founder of Women in 3D Printing

I wish this was a prediction for 2022, but it will probably take more than a year. However, I hope we will see a trend towards diversity, with people of different races and nationalities represented in key positions and at all levels of any organization.

In terms of technology, continuous improvement in the production of products and materials in general is to be expected. I wouldn't be surprised if AT doesn't look exactly the same in the next decade as it does today.

Sylvia Monsheimer, Head of New 3D Printing Technologies Evonik

I don't think we're going to see a "big bang" in 3D printing in the next decade. I rather expect to see specific approaches to mass production that will lead to huge success in the industry. Successful mass production using AT will require such specialization in terms of process parameters, equipment and material that allows 3D printing to surpass conventional production. I look forward to seeing new technologies! Now so many specialists are working to overcome the existing difficulties. This will be an exciting decade.

I rather expect to see specific approaches to mass production that will lead to huge success in the industry. Successful mass production using AT will require such specialization in terms of process parameters, equipment and material that allows 3D printing to surpass conventional production. I look forward to seeing new technologies! Now so many specialists are working to overcome the existing difficulties. This will be an exciting decade.

Fedor Antonov, CEO Anisoprint

The main technological trends will be further development and improvement, as well as an increase in preparedness and adoption of technologies - those technologies that have attracted market attention and have already been developed. I don't see any significant new technologies emerging in the next few years, and most likely it will be about the consolidation, maturation, improvement and market entry of existing technologies. New technologies will find a new niche. We are talking about the stable growth of the market and the destruction of the usual technological processes. Each group of companies and equipment will focus on a specific niche where it performs best. In the future, 3D printing technologies will be more specialized: even more tailored to specific industries and problems in various niches.

Each group of companies and equipment will focus on a specific niche where it performs best. In the future, 3D printing technologies will be more specialized: even more tailored to specific industries and problems in various niches.

The next decade will bring the prospect of 3D printing to new emerging markets such as commercial space, drones and aircraft, robotics, urban transportation and many others that will grow rapidly. They will be the main stimulus for the growth of technologies such as 3D printing. This is where new players will be able to defeat the old ones - due to greater flexibility through the use of 3D printing. Applying new technologies that are more stable and allow better, lighter parts to be made to order will help solve supply chain problems.

There is interaction between new and emerging markets such as 3D printing and the new technology markets I just mentioned. These segments are still growing at a very impressive rate of 20 to 30 percent and will collectively reach a trillion dollars in the next decade. Obviously, the 3D printing market will continue to grow at the same rate and we will have a significant share of this market.

Obviously, the 3D printing market will continue to grow at the same rate and we will have a significant share of this market.

Dr. Ingo Ederer, CEO Voxeljet

The past year has been marked by acquisitions and consolidations as the industry is extremely fragmented. We believe this trend will continue in the next couple of years. Despite the fact that additive manufacturing has been around for about half a century, we are currently seeing an incredible rate of development of the technology and the ecosystem around it.

Particularly in times of pandemic and climate change, additive manufacturing can position itself as a technology capable of solving problems in an extremely efficient manner. In terms of complementing existing manufacturing processes, to meet fluctuating excess demand, manufacturing locally, and in terms of lightweight construction and resource efficiency. However, there is still a lack of automation and wider application possibilities due to the lack of new materials and process standardization. These elements will be the focus of the industry over the next decade and will be needed to turn AT into a viable mass production technology.

These elements will be the focus of the industry over the next decade and will be needed to turn AT into a viable mass production technology.

With the expansion of the use of AT, the demand for skilled workers and AT education will also grow, while we are already seeing the first AT-oriented courses in schools and universities, the whole engineering mentality will shift towards more efficient use of resources and stable design. This will include the development of improved software solutions.

James DeMuth, founder and CEO of Seurat

The cost of LPBF (Powder Bed Laser Fusion) products will be significantly reduced and will compete with casting and milling in small to medium volumes while maintaining the high quality and benefits of AT that we are all used to today (and even more) . Mass production of AT parts will become commonplace.

Dr. Joshua Pierce, John M. Thompson Department of Information Technology and Innovation, Western University, Canada

Many predictions that a 3D printer will be in every home have not yet come true, but the steady and smooth growth of distributed production using 3D printers in the home is undeniable. 3D printing filament is now classified as "Amazon Basic" along with batteries and paper. The technology that I believe will tip the scales of distributed manufacturing in the next decade is distributed processing and additive manufacturing (or DRAM for short). Several open source technologies have already been created, from filament-producing recycling robots to “direct waste” 3D printers that allow us to use 3D printing at home to recycle plastic waste into valuable items. DRAM saves people real money. This technology allows consumers to make custom products at less than US sales tax (6%) - from skateboards and toys to syringe pumps and arthritis treatments. As more companies take advantage of the economic advantage and make more DRAM technologies available to their customers, DRAM should be expected to follow the growth curve of consumer 3D printing.

3D printing filament is now classified as "Amazon Basic" along with batteries and paper. The technology that I believe will tip the scales of distributed manufacturing in the next decade is distributed processing and additive manufacturing (or DRAM for short). Several open source technologies have already been created, from filament-producing recycling robots to “direct waste” 3D printers that allow us to use 3D printing at home to recycle plastic waste into valuable items. DRAM saves people real money. This technology allows consumers to make custom products at less than US sales tax (6%) - from skateboards and toys to syringe pumps and arthritis treatments. As more companies take advantage of the economic advantage and make more DRAM technologies available to their customers, DRAM should be expected to follow the growth curve of consumer 3D printing.

Alessio Lorusso, CEO, Roboze

The impact that additive technologies will have on the future is the most exciting and, at the same time, fantastic idea. I believe that the most important and overarching theme in which AT will continue to show breakthrough results is the response to the strategies for the environmental sustainability of our planet. The possibilities are endless. Creating local production on demand, reducing transport emissions and combating production waste is just the beginning. We at Roboze look forward to supporting the innovators who will change our future for the better.

I believe that the most important and overarching theme in which AT will continue to show breakthrough results is the response to the strategies for the environmental sustainability of our planet. The possibilities are endless. Creating local production on demand, reducing transport emissions and combating production waste is just the beginning. We at Roboze look forward to supporting the innovators who will change our future for the better.

The Roboze ARGO 1000. Photo by Michael Petch.

Ankush Venkatesh, intra-entrepreneur, additive manufacturing, Glidewell Dental

In the coming decade, AT will mature in its role in the digital manufacturing constellation. This will enable new innovative business models to take advantage of a suite of digital solutions. These solutions will be based on software platforms that will be modular, interoperable and highly complex. In part, this may lead to the emergence of many hyper-specialized service providers, but it will also force incumbents to focus on the development of "hot", complex offers. We have already seen this in the personal computer industry (1980s - 2000s), as well as in the smartphone industry (2000s - present).

We have already seen this in the personal computer industry (1980s - 2000s), as well as in the smartphone industry (2000s - present).