Ark 3d print etf

A Look at ARK’s 3D Printing Fund, “PRNT” - 3DPrint.com

ARK Investment Management LLC is the only investment management firm that offers an actively managed exchange-traded fund (ETF) dedicated to 3D printing, making it a unique player in the world of additive manufacturing (AM) finance. Established in 2016, the Total 3D-Printing Index (PRNT) is one of the few ways that individuals can invest in the AM market as a whole without purchasing shares in separate 3D printing stocks.

An ETF is a collection of stocks tied to a specific sector or commodity but that can be bought or sold on the market in the same way a traditional stock can. When ETFs are actively managed, a team or expert is making decisions about the stocks within the fund’s portfolio based on the performance of companies behind them or the economic markets as a whole.

ARK was founded in 2014 by Cathie Wood, a well-known investor who suggested the idea of actively managed ETFs based on disruptive technologies while working as chief investment officer for asset management firm AllianceBernstein. When the company deemed the concept too risky, she created ARK, now a roughly $23 billion-fund tracking such tech firms as Tesla and Square.

Since the beginning, ARK looked at 3D printing, establishing the Total 3D-Printing Index (PRNT) just two years after the company’s founding. ARK’s fund uses a replication strategy, investing in the securities of an index kept by a German company called Solactive, the world’s 13th largest provider of stock indices (The oldest index is the famous S&P 500, tracking 500 companies with market caps of over $4.6 billion and totaling nearly $400 billion in assets). By replicating the Solactive 3D-Printing Index, PRNT is passively managed, with changes made to the index and, therefore to PRNT, semi-annually.

As for PRNT, the universe is made up of about 50 percent 3D printer manufacturers, followed by 30 percent CAD and simulation software businesses, 13 percent service bureaus, five percent scanning and measurement, and two percent materials. Whereas a mutual fund might require something like a $10,000 minimum to invest, the PRNT index is an opportunity for more ordinary consumers to put funds toward a technological segment for which they anticipate growth.

Whereas a mutual fund might require something like a $10,000 minimum to invest, the PRNT index is an opportunity for more ordinary consumers to put funds toward a technological segment for which they anticipate growth.

Other benefits include the fact that ETFs are somewhat more transparent than other funds, in that the holdings can be viewed publicly online daily, in contrast to another private fund that might send a semi-annual statement to investors. ETFs also generally have lower fees. For PRNT, ARK takes a 0.6 percent cut, compared to a mutual fund’s fees of closer to two percent.

Every quarter, the ETF is rebalanced and every six months, ARK will suggest changes to the stocks in the fund, based on its research. Solactive, however, has the final say. With a minimum market cap threshold of $80 million and a liquidity threshold, Solactive examines the average daily volume of how a stock has traded over the course of three months, with a minimum volume exceeding $200,000. If the stock is large and liquid enough, it may be considered for the index. The PRNT fund is then rebalanced based on the index.

The PRNT fund is then rebalanced based on the index.

The companies in the fund are also scored based on such characteristics as management team, product portfolio, and execution. ARK hopes that the stocks within their funds will double over a five-year period. Ideally, these should make for a relatively balanced collection of firms involved in AM with the potential for double growth over the next five years.

Looking through the most recent list of holdings under the PRNT index, as of December 1, 2021, you’ll see nearly 60 firms comprised of everyone from Stratasys and 3D Systems to Hexagon and Oerlikon with their respective weight percentages. Desktop Metal has the highest weight in the list at a whopping 7.60 percent, with the next in line, HP, weighted at 5.17 percent.

This compares to a company like Align, known for the use of 3D printing in its manufacturing of invisible braces, which is weighted at 1.35 percent. In total, the fund manages $472.9 million in assets, with a weighted average market cap of $120 billion and median market cap of $5 billion. Since its inception in July of 2016, it has seen a positive market price change of 83.99%.

Since its inception in July of 2016, it has seen a positive market price change of 83.99%.

The consumer hype bubble turned many off of the technology, but that that was not the case for ARK. As evidenced by this chart from an ARK slide deck, 3D printing has barely begun to penetrate the market for end-use parts. The investment firm estimates the total addressable opportunity for this market to be worth nearly $500 billion, of which the current penetration by AM has only been about one percent.

Image courtesy of ARK.

However, since that hype bubble, the 3D printing industry has evolved significantly, with AM investment shifting from a consumer- to industry-focused technology, lending credence to ARK’s estimates.

For instance, 3D Systems dissolved its consumer line, while Stratasys began outsourcing the production of its MakerBot 3D printers. Now, not only have these stalwarts redirected their investments toward industrial 3D printing—3D Systems focusing heavily on its Figure 4 ecosystem for production and Stratasys developing a mass sintering platform—but numerous giants from outside of AM have entered into the space, making significant waves.

At first, this was signified by GE Additive, which acquired two important metal 3D printer manufacturers and is developing a metal binder jetting system, and HP, which has released a polymer sintering and metal binder jetting machine. However, numerous chemical companies have been shaping the industry a great deal. Specifically, BASF has made some important acquisitions, such as that of Sculpteo, and opened up a spare parts printing business.

Now, there is clearly a lot of attention being paid to the industry. The participation by major corporations in the space was amplified by the COVID-19 pandemic and the role that AM played in managing the supply chain disruptions that resulted. We reported numerous cases in which 3D printing was able to help produce replacement parts, molding, and medical components, showcasing its potential for manufacturing as a whole.

This reintroduced the technology to a number of firms that were left in the lurch. The technology proved valuable as a stopgap measure both for the production of medical supplies to address the pandemic and traditional manufacturing. As a result, we’ve seen numerous announcements related to SPAC mergers and traditional IPOs, as well as increased mergers and acquisitions more generally.

As a result, we’ve seen numerous announcements related to SPAC mergers and traditional IPOs, as well as increased mergers and acquisitions more generally.

In the past, reverse mergers would be considered with greater skepticism as small, sometimes unknown companies would use existing public entities in order to bypass regulations associated with IPOs. For instance, Tinkerine and Graphene Labs used reverse mergers to get onto less regulated markets. A reverse merger by 3D Group in Australia showcased the use of such a tactic to perform a pump-and-dump schemes.

More recently, the spat of SPACs that the industry has witnessed represent a laxer attitude toward reverse mergers. Companies that perform these operations don’t need to go through the typical IPO process and don’t have to file the same documents. A company with decent financials, and transparency about those financials, can likely use a SPAC to obtain a single, guaranteed source of capital. However, businesses with less transparent operations can also pursue SPACs without the rigors of a traditional IPO, in which a company must build up a collection of backers, convince a group of investors to participate, and go through banks in order to launch successfully.

Image courtesy of ARK.

Due to the recent excitement, individual investors may be eager to get into the game. According investors we’ve spoken to, including SmarTech Analysis’s own Scott Dunham, this is no hype bubble we’re experiencing. The technology is much more mature. By investing in the market as a whole, ARK hopes to capitalize on this evolution. In fact, it believes that the segment will reach a whopping $120 billion by 2025, which is more than others have anticipated. Whether or not it will get to that point is another story altogether.

Stay up-to-date on all the latest news from the 3D printing industry and receive information and offers from third party vendors.

Tagged with: 3d printing investment • ARK • business • investment • PRNT • Solactive

Please enable JavaScript to view the comments powered by Disqus.

Is Cathie Wood Giving Up on 3D Printing Stocks?

Critics claim 3D printing will never make it in the mass market, and so far they're right

By Dana Blankenhorn, InvestorPlace Contributor Sep 23, 2022, 9:53 am EST

- Cathie Wood has given over active management of her 3D Printing ETF (PRNT) to another ARK partner.

- The fund is down 39% in 2022.

- Critics question whether 3D printing can ever be used for mass production.

Source: shutterstock.com/Alex_Traksel

Cathie Wood’s decision to leave active management of ARK Investment’s 3D Printing ETF (BATS:PRNT) is raising concern about the whole sector. 3D printing stocks on the whole have done very poorly this year.

PRNT has lost 39% of its value in 2022, nearly double the loss of the S&P 500. It is focused on “additive manufacturing,” the creation of parts from printer-like machines that drip or cut precisely based on computer designs.

The market response is not only to sell PRNT, down 2.5% on Sept. 22 but to sell the leading players as well. 3D Systems (NYSE:DDD), the longtime industry leader, is down 7%. Velo3D (NYSE:VLD) is down 6%. Stratasys (NASDAQ:SSYS) is down 4%. Desktop Metal (NYSE:DM) is down nearly 13%. Only 3D Systems is currently worth as much as $1 billion, and just barely.

Desktop Metal (NYSE:DM) is down nearly 13%. Only 3D Systems is currently worth as much as $1 billion, and just barely.

Failure to Mass Produce

3D printing had a brief vogue a decade ago as Bre Pettis’ Brooklyn-based MakerBot, now owned by Stratasys, made consumer-priced 3D printers based on melting plastic and supported “maker faire” conventions for students and engineers.

The MakerBot, and a 3D Systems version called Cube, failed to catch on with the mass market. Companies then moved into industrial markets with specific use cases, like dental implants, knee replacements and wind turbines. But growth hasn’t followed. 3D Systems’ revenue in 2021 was $615 million, below the $646 million of 2017. The first two quarters of 2022 have seen a further slowdown. Profits have largely disappeared.

Stratasys, Velo3D and Desktop Metal have done little better, leading critics to call the whole idea a fad. The industry has, so far, failed to move beyond prototyping in most cases. Costs are too high for mass production.

Costs are too high for mass production.

3D Printing Stocks: What Happens Next?

Wood hasn’t given up on the field, recently buying shares in both Stratasys and Velo3D for her funds. But her step back gave critics another chance to criticize her “leading edge” technology investment strategy, and the failure of 3D printing stocks to launch.

Until 3D printing can deliver mass production at a cost competitive with other techniques, these stocks will remain in the dumper.

On the date of publication, Dana Blankenhorn held no positions in any companies mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Dana Blankenhorn has been a financial and technology journalist since 1978. He is the author of Technology’s Big Bang: Yesterday, Today and Tomorrow with Moore’s Law, available at the Amazon Kindle store. Write him at [email protected], tweet him at @danablankenhorn, or subscribe to his Substack.

Article printed from InvestorPlace Media, https://investorplace.com/2022/09/is-cathie-wood-giving-up-on-3d-printing-stocks/.

©2023 InvestorPlace Media, LLC

vacuum plastic molding and prototyping, CNC router; 3D printers, industrial equipment and liquid polyurethanes.

First in Russia First rapid prototyping service provider

Reverse engineering Development and restoration of parts according to ready-made samples

Participation in public procurement We participate in tenders and public procurement nine0003

Import substitution partner Production of analogues of plastic parts

Catalog

Whole catalog

- Prev

- Next

-

PICASO Designer XL 3D printer (series 2)

3D printers

- nine0002 PICASO Designer X PRO 3D printer (series 2)

3D printers

-

PICASO Designer X 3D printer (series 2)

3D printers

-

Standard C

Mixing and dosing equipment

- nine0002 RangeVision PRO 3D Scanner

3D scanners

-

XJRP SPS450H 3D Printer

3D printers

-

FVC-3A - vacuum injection molding machine

Vacuum casting equipment

- nine0002 Compact C

Mixing and dosing equipment

-

KLM V 1500 A

Vacuum casting equipment

-

Elast TDI

Mixing and dosing equipment

- nine0002 DC 1090A Metal Milling Center

Machining centers, 3D plotters

TPK Foliplast is a leading manufacturing and engineering company in the field of rapid prototyping, vacuum molding of plastics, CNC milling, 3D printing and scanning.

The basic principles of the company were laid down more than 20 years ago at the time of its creation:

- We work with proven equipment of the latest generation, we test equipment and materials at our production base immediately before sending it to the client. nine0089 — You can buy everything from us for creating engineering models, layouts, forms, their filling, processing.

— If there is no suitable technology in our assortment, we will create a solution for you!

— We cooperate with the best manufacturers and technical laboratories from around the world.

Foliplast is the official distributor of many well-known companies:

KLM (Germany), Harvest (Wings Technology) (Hong Kong), ASD-Technique (Belarus), Altropol (Germany), RangeVision, Shaanxi Hengtong (XJRP), UnionTech (China). nine0089 — We work according to ISO 9001 standards.

Creation of the Prototyping Center

Modification of industrial robot Kuka

Innovative project for the production of flexible ship guardrails

All articles

Articles

nine0002 December 13, 2022December 2, 2022

December 1, 2022

November 16, 2022

October 27, 2022

3D printers are able to "print" copies of objects and people

Computer technology is increasingly intertwined with real life. A real industrial revolution was made by 3D printers, capable of "printing" copies of any object and even a person. New technologies, in the development of which they began to actively invest in China, make it easier to realize their creative potential and allow dreams to materialize literally. nine0003

A real industrial revolution was made by 3D printers, capable of "printing" copies of any object and even a person. New technologies, in the development of which they began to actively invest in China, make it easier to realize their creative potential and allow dreams to materialize literally. nine0003

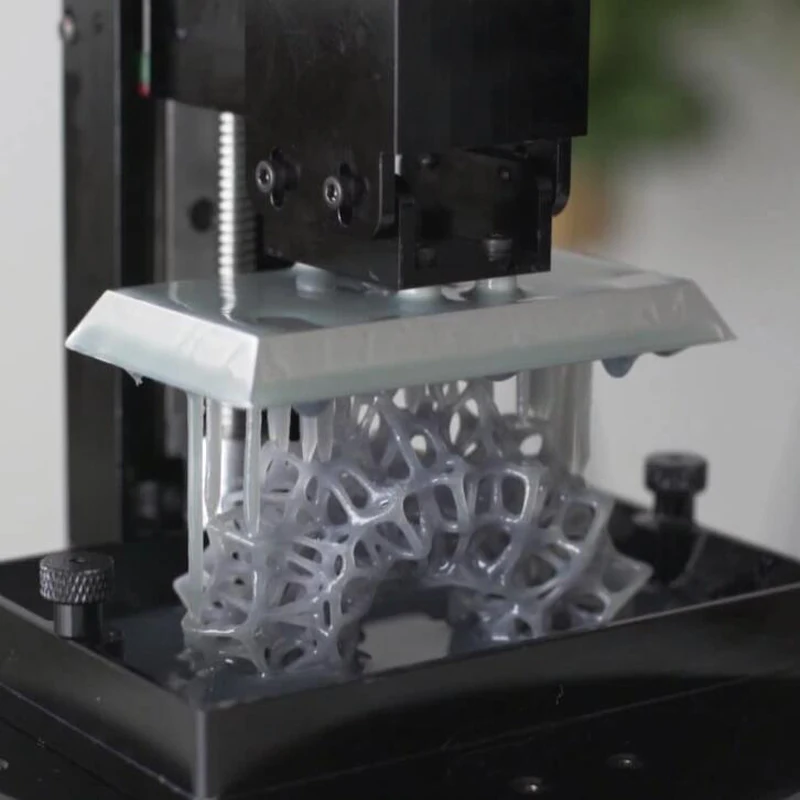

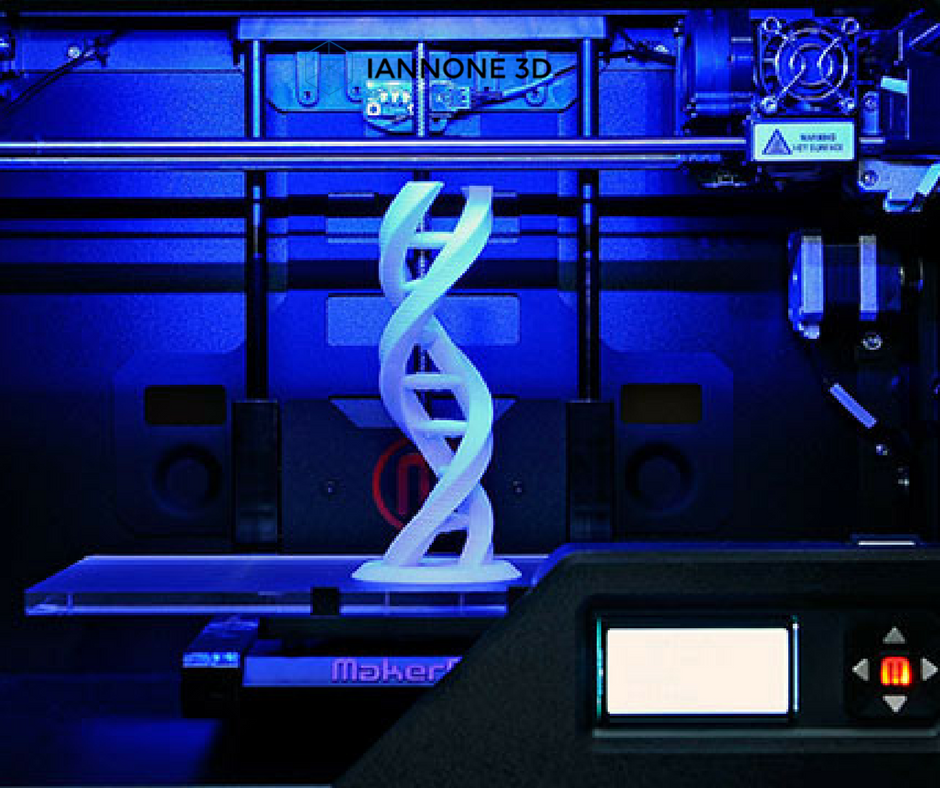

Unlike traditional printing methods, 3D printing is the process of creating three-dimensional solid objects with a dedicated digital printer. You can make a copy of not only any object, but also a person.

Shakhirezada Yeraliyeva, CCTV Correspondent-Russian:

"The digital model that the scanner creates is edited in a special computer program. Then this model is reproduced by the printer. Printing is based on the principle of layer-by-layer creation."

Shao Moyu, Director of the 3D Printing Center:

"3D printing can be used in areas such as mechanical engineering, aviation, electrical engineering, medicine and construction, as well as innovative design. Printing materials are very different: gypsum, nylon, metal , plastic, resin and others".

Printing materials are very different: gypsum, nylon, metal , plastic, resin and others".

A copy is ready in a few hours. Its quality depends on how accurately the scan was made. Copy sizes can be set to a variety of sizes, printing is also done by different types of printers, depending on the complexity of the job. nine0003

This innovation is called the industrial revolution, the prerequisites for which have been outlined for a long time. But since that time, 3D printing has greatly pushed the boundaries of possibilities, the number of components suitable as raw materials is growing, as well as the quality of the objects created is improving. The new technology has been tried in the creation of clothing, medical items, weapons, and in the near future, 3D printing will be used in the construction of houses.

Shao Moyu, Director of 3D printing center:

"This technology can not be called the latest, it appeared in the late 80s of the last century, and is more used in the industrial sector, so little is known about it in wide circles. Compared with traditional production, 3D printing has the advantage of being more efficient and less costs. It cannot completely replace traditional production, but it has great potential for development."

Compared with traditional production, 3D printing has the advantage of being more efficient and less costs. It cannot completely replace traditional production, but it has great potential for development."

You can print not only a scanned object, but also an object drawn or copied on the Internet. This is how design studios began to work with 3D printing. Everything that they create in their head, and then on paper or in a computer, then the printer puts it into a solid form. With the advent of home 3D printers, it will be possible to purchase any item without leaving home. nine0003

Experts predict great prospects for a new type of industry, the performance of which is growing even in the stock markets. Shares of companies engaged in 3D printing are growing at the fastest pace (diagram). Some players have already realized the scale of the upcoming changes and have stopped investing in "traditional production".

Liu Jing, Designer:

"I work as a designer myself, I have a small studio.