3D printing stocks 2023

Top 5 3D Printing Stocks to Buy: Desktop Metal ($DM), Protolabs ($PRLB), 3D Systems ($DDD), Plus 2 More To Watch in 2023

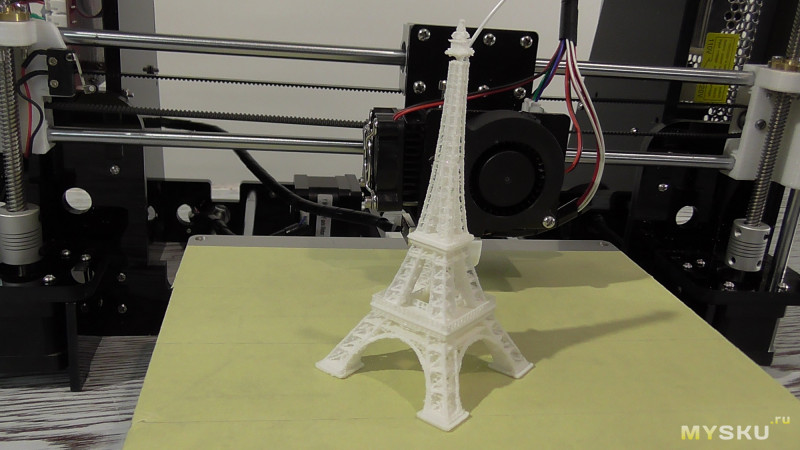

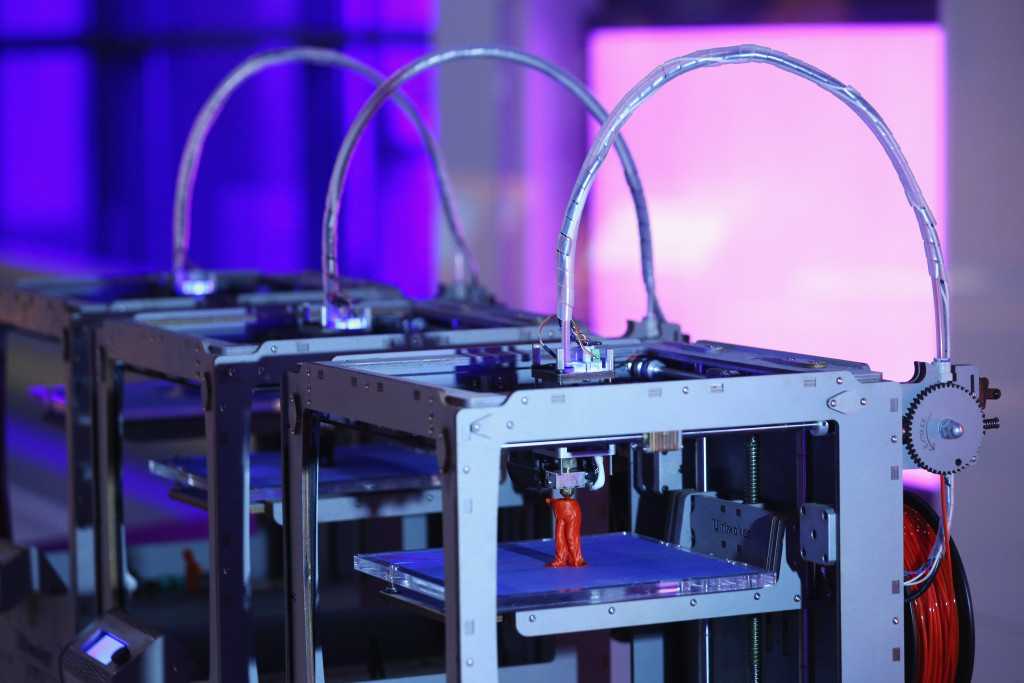

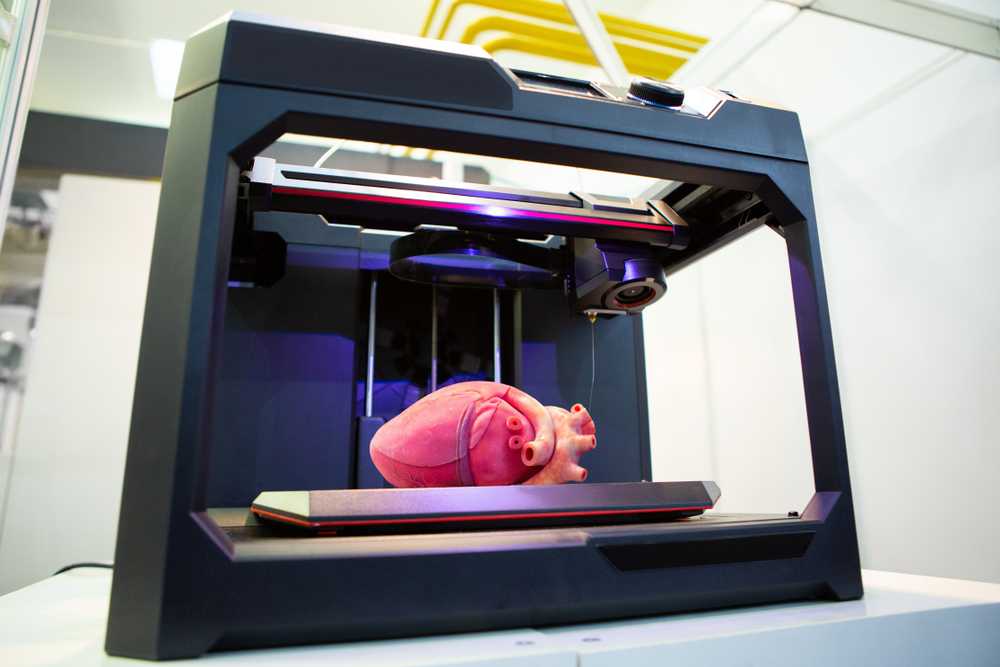

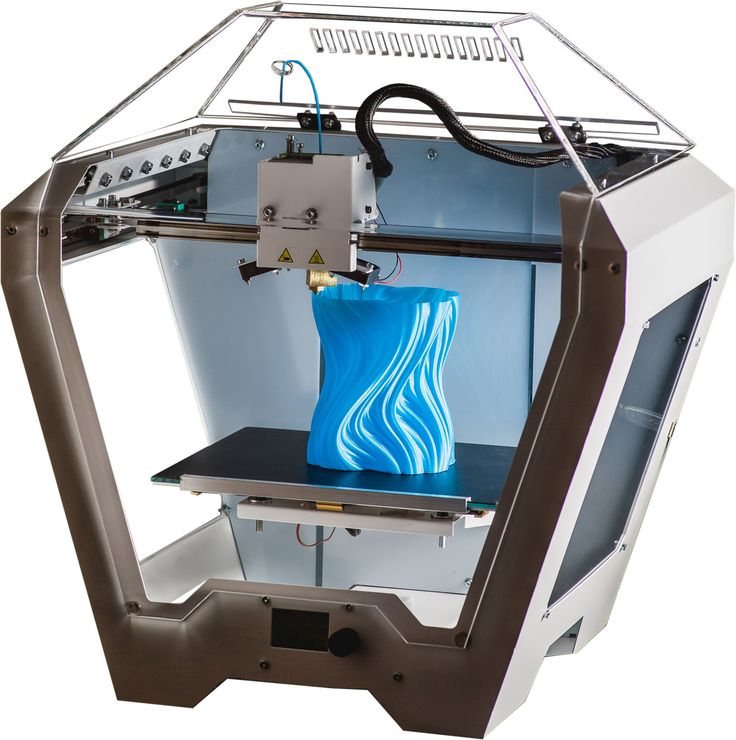

3D printing, also known as additive manufacturing, is driving innovation across multiple industries including aerospace and defense, automotive, and manufacturing.

The industry is still considered to be in its infancy as the true potential of 3D printing technology has yet to be fully unlocked. Thanks to the inherently flexible nature of 3D printing, its use cases will continue to grow and evolve over time. While not perfect, there is no doubt that 3D printing will increasingly shape new manufacturing techniques in everything from automobile manufacturing to healthcare in the coming decades.

Analysts have identified this growth industry and expect the global 3D printing market to reach nearly $80 billion in value by 2028, with no signs of slowing down over the coming decades.

Numerous 3D printing companies have tapped the public markets in order to raise capital that will allow them to invest in research and development, scale products, and reduce costs for end users.

There are over a dozen publicly traded 3D printing stocks. Below are the top five 3D printing stocks to watch as well as a list of additional companies:

1. 3D Systems (NYSE: DDD)More than 35 years ago, 3D Systems introduced the innovation of additive manufacturing to the industry. Today, as a leading additive manufacturing partner, the company brings innovation, performance, and reliability to every interaction. Its list of customers range from Lucid Motors (NASDAQ: LCID) to Airbus to Ignite Orthopedics.

3D Systems recently expanded its portfolio through the introduction of new production-grade materials that are being engineered for long-lasting mechanical performance and stability.

The company says that the new production-grade materials will be ideal for a wide range of end-use applications ranging from consumer goods to transportation to aerospace. The company expects the new materials to be available in Q4 2022.

The company expects the new materials to be available in Q4 2022.

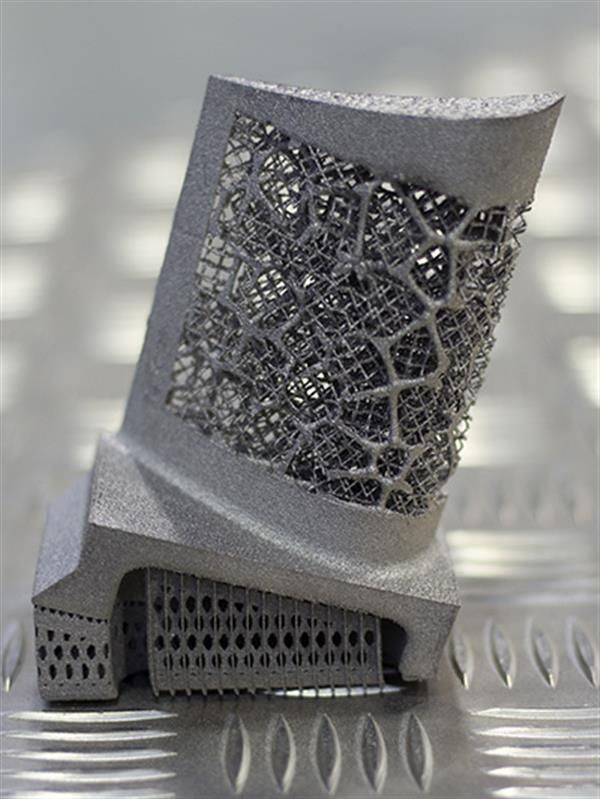

3D Systems operates a full digital manufacturing ecosystem consisting of plastic and metal 3D printers, print materials, on-demand manufacturing services, and a portfolio of end-to-end manufacturing software.

Shares of 3D Systems trade on the NYSE under the symbol DDD. For more information visit www.3dsystems.com.

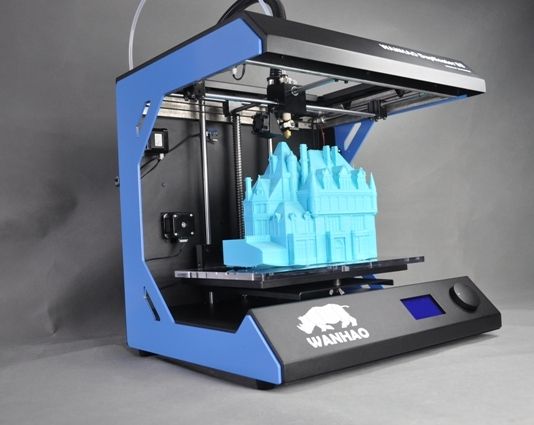

2. Protolabs (NYSE: PRLB)Protolabs is one of the world’s leading providers of digital manufacturing services. The e-commerce-based company offers injection molding, CNC machining, 3D printing, and sheet metal fabrication to product developers, engineers, and supply chain teams across the globe.

The company serves customers using in-house production capabilities that bring unprecedented speed in tandem with Hubs, a Protolabs subsidiary, which serves customers through its network of premium manufacturing partners. Together, Protolabs helps companies bring new ideas to market with the fastest and most comprehensive digital manufacturing service in the world.

The company claims that it is the world's fastest source for digital manufacturing of prototypes and low-volume production parts, with a turnaround time as low as 15 days. Its customers have the ability to upload 3D CAD models online and receive automated quotes with design feedback and pricing detail in as little as a few hours.

The interactive analysis helps eliminate potential manufacturability issues before any actual production happens. Once a design is ready, digital instructions are sent to the production floor where manufacturing begins shortly thereafter.

Shares of Protolabs trade on the NYSE under the ticker symbol PRLB. For more information visit www.protolabs.com.

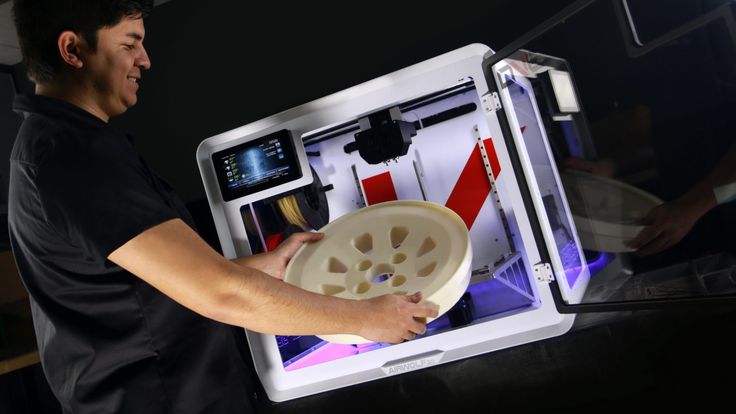

3. Desktop Metal (NYSE: DM)Desktop Metal, a global leader in additive manufacturing 2.0 technologies for mass production, recently announced a new multi-faceted partnership aimed at accelerating the adoption of additive manufacturing for production applications with a focus on the world’s largest manufacturers. Desktop Metal says that the new collaboration will include multiple aspects of its business and benefit end-users in a variety of ways.

Desktop Metal says that the new collaboration will include multiple aspects of its business and benefit end-users in a variety of ways.

The two companies will work on specific industrial-scale projects involving data handling and environmental, health and safety topics. Additionally, the new partnership will work to promote the benefits of additive manufacturing 2.0 technologies, with a focus on binder jet 3D printing as a key technology solution that can reduce waste, produce more, and build more resilient supply chains.

Founded in 2015 by leaders in advanced manufacturing, metallurgy, and robotics, Desktop Metal is addressing the unmet challenges of speed, cost, and quality to make additive manufacturing an essential tool for engineers and manufacturers around the world.

Shares trade on the NYSE under the symbol DM. For more information visit www.desktopmetal.com.

4. Stratasys (NASDAQ: SSYS)Stratasys, a leader in polymer 3D printing solutions, recently signed a definitive agreement to acquire the additive manufacturing materials business of Covestro AG for $43 million euros.

The acquisition is expected to be immediately accretive upon closing for Stratasys and includes R&D facilities and activities, a global sales team, a portfolio of approximately 60 additive manufacturing materials, and an extensive IP portfolio comprising hundreds of patents and patents pending.

Covestro has been a key part of Stratasys’ third-party materials ecosystem, and the acquisition will benefit customers using multiple Stratasys 3D printing platforms, including its Origin P3™, Neo® stereolithography, and h450™ printers. Stratasys is already a distributor of Covestro’s Somos® resins and they are already available for Neo and Origin® One 3D printers.

Stratasys is leading the global shift to additive manufacturing with innovative 3D printing solutions for industries such as aerospace, automotive, consumer products and healthcare. Through smart and connected 3D printers, polymer materials, a software ecosystem, and parts on demand, Stratasys solutions deliver competitive advantages at every stage in the product value chain.

Shares of Stratasys trade on the NASDAQ under the symbol SSYS. For more information visit www.stratasys.com.

5. Velo3D (NYSE: VLD)Velo3D announced recently that Hermeus, a private company developing hypersonic aircraft for defense and commercial applications, will utilize Sapphire 3D-printing equipment to build parts for Hermeus’ Chimera engine and Quarterhorse aircraft.

The engine is a turbine-based combined cycle engine that will power Hermeus’ first aircraft, Quarterhorse, an autonomous aircraft designed to touch high Mach speeds and prove reusability. Hermeus has planned Quarterhorse’s first flight for 2023.

Velo3D’s metal additive manufacturing technology has seen extensive adoption in the hypersonic and NewSpace industries due to its ability to build the complex, mission-critical parts engineers need without compromising design, quality, or performance. The company says that customers can print existing designs without the need to design the parts for additive manufacturing or obtain specialized training.

Velo3D trades on the NYSE under the ticker symbol VLD. For more information visit www.velo3d.com.

-

As the 3D printing industry grows in size and scale over the coming decades, numerous market participants will compete to grab market share. Listed below are additional 3D printing stocks to watch in 2023:

- Dassault Systemes (OTCMKTS: DASTY)

- Materialise (NASDAQ: MTLS)

- Nano Dimension (NASDAQ: NNDM)

- Faro Technologies (NASDAQ: FARO)

- MarkForged (NYSE: MKFG)

- Shapeways (NYSE: SHPW)

- Voxeljet (NASDAQ: VJET)

- Organovo (NASDAQ: ONVO)

- Sigma Additive Solutions (NASDAQ: SASI)

For a full list of 3D Printing stocks, quote and news visit: https://greenstocknews. com/stocks/3d-printing-stocks

com/stocks/3d-printing-stocks

Cautionary Statements: Green Stock News ("GSN") is not a financial advisory or advisor, investment advisor or broker-dealer and does not undertake any activities that would require such registration. The information contained herein is not intended to be used as the basis for investment decisions and should not be considered as investment advice or a recommendation, nor is the information an offer or solicitation to buy, hold or sell any security. GSN does not represent or warrant that the information posted is accurate, unbiased or complete and make no representations as to the completeness or timeliness of the material provided. GSN receives fees for producing content on financial news. Investors should consult with an investment advisor, tax and legal consultant before making any investment decisions. All materials are subject to change without notice.

3 3D Printing Stocks to Buy as Additive Manufacturing Goes Mainstream

Source: Pixel B / Shutterstock. com

com

3D printing technology has been around for over 30 years, but it’s still yet to go mainstream. Despite its disruptive potential and optimistic growth projections, it hasn’t caught on with daily life. Nevertheless, we have seen the massive potential of additive manufacturing during the pandemic and its ability to streamline supply chains.

Moreover, 3D printing will cease becoming a niche technology with data analytics, the Internet of Things, AI and other phenomena. Hence, early investing in 3D printing stocks can offer multi-bagger returns down the line.

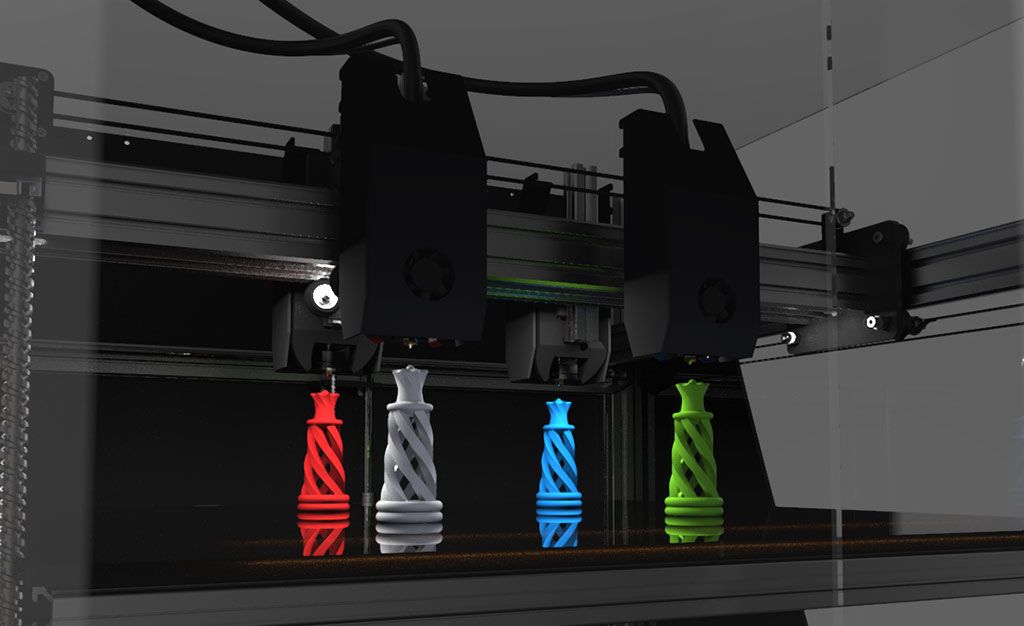

Industrial 3D printing has taken off in the past few years in a big way. The technology has moved quickly from tooling, prototyping, and trinkets. Additive manufacturing enables customers to develop safe and durable products in sizeable quantities. According to Grandview Research, the 3D printing market will grow at a staggering 21% CAGR from 2021 to 2028.

Having said that, let’s look at three of the needle-movers in the 3D printing space that are poised for big gains in the future.

- Stratasys (NASDAQ:SSYS)

- Desktop Metal (NYSE:DM)

- 3D Systems (NYSE:DDD)

All three are among the 61 stocks in The 3D Printing ETF (BATS:PRNT) portfolio, with both DM and SSYS stock among the top 10 holdings. (see price chart below) That exchange-traded fund is one of ARK Invest’s index-tracking offerings, though the firm is better known for its actively managed products. It has an expense ratio of 0.66%.

Click to Enlarge

Source: Lutsenko_Oleksandr / Shutterstock.com

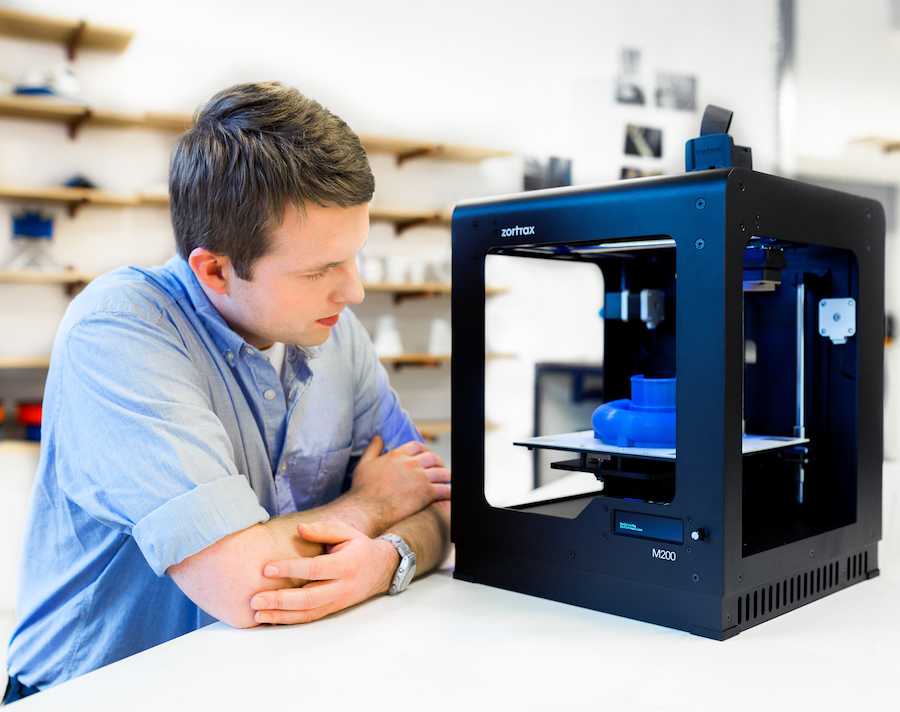

Stratasys is one of the top 3D manufacturers for parts development and rapid prototyping. SSYS stock was all hype for the past several years, offering little value for its investors. However, looking at the step changes in its sector, the firm will enter its stride and grow its business aggressively.

The quality of 3D printing is improving, and industries are seeing its value in reducing supply-chain bottlenecks.

Coupled with other technologies, the industry is set to boom, and Stratasys has set itself up from robust growth ahead. It has acquired several companies in expanding its competencies, such as Xaar 3D, which can make it an industrial 3D printing juggernaut.

Moreover, its double-digit top-line expansion is already showing the effects of the new growth cycle. However, the market is underplaying the long-term potential for SSYS stock, which presents an excellent buying opportunity.

Desktop Metal (DM)Source: shutterstock.com/Alex_Traksel

Desktop Metal is an additive manufacturing specialist, offering its customers a wide range of solutions and services.

DM stock has been on a negative run since listing on the New York Stock Exchange in December 2020. However, the investor skepticism was perhaps justified, considering how its share price got way ahead of its expectations.

Moreover, the frequent delays in its highly touted Production System P-50 were partly to blame for its stock’s weakness. Nevertheless, the first P-50 was shipped to industrial giant Stanley Black & Decker (NYSE:SWK) in February, and sales should start picking up in the not-so-distant future.

Its business is on fire, posting $112.4 million in revenue last year, representing 582.5% growth from 2020. Gross margins remain impressive at 16%, suggesting it could become profitable in a few years. DM stock trades dirt cheap based on its spectacular fundamentals and future estimates.

3D Printing Stocks to Buy: 3D Systems (DDD)Source: Image via 3D Systems

3D Systems is a South Carolina-based 3D printing company that has made great strides in healthcare and industrial markets.

It has steadily expanded into attractive sectors in the past couple of years and improved its industry-specific abilities. Hence, it was busy on the mergers and acquisitions front last year, cementing its market share in bioprinting, regenerative medicine, and other related niches.

Hence, it was busy on the mergers and acquisitions front last year, cementing its market share in bioprinting, regenerative medicine, and other related niches.

Its 2021 operating results were impressive and pointed to an exciting time ahead. Its sales grew 31.8% from the prior-year period after adjusting for divestitures. Moreover, its net income increased to $322.1 million compared to a loss of $149.6 million last year.

Additionally, it expects its revenues to surpass analyst estimates on both lines comfortably this year. DDD stock is currently trading at a price-to-sales multiple of 4.19 times, and near the low end of its 52-week range.

On the date of publication, Muslim Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Muslim Farooque is a keen investor and an optimist at heart. A life-long gamer and tech enthusiast, he has a particular affinity for analyzing technology stocks. Muslim holds a bachelor’s of science degree in applied accounting from Oxford Brookes University.

A life-long gamer and tech enthusiast, he has a particular affinity for analyzing technology stocks. Muslim holds a bachelor’s of science degree in applied accounting from Oxford Brookes University.

3D printing market. Is it time to buy shares? / Habr

In this article I would like to talk about companies, each of which is a "unicorn". Shares of two of the three can already be bought on the New York Stock Exchange. There is a pattern: they were all born in the large Boston metropolitan area. And if Silicon Valley is a Mecca for software startups, then Boston, and especially the Massachusetts Institute of Technology (MIT), is the Medina for manufacturing innovation.

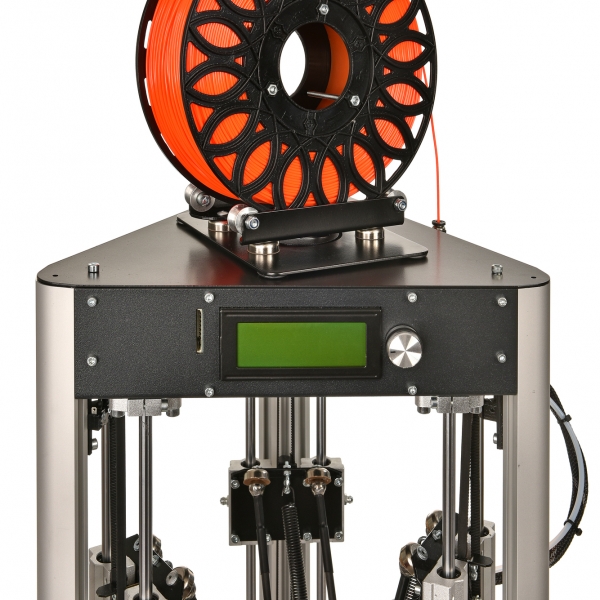

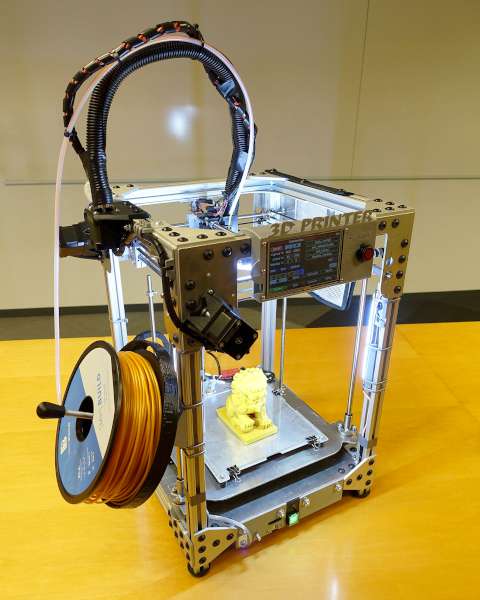

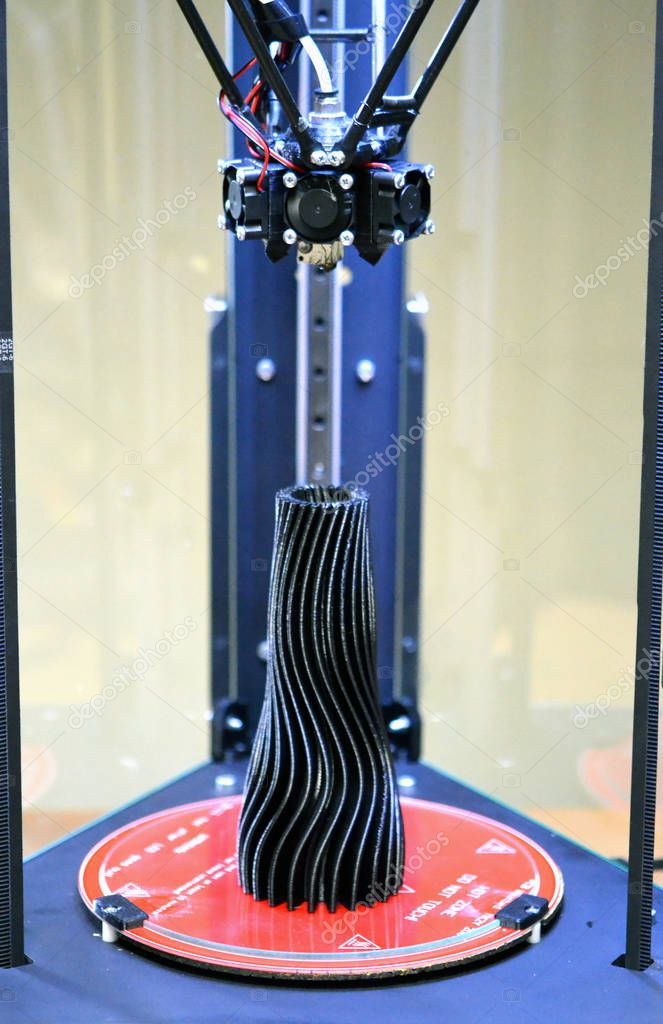

I'll make it clear right away: I won't analyze the entire 3D printing market, but will focus on some of the most notable representatives of the desktop 3D printing segment. But even here everything is very conditional, since in the process of improving technology, products smoothly flow from one category to another, and roughly three main categories can be distinguished: desktop, professional and industrial. So…

So…

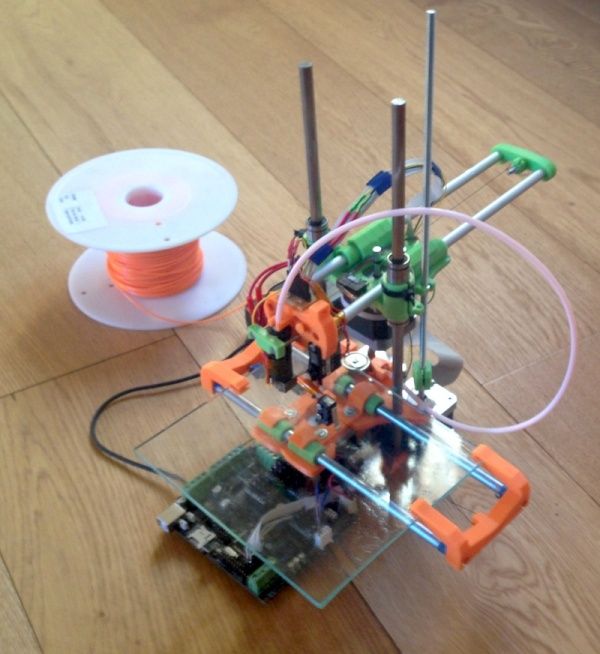

In 2011, three American students founded Formlabs in their garage. It was headed by Max Lobowski. Born into a family of engineers - emigrants from Ukraine, he was interested in robotics and new technologies from his youth, attended various specialized additional classes in high school. After earning a bachelor's degree from Cornell University, he went on to graduate school at MIT, where he began designing his desktop 3D printer, which is both powerful and affordable.

Max Lobowski The friends were able to quickly get an angel investment, with which they launched their first product, the Formlabs Form 1 printer, in 2013. On the Kickstarter crowdfunding platform, they managed to raise almost $ 3 million from more than 2,000 bakers from around the world, who were excited about the new product, which promised to make 3D printing accessible to almost everyone. At that time, there were models of printers on the market using the technology of illumination with a laser beam of photopolymer resin (SLA) with a price of 100 thousand dollars, Formlabs offered a printer for 1500 dollars. The company, of course, faced a lot of difficulties in the production of the first batch, but it managed to ship the printers to all buyers. And even though they were far from perfect, this made it possible to attract round A investments in the amount of 19million dollars and return the "angel" money.

The company, of course, faced a lot of difficulties in the production of the first batch, but it managed to ship the printers to all buyers. And even though they were far from perfect, this made it possible to attract round A investments in the amount of 19million dollars and return the "angel" money.

The company then continued to improve its product and create an ecosystem like Apple, which includes 3D printers themselves, consumables (resins for various tasks), software for preparing models for printing, and post-processing equipment. In 2019, the company's turnover reached $100 million, in May 2021 it received $150 million in a round of E from the SoftBank Investment Advisers fund, valuing the company at $2 billion. After that, there was talk of an IPO, which would be an absolutely logical step, since investment funds are planning this in the future for 7-10 years, and this period has already come for investors of the first round.

However, despite high market expectations, Max Lobowski said in an interview with BizJournals that he is in no rush to go public: “We would rather take our time and better prepare to be a great public company… We make more money than all 3D -companies taken together that have gone public with the help of SPAC (a procedure that allows startups to go public by merging with another private company). However, when I look at really large, successful, long-term public projects, which is what we are aiming for, I see that they are on a completely different level in terms of predictability and profitability than we are.” These are serious words, and apparently the head of the company has reason to pronounce them. Most likely, the forecast of the company's capitalization in the region of 4-6 billion dollars with a successful initial offering, which will make it the largest company in the market, because even the result of the veteran and long-term market leader - 3DSystems as of August 2021 is no more than 3.5 billion. dollars.

However, when I look at really large, successful, long-term public projects, which is what we are aiming for, I see that they are on a completely different level in terms of predictability and profitability than we are.” These are serious words, and apparently the head of the company has reason to pronounce them. Most likely, the forecast of the company's capitalization in the region of 4-6 billion dollars with a successful initial offering, which will make it the largest company in the market, because even the result of the veteran and long-term market leader - 3DSystems as of August 2021 is no more than 3.5 billion. dollars.

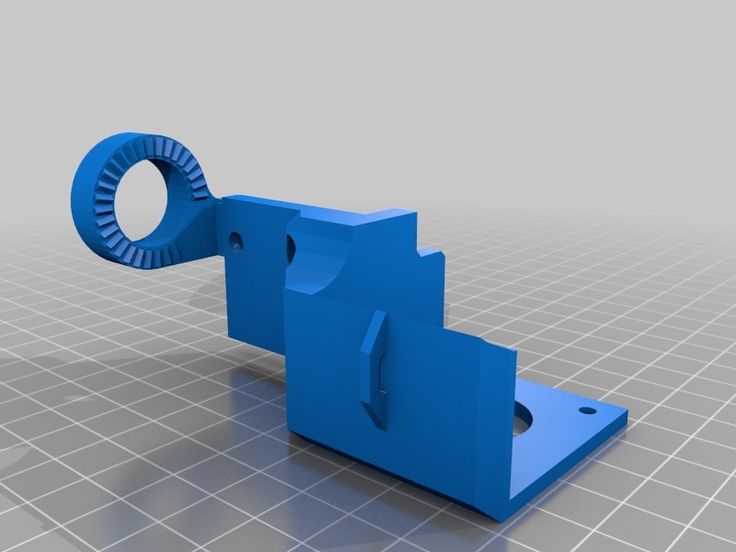

Unlike the students at Formlabs, Markforged was founded by older guys. However, even here it was not without MIT. MIT alumnus Mark Greg encountered 3D printing while his company was doing a job for the US Navy. Experiments in the field of improving the quality of products led him to the idea of creating a printer that could reinforce the printed model with carbon fiber to make it strong and suitable for use under load.

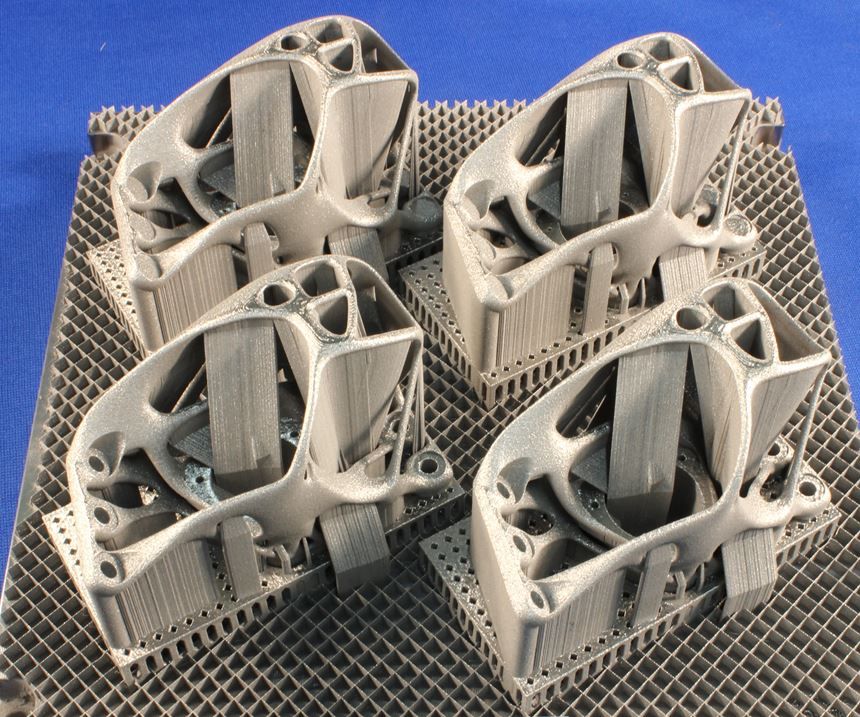

The company was founded in 2013, and already in 2014 at the Solidworks World exhibition, the startup presented its first product - the Mark One printer, which had two extruders and could reinforce the printed model with nylon, fiberglass and even Kevlar. Later, The Digital Forge, a cloud-based print management platform, was introduced, and already in 2017, MarkForged announced the release of a Metal X desktop metal 3D printer worth $100,000, while competitors' counterparts cost a million. In 2020, the company's turnover amounted to $70 million, and the management decided to bring the company to an IPO using SPAC. The company introduced the concept of additive manufacturing 2.0 to potential investors, allowing the production of finished products rather than prototypes, paving the way for 3D printing to the production of goods. The volume of this market is estimated by experts at 13 trillion dollars.

Based on the Wholers Report, in 2020 the company predicted the growth of the additive technologies market at an average rate of 27%, which means that in the next 8 years from the current 18 billion dollars, the market will grow to 118 billion in 2029 from 10 multiple growth of own revenue up to 700 million dollars already in 2025.

On July 15, 2021, MarkForged was listed on the New York Stock Exchange under the ticker MKFG. The placement was estimated at 2 billion dollars, but a month later the shares lost a little in price, and the current capitalization is about 1.5 billion dollars. The question remains: is it worth buying shares of a company that plans to be unprofitable for at least another 2 years (the company predicts a turnover of about $100 million this year).

On the one hand, there are enough companies on the market trading at even higher multiples, and on the other hand, 3D printing is not yet such a mature technology that one can be sure of the 100% success of exactly the concept that MarkForged offers. In fact, the company itself considers the emergence of new technologies as one of the risks that could undermine its current technological superiority. In general, investors are now positive about the future of 3D printing. They were impressed by how the technology performed in the first, most difficult months of the pandemic, when production chains were disrupted and many transport arteries stopped working. With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, the coin has two sides, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the market of additive technologies in general.

In fact, the company itself considers the emergence of new technologies as one of the risks that could undermine its current technological superiority. In general, investors are now positive about the future of 3D printing. They were impressed by how the technology performed in the first, most difficult months of the pandemic, when production chains were disrupted and many transport arteries stopped working. With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, the coin has two sides, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the market of additive technologies in general.

The last one in my story is DeskTop Metal. Formlabs was created by MIT students, Markforged - MIT graduates, DeskTop Metal was created by experienced entrepreneurs Rick Fulop and Johan Mayerberg, as well as 4 (!) MIT professors. Going to the goal, Rick Fulop founded 6 different companies, also headed an investment fund. Johan Maierberg has been a lead engineer for various companies and became the CTO of DeskTop Metal.

Going to the goal, Rick Fulop founded 6 different companies, also headed an investment fund. Johan Maierberg has been a lead engineer for various companies and became the CTO of DeskTop Metal.

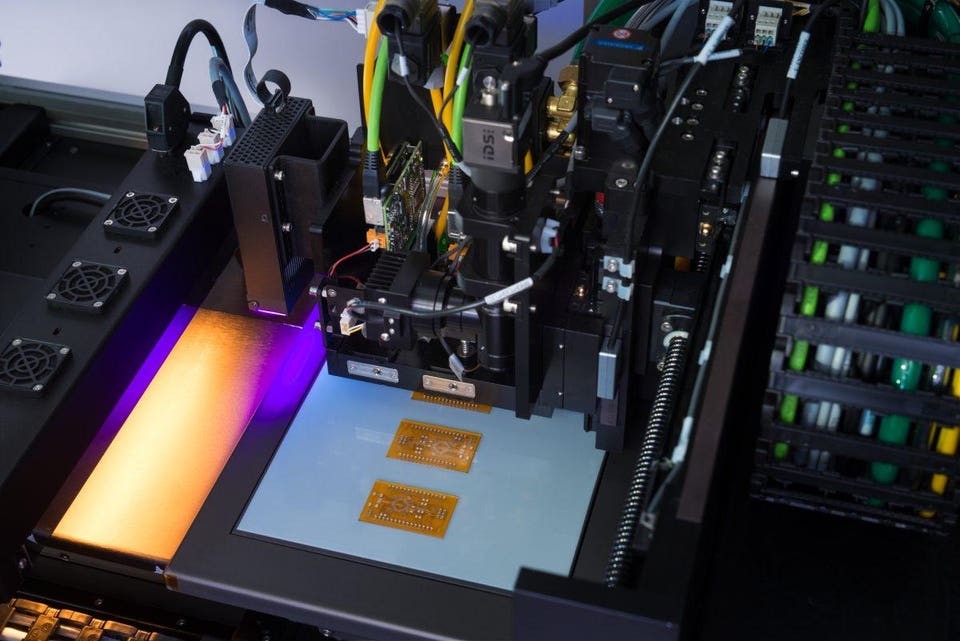

The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which can hardly be called a desktop one. The company claims that its Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it.

The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which can hardly be called a desktop one. The company claims that its Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it. The company entered the IPO on December 10, 2020 under the same SPAC scheme and in its presentation for potential investors outlined the following parameters: planned turnover in 2025 - 942 million dollars, reaching operating profit in 2023, and also indicated that , which plans to spend a significant portion of the proceeds on acquisitions of other 3D printing companies.

Capitalization on the New York Stock Exchange at the time of its IPO on December 10 was a fantastic $6 billion. During the placement, $580 million was raised and the company was assigned the laconic ticker DM. Already in February 2021, the shares rose even more, and the company's capitalization exceeded $8 billion. DM has said it will be the first company in 3D printing history to have a capitalization of over $10 billion. Having received huge funds at its disposal, already in January 2021, DM announced the first takeover deal: the German manufacturer of professional photopolymer 3D printers EnvisionTEC (founded in 2002 and is one of the oldest on the market) was bought for $ 300 million. For me, this choice was not obvious, it is difficult to find something in common between DM and EnvisionTEC and it will be difficult to achieve a significant synergistic effect from this transaction. EnvisionTEC has continued to operate under its own brand as a 100% subsidiary of DM and plans to release a number of new models for its key customers - dental clinics and jewelry companies. Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase announced in August of another public company, the American ExOne. Established in 2005 in Pittsburgh, it specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other and they have already presented a joint portfolio based on the products of both companies, in which one product complements the other.

Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase announced in August of another public company, the American ExOne. Established in 2005 in Pittsburgh, it specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other and they have already presented a joint portfolio based on the products of both companies, in which one product complements the other.

It would be logical to assume that DM stock skyrocketed after such high-profile acquisitions, but in reality the opposite happened. Since its peak in February, the shares have fallen 4 times and are now trading at $8 a share, and the capitalization is slightly over $2 billion. Apparently, the first euphoria of investors gave way to a more sober approach to the current results of the company. Perhaps this was influenced by the dissatisfaction of some ExOne shareholders, who considered the sale price of the company unfair and were preparing a class action lawsuit against management in order to block the deal.

Apparently, the first euphoria of investors gave way to a more sober approach to the current results of the company. Perhaps this was influenced by the dissatisfaction of some ExOne shareholders, who considered the sale price of the company unfair and were preparing a class action lawsuit against management in order to block the deal.

Should I buy DM stock now that it has fallen so much, or wait for further decline? I would say that their current level is very comfortable for entry, but, of course, such investments also have a certain risk. This is despite the fact that the company has reported strong first half results, which DM expects to generate over $100 million in revenue this year.

Summing up, I would like to say that a number of stock analysts consider what is happening in the market of additive technologies to be a "renaissance". The market came into motion after the pandemic, which gave everyone hope that the technology was ripe for serious tasks, and that the situation in the industry of 2013-2014 would not repeat itself. Then the technique was still very "raw", but attracted a lot of attention from the press and potential investors. This drove the stocks of market leaders 3DSystems and Stratasys to unknown heights, and then, when there was disappointment in the results of their work, the fall reached 20 times from peak values. Startups bought in batches, not really understanding what to do with them later. Most of these deals only made it harder for companies to focus on their core business. I would like to hope that history will be a good lesson for the new giants of the industry. There have already been a number of IPO exits by companies from the 3D printing industry through SPAC this year, with several more large listings planned for the end of the year. And, if you are interested in this sector, stay tuned.

Then the technique was still very "raw", but attracted a lot of attention from the press and potential investors. This drove the stocks of market leaders 3DSystems and Stratasys to unknown heights, and then, when there was disappointment in the results of their work, the fall reached 20 times from peak values. Startups bought in batches, not really understanding what to do with them later. Most of these deals only made it harder for companies to focus on their core business. I would like to hope that history will be a good lesson for the new giants of the industry. There have already been a number of IPO exits by companies from the 3D printing industry through SPAC this year, with several more large listings planned for the end of the year. And, if you are interested in this sector, stay tuned.

Alexander Kornveits

Expert in the field of additive technologies and 3D equipment, founder and head of Tsvetnoy Mir

3D printing market.

Is it time to buy shares?

Is it time to buy shares? In this article, I would like to talk about companies, each of which is a "unicorn". Shares of two out of three can already be bought on the New York Stock Exchange. There is a pattern: they were all born in the large Boston metropolitan area. And if Silicon Valley is a Mecca for software startups, then Boston, especially the Massachusetts Institute of Technology ( MIT ), - Medina for innovation in manufacturing.

I'll make it clear right away: I won't analyze the entire 3D printing market, but will focus on some of the most notable representatives of the desktop 3D printing segment. But even here everything is very conditional, since in the process of improving the technology there is a smooth flow of products from one category to another; roughly three main categories can be distinguished: desktop, professional and industrial. So…

In 2011, three American students founded Formlabs in their garage. It was led by Max Lobowski . Born into a family of engineers — emigrants from Ukraine, he was interested in robotics and new technologies from his youth, attended various specialized additional classes in high school. After earning a bachelor's degree from Cornell University, he enrolled in a master's program at MIT, where he began developing his desktop 3D printer, which is both powerful and affordable.

It was led by Max Lobowski . Born into a family of engineers — emigrants from Ukraine, he was interested in robotics and new technologies from his youth, attended various specialized additional classes in high school. After earning a bachelor's degree from Cornell University, he enrolled in a master's program at MIT, where he began developing his desktop 3D printer, which is both powerful and affordable.

The friends quickly secured an angel investment, using which they launched the first product, the Formlabs Form 1 printer, in 2013. They raised almost $3 million on Kickstarter from over 2,000 bakers around the world who were excited about a new product that promised to make 3D printing accessible to almost everyone. At that time, there were models of printers operating on the technology of illumination with a laser beam of photopolymer resin (SLA) on the market with a price of $100,000, while Formlabs offered a printer for $1,500. The company, of course, faced a lot of difficulties in the production of the first batch, but it managed to ship the printers to all customers. And even though they were far from perfect, this made it possible to attract a $19 round of investmentmillion and return the “angel” money.

And even though they were far from perfect, this made it possible to attract a $19 round of investmentmillion and return the “angel” money.

Then the company continued to improve the product and create an ecosystem like Apple, which includes 3D printers themselves, consumables (resins for various tasks), software for preparing models for printing, and post-processing equipment.

In 2019, the company's turnover reached $100 million, in May 2021 it received $150 million in a round E from the SoftBank Investment Advisers fund valuing the company at $2 billion. investment funds are planning this in the future for 7-10 years, and this period for investors of the first round has already come. However, despite the high expectations of the market, in an interview with BizJournals, Max Lobowski said that he was in no hurry to take the company public:

“We would rather take our time and better prepare to become a great public company… We make more money than all 3 D -companies put together that went public with SPAC (procedure for startups to go public) at IP O by merging with another private company).

However, when I look at really large, successful, long-term public projects, which is what we strive for, I see that they are on a completely different level in terms of predictability and profitability than we are.

These are serious words; apparently, the head of the company has reason to pronounce them. Most likely, the matter is in the forecast of the company's capitalization - it is in the region of $4-6 billion with a successful initial offering, which will make it the largest company on the market, because even the result of a veteran and long-term market leader - 3DSystems - as of August 2021 is no more than $3, 5 billion

Unlike the students at Formlabs, Markforged was founded by older kids. However, even here it was not without MIT. MIT Graduate Mark Greg encountered 3D printing while his company was doing an order for the US Navy. Experiments in product quality improvement led him to the idea of creating a printer that could reinforce the printed model with carbon filament to make it strong and usable under load.

Markforged employees with a Metal X printer, Mark Greg is sitting to the right of the printer

could reinforce the printed model with nylon, fiberglass and even Kevlar. Later, The Digital Forge, a cloud-based print management platform, was introduced, and already in 2017, Markforged announced the release of a Metal X desktop metal 3D printer worth $100,000, while competitors' counterparts cost a million. In 2020, the company's turnover amounted to $70 million; management decided to bring the company to an IPO with the help of SPAC. The company presented to potential investors the concept of additive technologies 2.0, which allows the production of finished products, rather than prototypes, which opens the way for 3D printing to the production of goods. The market size is estimated by experts at $13 trillion.

Based on the Wholers Report, in 2020 the company predicted the growth of the additive technologies market at an average rate of 27%, which means that in the next 8 years from the current $18 billion the market will grow to $118 billion in 2029 with a 10-fold increase in its own revenue up to $700 million already in 2025.

On July 15, 2021, Markforged was listed on the New York Stock Exchange under the ticker symbol MKFG. The placement was estimated at $2 billion, but a month later the shares lost a little in price. The current capitalization is about $ 1.5 billion. The question remains: is it worth buying shares of a company that plans to be unprofitable for at least another 2 years (the company predicts a turnover of about $ 100 million this year)?

On the one hand, there are enough companies on the market trading with even or higher multiples, and on the other hand, 3D printing is not yet such a mature technology that you can be sure of 100% success of exactly the concept that it offers Markforged. In fact, the company itself considers the emergence of new technologies as one of the risks that could undermine its current technological superiority. In general, investors are now positive about the future of 3D printing.

They were impressed by how the technology performed in the first, most difficult, months of the pandemic, when production chains were disrupted and many transport arteries stopped working. With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, there are two sides to the coin, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the additive technology market in general.

With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, there are two sides to the coin, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the additive technology market in general.

The last one in my story is DeskTop Metal. Formlabs was created by MIT students, Markforged is MIT graduates, DeskTop Metal was created by entrepreneurs with experience Rick Fulop and Johan Mayerberg , as well as four (!) MIT professors. Going to the goal, Rick Fulop founded 6 different companies, also headed an investment fund. Johan Maierberg has been a lead engineer for various companies and became the CTO of DeskTop Metal.

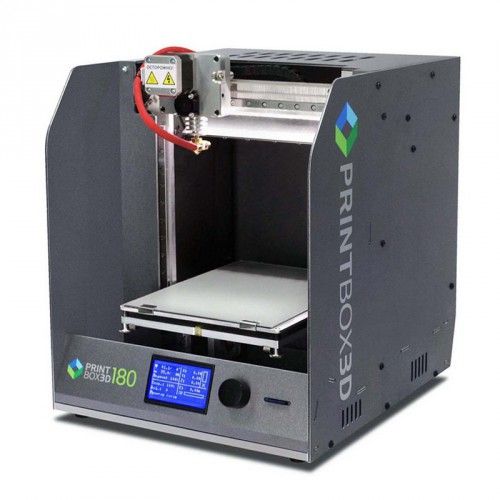

Rick Fulop in front of DeskTop Metal Studio System 9 printers0003

The company's goal was to create an affordable desktop 3D printer that prints metal models. The company immediately became a favorite among investors and attracted investment rounds with enviable constancy. Among her donors were BMW, Ford Motor, Stratasys (a pioneer in the creation of 3D printing technology), SaudiAramco investment fund, General Electric and others. The total valuation in the latest round reached $2.4 billion on a negligible turnover of $26 million in 2019. The funds received were used for R&D and attracting the best engineers and developers to the company. In 2017, a three-component metal printing system based on FDM layer-by-layer printing technology was introduced, followed by burning and baking the final model. The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which, however, can hardly be called a desktop one.

The company immediately became a favorite among investors and attracted investment rounds with enviable constancy. Among her donors were BMW, Ford Motor, Stratasys (a pioneer in the creation of 3D printing technology), SaudiAramco investment fund, General Electric and others. The total valuation in the latest round reached $2.4 billion on a negligible turnover of $26 million in 2019. The funds received were used for R&D and attracting the best engineers and developers to the company. In 2017, a three-component metal printing system based on FDM layer-by-layer printing technology was introduced, followed by burning and baking the final model. The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which, however, can hardly be called a desktop one. The company claims that Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it.

The company claims that Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it.

The company entered the IPO on December 10, 2020 under the same SPAC scheme and in its presentation for potential investors outlined the following parameters: the planned turnover in 2025 is $942 million, reaching operating profit in 2023, and also indicated that that it plans to spend a significant portion of the proceeds on acquisitions of other 3D printing companies.

Capitalization on the New York Stock Exchange at the time of its IPO on December 10 was a fantastic $6 billion. Already in February 2021, the shares rose even more: the company's capitalization exceeded $8 billion.DM announced that it would become the first company in the history of 3D printing with a capitalization of more than $10 billion.With huge funds at its disposal, already in January 2021, DM announced the first acquisition deal: for $300 million, the German manufacturer of professional photopolymer 3D printers EnvisionTEC (founded in 2002 and is one of the oldest on the market) was bought.

For me, this choice was not obvious: it is difficult to find something in common between DM and EnvisionTEC - it will be difficult to achieve a significant synergistic effect from the transaction. EnvisionTEC has continued to operate under its brand as a 100% subsidiary of DM and plans to release a number of new models for its key customers - dental clinics and jewelry companies.

Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase of another public company, American ExOne, announced in August. Established in 2005 in Pittsburgh, the company specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other, and they have already presented a joint portfolio based on the products of both companies, in which some products complement others.

In this case, we can say that the product lines of DM and ExOne are closer to each other, and they have already presented a joint portfolio based on the products of both companies, in which some products complement others.

It would be logical to assume that DM stock skyrocketed after such high-profile acquisitions, but in reality the opposite happened. Since its peak in February, the shares have fallen 4 times and are now trading at $8 a share, and the capitalization is slightly higher than $2 billion. Apparently, the first euphoria of investors has been replaced by a more sober approach to the current results of the company. Perhaps this was influenced by the dissatisfaction of some ExOne shareholders, who considered the sale price of the company unfair and were preparing a class action lawsuit against management in order to block the deal.

Should you buy DM stock now that it has fallen so much, or wait for it to fall further? I would say that their current level is very comfortable for entry, but, of course, such investments also have a certain risk. This is despite the fact that the company has reported strong 1H results, based on which DM expects revenue in excess of $100 million this year.

This is despite the fact that the company has reported strong 1H results, based on which DM expects revenue in excess of $100 million this year.

Summing up, I would like to say that a number of stock analysts consider what is happening in the market of additive technologies to be a “renaissance”. The market came into motion after the pandemic, which gave everyone hope that the technology was ripe for serious tasks, and that the situation in the industry of 2013-2014 would not repeat itself. Then the technique was still very "raw", but attracted a lot of attention from the press and potential investors. This drove the stocks of market leaders 3DSystems and Stratasys to unknown heights, and then, when there was disappointment in the results of their work, the fall reached 20 times from peak values. Startups bought in batches, not really understanding what to do with them later. Most of these deals only made it harder for companies to focus on their core business. I would like to hope that history will be a good lesson for the new giants of the industry.