3D printing companies ipo

SPACs Everywhere: 3D Printing Companies Going Public in 2021 - 3DPrint.com

The SPAC trend that revolutionized the IPO market in 2020 continues in 2021. Blank-check mergers through special purpose acquisition companies (SPACs) have surged globally to a record $170 billion in 2021, surpassing last year’s total of $157 billion. In fact, 248 SPAC IPO transactions made up 55% of the total U.S. stock launches in 2020, according to financial research firm SPAC Analytics.

With so many businesses going public via SPACs, several pure-play 3D printing companies also made the list. So far, we counted 13 businesses focused on 3D printing that have announced they would go public in 2021. Just like last year, SPACs are outpacing traditional IPOs in this category, considering that most of the U.S. companies in the additive space chose to merge with blank check firms. However, a handful of businesses – mostly in Asia and Europe – will go the regular IPO route. Check out 3DPrint.com’s Stock Zone to keep track of the trading, and learn more about the 3D printing market activity at SmarTech and Stifel‘s “AM Investment Strategies 2021” event on September 9, 2021.

- First trading day: July 15, 2021

- Exchange: New York Stock Exchange (NYSE)

- Symbol: MKFG

- SPAC merger company: one (NYSE: AONE)

- Initial share price: $7.76

- SPAC Valuation: $2.1 billion

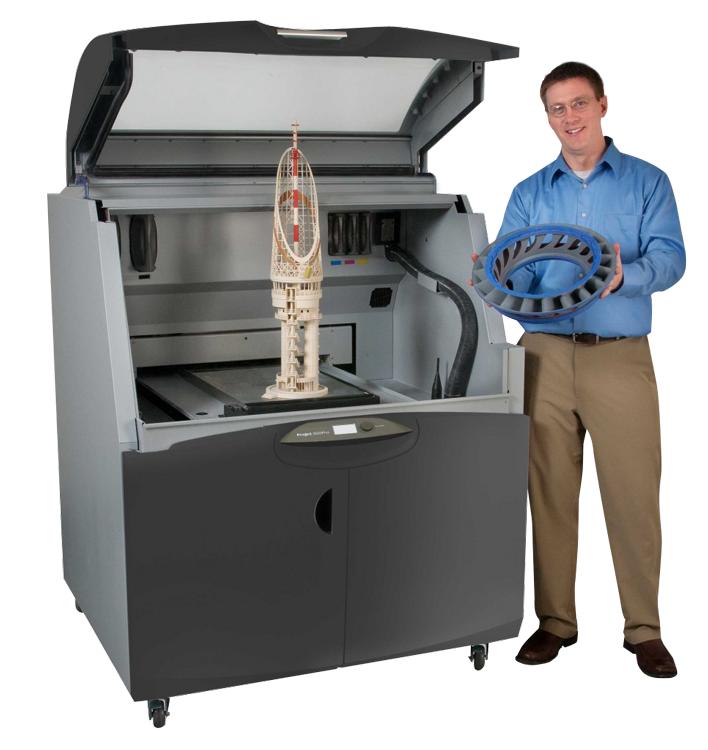

Markforged made its public debut in 2021 after closing a deal with blank-check company one. The leading industrial 3D printing company received approximately $361 million as part of the transaction to accelerate innovation and grow the company’s global footprint. To celebrate the occasion, the Markforged team even 3D printed their own bell in metal, claiming it was “the most Markforged way to go public.” Led by company founder and CTO Gregory Mark and CEO Shai Terem, the team left its mark on the NYSE floor after ringing the one-of-a-kind First Trade Bell built with their own industrial 3D printer.

Velo3D- Will go public: h3 2021

- Exchange: NYSE

- Symbol: VLD

- SPAC merger company: Jaws Spitfire Acquisition Corporation (NYSE: SPFR)

- SPAC Valuation: $1.6 billion

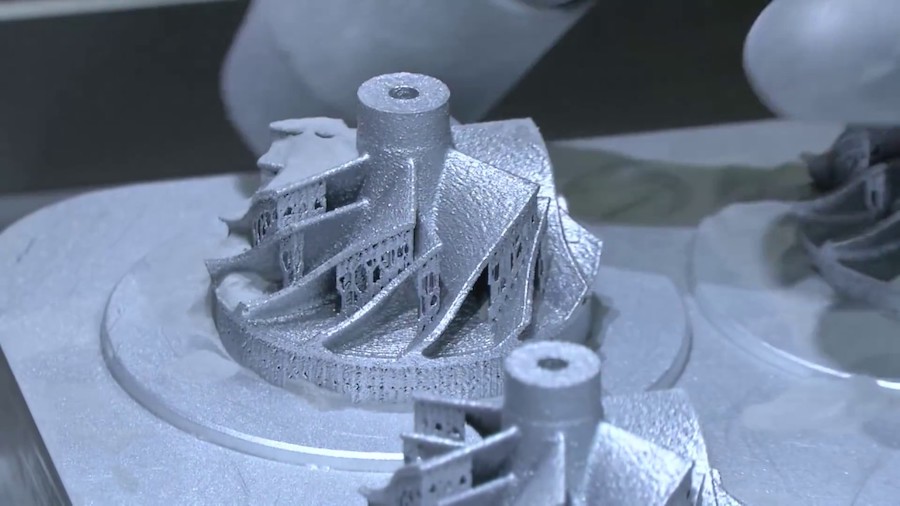

VELO3D technology has guided many companies in their mission to create complex metal designs previously considered impossible due to the constraints of legacy additive manufacturing (AM) technology. To continue on its growth path, VELO3D announced a merger deal to become publicly listed and expects to use the $500 million in cash proceeds from the transaction to extend the reach of its technology to even more customers globally.

Shapeways- Will go public: h3 2021

- Exchange: NYSE

- Symbol: SHPW

- SPAC merger company: Galileo Acquisition Corp.

(NYSE: GLEO)

(NYSE: GLEO) - SPAC Valuation: $605 million

The upcoming merger and public listing for 3D printing service provider Shapeways will provide more than $195 million of net proceeds to the company, including a $75 million fully committed common stock PIPE anchored by top-tier institutional investors, including strategic partner Desktop Metal. The funds will help accelerate its metal AM capabilities, expand the material and technology offerings to extend market reach, grow customer share of wallet, and provide additional working capital.

Bright Machines- Will go public: h3 2021

- Exchange: NYSE

- Symbol: BRTM

- SPAC merger company: SCVX Corp. (NYSE: SCVX)

- SPAC Valuation: $1.6 billion

An industry leader in intelligent, software-defined manufacturing, San Francisco-headquartered Bright Machines plans to go public later in 2021. The move will provide up to $435 million and help accelerate the company’s growth, including a highly anticipated expansion into new markets and the development of additional value-added software in areas such as production analytics and quality inspection.

- Will go public: h3 2021

- Exchange: NASDAQ

- Symbol: RKLB

- SPAC merger company: Vector Acquisition (NASDAQ: VACQ)

- SPAC Valuation: $4.1 billion

Since its inception, Rocket Lab has 3D printed rocket parts for its launch vehicles, deployed more than 100 satellites to space across 17 orbital launches, designed and manufactured Photon spacecraft currently operating in orbit, and been awarded contracts for Photon missions to the Moon and Mars. The new transaction will cement Rocket Lab’s position as a leader in the rapidly growing private space industry, and continue collaborations with 3D printing leading businesses, like SLM Solutions, to continue building large rocket engines.

Rocket Lab manufactures rockets with 3D printed parts. Image courtesy of Rocket Lab.

Redwire Space- Will go public: h3 2021

- Exchange: NYSE

- Symbol: undisclosed

- SPAC merger company: Genesis Park (NYSE: GNPK)

- SPAC Valuation: $615 million

A developer of mission-critical solutions for next-generation space infrastructure, Redwire will go public later this year. The company is at the forefront of microgravity AM platforms thanks to the acquisition of zero-G 3D printer manufacturer Made In Space. Future plans include the launch of Archinaut, the largest artificial structure in space, for next-generation off-world manufacturing needs.

The company is at the forefront of microgravity AM platforms thanks to the acquisition of zero-G 3D printer manufacturer Made In Space. Future plans include the launch of Archinaut, the largest artificial structure in space, for next-generation off-world manufacturing needs.

- Will go public: Q4 2021

- Exchange: NYSE

- Symbol: FDMG

- SPAC merger company: Altimar Acquisition Corp. II (NYSE: ATMR)

- SPAC Valuation: $1.5 billion

On-demand manufacturing pioneer Fathom confirmed a multi-million dollar SPAC deal to go public. After closing the transaction, more than $420 million of net proceeds will expand its on-demand digital manufacturing platform through a series of planned acquisitions under the continued leadership of CEO Ryan Martin.

Fast Radius is one of the largest service bureaus in the industry. Image courtesy of Fast Radius.

Fast Radius- Will go public: Q4 2021

- Exchange: NASDAQ

- Symbol: undisclosed

- SPAC merger company: ECP Environmental Growth Opportunities Corp.

(NASDAQ: ENNV)

(NASDAQ: ENNV) - SPAC Valuation: $1.4 billion

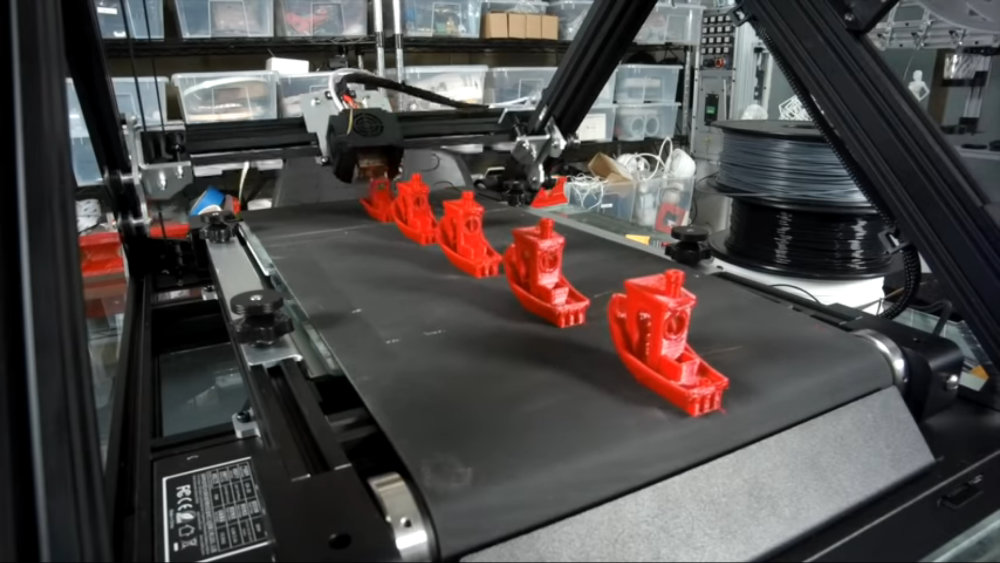

Digital manufacturing company Fast Radius will merge with a green-focused SPAC to become a publicly-traded company in 2021. Through its cloud manufacturing technology and on-site production centers in Chicago and within the UPS Worldport facility in Louisville, Fast Radius is leveraging digital manufacturing technology for a networked, global infrastructure that removes all the risk typically associated with outsourcing manufacturing projects.

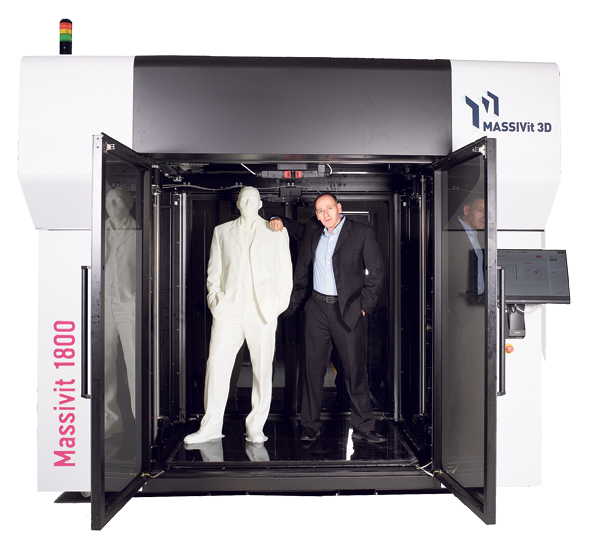

Massivit 3D- IPO date: March 8, 2021

- Exchange: Tel Aviv Stock Exchange (TASE)

- Symbol: MSVT

- IPO share price: $870

- Valuation at IPO: $203.6 million

Israeli provider of large-volume 3D printing systems Massivit 3D is backed by 50 patent assets. Like many of its competitors, its vision is to transform large-volume manufacturing from traditional, legacy processes to digital manufacturing by providing fast 3D printing technology and a range of industrial materials. Through the IPO, Massivit raised $52 million that will be leveraged to continue innovating vital and disruptive technology to address pertinent market gaps.

Through the IPO, Massivit raised $52 million that will be leveraged to continue innovating vital and disruptive technology to address pertinent market gaps.

Massivit 3D completed its IPO on the Tel Aviv Stock Exchange. Image courtesy of Massivit 3D.

MeaTech 3D- IPO date: March 12, 2021

- Exchange: NASDAQ

- Symbol: MITC

- IPO share price: $10.30

- Valuation at IPO: $1.1 billion

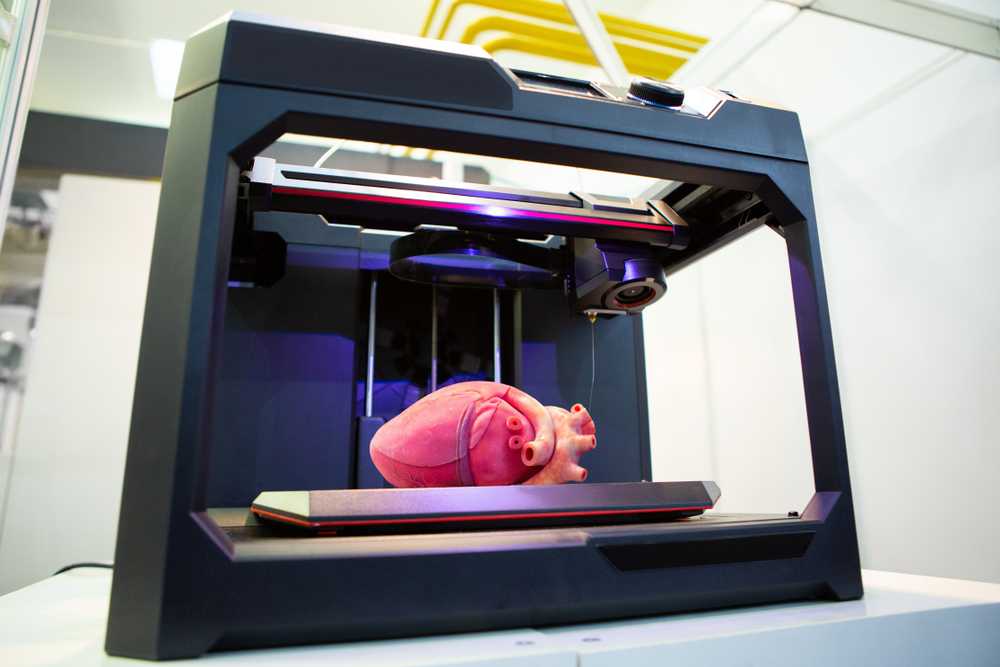

Focused on 3D printed cultured meat production, Israeli food-tech startup MeaTech 3D is developing and out-licensing its proprietary 3D printing technology, biotechnology processes, and customizable manufacturing processes to food processing and food retail companies seeking to manufacture proteins without the need for animal slaughter. An alternative to industrialized farming, MeaTech circumvents the ethical and environmental issues surrounding conventional animal agriculture by developing an industrial cultured meat production process with integrated 3D printing technology.

- IPO date: May 18, 2021

- Exchange: Euronext Growth Oslo Exchange

- Symbol: NTI

- IPO share price: $1.19

- Valuation at IPO: $326.3 million

Norsk Titanium is a producer of aerospace-grade, additively manufactured, structural titanium components for commercial aerospace tier-one suppliers. Its patented rapid plasma deposition (RPD) technology revolutionizes the industry by pioneering a new era of on-demand metal AM that delivers 3D printed, structural titanium, providing substantial lead-time and cost savings to the aerospace, defense, and industrial markets.

Xometry- IPO date: June 29, 2021

- Exchange: NASDAQ

- Symbol: XMTR

- IPO share price: $44

- Valuation at IPO: $2 billion

Xometry, an online AI-enabled marketplace for on-demand manufacturing, saw shares soar on the first day of trading. The Maryland manufacturer managed to raise $303 million by offering 6. 9 million shares at $44, above the range of $38 to $42. Since its foundation in 2013, over 6 million parts have been manufactured through Xometry’s platform.

9 million shares at $44, above the range of $38 to $42. Since its foundation in 2013, over 6 million parts have been manufactured through Xometry’s platform.

Xometry celebrates going public at the NASDAQ on June 29, 2021. Image courtesy of Xometry.

Rokit Healthcare- IPO date: upcoming h3 2021

- Exchange: Korean Stock Exchange

In March 2021, South Korean bioprinting startup Rokit Healthcare announced preparations for its upcoming IPO. Since 2012, Rokit has developed the 3D bioprinter Invivo, which is currently undergoing clinical trials in Korea and the U.S. to help regenerate damaged cartilage tissue in patients with arthritis ulcers. The business has already begun commercializing its flagship bioprinted skin patches to treat diabetic foot ulcers and ultimately expects to offer personalized services using a patient’s own cells to print organs and tissues.

Subscribe to Our Email Newsletter

Stay up-to-date on all the latest news from the 3D printing industry and receive information and offers from third party vendors.

Tagged with: 3d printing business news • 3d printing company IPO • 3D printing SPAC deal • going public • initial public offering (IPO) • nasdaq • New York Stock Exchange • SPAC merger • spacs • stock market

Please enable JavaScript to view the comments powered by Disqus.

5 3D Printing Stocks to Consider in 2022

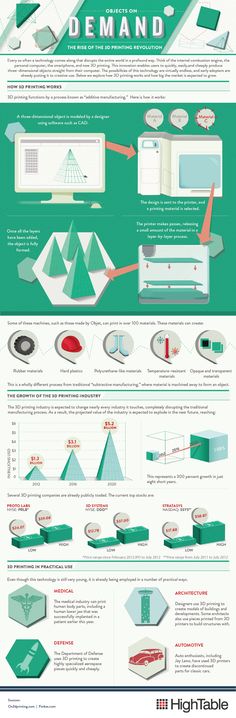

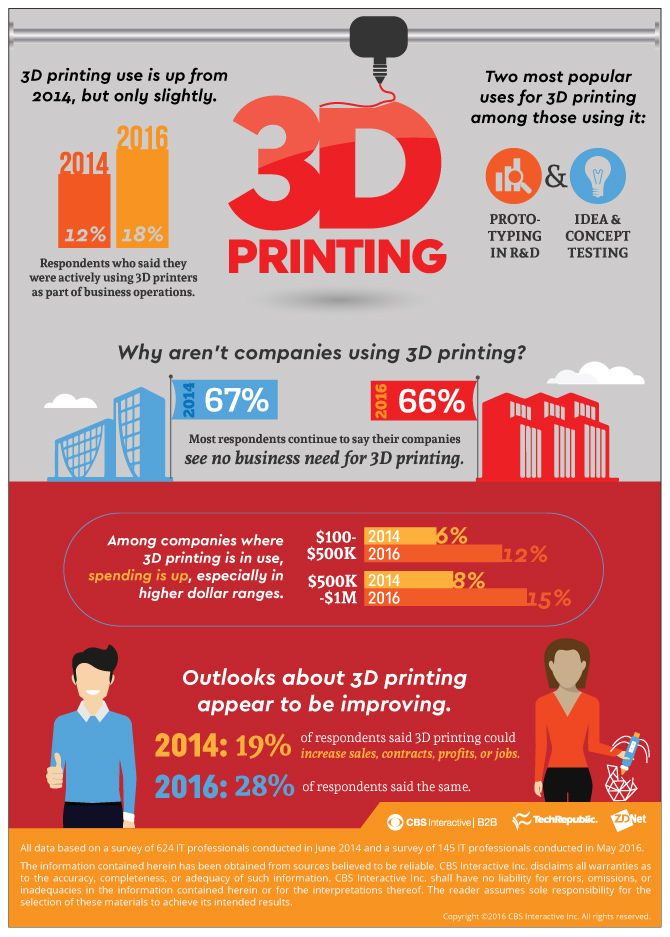

Back in the early 2010s, stocks were booming for 3D printing -- also known as additive manufacturing, a computer-controlled process in which three-dimensional objects are made. But the boom was followed by a bust as many pure-play 3D printing companies didn't immediately deliver on lofty expectations.

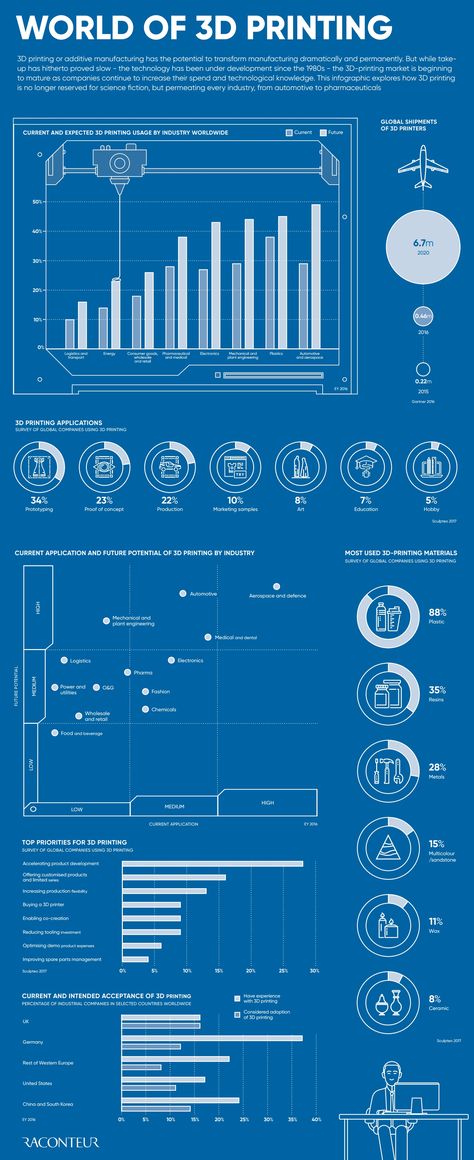

Rumors of the manufacturing technology's demise are clearly premature. These days, 3D printing is a high-growth niche that is steadily reshaping the manufacturing and industrial sectors. Some estimates point to a doubling in annual revenue from additive manufacturing between 2022 and 2026. Even growth investor Cathie Wood has launched a fund focused on manufacturing tech, The 3D Printing ETF (NYSEMKT:PRNT), via her company ARK Invest.

Even growth investor Cathie Wood has launched a fund focused on manufacturing tech, The 3D Printing ETF (NYSEMKT:PRNT), via her company ARK Invest.

Here's what you need to know about 3D printing and additive manufacturing stocks for 2022:

Image source: Getty Images.

Investing in 3D printing stocks

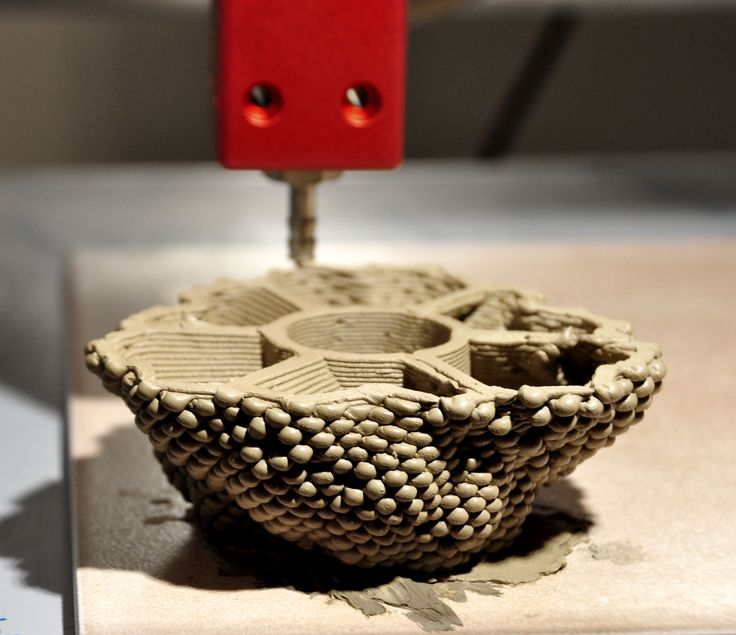

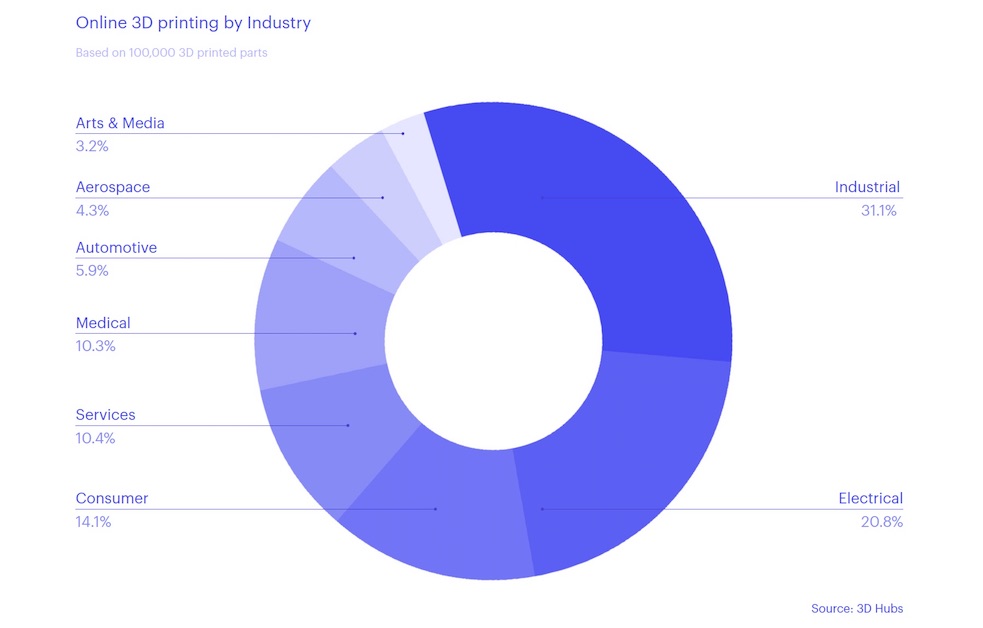

The manufacturing of products in all corners of the economy is being revolutionized by 3D printing, from healthcare equipment to metal fabrication to housing construction. It's invading so many sectors that tech giants such as Microsoft (NASDAQ:MSFT), Autodesk (NASDAQ:ADSK), and HP (NYSE:HPQ) have launched products aimed at 3D printing and additive manufacturing. Other engineering and software outfits such as Dassault Systemes (OTC:DASTY), ANSYS (NASDAQ:ANSS), and Trimble (NASDAQ:TRMB) have also gotten involved in 3D printing technology.

Here are five key players to consider for 2022 that are a more focused bet on 3D printing:

| Company | Market Cap | Description |

|---|---|---|

| Desktop Metal (NYSE:DM) | $1.3 billion | Recent IPO that focuses on metal fabrication technology. |

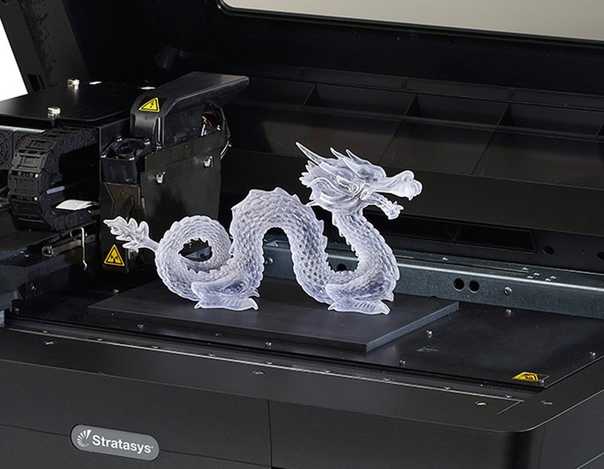

| Stratasys (NASDAQ:SSYS) | $1.5 billion | One of the original 3D printing pioneers, with a wide array of printers and supporting design software. |

| Xometry (NASDAQ:XMTR) | $1.9 billion | A manufacturing marketplace, including access to on-demand 3D printing services. |

| 3D Systems (NYSE:DDD) | $1.9 billion | Another original 3D printing pioneer and the largest pure-play stock on 3D printing technology. |

| PTC (NASDAQ:PTC) | $11.7 billion | A manufacturing technology provider with a suite of software and related services for industrial businesses. |

1.

Desktop Metal

Desktop MetalThis company is a recent entry into the 3D printing space after going public via a SPAC at the end of 2020. The stock has been a terrible market underperformer since then, losing three-quarters of its value as of spring 2022. However, Desktop Metal could still be a promising investment for the long term.

As its name implies, Desktop Metal develops 3D printing hardware and accompanying design software for metal and carbon fiber parts. The company's smaller systems can handle prototyping and one-off parts, and larger printers are production grade-designed for manufacturing facilities. Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

Despite a tenuous start as a public company, Desktop Metal was actually increasing revenue at a torrid triple-digit pace in 2021. Gross profit margins are thin, and the company generated a steep net loss, but that should improve over time as the business scales its operation. Desktop Metal also has several hundred million dollars in cash and investments to fund its expansion. It used some of these funds to acquire additive manufacturing peer ExOne at the end of 2021.

Desktop Metal also has several hundred million dollars in cash and investments to fund its expansion. It used some of these funds to acquire additive manufacturing peer ExOne at the end of 2021.

2. Stratasys

Stratasys was part of the early 2010s 3D printing stock boom and bust, but its business has endured. Sales took a dip early in the COVID-19 pandemic but are rebounding as the Israel-based company picks up new manufacturing contracts.

Stratasys serves a diverse set of customers, including aerospace and automotive parts manufacturers, medical and dental companies, and makers of basic consumer products. In addition to a wide array of 3D printer models, Stratasys develops software to help users accelerate the time between design and final printing.

It isn't the highest-growth name on this list, but Stratasys is profitable (on a free cash flow basis) and has more than $500 million in cash and investments on its balance sheet, as well as no debt. Management thinks its payoff from years of research and development into additive manufacturing will accelerate in 2022.

Management thinks its payoff from years of research and development into additive manufacturing will accelerate in 2022.

3. Xometry

This is another newcomer to public markets. Xometry completed its initial public offering (IPO) over the summer of 2021, raising almost $350 million in cash in the process. As is often the case with new IPOs, the stock has underperformed since then. It has lost over half of its value from the time it started trading on public markets, but the business itself is rapidly growing.

Xometry is a marketplace for on-demand manufacturing of prototyping and mass production. It has a network of more than 5,000 suppliers that companies can call on to meet their fabrication needs. Among the suppliers on the Xometry platform are 3D printing companies, injection molding, and automated machining. The company reported having more than 28,000 active buyers utilizing its platform at the end of 2021.

Although it isn't profitable yet, Xometry's unique approach to the 3D printing and additive manufacturing industry is growing fast. Like other names on this list, it has a sizable war chest of cash and short-term investments that it can spend on research and marketing as it tries to attract more suppliers and buyers to its marketplace.

4. 3D Systems

3D Systems was another early player in the 3D printing industry, and while it suffered through the boom-and-bust period of the early 2010s, its business has held steady for much of the past decade. After a brief dip during the early days of the pandemic, 3D Systems is back in growth mode.

The company develops printers and design software for all sorts of materials and industries (medical device makers, dental labs, semiconductor designers, aerospace, and automotive manufacturers). It claims leadership among independent 3D printing companies (as measured by sales). As the 3D printing industry expands in the coming years, 3D Systems thinks it will be able to attract lots of new business with its extensive experience and global reach.

As the 3D printing industry expands in the coming years, 3D Systems thinks it will be able to attract lots of new business with its extensive experience and global reach.

As an established tech outfit in the manufacturing sector, 3D Systems offers investors the prospect of more stable growth, along with profitability. It also has a large net cash position from which it can consolidate its lead in 3D printers and software technology.

5. PTC

By far the largest company on this list, PTC is a longtime technology partner of manufacturing and industrial enterprises. Fast approaching $2 billion in annualized sales and highly profitable, PTC has all the tools needed to digitally transform industrial businesses.

Besides 3D printing computer-aided design software (ANSYS is a peer and software partner that also operates in this space), PTC specializes in augmented reality, industrial IoT (Internet of Things), and product life-cycle management software. Most of its revenue is subscription-based (including its Creo software that enables 3D printing), making for a stable and steadily growing business model that generates ample cash flow. PTC puts spare cash to work developing new products for its partners and makes bolt-on acquisitions of other software companies that enhance its overall portfolio.

Most of its revenue is subscription-based (including its Creo software that enables 3D printing), making for a stable and steadily growing business model that generates ample cash flow. PTC puts spare cash to work developing new products for its partners and makes bolt-on acquisitions of other software companies that enhance its overall portfolio.

As a larger company, PTC won't be the fastest-growing stock in the additive manufacturing and 3D printing space. However, the company has established itself as a leader in industrial technology and should be a primary beneficiary as the production of manufactured goods gets more efficient.

The future of 3D printing

Manufacturing technology is making inroads throughout the global economy by reducing the cost of production and localizing and speeding up the time it takes to deliver customer orders. This is far from mere hype. Nevertheless, as is the case with all technology investments, progress won't go straight up. Expect twists and turns in these stocks as they develop new methods to design and make products.

Expect twists and turns in these stocks as they develop new methods to design and make products.

If you decide to invest, do so in a measured way. Maintain a diversified portfolio, be wary of stocks benefiting from investor over-optimism, and always leave spare cash to invest more when there are inevitable dips. Given enough time -- years and decades -- investing in 3D printing could eventually provide a big payoff.

Related communication stocks topics

Investing in 5G Stocks

As the 5G technology rollout continues, these companies look like winners.

Investing in Top Telecommunications Stocks

Our world is increasingly interconnected, and these companies make it happen.

Investing in Communication Stocks

Communications has a broad definition. These companies are the leaders in the space.

Investing in Top Consumer Discretionary Stocks

When people have a little extra cash, they indulge in offerings from these companies.

Nicholas Rossolillo has positions in Autodesk and PTC. The Motley Fool has positions in and recommends Autodesk, HP, and Microsoft. The Motley Fool recommends 3D Systems, ANSYS, Dassault Systemes, PTC, and Trimble Inc. The Motley Fool has a disclosure policy.

3D printing market. Is it time to buy shares? / Habr

In this article I would like to talk about companies, each of which is a "unicorn". Shares of two of the three can already be bought on the New York Stock Exchange. There is a pattern: they were all born in the large Boston metropolitan area. And if Silicon Valley is a Mecca for software startups, then Boston, and especially the Massachusetts Institute of Technology (MIT), is the Medina for manufacturing innovation.

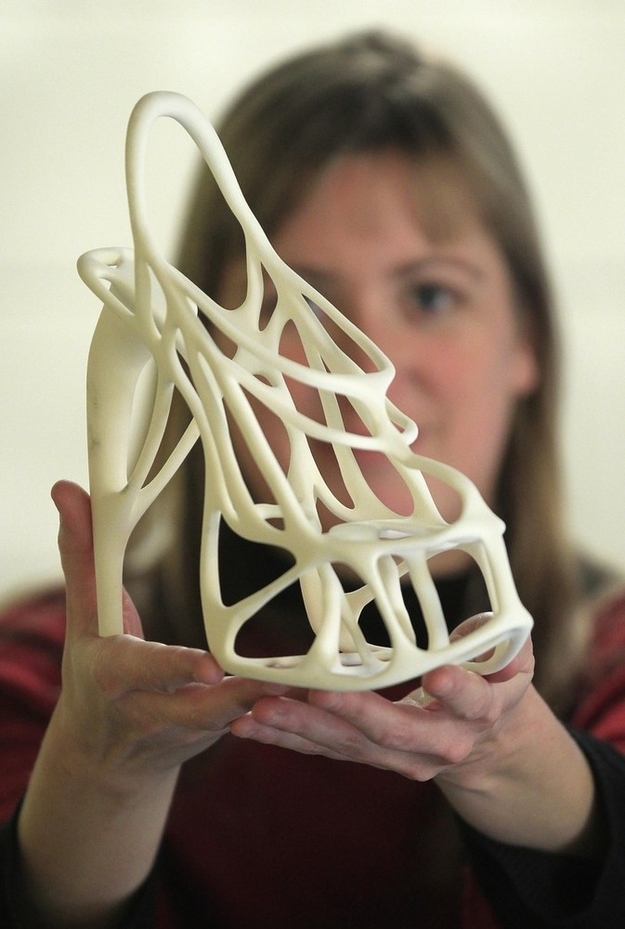

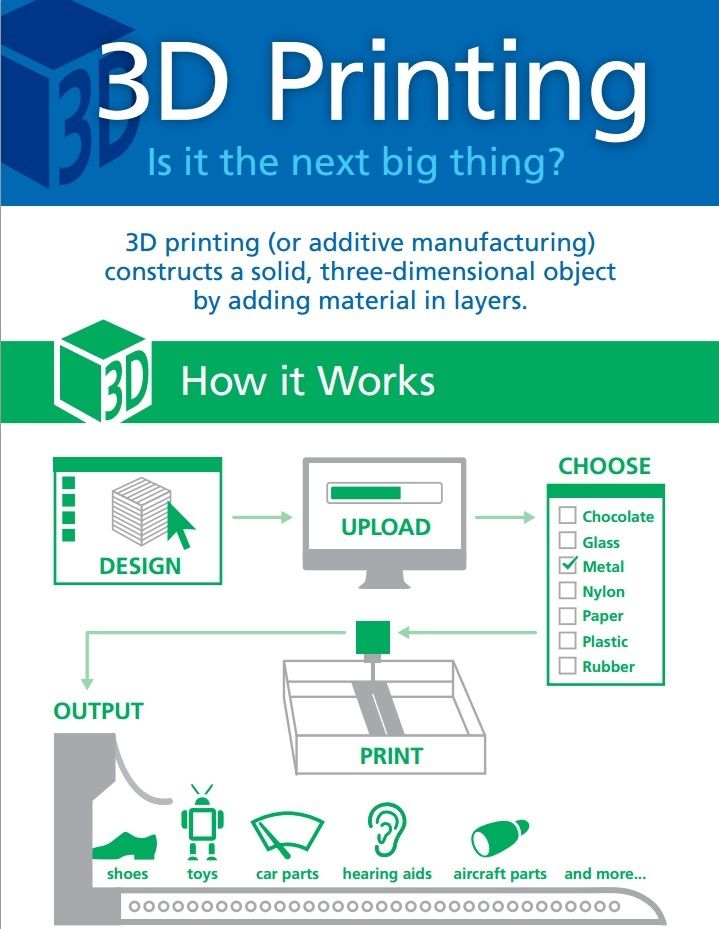

I'll make it clear right away: I won't analyze the entire 3D printing market, but will focus on some of the most notable representatives of the desktop 3D printing segment. But even here everything is very conditional, since in the process of improving technology, products smoothly flow from one category to another, and roughly three main categories can be distinguished: desktop, professional and industrial. So…

So…

In 2011, three American students founded Formlabs in their garage. It was headed by Max Lobowski. Born into a family of engineers - emigrants from Ukraine, from his youth he was interested in robotics and new technologies, attended various specialized additional classes in high school. After earning a bachelor's degree from Cornell University, he went on to graduate school at MIT, where he began designing his desktop 3D printer, which is both powerful and affordable. nine0003 Max Lobowski

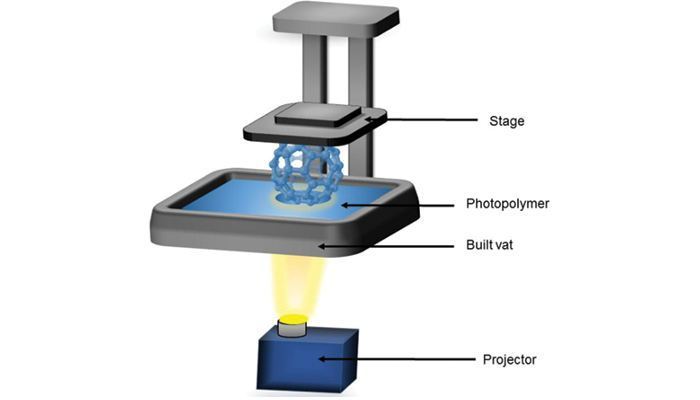

The friends were able to quickly get an angel investment, with which they launched their first product, the Formlabs Form 1 printer, in 2013. On the Kickstarter crowdfunding platform, they managed to raise almost $ 3 million from more than 2,000 bakers from around the world, who were excited about the new product, which promised to make 3D printing accessible to almost everyone. At that time, there were models of printers on the market using the technology of illumination with a laser beam of photopolymer resin (SLA) with a price of 100 thousand dollars, Formlabs offered a printer for 1500 dollars. The company, of course, faced a lot of difficulties in the production of the first batch, but it managed to ship the printers to all buyers. And even though they were far from perfect, this made it possible to attract round A investments in the amount of 19million dollars and return the "angel" money.

The company, of course, faced a lot of difficulties in the production of the first batch, but it managed to ship the printers to all buyers. And even though they were far from perfect, this made it possible to attract round A investments in the amount of 19million dollars and return the "angel" money.

The company then continued to improve its product and create an ecosystem like Apple, which includes 3D printers themselves, consumables (resins for various tasks), software for preparing models for printing, and post-processing equipment. In 2019, the company's turnover reached $100 million, in May 2021 it received $150 million in a round of E from the SoftBank Investment Advisers fund, valuing the company at $2 billion. After that, there was talk of an IPO, which would be an absolutely logical step, since investment funds are planning this in the future for 7-10 years, and this period has already come for investors of the first round. nine0003

However, despite high market expectations, Max Lobowski said in an interview with BizJournals that he is in no rush to go public: “We would rather take our time and better prepare to be a great public company… We make more money than all 3D -companies taken together that have gone public with the help of SPAC (a procedure that allows startups to go public by merging with another private company). However, when I look at really large, successful, long-term public projects, which is what we are aiming for, I see that they are on a completely different level in terms of predictability and profitability than we are.” These are serious words, and apparently the head of the company has reason to pronounce them. Most likely, the forecast of the company's capitalization in the region of 4-6 billion dollars with a successful initial offering, which will make it the largest company in the market, because even the result of the veteran and long-term market leader - 3DSystems as of August 2021 is no more than 3.5 billion. dollars. nine0003

However, when I look at really large, successful, long-term public projects, which is what we are aiming for, I see that they are on a completely different level in terms of predictability and profitability than we are.” These are serious words, and apparently the head of the company has reason to pronounce them. Most likely, the forecast of the company's capitalization in the region of 4-6 billion dollars with a successful initial offering, which will make it the largest company in the market, because even the result of the veteran and long-term market leader - 3DSystems as of August 2021 is no more than 3.5 billion. dollars. nine0003

Unlike the students at Formlabs, Markforged was founded by older guys. However, even here it was not without MIT. MIT alumnus Mark Greg encountered 3D printing while his company was doing a job for the US Navy. Experiments in the field of improving the quality of products led him to the idea of creating a printer that could reinforce the printed model with carbon fiber to make it strong and suitable for use under load.

nine0003

nine0003 Based on the Wholers Report, in 2020 the company predicted the growth of the additive technologies market at an average rate of 27%, which means that in the next 8 years from the current 18 billion dollars, the market will grow to 118 billion in 2029 from 10 multiple growth of own revenue up to 700 million dollars already in 2025.

On July 15, 2021, MarkForged was listed on the New York Stock Exchange under the ticker MKFG. The placement was estimated at 2 billion dollars, but a month later the shares lost a little in price, and the current capitalization is about 1.5 billion dollars. The question remains: is it worth buying shares of a company that plans to be unprofitable for at least another 2 years (the company predicts a turnover of about $100 million this year). nine0003

On the one hand, there are enough companies on the market trading at even higher multiples, and on the other hand, 3D printing is not yet such a mature technology that one can be sure of the 100% success of exactly the concept that MarkForged offers. In fact, the company itself considers the emergence of new technologies as one of the risks that could undermine its current technological superiority. In general, investors are now positive about the future of 3D printing. They were impressed by how the technology performed in the first, most difficult months of the pandemic, when production chains were disrupted and many transport arteries stopped working. With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, the coin has two sides, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the market of additive technologies in general. nine0003

In fact, the company itself considers the emergence of new technologies as one of the risks that could undermine its current technological superiority. In general, investors are now positive about the future of 3D printing. They were impressed by how the technology performed in the first, most difficult months of the pandemic, when production chains were disrupted and many transport arteries stopped working. With the help of 3D printing, it was quickly possible to establish the production of urgently needed valves for ventilation, protective masks, adapters and much more. The concept of distributed production immediately turned from a beautiful idea into a real necessity. So, as always, the coin has two sides, but if you are interested in stocks with great potential, you should at least take a closer look at this company and the market of additive technologies in general. nine0003

The last one in my story is DeskTop Metal. Formlabs was created by MIT students, Markforged - MIT graduates, DeskTop Metal was created by experienced entrepreneurs Rick Fulop and Johan Mayerberg, as well as 4 (!) MIT professors. Going to the goal, Rick Fulop founded 6 different companies, also headed an investment fund. Johan Maierberg has been a lead engineer for various companies and became the CTO of DeskTop Metal.

Going to the goal, Rick Fulop founded 6 different companies, also headed an investment fund. Johan Maierberg has been a lead engineer for various companies and became the CTO of DeskTop Metal.

The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which can hardly be called a desktop one. The company claims that its Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it. nine0003

The system was very "raw": a small amount of materials was available for printing, and the printing itself had a lot of restrictions, the final products looked rough with large dimensional errors. Nevertheless, the developments continued, and the company announced its potential star - the Production System, a high-speed metal printing system, which can hardly be called a desktop one. The company claims that its Single Pass Jetting technology is 100 times faster than any other existing metal 3D printing technology, but deliveries of printers should begin only at the end of this year, so in this case you have to take our word for it. nine0003 The company entered the IPO on December 10, 2020 under the same SPAC scheme and in its presentation for potential investors outlined the following parameters: planned turnover in 2025 - 942 million dollars, reaching operating profit in 2023, and also indicated that , which plans to spend a significant portion of the proceeds on acquisitions of other 3D printing companies.

Capitalization on the New York Stock Exchange at the time of its IPO on December 10 was a fantastic $6 billion. During the placement, $580 million was raised and the company was assigned the laconic ticker DM. Already in February 2021, the shares rose even more, and the company's capitalization exceeded $8 billion. DM has said it will be the first company in 3D printing history to have a capitalization of over $10 billion. Having received huge funds at its disposal, already in January 2021, DM announced the first takeover deal: the German manufacturer of professional photopolymer 3D printers EnvisionTEC (founded in 2002 and is one of the oldest on the market) was bought for $ 300 million. For me, this choice was not obvious, it is difficult to find something in common between DM and EnvisionTEC and it will be difficult to achieve a significant synergistic effect from this transaction. EnvisionTEC has continued to operate under its own brand as a 100% subsidiary of DM and plans to release a number of new models for its key customers - dental clinics and jewelry companies. Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase announced in August of another public company, the American ExOne. Established in 2005 in Pittsburgh, it specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other and they have already presented a joint portfolio based on the products of both companies, in which one product complements the other.

Also during this year, several small companies specializing in the production of materials and software were bought. DM expands its patent base due to this and gathers under its wing the best ideas and people. The most high-profile acquisition was the $575 million purchase announced in August of another public company, the American ExOne. Established in 2005 in Pittsburgh, it specializes in the production of industrial 3D printers for creating injection molds from sand and other materials. It is also noteworthy that she managed to commercialize a patent for this technology, issued by MIT back in 1993 year. In this case, we can say that the product lines of DM and ExOne are closer to each other and they have already presented a joint portfolio based on the products of both companies, in which one product complements the other.

It would be logical to assume that DM stock skyrocketed after such high-profile acquisitions, but in reality the opposite happened. Since its peak in February, the shares have fallen 4 times and are now trading at $8 a share, and the capitalization is slightly over $2 billion. Apparently, the first euphoria of investors gave way to a more sober approach to the current results of the company. Perhaps this was influenced by the dissatisfaction of some ExOne shareholders, who considered the sale price of the company unfair and were preparing a class action lawsuit against management in order to block the deal. nine0003

Apparently, the first euphoria of investors gave way to a more sober approach to the current results of the company. Perhaps this was influenced by the dissatisfaction of some ExOne shareholders, who considered the sale price of the company unfair and were preparing a class action lawsuit against management in order to block the deal. nine0003

Should I buy DM stock now that it has fallen so much, or wait for further decline? I would say that their current level is very comfortable for entry, but, of course, such investments also have a certain risk. This is despite the fact that the company has reported strong first half results, which DM expects to generate over $100 million in revenue this year.

Summing up, I would like to say that a number of stock analysts consider what is happening in the market of additive technologies to be a "renaissance". The market came into motion after the pandemic, which gave everyone hope that the technology was ripe for serious tasks, and that the situation in the industry of 2013-2014 would not repeat itself. Then the technique was still very "raw", but attracted a lot of attention from the press and potential investors. This drove the stocks of market leaders 3DSystems and Stratasys to unknown heights, and then, when there was disappointment in the results of their work, the fall reached 20 times from peak values. Startups bought in batches, not really understanding what to do with them later. Most of these deals only made it harder for companies to focus on their core business. I would like to hope that history will be a good lesson for the new giants of the industry. There have already been a number of IPO exits by companies from the 3D printing industry through SPAC this year, with several more large listings planned for the end of the year. And, if you are interested in this sector, stay tuned. nine0003

Then the technique was still very "raw", but attracted a lot of attention from the press and potential investors. This drove the stocks of market leaders 3DSystems and Stratasys to unknown heights, and then, when there was disappointment in the results of their work, the fall reached 20 times from peak values. Startups bought in batches, not really understanding what to do with them later. Most of these deals only made it harder for companies to focus on their core business. I would like to hope that history will be a good lesson for the new giants of the industry. There have already been a number of IPO exits by companies from the 3D printing industry through SPAC this year, with several more large listings planned for the end of the year. And, if you are interested in this sector, stay tuned. nine0003

Alexander Kornveits

Expert in the field of additive technologies and 3D equipment, founder and head of Tsvetnoy Mir

The largest companies in the 3D printing sector listed on the stock exchange

1980s. At the end of 2018, the size of the 3D printing market, according to various estimates, reached from $9 trillion to $10 trillion. Calculations were made based on the cost of producing printers, components and 3D printing.

At the end of 2018, the size of the 3D printing market, according to various estimates, reached from $9 trillion to $10 trillion. Calculations were made based on the cost of producing printers, components and 3D printing.

In the coming years, expert agencies (IMARC, Inkwood Reasearch, Marketwatch, etc.) predict a steady growth of at least 20% per year. In this scenario, by the end of 2025, the scale of the entire 3D printing segment will reach at least $ 32 trillion - 3.5 times higher than the current values. nine0003

The outlook for the sector makes it attractive to investors. Consider the largest and most stable companies in this segment, whose shares can be considered for purchase and take their rightful place in your portfolio.

1. HP Inc Capitalization: $29.3 billion

HP manufactures computers, printers, tablets and a number of other devices. The release of 3D printers is not the main specialization of the company, but HP occupies one of the leading positions in the 3D printing segment. In 2014, the company developed the Multi Jet Fusion technology, which allowed to increase productivity and reduce the cost of professional (industrial) 3D printers. The technology has been successfully applied in mass production of printers since 2016.

In 2014, the company developed the Multi Jet Fusion technology, which allowed to increase productivity and reduce the cost of professional (industrial) 3D printers. The technology has been successfully applied in mass production of printers since 2016.

In 2017, HP opens the world's first 3D lab, equipped with printers in various build states and essential tools for device experimentation. The company has opened up the first opportunities to test new materials in 3D printers to increase efficiency.

In 2018, HP will open a joint manufacturing center with China's Guangdong in Guangdong, China, which is the largest such 3D printing project in Asia Pacific and Japan. The facility is equipped with ten high-tech next-generation HP Metal Jet printers to produce parts and prototypes for industrial customers. nine0003

2. Proto L abs (NYSE: PRLB). Capitalization: $2.56 billion

The company was founded in 1999 and has more than 10 production sites in seven countries. The head office is located in Minnesota. The company specializes in the production of parts for other manufacturing companies. The corporation positions itself as the fastest in the world in the production of custom prototypes and finished parts for industrial customers. In 2014, Proto Labs launched 3D printed parts. nine0003

The head office is located in Minnesota. The company specializes in the production of parts for other manufacturing companies. The corporation positions itself as the fastest in the world in the production of custom prototypes and finished parts for industrial customers. In 2014, Proto Labs launched 3D printed parts. nine0003

In addition to 3D printing, the company produces CNC (Computer Numerical Control) parts, injection molding, and sheet metal parts. In 2015, Proto Labs bought Alphaform (specializing in innovative 3D printing) with divisions in Germany, Finland and the UK. This allowed the company to expand its 3D printing business in Europe. To diversify its business and introduce sheet metal manufacturing, the company acquired Rapid Manufacturing in 2017 for $120 million.

3. 3 D Capitalization: $1.01 billion

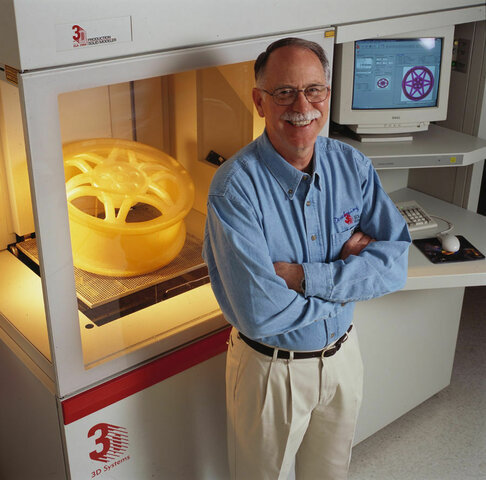

3D Systems was founded by inventor Chuck Hull in 1986, becoming the world's first 3D printing company. It produces 3D printers and components, including software, and also designs them. The company provides services at various stages of design, development and production of products for many large industries, including aerospace, automotive, medical, entertainment and other areas. It should be noted that the corporation also works with retail consumers. Business diversification within the 3D segment makes the company financially stable. nine0003

It produces 3D printers and components, including software, and also designs them. The company provides services at various stages of design, development and production of products for many large industries, including aerospace, automotive, medical, entertainment and other areas. It should be noted that the corporation also works with retail consumers. Business diversification within the 3D segment makes the company financially stable. nine0003

3D Systems is headquartered in Rock Hill, South Carolina, USA. The number of employees of the company exceeds 2600 (as of the end of 2018), which is twice as high as five years ago.

4. Stratasys Capitalization: $0.98 billion

The company was founded in 1989 by Scott Crump. The technology was based on the idea of creating the shape of a figure by layering after Scott decided in 1988 to make a toy for his daughter using a gun filled with glue. At 1992 Stratasys released its first 3D Modeler product.

Today, Stratasys manufactures industrial and desktop 3D printers and related accessories. The range of services includes installation, maintenance and training in working with printers. The company serves various industries by developing technologies for the production of prototypes and parts. The first public offering of Stratasys shares took place in 1994 at $5 per share and a total volume of $5.7 million. The head office is located in Minnesota. nine0003

5. Materialize Capitalization: $0.88 billion

Materialize was incorporated in 1990 in Leuven, Belgium and specializes in 3D printing services and software for 3D printers. Like other leaders in this sector, Materialize works with various major manufacturers around the world (Adidas, HP), but a significant share of the business is in cooperation with medical centers and institutions. The company's portfolio includes more than 150 medical patents. Materialize offices are located in 18 countries, including one office located in the CIS in Ukraine. nine0003

nine0003

Comparison of issuers

The most valuable company among the leaders is HP, which is due to the scale and diversification of the company's business in the entire technology segment. 3D Systems, Stratasys and Materialize specialize exclusively in the 3D printing segment, while their capitalization is on the same level. Proto Labs has three businesses besides 3D printing and is in the middle of our list in terms of capitalization.

The most undervalued company in terms of EV/EBITDA is HP, but it is not correct to compare it with other issuers by this multiplier due to the differentiation of the company's products and services. 3D Systems has the highest EV/EBITDA, and from this point of view, the paper is not so attractive to buy. Moreover, over the past four years, 3D Systems shares have been in a stable sideways trend without technical prerequisites for growth. nine0003

The remaining three companies, in our opinion, may be of interest.

Market cap as of April 19, 2022.

Market cap as of April 19, 2022.