3D scanner stocks

3D Scanner Market worth $1324 million by 2026 - Exclusive Report by MarketsandMarkets™

CHICAGO, March 18, 2021 /PRNewswire/ -- The report "3D Scanner Market with COVID-19 Impact by Offering (Hardware, Software and Solutions, Services), Type (3D Laser Scanners, Structured Light Scanners), Range, Technology, Product, Application, End-Use Industry, Region - Global Forecast to 2026", published by MarketsandMarkets™, was valued at USD 924 million in 2021 and is projected to reach USD 1324 million by 2026; growing at a CAGR of 7.5% from 2021 to 2026. A few key factors driving the growth of this market are increased R&D spending on 3D metrology, focus on quality control while manufacturing goods, and demand for higher productivity by electronics manufacturing services companies. Factors such as increasing adoption of cloud computing services and surging demand for industry 4.0 are expected to provide growth opportunities to players in the 3D scanner market.

Ask for PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=119952472

3D scanner market for hardware offering is expected to hold largest share during forecast period.

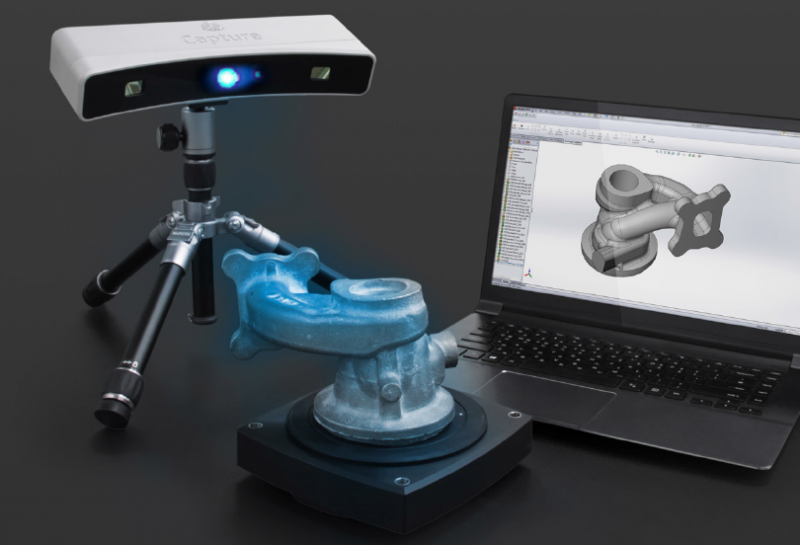

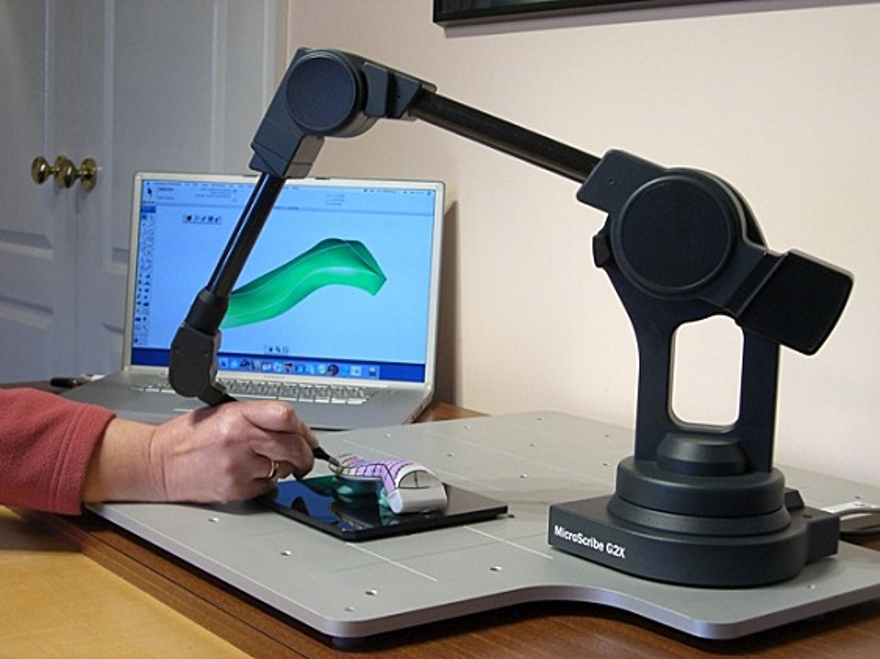

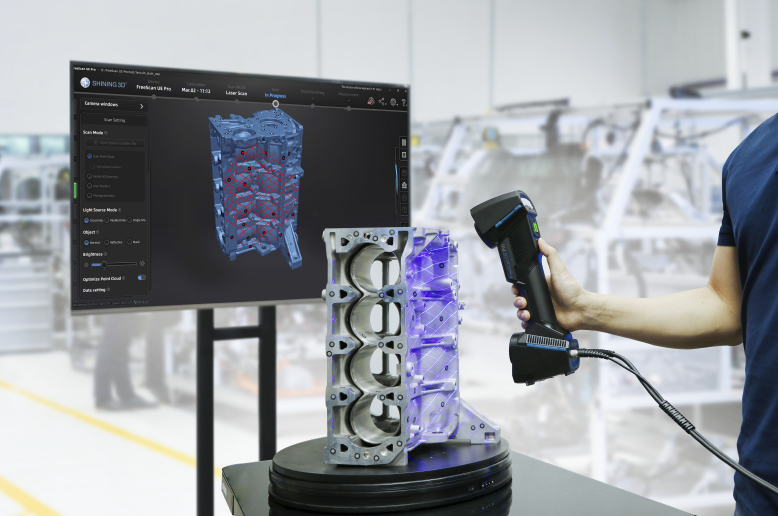

Hardware is expected to hold largest share of 3D scanner market from 2021 to 2026. The increasing adoption of 3D scanning equipment in industries such as aerospace & defense, automotive, architecture & construction, medical, electronics, energy & power, and heavy machinery to maintain product quality is the major driver for the growth of the hardware market.

3D Laser scanner is expected to hold largest share of 3D scanner market during forecast period.

The ability of 3D laser scanners to measure environmental parameters or object dimensions quickly in any indoor lighting condition are the key factors contributing to the growth of the 3D laser scanners segment of the 3D scanner market. The market for 3D laser scanners is projected to grow at a significant rate owing to their easy availability and convenience of usage. These scanners are being widely used in industries such as automotive, architecture and construction, medical, and energy and power.

The market for 3D laser scanners is projected to grow at a significant rate owing to their easy availability and convenience of usage. These scanners are being widely used in industries such as automotive, architecture and construction, medical, and energy and power.

Browse in-depth TOC on "3D Scanner Market"

104 – Tables

55 – Figures

206 – Pages

Inquiry Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=119952472

The 3D scanner market for mining industry is expected to grow at the highest CAGR between 2021 to 2026.

3D scanners provide critical and precise information regarding an area or a tunnel to design engineers and contractors in the mining industry. Engineers can assess tunnel conditions through virtual inspection using 3D models created by point cloud captured by 3D scanners. This enables the quick detection of cracks, chips, moisture, or other issues in tunnels, thereby resulting in a significant reduction in the tunnel downtime and improvement in the objectivity and repeatability of the scan results. Moreover, the detailed 3D models created by 3D scanners can be permanently recorded for future references, as well as for studying the changing tunnel conditions over time.

This enables the quick detection of cracks, chips, moisture, or other issues in tunnels, thereby resulting in a significant reduction in the tunnel downtime and improvement in the objectivity and repeatability of the scan results. Moreover, the detailed 3D models created by 3D scanners can be permanently recorded for future references, as well as for studying the changing tunnel conditions over time.

3D scanner market in APAC to grow at highest CAGR during forecast period.

The key countries contributing to the growth of the 3D scanner market in APAC include Japan, China, India, and South Korea. Countries in APAC are involved in the manufacturing of defense aircraft, which is expected to increase the scope of 3D scanning inspection applications in the aerospace & defense industry. The demand for automobiles and electronic products in APAC is likely to grow in the coming years, which would result in an increased production of vehicles.

Hexagon (Sweden), FARO Technologies (US), KEYENCE Corp. (Japan), Jenoptik (Germany), Nikon Corp. (Japan), ZEISS Group (Germany), Perceptron (US), Renishaw (UK), Creaform (Canada), CyberOptics Corp. (US), Trimble, Inc. (US), 3D Systems, Inc. (US), Automated Precision, Inc. (US) and Metrologic Group (France) are few major players in 3D scanner market.

Related Reports:

3D Metrology Market with COVID-19 Impact by Product Type (CMM, ODS, VMM, 3D AOI, 3D X-ray &CT), Application (Quality Control & Inspection, Reverse Engineering, Virtual Simulation), Offering, End-user Industry, and Geography - Global Forecast to 2026

Industrial Metrology Market with COVID-19 Impact Analysis by Offering, Equipment, Application (Quality & Inspection, Reverse Engineering, Mapping & Modelling), End-User Industry, Geography - Global Forecast to 2026

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets' flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: [email protected]

Research Insight : https://www.marketsandmarkets.com/ResearchInsight/3d-scanner-market.asp

Visit Our Web Site: https://www.marketsandmarkets.com

Content Source : https://www.marketsandmarkets.com/PressReleases/3d-scanner.asp

Logo: https://mma.prnewswire.com/media/660509/MarketsandMarkets_Logo.jpg

Markets Insider and Business Insider Editorial Teams were not involved in the creation of this post.

DDD | 3D Systems Corp. Annual Income Statement

| Sales/Revenue Sales/Revenue | 646.07M | 687.66M | 636.35M | 557.24M | 615.64M | |

| Sales Growth Sales Growth | - | 6. | -7.46% | -12.43% | 10.48% | |

| Cost of Goods Sold (COGS) incl. D&A Cost of Goods Sold (COGS) incl. D&A | 341.23M | 363.27M | 355.81M | 333.87M | 351.86M | |

| COGS Growth COGS Growth | - | 6. | -2.05% | -6.17% | 5.39% | |

| COGS excluding D&A COGS excluding D&A | 279.19M | 303.97M | 305.42M | 289.66M | 317.15M | |

| Depreciation & Amortization Expense Depreciation & Amortization Expense | 62. | 59.29M | 50.4M | 44.21M | 34.71M | |

| Depreciation Depreciation | 25.56M | 29.3M | 30.08M | 28.4M | 24.24M | |

| Amortization of Intangibles Amortization of Intangibles | 36. | 29.99M | 20.31M | 15.81M | 10.47M | |

| Gross Income Gross Income | 304.84M | 324.39M | 280.54M | 223.38M | 263.78M | |

| Gross Income Growth Gross Income Growth | - | 6. | -13.52% | -20.38% | 18.09% | |

| Gross Profit Margin Gross Profit Margin | - | - | - | - | 42.85% | |

| SG&A Expense SG&A Expense | 358. | 367.59M | 337.46M | 270.58M | 294.94M | |

| SGA Growth SGA Growth | - | 2.45% | -8.19% | -19.82% | 9.00% | |

| Research & Development Research & Development | 94. | 95.3M | 83.29M | 74.14M | 69.15M | |

| Other SG&A Other SG&A | 264.19M | 272.29M | 254.17M | 196.44M | - | |

| Other Operating Expense Other Operating Expense | - | - | - | - | - | |

| Unusual Expense Unusual Expense | - | - | 1. | 74.12M | 1.91M | |

| EBIT after Unusual Expense EBIT after Unusual Expense | - | - | (1.11M) | (121.32M) | (33.07M) | |

| Non Operating Income/Expense Non Operating Income/Expense | (3. | 362K | (3.84M) | (18.1M) | 354.51M | |

| Non-Operating Interest Income Non-Operating Interest Income | 784K | 789K | 1.21M | 400K | 438K | |

| Equity in Affiliates (Pretax) Equity in Affiliates (Pretax) | - | - | - | - | - | |

| Interest Expense Interest Expense | 919K | 1. | 4.44M | 4.39M | 2.34M | |

| Interest Expense Growth Interest Expense Growth | - | 29.27% | 273.91% | -1.15% | -46.71% | |

| Gross Interest Expense Gross Interest Expense | 919K | 1. | 4.44M | 4.39M | 2.34M | |

| Interest Capitalized Interest Capitalized | - | - | - | - | - | |

| Pretax Income Pretax Income | (57. | (43.23M) | (65.1M) | (143.41M) | 319.54M | |

| Pretax Income Growth Pretax Income Growth | - | 24.85% | -50.60% | -120.29% | 322. | |

| Pretax Margin Pretax Margin | - | - | - | - | 51.90% | |

| Income Tax Income Tax | 7. | 2.04M | 4.53M | 6.18M | (2.51M) | |

| Income Tax - Current Domestic Income Tax - Current Domestic | 658K | (5.6M) | 666K | 1.75M | (6. | |

| Income Tax - Current Foreign Income Tax - Current Foreign | 12.71M | 10.62M | 7.22M | 5.65M | 6.86M | |

| Income Tax - Deferred Domestic Income Tax - Deferred Domestic | 1. | (319K) | (1.01M) | 67K | - | |

| Income Tax - Deferred Foreign Income Tax - Deferred Foreign | (6.66M) | (2.67M) | (2.35M) | (1.27M) | (2. | |

| Income Tax Credits Income Tax Credits | - | - | - | - | - | |

| Equity in Affiliates Equity in Affiliates | - | - | - | - | - | |

| Other After Tax Income (Expense) Other After Tax Income (Expense) | - | - | - | - | - | |

| Consolidated Net Income Consolidated Net Income | (65. | (45.26M) | (69.63M) | (149.59M) | 322.05M | |

| Minority Interest Expense Minority Interest Expense | 868K | 242K | 248K | - | - | |

| Net Income Net Income | (66. | (45.51M) | (69.88M) | (149.59M) | 322.05M | |

| Net Income Growth Net Income Growth | - | 31.25% | -53.57% | -114.07% | 315. | |

| Net Margin Growth Net Margin Growth | - | - | - | - | 52.31% | |

| Extraordinaries & Discontinued Operations Extraordinaries & Discontinued Operations | - | - | - | - | - | |

| Extra Items & Gain/Loss Sale Of Assets Extra Items & Gain/Loss Sale Of Assets | - | - | - | - | - | |

| Cumulative Effect - Accounting Chg Cumulative Effect - Accounting Chg | - | - | - | - | - | |

| Discontinued Operations Discontinued Operations | - | - | - | - | - | |

| Net Income After Extraordinaries Net Income After Extraordinaries | (66. | (45.51M) | (69.88M) | (149.59M) | 322.05M | |

| Preferred Dividends Preferred Dividends | - | - | - | - | - | |

| Net Income Available to Common Net Income Available to Common | (66. | (45.51M) | (69.88M) | (149.59M) | 322.05M | |

| EPS (Basic) EPS (Basic) | (0.59) | (0.41) | (0.61) | (1.27) | 2.62 | |

| EPS (Basic) Growth EPS (Basic) Growth | - | 31. | -51.57% | -107.21% | 306.01% | |

| Basic Shares Outstanding Basic Shares Outstanding | 111.55M | 112.33M | 113.81M | 117.58M | 122.87M | |

| EPS (Diluted) EPS (Diluted) | (0. | (0.41) | (0.61) | (1.27) | 2.62 | |

| EPS (Diluted) Growth EPS (Diluted) Growth | - | 31.73% | -51.57% | -107.21% | 306.01% | |

| Diluted Shares Outstanding Diluted Shares Outstanding | 111. | 112.33M | 113.81M | 117.58M | 122.87M | |

| EBITDA EBITDA | 8.07M | 16.1M | (6.53M) | (3M) | 3.55M | |

| EBITDA Growth EBITDA Growth | - | 99. | -140.54% | 54.07% | 218.45% | |

| EBITDA Margin EBITDA Margin | - | - | - | - | 0.58% |

3D laser scanning technologies at the Kostomuksha iron ore deposit

3D laser scanning technologies at the Kostomuksha iron ore deposit OAO Karelsky Okatysh, a subsidiary of OAO Severstal, is developing the Kostomukshskoye iron ore deposit, the largest in Northwest Russia. The industrial reserves of iron ore, approved in the design contours of the quarry, amount to 1.15 billion tons with a deposit development period of 40 years.

The industrial reserves of iron ore, approved in the design contours of the quarry, amount to 1.15 billion tons with a deposit development period of 40 years.

In the fall of 2012, the company's mine surveying service specialists were among the first in Russia to start using the Leica HDS8800 mine surveying scanner in their work, capable of scanning from a distance of up to 2000 m and working confidently at air temperatures down to -40 ° C. NAVGEOKOM specialists talked to Vladimir Vitalievich Shmelev, mine surveyor at the Karelsky Okatysh quarry, about how the scanner is used in open pit mines and the expediency of using 3D laser scanning technology in mine surveying.

Vladimir Vitalyevich, what tasks do you solve with the Leica HDS8800?

The main direction of our work with the scanner is to capture the collapse of the exploded rock mass. This information is further used for weekly-daily planning of mining operations. The presence of the collapse surface allows you to improve the quality of planning. Twice a week, blasting is carried out in the quarry, after which the mining of the blown-up blocks begins. After the mass explosion, we scan the blown-up sections of the quarry. On the day of the explosion, we scan those blocks or those sections of them that are primarily going to be mined. The next day, we scan the remaining blocks or their sections. We are required to complete the survey as quickly as possible, since the situation in the quarry is rapidly changing, and the information in the digital model must correspond to the situation in the quarry before the blocks are mined, and our subcontractors — geologists and technologists — are waiting for this information for further calculations. Now we are trying to develop the second direction of laser scanning technology - monitoring the stability of the pit walls. Fortunately, the I-Site Studio software has a module that allows you to analyze the state of the boards captured at a certain time interval. We tried to survey the terrain at a new field.

Twice a week, blasting is carried out in the quarry, after which the mining of the blown-up blocks begins. After the mass explosion, we scan the blown-up sections of the quarry. On the day of the explosion, we scan those blocks or those sections of them that are primarily going to be mined. The next day, we scan the remaining blocks or their sections. We are required to complete the survey as quickly as possible, since the situation in the quarry is rapidly changing, and the information in the digital model must correspond to the situation in the quarry before the blocks are mined, and our subcontractors — geologists and technologists — are waiting for this information for further calculations. Now we are trying to develop the second direction of laser scanning technology - monitoring the stability of the pit walls. Fortunately, the I-Site Studio software has a module that allows you to analyze the state of the boards captured at a certain time interval. We tried to survey the terrain at a new field. 30 hectares in 40 minutes is amazing.

30 hectares in 40 minutes is amazing.

How is your workflow going, what are the most important steps?

The success of scanning depends on three conditions: the state of the atmosphere, the condition of the scanned surface (mainly wet or not) and the placement of the scanned object in the quarry (the presence of "dead" zones depends on how the object is viewed). With a favorable combination of these factors, scanning takes place quickly and with the least labor costs. On the eve of departure, we check the battery charge in the scanner, in the tablet computer, in the GNSS receivers that we use with the scanner. Then we study exactly which areas will be blown up, apply them to the digital model of the quarry. Thus, we are trying to preliminarily determine for ourselves from which places we will have to scan, which side is better to call in, how many stations we have to do. We study the weather forecast. It is very bad if it is pouring heavy rain or thick snow. For the scanner itself, this is nothing, it is waterproof. But a wet surface loses its reflectivity, visibility is seriously reduced - all this leads to a decrease in the shooting range, and, accordingly, to a drop in performance, since you have to scan from additional points to cover the entire object. Moreover, we usually scan from a distance of up to a kilometer. It is gratifying that frost is not a problem for the scanner: our temperature dropped below -35°C. The scanner worked well. After we have determined the weather conditions, the departure itself takes place. Upon arrival at the scanning site, a reconnaissance is done: a place is determined where it is better to stand in order to ensure maximum visibility. A scanner is transferred from the machine to this place, a tripod, a device are placed, a GNSS receiver is installed, the scanner is oriented and scanning is performed.

For the scanner itself, this is nothing, it is waterproof. But a wet surface loses its reflectivity, visibility is seriously reduced - all this leads to a decrease in the shooting range, and, accordingly, to a drop in performance, since you have to scan from additional points to cover the entire object. Moreover, we usually scan from a distance of up to a kilometer. It is gratifying that frost is not a problem for the scanner: our temperature dropped below -35°C. The scanner worked well. After we have determined the weather conditions, the departure itself takes place. Upon arrival at the scanning site, a reconnaissance is done: a place is determined where it is better to stand in order to ensure maximum visibility. A scanner is transferred from the machine to this place, a tripod, a device are placed, a GNSS receiver is installed, the scanner is oriented and scanning is performed.

How do you use GNSS receivers - do you put them directly on the scanner? How, in general, is the device oriented?

We use single-frequency receivers - we mount them on the scanner (everything is provided for this in the scanner) and determine the coordinates of the device's standing point during post-processing. The orientation of the scanner is done by aiming at the backsight - and this is a very big advantage of Leica, which I want to point out. We can do everything very quickly. If compared with other scanners with which I am a little familiar, then when scanning from different points, it is imperative to take care that there is an overlap zone, or marks are needed, the coordinates of which must be determined and they must be scanned. All this takes time. And then he pointed and - forward. We never carry a total station with us. We only need a GNSS receiver, which is placed on top, and points to navigate, and we always have them: around the quarry there are points of reference justification, we know their coordinates. To get a fixed solution when the GNSS receiver is running, 10-12 minutes is enough for us. Thus, in a working day we can make up to 15-16 stations, and speed is very important for us. In the case of using a dual-frequency GNSS receiver and switching to work in RTK mode, the standing time at the point can be reduced to 5-7 minutes, and, accordingly, the number of stations can be increased.

The orientation of the scanner is done by aiming at the backsight - and this is a very big advantage of Leica, which I want to point out. We can do everything very quickly. If compared with other scanners with which I am a little familiar, then when scanning from different points, it is imperative to take care that there is an overlap zone, or marks are needed, the coordinates of which must be determined and they must be scanned. All this takes time. And then he pointed and - forward. We never carry a total station with us. We only need a GNSS receiver, which is placed on top, and points to navigate, and we always have them: around the quarry there are points of reference justification, we know their coordinates. To get a fixed solution when the GNSS receiver is running, 10-12 minutes is enough for us. Thus, in a working day we can make up to 15-16 stations, and speed is very important for us. In the case of using a dual-frequency GNSS receiver and switching to work in RTK mode, the standing time at the point can be reduced to 5-7 minutes, and, accordingly, the number of stations can be increased.

What happens to the scan data after it is collected? How is data processed and presented?

The final goal of our work is a digital model of a quarry with the collapse of the blasted rock mass. We have to present it in the Surpac software (Gemcom Surpac™ - ed.). We start data processing in the I-Site Studio program: we stitch the point clouds, clear them of "garbage", cut out a specific area, sparse it a bit and build a triangulation surface. We export this surface to DXF format and load it into Surpac, where we work with it further: draw feature lines with reference to the surface, outline. The program has tools for constructing a grid with a given step, we "plant" this grid on a triangulation surface and bind it to the model. Some of these tools are also in the I-Site Studio program, but we are more familiar with Surpac. And then these data are used to calculate the volume of blasted rock mass, which we can now calculate very accurately. Field stage, dependence on weather conditions, complex data processing. Seems like 3D laser scanning is a rather laborious process.

Seems like 3D laser scanning is a rather laborious process.

To what extent is this technology really necessary and in demand in mine surveying, in your opinion?

Overall, we are satisfied with the purchase of the scanner . He works very intensively for us. Previously, all mining enterprises and open pits used ground-based stereophotogrammetric survey. And we had such equipment. But we abandoned photogrammetry at one time, because the configuration of the quarry is such that there were many "dead" zones. And in order to cover these zones, it was necessary to lay additional bases, correction points, etc. And this entailed an increase in labor costs and a drop in productivity. Compared to laser scanning technology, it was necessary to perform dozens of times more work. That was a really laborious process. Because we abandoned photogrammetry, of course, we experienced certain difficulties. We tried to shoot collapses with electronic reflectorless total stations, but it was unproductive, so we did this in exceptional cases. With the acquisition of the scanner, we received new opportunities, we try to use them as much as possible and develop them.

With the acquisition of the scanner, we received new opportunities, we try to use them as much as possible and develop them.

Source: GeoProfi magazine, 2012.

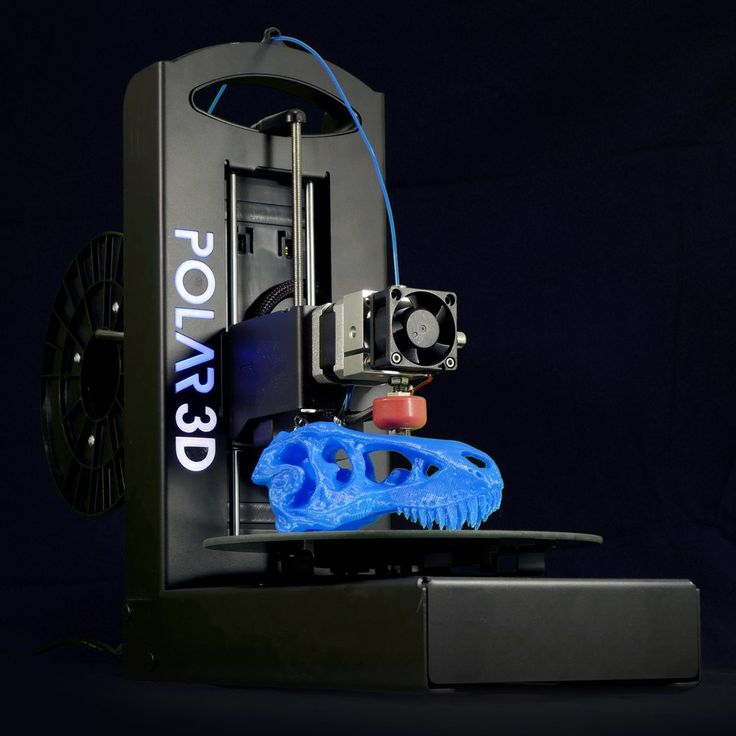

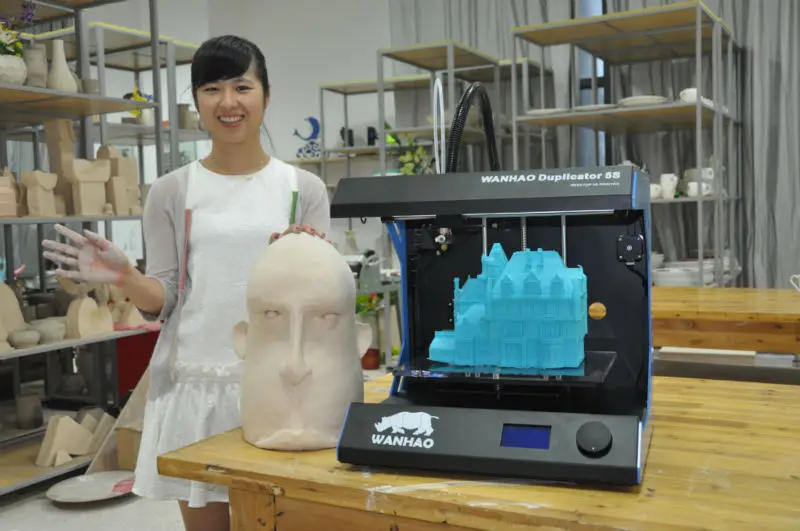

3D printing - salvation in the conditions of total sanctions and import substitution

Many Russian enterprises are already facing a shortage of spare parts. Imports are limited due to sanctions, supply chains are broken, and suppliers have significantly raised prices for what is left in warehouses. Economists predict that by the beginning of autumn the problem will become global, since stocks of imported components will run out at almost all enterprises that have fallen under the rink of sanctions.

But it is not for nothing that in China the word “crisis” is denoted by two hieroglyphs: “danger” and “opportunity”. Those who do not sit idly by, but are looking for ways out of the current situation, will definitely find them. One of the opportunities not just to implement the import substitution program, but to accelerate development is the use of 3D printing technologies.

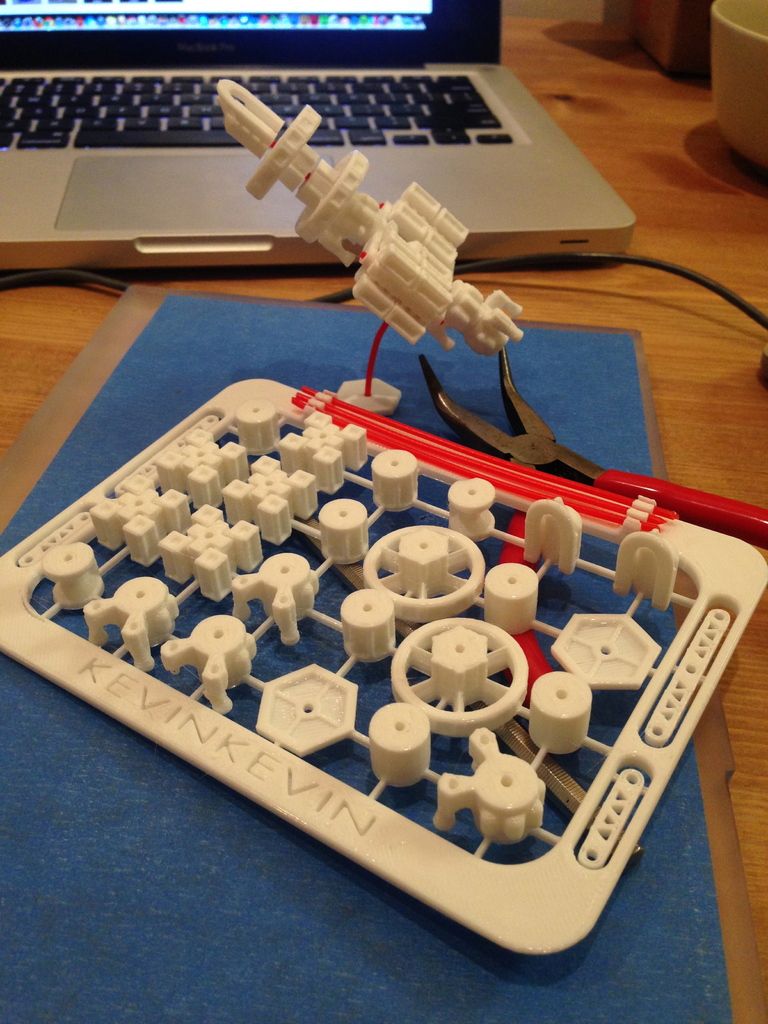

How to replace the irreplaceable plastic

In any modern technology: from a mixer to a car, there are a lot of plastic parts. And no matter what we are told about the strength of ABS plastic, items made from it do not last as long as metal ones. In everyday life, due to the breakdown of a plastic part, it is often necessary to throw away another working device. In industry, the lack of any plastic small things leads to a halt in the production process.

Printing plastic parts is the most basic thing you can do with a 3D printer. "Craftsmen" have long learned to print a variety of gears: for meat grinders, mixers, blenders. Manufacturers, out of concern for profit, do not supply these parts for repair at all or sell them as a kit at such a price that it is easier to buy a new device. Printing a gear on a 3D printer is much cheaper.

3D printing is used to produce the most vulnerable plastic components of cars. For example, Mazda power window gears or rear-view mirror mounts have long been printed by everyone and sundry. These parts are sold on all platforms: from Avito to AliExpress.

These parts are sold on all platforms: from Avito to AliExpress.

By order of motorists, 3D printer owners print a variety of bushings, adapters, spoilers, body kits, even parts of bumpers. Such products are not cheap, but mainly because private traders constantly have to create models, and this takes a long time, a 3D scanner is needed. Although recently free libraries of models of various parts have appeared on the Internet.

What is within the power of private traders, with much greater success, can be done at the enterprise. Moreover, due to the industrial printing of a large batch of parts, the cost of one product will be less than that of private traders.

Metal 3D printing

There are 2 technologies for 3D printing of metal products. The first technology is a variation of the classic FDM plastic printing process, where metal-filled filaments are used as the material. In this case, the production is carried out in 3 stages, for example, as in the process of using the Raise3D MetalFuse system. The 3D printer prints the product, then the binder polymer is removed in a special station. And the third stage is the sintering of the part in the furnace. This method of metal 3D printing is the most cost-effective, compared to metal powder printing, which will be discussed below. It also takes less time to process and remove supports. The second technology is SLM, selective laser melting. Metal powder is used as a material for printing in such 3D printers.

The 3D printer prints the product, then the binder polymer is removed in a special station. And the third stage is the sintering of the part in the furnace. This method of metal 3D printing is the most cost-effective, compared to metal powder printing, which will be discussed below. It also takes less time to process and remove supports. The second technology is SLM, selective laser melting. Metal powder is used as a material for printing in such 3D printers.

But technology is advancing by leaps and bounds. In the West, parts of drilling rigs and turbines are already being manufactured using 3D printing. Russia has a successful experience of using 3D printing in aircraft construction. If you need metal parts, you first need to consult with experts about which industrial 3D printer is suitable for the task at hand and what printing material is best to use.

3D printing in medicine

Products printed on a 3D printer perfectly match the model in shape and size. This quality is highly valued in dentistry. It has already been proven that printed crowns are better than milled crowns. In addition, during milling, part of the material is ground off and thrown away, and 3D printing with ceramics is a much more waste-free production.

This quality is highly valued in dentistry. It has already been proven that printed crowns are better than milled crowns. In addition, during milling, part of the material is ground off and thrown away, and 3D printing with ceramics is a much more waste-free production.

Prostheses and orthoses are printed on a 3D printer. They are easy to model taking into account the anatomical features of the patient. Clinics are gradually refusing to apply a plaster cast for fractures. Due to itching under the cast, patients often remove it prematurely, which leads to bone and joint pathologies. Orthoses do not cause itching and do not interfere with air access to the skin.

So far, scientists are only experimenting with printing human organs from living tissues. But the results are so impressive that it's likely that transplant organs will be printed for the foreseeable future.

3D printing in construction

There are construction 3D printers that even print multi-storey buildings. The printer will not print a 20-story building, but a 5-story building can easily be brought to life. With the use of additive technologies, panels, columns, decor elements are made. In the Netherlands, a 12-meter pedestrian bridge was printed from metal.

The printer will not print a 20-story building, but a 5-story building can easily be brought to life. With the use of additive technologies, panels, columns, decor elements are made. In the Netherlands, a 12-meter pedestrian bridge was printed from metal.

How to build your own business

Additive technologies are constantly being improved, new materials for 3D printing are emerging. The list of what can be printed is expanding. So far, there are not so many 3D printing specialists in Russia, and the demand for their services is constantly growing.

It is easy to print almost the entire IKEA range on a 3D printer: holders, cups, vases, coasters and other little things. It is possible to manufacture furniture fittings of such bizarre shapes as far as the customer's imagination suffices in any batches. The hulls of quadrocopters, parts of children's toys are excellent.

3D printing to order is a fairly profitable business for both an individual entrepreneur and an enterprise, even during a crisis.

44%

44% 46%

46% 04M

04M 48M

48M 41%

41% 81M

81M 63M

63M 11M

11M 41M)

41M) 19M

19M 19M

19M 52M)

52M) 82%

82% 8M

8M 58M)

58M) 1M

1M 8M)

8M) 32M)

32M) 19M)

19M) 28%

28% 19M)

19M) 19M)

19M) 73%

73% 59)

59) 55M

55M 58%

58%