3D printers etf

Total 3D-Printing Index - ETF Tracker

ETFs Tracking Other Mutual Funds

Mutual Fund to ETF Converter Tool

- Overview

- Returns

- Fund Flows

- Expenses

- Dividends

- Holdings

- Taxes

- Technicals

- Analysis

- Realtime Ratings

ETFs Tracking The Total 3D-Printing Index – ETF List

ETFs tracking the Total 3D-Printing Index are presented in the following table.

ETFs Tracking The Total 3D-Printing Index – ETF Returns

The following table presents historical return data for ETFs tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Fund Flow

The table below includes fund flow data for all U.S. listed Highland Capital Management ETFs. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

Fund Flows in millions of U.S. Dollars.

ETFs Tracking The Total 3D-Printing Index – ETF Expenses

The following table presents expense information for ETFs tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Dividends

The following table presents dividend information for ETFs tracking the Total 3D-Printing Index, including yield and dividend date.

ETFs Tracking The Total 3D-Printing Index – ETF Holdings

The following table presents holdings data for all ETFs tracking the Total 3D-Printing Index. For more detailed holdings data for an ETF click the ‘View’ link in the right column.

ETFs Tracking The Total 3D-Printing Index – ETF Tax Rates

The following table presents sortable tax data for ETFs currently tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Technicals

The following table presents certain technical indicators for ETFs tracking the Total 3D-Printing Index. To see complete technical metrics click the ‘View’ link in the right column.

ETFs Tracking The Total 3D-Printing Index – ETF Analysis

The following table presents links to in-depth analysis for ETFs tracking the Total 3D-Printing Index.

ETFs Tracking The Total 3D-Printing Index – ETF Realtime Ratings

The following table presents a proprietary ETF Database rating for ETFs tracking the Total 3D-Printing Index.

Total 3D-Printing Index - ETF Tracker

| Symbol | ETF Name | Asset Class | Total Assets* | YTD | Avg Volume | Previous Closing Price | 1-Day Change | Overall Rating | 1 Week | 1 Month | 1 Year | 3 Year | 5 Year | YTD FF | 1 Week FF | 4 Week FF | 1 Year FF | 3 Year FF | 5 Year FF | ETF Database | Inception | ER | Commission Free | Annual Dividend Rate | Dividend Date | Dividend | Annual Dividend Yield % | P/E Ratio | Beta | # of Holdings | % In Top 10 | Complete | ST Cap Gain Rate | LT Cap Gain Rate | Tax Form | Lower Bollinger | Upper Bollinger | Support 1 | Resistance 1 | RSI | Advanced | Fact Sheet | ETF Holdings | Chart | ETF Home Page | Head-To-Head | Liquidity Rating | Expenses Rating | Returns Rating | Volatility Rating | Dividend Rating | Concentration Rating |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PRNT | 3D Printing ETF | Equity | $178,152 | 0. 6% 6% | 23,441.0 | $20.62 | -1.20% | 0.4% | -5.5% | -38.0% | -7.9% | -17.3% | Technology Equities | 2016-07-19 | 0.66% | N/A | $0.00 | 2019-12-27 | $0.02 | 0.00% | 39.1 | 1.30 | 58 | 43.0% | View | 40% | 20% | 1099 | $19. 49 49 | $22.15 | $20.51 | $20.73 | 47.44 | View | View | View | View | View | View | B+ | B- |

Sort By:

- Overview

- Returns

- Fund Flows

- Expenses

- Dividends

- Holdings

- Taxes

- Technicals

- Analysis

- Realtime Ratings

ETFs Tracking Other Technology Equities

ETF Database staff has allocated each ETF in the ETF database, as well as each index, to a single ‘best-fit’ ETF Database Category. Other ETFs in the Technology Equities ETF Database Category are presented in the following table.

Other ETFs in the Technology Equities ETF Database Category are presented in the following table.

* Assets in thousands of U.S. Dollars. Assets and Average Volume as of 2023-01-05 15:16:04 -0500

ETFs Tracking Other Technology Equities

Historical return data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Fund flow information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Expense information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Dividend information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Holdings data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Tax Rate data for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Technical information for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Links to analysis of other ETFs in the Technology Equities ETF Database Category is presented in the following table.

ETFs Tracking Other Technology Equities

Links to a proprietary ETF Database rating for other ETFs in the Technology Equities ETF Database Category is presented in the following table.

| Symbol | ETF Name | Asset Class | Total Assets* | YTD | Avg Volume | Previous Closing Price | 1-Day Change | Overall Rating | 1 Week | 1 Month | 1 Year | 3 Year | 5 Year | YTD FF | 1 Week FF | 4 Week FF | 1 Year FF | 3 Year FF | 5 Year FF | ETF Database | Inception | ER | Commission Free | Annual Dividend Rate | Dividend Date | Dividend | Annual Dividend Yield % | P/E Ratio | Beta | # of Holdings | % In Top 10 | Complete | ST Cap Gain Rate | LT Cap Gain Rate | Tax Form | Lower Bollinger | Upper Bollinger | Support 1 | Resistance 1 | RSI | Advanced | Fact Sheet | ETF Holdings | Chart | ETF Home Page | Head-To-Head | Liquidity Rating | Expenses Rating | Returns Rating | Volatility Rating | Dividend Rating | Concentration Rating |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| VGT | Vanguard Information Technology ETF | Equity | $39,110,100 | -2. 6% 6% | 755,097.0 | $311.14 | -2.07% | -2.6% | -10.2% | -28.8% | 29.5% | 92.9% | Technology Equities | 2004-01-26 | 0.10% | Vanguard | $2.79 | 2021-09-29 | $0.89 | 0.63% | 32.8 | 1.08 | 374 | 58.8% | View | 40% | 20% | 1099 | $305. 11 11 | $346.30 | $309.22 | $314.53 | 41.59 | View | View | View | View | View | View | A | A | |||||||||||

| XLK | Technology Select Sector SPDR Fund | Equity | $37,953,600 | -2.6% | 7,012,269.0 | $121.18 | -1.94% | -2.8% | -10. 2% 2% | -27.3% | 35.2% | 95.6% | Technology Equities | 1998-12-16 | 0.10% | N/A | $1.10 | 2021-09-20 | $0.27 | 0.67% | 27.5 | 1.04 | 78 | 66.5% | View | 40% | 20% | 1099 | $118.98 | $135.08 | $120.34 | $122. 65 65 | 41.34 | View | View | View | View | View | View | A+ | A | |||||||||||

| IYW | iShares U.S. Technology ETF | Equity | $7,786,280 | -2.6% | 934,052.0 | $72.54 | -2.21% | -2.7% | -10.4% | -33.6% | 25.3% | 78.4% | Technology Equities | 2000-05-15 | 0. 39% 39% | N/A | $0.32 | 2021-09-24 | $0.07 | 0.29% | 39.3 | 1.06 | 142 | 61.2% | View | 40% | 20% | 1099 | $71.15 | $80.78 | $72.10 | $73.32 | 41.60 | View | View | View | View | View | View | A | A- | |||||||||||

| SMH | VanEck Semiconductor ETF | Equity | $6,435,910 | -0. 1% 1% | 4,396,741.0 | $202.80 | -1.79% | -0.5% | -8.4% | -32.4% | 45.9% | 110.0% | Technology Equities | 2000-05-05 | 0.35% | N/A | $1.50 | 2020-12-21 | $1.50 | 0.50% | 28.2 | 1.17 | 25 | 59.2% | View | 40% | 20% | 1099 | $193. 86 86 | $225.48 | N/A | N/A | 46.66 | View | View | View | View | View | View | A | A | |||||||||||

| SOXX | iShares Semiconductor ETF | Equity | $5,943,810 | -0.1% | 1,131,642.0 | $347.50 | -1.69% | -0.2% | -8.5% | -34. 0% 0% | 42.4% | 106.1% | Technology Equities | 2001-07-10 | 0.35% | N/A | $3.17 | 2021-09-24 | $1.16 | 0.61% | 32.7 | 1.17 | 31 | 57.1% | View | 40% | 20% | 1099 | $331.39 | $387.23 | $345.47 | $351.00 | 46. 45 45 | View | View | View | View | View | View | A | A- | |||||||||||

| FTEC | Fidelity MSCI Information Technology Index ETF | Equity | $4,898,060 | -2.6% | 174,317.0 | $92.02 | -2.13% | -2.7% | -10.2% | -28.8% | 29.4% | 87.7% | Technology Equities | 2013-10-21 | 0. 08% 08% | Fidelity | $0.79 | 2021-09-17 | $0.20 | 0.60% | 31.7 | 1.08 | 365 | 58.2% | View | 40% | 20% | 1099 | $90.28 | $102.44 | $91.45 | $93.06 | 41.58 | View | View | View | View | View | View | A- | A+ | |||||||||||

| CIBR | First Trust NASDAQ Cybersecurity ETF | Equity | $4,492,910 | -3. 6% 6% | 669,667.0 | $37.31 | -3.39% | -3.4% | -9.3% | -24.1% | 25.6% | 62.4% | Technology Equities | 2015-07-07 | 0.60% | N/A | $0.06 | 2021-06-24 | $0.03 | 0.11% | 28.0 | 1.02 | 39 | 46.5% | View | 40% | 20% | 1099 | $37. 07 07 | $40.99 | $36.92 | $38.03 | 40.51 | View | View | View | View | View | View | A | B- | |||||||||||

| IGV | iShares Expanded Tech-Software Sector ETF | Equity | $4,428,820 | -2.4% | 1,331,675.0 | $249.85 | -3.22% | -2.5% | -8. 1% 1% | -31.6% | 6.3% | 58.0% | Technology Equities | 2001-07-10 | 0.40% | N/A | $0.00 | 2020-06-15 | $0.07 | 0.00% | 50.1 | 0.99 | 121 | 56.8% | View | 40% | 20% | 1099 | $246.29 | $268.79 | $247.46 | $253. 77 77 | 43.86 | View | View | View | View | View | View | A | A- | |||||||||||

| IXN | iShares Global Tech ETF | Equity | $2,663,040 | -1.9% | 333,402.0 | $43.97 | -1.79% | -2.2% | -9.8% | -29.0% | 26.9% | 73.0% | Technology Equities | 2001-11-12 | 0. 40% 40% | N/A | $1.13 | 2021-06-10 | $0.20 | 1.82% | 38.5 | 1.03 | 132 | 57.0% | View | 40% | 20% | 1099 | $42.99 | $48.72 | $43.76 | $44.36 | 42.36 | View | View | View | View | View | View | A | A- | |||||||||||

| SKYY | First Trust Cloud Computing ETF | Equity | $2,593,320 | -3. 5% 5% | 431,345.0 | $55.57 | -3.96% | -3.7% | -12.2% | -42.8% | -8.0% | 21.4% | Technology Equities | 2011-07-05 | 0.60% | N/A | $0.18 | 2021-09-23 | $0.04 | 0.15% | N/A | 0.97 | 68 | 36.4% | View | 40% | 20% | 1099 | $54. 46 46 | $62.66 | $54.89 | $56.74 | 40.38 | View | View | View | View | View | View | A | B | |||||||||||

| Click Here to Join to ETF Database Pro for 14 Days Free, Export This Data & So Much More | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Content continues below advertisement

NewLoading Articles...

3D Printing ETF: Long-Term Bet On A Megatrend (BATS:PRNT)

Oct. 29, 2021 9:38 PM ET3D Printing ETF (PRNT)DM, DDD, CLLKF, CFMS, SLGRF14 Comments

Main Street Investor

3. 95K Followers

95K Followers

Summary

- ARK's printing ETF offers exposure to the 3D printing industry while diversifying individual risk to investors.

- The ETF successfully rotates along the most promising companies engaging in the 3D printing industry.

- While the ETF is trading below all-time highs reached earlier this year, the ETF still outperformed the broader market.

- Looking for more investing ideas like this one? Get them exclusively at Blue Ocean Investing. Learn More »

izusek/E+ via Getty Images

Overview

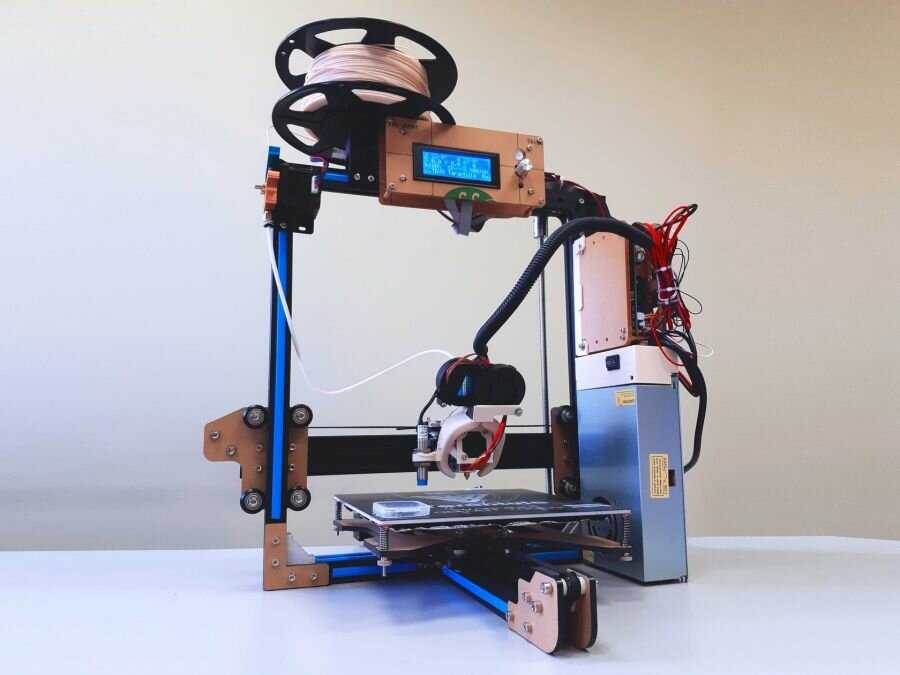

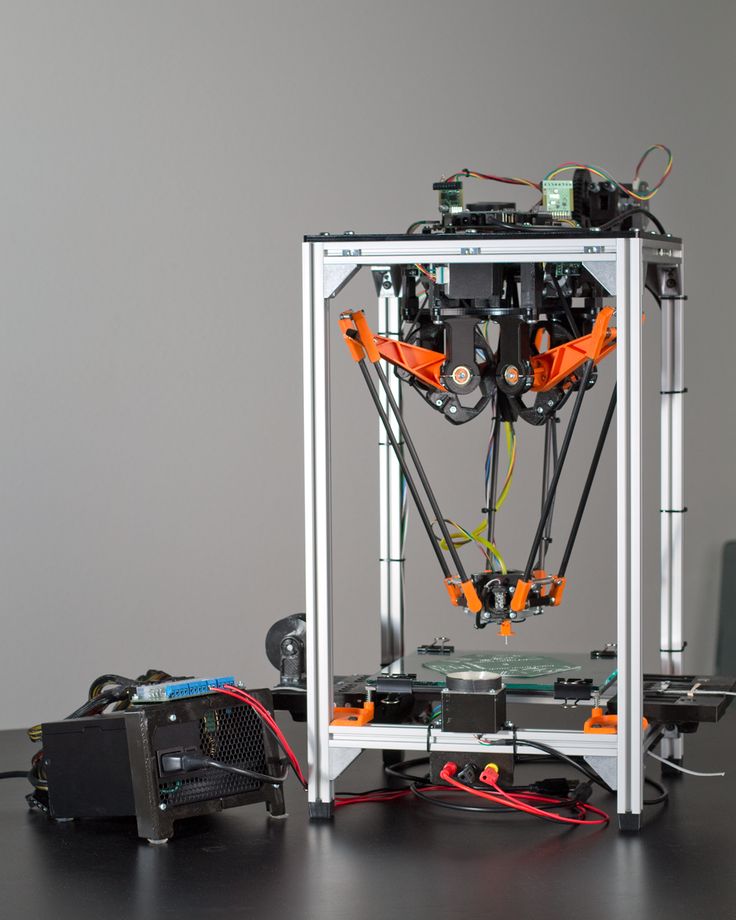

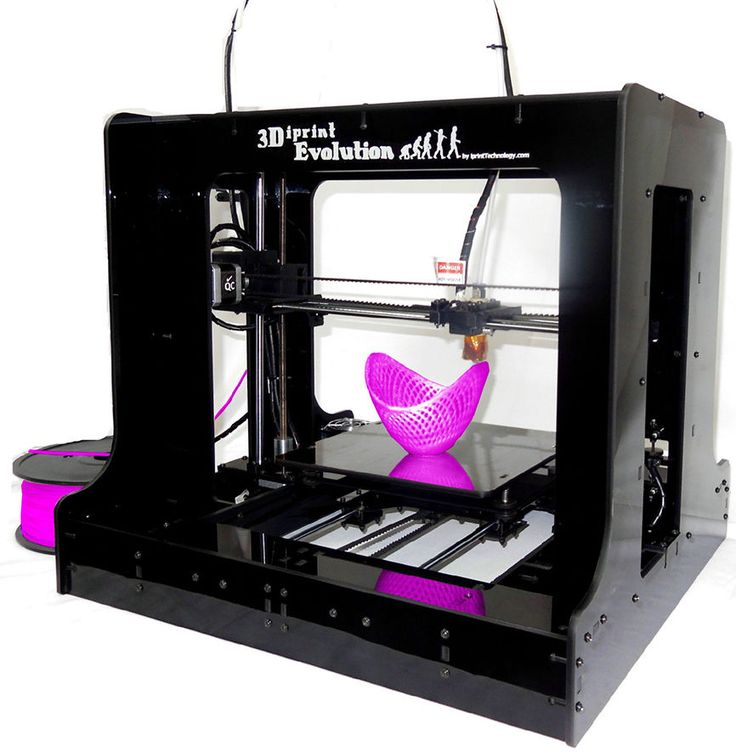

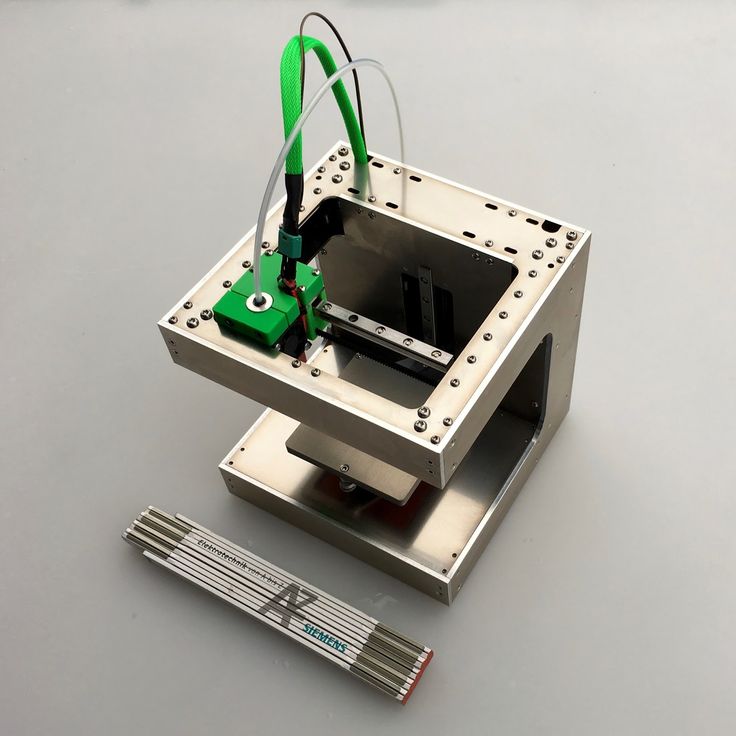

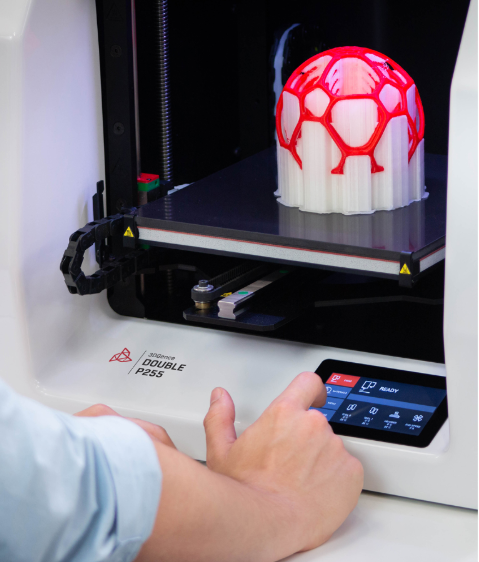

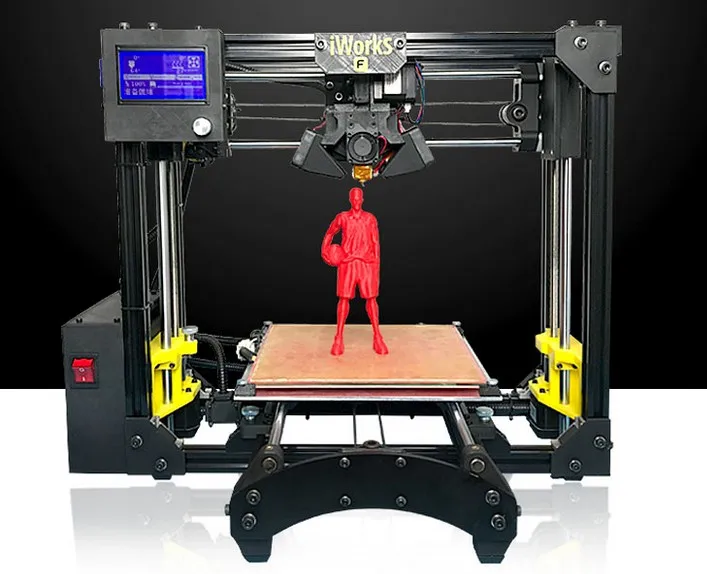

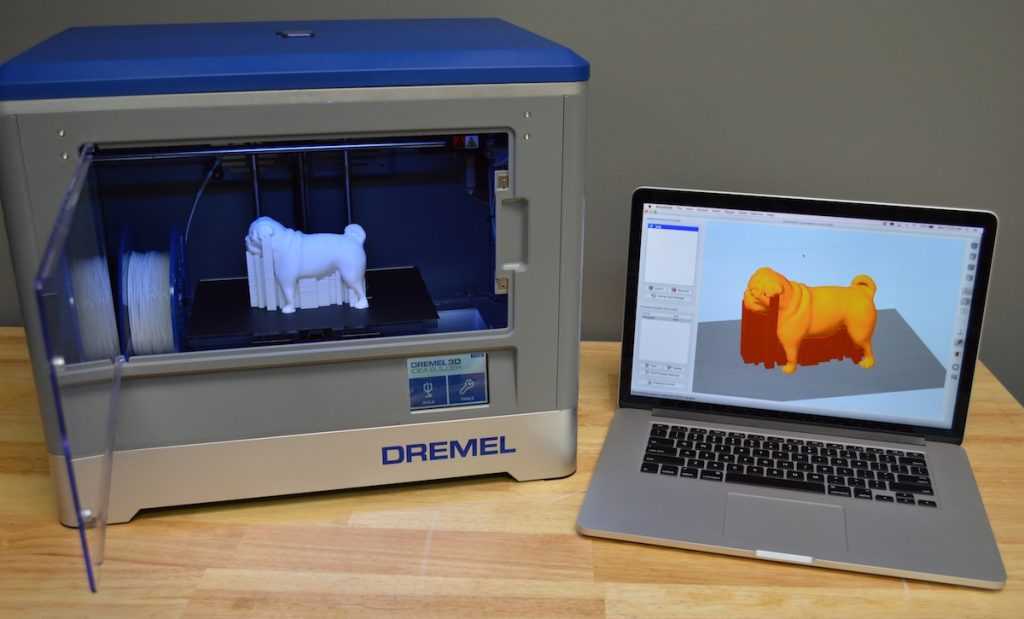

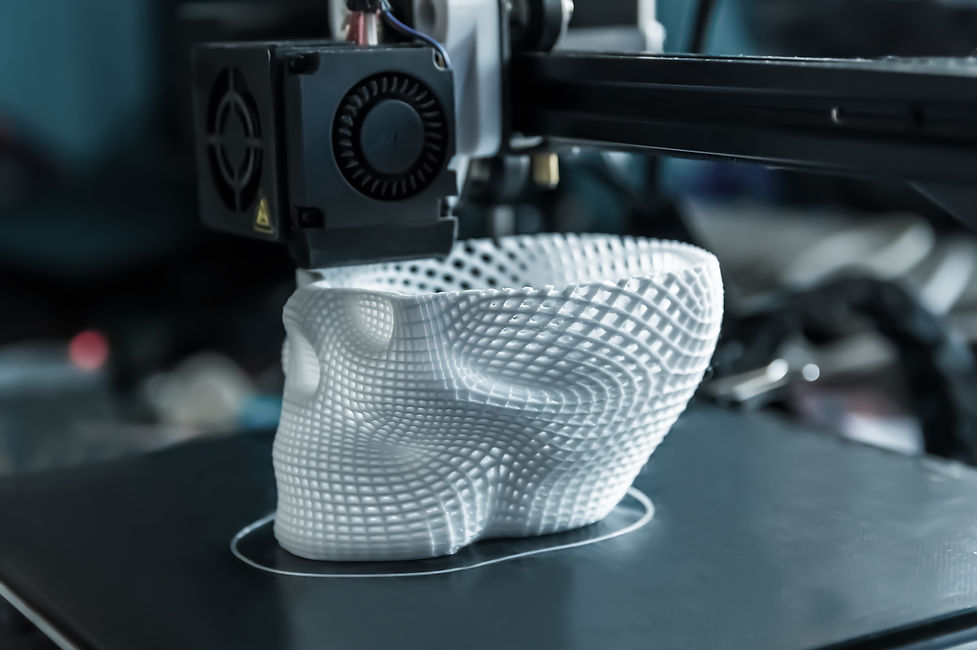

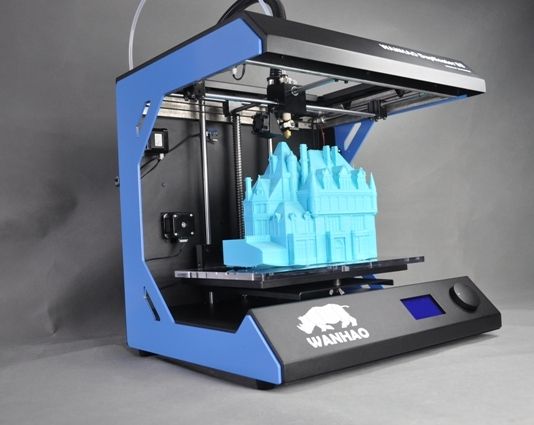

3D Printing ETF (BATS:PRNT) offers an attractive investment opportunity to capitalize on the massive growth of 3D printing in the future. The technology, which has been characterized as a 'hobby' for long, is used increasingly for commercial use and is underestimated in terms of applications. In this regard, 3D printing is being adopted in nearly every significant industry, ranging from the private sector to health, manufacturing, education and more. The market for 3D solutions is growing quickly, therefore the ETF offers a chance to capture growth while diversifying individual risk.

In this regard, 3D printing is being adopted in nearly every significant industry, ranging from the private sector to health, manufacturing, education and more. The market for 3D solutions is growing quickly, therefore the ETF offers a chance to capture growth while diversifying individual risk.

Source: ETF.com

The ETF focuses specifically on 3D printing, including physical printers, hardware, software, printing centers, and materials. Within each category, the selected securities are given equal weight. The top 10 holdings of PRNT ETF account for 50%, while it includes 52 holdings in total. Roughly 66% of the holdings are American companies, while the remaining are well diversified across Europe.

The ETF is rebalanced quarterly and has an average expense ratio of 0.66%, representing the cost of an initial investment. That said, Cathie Woods' ARK fund has gained significant traction at the end of 2020, as innovation technologies surged. However, after trading sideways for some time, the question remains as to whether the ETF can break out once more.

Holdings

Source: Ark Funds

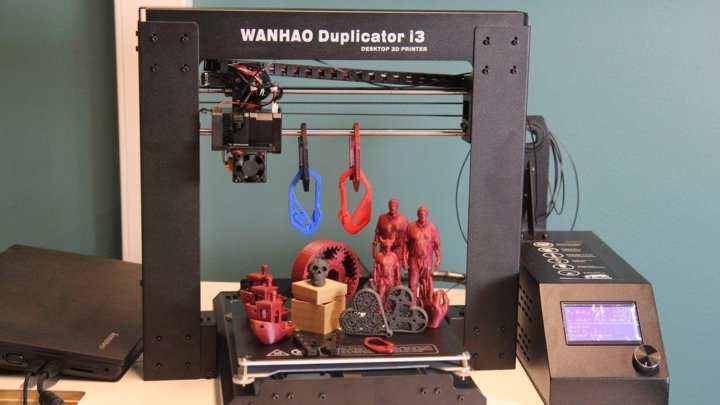

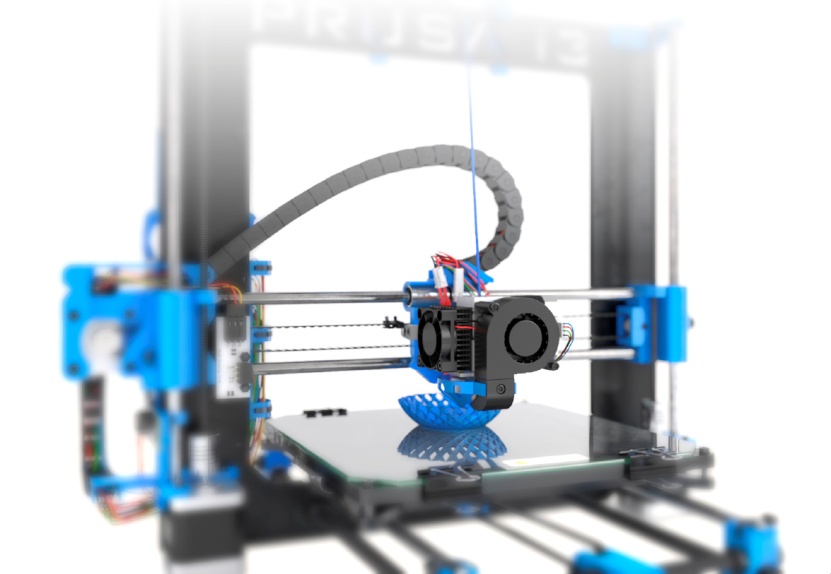

ExOne Co. (NASDAQ:XONE): Being the largest holding of the ETF, the firm develops, manufactures, and markets three-dimensional (3D) printing machines, 3D printed and other products, materials, and services to industrial customers in the United States, Germany, and Japan. It directly sells 3D printing machines as well as indirect applications, including components and tools for 3D printing. Although shares are still down roughly 65% from all-time highs, the stock is trading 120% higher year-over-year.

3D Systems Corp. (NYSE:DDD): Headquartered in the U.S., the company offers 3D printers, such as stereolithography, selective laser sintering, direct metal printing, multi-jet printing, and color jet printers that transform digital data input generated by 3D design software, computer-aided design software, or other 3D design tools into printed parts. The stock has surged over 372% YoY as sales jumped 44% last quarter.

BICO Group (OTCPK:CLLKF): The Swedish bio convergence startup designs and supplies technologies and services to enhance biology research by commercializing bioprinting through artificial intelligence, robotics, multi-omics, and diagnostics. The company is in an ultra growth stage, as sales surged nearly 500% last quarter to $38 million. As a result, Stockholm-listed shares are up 147% YoY.

Conformis Inc. (NASDAQ:CFMS): The medical company develops and manufactures joint replacement implants through the use of 3D printing technologies. It markets and sells its products to orthopedic surgeons, hospitals, and other medical facilities in the United States, Argentina, Europe, the Middle East, and Australia. Trading at just $1.2, Conformis shares have been surging 72% over the last year.

SLM Solutions (OTC:SLGRF): The German-based company engages in the development, production, marketing, and sale of machines and peripheral equipment for selective laser melting. These machines operate based on 3D technology and serve the aerospace, mechanical engineering, tool construction, and automotive industries. The stock is up roughly 100% year-over-year.

These machines operate based on 3D technology and serve the aerospace, mechanical engineering, tool construction, and automotive industries. The stock is up roughly 100% year-over-year.

Data by YCharts

As briefly mentioned earlier, the ETF jumped sharply in early 2021, as the underlying stocks benefited from a momentum-driven rally in the technology market. However, after giving up some gains, the ETF has mostly traded sideways, which can be tied back to an overall rotation from growth to value stocks, after rising inflation and the reopening of the economy have made investors more cautious of technology solutions. Still, the ETF has returned 50% to investors, outperforming the broader technology market, which has gained only 35%. It has also outperformed its 'parent ETF' ARK Innovation ETF, which bundles future technologies including Genomics, Internet, Artificial Intelligence, and 3D Printing.

Defiance Quantum ETF (QTUM) has slightly outperformed the ETF, although the ETF rather concentrates on machine learning such as quantum computers and semiconductors. This is also reflected in its holdings including Analog Devices, AMD, and Ambarella. As a result of the semiconductor shortage, the ETF performed slightly better.

This is also reflected in its holdings including Analog Devices, AMD, and Ambarella. As a result of the semiconductor shortage, the ETF performed slightly better.

Attractive Valuation-Even Now

Data by YCharts

Despite the massive rally in 3D stocks, valuations remain attractive concerning the growth potential. In this regard, most 3D printing stocks in PRNT trade below 10x EV to Sales, indicating general undervaluation, IMO. HP Inc. (NYSE:HPQ) especially catches my attention, yet it should be noted that the market cap stands at $35 billion; thus, it may not be as volatile to the upside as other stocks such as Conformis, which is worth around only $220 million.

On the other hand, Bico Group and Straumann Holdings appear more pricey at 42 times Price to Sales and 17 times Price to Sales, although it should be noted that they also hold strong growth rates. Thus, from a valuation standpoint, PRNT remains attractive, although higher valuations than in past years could lead to short to mid-term weakness in the ETF's performance.

Moreover, if we compare these valuations to the main ARKK Innovation ETF, the individual holdings appear reasonably priced when accounting for growth rates and future growth aspects. While almost no securities trade above 20 times sales, the opposite can be said about ARRK's holdings, although margins and growth rates in the fund tend to be higher.

Risks

Despite the enormous opportunity of investing in a quickly-growing industry through a diversified portfolio, various risks should be considered. The commercial 3D printing industry is still relatively new and thus nowhere near saturation. It is still unclear which companies will win the race of 3D printing in the future and many new startups should arise in the next few decades.

Therefore, it is not guaranteed that PRNT ETF will include all these winners and miss out. Also, the ETF performed well in 2020 due to a broad rally in the stock market, and more specifically in Tech stocks. However, when a bear market occurs, the ETF will likely fall proportionally more, as its underlying volatility is higher.

Takeaways

3D Printing ETF is an attractive bundled fund, which deserves more attention from growth-focused investors. The 3D printing industry has more useful applications than most would imagine. The ETF offers exposure to an ultra-growing multibillion-dollar industry, including the most promising companies in the space. Unsurprisingly, investors have been rewarded mightily, as the ETF outperformed the broader market and competing ETFs. Even after an impressive surge of 3D printing stocks, valuations remain attractive, considering the industry's massive potential.

On the other hand, investors have a reason to stay cautious: While the ETF benefitted from a pandemic-induced rally among tech stocks, a higher return converts into higher risk. Thus, if the current bull market fades (or turns into a bear market), performance will reverse quickly. Either way, 3D Printing ETF remains an attractive investment opportunity and is among the only diversified ETFs concentrating solely on 3D printing.

Blue Ocean Investing focuses on finding the next big disruptors that can multiply many times over the long run. We consistently screen and research the most innovative businesses that enjoy gigantic competitive advantages and may be discounted by the market. With a membership you will gain access to:

- Portfolio and Watchlist

- Deep-dive investment research

- 24/7 Live-Chat

- Upcoming IPOs

- An interactive investment community

Get your free 14-day trial now!

This article was written by

Main Street Investor

3.95K Followers

I am a 22 year old investor with a Bachelors degree in Finance and Business. My investing strategy is focused on finding the best opportunities from every sector: value or growth - there is value in everything. For all my investment decisions I undertake extensive research, collecting relevant data, charts and graphs for the given company. The three most crucial ratios for my analysis are margins, CAGR revenue growth and marketing spend as a % of revenue. These measures are all based on 2024 estimates in order to evaluate the given moat of a company/stock. Therefore, all my investments are long-term, with the exception of large fluctuations in the fundamentals of an investment or drastic valuation changes. I hope that I am able to share some of my investment opinions with you and look forward to learning more in the process! Best regards

The three most crucial ratios for my analysis are margins, CAGR revenue growth and marketing spend as a % of revenue. These measures are all based on 2024 estimates in order to evaluate the given moat of a company/stock. Therefore, all my investments are long-term, with the exception of large fluctuations in the fundamentals of an investment or drastic valuation changes. I hope that I am able to share some of my investment opinions with you and look forward to learning more in the process! Best regards

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Comments (14)Recommended For You

To ensure this doesn’t happen in the future, please enable Javascript and cookies in your browser.

Is this happening to you frequently? Please report it on our feedback forum.

If you have an ad-blocker enabled you may be blocked from proceeding. Please disable your ad-blocker and refresh.

3D printing market. Why don't we print something new

Last year we already talked about this market, we will update the data and conduct an analysis.

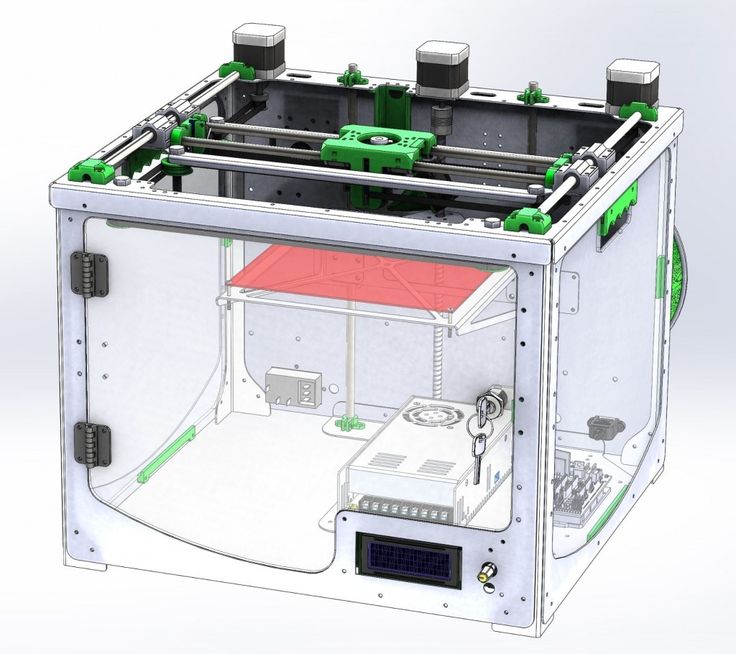

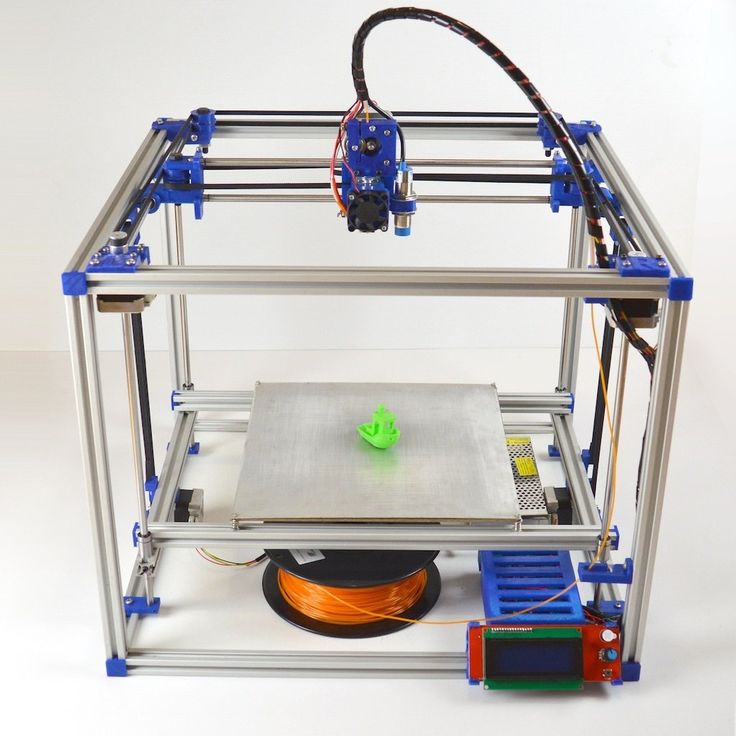

Additive manufacturing, or 3D printing, is based on the layer-by-layer creation of products of the desired shape using a three-dimensional model.

According to the Wohlers report, the 3D printing market grew by 21.2% in 2019 to almost $12 billion. problems of shortage of medical devices and personal protective equipment during a pandemic. With its help, masks, small parts and necessary devices in medicine were created. nine0009

The market is relatively small and needs to be scaled up. Now 3D printing companies are gaining popularity again. As industry representatives say, people have begun to understand the value of additive manufacturing: it is cheap, compact and mobile. In the current situation, technology has begun to develop faster, increasing capacity to meet demand.

In the current situation, technology has begun to develop faster, increasing capacity to meet demand.

Consider a few stocks in the industry and make a prediction. The goal is to maximize the benefits of the growth of the 3D sector, that is, the company should be more active in additive manufacturing. nine0009

HP Inc. Capitalization $27.6 billion

This is a well-known company for the production of computers and peripherals, including 3D printers. Additive manufacturing is not the main activity of the company, but the company has a leading position in the sector.

Total printing revenue in 1H 2020 fell by 20%. But there is a share of commercial equipment, which grew by 7% y/y. It includes office printing solutions. These include commercial products and OEM equipment, graphics solutions and 3D printing, digital manufacturing, excluding consumables. nine0009

Commercial equipment revenue accounts for 5% of the total, in the first half of 2020 - $ 0. 7 billion. The company did not disclose how much it was for 3D printing.

7 billion. The company did not disclose how much it was for 3D printing.

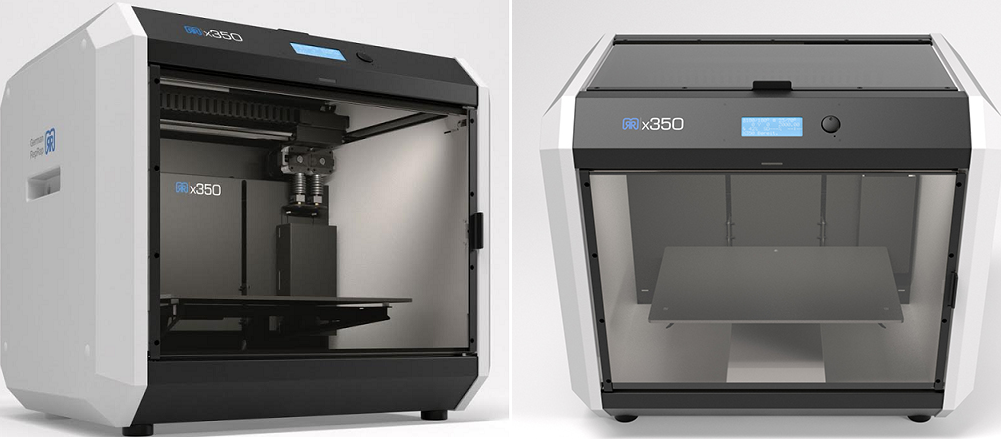

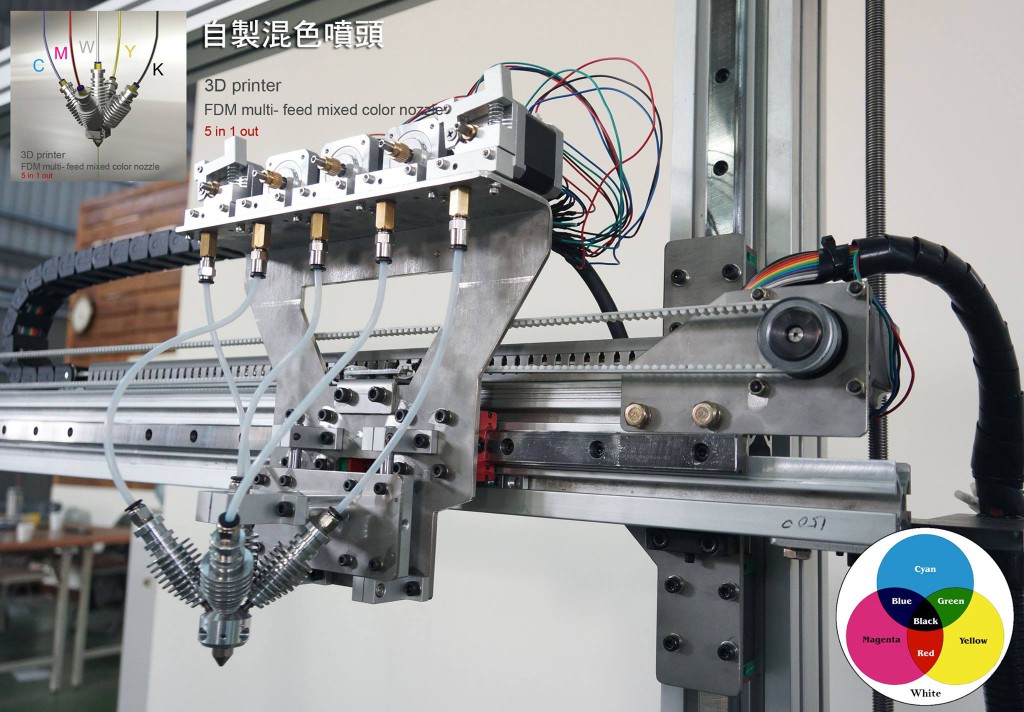

In 2014, the company developed Multi Jet Fusion technology to increase productivity and reduce the cost of professional (industrial) 3D printers. One of these models is now the most popular among industrial equipment - HP Jet Fusion 5200 3D printers.

Proto Labs . Capitalization $4.1 billion

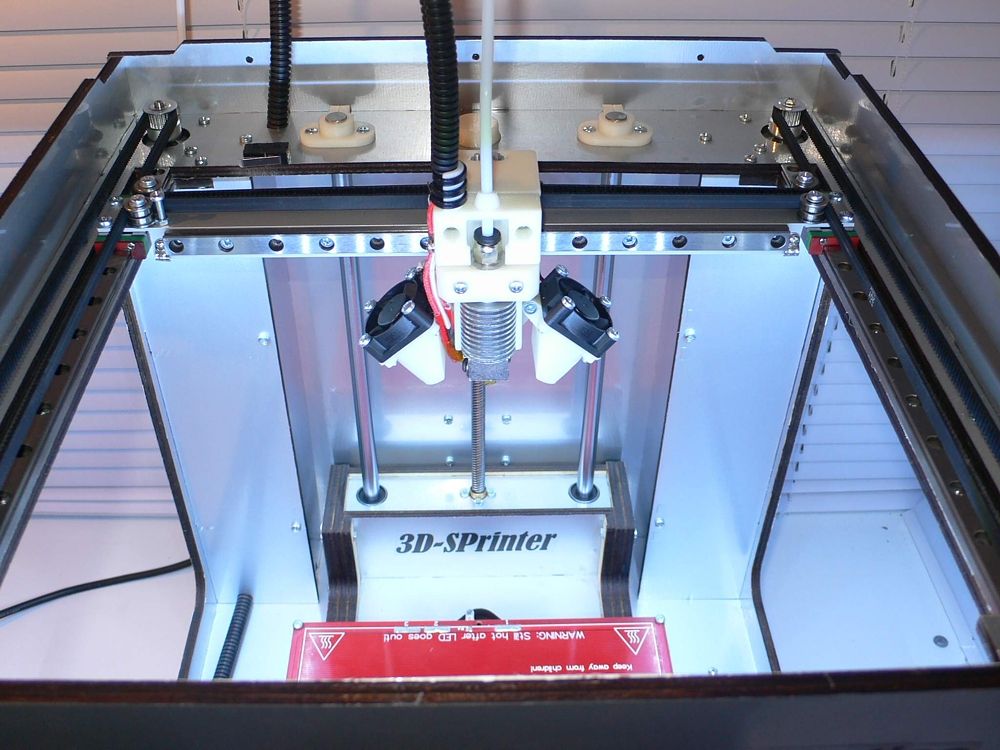

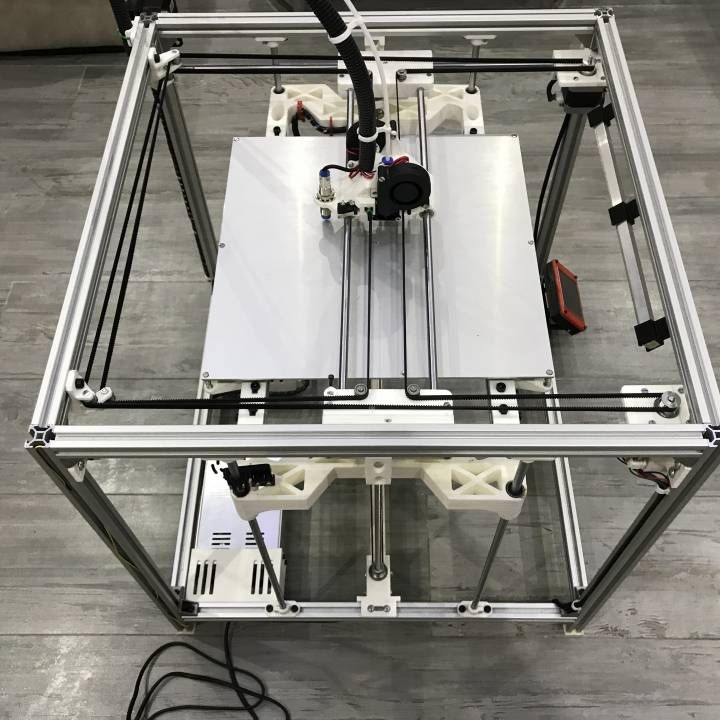

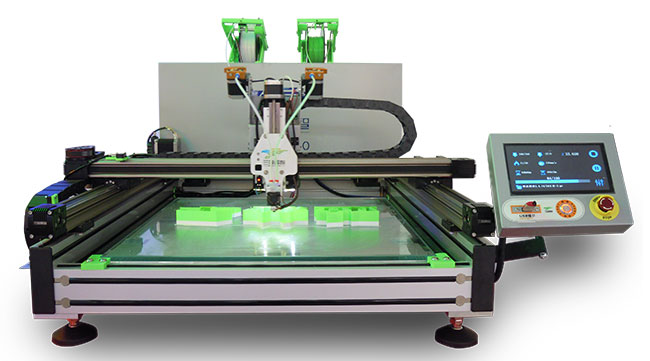

The company is engaged in industrial fabrication of products using 3D printing, computer numerical control (CNC) processing, sheet metal fabrication and injection molding . The company claims to have the fastest production.

Proto Labs products include prototyping and small-batch manufacturing. They are created at the request of large and small companies. Since the beginning of the year, quotations have grown by more than 40%. nine0009

One of the growth drivers was the development of new 3D printing technologies and new polystyrene foam material. The material is able to expand many times, which helps to overcome some limitations in the manufacture of larger parts. The company continues to invest in new 3D printing facilities, with a 50% increase in productivity expected.

The material is able to expand many times, which helps to overcome some limitations in the manufacture of larger parts. The company continues to invest in new 3D printing facilities, with a 50% increase in productivity expected.

1H 2020 revenue was $221.6 million, of which 3D printing accounted for 13.6%, or $30.1 million. 3D printing, although a relatively small share of revenue, is one of the fastest growing . nine0009

Materialize . Capitalization $2.1 billion

The Belgian company is one of the largest and independent in the field of additive manufacturing. Materialize is engaged in manufacturing in various fields, but is aimed at cooperation with the medical sector. In 2019, Materialize acquired a 75% stake in Brazilian medical device manufacturer Engimplan to expand its footprint in the fast-growing Brazilian market.

Working with 70% of the top 30 in the medical technology sector has helped the company gain a wealth of experience, leading to certifications in the medical consumables industry. This is especially important during a pandemic: the company is one of the few that meet specific requirements. nine0009

This is especially important during a pandemic: the company is one of the few that meet specific requirements. nine0009

In H1 2020, Materialize's revenue decreased by 11.7% YoY to €84.3 million.

Stratasys . Capitalization $0.7 billion

American-Israeli company, manufacturer of 3D printers and 3D manufacturing systems for office solutions aimed at rapid prototyping and direct digital manufacturing.

Operates with world leaders in the aerospace and automotive industries, pioneering medical start-ups and technology giants. Stratasys is a pioneer in developing new standards for 3D printing. nine0009

One of the printer models, the J750, was named Enterprise 3D Printer of the Year in the Resin Printer category at the 2019 3D Printing Industry Awards in London.

This year announced the release of MakerBot CoudPrint software, designed for a seamless 3D printing workflow. Remote and on-site users can prepare, queue, print, monitor and manage 3D print jobs from a centralized cloud application. nine0009

nine0009

In the first half of the year, the company received revenue of $250 million, net loss was $49 million.

3 D Capitalization $0.6 billion

The company develops, manufactures and sells 3D printers, materials for them, and also provides 3D printing services.

Like others in the industry, mainly focused on prototyping in various fields, including aerospace, automotive, medical, dental, entertainment. 3D Systems has many different technologies, products and more than 1000 patents in its arsenal. nine0009

In the first half of 2020, the company received $246.8 million in revenue, with a loss of $52.1 million. Businesses have different directions and 3D is not the main one. Given the goal, the company does not fully meet the criteria. Business diversification is a definite plus, but risks from other segments increase.

Stratasys, 3D Systems and Materialize are fully immersed in additive manufacturing, while Proto Labs has additional lines of business. nine0009

nine0009

3D Systems shares ended their uptrend at the end of 2013, at the moment the quotes have returned to the IPO level: that is, the price has been declining for 6 years, like that of Stratasys. Financial indicators do not show investment attractiveness. Companies need new growth drivers. For example, to create breakthrough technologies that will be applied in different areas, then large companies will conclude contracts.

HP continues to be the most undervalued in terms of EV/EBITDA multiple. Materialize has the highest score, but from a buying point of view, it is not attractive. Dividends are paid only by HP, this is an additional bonus. The buyback was carried out by HP and Proto Labs, which is also a positive factor for investors. nine0009

HP and Proto Labs are more attractive investments. Both companies are listed on the St. Petersburg Stock Exchange. Between the two companies, in my opinion, HP is less interesting in terms of investment in the 3D printing sector. Companies with a large presence of additive manufacturing will be better able to feel sectoral changes.

Companies with a large presence of additive manufacturing will be better able to feel sectoral changes.

About the future 3 D -prints

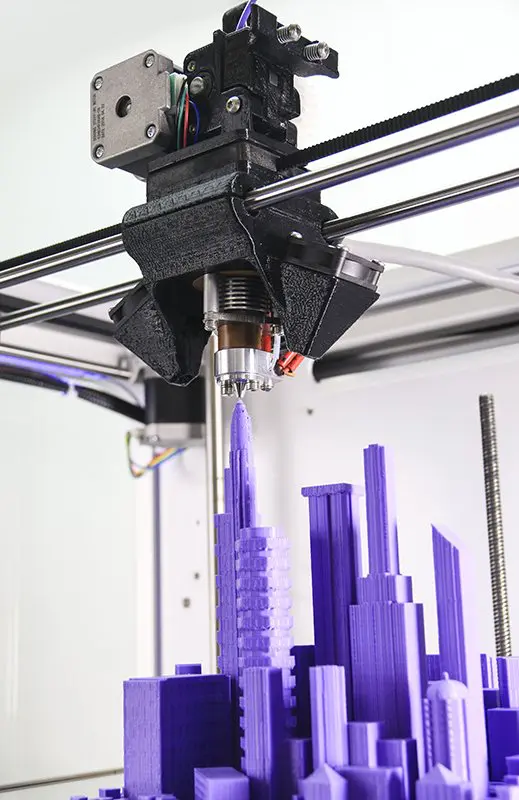

Additive Technologies magazine prepared a material on the industry trends. According to the survey, 3D printing continues to be in demand for prototyping and testing. This can be attributed to the negative impact on the sector, as the potential goes beyond prototypes and can be developed as a full-fledged production. nine0009

Product material is mainly used in the form of plastic, photopolymer and metal.

Consistency and quality control continue to be a major concern for users seeking to exploit the possibilities of 3D printing.

The use of additive technologies is convenient and developing. New materials, technologies and scales are applied, which stimulates the growth of the customer base and expands the scope.

Metal printing is one of the promising areas for additive manufacturing. The growth rate of the use of metal components for 3D printing is increasing every year. In 2019The market was valued at $772 million. CAGR is expected to be 27.8% through 2027.

The growth rate of the use of metal components for 3D printing is increasing every year. In 2019The market was valued at $772 million. CAGR is expected to be 27.8% through 2027.

Additive manufacturing has found application in a variety of areas: aerospace, defense, medical, automakers (BMW, Ford, and Volkswagen) . NASA plans to 3D print more than 80% of future rocket engines using metal systems.

View this post on Instagram

Posted by Tekhnikum (@tekhnikum_)

All of the above points to the growing potential of using additive manufacturing. The companies we singled out are participants in this revolutionary process. You should keep an eye on the news in this area, especially technological breakthroughs and new contracts.

Taking stock

3D printing has been hit hard in 2020 by the pandemic. The market is no longer growing at the same pace, but it has huge potential. nine0003 Three companies, in our opinion, worthy of the attention of investors: Proto Labs, HP and Materialize. A Belgian company has been hit hard this year and needs special attention. As the global economy recovers, the company's performance may stabilize.

HP can be seen as one of the leaders in the 3D sector, but business segmentation needs to be considered. The bonus is the payment of dividends.

Proto Labs shows good financial results. Like everyone else, Proto has been hit by the pandemic but could soon bounce back, especially with negative net debt. Research and development in the additive manufacturing market, as well as the growth of the sector as a whole, will undoubtedly have a positive impact on quotes. It is worth noting that Proto Labs works in a promising environment - metal products. nine0009

nine0009

BCS Broker

Why oilmen should now pray for 3D printing and invest in its development. And also male

Why oilmen should now pray for 3D printing and invest in its development. As well as a small retro review of the last major exhibition of 3D printing last year in Russia.

It's no secret that lately oil prices are as low as they have ever been in the entire history of mankind known to us (unless, of course, we take into account the real inflation of the dollar). And the main thing is not that prices can drop even lower, but that they will be down for a long time. It is already clear to all oil companies and governments that this cycle of low prices can go from several years to ten years. But everyone hopes that it will end, and the demand for oil will rise again. On the one hand, there is also a hypothetical peak in oil production, after which the planet's reserves will not be enough to increase the pace, and oil production will begin to fall. Different experts give different dates from 2020 to 2050. This should lead to an increase in the price of oil. On the other hand, alternative energy sources are growing fast enough, and the demand for oil may never recover to its previous volume. But even if you look from an optimistic point of view for the oil industry, it's all the same, you have to somehow survive until the period of high prices. It is even harder to live this period for countries dependent on oil. Using the example of the Russian Federation, which is at the forefront of these countries, one can see that it is becoming more and more difficult to live to see a bright oil tomorrow, as the national currency is hopelessly looking for a bottom, and social spending has to be reduced, which threatens to lose the power of the oil lobby and generally destroy the state and business. So what should oilmen and state officials do so that tomorrow they don't take away their business, or even worse, put them up against the wall? Often in difficult situations, statesmen and big corporate bosses turn to historical experience in search of already tested ways out of similar situations.

Different experts give different dates from 2020 to 2050. This should lead to an increase in the price of oil. On the other hand, alternative energy sources are growing fast enough, and the demand for oil may never recover to its previous volume. But even if you look from an optimistic point of view for the oil industry, it's all the same, you have to somehow survive until the period of high prices. It is even harder to live this period for countries dependent on oil. Using the example of the Russian Federation, which is at the forefront of these countries, one can see that it is becoming more and more difficult to live to see a bright oil tomorrow, as the national currency is hopelessly looking for a bottom, and social spending has to be reduced, which threatens to lose the power of the oil lobby and generally destroy the state and business. So what should oilmen and state officials do so that tomorrow they don't take away their business, or even worse, put them up against the wall? Often in difficult situations, statesmen and big corporate bosses turn to historical experience in search of already tested ways out of similar situations. Let's turn to them. nine0009

Let's turn to them. nine0009

At the end of the 19th century, Rockefeller was the largest oil monopoly in the United States. He had a very large market for kerosene for lamps. At that time, kerosene lamps burned in every house. But something terrible happened, Edison invented the electric incandescent lamp, and the magnate Morgan invested big money to promote electricity. From that moment on, it became clear to Rockefeller that his oil empire was in for an imminent collapse. However, a way out was found from an unexpected side. There was an internal combustion engine for cars and Henry Ford appeared with his idea of a mass car. Rockefeller immediately realized that his almost lost empire, on the contrary, would increase if he supported Ford. Ford had competitors on the way to implementing his idea, these were other manufacturers of non-mass-produced cars, as well as electric cars, but he defeated them not without the help of friends. Now, perhaps it is clear why Ford and Rockefeller were good friends. nine0009

nine0009

From this historical experience, it is clear that the oil industry needs to look for an analogue of the mass car in modern times and the new Heinrich Fords. It is clear that now you can’t put it on a car. Cars have long been massive, besides, they are increasingly economical in terms of gasoline consumption. And the market for electric vehicles is growing at an accelerated pace. So we can say that, at best, cars in the near future will consume as much gasoline as they do now. Of course, there is another option with unleashing a war and thus eliminating competitors (other oil-producing countries and corporations). But war is a risky business and often with unpredictable results (for example, turning an imperialist war into a civil one). nine0009

There is a way out: this is 3D printing. Most 3D printers in the world currently run on plastic made from petroleum. And there is more good news: the 3D printing market is growing at almost 50% per year. There is only one problem, in order to really cover the demand in oil, it is necessary to have a 3D printer in every home, and 3D printing has become a hypermass hobby and business. How to achieve this in two years (after all, the Russian Federation can stretch, according to most experts, no further than 2017, after which destabilization and complete economic collapse are inevitable)? nine0009

How to achieve this in two years (after all, the Russian Federation can stretch, according to most experts, no further than 2017, after which destabilization and complete economic collapse are inevitable)? nine0009

We need to act on at least two main fronts. The first is support for 3D printing PR in the media. So far, the vast majority of the media in the Russian Federation is controlled by the government, and it is in their interests to save oil workers, since they are a very large budget replenishment item. It is necessary every day instead of reports from the oil markets, exchange rates, cunning plans and other things, to spin reports about 3D printing. It is necessary to place advertisements for 3D printers instead of cars and iPhones. It is necessary to drive in the younger generation that having a 3D printer at home is cool, and if you don’t have a 3D printer, you are a sucker and not a single girl will give you, because you can’t print her a heart or any other trinket. At each meeting of the Duma and the government, each official should have a working 3D printer on their desks. Every school, technical school, lyceum and institute should have a 3D printer behind every desk. Every Internet blogger on the Kremlin salary must write 1000 posts a day about 3D printing. It would not be superfluous to make several educational films for the mass audience in the genres: melodrama, crime, series, comedy with 3D printing in the center of events. As we remember, at one time the films "Brigada" and "Boomer" determined the demand for BMW cars and various jeeps of a huge number of people. And glamorous television series make women buy various branded clothes. For this case, you can attract already well-known domestic brilliant directors and actors. For example, Bezrukov could star in another sequel to the Brigade, where his children smuggle a German 3D printer for metal and make drones in the garage for a PMC howling in Mexico with damned Pindos, and not conscious corrupt officials are trying to stop them, so how they still earn extra money as agents of the State Department and at the same time as the sixth column.

At each meeting of the Duma and the government, each official should have a working 3D printer on their desks. Every school, technical school, lyceum and institute should have a 3D printer behind every desk. Every Internet blogger on the Kremlin salary must write 1000 posts a day about 3D printing. It would not be superfluous to make several educational films for the mass audience in the genres: melodrama, crime, series, comedy with 3D printing in the center of events. As we remember, at one time the films "Brigada" and "Boomer" determined the demand for BMW cars and various jeeps of a huge number of people. And glamorous television series make women buy various branded clothes. For this case, you can attract already well-known domestic brilliant directors and actors. For example, Bezrukov could star in another sequel to the Brigade, where his children smuggle a German 3D printer for metal and make drones in the garage for a PMC howling in Mexico with damned Pindos, and not conscious corrupt officials are trying to stop them, so how they still earn extra money as agents of the State Department and at the same time as the sixth column. And for detective stories, a 3D printer is just a storehouse, since criminals can make disposable plastic pistols, but the police are also not badly sewn and understand 3D printing, they know which printer printed the plastic and where the criminal got the consumables. New movie titles will appear on movie posters: the socio-political action movie Consumables; fantastic blockbuster "Extruder", fantasy "Print Stalin", etc. However, Russian directors are simply Atlanteans in this matter, so I will not advise them. Like no one else, they feel the wind of change and immediately line up to meet the demands of the time. nine0009

And for detective stories, a 3D printer is just a storehouse, since criminals can make disposable plastic pistols, but the police are also not badly sewn and understand 3D printing, they know which printer printed the plastic and where the criminal got the consumables. New movie titles will appear on movie posters: the socio-political action movie Consumables; fantastic blockbuster "Extruder", fantasy "Print Stalin", etc. However, Russian directors are simply Atlanteans in this matter, so I will not advise them. Like no one else, they feel the wind of change and immediately line up to meet the demands of the time. nine0009

The second direction is the search and support of new Henry Fords. You can take several of the largest domestic manufacturers of 3D printers, such as Picaso, and help them organize the hyperproduction of cheap 3D printers, costing no more than 10,000 rubles, so that any person from the outback can afford them. It is also necessary to organize the mass production of consumables, i. e. bobbins with plastic thread for 3D printers. Now the cost of one babin is from 600 rubles to 3000 rubles, and this is just a gold mine. You can sell consumables for 400 rubles per 1 kg (one reel). When creating a cheap 3D printer, we will be able to export it to all countries of the world, including China (taking into account the current exchange rate of the ruble against the dollar), thereby raising oil consumption on the entire planet. Also, in order not to drag chestnuts out of the fire alone, it is necessary to agree on the support of 3D printing with other oil corporations and countries. nine0009

e. bobbins with plastic thread for 3D printers. Now the cost of one babin is from 600 rubles to 3000 rubles, and this is just a gold mine. You can sell consumables for 400 rubles per 1 kg (one reel). When creating a cheap 3D printer, we will be able to export it to all countries of the world, including China (taking into account the current exchange rate of the ruble against the dollar), thereby raising oil consumption on the entire planet. Also, in order not to drag chestnuts out of the fire alone, it is necessary to agree on the support of 3D printing with other oil corporations and countries. nine0009

Now let's do some math. Each 1 kg of plastic thread is about 5-10 kg of oil (and it takes about 2 liters of oil to create 1 liter of gasoline). One 3D printer will consume this consumable on average once every three days, and a car will consume 6-8 liters of gasoline per day on average. Yes, oil consumption in a car is higher on average per day, but imagine how much oil tens of millions of 3D printers will spend per day? In fact, we can say that three 3D printers are equal in terms of oil consumption to one car. Even if our calculations have an error of plus or minus 50%, this is still a significant demand for oil. nine0009

Even if our calculations have an error of plus or minus 50%, this is still a significant demand for oil. nine0009

And what about ordinary citizens of the Russian Federation and, in general, all other ordinary people on planet Earth? There is no need to wait for the weather with oil and hope that world markets will come to a good state, and military conflicts will resolve themselves. It is necessary to prepare an entry into the coming post-industrial society for yourself. Regardless of whether oilmen or states fit into the new world, you and your children must fit into it. To do this, it’s not bad to take 3D modeling and 3D printing courses yourself. And send your children to 3D printing circles. For example, in Moscow there are centers for youth and creativity (TsMITy), where children are still accepted free of charge (for example, TsMIT Academy). nine0009

And now a little about the 3D-Expo exhibition of 3D printing and other 3D technologies that took place in November last year in Moscow.

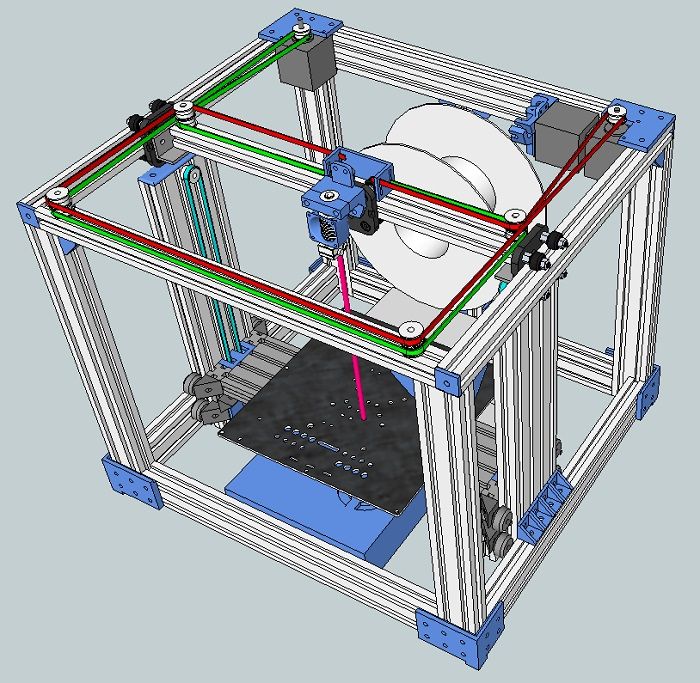

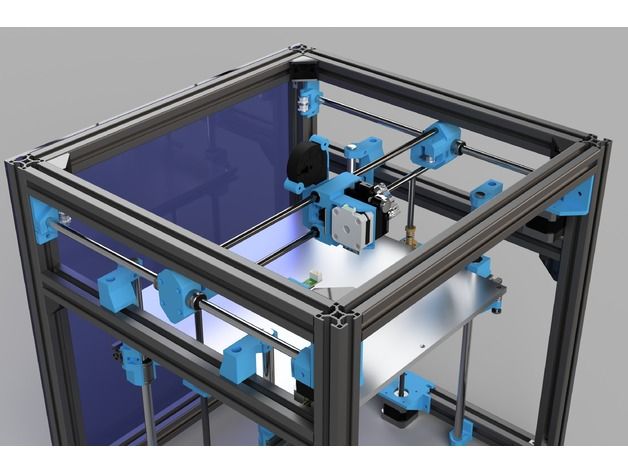

The exhibition itself pleasantly surprised me. Still, I did not expect that there would be Russian companies involved in new areas in 3D printing. For example, Russian companies involved in 3D construction, making molds for pouring metal with a sand 3D printer, etc. were presented. Also pleased with the increase in the number of very large 3D printers. In general, see for yourself:

Such a huge 3D printer prints UAV cases and much more.

Children love to work with 3D pens and make a bunch of three-dimensional drawings, but we must not forget that the nozzle of the pen is hot, so adult supervision is required, they also teach children. (Note to oil workers, children are very fond of toys made on a 3D printer or with a 3D pen and are ready to receive them and participate in the process of their creation at least every day, and adults do not need to buy a new Chinese toy every time, but only consumables, than will support the domestic oil and oil refining industry). nine0170

nine0170

Children also dream of having a toy character of their favorite computer game. 3D printers provide this opportunity without problems. (Farewell to China, hello to domestic oilmen).

Domestic construction 3D printer. Already able to print one-story boxes for houses. (Goodbye Turkish workers, hello Russian robots).

Parts made of different composites are used in shipbuilding, aircraft building and other areas. Complete import substitution of components is possible. (Sanctions are not terrible. You can make your own cheaper and high-quality drilling rigs). nine0009

The robot draws in 3D pictures, exact copies of the originals and even better, because the colors are fresh and the strokes are perfect. (A possible cultural boycott from the West does not threaten, since we can reproduce any Louvre in our country and even better than the original).

Large 3D printer makes large items. (Really, after that, do we need Chinese vases? And how much oil will it take to make such a vase? And how many such vases can a woman demand from a man, if the flight of fancy is not limited, since there are tens of thousands of vases on the Internet on the websites of banks of 3D models, and Is the material for manufacturing cheap? nine0009

Musical instruments also perfectly replace imports.

Using a color plaster 3D printer, you can print models of buildings, refineries or temples immediately in color. (This reduces the cost of developing buildings, which increases the efficiency of designing technological industries and strengthens spiritual bonds).

Russian robots will solve the problem of illegal labor. (I wonder how much oil it will take to print the bodies and parts of several million robots?)

Domestic medical 3D scanners and 3D printers make it possible to treat not only teeth, but also make artificial tracheas and other organs. (Our medicine is afraid of the sanctions blockade or the collapse of the ruble).

Parts for this machine were printed on the most ordinary Picaso 3D printer. And the body of the machine was also printed on a larger printer. (Who said that without Western spare parts, cars on Russian roads will stop forever? Most spare parts can be made of plastic. The cost of such spare parts is a penny, and therefore the service life is not so important.