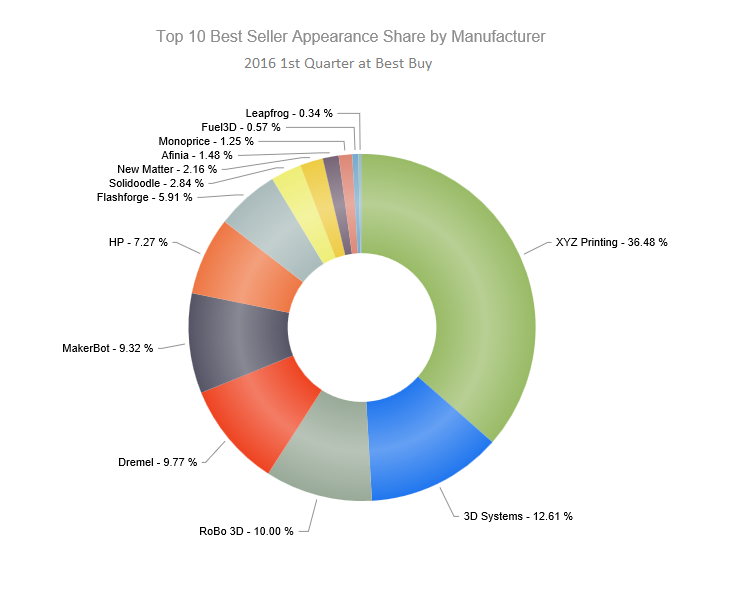

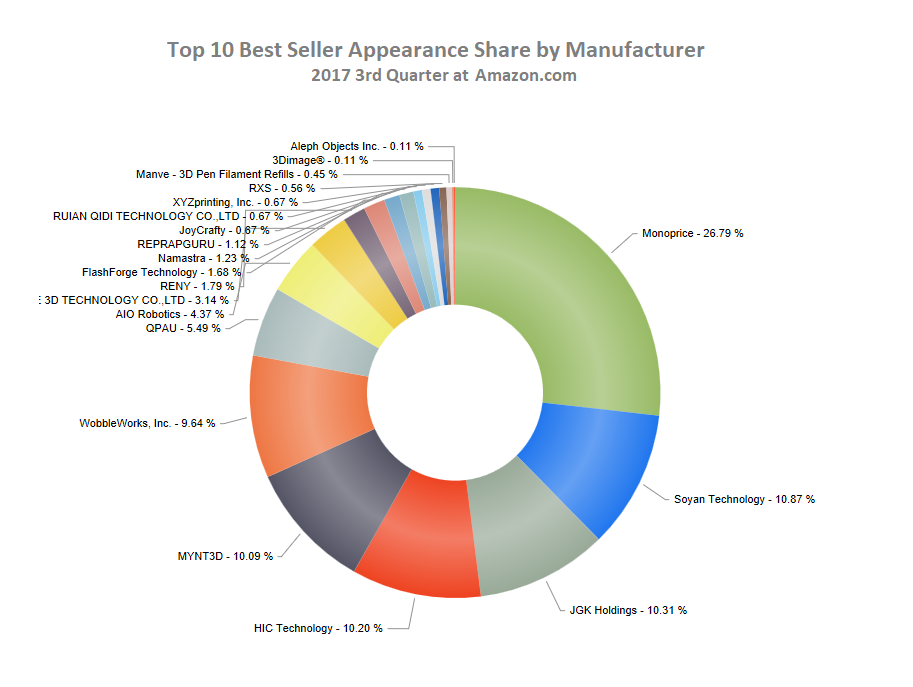

3D printer manufacturers market share

With 21% CAGR, 3D Printing Market Size Worth USD 77.83

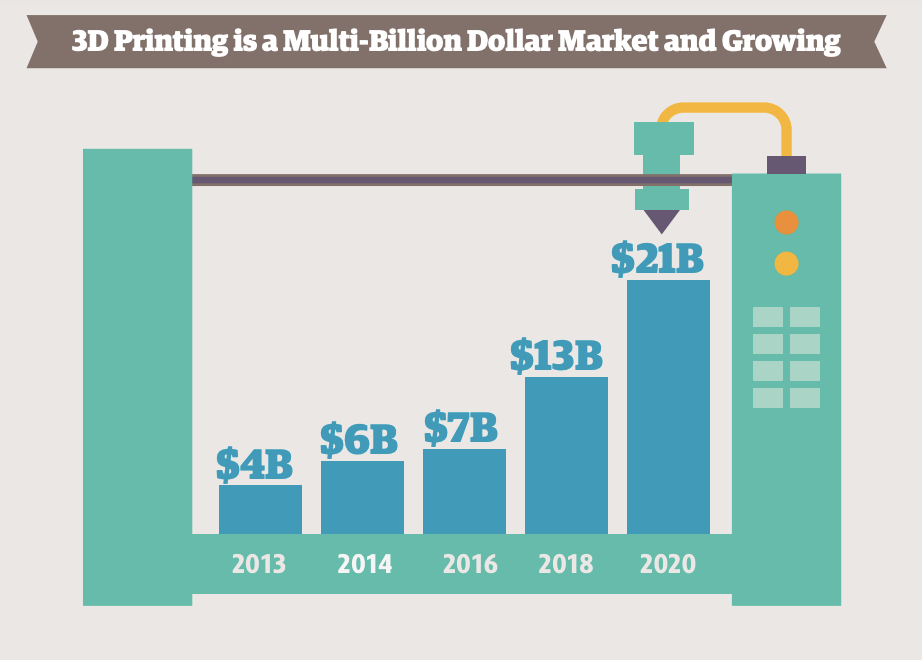

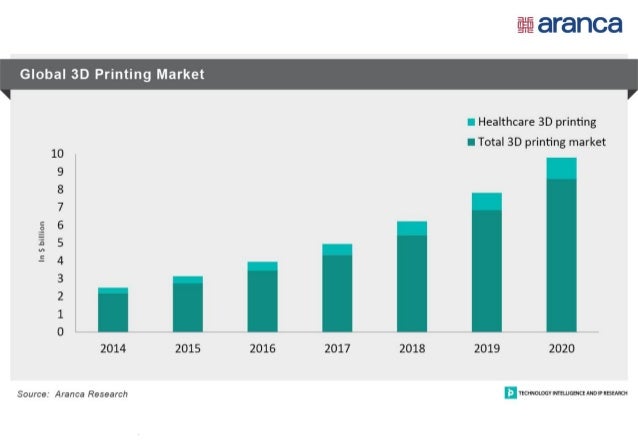

As per the global industry report by Strategic Market Research, the Global 3D Printing Market Size is projected to reach USD 77.83 billion in 2030, growing at a CAGR of 21% during the forecast period, 2021-2030. The Ongoing R&D along with the rising demand of prototypes for various business applications like healthcare, aerospace, automotive etc. to drive the growth, confirms Strategic Market Research. Companies profiled in the report are HP Inc., 3D Systems Inc., Envision TEC Inc., Autodesk Inc., Materialize, Canon Inc. and Stratasys Ltd, among others.

| Source: STRATEGIC MARKET RESEARCH LLP STRATEGIC MARKET RESEARCH LLP

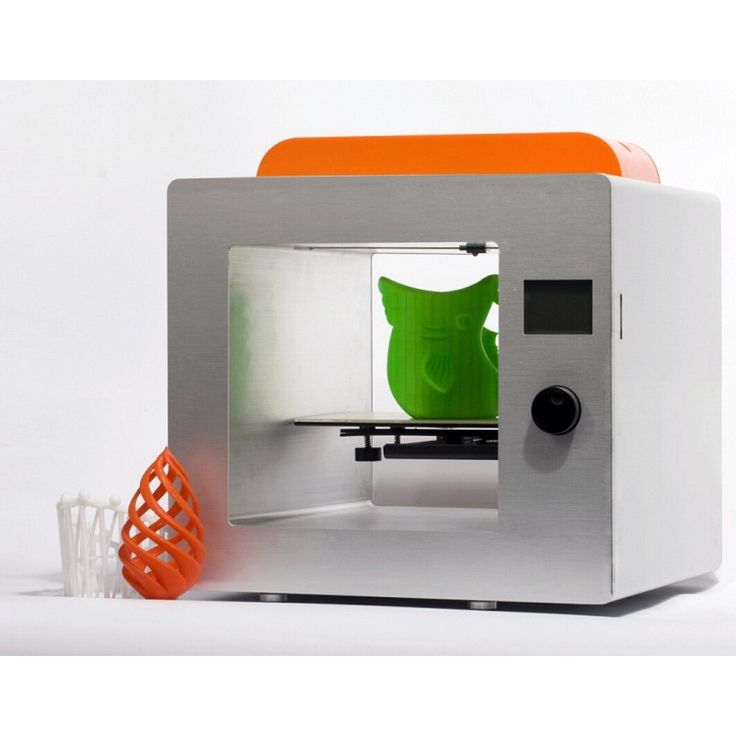

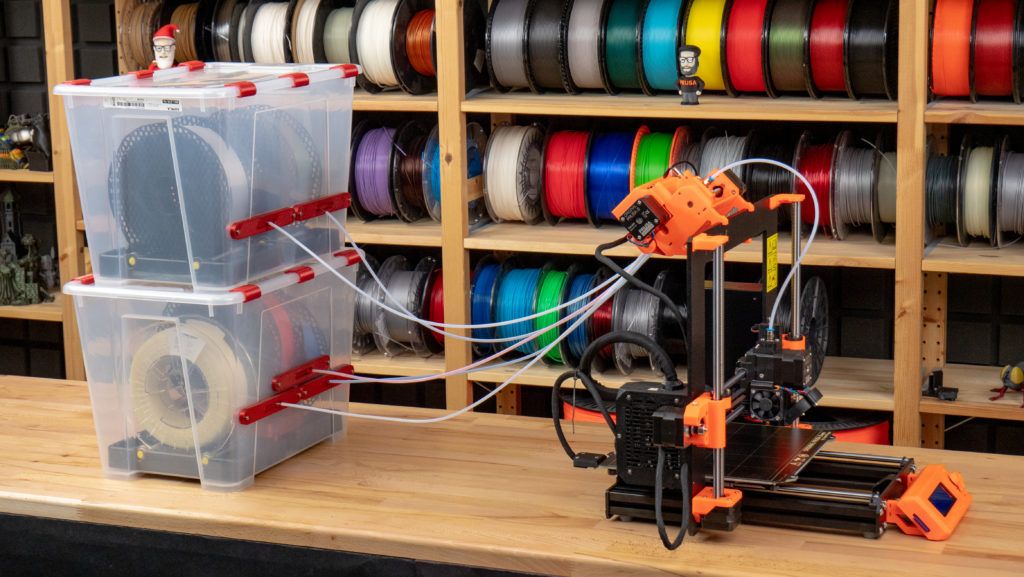

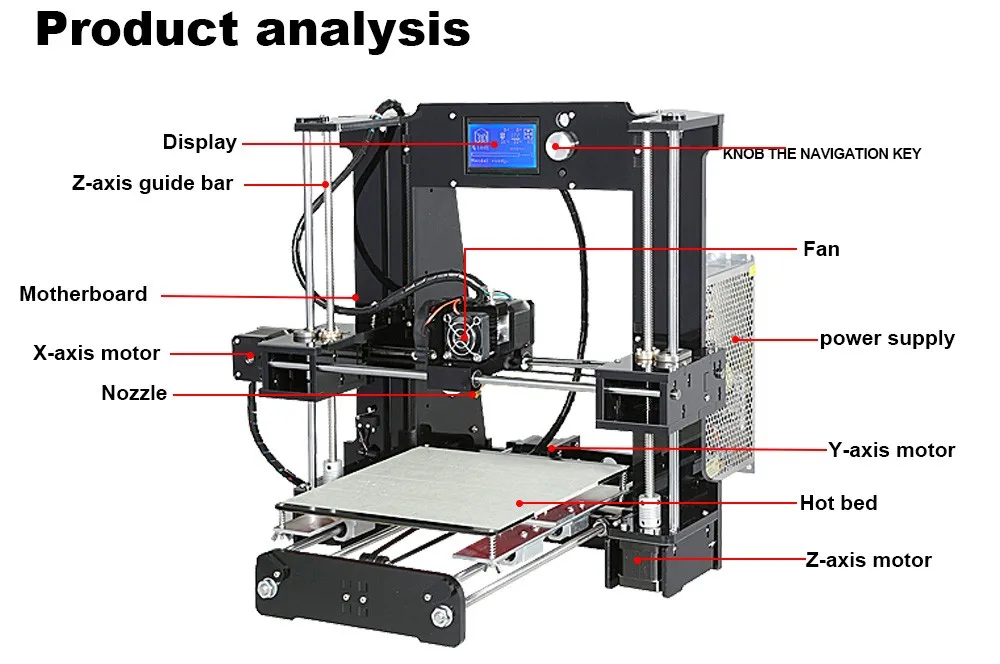

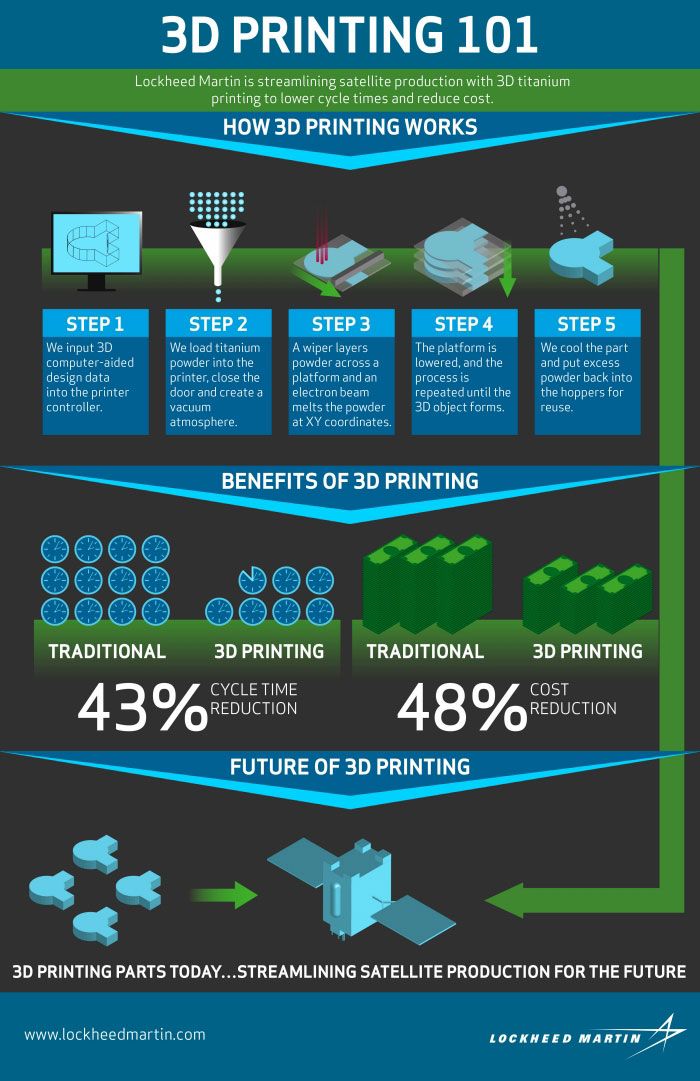

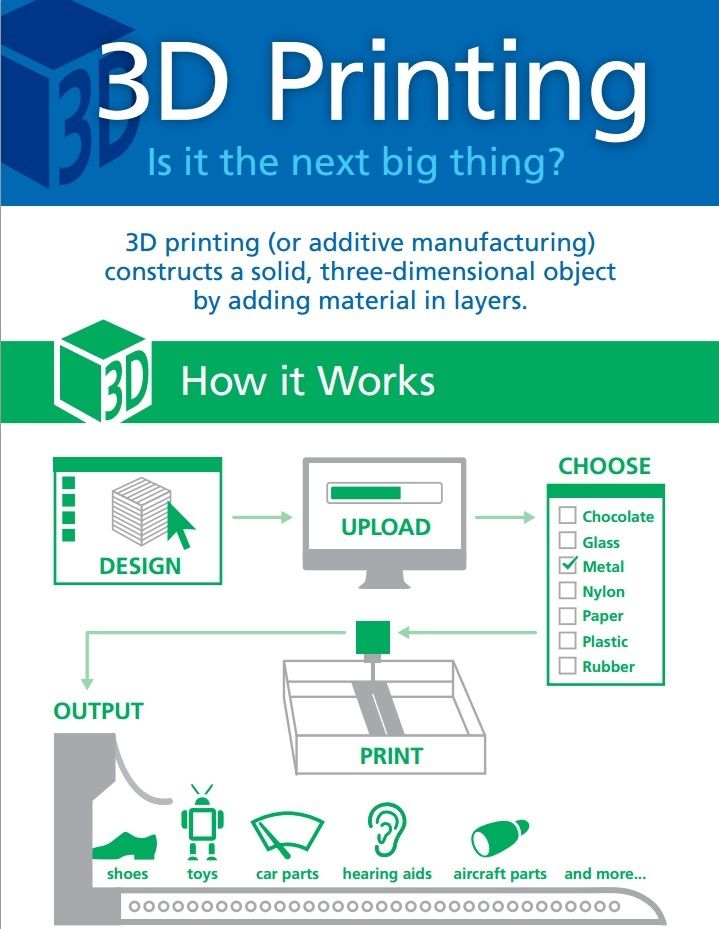

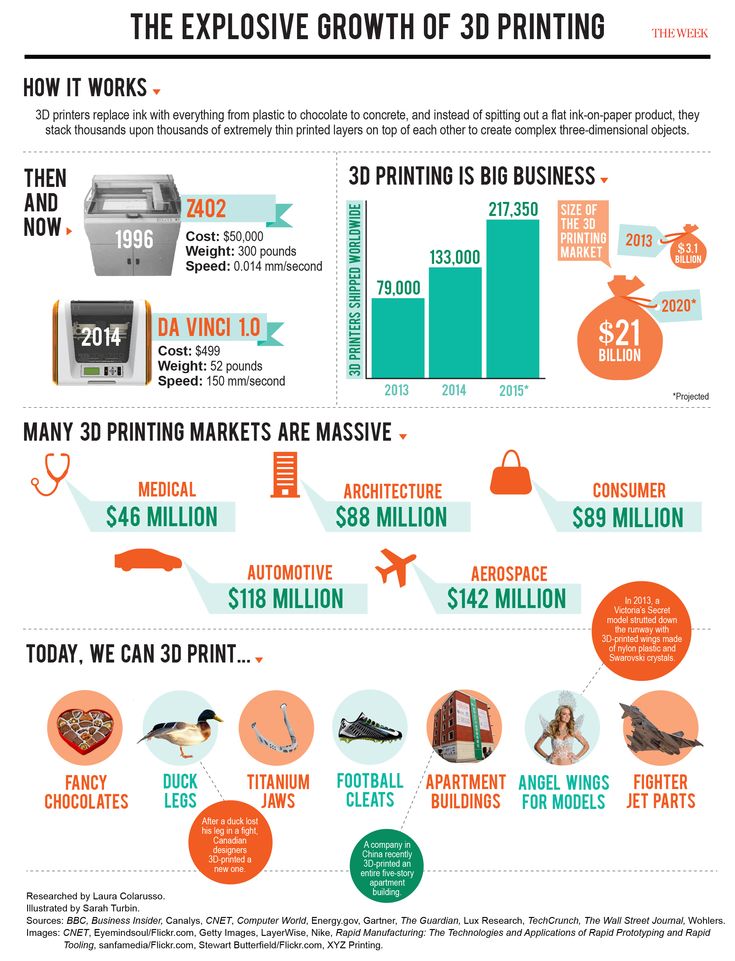

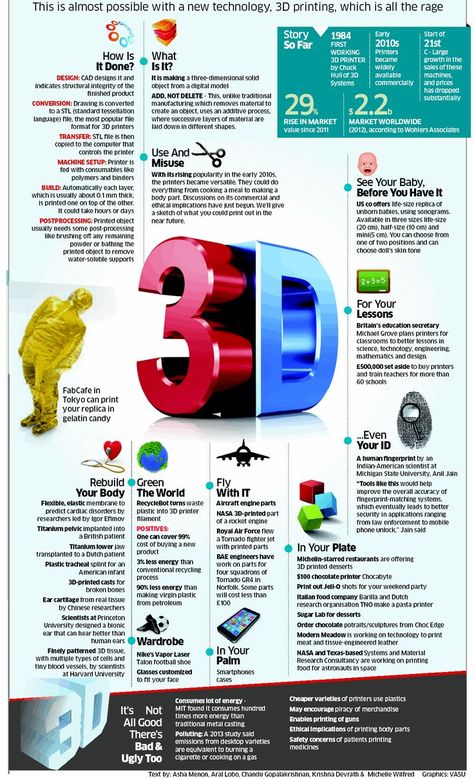

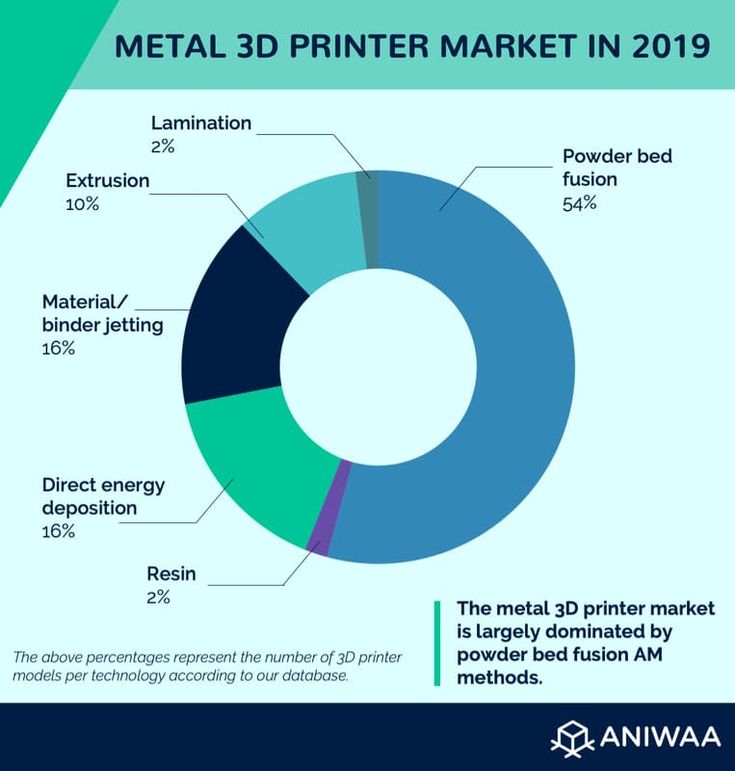

New York, USA, Oct. 04, 2022 (GLOBE NEWSWIRE) -- The Global 3D Printing Market value in 2021 was USD 14 billion, and by 2030 it will be worth USD 77.83 billion with a 21% CAGR. The technique of creating a three-dimensional solid object from a digital file or computer-aided design (CAD) model is known as 3D printing. It is also known as additive printing, desktop fabrication, or additive manufacturing since the product is built up using several thin layers of material. Powder Bed Fusion, Material Jetting, Binder Jetting, Directed Energy Deposition, Material Extrusion, Vat Photopolymerization, and Sheet Lamination are some of the processes used to develop an object.

To get a first-hand overview of the report, Request a Sample at

https://www.strategicmarketresearch.com/request-sample/3d-printing-market

3D Printing Market Insights:

- On the basis of printer type, in 2021, the industrial printer segment held a dominant position with a market share of over 70%.

- In 2021, the stereolithography segment recorded a maximum revenue share of more than 8.0% on the basis of technology.

- In terms of software, with a market share of more than 30%, the design software segment held a significant position in 2021.

- The prototyping segment in 2021 held a dominant position with a revenue share of nearly 55% in terms of application.

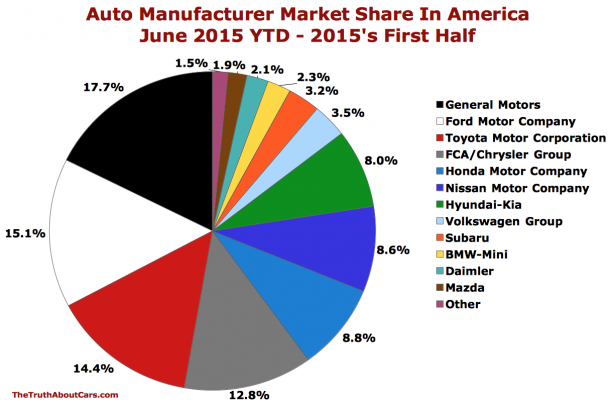

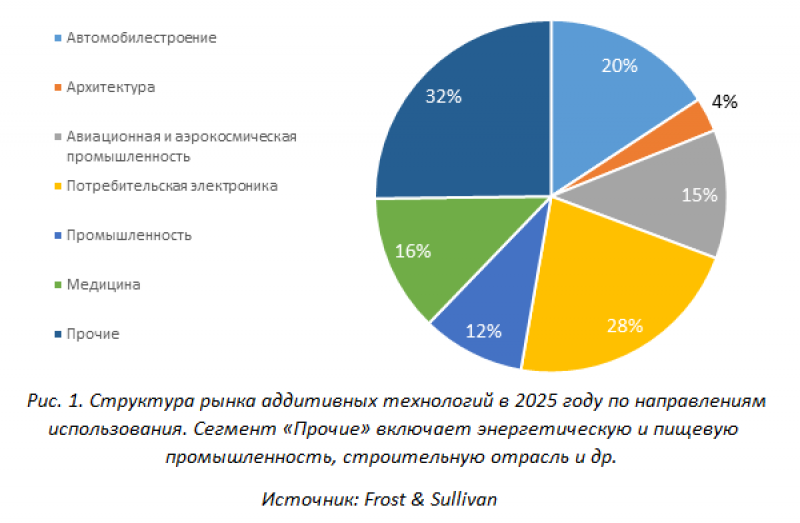

- In 2021, the automotive segment ruled the overall market with a share of more than 20% in terms of vertical.

- On the basis of materials, in 2021, the metal segment held a significant position with the largest market share of more than 50%.

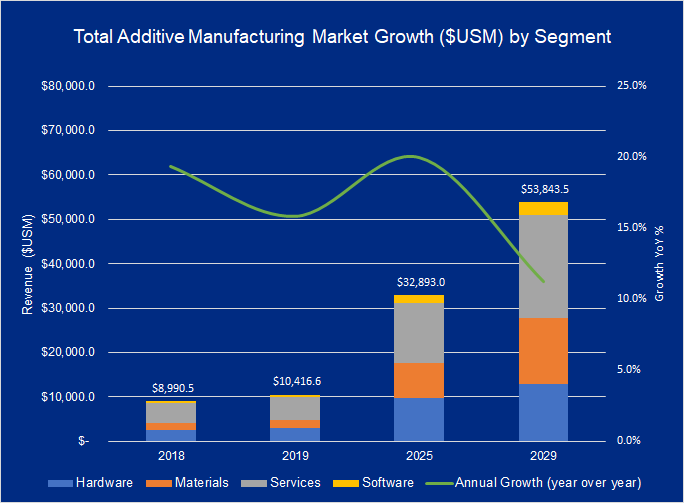

- By components, in 2021, the hardware segment held the highest revenue share of over 60%.

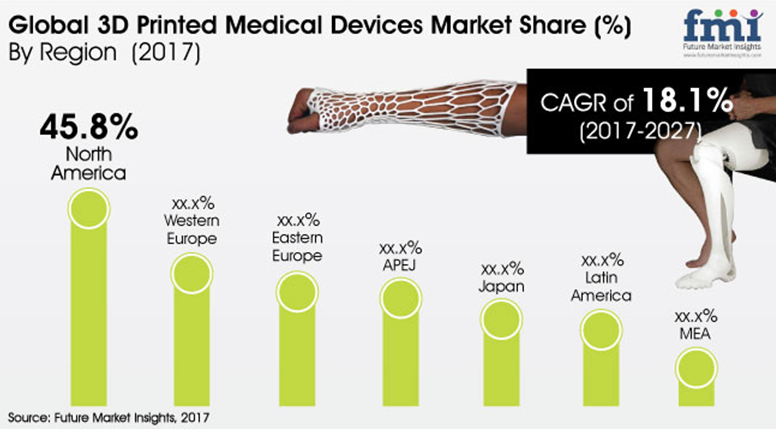

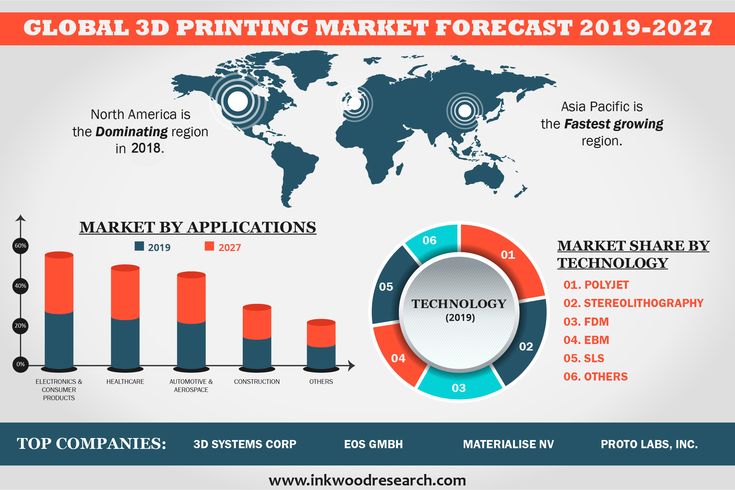

- North America ruled the overall market by region, with a market share of approximately 30% in 2021.

Factors influencing the 3D Printing Market growth:

Factors like the increasing investment by the government in R&D and technological advancement are augmenting its growth rate.

- Governments all around the world have already begun to engage in 3D printing research and development, which has resulted in a good response to technological spread and acceptance. For example, the Dutch government has invested USD 150 million in its research and innovation budget for 3D printing.

- Various technology developments, such as ML and AI, are accelerating the adoption of 3D printing machines by enabling automated printing for effective production. For example, at Formnext 2019, Additive Manufacturing Technologies (AMT), a UK-based company, launched its innovative Digital Manufacturing Systems in November 2019. It offers an automated digital solution for the full manufacturing workflow using AMT's patented technologies.

Make a Direct Purchase of the latest 3D Printing Market Report published in the month of Sep-2022. Click the below link to initiate the purchase:

https://www. strategicmarketresearch.com/buy-now/3d-printing-market

strategicmarketresearch.com/buy-now/3d-printing-market

3D Printing Market: A thorough Segmentation Analysis

The worldwide 3D Printing Market segmentation has been done on the basis of printer type, technology, software, application, vertical, material, component, and region.

By Printer type:

- Industrial

- Desktop

By Technology

- Selective Laser Sintering

- Polyjet/Multijet Printing

- Fused Deposition Modelling

- Electron Beam Melting

- Stereolithography

- Digital Light Processing

- Direct Metal Laser Sintering

By Software

- Inspection Software

- Printer Software

- Design Software

- Scanning Software

By Application

- Prototyping

- Tooling

- Manufacturing Functional Parts

By Vertical

- Desktop 3D printing

- Fashion and Jewellery

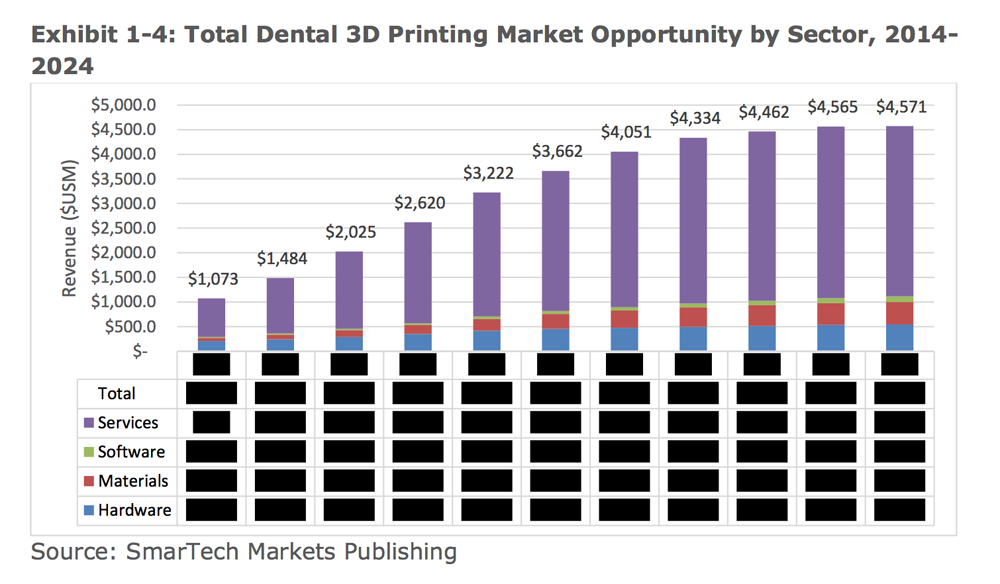

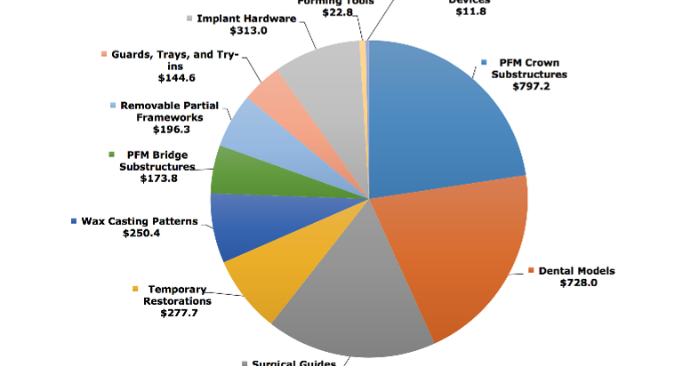

- Dental

- Educational Purpose

- Object

- Food

- Industrial 3D printing

- Healthcare

- Consumer Electronics

- Aerospace and Defence

- Industrial

- Automotive

- Power and Energy

- Others

By Material

- Thermoplastics

- Photopolymer

- Plastic

- Ceramics

- Metal

- Other Materials

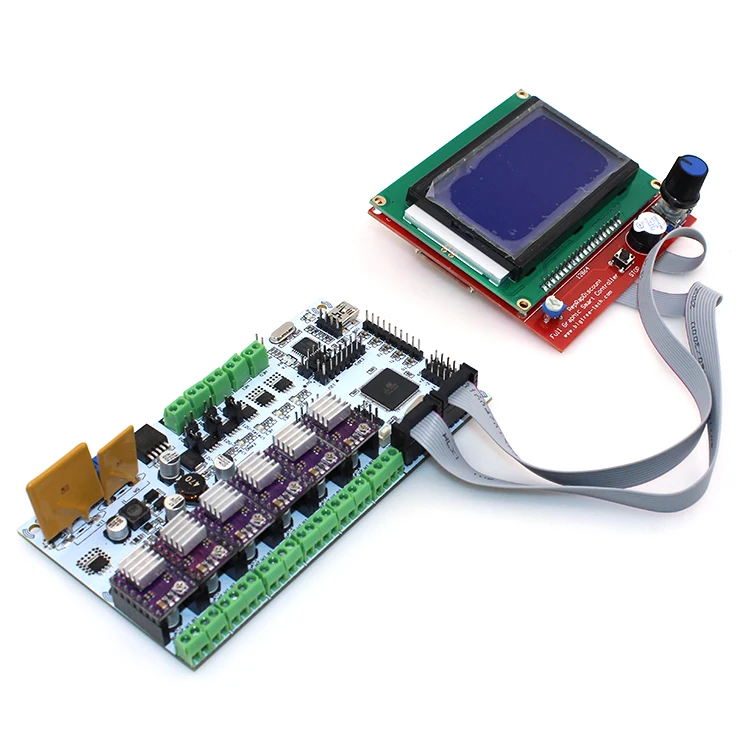

By component

- Hardware

- Service

- Software

By Region

North America

- Canada

- United States

- Mexico

Europe

- United Kingdom

- France

- Germany

- Italy

- Rest of Europe

Asia Pacific

- Japan

- India

- China

- South Korea

- Rest of Asia Pacific

Rest of the world

- Africa

- Middle East

- South America

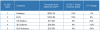

| Report Attribute | Details | |

| Forecast Period | 2020 – 2030 | |

| 3D Printing Market size value in 2020 | USD 14 Billion | |

| 3D Printing Market Size forecast in 2030 | USD 77. 838 Billion 838 Billion | |

| 3D Printing Market Growth rate | 21 | % |

| The base year for estimation | 2020 | |

| Historical data | 2017 - 2020 | |

| Segments Covered | Component, Application, Software Insight, Material Type, Technology, Region | |

| Regional scope | Europe, APAC, North America, Rest of the World | |

| Country scope | Italy, Germany, France, United Kingdom, Rest of Europe, Mexico, United States, Canada, South Korea, China, India, Japan, Rest of Asia-Pacific, South America, Africa, Middle East | |

| Key companies profiled | The ExOne Company, Autodesk Inc, GE Additive, Made In Space, Voxeljet AG, Stratasys Ltd, Canon Inc, Materialise, Autodesk Inc., EnvisionTEC Inc, 3D Systems Inc, HP Inc | |

Before initiating a purchase, make a Pre-order enquiry and get a detailed overview of the content of the report.

https://www.strategicmarketresearch.com/pre-order-enquiry/3d-printing-market

On the basis of printer type, in 2021, the industrial printer segment held a dominant position with a market share of over 70%. The widespread use of industrial printers in large industries, such as electronics, aerospace & defense, automotive, and healthcare, are the factors responsible for the significant market share of industrial 3D printers. Some of the most popular industrial applications among these industry verticals include designing, prototyping, and tooling. Therefore, the industrial printer segment will maintain its position in the coming years.

In 2021, the stereolithography segment recorded a maximum revenue share of more than 8.0% on the basis of technology. Stereolithography is among the oldest and most widely used printing processes. The benefits and ease of implementation related to stereolithography technology are promoting its adoption, research and development activities carried out by industry researchers and experts, and technological advancements are creating opportunities for various effective and dependable technologies. Because of its widespread adoption of technology across several 3d Printing processes, the Fused Deposition Modelling also contributed to a significant market share in 2021.

Because of its widespread adoption of technology across several 3d Printing processes, the Fused Deposition Modelling also contributed to a significant market share in 2021.

In terms of software, with a market share of more than 30%, the design software segment held a significant position in 2021. Design software is used to create designs for printed objects, primarily in the automotive, aerospace and military, and construction and engineering industries. The printer's hardware is connected to the objects that will be printed via design software. The scanning software segment is expected to grow at a CAGR of 21.5%, owing to the increasing adoption of scanners during the forecast period.

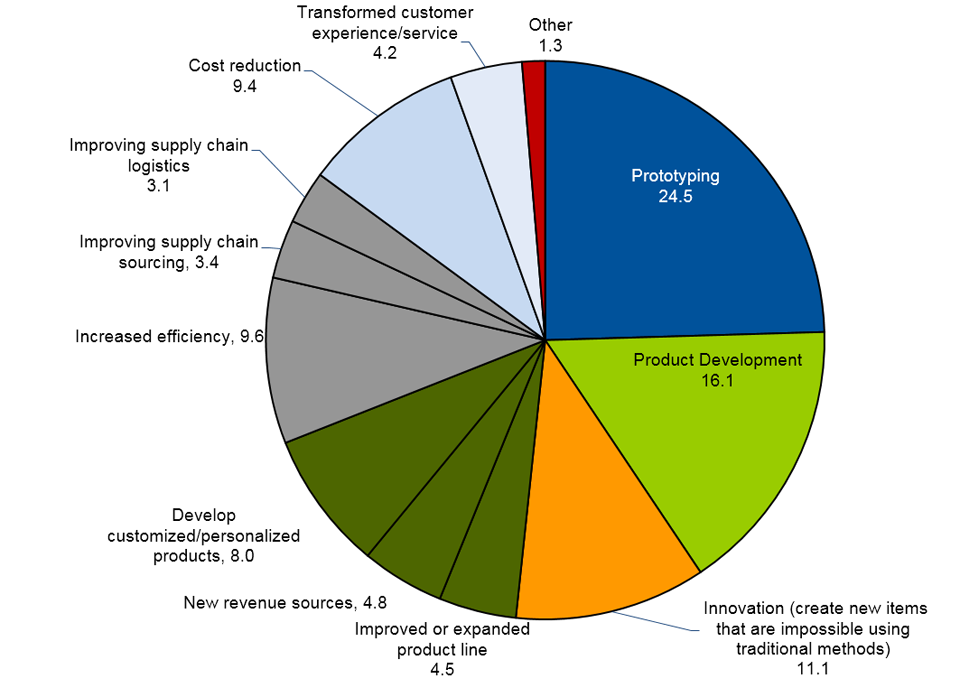

The prototyping segment in 2021 held a dominant position with a revenue share of nearly 55% in terms of application due to the extensive use of prototype processes in various industries. Prototyping is broadly used in defense & aerospace, and automotive industries to design and build critical systems, parts, and components. Manufacturers use prototyping to achieve improved accuracy and build more durable end products. As a result, the prototyping category will likely maintain its market position during the projected period.

Manufacturers use prototyping to achieve improved accuracy and build more durable end products. As a result, the prototyping category will likely maintain its market position during the projected period.

On the basis of materials, in 2021, the metal segment held a significant position with the largest market share of more than 50%. Furthermore, it is estimated that the metal segment will remain ahead during the forecast period and expand at the greatest CAGR. In 2021, the polymer segment occupied the second-largest market revenue. The ceramic material segment is destined to increase significantly during the projected period.

By components, in 2021, the hardware segment held the highest revenue share of over 60%. The increased importance of quick prototyping and improved production processes has boosted the hardware industry significantly. Factors such as increased consumer electronics usage, lower labor costs, rapid industrialization, enhanced civil infrastructure, and rapid urbanization influence this market segment's growth rate.

North America ruled the overall market by region, with a market share of approximately 30% in 2021 due to the widespread use of additive manufacturing.

North American countries like Canada and United States have been early consumers of these technologies in various production processes. In terms of geographic impact, Europe is the biggest region. It is home to a number of industry participants in additive manufacturing that have extensive technical knowledge of the procedures. As a result, in 2021, the European market has grown to become the second-largest growing region.

To read the summary of the report, visit the website at

https://www.strategicmarketresearch.com/market-report/3d-printing-market

Key players in 3D Printing Market:

- HP Inc

- 3D Systems Inc

- Envision TEC Inc

- Autodesk Inc.

- Materialize

- Canon Inc

- Stratasys Ltd

- Voxeljet AG

- Made In Space

- GE Additive

- The ExOne Company

Recent Developments

- On 3 October 2022, a 3D printing startup situated in the Netherlands, Veda 3D, launched Veda Extrusion System (VXS), a material throughput-boosting extruder developed for Fused Filament Fabrication (FFF) systems. As compared to various other FFF 3D printers, the extruders help the users to boost the production of tools, restorations, spares, or custom parts once installed.

- On 12 September 2022, HP launched its HP Metal Jet 3D printer at the International Manufacturing Technology Show.

- On 28 September 2022, GA-ASI (General Atomics Aeronautical Systems Inc.) collaborated with Conflux on the production and manufacturing of a 3D printed fuel oil exchanger for MQ-9B.

Related Reports

3D Printed Battery Market

The report on 3D Printed Battery Market explains its restraining factors, opportunities, challenges etc. The 3D Printed Battery Market will grow at a 19.53% CAGR during 2022-2030. The rising demand for flexible and portable energy sources and the rising demand for wearable technologies are the factors boosting its growth rate. Key players in this market are Neware, 3D Systems, GE Additive, HP Company, SLM Solutions, etc.

The 3D Printed Battery Market will grow at a 19.53% CAGR during 2022-2030. The rising demand for flexible and portable energy sources and the rising demand for wearable technologies are the factors boosting its growth rate. Key players in this market are Neware, 3D Systems, GE Additive, HP Company, SLM Solutions, etc.

Aerospace 3D Printing Market

Aerospace 3D Printing Market Report by SMR provides insights on its growth factors, restraints, opportunities etc. The Aerospace 3D Printing Market value in 2021 was USD 1.76 Billion, and by 2030 it will reach USD 9.23 Billion at a CAGR of 20.93%. Increasing prevalence in the usage of lightweight components and a decrease in the production rate of aircraft components are the factors accelerating the growth of this market. Companies operating in this market are Arcam AB, Safran SA, Aerojet Rocketdyne, Norsk Titanium AS, 3D Systems Corporation, etc.

3D Cell Culture Market

SMR's 3D Cell Culture Market Report explains its challenges, augmenting factors, restraints, etc. The 3D Cell Culture Market in 2021 was USD 1.66 billion, and it will be worth USD 6.46 billion, at a 16.3% CAGR. Factors proliferating the overall market growth rate are increasing investments, expanding emphasis on healthcare quality, and a rise in infectious diseases. Major organizations in this market are Tecan Trading Ag, InSphero, 3D Biotek LLC, PromoCell GmbH, Corning, Inc., etc.

The 3D Cell Culture Market in 2021 was USD 1.66 billion, and it will be worth USD 6.46 billion, at a 16.3% CAGR. Factors proliferating the overall market growth rate are increasing investments, expanding emphasis on healthcare quality, and a rise in infectious diseases. Major organizations in this market are Tecan Trading Ag, InSphero, 3D Biotek LLC, PromoCell GmbH, Corning, Inc., etc.

Digital Twin Market

The Digital Twin Market Report by SMR outlines its opportunities, challenges, restraints, etc. The Digital Twin Market value was worth USD 6.30 Billion in 2021, and by 2030 it will reach USD 131.09 Billion at a 40.1% CAGR. Factors propelling the growth rate are the increased use of digital twin in manufacturing sectors to reduce cost and enhance supply chain efficiency etc. Prominent players in this market include Siemens, Microsoft Corporation, Dassault Systemes, SAP, IBM Corporation, ABB, etc.

Breast Reconstruction Market

SMR's Breast Reconstruction Market Report provides a detailed overview of its restraints, opportunities, growth factors, etc. The Breast Reconstruction Market's worth in 2021 was USD 2.68 Billion, and it will reach USD 4.98 Billion by 2030 at a 7.11% CAGR. Technological advancements related to breast cancer and the increasing number of breast cancer cases are stimulating the growth rate of the market. Companies playing a major role in this market are GC Aesthetics, PMT Corporation, Wanhe, Sebbin, DPS Technology Development Ltd, CEREPLAS, Johnson & Johnson, etc.

The Breast Reconstruction Market's worth in 2021 was USD 2.68 Billion, and it will reach USD 4.98 Billion by 2030 at a 7.11% CAGR. Technological advancements related to breast cancer and the increasing number of breast cancer cases are stimulating the growth rate of the market. Companies playing a major role in this market are GC Aesthetics, PMT Corporation, Wanhe, Sebbin, DPS Technology Development Ltd, CEREPLAS, Johnson & Johnson, etc.

About Us:

Strategic Market Research facilitates the organizations globally in taking pivotal business decisions by furnishing the Syndicated and Customized Research Reports, which are highly precise in terms of market numbers. We believe that every firm, whether it is a startup which is in the Introduction stage of the Product Life cycle or an established one which is at the growth stage, requires market research services in order to streamline its key business blueprint. It may be related to Product Launch, Go to Market strategies, Competitive Analysis or new geographical penetration and expansion.

Contact Us:

Strategic Market Research LLP.

Sunil Kumar

India: +91-8260836500

Email: [email protected]

Web: https://www.strategicmarketresearch.com

Blog: https://www.strategicmarketresearch.com/blog

Blog: https://www.strategicmarketresearch.com/blogs/property-management-industry-statistics

Press Release: https://www.strategicmarketresearch.com/press-releases

Connect Us:

LinkedIn: https://www.linkedin.com/company/strategic-market-research/

Twitter: https://twitter.com/smrstrategic

Facebook: https://www.facebook.com/StrategicMarketResearch

Instagram: https://www.instagram.com/strategicmarketresearchsmr/

Tags

3D Printing Market 3D Printing Materials 3D Printing Industry Additive Manufacturing Prototyping3D Printing Market Size, Growth

The global 3D printing market size was valued at USD 15. 10 billion in 2021. The market is projected to grow from USD 18.33 billion in 2022 to USD 83.90 billion by 2029, exhibiting a CAGR of 24.3% during the forecast period. Based on our analysis, the global market exhibited an average growth of 20.2% in 2020 as compared to 2019.

10 billion in 2021. The market is projected to grow from USD 18.33 billion in 2022 to USD 83.90 billion by 2029, exhibiting a CAGR of 24.3% during the forecast period. Based on our analysis, the global market exhibited an average growth of 20.2% in 2020 as compared to 2019.

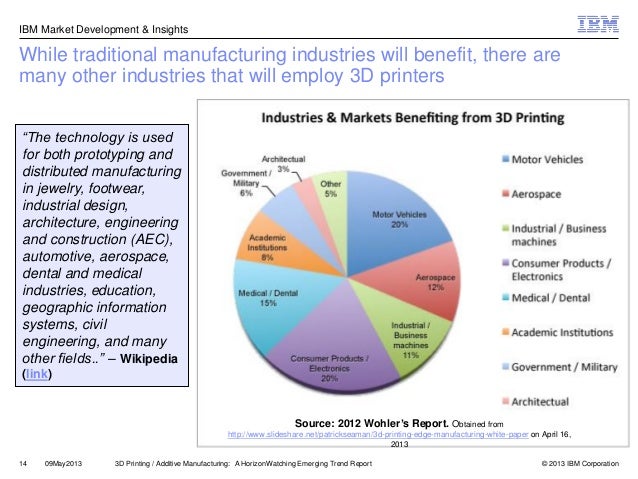

Rapidly increasing digitization, increasing adoption of advanced technologies such as Industry 4.0, smart factories, robotics, machine learning, and others fuel the demand for online 3D printing for simulation purposes. These technologies increase the chances of broader adoption and greater utilization of this technology across industries, including aerospace, automotive, healthcare, among others. For instance,

- Aerospace companies are exploring this 3D printing for manufacturing various hardware parts of their products. For instance, Boeing leverages industrial 3D printing to manufacture the interior parts of its plane, whereas, NASA uses it to build rocket engines and parts of the satellite.

- Automotive industry is expected to show a huge adoption of this technology. Rapid tooling incorporated with additive manufacturing has become the priority of many automotive manufacturers. Customization of the automotive interior is another major application of this technology in the automotive industry.

COVID-19 IMPACT

Supply Chain Disruption and Halts on Production Units Negatively Impact Printing Industry Amid Lockdown

Post outbreak of the COVID-19 crisis, industrial hubs, manufacturing sectors witnessed an immediate supply chain disruption and halts on production. As a result of the fast-spreading pandemic, the overall industrial production across the globe experienced a sharp decline. It was demobilized, reflecting supply chain disruption, and reviving financial market conditions. The crisis forced market players across the globe to reduce their operational expenditure. Fewer operation expenditures restricted the investments of market players in this technology in 2020, impacting the 3D printing market growth.

The temporary closures of the factories in major economies such as China, Southeast Asia, the U.K., Germany, and others have impacted the production plants of the 3D technology industry and operations of suppliers resulting in short-term supply shortages. Manufacturing capacity was observed to be restored to normalized levels by the end of July 2020. The short-term disruptions in supply shortages have resulted in logistics challenges, including delays in delivering services to end-use industries. Such a situation affected the company’s ability to meet the technology demand of the end customers. For instance,

- Stratasys, one of the well-known companies in the market, experienced dip in sales in the early months of COVID-19 pandemic. However, later, the company started rebounding as it picked up new manufacturing contracts.

However, the study conducted by the ‘Society of Manufacturing Engineers’ states that 25% of the manufacturers in the United States plan to change their supply chains in response to the pandemic. The study also found that they prioritize investing in this technology post-COVID-19 out of other technologies such as robotics, 5G, digital security, and artificial intelligence. This shows that the increasing investments of manufacturers in 3D technologies are likely to uplift the growth of the market in the forthcoming years.

The study also found that they prioritize investing in this technology post-COVID-19 out of other technologies such as robotics, 5G, digital security, and artificial intelligence. This shows that the increasing investments of manufacturers in 3D technologies are likely to uplift the growth of the market in the forthcoming years.

LATEST TREND

Request a Free sample to learn more about this report.

Advancement in 3D Hardware and Software is Generating New Revenue Streams for Market Players

Techno-savvy start-ups and established market players are upgrading and developing new technologies. The advancements in hardware have led to faster and reliable 3D printers for production applications. Polymer printers are one of the most used 3D printers.

- According to a 2019 report by Ernst & Young Global Limited, 72% of the enterprises leveraged polymer additive manufacturing systems, whereas the remaining 49% used metal additive manufacturing systems.

The statistics show that developments in polymer additive manufacturing would create new market opportunities for market players.

The statistics show that developments in polymer additive manufacturing would create new market opportunities for market players.

Fused Filament Fabrication (FFF) and powder bed fusion technologies such as Multi Jet Fusion offered by HP Inc. are expected to be the most preferred industrial 3D technologies by the manufacturers due to their ability of volume manufacturing and high productivity. Similarly, resin-based technologies such as digital light processing (DLP) and Stereolithography (SLA) are more likely to have a growing demand from the dental and consumer goods industry.

Similarly, software developments are gaining pace in the 3D industry driven by the demand to streamline operations. The technology has been extensively used in the manufacturing process, which has surged the need for software that can help manufacturers to increase production volumes and enhance their additive manufacturing processes efficiently.

DRIVING FACTORS

Substantial Investments of Governments and Tech Giants to Foster Market Growth

Many countries across the globe are experiencing massive digital disruptions in advanced manufacturing technologies. The United States is a potential user of 3D technology. In 2018, the United States Department of Defense included this technology as an important capability in their budget. Even tech software giants such as Autodesk, Microsoft, and HP have launched products aimed at additive and 3D printing manufacturing.

The United States is a potential user of 3D technology. In 2018, the United States Department of Defense included this technology as an important capability in their budget. Even tech software giants such as Autodesk, Microsoft, and HP have launched products aimed at additive and 3D printing manufacturing.

Similarly, China is making significant efforts to maintain the competitive index of the manufacturing industry in the global market. Chinese manufacturers foresee this technology as both a risk and opportunity for the Chinese manufacturing economy, and hence they tend to invest in the research and development of this technology.

Whereas India is looking forward to this technology as an opportunity to increase its share in global manufacturing competitiveness. The market in India is supported by active government initiatives such as the ‘Make in India’ Initiative.

Korea has established an independent roadmap for research and development of this technology and provides national support to execute it. The government of Korea is introducing tax incentives and accelerating industry regulatory agreements to encourage the adoption of this technology.

The government of Korea is introducing tax incentives and accelerating industry regulatory agreements to encourage the adoption of this technology.

The U.K. government has developed an independent 3D technology strategy; however, it is witnessing some uncertainties in the U.K. manufacturing sector due to Brexit. Germany is expected to define new strategies for the technology as Germany has a well-established Industry 4.0 infrastructure.

RESTRAINING FACTORS

High Initial Investments to Restrict Market Growth

High initial investments are observed to be the most significant restraint for adoption of this technology. This investment encompasses investment in hardware, software, materials, certification, additive & manufacturing education, and training for the employees. The capital costs and resources required to set up a 3 dimensional system are quite expensive than traditional printing methods.

However, with the introduction of the industrial Desktop 3D printer, the manufacturers are helping the end-customers cut the high initial costs. Desktop printers are easy to use and handle and also are less expensive than the 3 dimensional system.

Desktop printers are easy to use and handle and also are less expensive than the 3 dimensional system.

SEGMENTATION

By Component Analysis

Wider Adoption of the Software to Make Designs of Objects and Parts to Fuel its Growth Rate

On the basis of component, the market is divided into hardware, software, and services.

Adoption of hardware for manufacturing 3D printed material is maximum and is likely to maintain its dominance during the forecast period. The demand for hardware is increasing as major key players are enhancing their product portfolio and launching new technologies to serve high demand from several industry verticals. Companies are investing in research & development activities, which have a positive impact on the market growth.

The software is expected to grow at a high CAGR during the forecast period. The 3D printing software is widely used in different industry verticals to design the objects and parts to be printed. As manufacturing companies are shifting away from traditional manufacturing methods, the adoption of 3D software has grown to print iterations of different manufacturing parts.

As manufacturing companies are shifting away from traditional manufacturing methods, the adoption of 3D software has grown to print iterations of different manufacturing parts.

By Technology Analysis

Fused Deposition Modeling (FDM) Technology to be at Forefront

Based on technology, the market has been divided into FDM, SLS, SLA, DMLS/SLM, Polyjet, Multi Jet Fusion, DLP, Binder Jetting, EBM, CLIP/CDLP, SDL, and LOM.

Among these, fused Deposition Modeling (FDM) technology captured the maximum share in 2021. The growth of FDM is mainly due to the ease of operation and advantages associated with the technology. FDM technology is highly used in making durable, strong, and dimensionally stable parts.

Direct Metal Laser Sintering (DMLS/SLM) technology is expected to grow at a high CAGR during the forecast period. The technology promotes the production of high-quality metal components, which makes them suitable for the manufacturing industry since they enable the creation of complex geometries of metals of extremely small sizes.

Selective Laser Sintering (SLS) is expected to show significant growth in coming years. SLS finds a wide variety of vertical applications, including aerospace, defense, automotive, and others. Polyjet, Multi Jet Fusion, DLP, Binder Jetting, EBM, CLIP/CDLP, SDL, LOM technologies are expected to witness a significant rise in adoption in the upcoming years.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Prototyping to Capture Maximum Market Share Due to its Widespread Acceptance Across Various Vertical Industries

This technology has application in prototyping, production, proof of concept, and others.

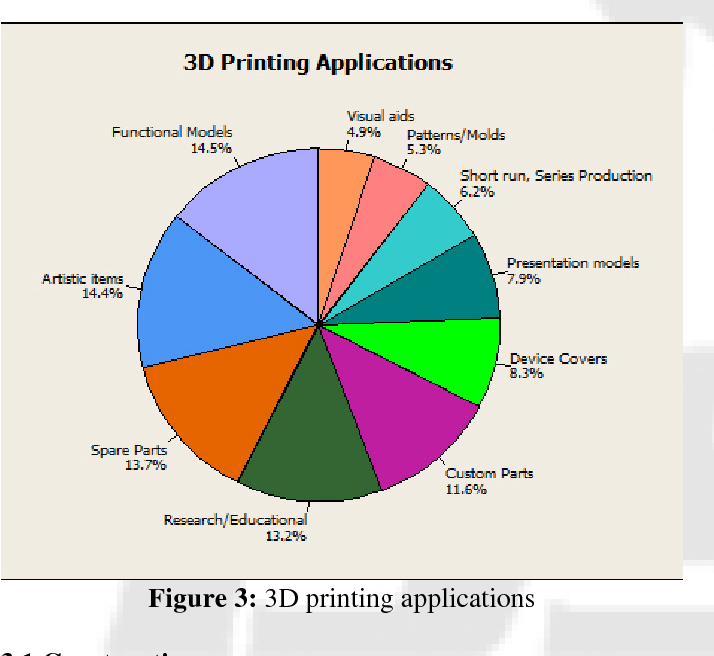

Due to widespread acceptance of the prototyping process across various vertical industries, the prototyping represented the largest market share in 2021. Prototyping helps businesses to achieve greater precision and produce consistent end products. This technology helps to manufacture 3 dimensional computer-aided design (CAD) models and prototypes.

This technology helps to manufacture 3 dimensional computer-aided design (CAD) models and prototypes.

The production is expected to witness strong growth during the forecast period. While manufacturers are shifting their traditional manufacturing units toward advanced manufacturing processes, the adoption of this technology to produce complex and low-volume parts is expected to grow during the forecast period.

By End User Analysis

Automotive Industry to Lead Market Owing to its Maximum Use in Producing Prototype Equipment

Automotive, aerospace and defense, healthcare, architecture and construction, consumer products, education, and others are some of the end-users of 3D printing.

The adoption of this technology in the automotive industry is expected to hold a maximum share in 2021. For decades, the automotive industry has been using this technology to produce prototype equipment and small custom products in a short time span. The technology is being widely used for the construction of lightweight components for automobiles and OEMs.

The technology is being widely used for the construction of lightweight components for automobiles and OEMs.

Additive manufacturing has tremendous potential for the aerospace industry, where light, solid, and geometrically complex parts are required — and normally manufactured in limited quantities. Aerospace and defense companies are heavily using this technology to produce lightweight components.

Additive processing in the healthcare industry helps create artificial tissues and muscles that mimic normal human tissues that can be used in substitution operations. These skills are anticipated to lead to vertical acceptance of 3DP in healthcare and the sector's development.

On the other hand, architecture and construction, consumer products, education verticals are anticipated to grow at a significant CAGR during the forecast period.

REGIONAL INSIGHTS

North America 3D Printing Market Size, 2021 (USD Billion)

To get more information on the regional analysis of this market, Request a Free sample

Geographically, the market is divided into five major regions such as North America, South America, Asia Pacific, Europe, and the Middle East & Africa. They are further categorized into countries.

They are further categorized into countries.

Globally, North America accounted for the maximum share in the global market mainly due to rising expenditure on advanced manufacturing technologies by developed countries such as Canada and the U.S. Also, various government agencies, such as the National Aeronautics and Space Administration (NASA), have identified major R&D investments that can greatly contribute to space applications and create new technologies that drive business expansion.

Europe holds the second-highest market share in the global market. The demand for this technology is high among small and medium-sized industries that require high-speed, reliable, and inexpensive prototypes for manufacturing purposes. The regional market is expected to showcase strong growth in the adoption of this technology in the manufacturing and semiconductors industry.

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. An increasing interest in the development of a sustainable 3D printing environment has been backed by APAC manufacturers and the implementation of several policies and legislative proposals by governments in the region. Given the massive government funding for the industry, China is possibly the main force behind adopting this technology in Asia.

Given the massive government funding for the industry, China is possibly the main force behind adopting this technology in Asia.

To know how our report can help streamline your business, Speak to Analyst

The Middle East & Latin America is expected to showcase high growth during the forecast period. The rapid adoption of 3D technology in the region is mainly due to technological advancements and improvements in the manufacturing industry.

KEY INDUSTRY PLAYERS

Companies are Focusing on Partnership and Collaboration Activities for Safer Internet Environment

The prominent players of the market are focusing on offering advanced and innovative solutions catering to the growing needs of industries. These key players are investing in R&D to provide innovative services and materials. They are entering into strategic partnership and collaboration to provide next-generation solutions. These companies are offering consumer-centric solutions to help in boosting business growth. Similarly, the key players are keen on offering a vast range of 3-dimensional materials to grow across every industry application.

Similarly, the key players are keen on offering a vast range of 3-dimensional materials to grow across every industry application.

February 2022 – Imaginarium partnered with Ultimaker to introduce desktop & industrial 3D printer range in the India market. This partnership would help Ultimaker to expand its business in India, where additive manufacturing is anticipated to reach a point of breakthrough in the coming years.

November 2021 – 3D Systems is planning to enhance additive manufacturing innovation through partnerships and launch of products. The company launched new 3-dimensional printing tools and collaborated with the U.K.-based startup Additive Manufacturing Technologies (AMT) to present novel 3-dimensional printing workflows and improve AM software, which is ideal for automotive components.

List of the Key Companies Profiled:

- 3D Systems Corporation (U.S.)

- The ExOne Company (Germany)

- voxeljet AG (Germany)

- Materialise NV (Belgium)

- Made in Space, Inc.

(U.S.)

(U.S.) - Envisiontec, Inc. (Germany)

- Stratasys Ltd. (U.S.)

- HP, Inc. (U.S.)

- General Electric Company (GE Additive) (U.S.)

- Autodesk Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2022 – South Africa’s Department of Science and Innovation (DSI) launched a pilot project to build around 25 houses by utilizing 3D printing technology to combat the shortage of housing in the country.

- March 2022 – 3DGence, a European manufacturer, launched a new industrial FFF machine, INDUSTRY F421, which is well-suited with high performance materials. Additionally, the firm has also introduced AS9100, a new high-temperature filament, which is made using polyether ether ketone (PEEK) and certified for use in defense and aerospace sectors.

REPORT COVERAGE

An Infographic Representation of 3D Printing Market

View Full Infographic

To get information on various segments, share your queries with us

The global 3D printing market research report highlights leading regions across the world to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further offers drivers and restraints, helping the reader gain in-depth knowledge about the market.

Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further offers drivers and restraints, helping the reader gain in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

ATTRIBUTE | DETAILS |

Study Period | 2018-2029 |

Base Year | 2021 |

Estimated Year | 2022 |

Forecast Period | 2022-2029 |

Historical Period | 2018-2020 |

Unit | Value (USD billion) |

Segmentation | By Component, Technology, Application, End-User, and Region |

By Component |

|

By Technology |

|

By Application |

|

By End-User |

|

By Region |

|

Overview of the 3D printing market in 2020

Analytics and business

Experts recommend

Author: Andrey Kombarov

Author: Andrey Kombarov

Additive Manufacturing Trends | Application of 3D printing | A look at additive technologies | Business Strategies for 3D Printing | Overview of the 3D printing industry over the past 6 years | Key Findings

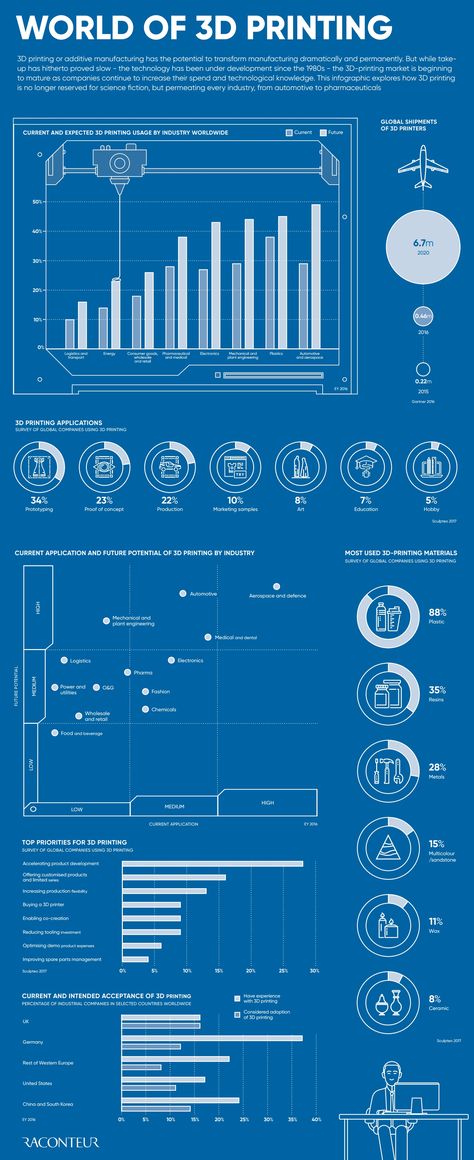

The future of additive manufacturing starts with understanding the goals and expectations of 3D printing users around the world. This was the reason for the launch of an ambitious research project by the French company Sculpteo - the annual State of 3D Printing report. Today it is one of the most authoritative and comprehensive sources of information about the real situation and prospects of the industry. nine0003

This was the reason for the launch of an ambitious research project by the French company Sculpteo - the annual State of 3D Printing report. Today it is one of the most authoritative and comprehensive sources of information about the real situation and prospects of the industry. nine0003

This year, 1,600 respondents from 71 countries took part in the Sculpteo survey. According to the report, a growing number of companies are realizing the possibilities of additive manufacturing, increasing investments and demonstrating undeniable confidence in the future of professional use of 3D printing.

This material offers a complete overview of the world of additive manufacturing and will help you develop the right business strategy.

In the blog , the State of the 3D Printing Market 2020 is published in abbreviated form. You can download the full version for free in our virtual library:

Additive Manufacturing Trends

Materials

- New and available materials.

- Improving the quality and stability of budget additive technologies. nine0035 Improving post-processing technologies to obtain parts with the highest quality surface.

- 3D printing from multiple materials at once.

Environmental sustainability

- Biodegradable materials and materials of biological origin.

- Manufactured on demand and on site to reduce transport and environmental costs.

- Application of 3D printing to meet the challenges of renewable energy and energy efficiency. nine0036

Technology Development

- Improved usability of software and printers

- Mass Production: Printing and 3D Scanning Speed

- Generative design

Availability

- Reducing the cost of 3D printers and materials (metals, photopolymers).

- Low post-processing costs.

- Sharing projects and tools. nine0036

iQB Technologies experts recommend articles:

3D printing as a full-fledged manufacturing technology in the context of the COVID-19 pandemic

2020 results and forecasts: the 3D printing market will grow by 25% annually

Application of 3D printing

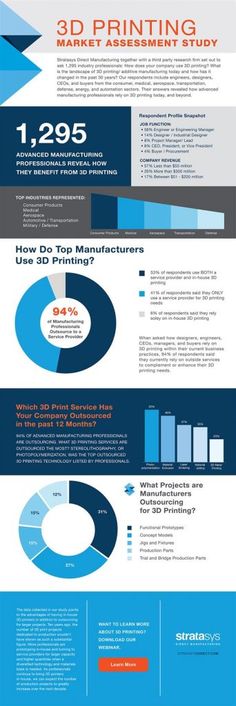

The possibilities of 3D printing are growing every day, and with them the scope of its application is expanding. Gradually, companies begin to feel more confident in relation to 3D technologies. nine0082 68% of respondents are looking to use additive manufacturing to solve more problems, and 44% of are going to introduce new 3D printing technologies. Most professionals outsource SLS and Jet Fusion printing, as well as metal 3D printing, so they do not need to maintain their own equipment, and this will encourage them to test new technologies.

Gradually, companies begin to feel more confident in relation to 3D technologies. nine0082 68% of respondents are looking to use additive manufacturing to solve more problems, and 44% of are going to introduce new 3D printing technologies. Most professionals outsource SLS and Jet Fusion printing, as well as metal 3D printing, so they do not need to maintain their own equipment, and this will encourage them to test new technologies.

So what are the most popular 3D printing and post-processing technologies? Let's find out! nine0003

We emphasize once again that production volumes using 3D printing continue to grow. We are seeing this growth in research and development and education, which is in line with the increased demand for new materials and technologies in the market.

Click image to enlarge

The use of photopolymers is increasing through both internal and external services, while for metal 3D printing, most users outsource. nine0003

nine0003

Design, testing and prototyping remain the main tasks solved with the help of 3D printing.

Stability and quality control remain a major concern for users seeking to scale up the use of 3D printing.

Most users use SLS, Jet Fusion and metal 3D printing technologies through outsourcing without purchasing equipment.

nine0002 3D printing users are interested in exploring new applications, technologies and materials.Typically, 3D printing is used in conjunction with traditional manufacturing methods such as laser cutting, CNC machining, and injection molding.

A look at additive technologies

What do respondents think about 3D printing technologies? In this section, we will look at the main benefits of 3D printing for users and their companies. How exactly does it optimize production processes? nine0003

66% of respondents use 3D printing to create parts with complex geometries. Survey participants cite the reduction in iterations, lead times and costs as the most important benefits of this technology.

Survey participants cite the reduction in iterations, lead times and costs as the most important benefits of this technology.

In this section, we will also look at the future of the additive industry and the factors driving its growth and business adoption. What needs to be done to accelerate the adoption of 3D technologies? Now we'll find out.

nine0002 As technology and materials become more accessible, the cost savings of 3D printing become clear to more and more users. Many also cite time savings due to reduced iterations and lead times as a benefit.Set-up costs and lack of knowledge are seen as the main limiting factors for the adoption of 3D printing.

nine0002 The role of 3D printing in business and manufacturing continues to grow.New materials and reliable technologies are in demand for more than 55% industries.

Business Strategies for 3D Printing

Additive manufacturing is a huge competitive advantage. With some significant benefits of 3D printing, such as reduced lead times and speed of innovation, the vast majority of respondents view 3D printing as a significant improvement for their business. nine0003

With some significant benefits of 3D printing, such as reduced lead times and speed of innovation, the vast majority of respondents view 3D printing as a significant improvement for their business. nine0003

As for money, investment in additive technologies is growing every year. Most of these users will increase their investments in 2020! It can also be seen that the vast majority of those surveyed have been using 3D printing for several years and plan to invest more in this technology in the near future. The business world believes in the promise of additive manufacturing.

Let's watch how 3D printing becomes a real asset for companies, helping them develop their business strategy! nine0003

63% of see a significant or dramatic impact on sales. Reduced lead times and speed of innovation are the most important success metrics for 3D printing.

Nearly 60% of consider 3D printing one of their strengths compared to the competition.

65% of companies plan to increase their investment in 3D printing in 2020.

nine0002 The integration of 3D printing into manufacturing processes continues to increase: 74% of actively use 3D printing in their companies.Overview of the 3D printing industry over the past 6 years

The Sculpteo report offers a look at the analysis of the state of the 3D printing industry for each year since 2015. How has the use of 3D printing evolved over the period 2015-2020? Let's look at the answers of the latest polls.

nine0002 Large-scale production using 3D printing continues to spread, becoming as commonplace as prototyping and testing.Accelerating development and offering customized products and limited editions remains a major challenge for companies using 3D printing.

The market share of photopolymers continues to increase, showing significant growth over the past two years. nine0003

Key Findings

1.

Lack of stability is the Achilles' heel of 3D printing

Lack of stability is the Achilles' heel of 3D printing In order for additive technologies to become an integral part of any production, it is necessary to develop equipment and materials that ensure high stability.

- 51% claims to use 3D printing mostly for quality control purposes.

- 62% of believe the 3D printing industry needs more robust technology to grow.

2. 3D printing is gaining ground in certain industries

Many industries are beginning to increase their use of 3D printing as its role in their manufacturing processes becomes more significant. Users are constantly deepening their knowledge and experience in the application of additive technologies.

- 80% of have been using 3D printing in their companies for over 2 years.

- 33% expect up to 50% increase in investment this year, which is a more conservative estimate than in previous years.

3.

3D printing may not be profitable

3D printing may not be profitable For wider use of additive technologies, the cost of manufactured parts must be reduced - this will attract more industries and sectors. nine0003

- More than 50% of outsource SLS, Jet Fusion, SLM/DMLS and Binder Jetting to offset equipment and service costs.

- 59% indicate that the cost of organizing production is a limiting factor for the adoption of 3D printing.

4. Changing Perceptions: From Prototyping to Full Manufacturing Technology

Despite the increasing use of 3D printing in manufacturing, its benefits are so far only apparent for prototyping and small-scale production. Businesses need to be shown the real benefits of 3D printing for industrial production. nine0003

- 60% report a significant reduction in part cost when using 3D printing.

- 52% of use 3D printing for manufacturing, while 68% of use 3D printing for prototyping.

This article is an abridged version of the Sculpteo report. The full version is available at link .

© 2020 Sculpteo. The material was translated by iQB Technologies exclusively for the 3D experts' blog blog.iqb.ru. nine0020

Download material

Article published on 08/20/2020, updated on 06/11/2021

3D printing market. Why don't we print something new

Last year we already talked about this market, we will update the data and conduct an analysis.

Additive manufacturing, or 3D printing, is based on the layer-by-layer creation of products of the desired shape using a three-dimensional model. nine0003

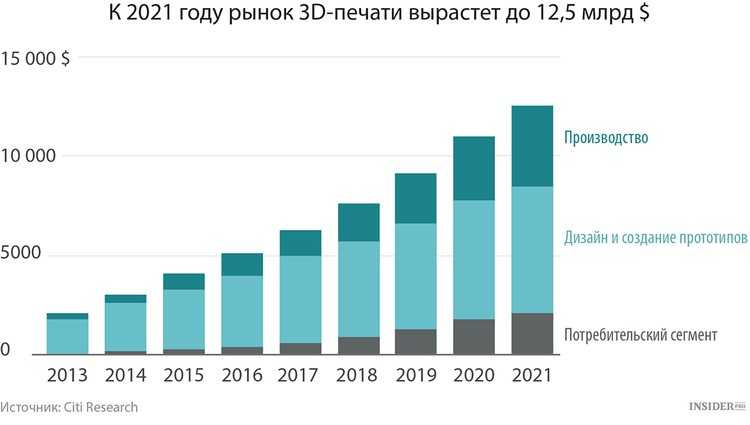

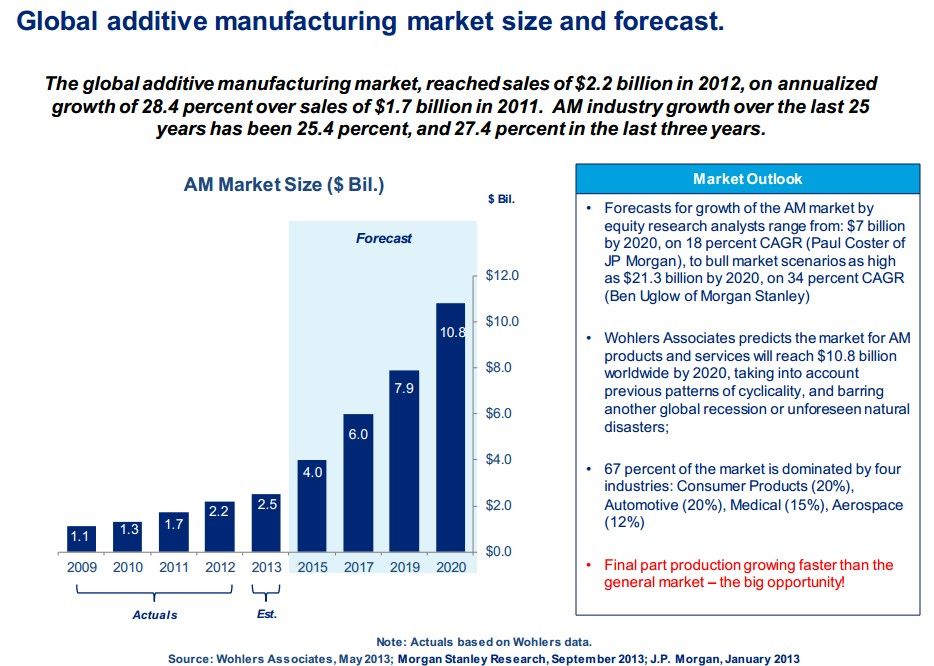

According to the Wohlers report, the 3D printing market grew by 21.2% in 2019 to almost $12 billion. problems of shortage of medical devices and personal protective equipment during a pandemic. With its help, masks, small parts and necessary devices in medicine were created.

The market is relatively small and needs to be scaled up. Now 3D printing companies are gaining popularity again. As industry representatives say, people have begun to understand the value of additive manufacturing: it is cheap, compact and mobile. In the current situation, technology has begun to develop faster, increasing capacity to meet demand. nine0003

Consider a few stocks in the industry and make a prediction. The goal is to maximize the benefits of the growth of the 3D sector, that is, the company should be more active in additive manufacturing.

HP Inc. Capitalization $27.6 billion

This is a well-known company for the production of computers and peripherals, including 3D printers. Additive manufacturing is not the main activity of the company, but the company has a leading position in the sector. nine0003

Total print revenue in 1H 2020 fell by 20%. But there is a share of commercial equipment, which grew by 7% y/y. It includes office printing solutions. These include commercial products and OEM equipment, graphics solutions and 3D printing, digital manufacturing, excluding consumables.

These include commercial products and OEM equipment, graphics solutions and 3D printing, digital manufacturing, excluding consumables.

Commercial equipment revenue is 5% of the total, in the first half of 2020 - $ 0.7 billion. The company did not disclose how much it was for 3D printing. nine0003

In 2014, the company developed Multi Jet Fusion technology to increase productivity and reduce the cost of professional (industrial) 3D printers. One of these models is now the most popular among industrial equipment - HP Jet Fusion 5200 3D printers.

Proto Labs Capitalization $4.1 billion

The company is engaged in industrial production of products using 3D printing, computer numerical control (CNC) processing, sheet metal fabrication and injection molding . The company claims to have the fastest production.

Proto Labs' products include prototyping and small batch production. They are created at the request of large and small companies. Since the beginning of the year, quotations have grown by more than 40%.

Since the beginning of the year, quotations have grown by more than 40%.

One of the growth drivers was the development of new 3D printing technologies and new polystyrene foam material. The material is able to expand many times, which helps to overcome some limitations in the manufacture of larger parts. The company continues to invest in new 3D printing facilities, with a 50% increase in productivity expected. nine0003

1H 2020 revenue was $221.6 million, of which 3D printing accounted for 13.6%, or $30.1 million. 3D printing, although accounting for a relatively small share of revenue, is one of the fastest growing .

Materialize . Capitalization $2.1 billion

The Belgian company is one of the largest and independent in the field of additive manufacturing. Materialize is engaged in manufacturing in various fields, but is aimed at cooperation with the medical sector. In 2019Materialize has acquired a 75% stake in Brazilian medical device manufacturer Engimplan to expand its presence in the fast-growing Brazilian market.

Working with 70% of the top 30 in the medical technology sector has helped the company gain a wealth of experience, leading to certifications in the medical consumables industry. This is especially important during a pandemic: the company is one of the few that meet specific requirements. nine0003

In 1H 2020, Materialize's revenue decreased by 11.7% YoY to €84.3 million.

Stratasys . Capitalization $0.7 billion

American-Israeli company, manufacturer of 3D printers and 3D manufacturing systems for office solutions aimed at rapid prototyping and direct digital manufacturing.

Operates with world leaders in the aerospace and automotive industries, pioneering medical start-ups and technology giants. Stratasys is a pioneer in developing new standards for 3D printing. nine0003

One of the printer models, the J750, was named Enterprise 3D Printer of the Year in the Resin Printer category at the 2019 3D Printing Industry Awards in London.

This year announced the release of MakerBot CoudPrint software, designed for a seamless 3D printing workflow. Remote and on-site users can prepare, queue, print, monitor and manage 3D print jobs from a centralized cloud application. nine0003

In the first half of the year, the company received revenue of $250 million, net loss was $49 million.

3 D Capitalization $0.6 billion

The company develops, manufactures and sells 3D printers, materials for them, and also provides 3D printing services.

Like others in the industry, mainly focused on prototyping in various fields, including aerospace, automotive, medical, dental, entertainment. 3D Systems has many different technologies, products and more than 1000 patents in its arsenal. nine0003

In the first half of 2020, the company received $246.8 million in revenue, with a loss of $52.1 million. Businesses have different directions and 3D is not the main one. Given the goal, the company does not fully meet the criteria. Business diversification is a definite plus, but risks from other segments increase.

Given the goal, the company does not fully meet the criteria. Business diversification is a definite plus, but risks from other segments increase.

Stratasys, 3D Systems and Materialize are fully immersed in additive manufacturing, while Proto Labs has additional lines of business. nine0003

3D Systems shares ended their uptrend at the end of 2013, at the moment the quotes have returned to the IPO level: that is, the price has been declining for 6 years, like that of Stratasys. Financial indicators do not show investment attractiveness. Companies need new growth drivers. For example, to create breakthrough technologies that will be applied in different areas, then large companies will conclude contracts.

HP continues to be the most undervalued in terms of EV/EBITDA multiple. Materialize has the highest score, but from a buying point of view, it is not attractive. Dividends are paid only by HP, this is an additional bonus. The buyback was carried out by HP and Proto Labs, which is also a positive factor for investors. nine0003

nine0003

HP and Proto Labs are more attractive investments. Both companies are listed on the St. Petersburg Stock Exchange. Between the two companies, in my opinion, HP is less interesting in terms of investment in the 3D printing sector. Companies with a large presence of additive manufacturing will be better able to feel sectoral changes.

About the future 3 D -prints

Additive Technologies magazine prepared an article on the industry trends. According to the survey, 3D printing continues to be in demand for prototyping and testing. This can be attributed to the negative impact on the sector, as the potential goes beyond prototypes and can be developed as a full-fledged production. nine0003

Product material is mainly used in the form of plastic, photopolymer and metal.

Consistency and quality control continue to be a major concern for users seeking to exploit the possibilities of 3D printing.

The use of additive technologies is convenient and developing. New materials, technologies and scales are applied, which stimulates the growth of the customer base and expands the scope.

Metal printing is one of the promising areas for additive manufacturing. The growth rate of the use of metal components for 3D printing is increasing every year. In 2019The market was valued at $772 million and is expected to grow at a CAGR of 27.8% through 2027.

Additive manufacturing has found application in a variety of areas: aerospace, defense, medical, automakers (BMW, Ford, and Volkswagen) . NASA plans to 3D print more than 80% of future rocket engines using metal systems.

View this post on Instagram

Posted by Tekhnikum (@tekhnikum_)

All of the above points to the growing potential of using additive manufacturing. The companies we singled out are participants in this revolutionary process. You should keep an eye on the news in this area, especially technological breakthroughs and new contracts.

The companies we singled out are participants in this revolutionary process. You should keep an eye on the news in this area, especially technological breakthroughs and new contracts.

Taking stock

3D printing has been hit hard in 2020 by the pandemic. The market is no longer growing at the same pace, but it has huge potential. nine0242 Three companies, in our opinion, worthy of the attention of investors: Proto Labs, HP and Materialize. The Belgian company has been hit hard this year and needs special attention. As the global economy recovers, the company's performance may stabilize.

HP can be seen as one of the leaders in the 3D sector, but business segmentation needs to be taken into account. The bonus is the payment of dividends.

Proto Labs shows good financial results. Like everyone else, Proto has been hit by the pandemic but could soon bounce back, especially with negative net debt. Research and development in the additive manufacturing market, as well as the growth of the sector as a whole, will undoubtedly have a positive impact on quotes.

S. (By Application)

S. (By Application)