3D printing funding

Funding for 3D printing grows in lockstep with ambitions

Funding for 3D printing grows in lockstep with ambitions | PitchBookLog in Request a free trial

driven by the PitchBook Platform

All articles

All

- Europe

- Venture capital

- Private equity

- M&A

- Tech

- Leveraged loans

Research Center Subscribe

VC Fundraising

Funding for 3D printing grows in lockstep with ambitions

By James Thorne

July 7, 2022

- Share:

Investors are rewarding a new generation of 3D printing startups that aim to disrupt industries ranging from aerospace and healthcare to housing and plant-based meat.

Venture funding for these companies reached $1.5 billion in the first six months of 2022, the most of any year except 2021, when more than $2 billion was raised, according to PitchBook data.

The current market for 3D-printed products remains niche, but the number of those niche applications has grown. Several recent megadeals have underscored the diversity of companies innovating in a category once defined by hobbyists.

- Industrial manufacturer VulcanForms raised $250 million at a more than $1 billion valuation led by D1 Capital Partners. The startup operates a pair of production facilities in Massachusetts that combine laser-based 3D printing with precision machining and other advanced manufacturing techniques to make high-end components.

- Redefine Meat has developed a printer for plant-based steaks and reportedly raised $135 million in January led by Hanaco Ventures and Synthesis Capital.

The steaks debuted commercially last year in Europe, and the company plans to expand into US and Asian markets in 2022.

The steaks debuted commercially last year in Europe, and the company plans to expand into US and Asian markets in 2022.

- Icon Technology, which builds homes using a massive concrete "printer," reportedly raised $392 million in 2021 with a round led by Norwest Venture Partners and Tiger Global. After starting its home production efforts last year, the company recently debuted an improved model of its printer.

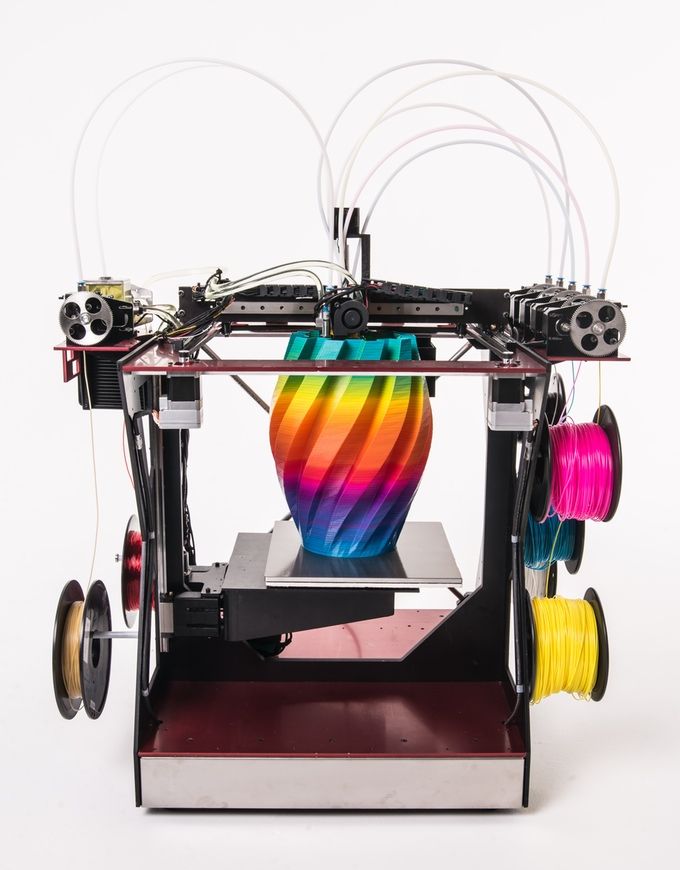

- Formlabs, which specializes in prototyping machines, raised $150 million at a $2 billion valuation in a round led by SoftBank's Vision Fund 2 in 2021. Its professional printers are used in industries ranging from healthcare and education to jewelry and entertainment.

Despite winning VC deals, 3D printing companies that went public during the SPAC craze of recent years have faced a chilly reception.

Desktop Metal was valued at $2.8 billion post-money in its SPAC deal and now trades at a market capitalization around $711 million. Such high-profile stumbles—others include Markforged and Velo3D—may weigh on the future valuations of late-stage companies in the space.

Such high-profile stumbles—others include Markforged and Velo3D—may weigh on the future valuations of late-stage companies in the space.

Featured image by Icon Technology

- Share:

-

-

-

-

Tags:

- VC Fundraising

- Venture Capital

- Tech

- 3d printing

Join the more than 1.5 million industry professionals who get our daily newsletter!

First name

Last name

Business email

I agree to receive PitchBook Data's electronic newsletters, updates, promotions and related messages regarding PitchBook Data's products.

You can unsubscribe at any time by clicking on the unsubscribe link at the bottom of our emails. Please refer to our privacy policy or contact us for more details.

Related content

Simplifyber secures $3.5 million seed funding to bring 3D printed cellulose garments to market

0Shares

3D printing newcomer Simplifyber has raised $3.5 million in seed funding to bring its biodegradable 3D printed cellulose-based garments to market.

The firm’s novel approach centers around its additive manufacturing system and proprietary cellulose formula, which it leverages to produce fully biodegradable products ranging from T-shirts to shoe uppers.

The start-up is led by fashion designer Maria Intscher-Owrang, whose tenure at leading fashion houses such as Vera Wang, Calvin Klein, and Alexander McQueen spans more than two decades.

“I saw how additive manufacturing was disrupting nearly every other industry, but not in fashion,” she said. “I set out to find the people that could make this a reality.”

“I set out to find the people that could make this a reality.”

Cellulose-based 3D printing

Cellulose’s potential as a natural, sustainable, and versatile replacement for a wide variety of synthetic materials has granted it much attention within the 3D printing sector.

For instance, the material has been utilized to form more sustainable 3D printing feedstocks, and to 3D print components for use in the automotive, marine, and electrical insulation sectors. Cellulose has also been explored for 4D printed applications to produce structures that transform in response to water.

As such, Simplifyber is not the only start-up eyeing up cellulose’s benefits within the fashion sector. Last month, UK-based biomaterials start-up Modern Synthesis closed its own seed funding round, raising $4.1 million, as it looks to further develop its microbial weaving textile platform. The technology works by creating a customizable cellulose-based biomaterial from bacteria, sugar, and agricultural waste which can be grown to produce textiles of a desired shape and size.

Last month, UK-based biomaterials start-up Modern Synthesis closed its own seed funding round, raising $4.1 million, as it looks to further develop its microbial weaving textile platform. The technology works by creating a customizable cellulose-based biomaterial from bacteria, sugar, and agricultural waste which can be grown to produce textiles of a desired shape and size.

Improving fashion sustainability

Simplifyber’s novel approach to clothing and accessory manufacturing aims to remove traditional spinning, weaving, cutting, and sewing processes and replace them with a more sustainable, less resource-intensive alternative.

Leveraging its additive manufacturing system and proprietary fully-biodegradable material formula, the firm can reportedly cut out 60% of the steps and reduce 35% of materials in the fashion supply chain that currently ends up as waste.

The company’s cellulose-based formula is “100% natural”, derived from a combination of wood pulp and other plant-based materials and non-toxic additives. Garments and accessories made from this material are fully biodegradable, and can be easily returned to nature and recycled as paper or other forms of clothing, the firm claims.

“We discovered a way to create clothing using soft plant fibers,” Intscher-Owrang said. “We start with liquid cellulose – made in a lab, not in a mill – which is then poured on specially-designed molds and dried, eliminating fabric waste altogether and allowing on-demand, stock-free service.”

Simplifyber is aiming to replace wovens and knits, which together make up a $25 billion global market, with its cellulose-based material and 3D printing technology.

Simplifyber’s soft, fabric-like shoe uppers are created from a cellulose-based liquid, and are fully biodegradable and recyclable. Photo via Simplifyber.Securing $3.5 million

The company is now one step closer to realizing its vision with the closing of a $3. 5 million seed funding round. The financing was led by At One Ventures and saw participation from Techstars, Heritage Group Ventures, The Helm, W Fund, Jetstream Ventures, Plug & Play Ventures, REFASHIOND Ventures, CapitalX Ventures, and Keeler Investments Group.

5 million seed funding round. The financing was led by At One Ventures and saw participation from Techstars, Heritage Group Ventures, The Helm, W Fund, Jetstream Ventures, Plug & Play Ventures, REFASHIOND Ventures, CapitalX Ventures, and Keeler Investments Group.

In addition to the funding round, Simplifyber also revealed a pilot project with 3D printer OEM HP to create molded shoe uppers from a custom formula derived from natural fibers.

“With its single-step process for clothing making, Simplifyber has the potential to beat the unit economics of polyester, becoming an economically and environmentally viable solution against plastic waste,” said Laurie Menoud, Partner at At One Ventures. “We’re looking forward to partnering with the team to bring this solution to scale.

“We believe Simplifyber could be the apparel of the future: They are not only beautifully designed but have a low carbon footprint and are price-accessible, which is a significant differentiation from other sustainable clothing brands.

”

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Subscribe to our YouTube channel for the latest 3D printing video shorts, reviews, and webinar replays.

Featured image shows Simplifyber’s soft, fabric-like shoe uppers are created from a cellulose-based liquid, and are fully biodegradable and recyclable. Photo via Simplifyber.

Tags alexander mcqueen At One Ventures Calvin Klein CapitalX Ventures Heritage Group Ventures HP Jetstream Ventures Keeler Investments Group Laurie Menoud Maria Intscher-Owrang Modern Synthesis Plug & Play Ventures REFASHIOND Ventures Simplifyber Techstars The Helm Vera Wang W Fund

Hayley Everett

Hayley is a Technology Journalist for 3DPI and has a background in B2B publications spanning manufacturing, tools and cycling. Writing news and features, she holds a keen interest in emerging technologies which are impacting the world we live in.

Writing news and features, she holds a keen interest in emerging technologies which are impacting the world we live in.

Why investors are investing millions of dollars in 3D printing?

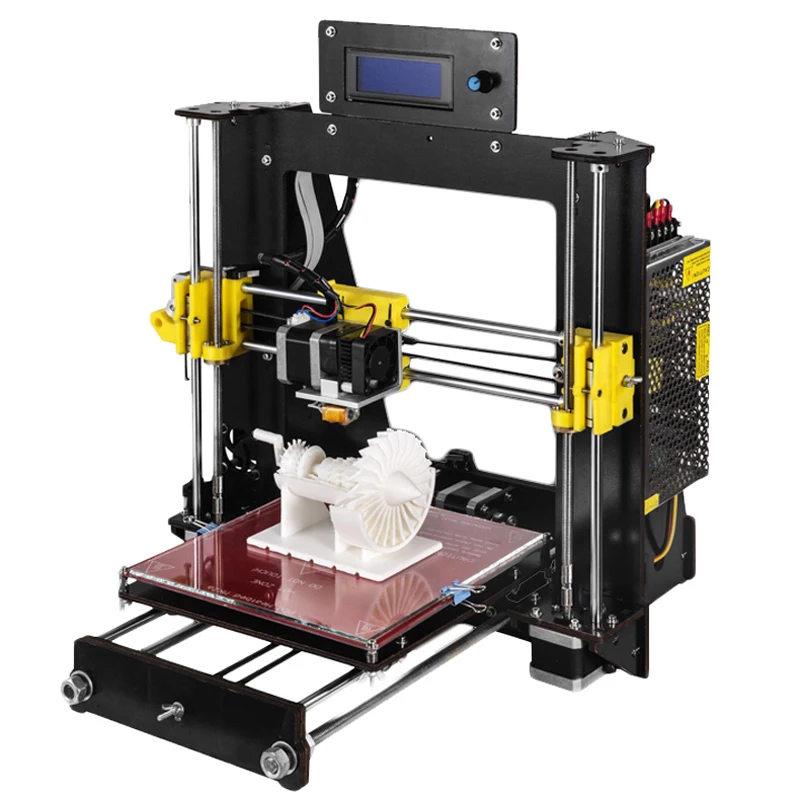

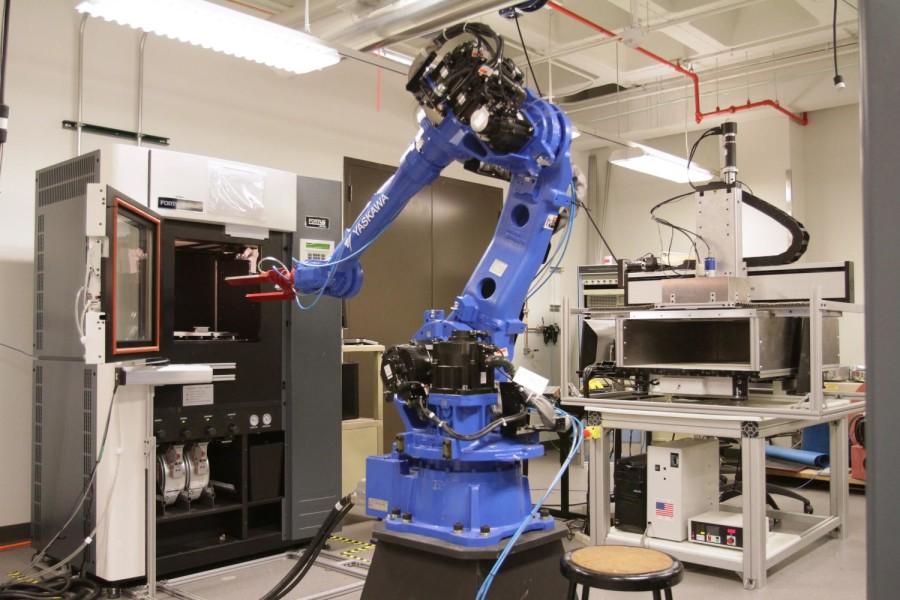

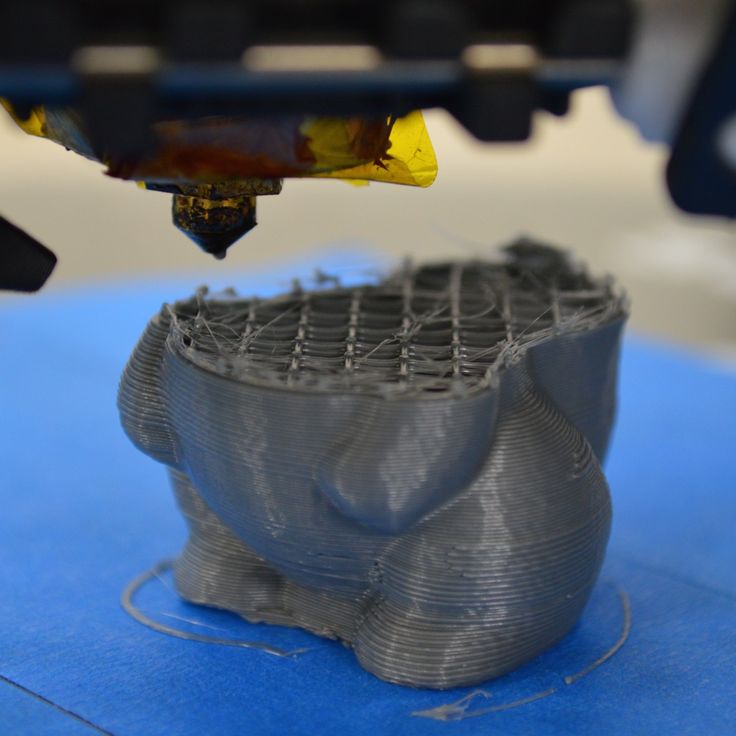

Once considered a consumer solution, 3D printing is now increasingly found in industrial environments, accelerating prototyping processes and increasingly producing final parts. In the automotive, aerospace, and medical industries, 3D printers are installed on both desktop and industrial devices that print from plastic and metal. In order to show progress in additive manufacturing, technology companies need significant funds. And they get them.

Only in the last week alone, a $160 million Desktop Metal investment and a $22 million Essentium funding round can be made available. unicorns" Carbon, Desktop Metal and Formlabs, has grown significantly over the past few years.

Carbon, which became a unicorn back in 2015, has raised $422 million in venture capital funding at a $1. 7 billion valuation as of November 2018. Since then, more have joined The Redwood City, based in California. two firms from Boston in the status of unicorn companies. Desktop Metal reached the billion dollar mark in 2017; after a new round this week, the startup was valuated at about $1.5 billion with a total investment of $438 million. Starting on Kickstarter and raising over $100 million in investments, generating significant sales of desktop 3-D printers, Formlabs achieved unicorn status in August 2018.

7 billion valuation as of November 2018. Since then, more have joined The Redwood City, based in California. two firms from Boston in the status of unicorn companies. Desktop Metal reached the billion dollar mark in 2017; after a new round this week, the startup was valuated at about $1.5 billion with a total investment of $438 million. Starting on Kickstarter and raising over $100 million in investments, generating significant sales of desktop 3-D printers, Formlabs achieved unicorn status in August 2018.

Thanks to successful start-ups and long-standing public companies that patented some of the first 3D printing technologies - 3D systems (Selective Laser Sintering or SLS) and Stratasys (Fusion Deposition Simulation or FDM) - generating huge revenues, this the industry is gaining momentum and attracting investors. Companies' valuations are high, investments are growing steadily, and business prospects are thriving.

This week's investment announcements give some insight: both Desktop Metal and Essentium are looking for industrial-specific solutions. While 3D printing has its roots in prototyping applications - where there remains a significant opportunity to reduce costs and reduce time in the product development cycle - the main focus in 2019 isyear will be centered around production. Large-scale production that rivals traditional technologies in speed and cost remains something of a holy grail for 3D printing.

While 3D printing has its roots in prototyping applications - where there remains a significant opportunity to reduce costs and reduce time in the product development cycle - the main focus in 2019 isyear will be centered around production. Large-scale production that rivals traditional technologies in speed and cost remains something of a holy grail for 3D printing.

The additive manufacturing workflow continues to be hampered by several well-known hurdles and barriers to entry. Design for additive manufacturing (DfAM) is a proprietary skill set unique compared to traditional design for subtractive technologies, and mastering these new techniques and leveraging next generation capabilities (e.g. generative design, topology optimization) is a stumbling block in mastering. Process control and metrology are very important, as is the structure of the powders, resins, granules, filaments, or other raw materials from which the product will be made. Post-processing has long been referred to in the industry as the “stumbling block” in additive manufacturing, as impressive print speeds will be accompanied by a need for post-processing that can be equivalent to 100% print time, considering many processes such as: auxiliary material removal, metal sintering, surface finishing and other.

Companies that overcome these obstacles in the process of complex additive manufacturing attract investments in the first place.

Essentium, for example, has developed a High Speed Extrusion (HSE) platform that promises unparalleled speed and strength in 3D printed extrusion. Project work with partners BASF for materials and Materialize for software raised an additional $22 million in funding, given that both partners are also co-investors. The relationship between the three companies is closely linked, as BASF previously invested $25 million in Materialize. The partners hope that HSE will be able to overcome the current limitations in extrusion (FFF/FDM) 3D printing and ultimately make an impact in industries such as aerospace, automotive, biomedical and contract industries. This Series A funding round is for large-scale production, engineering, international distribution, sales and marketing operations to meet HSE market demand as the technology targets injection molding for strength, speed and printing scale.

In turn, Desktop Metal's $438 million combined funding rounds place it among the largest privately owned 3D printers in history. After officially introducing a suite of products to the market, including a studio system that seems to associate its Desktop Metal name with desktop 3D printers, the company is poised to start shipping its larger production systems as early as this year.

However, it should be noted that the enormous amount of funds raised in Desktop Metal is associated not only with these two systems. A recent conversation with Desktop Metal co-founder and CEO Rick Fulop sparked even more intrigue. Rico Fulop, who called from Davos, where he exchanged thoughts on 3D printing at the World Economic Forum, said his team is “continuing to do its job” and this investment round opens “a lot of new opportunities.” “We have a very rich product roadmap that we haven't talked about publicly. What's exciting for us in funding these projects is that we're expanding the areas of application that our technology is targeting. Hopefully it will create a lot of new things that will really move our industry forward.”

Hopefully it will create a lot of new things that will really move our industry forward.”

The company intends to explore advanced materials and metal processing processes, working towards the optimization of 3D printing.

People who were of the opinion that they would never need a metal 3D printer today tend to believe that metal parts are used everywhere, and if you can change the design of products, then new horizons really open up.

Opening up new possibilities kind of like a throughline in 3D printing that includes new geometries and properties not possible with any other manufacturing method. Modern technologies are becoming more diverse, new solutions are emerging to eliminate existing shortcomings.

Recent multiple funding rounds point to many new avenues for development in the additive industry. A very small selection of recent investments include:

- $19 million in Stratasys spin-off Evolve Additive Solutions; 90,039 $13 million to Digital Alloys, a metals company;

- $5 million in post-production for startup Dye Mansion;

- $2.

5 million in Fortify and its composite technologies;

5 million in Fortify and its composite technologies; - $1.2 million to ASTM International to continue developing standards for additive manufacturing.

Many companies continue to look for additional investments for growth. For example, the Israeli company Nano Dimension, which currently has about $30 million in investments for the development of 3D electronics printing technology, is seeking a new round of investments in the amount of $29 million. The Polish company Sinterit, which raised $1 million in 2017, is currently time is also looking for new investors for its desktop SLS 3-D printers.

The breadth and depth of use of the 3D printing industry speaks of an increasingly competitive environment. With seven ASTM recognized 3-D printing processes to date, each with its own unique pros and cons, and additional technologies evolving at a rapid pace, investors have quite a lot to explore.

“The era of reckless start-ups and money-burning companies is over. Now, especially in Europe, it is more difficult to get financing for an enterprise, so companies must show real potential," admits Sinterit, preparing for the next round of financing. The company says that in 2018 it showed a growth of 260%, adding that "investment The trend shows that we are facing a professionalization of the market.”

Now, especially in Europe, it is more difficult to get financing for an enterprise, so companies must show real potential," admits Sinterit, preparing for the next round of financing. The company says that in 2018 it showed a growth of 260%, adding that "investment The trend shows that we are facing a professionalization of the market.”

3-D printing has already experienced a wave of popularity in the past and an accompanying disappointment in technologies that have not lived up to their promises and companies whose stock prices have plummeted. the growth of the industry, and investors increasingly need more evidence to make sure and open their wallets.0003

Growth in 3D printing is significant, and the 3D industry, now valued at $7 billion, is now expected to continue posting double-digit annual growth. Major players see great potential, in particular, the intentions of HP Inc. enter the $12 trillion global manufacturing market as 3D printing in manufacturing grows.

As VCs continue to invest in 3D printing, news of larger funding rounds can be expected soon as R&D and proof of concept continues to approach viability.

The Japanese government has allocated 4 billion yen to fund a national project to develop 3D printing

Archive

3D printing market, the Japanese government is looking for ways to take revenge.

The Japanese government has allocated 4 billion yen (US$38.6 million) to finance its national 3D printing projects, including the research and development of 3D printing equipment and the development of advanced 3D molding technology.

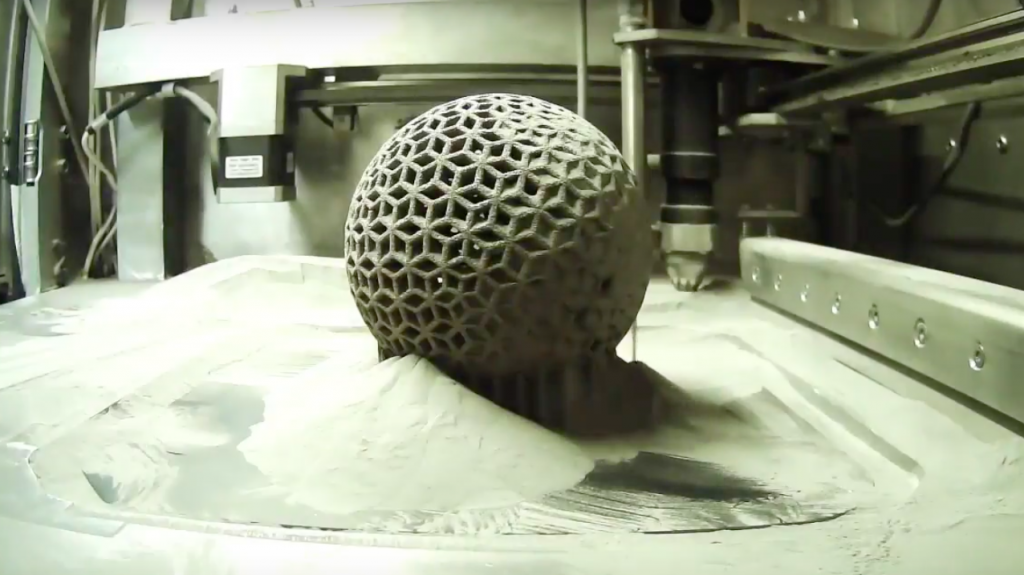

3D printed part made of metal by selective laser sintering

Of the allocated funds, 3.2 billion yen will be used to fund the research and development of 3D printers capable of producing metal end-use products for industrial use. Another 550 million yen is earmarked for the development of super-precise 3D printing technology, including deposition modeling, selective laser sintering, and post-processing and powder recycling technologies. The remaining 250 million yen will be used to finance the development of new 3D measuring instruments and imaging software.

In the short term, Japan plans to support the use of 3D printers in educational institutions, where students can gain hands-on experience in learning about 3D data and 3D printing technology. By introducing students to 3D printing technologies, they hope to develop skills and provide experiences for their students that will enable them to work comfortably with similar research and design tools – and use their imagination.

In 2014, the Ministry of Economy, Trade and Industry of Japan plans to launch new research projects and programs to encourage research and development in the field of 3D metal printing printers. The goal set for Japanese researchers is to have a working prototype of the machine by 2015.

Japan's long-term goal is to build the most advanced industrial 3D printers by 2020 to have a major impact on the 3D printing market. Internationally, the 3D printer market is now dominated by the US and Germany, with 75% and 15% market shares, respectively. The share of Japan is only 0.