Medical 3d printer manufacturers

Top 10 companies in medical 3D printing

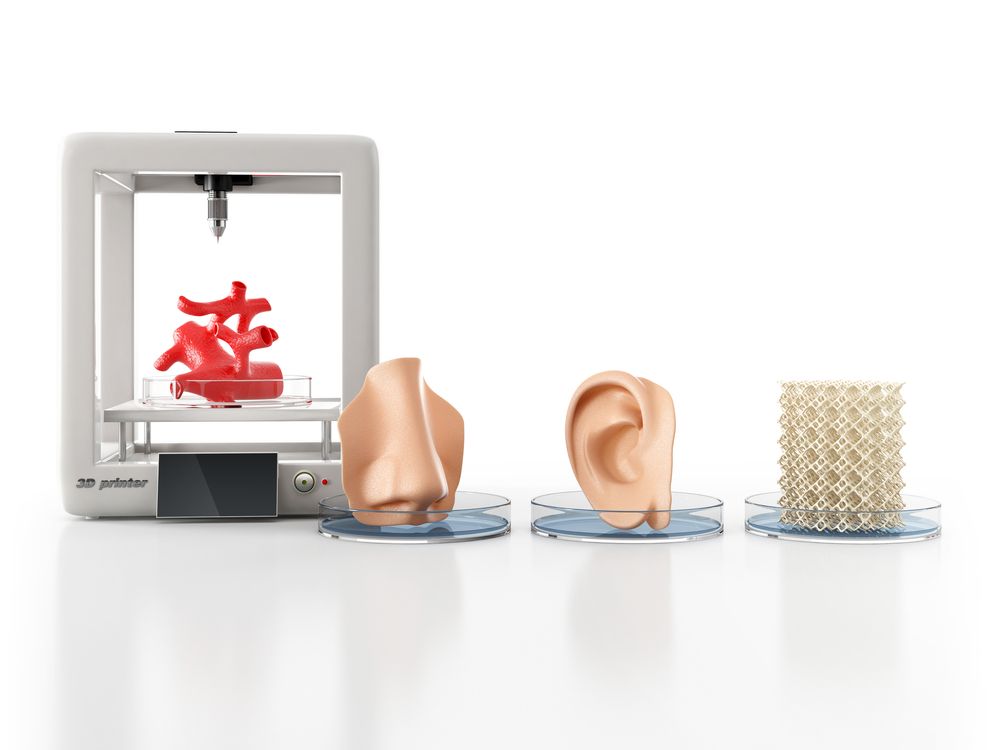

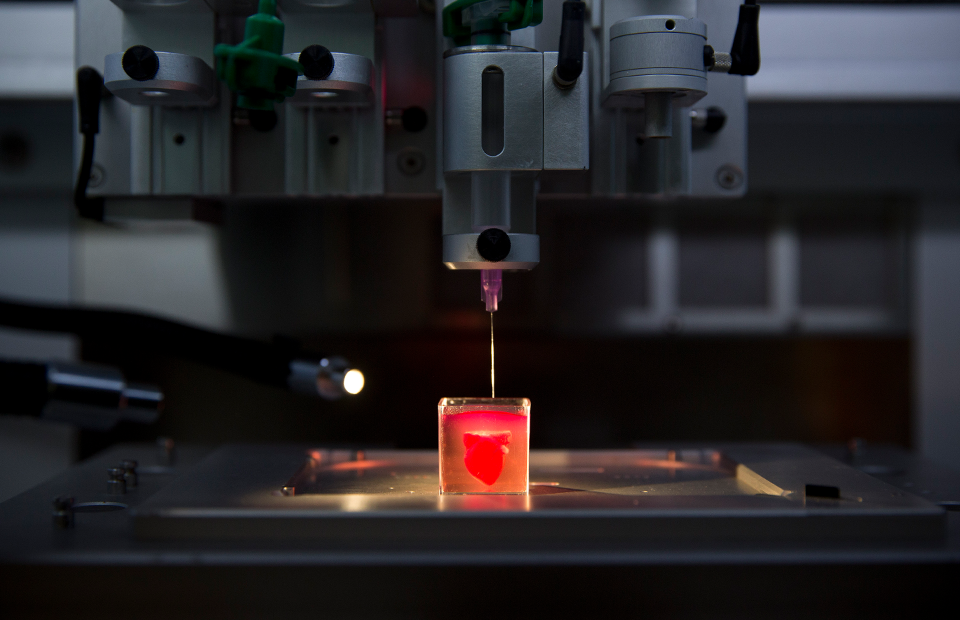

Unquestionably, one of the most exciting areas of the 3D printing space is that of bioprinting. Using layer-by-layer fabrication procedures, several companies are in the process of pushing forward a new shift within the medical transplantation, implant, and surgical spaces by exploiting 3D bioprinting.

The 3D bioprinting global market is in its developing phase and, thus, only a handful of companies have entered the market. This technology started growing in developed nations and had an opportunity to increase in developing countries too. Here, we thought it would be our privilege to underline the companies that may be about to change the future of healthcare industry.

1. Organovo

The organization, headquartered in San Diego, California, has been at the front of research and development of 3D bioprinting for some time now. They are currently generating profits by offering pharmaceutical companies with their exVive3D™ Liver Tissue for medicine toxicity testing, and they have joined with some major companies including Merck and L’Oréal in the health space and are preparing on introducing their exVive3D™ Kidney Tissue product by 2018.

With a goal of 3D printing patches made of human tissue for defunct organs and entire organs for transplantation, Organovo has a difficult task ahead, but not impossible to pursue.

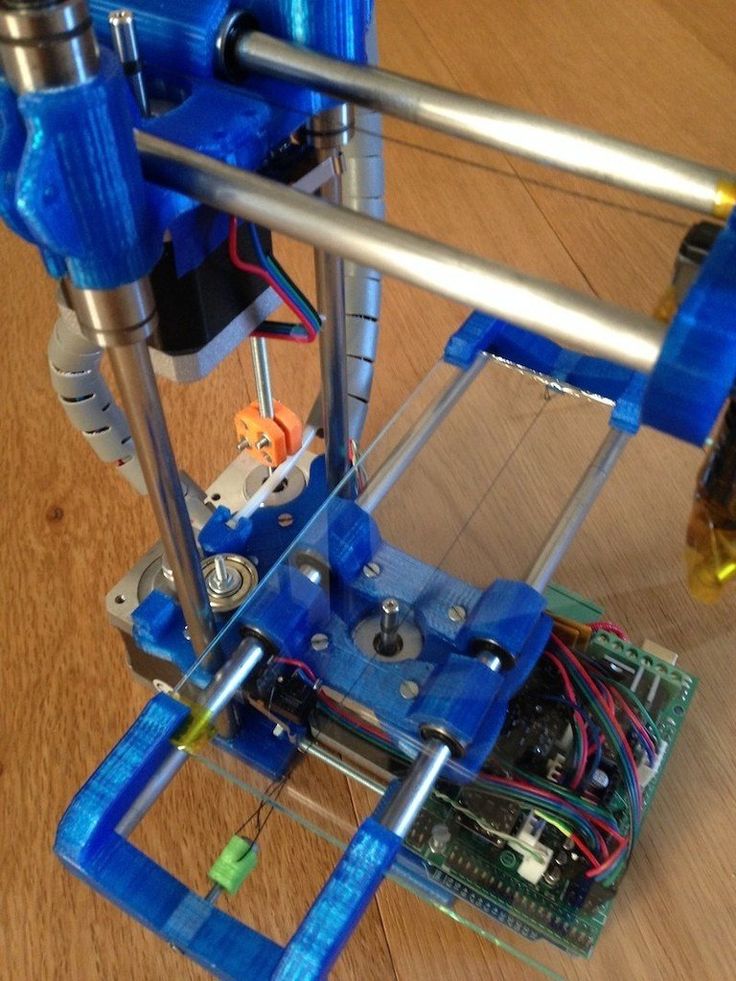

2. BioBots

Biobots is a new startup, has recently raised over $1.25 Million USD through equity crowdfunding platform, is adopting an alternate strategy to the market. Rather than printing original tissue samples and offering those to researchers, they are putting forth reasonable desktop bioprinters to pharmaceutical companies, researchers, and whoever else needs this innovative technology.

While the printers themselves are priced inexpensively at 25,000 USD, it’s the particularly formulated bio-inks, valued at 1,000 USD per 100ml, which will be the cash machine for BioBots in the future.

3. Cyfuse Biomedical

Cyfuse Biomedical is another company working on a bioprinter called as Regenova. Utilizing a technique, they call Kenzan; they can print three-dimensional cell structures, for example, human tissue, using cell spheroids in little needle clusters. Every spheroid contains a huge number of cells, and once they are put in a request alongside different spheroids, they are refined and cultured, prompting to self-organization, and ultimate tissue. The firm has already raised 16.5 million USD and can print biological components such as digestive and urinary organs, cartilage, blood vessels, tubular tissues, and even functional liver.

Every spheroid contains a huge number of cells, and once they are put in a request alongside different spheroids, they are refined and cultured, prompting to self-organization, and ultimate tissue. The firm has already raised 16.5 million USD and can print biological components such as digestive and urinary organs, cartilage, blood vessels, tubular tissues, and even functional liver.

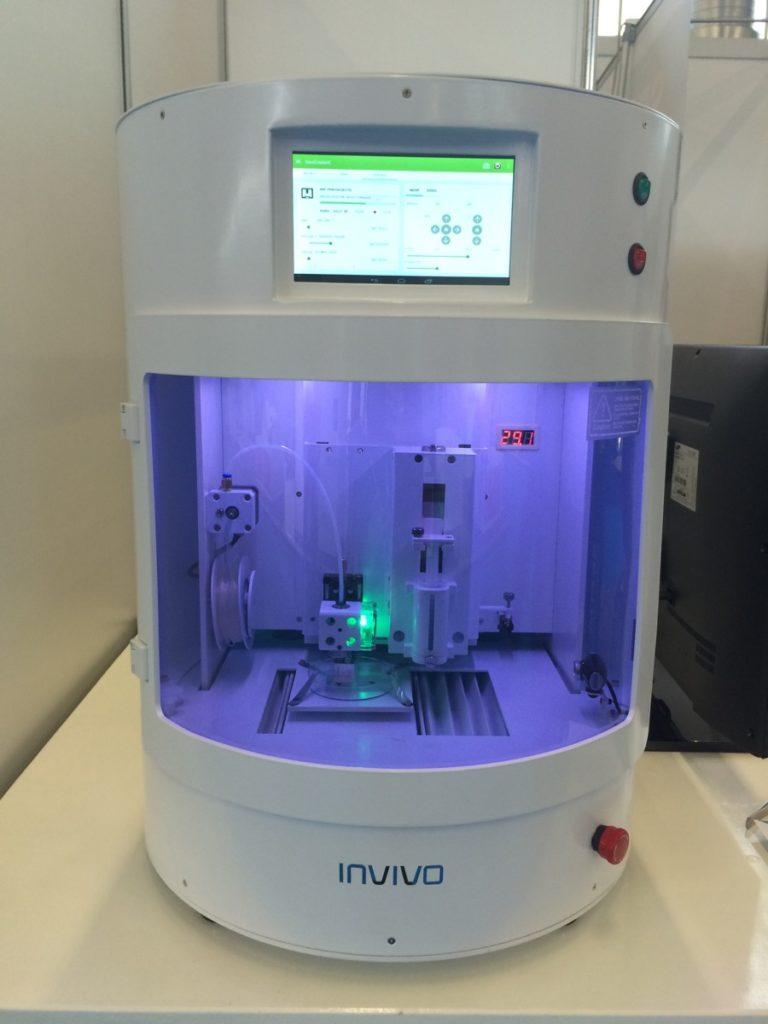

4. 3D Bioprinting Solutions

As Russia’s major bioprinting firm, 3D Bioprinting Solutions focus to 3D print several human organs. They were recently successful in the manufacture of the first known mouse thyroid gland as a prototype, and which they have implanted into a test subject mouse. The organization now has an unbelievably aggressive course of events in which they try to build up a 3D printed kidney by 2018.

Their machine uses stem cells taken from a patient using their fat cells which are then blended with hydrogels before being printed layer-by-layer. At the point when the hydrogel breaks down, only the cells remain, forming tissue.

5. Aspect Biosystems

Canadian Company, Aspect Biosystems granted 450,000 CAD in funding by the National Research Council-Industry Research Assistance Program for the development of its Lab-on-a-Printer platform technology and related tissue 3D printing applications. The organization, established in 2013 by CEO Konrad Walus, is looking towards the drug discovery markets for incomes, as they push forward with development of their exceptional lab-on-a-printer technology.

6. Materialise NV

Materialize is a Belgium-based company concentrates on software and services in the 3D printing industry with a portfolio of nearly 100 patents. In March, the company proclaimed FDA clearance for its 3D-printed patient-specific radius and ulna osteotomy guides for children which mean Materialise will be able to create patient-specific guides at a reasonable cost. Additionally, with Materialise Heart Print product, the cardiovascular anatomy as a physical 3D model can be printed for evaluating a treatment strategy.

7. Rokit

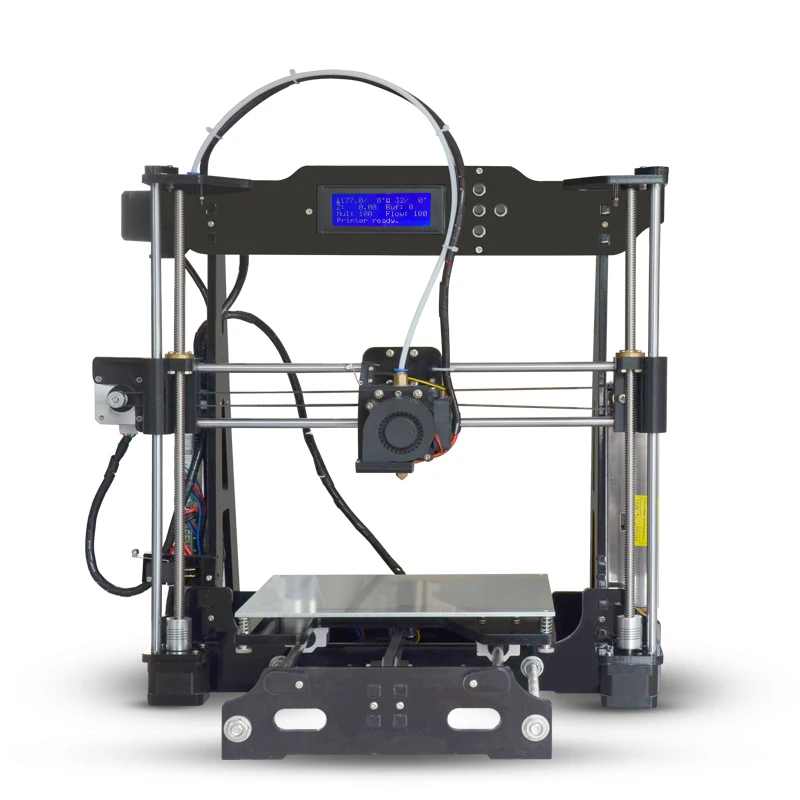

This company is well known for its series of 3D desktop printers in South Korea. They recently proclaimed that they too would enter the 3D bioprinting space using a $3 million government grant. They are eager to develop an in-situ 3D bioprinter by next year.

They aim at doing 3D printing human skin for burn victims and those with dermatological ailments.

8. Stratasys

Stratasys works fundamentally in the health care, aviation, automobiles, and education markets. The business holds over 600 granted or pending additive manufacturing patents worldwide. Some of its essential patents are the WDM™ 3D, PolyJet™, and FDM® printing technologies, which create prototypes and fabricate products directly from 3D CAD files and other content. The company’s subsidiaries include Solidscape and MakerBot and. Recently, the company presented the J700 Dental, which is a modern dental 3D printer that can produce clear aligners for orthodontics.

9. MedPrin

MedPrin aims to become a pioneer in the field of implantable medical devices, depending on astonishing capacity to give exceptional products for the patients worldwide based on biological 3D printing technology and Nano-bionics technology. Its first product ReDura® is considered as the dura mater (ridge) membrane neighboring to patient’s autologous cells with the finest repair effect. In addition to ReDura®, MEDPRIN is doing the endeavor to develop a dozen of human tissue repair products, including female pelvic diaphragm replacement system, maxillofacial repair system and more.

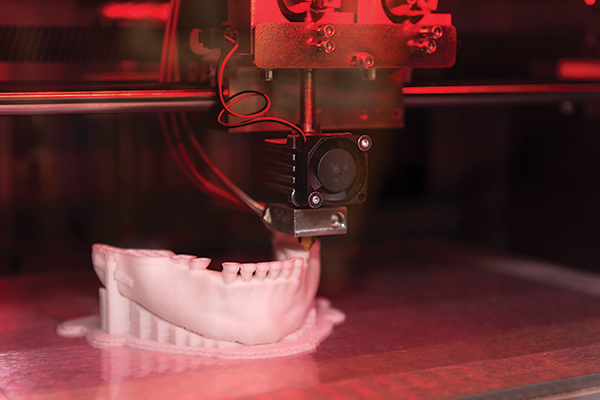

10. Formlabs

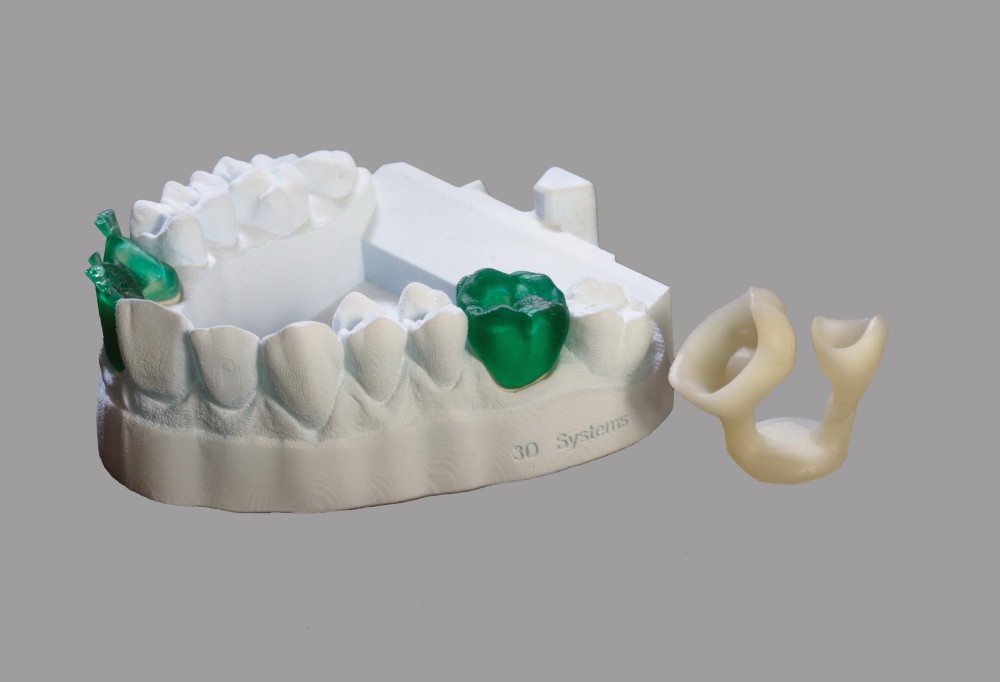

3D printing has many applications in dentistry because each person’s mouth structure is unique. Formlabs is dedicated to bringing sophisticated and innovative fabrication tools to the creative minds of designers, engineers around the world. Formlabs is in the dentistry market and with the release of their new Form 2 3D Printer which is already successfully being used in dental offices recently. They can capture the details of the patient’s teeth by 3D scanning the mouth and turn it into 3D software file for printing. At 3,500 USD, this would be quite an investment. Additionally, the print material, a liquid called resin, starts at 149 USD per one-liter cartridge.

They can capture the details of the patient’s teeth by 3D scanning the mouth and turn it into 3D software file for printing. At 3,500 USD, this would be quite an investment. Additionally, the print material, a liquid called resin, starts at 149 USD per one-liter cartridge.

We are living in exciting times, particularly inside the field of health care, and the stride of innovation is only going to increase. It will be fascinating to see which of these corporations dominate the competition, and which fail to make it through the bioprinting marathon, as the next several years will see the rise of quick and cheap prototypes with 3-D printing.

From the big enterprises to the startups, there are a lot of companies using 3D printers to create new products, enhance old ones, and better their business forms. As the innovation turns out to be more acknowledged in the market, it will rapidly prove to be more mainstream and popular.

Image credit: www.istockphoto.com

Profiling six major companies in medical device additive manufacturing

We take a closer look at six major companies working in the medical device additive manufacturing market - including 3D Systems, GE Additive and EOS

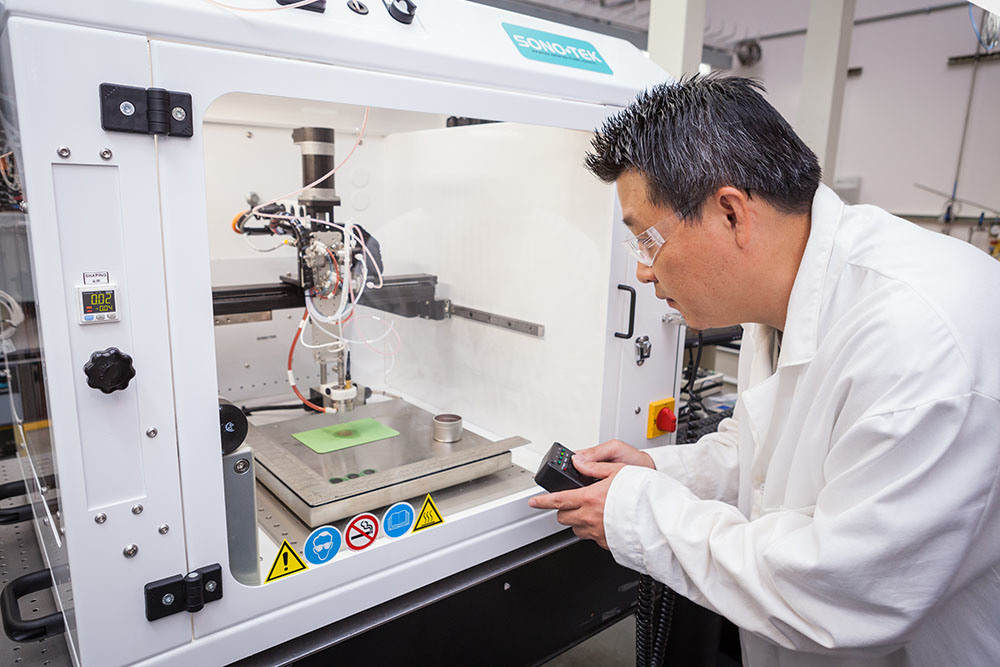

Additive manufacturing can be used to make personalised orthopaedics and prosthetics, surgical planning guides, and even artificial human organs (Credit: Scharfsinn/Shutterstock)

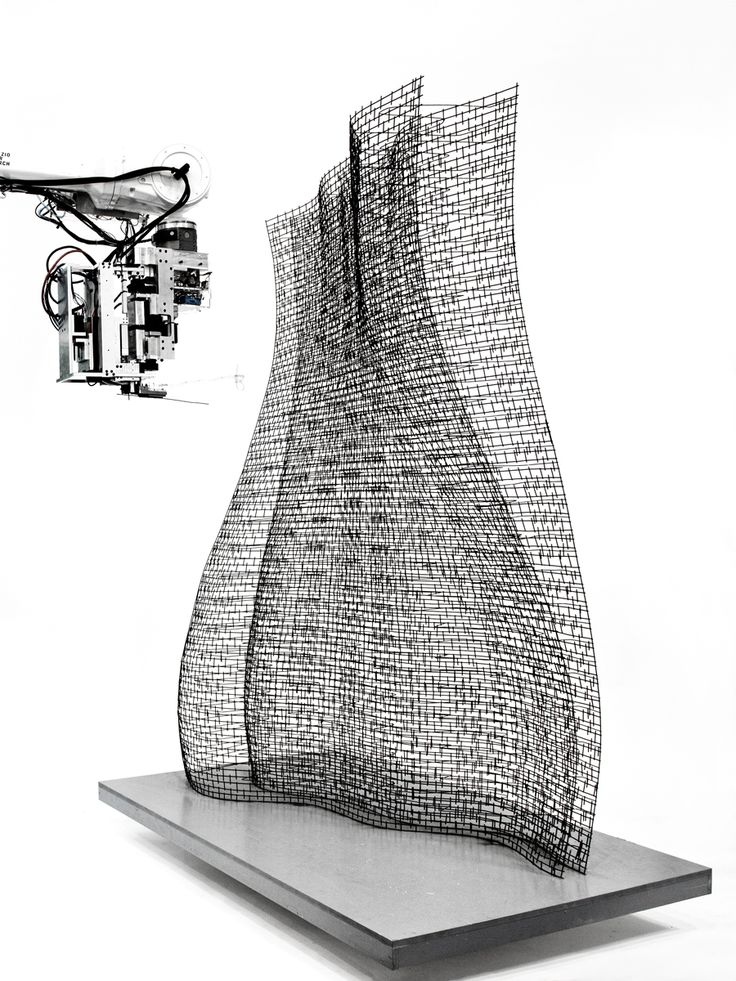

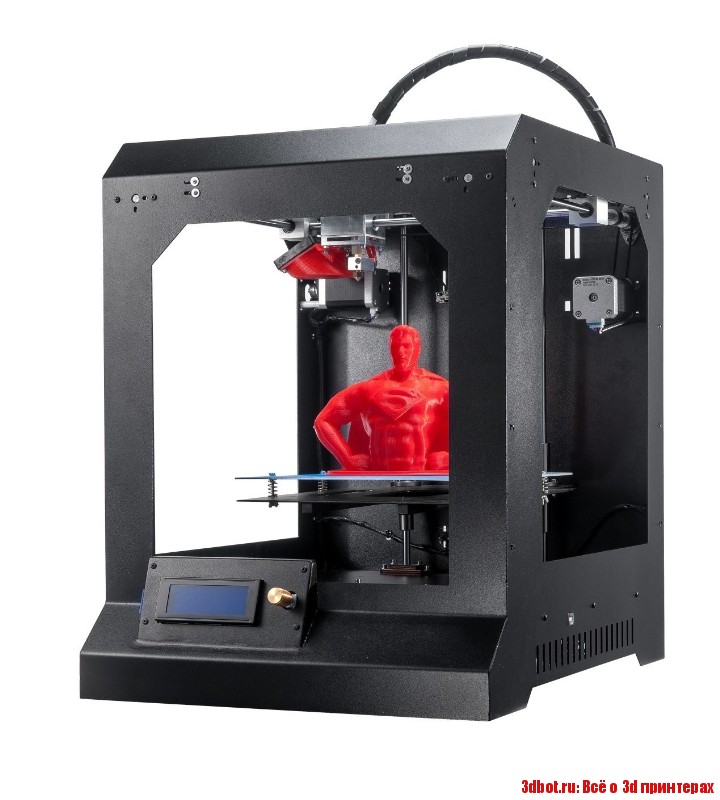

The ever-expanding production method that is additive manufacturing – more commonly referred to as 3D printing – has been harnessed by companies to enhance medical device prototyping, surgical planning and many other applications within the healthcare sector.

This has resulted in rising demands and significant growth, with Research and Markets anticipating that the market for medical device additive manufacturing will grow at an estimated CAGR (compound annual growth rate) of 16.2% over the next few years, and reach a total value of $4.4bn by 2027.

In a report released in late-2020, the Ireland-based market research firm also highlighted some of the more noteworthy companies currently operating in this sector – including both manufacturing heavyweights and rapidly-growing start-ups.

We take a closer look at who these medical device additive manufacturing companies are, and the innovative work they do in this space.

3D Systems

US additive manufacturing firm 3D Systems is currently one of the world’s leading providers of 3D printing for the healthcare industry.

The South Carolina-based company’s printing devices, materials and engineering software are used in several different areas, including plastics, metals and metal casting, jewellery, and dentistry.

Within healthcare, 3D Systems primarily makes 3D-printed implants and orthopaedics, surgical instruments, and orthodontics, as well as providing anatomic models and virtual surgery planning solutions.

Chuck Hull – the company’s co-founder, executive vice president and chief technology officer – is widely credited with inventing 3D printing, having created the world’s first commercial rapid prototyping technology in the mid-1980s.

3D Systems currently has a market cap just shy of $5.6bn, reported total revenues of $629m in 2019 and employs about 2,500 people globally.

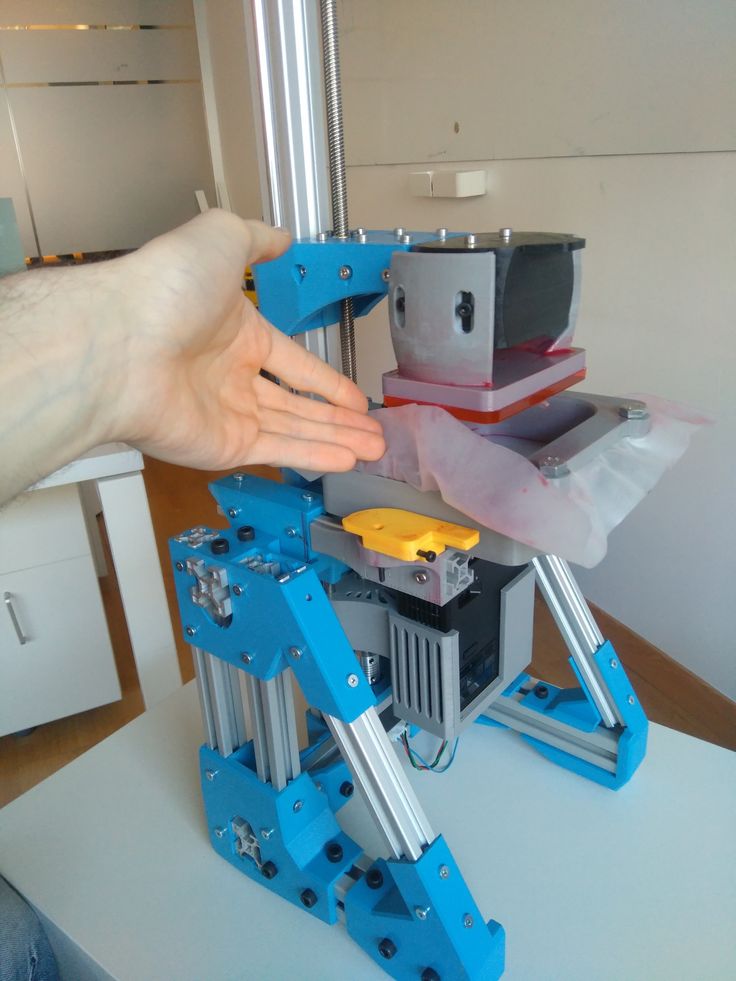

Allevi

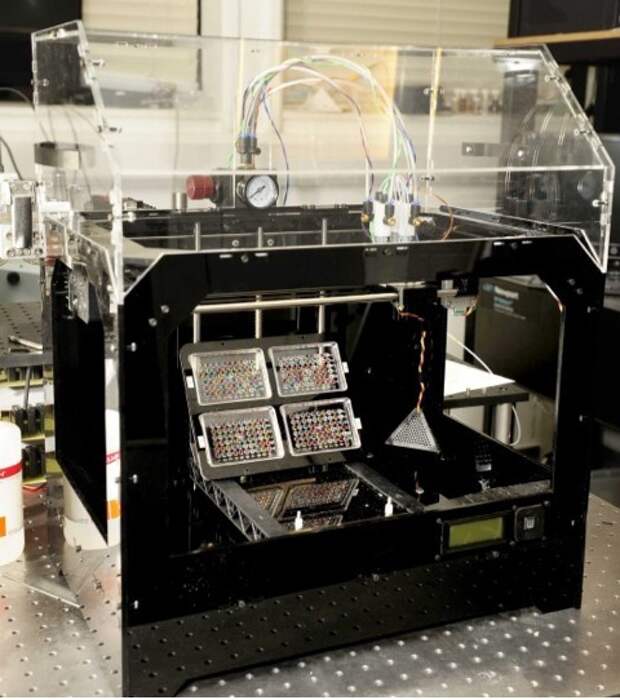

While many companies on this list spread themselves across a range of sectors and have numerous areas of expertise, American firm Allevi specialises in 3D bioprinters and biomaterials used predominantly in the life sciences field.

The Pennsylvania-based company claims hundreds of global labs use its bioprinting solutions in 3D tissue engineering, organ-on-a-chip research, drug testing, biomaterial development, and regenerative medicine.

Alongside its bioprinting software, bioinks, additives, cells, reagents, and consumables, Allevi makes several versatile, powerful and easy-to-use bioprinters – and says its Allevi 2 device was the world’s first desktop 3D bioprinter.

The company was founded in 2014 and has raised a total of at least $3.6m in funding to date.

EOS

German industrial 3D printing firm EOS has more than 30 years of experience in the additive manufacturing sector, and its technologies are used in aviation, aerospace, automotive, consumer goods, production and healthcare.

Under the umbrella of medical technology, EOS’ customers have made nasal swabs for Covid-19 testing kits, orthopaedic implants, dental prosthetics, biocompatible materials and surgical components using the Bavaria-based company’s solutions.

It is also working to make the production of laboratory equipment and equipment used in medical imaging systems faster, more cost-effective, and more flexible, using additive manufacturing.

EOS and its partners can be found in 35 different countries, and the company claims to have about 1,200 global employees and has installed more than 3,000 of its 3D printing systems across the world.

GE Additive

GE Additive – a subsidiary of US manufacturing giant GE (General Electric) – was founded in 2016, and is based in Munich, Germany.

Its 3D printing work straddles several areas, from aerospace, military and defence, and industrial manufacturing, to automotive, dental and medical.

GE Additive also claims to be the only company that offers two different types of metal additive technologies – electron beam melting (EBM) and direct metal laser melting (DMLM) – and offers a range of certified, high-performing powder materials.

GE Additive specialises in medical device additive manufacturing using metals and metal casting (Credit: GE Additive)Its main offerings within the medical sector are customised metal orthopaedics, including spinal, cranio-maxillofacial and joint implants.

GE Additive’s multinational parent company boasts a market cap in excess of $100bn, employs 184,000 people globally and generated revenues of $79.6bn in 2020.

Materialise

Belgian 3D printing firm Materialise provides additive manufacturing services and software solutions for the healthcare, automotive, aerospace, consumer goods, and art and design industries.

Its applications in the medical space range from software used by researchers and surgeons, personalised surgical guides, and other point-of-care tools, to customisable orthopaedics – including shoulder, acetabular hip and cranio-maxillofacial implants.

Having been founded in 1990, the Leuven-based company now has a market cap of about $3.4bn, employs more than 2,100 people across the globe and reported a total revenue of €197m ($238m) in 2019.

Stratasys

Minnesota-based additive manufacturing specialist Stratasys produces numerous different types of 3D printer, including FDM (fused deposition modelling), SLA (stereolithography) and PolyJet machines, as well as several related softwares and materials.

These technologies have been used across a wide range of industries – and by some of the most recognisable names in the manufacturing space, such as Google, Ford, Airbus, Siemens and Lockheed Martin.

When it comes to medical applications, Stratasys’ 3D printing capabilities are mainly deployed in surgical planning models, educating and training healthcare professionals, medical device prototyping and dental solutions.

The company currently has a market cap of more than $2.3bn, generated revenues of $636m in 2019 and employs more than 2,000 people across Europe, the Americas and the Asia-Pacific region.

SLS 3D printers in medicine. Additive Manufacturing of Sterile and Customized Surgical Instruments

The medical industry is in a state of flux and looking for solutions to modernize current manufacturing processes. Profile specialists are interested in introducing the most efficient and innovative means of production to enterprises.

The French holding Prodways offers medical practitioners (surgeons, prosthetists) modern 3D printing technologies that allow them to create:

- Unique orthopedic products, taking into account the structural features of the body of a particular patient;

- Demonstration models of various parts of the skeleton

- Ceramic replacement components for bone reconstruction

Biocompatible 3D printing materials and high-precision 3D printers from Prodways are the answer to today's demands and needs of the medical industry.

Industrial SLS 3D Printers Prodways

Prodways Technologies employees are experts in the production of industrial 3D printers and materials for the medical sector.

The company's offer includes equipment that uses the following 3D printing technologies:

- SLS - selective laser sintering of plastic powder

- DLP MOVINGLight ® digital curing photopolymer resin

Prodways printers can be used in prototyping for medical device testing, as well as in the production of customized end-use products and tools.

3D Print Ceramic Bone Substitutes

With DLP MOVINGLight ® you can 3D print high resolution ceramics with 99% ceramic density.

The Prodways ProMaker V10 industrial ceramic 3D printer enables direct 3D printing of unique bone replacement components made from biocompatible ceramics - hydroxylapatite or calcium orthophosphate.

DLP MOVINGLight ® eliminates the machining step that is part of traditional ceramic casting technology.

Production of surgical demonstration models

Prodways SLS and DLP 3D printers provide a wide range of imaging options for training healthcare professionals and presentations to patients. 3D technologies allow:

- Design and grow products that illustrate a wide variety of clinical diseases and pathologies

- Create a 3D model of a patient's bone using a 3D scan and then send the 3D file to a printer for printing

Solutions offered by Prodways will make it possible to grow:

Large models with complex geometric shapes in high resolution on SLS 3D printers. The plastic powder used during the operation of the printer can be recycled and used during the subsequent production cycle, which can significantly optimize the cost of creating products.

Small parts that require high detail and print accuracy to correctly identify existing pathologies using DLP MOVINGLight ® 3D printer.

Additive manufacturing of sterile and customized surgical instruments

Industrial SLS printers support printing with USP Class VI certified polyamide (PA 11-SX 1450). With this material it is possible to manufacture small and medium batches of products intended for single use in implant surgery. In this case, the products will be customized, impact-resistant and can be sterilized by means of gamma radiation.

With this material it is possible to manufacture small and medium batches of products intended for single use in implant surgery. In this case, the products will be customized, impact-resistant and can be sterilized by means of gamma radiation.

Fast 3D printing of orthopedic products

Prodways selective laser sintering technology allows you to create orthopedic corrective insoles that match the individual characteristics of the human foot.

Thanks to high-precision 3D scanning of the foot, it is possible to obtain a 3D model of the insole of the desired shape, with a lattice or honeycomb structure. Thus, it is possible to adjust the fit of the insole to different parts of the foot.

Orthotic insoles can be printed in either PA12 or PA11 powder depending on their type, both plastics are medical grade materials and are USP Class VI certified.

High Precision 3D Printing of Surgical Guides

With Prodways 3D printers it is possible to produce medical instruments of high quality and precision (with a tolerance level of a few microns). For example, individual surgical guides used to fix the patient's bone during surgery.

For example, individual surgical guides used to fix the patient's bone during surgery.

Prodways' wide range of medical, biocompatible materials greatly expands the scope of additive technologies and makes it possible to use them to solve the most complex and demanding problems.

Office Equipment Jetcom is the official distributor of Prodways 3D printers in the Russian Federation.

We provide comprehensive support to our customers at each stage of cooperation - from the correct selection of equipment to maintenance of installed equipment.

You can get acquainted with Prodways SLS 3D printers in our showroom in Moscow, we will also be happy to perform test printing for you and demonstrate the capabilities of the devices.

For detailed advice, please contact us in any way convenient for you:

Tel.: + 7 (495) 739-09-09

E-mail – [email protected]

printers 3D printing appeared in the late 1980s, but 2020 became a breakthrough year for the technology. The pandemic disrupted supply chains, and it was 3D printing that made it possible to quickly obtain the necessary items and spare parts, ranging from consumables for hospitals and clinics to parts for medical, industrial and other equipment.

The pandemic disrupted supply chains, and it was 3D printing that made it possible to quickly obtain the necessary items and spare parts, ranging from consumables for hospitals and clinics to parts for medical, industrial and other equipment.

The prospects and pace of development of the sector in recent years have significantly increased its investment attractiveness, however, there are certain risks that should not be discounted.

Vadim Kizimov

private investor

Author profile

Buy

Buy

Buy

Buy

Service in partnership with Tinkoff Investment Quotes are updated every 15 minutes

Technology Brief

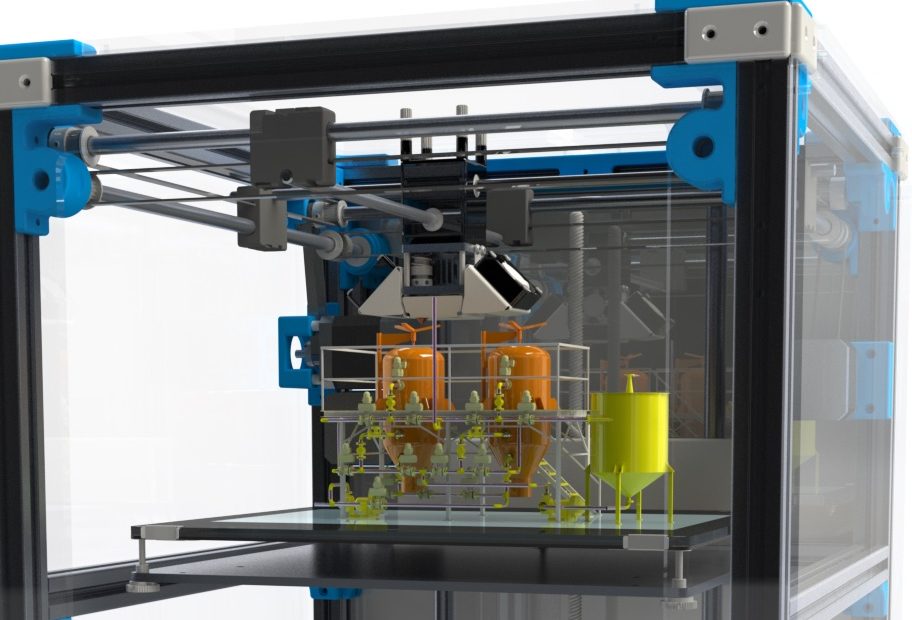

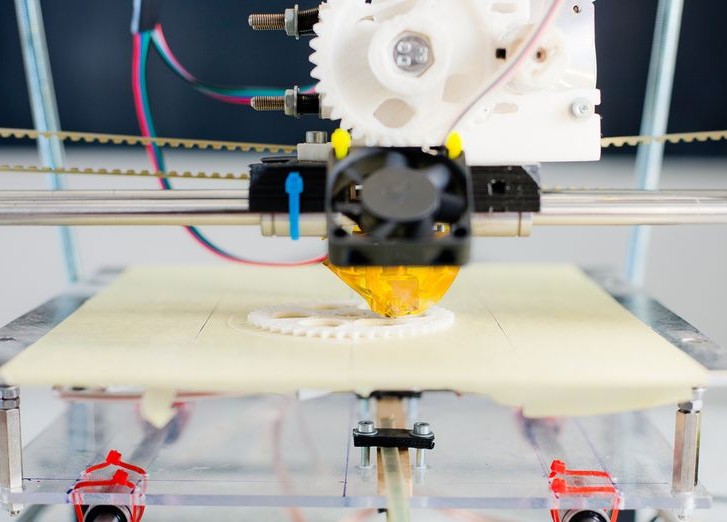

3D printing is the process of converting a model developed on a computer into a real three-dimensional object. Printing occurs due to the successive layering of thin layers of material. These are mainly thermoplastics of various types, but ceramic, biocompatible and other composite mixtures can also be used. That is why this technology is called additive.

That is why this technology is called additive.

3D printing technologies differ depending on the materials and equipment used, but the general scheme of the process is always the same:

- A virtual model of the object is created on the computer, and in order to make a model, you do not need to have 3D modeling skills. A special scanner photographs a real object from different angles, creating a digital copy of it.

- The program is slicing - splitting the model into many thin horizontal layers.

- The template is loaded onto the 3D printer, the device reads the diagram and prints it layer by layer in volumetric form.

Application

Using a 3D printer, you can copy any object or create your own. The possibilities for additive printing are almost limitless. Now the technology has already found application in various industries:

- health care: the creation of orthopedic orthoses, dentistry, transplantology, the manufacture of prostheses;

- industrial production: parts of machine tools and equipment;

- space, aviation and automotive industry;

- robotics;

- construction: models of buildings or individual structural elements;

- food production: figured chocolate, jellies and other desserts;

- household items: from smartphone cases and collectible figurines to shoes and interior items;

- jewelry.

At the moment, additive technologies are most in demand in medicine — 3D printing makes it possible to create consumables, prostheses, orthoses, mouthguards, and even absolutely accurate models of human organs — and in industrial production when creating parts and equipment elements.

But the scope of 3D printing is constantly expanding, opening up new opportunities for both large companies and small start-ups.

Industry Prospects

While 3D printing is not yet able to achieve fast and large-scale results, the technology has proven itself in areas that require precision and uniqueness.

The increased availability of equipment and the absence of the need for long training of personnel to work with 3D printers also played a role. Over the past six years, the number of global and specific industries that use 3D printing technology has increased, and this market is truly limitless:

- large companies or organizations may refuse to purchase the necessary consumables or parts, producing them on their own in the volumes they need;

- the role of additive printing in medicine has already been mentioned above, and there are also broad development prospects here;

- 3D solutions lower the barrier to entry for new players.

Now, to launch your own production, there is no need to rent a room and purchase sophisticated equipment. For example, niches for creating custom car tuning parts, collectible figurines for computer game fans or unique gifts have just begun to open and have already begun to gain popularity.

Now, to launch your own production, there is no need to rent a room and purchase sophisticated equipment. For example, niches for creating custom car tuning parts, collectible figurines for computer game fans or unique gifts have just begun to open and have already begun to gain popularity.

In 2021, the additive printing market was worth $15 billion based on 3D printing and printer and component costs. In the coming years, the expert agency Business Insights predicts an annual growth of the segment by more than 24%. At this pace, by the beginning of 2029, the size of the 3D printing market will grow at least five and a half times.

Technology deficiencies and risks of companies

Despite the prospects for the development of 3D technologies, 3D printing cannot yet be unequivocally called a profitable industry. There are a number of difficulties that do not allow you to fully rely on additive technologies.

Still high cost of equipment. Cheap 3D printers allow you to print small objects. To create parts of large dimensions, it is necessary to purchase expensive equipment, which may turn out to be unprofitable.

To create parts of large dimensions, it is necessary to purchase expensive equipment, which may turn out to be unprofitable.

Poor performance. This disadvantage should be considered in conjunction with the previous one: now the speed and cost of 3D printers do not allow them to be used in mass production, making a tangible profit.

Insufficient strength of manufactured parts. The layered structure is more brittle in the direction of the layers than the monolith and cannot withstand heavy loads.

Lack of stability. The use of additive technologies on an industrial scale requires equipment and materials that can provide higher production reliability. At the moment, 3D printing is most often used for prototyping, quality control, or for the production of single parts.

The need for post-processing , which increases the cost and time of production of each unit.

Unpredictability. Additive manufacturing is constantly evolving, new materials and printer models are emerging, and there is always a risk that equipment that has been heavily invested in will suddenly become obsolete.

Additive manufacturing is constantly evolving, new materials and printer models are emerging, and there is always a risk that equipment that has been heavily invested in will suddenly become obsolete.

3D printing companies on the St. Petersburg Stock Exchange

There are quite a few companies associated with 3D printing on the St. Petersburg Stock Exchange, and it is not their main activity. This industry is so young that at the moment it does not even have a benchmark significant index.

But the global trend of increasing demand for additive technologies in various areas of life can open up new prospects for industry pioneers.

Proto Labs (NYSE: PRLB). Capitalization - 2.56 billion Proto Labs was founded in 1999 in Minnesota, and by 2022 it already has more than ten branches in seven countries of the world. The company specializes in the creation of prototypes and finished parts for individual orders. In this niche, Proto Labs is one of the largest and fastest manufacturers: it takes only a few days to create a part of any complexity.:quality(80)/images.vogel.de/vogelonline/bdb/1612700/1612740/original.jpg)

Since 2014, Proto Labs has been using additive technology for manufacturing parts. In total, the company operates in four areas:

- Injection molding, revenue growth +4% year-on-year.

- CNC machining, +41%.

- 3D printing, +17%.

- Sheet metal production, +24%.

While 3D printing still only accounted for 14.8% of the company's revenue as of the end of 2021, growth trends in the technology's popularity may bring more tangible profits in the future.

Source: Tinkoff Investments Source: Tinkoff Investments3D Systems Corp (NYSE: DDD). Capitalization - 1.88 billion. The company was founded in 1986, headquarters - in Rock Hill, South Carolina.

3D Systems manufactures and sells equipment, software and materials for additive manufacturing. Most often, the company's products are used in the aerospace, automotive, semiconductor and healthcare industries.

In 2021, 3D Systems announced two separate acquisitions. The company has agreed to acquire Titan Additive LLC, a developer and manufacturer of large-format industrial 3D printers, and Kumovis, a German provider of additive manufacturing solutions for personalized medical applications.

The company has agreed to acquire Titan Additive LLC, a developer and manufacturer of large-format industrial 3D printers, and Kumovis, a German provider of additive manufacturing solutions for personalized medical applications.

After the announcement of the results for the fourth quarter of 2021, the company's quotes increased by 15%. This positive reaction was driven by double-digit revenue growth of 13.1% yoy, excluding sales of part of the business. In addition, 3D Systems reduced its net loss by almost three times, and the revenue forecast for 2022 was increased by 10%.

Source: Tinkoff Investments Source: Tinkoff Investments Align Technology (NYSE: ALGN). Capitalization - 32.4 billion American company Align Technology is a manufacturer of medical equipment for dentistry and orthodontics. The patented Invisalign bite treatment system is based on the use of transparent removable orthodontic caps, which are printed on a 3D printer individually for each client.

The company is headquartered in Silicon Valley and has a rapidly growing branch network covering Russia, Mexico, Costa Rica, the Netherlands, Australia and Japan.

Digital orthodontics is rapidly evolving, and Align Technology is not going to give up just yet. The percentage structure of revenue for 2021 is distributed as follows: 80% - sales of Invisalign products, 20% - sales of intraoral scanners and other dental equipment.

Source: Tinkoff Investments Source: Tinkoff InvestmentsHP Inc. (NYSE: HPQ). Capitalization - 39.7 billion. The company does not specialize in the production of 3D printers, but is still one of the leaders in the additive printing market.

In 2014, HP developed Multi Jet Fusion 3D powder printing technology to lower the price and speed of industrial 3D printers, and two years later, the first HP Multi Jet Fusion models went on sale.

In 2017, Hewlett Packard introduced the world's first 3D lab for testing various types of additive printing raw materials. And in 2018, it announced Metal Jet technology for 3D printing of industrial quality metal products.

And in 2018, it announced Metal Jet technology for 3D printing of industrial quality metal products.

HP Metal Jet Printer delivers 50 times the performance and significantly lower cost of finished parts than other technologies.

On April 7, 2022, investors were shocked by the news that Warren Buffett had bought $4.2 billion worth of shares in the company. Immediately after the announcement of the deal, HP shares grew by 14.75%.

Compare companies by multiples, growth rates, and R&D spending.

Source: Tinkoff Investments Source: Tinkoff InvestmentsCompany multiples

| Capitalization, billion dollars | P/E | Forecast P/E | P/S | Debt to equity | |

|---|---|---|---|---|---|

| PRLB | 2.56 | 38.00 | 28.00 | 2.81 | 0.01 |

| ALGN | 32.40 | 41.00 | 32.00 | 8.18 | 0.04 |

| DDD | 1. 88 88 | 5.30 | 5.00 | 2.88 | 0.60 |

| HPQ | 39.70 | 6.80 | 8.70 | 0.69 | −3.58 |

Capitalization, billion dollars

PRLB

2.56

ALGN

32.4

DDD 9008

0002 HPQ39,7,000

Algn

32

HPQ

8.7

PRLB

2.81

Algn

8,18

DDD

2.88

HPQ

0.69

DEBT TO equity

PRLB

0.01

Algn

0.04

DD

0.6

HPQ

−3.58

REPARY PRODUCTIONS, MILLLEL dollars

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| PRLB | 458 (+2.69%) | 434 (−5.24%) | 488 (+12.44%) |

| ALGN | 2406 (+22%) | 2471 (+3%) | 3952 (+60%) |

| DDD | 636 (−8%) | 557 (−12%) | 615 (+10. 4%) 4%) |

| HPQ | 58,760 (+1.3%) | 56,630 (−3.62%) | 63,000 (+11.25%) |

2019

458 (+2.69%)

2020

434 (−5.24%)

2021

488 (+12.44%)

2019

2406 (+2222 %)

2020

2471 (+3%)

2021

3952 (+60%)

2019

636 (−8%)

2020

557 (−12%)

2021

615 (+10.4%)

2019

58 760 (+1.3%)

2020

56 630 (−3.62%)

2021

63 000 (+11.25%) 9,0003

$

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| PRLB | 63 | 50 | 35 |

| ALGN | 442 | 1775 | 772 |

| DDD | −69 | −149 | 322 |

| HPQ | 3152 | 2884 | 6503 |

2019

63

2020

50

2021

35

2019

442

2020

1775

2021

772

2019

−69

2020

−149

2021

322

2019

3152

2020

2884

2021

6503

R&D costs, as a percentage of revenue

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| PRLB | 7. 2% 2% | 8.5% | 9.0% |

| ALGN | 6.5% | 7.1% | 6.3% |

| DDD | 13.1% | 13.3% | 11.2% |

| HPQ | 2.6% | 2.6% | 3.0% |

2019

7.2

2020

8.5

2019

6.5

2020

7.1

2021

6.3

2019

13.1

2020 9000 9000 9000

13.3

2021

11,2,2

2019

2.6

20000 2020

2.6

Summarizing the data, several conclusions can be drawn:

- All companies are profitable, with the exception of DDD, which received a one-time profit in 2021 through the sale of non-core assets.

- ALGN and PRLB have the lowest leverage.

- All companies are growing.

- DDD has the highest R&D spending and the lowest revenue growth rate. Investors should pay attention to this.

Bottom line

Modern 3D printers can significantly reduce the time and cost of solving geometry control and reverse engineering problems in the automotive, aviation, mechanical engineering, shipbuilding, jewelry and medicine industries.