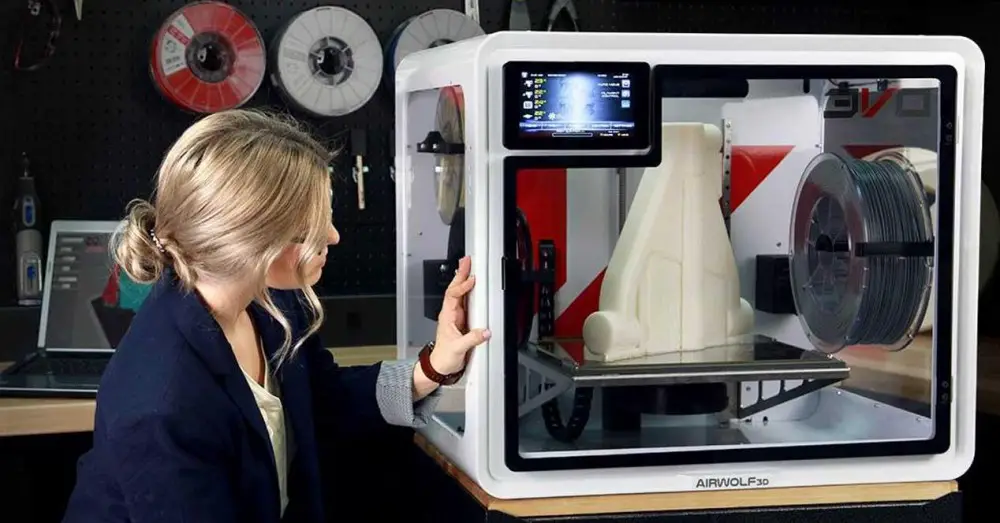

3D printer in business

3D Printing Applications for Business

- 3D printing can help your business with prototyping or low-volume manufacturing. It also has applications in design, biomedical devices and mechanical parts.

- You should guarantee your supply chain and product quality to protect against unlicensed 3D printing. You should also hire only people with skills and experience relevant to your 3D printing projects.

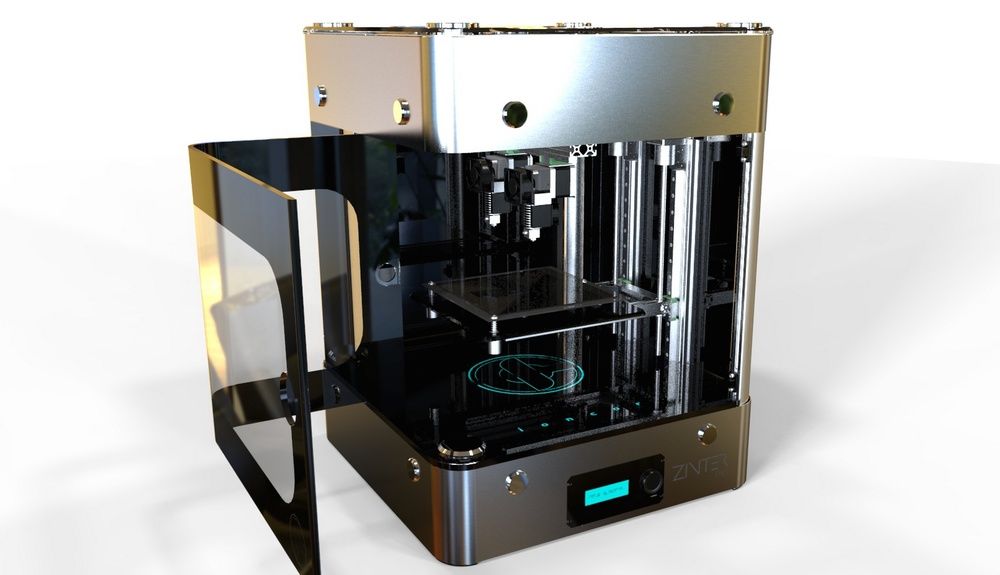

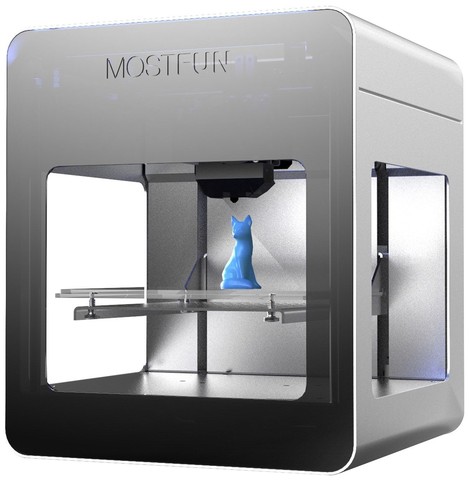

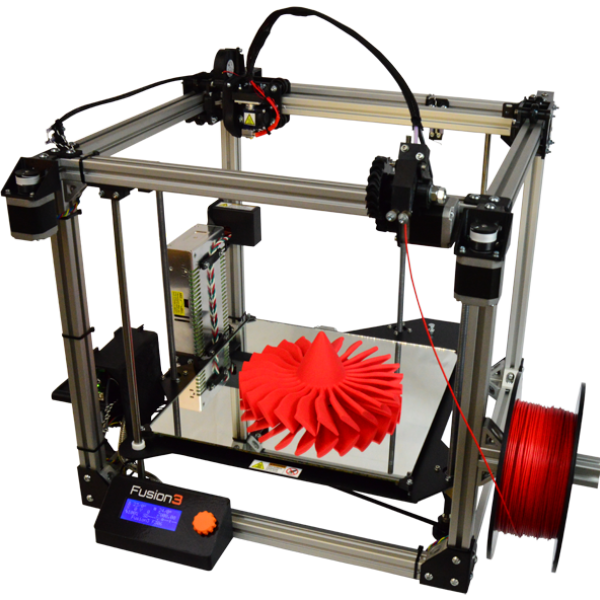

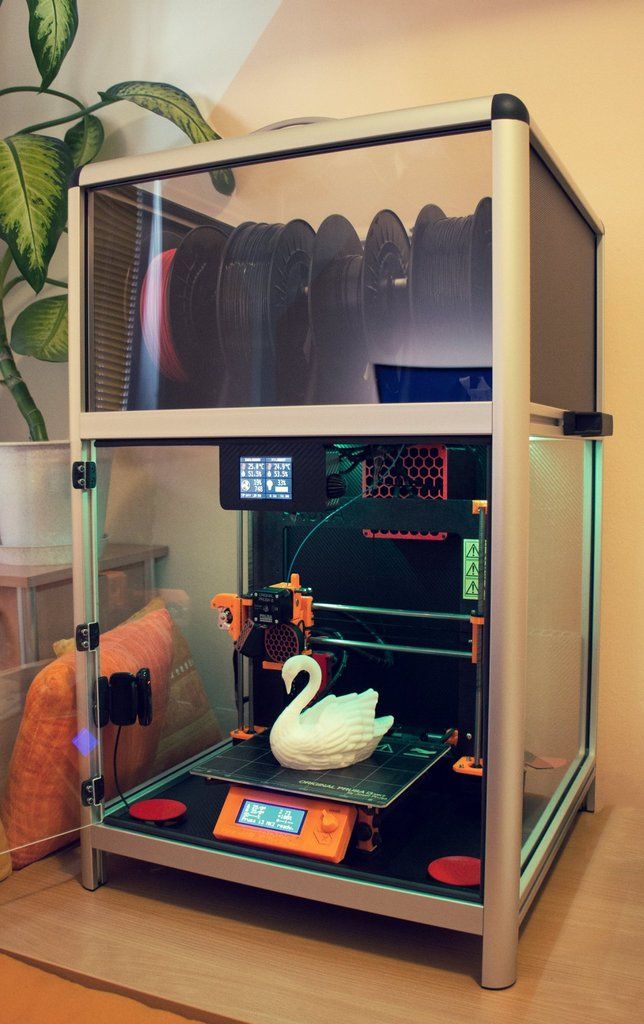

- Your small business could benefit from a 3D printer, such as the Original Prusa MINI, Ultimaker S3 or Anycubic Vyper.

- This article is for small business owners who manufacture products and are interested in 3D printing.

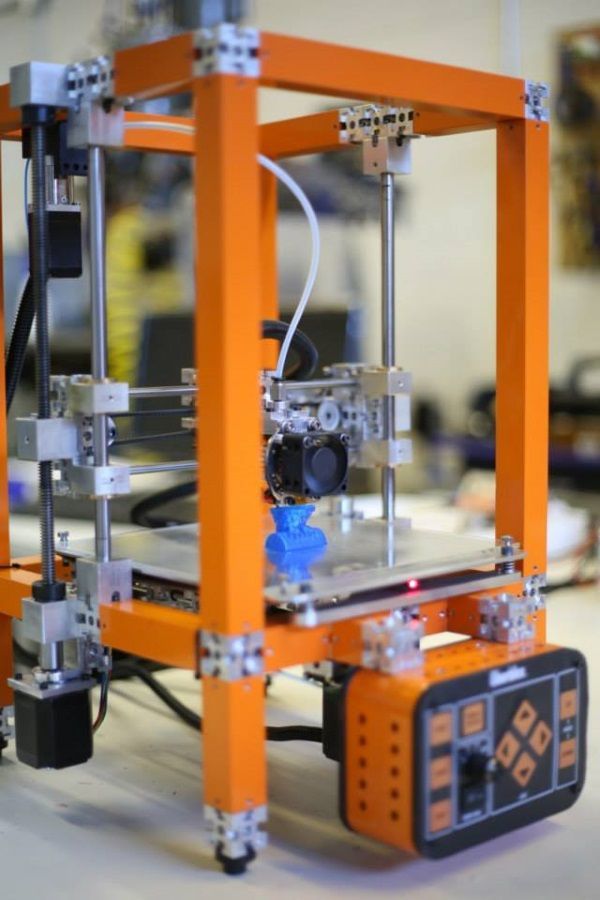

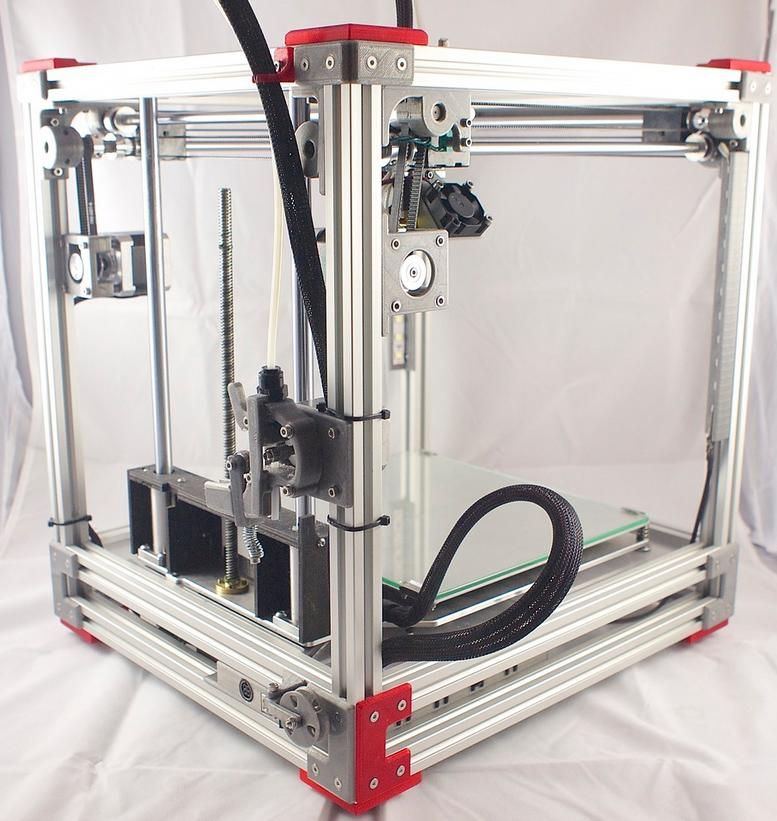

Manufacturing plays an essential role in the lives of many entrepreneurs and small business owners. As technology continues to improve, new methods of manufacturing continue to emerge as viable methods for small- and mid-scale production. Among these is 3D printing, and its widespread use in manufacturing has grown in recent years.

Just because 3D printing is an exciting way to manufacture doesn’t mean it makes sense for your business. There are still issues regarding cost and speed. In addition to the drawbacks, rumors constantly pop up discussing “the next big thing” in 3D printing.

With a lot of misinformation surrounding the future of 3D printing, we turned to experts to develop a clear picture of how 3D printing can help your business and determine what the future of 3D printing holds.

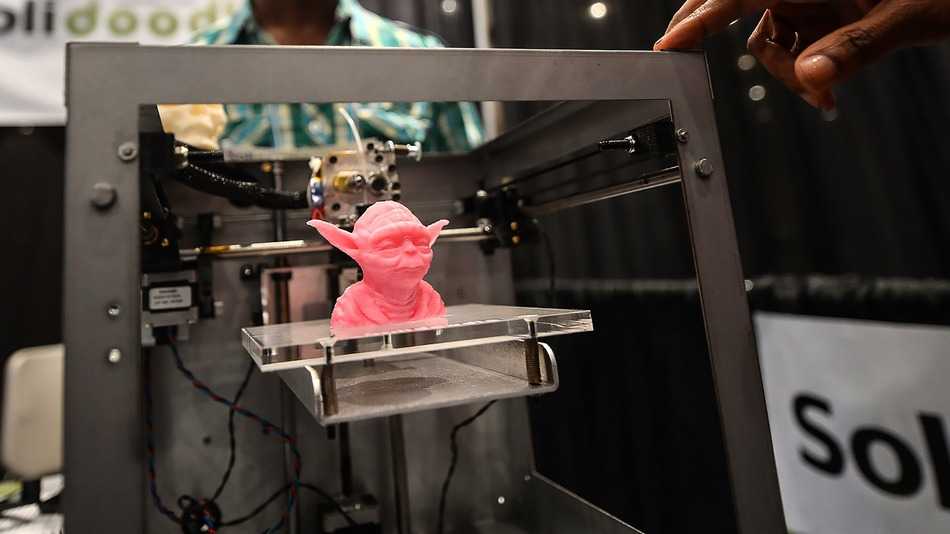

What is 3D printing?

3D printing is the process by which three-dimensional digital models are made into physical objects. Working in tandem with computer software, the 3D printer reads a digital STS file on a computer and then uses a filament or a resin to render the digital representation in tangible material, layer by layer.

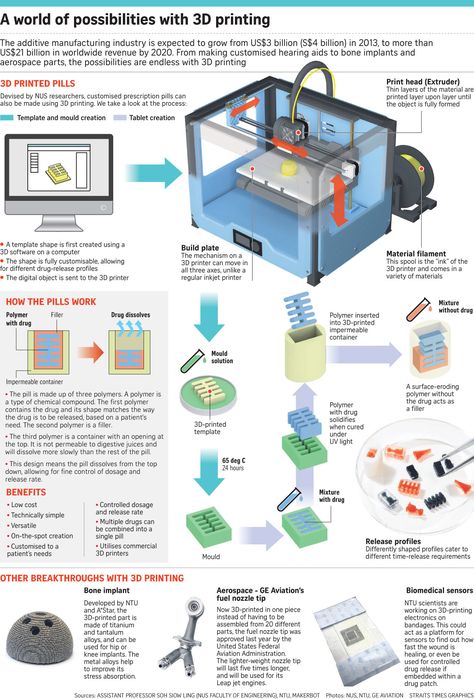

3D printers employ a variety of materials, including plastics and polymers, steel, titanium, gold, and ceramic. This versatility means 3D-printed models can be used for various objects, including artistic sculptures and airplane components. Some 3D printers can even print proteins and chemicals, enabling the devices to create foods and medicines.

Some 3D printers can even print proteins and chemicals, enabling the devices to create foods and medicines.

“I don’t think there’s a component made today that won’t somehow be touched by 3D printing in some fashion or another, whether directly or indirectly,” said Mark Cola, former CEO of 3D printing company Sigma Labs.

Developments in the industry continue to arise. In fact, Statista projects the global 3D printing industry to reach $37.2 billion in 2026. That’s more than double the 2022 projection of $17.4 billion. Still, 3D printing is predominantly used for just a handful of project types.

Did you know? The 3D printing industry could more than double in size by 2026, according to market projections.

Applications for 3D printers

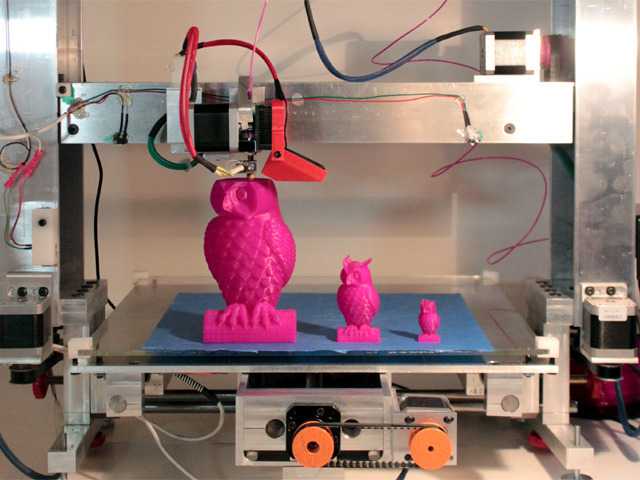

Prototyping

One of the oldest uses for 3D printers is the quick and efficient creation of prototypes. Since the printers were invented in 1983, companies have employed 3D printing to create a workable model of their desired end product, either to test the concept or present it to future investors.

“Before we called it ‘3D printing,’ it was called ‘rapid prototyping,'” said Greg Paulsen, director of applications engineering for third-party manufacturer Xometry. “It was seen as a way to get close enough to a functional model.”

Now that’s changing. While entrepreneurs still gladly use 3D printing for prototyping, the technology has become more accessible and adaptable, leading to new applications.

“The main development I’d summarize is moving from a primarily prototyping solution, currently the killer [application] for 3D printing, to end-part production,” said Filemon Schoffer, co-founder and CCO of online manufacturing platform Hubs. “This is already happening but will continue to accelerate.” [Related: How to Test a Business Idea]

Low-volume manufacturing

Though 3D printers can be slow, they’re adept at fulfilling low-volume production needs. Much like with prototyping, if an entrepreneur is ready to launch a new product and isn’t certain of the demand, they can print a small amount to test the waters. Low-volume production is also common for medical devices, for example, as manufacturers create, test and redesign their products for optimization.

Low-volume production is also common for medical devices, for example, as manufacturers create, test and redesign their products for optimization.

While low-volume manufacturing suits the capabilities of 3D printing, advances in technology make 3D printing a viable option of higher-volume production. Small businesses should consider the potential value of 3D printing in the mass customization of goods.

“Currently, 3D printing is mostly used in industries and applications with low-volume, high-unit cost and the need for customization, where costs of 3D printing are outweighed by the benefits,” said J. Scott Schiller, global head of customer and market development for HP Inc.’s 3D printing business. “However, [technological] improvement has been pushing the limits of the technology and unlocking its use in mass production applications. In the next five years, we’ll see part design become more function- and volume-oriented, and 3D printing will begin to fit into production systems across industries. ”

”

Mechanical parts

Another beneficial use for 3D printers is the creation of mechanical parts – either for sale in large industries or for personal repairs. Many products of 3D printing aren’t sold directly to consumers, but are created by companies – or third-party contractors – as components of a larger project. One example is GE Aviation’s 3D-printed fuel nozzle, which rolled out in 2015.

Small machine shops or individuals looking to make home repairs can also employ the same techniques for their projects. 3D printing has made it far easier to reproduce parts for machines that might no longer be in production or would take too long to arrive.

Biomedical devices

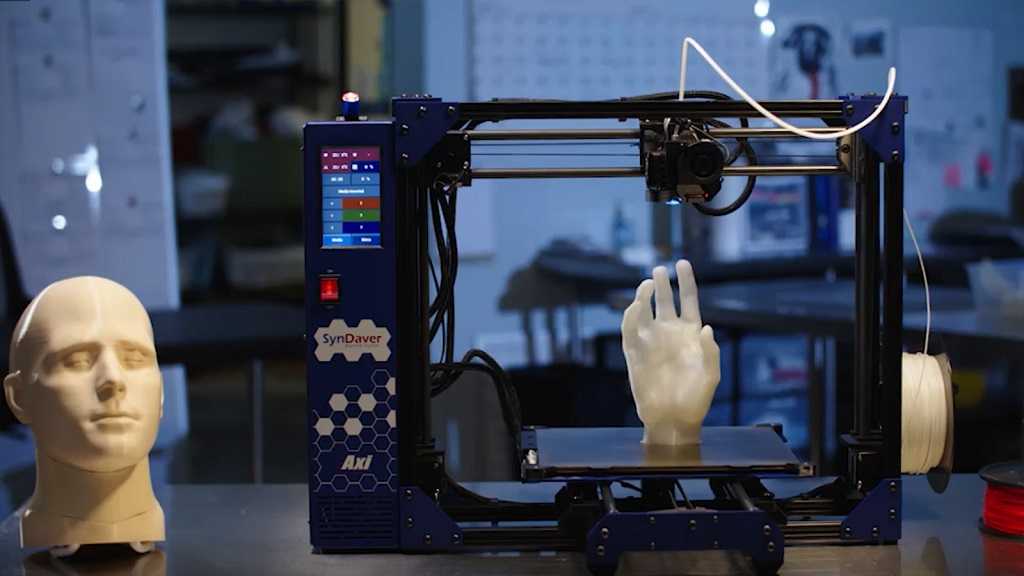

One particularly exciting aspect of 3D printing is the ability to print biomedical devices customized to individuals. For example, some companies are developing 3D-printed, custom prosthetics for amputees; these prosthetics are designed to be far more comfortable for the user.

“[Biomedical engineers are] 3D printing components for people that better match their characteristics than the off-the-shelf components,” Cola said. “I think where you see this tech going is more toward the performance and athletic side of the business, where you have athletes fully regain their performance levels after injuries, or maybe even enhance their performance levels with 3D components tailored to their needs.”

Other notable uses of 3D printing in the healthcare space are in ongoing efforts to develop printable organs for patients in need of transplants, and the printing of chemicals and proteins to develop new medicines.

Design

When engineers design a product, they must keep in mind the limitations of the production process. 3D printers can create parts previously considered unachievable with traditional manufacturing techniques. This opens an entirely new world in the design phase, which can lead to better, more efficient products and components. Many of these 3D-printed creations add value to important products, while others are downright unusual.

Many of these 3D-printed creations add value to important products, while others are downright unusual.

“It opens your mind up to everything you can do with it,” Paulsen said. “I’d really like to take this technology off the pedestal and say, ‘This is a normal manufacturing process,’ just like anything else.”

Copyrights and 3D printing

As 3D printers proliferate, so do the means of easily reproducing protected intellectual property. Roy Kaufman, managing director of business development and government relations at Copyright Clearance Center, warns that the manufacturing industry could be approaching its “Napster moment.” By that, he means the experience of the entertainment industry when music and movies could be quickly reproduced and pirated online.

“I think we’re going to see, as we see with almost every technology, two things happen: Things get cheaper, and they get better,” Kaufman said. “As the quality of the printers gets better, the available materials to print get better, and as costs come down, you get to that moment – the Napster moment. [That’s] when the means of reproduction are now so diffuse, the ability to reproduce at a low cost had been so spread out, that you can no longer really enforce your rights entirely effectively with existing IP [intellectual property] laws.”

[That’s] when the means of reproduction are now so diffuse, the ability to reproduce at a low cost had been so spread out, that you can no longer really enforce your rights entirely effectively with existing IP [intellectual property] laws.”

That moment could be coming quickly, Kaufman said, or it might not come at all. However, the mere fact that 3D printers are becoming more widespread makes it a plausible scenario that requires appropriate strategic planning. Kaufman suggested insulating your company by guaranteeing your supply chain and the quality of your products.

Tip: Protect your products from unlicensed 3D printing by guaranteeing your supply chain and your product quality. Also take measures to make sure your own business doesn’t accidentally steal intellectual property.

“[The consumer] might pay a premium for the assurances of the supply chain,” Kaufman added, “but they want to know that it’s not just a matter of what [the product] looks like but that it’s right. Testing and certification will become more important.”

Testing and certification will become more important.”

Within these major developments, there also lies opportunity. 3D printing will allow manufacturers to license the rights to their designs, which could be made downloadable to the licensee to 3D print. The technology could also bring production levels more in line with demand, thereby saving on production, shipment and storage costs.

“If you look at a typical pharmacy, for example, they have all these medicines with a sell-by date and are hoping someone will come in and need a prescription for it before they have to throw it out,” Kaufman said. “They pay to store it, pay to save it, and maybe even have to keep it in a central warehouse. But imagine your local CVS can print everything under license, get the chemicals from the pharmaceutical company, and maybe even [the] machine. The company doesn’t have to make things that might never get taken, never has to ship them, and never has to store them. Everything can be manufactured as needed. ”

”

The future of the industry

According to Sarah Boisvert, founder of Fab Lab Hub, “we’ve gotten past the hype stage” of 3D printing. The rumors about being able to 3D print everything under the sun have died down, and people are beginning to understand the practical aspects of 3D printing. This doesn’t mean the industry doesn’t face challenges moving forward, though.

Boisvert mentioned the need for skilled manufacturing workers. She isn’t alone in her concern, as the National Association of Manufacturers (NAM) continues to harp on the difficulties manufacturing companies face when seeking qualified employees. In a recent NAM study, 46.3% of small and midsize manufacturers surveyed consider finding quality employees a serious problem.

With 3D printing becoming an increasingly feasible integration into the supply chain for manufacturers, it’s critical that manufacturers have the employees with the skill set to properly work the printers in an efficient and timely manner. Additionally, the current price and speed of 3D printing can pose an issue for supply chain integration, Boisvert explained. At the end of the day, the decision to use 3D printing boils down to whether it truly makes sense for your business and if the cost is worth the benefit.

Additionally, the current price and speed of 3D printing can pose an issue for supply chain integration, Boisvert explained. At the end of the day, the decision to use 3D printing boils down to whether it truly makes sense for your business and if the cost is worth the benefit.

“We use everything,” Boisvert said of her manufacturing process for Potomac Photonics, another company she helped found. “We use 3D printing, laser cutting … I think it’s integrating 3D printing into the production flow and into the supply chain. No matter what tool you have, it’s about choosing the right tool for the job.” [Related: 3D Printing Jobs]

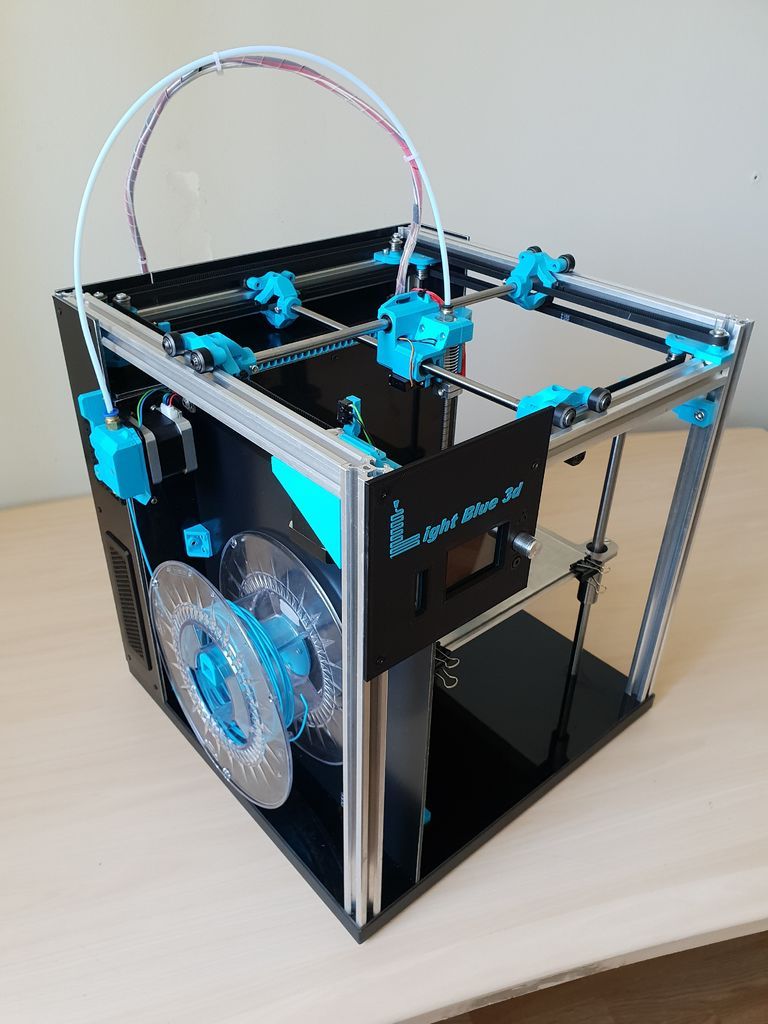

Top 3D printer picks for at-home small businesses

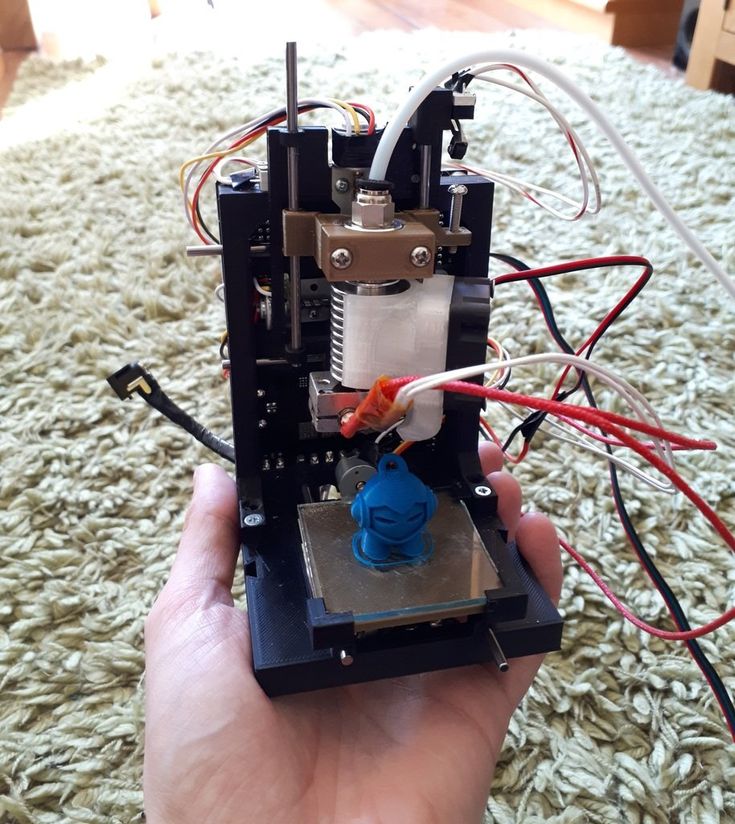

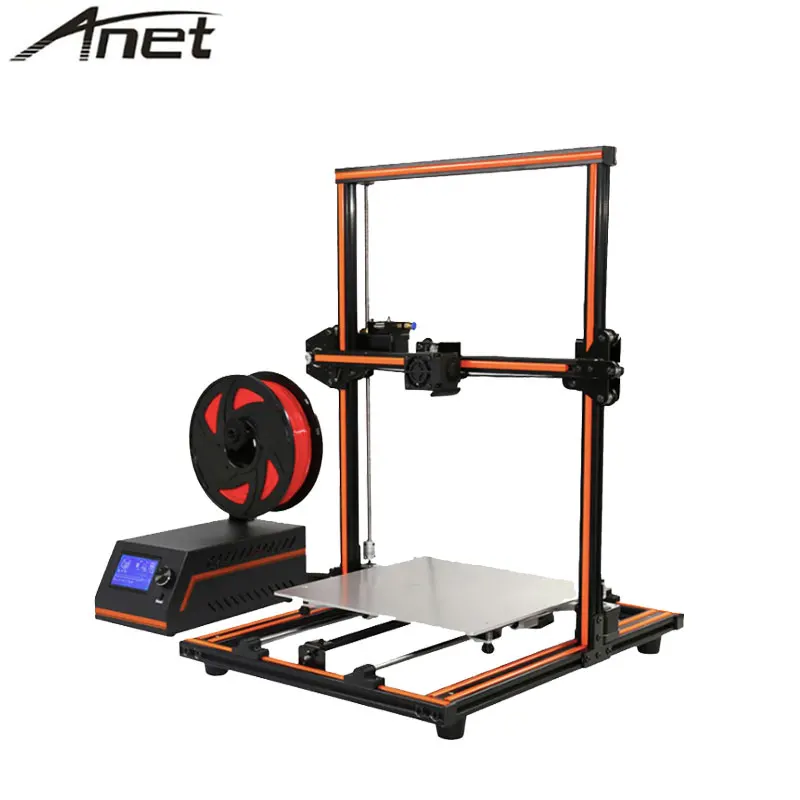

3D printing technology has come far enough that it’s now available at home. In fact, the 3D printers below are great choices for at-home small businesses.

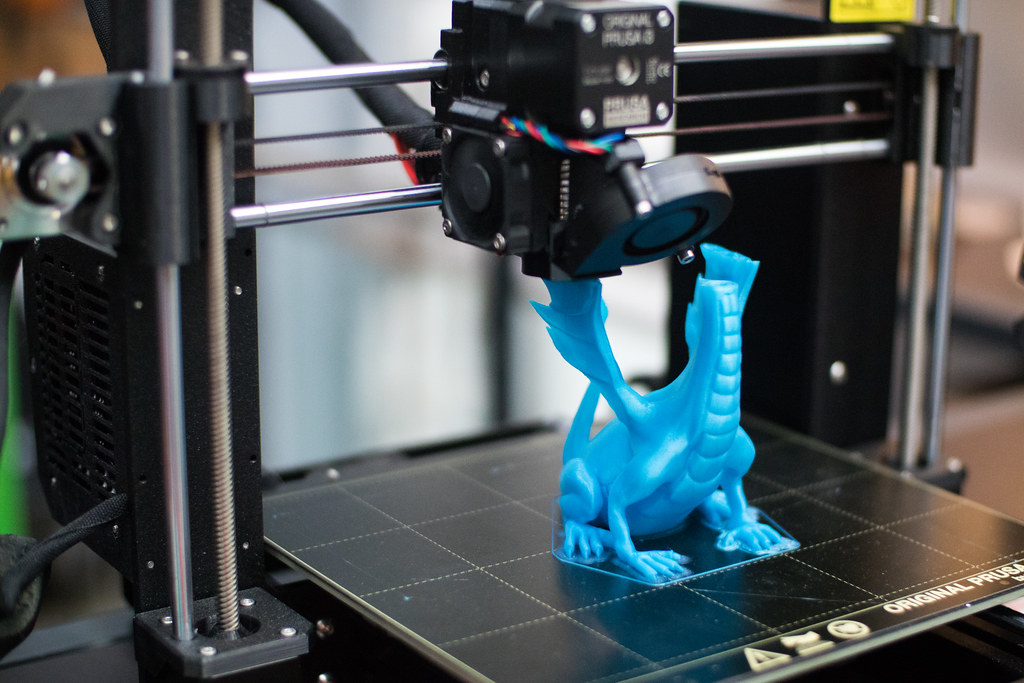

1. Original Prusa MINI

The Original Prusa MINI is the best overall choice for at-home small businesses. It takes up less than 2 square feet of precious desktop space, and its build area occupies about 355 square inches. Its layer resolution spans 50 to 200 microns, and you can easily use it with many types of filaments. Calibration can be challenging, but for the $350 price, this issue might be worth bearing.

It takes up less than 2 square feet of precious desktop space, and its build area occupies about 355 square inches. Its layer resolution spans 50 to 200 microns, and you can easily use it with many types of filaments. Calibration can be challenging, but for the $350 price, this issue might be worth bearing.

2. Ultimaker S3

The Ultimaker S3 is your best bet for printing larger objects. You can use it with many materials and achieve a layer resolution of 20 to 600 microns. It’s also relatively compact for a large object printer, with a build area of about 530 square inches. However, it’s known to be slow to print, and its $4,080 price tag is quite high.

3. Anycubic Vyper

If you need to print large objects but can’t afford Ultimaker’s models, the Anycubic Vyper might better suit your needs – and budget. You’ll get at least 100 microns of layer resolution for $680. You also get about 950 square inches of build area and a built-in accessories drawer. Some reviewers, though, have noted that the Vyper results in excessive initial stringing and uneven build quality.

Some reviewers, though, have noted that the Vyper results in excessive initial stringing and uneven build quality.

3D printing continuously evolves. Years ago, rumors spread about the possibility of 3D printers being in every home by now. While that notion proved too ambitious, there are practical implications of 3D printing that can benefit your small business.

3D printing consistently shows its worth, based on its prototyping, design considerations and mass customization. Keep tabs on changes as the industry evolves, and use 3D printing when it’s cost- and time-effective for your company.

Max Freedman and Adam Uzialko contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

The 3-D Printing Revolution

Idea in Brief

The Breakthrough

Additive manufacturing, or 3-D printing, is poised to transform the industrial economy. Its extreme flexibility not only allows for easy customization of goods but also eliminates assembly and inventories and enables products to be redesigned for higher performance.

The Challenge

Management teams should be reconsidering their strategies along three dimensions: (1) How might our offerings be enhanced, either by us or by competitors? (2) How should we reconfigure our operations, given the myriad new options for fabricating products and parts? (3) How will our commercial ecosystem evolve?

The Big Play

Inevitably, powerful platforms will arise to establish standards and facilitate exchanges among the designers, makers, and movers of 3-D-printed goods. The most successful of these will prosper mightily.

Leer en español

Ler em português

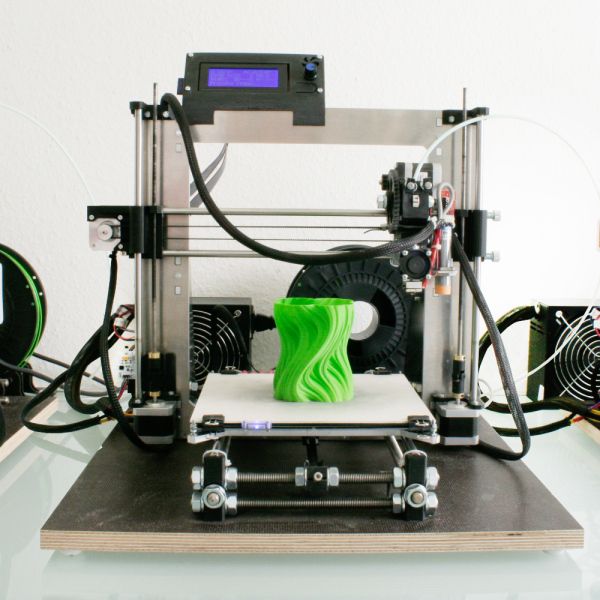

Industrial 3-D printing is at a tipping point, about to go mainstream in a big way. Most executives and many engineers don’t realize it, but this technology has moved well beyond prototyping, rapid tooling, trinkets, and toys. “Additive manufacturing” is creating durable and safe products for sale to real customers in moderate to large quantities.

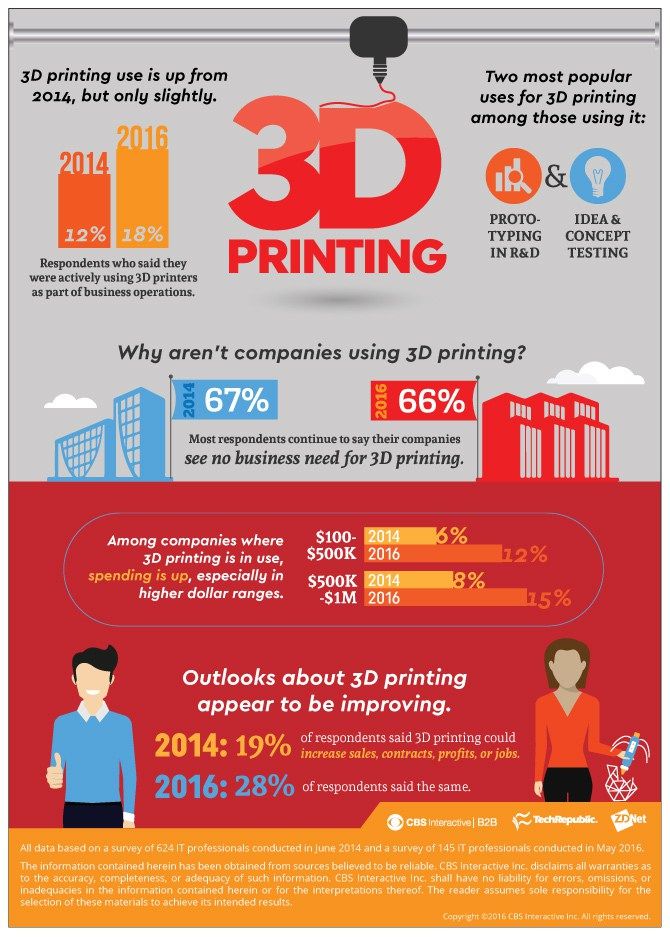

The beginnings of the revolution show up in a 2014 PwC survey of more than 100 manufacturing companies. At the time of the survey, 11% had already switched to volume production of 3-D-printed parts or products. According to Gartner analysts, a technology is “mainstream” when it reaches an adoption level of 20%.

At the time of the survey, 11% had already switched to volume production of 3-D-printed parts or products. According to Gartner analysts, a technology is “mainstream” when it reaches an adoption level of 20%.

Among the numerous companies using 3-D printing to ramp up production are GE (jet engines, medical devices, and home appliance parts), Lockheed Martin and Boeing (aerospace and defense), Aurora Flight Sciences (unmanned aerial vehicles), Invisalign (dental devices), Google (consumer electronics), and the Dutch company LUXeXcel (lenses for light-emitting diodes, or LEDs). Watching these developments, McKinsey recently reported that 3-D printing is “ready to emerge from its niche status and become a viable alternative to conventional manufacturing processes in an increasing number of applications.” In 2014 sales of industrial-grade 3-D printers in the United States were already one-third the volume of industrial automation and robotic sales. Some projections have that figure rising to 42% by 2020.

Further Reading

More companies will follow as the range of printable materials continues to expand. In addition to basic plastics and photosensitive resins, these already include ceramics, cement, glass, numerous metals and metal alloys, and new thermoplastic composites infused with carbon nanotubes and fibers. Superior economics will eventually convince the laggards. Although the direct costs of producing goods with these new methods and materials are often higher, the greater flexibility afforded by additive manufacturing means that total costs can be substantially lower.

With this revolutionary shift already under way, managers should now be engaging with strategic questions on three levels:

First, sellers of tangible products should ask how their offerings could be improved, whether by themselves or by competitors. Fabricating an object layer by layer, according to a digital “blueprint” downloaded to a printer, allows not only for limitless customization but also for designs of greater intricacy.

Second, industrial enterprises must revisit their operations. As additive manufacturing creates myriad new options for how, when, and where products and parts are fabricated, what network of supply chain assets and what mix of old and new processes will be optimal?

Third, leaders must consider the strategic implications as whole commercial ecosystems begin to form around the new realities of 3-D printing. Much has been made of the potential for large swaths of the manufacturing sector to atomize into an untold number of small “makers.” But that vision tends to obscure a surer and more important development: To permit the integration of activities across designers, makers, and movers of goods, digital platforms will have to be established. At first these platforms will enable design-to-print activities and design sharing and fast downloading. Soon they will orchestrate printer operations, quality control, real-time optimization of printer networks, and capacity exchanges, among other needed functions. The most successful platform providers will prosper mightily by establishing standards and providing the settings in which a complex ecosystem can coordinate responses to market demands. But every company will be affected by the rise of these platforms. There will be much jockeying among incumbents and upstarts to capture shares of the enormous value this new technology will create.

The most successful platform providers will prosper mightily by establishing standards and providing the settings in which a complex ecosystem can coordinate responses to market demands. But every company will be affected by the rise of these platforms. There will be much jockeying among incumbents and upstarts to capture shares of the enormous value this new technology will create.

These questions add up to a substantial amount of strategic thinking, and still another remains: How fast will all this happen? For a given business, here’s how fast it can happen: The U.S. hearing aid industry converted to 100% additive manufacturing in less than 500 days, according to one industry CEO, and not one company that stuck to traditional manufacturing methods survived. Managers will need to determine whether it’s wise to wait for this fast-evolving technology to mature before making certain investments or whether the risk of waiting is too great. Their answers will differ, but for all of them it seems safe to say that the time for strategic thinking is now.

Additive’s Advantages

It may be hard to imagine that this technology will displace today’s standard ways of making things in large quantities. Traditional injection-molding presses, for example, can spit out thousands of widgets an hour. By contrast, people who have watched 3-D printers in action in the hobbyist market often find the layer-by-layer accretion of objects comically slow. But recent advances in the technology are changing that dramatically in industrial settings.

Some may forget why standard manufacturing occurs with such impressive speed. Those widgets pour out quickly because heavy investments have been made up front to establish the complex array of machine tools and equipment required to produce them. The first unit is extremely expensive to make, but as identical units follow, their marginal cost plummets.

Additive manufacturing doesn’t offer anything like that economy of scale. However, it avoids the downside of standard manufacturing—a lack of flexibility. Because each unit is built independently, it can easily be modified to suit unique needs or, more broadly, to accommodate improvements or changing fashion. And setting up the production system in the first place is much simpler, because it involves far fewer stages. That’s why 3-D printing has been so valuable for producing one-offs such as prototypes and rare replacement parts. But additive manufacturing increasingly makes sense even at higher scale. Buyers can choose from endless combinations of shapes, sizes, and colors, and this customization adds little to a manufacturer’s cost even as orders reach mass-production levels.

Because each unit is built independently, it can easily be modified to suit unique needs or, more broadly, to accommodate improvements or changing fashion. And setting up the production system in the first place is much simpler, because it involves far fewer stages. That’s why 3-D printing has been so valuable for producing one-offs such as prototypes and rare replacement parts. But additive manufacturing increasingly makes sense even at higher scale. Buyers can choose from endless combinations of shapes, sizes, and colors, and this customization adds little to a manufacturer’s cost even as orders reach mass-production levels.

A big part of the additive advantage is that pieces that used to be molded separately and then assembled can now be produced as one piece in a single run. A simple example is sunglasses: The 3-D process allows the porosity and mixture of plastics to vary in different areas of the frame. The earpieces come out soft and flexible, while the rims holding the lenses are hard. No assembly required.

No assembly required.

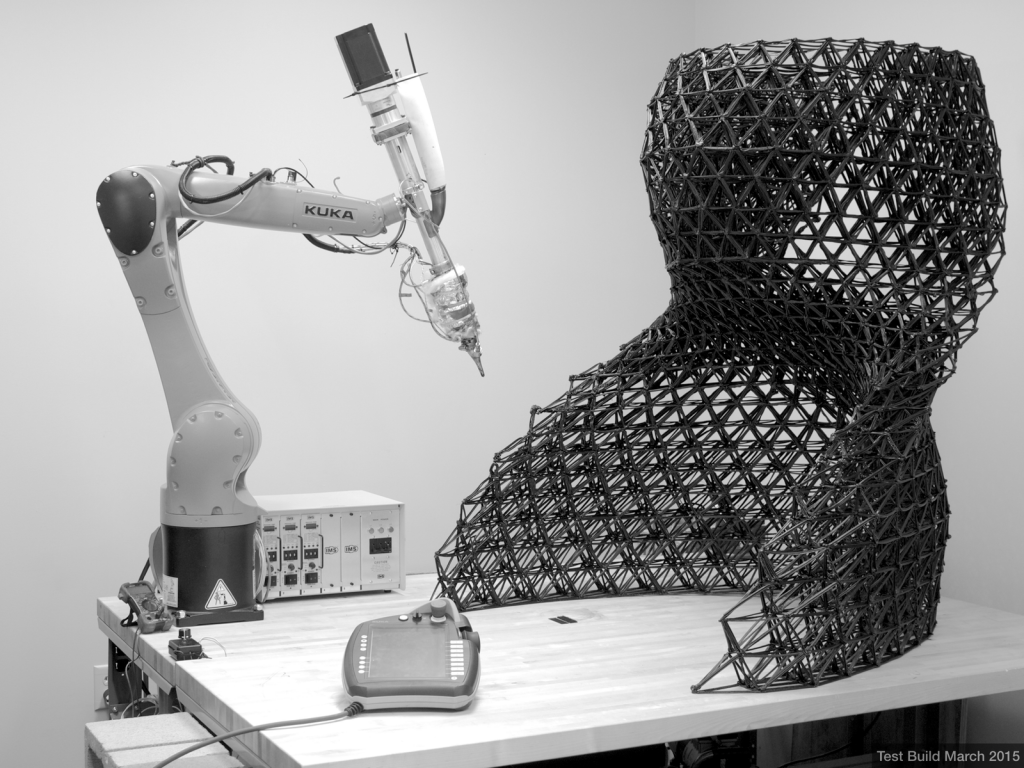

Printing parts and products also allows them to be designed with more-complex architectures, such as honeycombing within steel panels or geometries previously too fine to mill. Complex mechanical parts—an encased set of gears, for example—can be made without assembly. Additive methods can be used to combine parts and generate far more interior detailing. That’s why GE Aviation has switched to printing the fuel nozzles of certain jet engines. It expects to churn out more than 45,000 of the same design a year, so one might assume that conventional manufacturing methods would be more suitable. But printing technology allows a nozzle that used to be assembled from 20 separately cast parts to be fabricated in one piece. GE says this will cut the cost of manufacturing by 75%.

U.S. hearing aid companies converted to 100% 3-D printing in less than 500 days.

Additive manufacturing can also use multiple printer jets to lay down different materials simultaneously. Thus Optomec and other companies are developing conductive materials and methods of printing microbatteries and electronic circuits directly into or onto the surfaces of consumer electronic devices. Additional applications include medical equipment, transportation assets, aerospace components, measurement devices, telecom infrastructure, and many other “smart” things.

Thus Optomec and other companies are developing conductive materials and methods of printing microbatteries and electronic circuits directly into or onto the surfaces of consumer electronic devices. Additional applications include medical equipment, transportation assets, aerospace components, measurement devices, telecom infrastructure, and many other “smart” things.

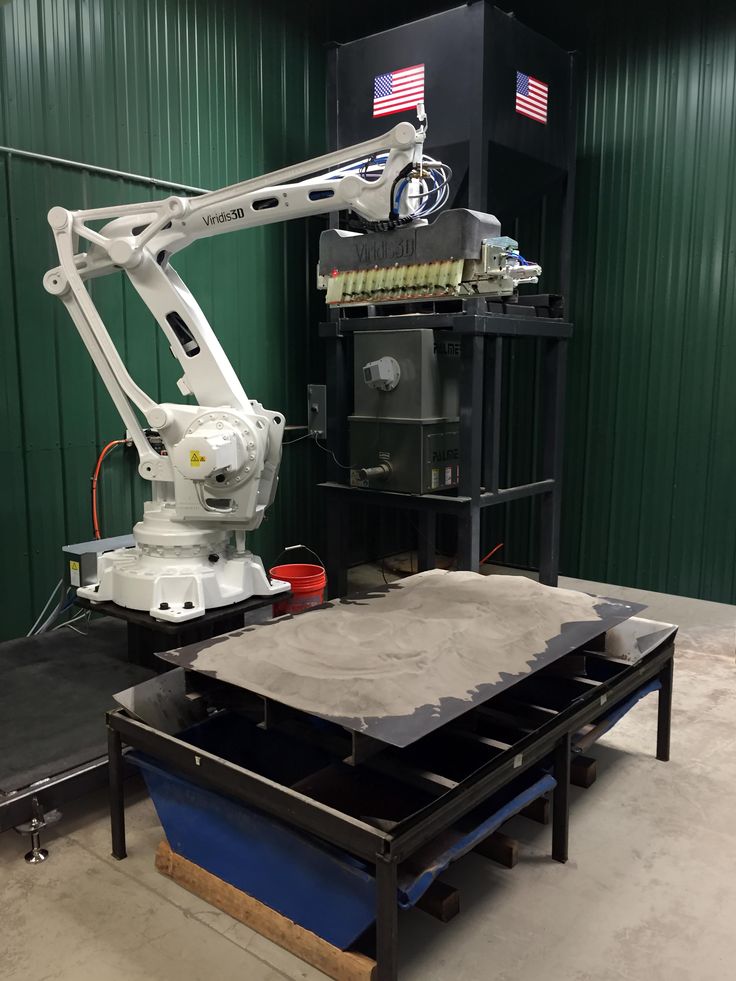

The enormous appeal of limiting assembly work is pushing additive manufacturing equipment to grow ever larger. At the current extreme, the U.S. Department of Defense, Lockheed Martin, Cincinnati Tool Steel, and Oak Ridge National Laboratory are partnering to develop a capability for printing most of the endo- and exoskeletons of jet fighters, including the body, wings, internal structural panels, embedded wiring and antennas, and soon the central load-bearing structure. So-called big area additive manufacturing makes such large-object fabrication possible by using a huge gantry with computerized controls to move the printers into position. When this process has been certified for use, the only assembly required will be the installation of plug-and-play electronics modules for navigation, communications, weaponry, and electronic countermeasure systems in bays created during the printing process. In Iraq and Afghanistan the U.S. military has been using drones from Aurora Flight Sciences, which prints the entire body of these unmanned aerial vehicles—some with wingspans of 132 feet—in one build.

When this process has been certified for use, the only assembly required will be the installation of plug-and-play electronics modules for navigation, communications, weaponry, and electronic countermeasure systems in bays created during the printing process. In Iraq and Afghanistan the U.S. military has been using drones from Aurora Flight Sciences, which prints the entire body of these unmanned aerial vehicles—some with wingspans of 132 feet—in one build.

Three-Dimensional Strategy

This brief discussion of additive manufacturing’s advantages suggests how readily companies will embrace the technology—and additional savings in inventory, shipping, and facility costs will make the case even stronger. The clear implication is that managers in companies of all kinds should be working to anticipate how their businesses will adapt on the three strategic levels mentioned above.

Offerings, redesigned.

Product strategy is the answer to that most basic question in business, What will we sell? Companies will need to imagine how their customers could be better served in an era of additive manufacturing. What designs and features will now be possible that were not before? What aspects can be improved because restrictions or delivery delays have been eliminated?

What designs and features will now be possible that were not before? What aspects can be improved because restrictions or delivery delays have been eliminated?

For example, in the aerospace and automotive industries, 3-D printing will most often be used in the pursuit of performance gains. Previously, the fuel efficiency of jet fighters and vehicles could be enhanced by reducing their weight, but this frequently made them less structurally sound. The new technology allows manufacturers to hollow out a part to make it lighter and more fuel-efficient and incorporate internal structures that provide greater tensile strength, durability, and resistance to impact. And new materials that have greater heat and chemical resistance can be used in various spots in a product, as needed.

Want to know how fast the 3-D future is coming? Don’t look only at adoption rates among manufacturers. Look at the innovation rates of inventors. In 2005 only 80 patents relating to additive manufacturing materials, software, and equipment were granted worldwide, not counting duplicates filed in multiple countries. By 2013 that number had gone into orbit, with approximately 600 new nonduplicative patents issued around the globe.

By 2013 that number had gone into orbit, with approximately 600 new nonduplicative patents issued around the globe.

What are some of the companies behind these patents? Not surprisingly, the two leaders are Stratasys and 3D Systems, rivals that have staked out positions in additive manufacturing. They hold 57 and 49 nonduplicative patents respectively. As befits its printing heritage, Xerox, too, has invested heavily in additive technologies for making electronics and has developed a strong alliance with 3D Systems. Panasonic, Hewlett-Packard, 3M, and Siemens likewise hold numerous patents.

But surprisingly, the largest users of 3-D printing have also been active innovators. Fourth on the list, with 35 patents, is Therics, a manufacturer of medical devices. These commercial companies understand additive manufacturing’s potential to give them important advantages over competitors.

Also noteworthy among patent holders are companies that straddle both worlds. GE and IBM are important manufacturers but are increasingly invested in platforms that optimize value chains run by other companies. GE (11 patents) is developing the industrial internet, and IBM (19) has worked out what it is calling the “software-defined supply chain” and optimization software for smart manufacturing systems. Both are well positioned to take on similar roles with regard to additive manufacturing—and both bear watching as models for how incumbents can capture disproportionate value from a highly disruptive technology.

GE (11 patents) is developing the industrial internet, and IBM (19) has worked out what it is calling the “software-defined supply chain” and optimization software for smart manufacturing systems. Both are well positioned to take on similar roles with regard to additive manufacturing—and both bear watching as models for how incumbents can capture disproportionate value from a highly disruptive technology.

In other industries, the use of additive manufacturing for more-tailored and fast-evolving products will have ramifications for how offerings are marketed. What happens to the concept of product generations—let alone the hoopla around a launch—when things can be upgraded continually during successive printings rather than in the quantum leaps required by the higher tooling costs and setup times of conventional manufacturing? Imagine a near future in which cloud-based artificial intelligence augments additive manufacturing’s ability to change or add products instantly without retooling. Real-time changes in product strategy, such as product mix and design decisions, would become possible. With such rapid adaptation, what new advantages should be core to brand promises? And how could marketing departments prevent brand drift without losing sales?

Real-time changes in product strategy, such as product mix and design decisions, would become possible. With such rapid adaptation, what new advantages should be core to brand promises? And how could marketing departments prevent brand drift without losing sales?

Operations, reoptimized.

Operations strategy encompasses all the questions of how a company will buy, make, move, and sell goods. The answers will be very different with additive manufacturing. Greater operational efficiency is always a goal, but it can be achieved in many ways. Today most companies contemplating the use of the technology do piecemeal financial analysis of targeted opportunities to swap in 3-D equipment and designs where those can reduce direct costs. Much bigger gains will come when they broaden their analyses to consider the total cost of manufacturing and overhead.

How much could be saved by cutting out assembly steps? Or by slashing inventories through production only in response to actual demand? Or by selling in different ways—for example, direct to consumers via interfaces that allow them to specify any configuration? In a hybrid world of old and new manufacturing methods, producers will have many more options; they will have to decide which components or products to transition over to additive manufacturing, and in what order.

Additional questions will arise around facilities locations. How proximate should they be to which customers? How can highly customized orders be delivered as efficiently as they are produced? Should printing be centralized in plants or dispersed in a network of printers at distributors, at retailers, on trucks, or even in customers’ facilities? Perhaps all of the above. The answers will change in real time, adjusting to shifts in foreign exchange, labor costs, printer efficiency and capabilities, material costs, energy costs, and shipping costs.

This article also appears in:

A shorter traveling distance for products or parts not only saves money; it saves time. If you’ve ever been forced to leave your vehicle at a repair shop while the mechanic waits for a part, you’ll appreciate that. BMW and Honda, among other automakers, are moving toward the additive manufacturing of many industrial tools and end-use car parts in their factories and dealerships—especially as new metal, composite plastic, and carbon-fiber materials become available for use in 3-D printers. Distributors in many industries are taking note, eager to help their business customers capitalize on the new efficiencies. UPS, for example, is building on its existing third-party logistics business to turn its airport hub warehouses into mini-factories. The idea is to produce and deliver customized parts to customers as needed, instead of devoting acres of shelving to vast inventories. If we already live in a world of just-in-time inventory management, we now see how JIT things can get. Welcome to instantaneous inventory management.

Distributors in many industries are taking note, eager to help their business customers capitalize on the new efficiencies. UPS, for example, is building on its existing third-party logistics business to turn its airport hub warehouses into mini-factories. The idea is to produce and deliver customized parts to customers as needed, instead of devoting acres of shelving to vast inventories. If we already live in a world of just-in-time inventory management, we now see how JIT things can get. Welcome to instantaneous inventory management.

Indeed, given all the potential efficiencies of highly integrated additive manufacturing, business process management may become the most important capability around. Some companies that excel in this area will build out proprietary coordination systems to secure competitive advantage. Others will adopt and help to shape standard packages created by big software companies.

Ecosystems, reconfigured.

Finally comes the question of where and how the enterprise fits into its broader business environment. Here managers address the puzzles of Who are we? and What do we need to own to be who we are? As additive manufacturing allows companies to acquire printers that can make many products, and as idle capacity is traded with others in the business of offering different products, the answers to those questions will become far less clear. Suppose you have rows of printers in your facility that build auto parts one day, military equipment the next day, and toys the next. What industry are you part of? Traditional boundaries will blur. Yet managers need a strong sense of the company’s role in the world to make decisions about which assets they will invest in—or divest themselves of.

Here managers address the puzzles of Who are we? and What do we need to own to be who we are? As additive manufacturing allows companies to acquire printers that can make many products, and as idle capacity is traded with others in the business of offering different products, the answers to those questions will become far less clear. Suppose you have rows of printers in your facility that build auto parts one day, military equipment the next day, and toys the next. What industry are you part of? Traditional boundaries will blur. Yet managers need a strong sense of the company’s role in the world to make decisions about which assets they will invest in—or divest themselves of.

Aurora Flight Sciences can print the entire body of a drone in one build.

They may find their organizations evolving into something very different from what they have been. As companies are freed from many of the logistical requirements of standard manufacturing, they will have to look anew at the value of their capabilities and other assets and how those complement or compete with the capabilities of others.

The Platform Opportunity

One position in the ecosystem will prove to be the most central and powerful—and this fact is not lost on the management teams of the biggest players already in the business of additive manufacturing, such as eBay, IBM, Autodesk, PTC, Materialise, Stratasys, and 3D Systems. Many are vying to develop the platforms on which other companies will build and connect. They know that the role of platform provider is the biggest strategic objective they could pursue and that it’s still very much up for grabs.

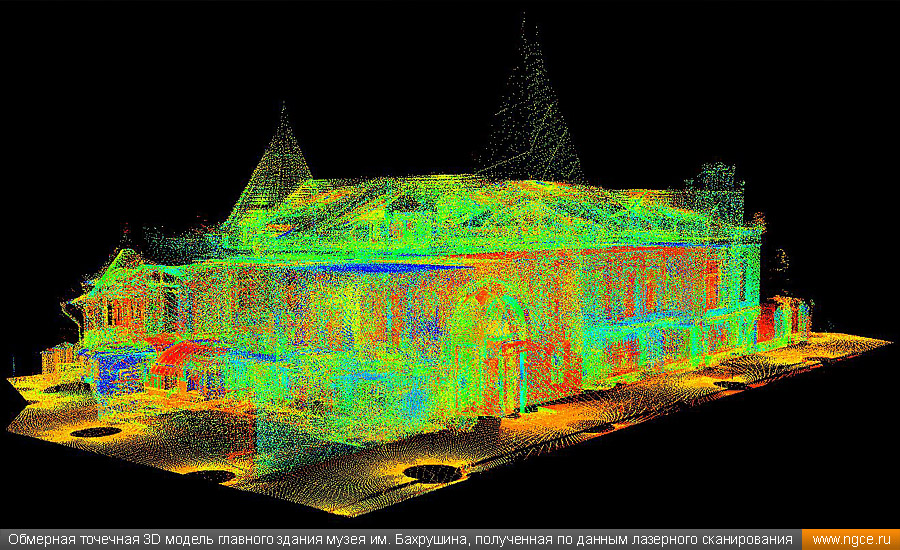

Platforms are a prominent feature in highly digitized 21st-century markets, and additive manufacturing will be no exception. Here platform owners will be powerful because production itself is likely to matter less over time. Already some companies are setting up contract “printer farms” that will effectively commoditize the making of products on demand. Even the valuable designs for printable products, being purely digital and easily shared, will be hard to hold tight. (For that matter, 3-D scanning devices will make it possible to reverse-engineer products by capturing their geometric design information.)

(For that matter, 3-D scanning devices will make it possible to reverse-engineer products by capturing their geometric design information.)

Everyone in the system will have a stake in sustaining the platforms on which production is dynamically orchestrated, blueprints are stored and continually enhanced, raw materials supplies are monitored and purchased, and customer orders are received. Those that control the digital ecosystem will sit in the middle of a tremendous volume of industrial transactions, collecting and selling valuable information. They will engage in arbitrage and divide the work up among trusted parties or assign it in-house when appropriate. They will trade printer capacity and designs all around the world, influencing prices by controlling or redirecting the “deal flow” for both. Like commodities arbitrageurs, they will finance trades or buy low and sell high with the asymmetric information they gain from overseeing millions of transactions.

Any manufacturer whose strategy for the future includes additive techniques has to lay out a road map for getting there. Companies already on the journey are taking things step-by-step, but in three different ways.

Companies already on the journey are taking things step-by-step, but in three different ways.

Trickle Down

Some start with their high-end products, knowing that their most sophisticated (and price-insensitive) customers will appreciate the innovation and flexibility. The luxury will trickle down in the time-honored way as the technology matures and becomes more affordable. Automotive manufacturers, for example, tend to engineer one-off parts specially for Formula One racing cars and then find ways to introduce versions of those innovations to high-end sports and luxury cars. As engineers’ familiarity with the technology grows, they spot opportunities to bring it to parts for mass-market car segments.

Swap Out

Other pioneers proceed in a less splashy way, focusing first on the components of a given product that are easiest to migrate to additive manufacturing. The objective is to develop the organization’s know-how by advancing to more-challenging components of the same product. This is common in aerospace, where companies have selected a specific product, such as an F-35 fighter jet, and started with mundane brackets and braces before moving to, say, internal panels and partitions. As the manufacturers learn more, they begin printing the fighter’s exterior skin. Experiments with printing its load-bearing structures are now under way.

This is common in aerospace, where companies have selected a specific product, such as an F-35 fighter jet, and started with mundane brackets and braces before moving to, say, internal panels and partitions. As the manufacturers learn more, they begin printing the fighter’s exterior skin. Experiments with printing its load-bearing structures are now under way.

Cut Across

A third approach is to find components that show up in multiple products and use them to establish a 3-D foothold. For example, a design improvement for a fighter jet could be transferred to drones, missiles, or satellites. Such cross-product improvement builds knowledge and awareness throughout the company of how additive manufacturing can enhance performance on key dimensions such as weight, energy use, and flexibility.

The common theme here is small, incremental steps. In all three approaches, engineers are being given fascinating new puzzles to solve without having their world upended by still-evolving methods and materials, thus minimizing risk and resistance to change. It is up to more-senior managers to maintain the appropriate level of pressure for taking each successive step. As they push for further adoption, they should allow naysayers to explain why 3-D printing isn’t right for a given part or process, but then challenge them to overcome that roadblock. Traditionalists will always be quick to tell you what 3-D printing can’t do. Don’t let them blind you to what it can.

It is up to more-senior managers to maintain the appropriate level of pressure for taking each successive step. As they push for further adoption, they should allow naysayers to explain why 3-D printing isn’t right for a given part or process, but then challenge them to overcome that roadblock. Traditionalists will always be quick to tell you what 3-D printing can’t do. Don’t let them blind you to what it can.

Responsibility for aligning dispersed capacity with growing market demand will fall to a small number of companies—and if the whole system is to work efficiently, some will have to step up to it. Look for analogs to Google, eBay, Match.com, and Amazon to emerge as search engines, exchange platforms, branded marketplaces, and matchmakers among additive manufacturing printers, designers, and design repositories. Perhaps even automated trading will come into existence, along with markets for trading derivatives or futures on printer capacity and designs.

In essence, then, the owners of printer-based manufacturing assets will compete with the owners of information for the profits generated by the ecosystem. And in fairly short order, power will migrate from producers to large systems integrators, which will set up branded platforms with common standards to coordinate and support the system. They’ll foster innovation through open sourcing and acquiring or partnering with smaller companies that meet high standards of quality. Small companies may indeed continue to try out interesting new approaches on the margins—but we’ll need big organizations to oversee the experiments and then push them to be practical and scalable.

And in fairly short order, power will migrate from producers to large systems integrators, which will set up branded platforms with common standards to coordinate and support the system. They’ll foster innovation through open sourcing and acquiring or partnering with smaller companies that meet high standards of quality. Small companies may indeed continue to try out interesting new approaches on the margins—but we’ll need big organizations to oversee the experiments and then push them to be practical and scalable.

Digital History Replicated

Thinking about the unfolding revolution in additive manufacturing, it’s hard not to reflect on that great transformative technology, the internet. In terms of the latter’s history, it might be fair to say that additive manufacturing is only in 1995. Hype levels were high that year, yet no one imagined how commerce and life would change in the coming decade, with the arrival of Wi-Fi, smartphones, and cloud computing. Few foresaw the day that internet-based artificial intelligence and software systems could run factories—and even city infrastructures—better than people could.

The future of additive manufacturing will bring similar surprises that might look strictly logical in hindsight but are hard to picture today. Imagine how new, highly capable printers might replace highly skilled workers, shifting entire companies and even manufacturing-based countries into people-less production. In “machine organizations,” humans might work only to service the printers.

And that future will arrive quickly. Once companies put a toe in the water and experience the advantages of greater manufacturing flexibility, they tend to dive in deep. As materials science creates more printable substances, more manufacturers and products will follow. Local Motors recently demonstrated that it can print a good-looking roadster, including wheels, chassis, body, roof, interior seats, and dashboard but not yet drivetrain, from bottom to top in 48 hours. When it goes into production, the roadster, including drivetrain, will be priced at approximately $20,000. As the cost of 3-D equipment and materials falls, traditional methods’ remaining advantages in economies of scale are becoming a minor factor.

Local Motors can print a good-looking roadster from bottom to top in 48 hours.

Here’s what we can confidently expect: Within the next five years we will have fully automated, high-speed, large-quantity additive manufacturing systems that are economical even for standardized parts. Owing to the flexibility of those systems, customization or fragmentation in many product categories will then take off, further reducing conventional mass production’s market share.

Smart business leaders aren’t waiting for all the details and eventualities to reveal themselves. They can see clearly enough that additive manufacturing developments will change the way products are designed, made, bought, and delivered. They are taking the first steps in the redesign of manufacturing systems. They are envisioning the claims they will stake in the emerging ecosystem. They are making the many layers of decisions that will add up to advantage in a new world of 3-D printing.

A version of this article appeared in the May 2015 issue (pp. 40–48) of Harvard Business Review.

40–48) of Harvard Business Review.

Content

-

- Creation of model

- Creation of model

- Materials for 3D printing

- Post-cutting

- What to pay attention to when choosing a 3D printer

One of the oldest professions on earth is a jeweler. For the ancients, jewelry did not have the value that it has for us today. They believed that jewels carry a certain magical meaning, that they somehow protect us from evil spells, from grief, and even from physical attacks. Part of this tradition has survived to this day. nine0003

Nevertheless, even in such traditional areas of production, digital technologies are coming.

And as always, in our series of articles on the application of 3D printing in various fields, you need to start by creating a 3D model.

Model building

Many jewelers have long since moved on to creating digital 3D models in specialized software such as Rhinoceros, Magics and ZBrush. We will not dwell here on the features of each of these programs, but it is important to understand that this is quite complex software that requires additional training and adaptation. nine0003

We will not dwell here on the features of each of these programs, but it is important to understand that this is quite complex software that requires additional training and adaptation. nine0003

The second source of 3D models can be reverse engineering , this term is more related to industry, but nevertheless it is fully applicable to jewelry. In this case, a 3D model is obtained by scanning, refining and then creating a new model. A simple example of such a task is, for example, the loss of one of the two earrings and the need to create a copy of the original model. Naturally, the master to whom you will come with this task does not have your earring model and he will need to start creating it from scratch. A 3D scanner can be of great help in this - the earring is scanned, processed, and then a model is printed, according to which it is already possible to make a casting. nine0003

At the same time, the laboriousness of the process is significantly reduced, and in addition, complete identity of even small parts is guaranteed.

Model building

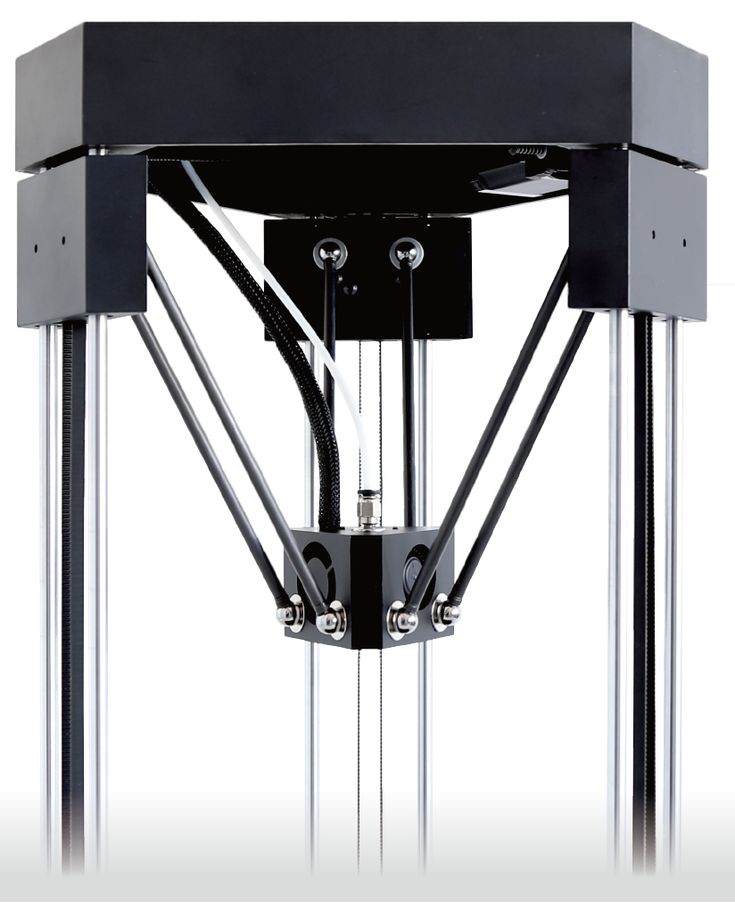

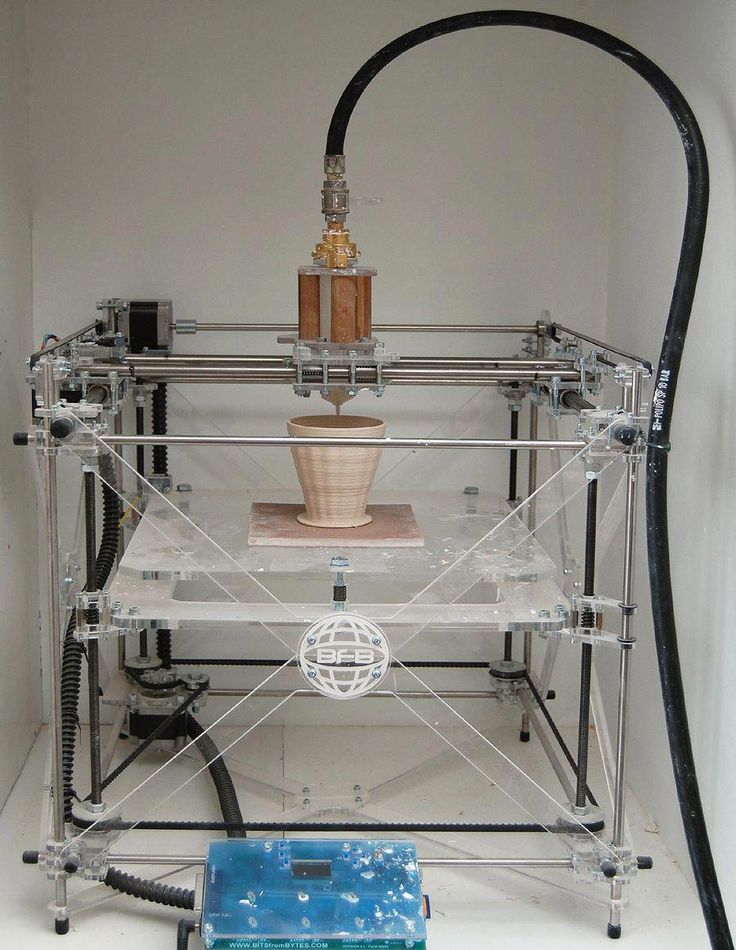

There are several 3D printing technologies that differ in the way the 3D model is formed and the material from which the model is made. For jewelers, two technologies are best suited - photopolymer SLA / DLP / LCD 3D printing and MJP 3D wax printing, these methods allow you to create models with high detail and accuracy. nine0003

The essence of the first technology is that liquid photopolymer resin hardens under the influence of a light source and forms a model. The difference in technology name reflects the way this process takes place, SLA with a laser, DLP with a projector lamp, LCD with an LCD matrix.

Each technology has its pros and cons, there are many good articles on this topic, and I won't dwell on it in detail. nine0003

3D printing materials

The most popular materials for jewelers are burnt resins. When choosing this resin, you should pay attention to the percentage of ash content after burning out and the original purpose of the material, as there are burnt resins for dentists and jewelers. The resins used by dentists are tougher, while the resins used by jewelers often contain wax.

The resins used by dentists are tougher, while the resins used by jewelers often contain wax.

Postprocessing

When buying a photopolymer 3D printer, it is also worth considering that after printing, models need post-processing. First of all, they need to be washed in technical alcohol to remove resin residues. This can be done manually in a bath with alcohol, but it is best to use a special ultrasonic cleaner, which copes with this task as quickly and efficiently as possible. nine0003

A UV camera is needed to illuminate the model after printing, this also gives the model additional strength. This can be done by placing the model in the sun or in a household chamber for drying nails, but then the process can take from 12 hours to a day, in a UV chamber it takes 10-15 minutes. If we talk about specific models, we recommend that you pay attention to the Wanhao Boxman-1 UV camera

and ultrasonic cleaner UNIZ UC-4120. nine0003

nine0003

At the same time, perhaps the main advantage of photopolymer 3D printers is their relatively low price and high performance. It is also worth noting the affordable cost of printing materials.

If you opt for MJP wax 3D printing, you will get a higher degree of detail for the production of geometrically complex products, with a minimum layer thickness of up to 16 microns. But in this case, post-processing will also be required. With the help of a special solution, supports are removed, and then the model is dried. When printing with wax, two types of materials are used: a harder (melting at a temperature of about 70 ° C) - model wax for printing a product and a softer or fusible one - to create supports. nine0003

An example of such a printer is the FlashForge WaxJet 300.

What to look for when choosing a 3D printer

When choosing a 3D printer, you should also pay attention to several aspects, first of all: the build area, print speed, the ability to use various resins, and the convenience of the slicer.

A slicer is a program that converts a 3D model into a printable file. This file contains information for the printer, how the model will be physically printed, with what layer thickness, how long each layer will be illuminated, and most importantly, how the slicer will form the support structure. nine0003

Supports are additions to a 3D model that allow it to print normally. The final result of printing will largely depend on the quality and quantity of supports.

Even before buying a printer, you can download various slicers and see which one is more intuitive for you. Each manufacturer supplies its own slicer in the kit, but this product is not always optimal, you can also use another free or paid slicer if the printer manufacturer allows this. nine0003

The choice of the 3D printer itself seems to be the most difficult task for a user who has not previously encountered this technology. Here I would advise to proceed primarily from the budget for the initial purchase, as well as calculate the cost of subsequent ownership, which consists of the cost of resins, printing trays, replaceable films and LCD matrices that have a certain resource of use. When choosing, you must, first of all, understand that in skillful hands the most budget printer works wonders, and in inept hands, the most sophisticated machine will only be a beautiful addition to your workshop or office. nine0003

When choosing, you must, first of all, understand that in skillful hands the most budget printer works wonders, and in inept hands, the most sophisticated machine will only be a beautiful addition to your workshop or office. nine0003

Specifically speaking about models, I would draw your attention to the following photopolymer printers.

First of all, Phrozen Shuffle 4K, which is equipped with a 4K resolution sensor and is able to create models with high detail and high quality surface finish.

And also new is the UNIZ Slash 2 3D printer, which combines high print speed with a 4K matrix and a host of additional features, such as automatic resin filling, a built-in webcam and a large print area. nine0003

Also worth checking out is the FormLabs Form 3 SLA 3D printer, which, along with additional options and custom-made resins, is the complete solution for the industry.

Among wax printers, two American companies can be distinguished, first of all, SolidScape, the industry pioneer and its SolidScape S300 and S500 series models. It must be said right away that this equipment is not very productive, and when buying it, one must take this into account. nine0025

It must be said right away that this equipment is not very productive, and when buying it, one must take this into account. nine0025

The second market leader is 3D Systems and its ProJet MJP 2500W model. This printer is more productive, but at the same time more expensive. Before buying such equipment, I would recommend that you first make a number of test prints, as well as evaluate the cost and quality of the final product.

The specialists of our company will be happy to help you with the selection of the necessary equipment, in addition, we provide the possibility of test printing with your chosen materials on printers that you are considering buying. nine0003

Article author

Alexander Kornveits, 3D printing market expert

© A. I. Kornveits, 2020

Add to compare

Product added to compare Go

| Manufacturer | Uniz |

Add to compare

Product added to compare Go nine0003

| Manufacturer | Wanhao

Free Shipping

Add to compare

Product added to compare Go

| Manufacturer | Phrozen |

Free Shipping

Add to compare

Product added to compare Go nine0003

| Manufacturer | Flash Forge |

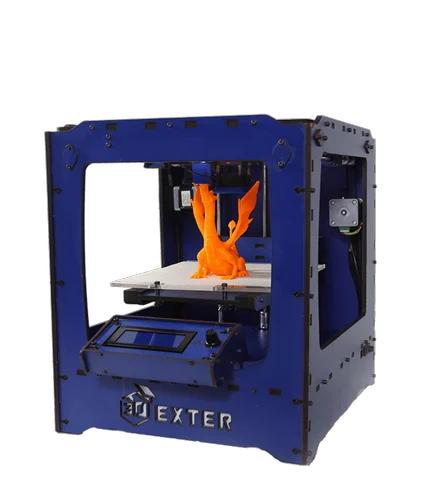

3D printers in jewelry making

08/01/2022

Printers 3 D in jewelry making

The scope of high-tech 3D printers is rapidly expanding. Now this equipment is used not only in manufacturing industries, but also in such a specific craft as jewelry making. One of the stages of this creative process is the creation of casting molds. Moreover, it is often necessary to produce models of a high level of complexity, as customers want to receive an original, unique piece of jewelry. Doing this kind of work manually is not easy. It takes a lot of time and effort. 3D printing technology eliminates these problems. A printer with specialized software will quickly cope with the manufacture of a jewelry model, with absolute accuracy implements a given project from photopolymers or wax. nine0003

Now this equipment is used not only in manufacturing industries, but also in such a specific craft as jewelry making. One of the stages of this creative process is the creation of casting molds. Moreover, it is often necessary to produce models of a high level of complexity, as customers want to receive an original, unique piece of jewelry. Doing this kind of work manually is not easy. It takes a lot of time and effort. 3D printing technology eliminates these problems. A printer with specialized software will quickly cope with the manufacture of a jewelry model, with absolute accuracy implements a given project from photopolymers or wax. nine0003

Benefits 3 D printing in jewelry

Using 3D printers to create jewelry provides several benefits. First of all, this is the high quality of the models and the accuracy of their implementation. Efficiency is an important advantage. It takes a lot of time to make a model by hand, while 3D printing allows you to get a product within a few hours. After creating master models manually, you have to carry out additional work to adjust, to give the surfaces an ideal texture. The product made by the printer does not require such modifications. Traditional technology does not allow making complex structures of small sizes. In 3D printing, there are no restrictions on size and complexity. The printer has a moderate cost, it can be purchased by an individual entrepreneur, a small workshop. nine0003

After creating master models manually, you have to carry out additional work to adjust, to give the surfaces an ideal texture. The product made by the printer does not require such modifications. Traditional technology does not allow making complex structures of small sizes. In 3D printing, there are no restrictions on size and complexity. The printer has a moderate cost, it can be purchased by an individual entrepreneur, a small workshop. nine0003

The process of creating jewelry models on 3 D printer

- A CAD program is used to draw a model of a future piece of jewelry. The absence of restrictions in the level of complexity allows you to implement any creative idea, to design a unique product.

- Master model on a 3D printer is created quickly. You can use photopolymer in your work. It is burned out during heat treatment with a temperature above 900°C. Wax models melt, flow out at a temperature of 70°C.

- The lined, cleaned pattern produced by the printer is a high quality mold.

Learn more