3D printing competitors

5 Biggest 3D Printing Companies

DDD, PRLB, and FARO lead the 5 biggest 3D printing companies list

By

Nathan Reiff

Full Bio

Nathan Reiff has been writing expert articles and news about financial topics such as investing and trading, cryptocurrency, ETFs, and alternative investments on Investopedia since 2016.

Learn about our editorial policies

Updated August 01, 2022

Reviewed by

Thomas Brock

Reviewed by Thomas Brock

Full Bio

Thomas J. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and accounting, personal investment and financial planning advice, and development of educational materials about life insurance and annuities.

Learn about our Financial Review Board

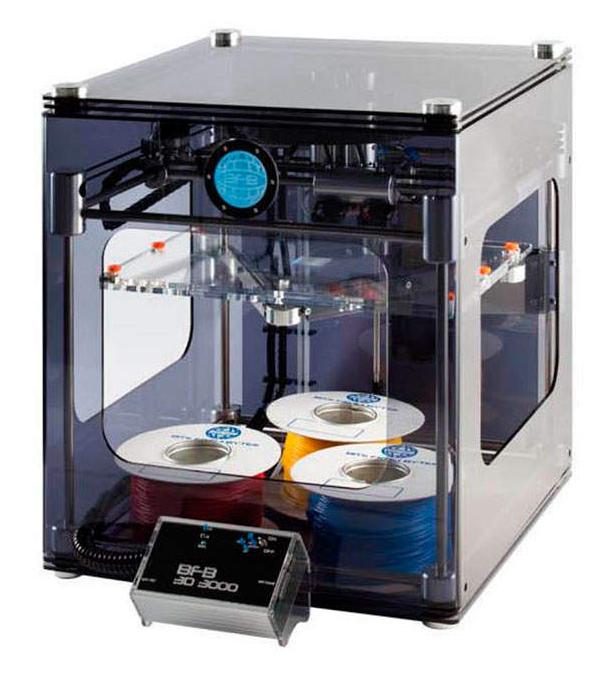

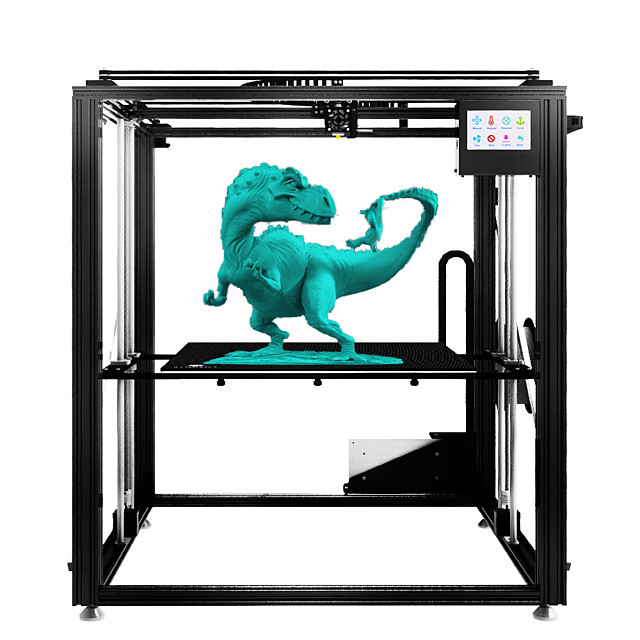

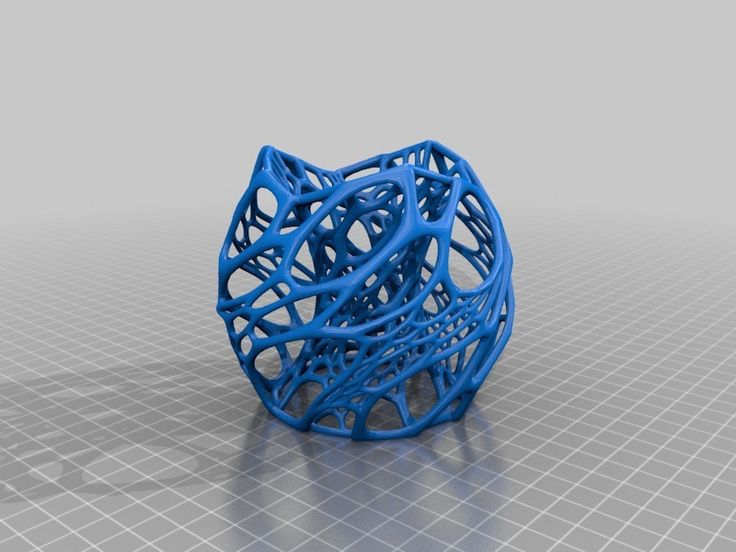

The manufacturing process known as 3D printing is one of the most promising and rapidly developing technologies with applications across a multitude of industries. 3D printing involves the additive layering of thin sheets of material that are fused together to create a physical product from a digital design. While the industry is currently hampered by relatively slow production times, advocates believe that 3D printing ultimately will have the capability to mass produce everything from medical equipment to automotive parts to airline components. Below, we look at the 5 biggest 3D printing companies by 12-month trailing (TTM) revenue. This list is limited to companies that are publicly traded in the U.S. or Canada, either directly or through ADRs. Some foreign companies may report semiannually, and so may have longer lag times. All data are from YCharts as of September 8, 2020.

- Revenue (TTM): $566.6 million

- Net Income (TTM): -$78.4 million

- Market Cap: $632.3 million

- 1-Year Trailing Total Return: -24.6%

- Exchange: New York Stock Exchange

3D Systems invented 3D printing in 1989 with the development and patenting of its stereolithography technology, which uses ultraviolet lasers to help create highly precise parts. DDD built on that by developing new technologies, including selective laser sintering, multi-jet printing, film-transfer imaging, color jet printing, direct metal printing, and plastic jet printing. 3D Systems has three business units: products, materials, and services. The products category offers 3D printers and software and includes small desktop and commercial printers that print in plastics and other materials.

DDD built on that by developing new technologies, including selective laser sintering, multi-jet printing, film-transfer imaging, color jet printing, direct metal printing, and plastic jet printing. 3D Systems has three business units: products, materials, and services. The products category offers 3D printers and software and includes small desktop and commercial printers that print in plastics and other materials.

- Revenue (TTM): $451.0 million

- Net Income (TTM): $58.6 million

- Market Cap: $3.9 billion

- 1-Year Trailing Total Return: 58.2%

- Exchange: New York Stock Exchange

Proto Labs was founded in 1999 with a focus on building automated solutions to develop plastic and metal parts used in the manufacturing process. The company expanded to launch an industrial-grade 3D printing service that allowed developers and engineers to move prototypes into the production process. The company's primary business services include injection molding, sheet metal fabrication and 3D printing.

- Revenue (TTM): $334.7 million

- Net Income (TTM): -$79.7 million

- Market Cap: $1.0 billion

- 1-Year Trailing Total Return: 20.6%

- Exchange: NASDAQ

FARO specializes in 3D measurement and other services for the fields of architecture, engineering, and construction. With a 40-year history, FARO' began before the advent of 3D printing. The company's products include coordinate measuring machines, laser trackers and projectors, mappers, scanners, and software. FARO also serves the aerospace, automotive, and power generation industries.

- Revenue (TTM): $205.3 million

- Net Income (TTM): -$2.7 million

- Market Cap: $1.9 billion

- 1-Year Trailing Total Return: 94.8%

- Exchange: NASDAQ

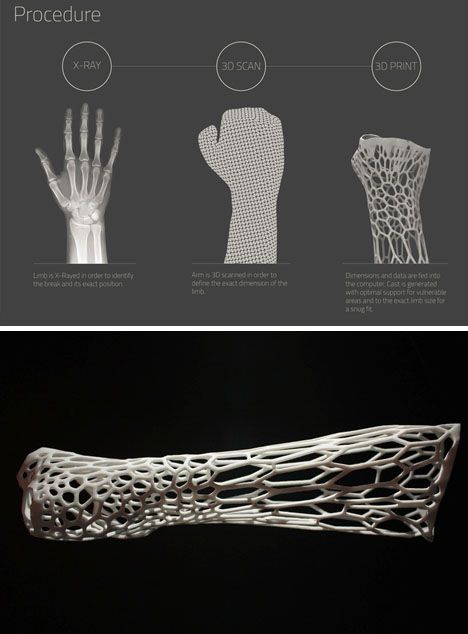

Belgian company Materialise has a 30-year history providing 3D printing solutions and related software. It provides platforms to facilitate the development of 3D printing applications in industries such as healthcare, automotive, aerospace, and art and design. Some of the company's first 3D printing activities included anatomical models in both dental and hearing aid products. Materialise also produces eyewear and automobile products.

Some of the company's first 3D printing activities included anatomical models in both dental and hearing aid products. Materialise also produces eyewear and automobile products.

- Revenue (TTM): $52.9 million

- Net Income (TTM): -$14.5 million

- Market Cap: $238.2 million

- 1-Year Trailing Total Return: 48.3%

- Exchange: NASDAQ

ExOne specializes in manufacturing 3D printing machines for customers across various industries. It also produces 3D printed products to specification for industrial customers. ExOne 3D printers utilize binder jetting technology, fusing powder particles of materials like metal or sand into molds, cores, and other products.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

YCharts. "YCharts."

3D Systems. "Our Story."

Materialise. "Timeline."

Why 2 Competitors to 3D Systems and Stratasys Are Among the 50 "Smartest Companies" in the World

Venture capital-backed 3D printing companies Carbon and Desktop Metal are among the smartest companies in the world for 2017, according to MIT Technology Review, which recently released its annual list of the 50 companies that "best combine innovative technology with an effective business model."

Yes, that combo sounds like a recipe for long-term success, so investors in 3D Systems (DDD -0.10%) and Stratasys (SSYS -0.84%) -- neither of which made the list -- would be wise to keep an eye on these start-ups. Carbon began competing with the two 3D printing bigwigs last year, while Desktop Metal -- which has ties to Stratasys -- will become a competitor to 3D Systems when it launches its first metal 3D printer this fall.

Here's what you should know.

Image source: Getty Images.

Why Carbon is among the smartest

Silicon Valley-based Carbon is making its second consecutive appearance on MIT Technology Review's smartest list, moving up to No. 18 from No. 32. The company received the honor because its "novel 3-D printing process makes it possible to fabricate parts out of a wide variety of plastics," according to the renowned tech publication.

Indeed, Carbon's Continuous Liquid Interface Production (CLIP) technology opens up a vast array of materials possibilities. Another notable advantage for the process is its speed, which is about 25 to 100 times faster than the leading polymer 3D printing technologies, according to the company. Materials limitations and slow speeds are among the major hurdles that have been holding 3D printing back from making more inroads into manufacturing. So it's not surprising that Carbon made a splash when co-founder and CEO Joseph DeSimone unveiled and demonstrated CLIP at the TED 2015 conference.

Unlike conventional 3D printing technologies, which print layer by layer, CLIP "grows" polymer parts continuously from a pool of liquid resin by harnessing ultraviolet light and oxygen. Eliminating the pauses between print layers is one major factor in CLIP's speed advantage.

Image source: Carbon.

Carbon has been moving at the speed of light since 2015. It has amassed $221 million in funding from top venture capital firms and the VC arms of Alphabet, General Electric, and Autodesk. In April 2016, it launched its flagship 3D printer, the M1, followed in March of this year by the launch of the larger M2, along with its 3D-printing production platform called SpeedCell. The company has inked partnerships with Ford, Johnson & Johnson, BMW, UPS, and Adidas, with the latter announcing in April that it will be using Carbon's tech to make athletic shoes with 3D-printed midsoles for the mass market.

The publication didn't share what it found special about Carbon's business model, but I think its subscription-pricing model was probably a big factor. I've opined that this pricing model was a brilliant move because it should help expand the size of the 3D printing market. Not only does it cut down on a customer's initial capital outlay, but it should also help alleviate concerns about being stuck with pricey technology that could quickly become outdated.

Why Desktop Metal is among the brainiest

Ranking at No. 19, Desktop Metal, based in the Boston area, made its inaugural showing on MIT Technology Review's smartest list this year. The publication cited the following reason for including the start-up, which was founded in 2015: "With nearly $100 million from VC firms, GE, Alphabet, and others, this start-up is focused on cheap, fast 3-D printing of metal parts."

Desktop Metal's $97 million in funding should go a long way toward helping it gets its business (along with the industry's metal 3D printers) off the ground. In addition to the backers mentioned above, the company has also received investments from BMW, Lowe's, and Stratasys, which was an early investor, as I shared with Foolish readers in 2015. Stratasys strengthened its ties to Desktop Metal in May when it announced a strategic partnership that involves its distributors selling the start-up's 3D printers.

In addition to the backers mentioned above, the company has also received investments from BMW, Lowe's, and Stratasys, which was an early investor, as I shared with Foolish readers in 2015. Stratasys strengthened its ties to Desktop Metal in May when it announced a strategic partnership that involves its distributors selling the start-up's 3D printers.

Today's metal 3D printers are large, slow, and extremely expensive, with most costing upward of a several hundred thousand dollars. These drawbacks have kept many entities on the sidelines with respect to 3D printing in metals. So Desktop Metal could expand the metal 3D printing market considerably if it succeeds at its goal of producing more affordable and speedier metal 3D printers that are office-friendly.

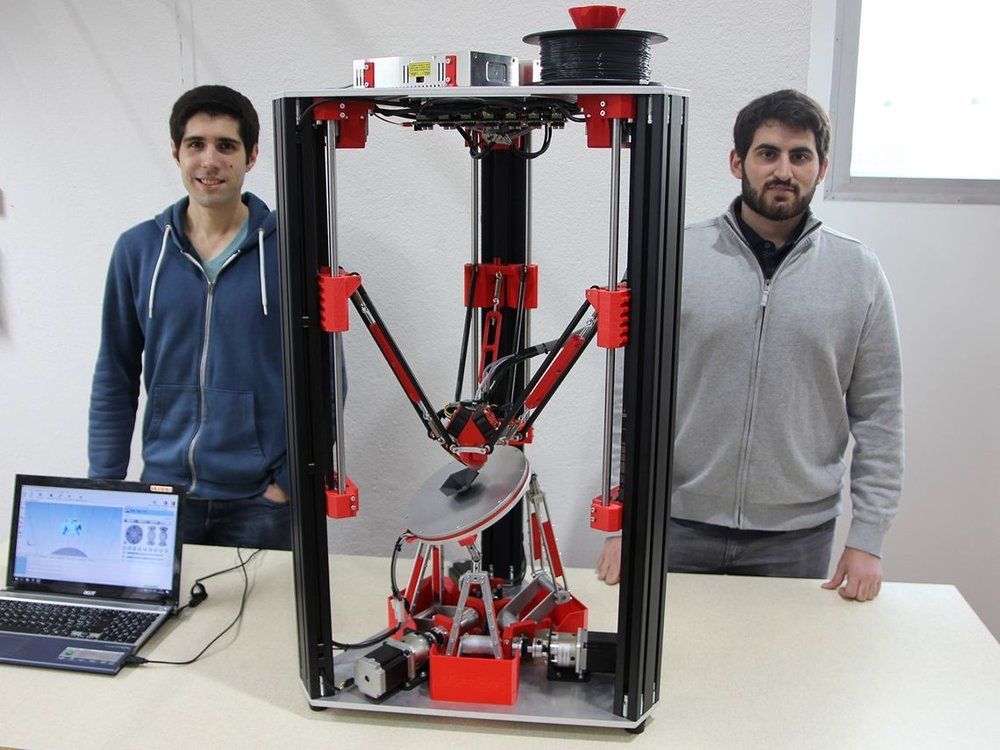

Image source: Desktop Metal.

In April, Desktop Metal generated much buzz when it unveiled two metal 3D printing systems that it claims are faster and more cost-effective than those now on the market, and suited for an office environment. The DM Studio System, which includes a printer and sintering furnace, is priced at $120,000, and is slated to start shipping in September. It uses a proprietary technology that Desktop Metal calls Bound Metal Deposition (BMD). The DM Production System, which will cost $420,000, is expected to begin shipping next year, and is powered by a proprietary technology called Single Pass Jetting (SPJ). The company claims this system is 100 times faster than today's laser-based 3D printing systems. Taking a page from Carbon's playbook, the company has said that renting its systems will also be an option.

The DM Studio System, which includes a printer and sintering furnace, is priced at $120,000, and is slated to start shipping in September. It uses a proprietary technology that Desktop Metal calls Bound Metal Deposition (BMD). The DM Production System, which will cost $420,000, is expected to begin shipping next year, and is powered by a proprietary technology called Single Pass Jetting (SPJ). The company claims this system is 100 times faster than today's laser-based 3D printing systems. Taking a page from Carbon's playbook, the company has said that renting its systems will also be an option.

What this all means for 3D Systems and Stratasys

Carbon presents a notable competitive threat to 3D Systems, Stratasys, and other 3D printing companies in the polymer 3D printing space, as I've previously opined. Stratasys only makes polymer 3D printers, and they comprise the lion's share of 3D Systems' 3D printer business, though the company also makes metal 3D printers. Both companies also have sizable service operations. HP Inc., which entered the market last year, also has the potential to be a significant threat to the incumbent polymer players.

HP Inc., which entered the market last year, also has the potential to be a significant threat to the incumbent polymer players.

3D Systems has a weapon to fight back, though we don't yet know how successful it will be in the market. In March, the company announced that it recently shipped its first speedy 3D printing production platform, Figure 4, to a "Fortune 50 industrial company." Figure 4 is powered by a form of stereolithography (SLA) 3D printing technology, which is a photopolymerization tech that uses a light source to harden resin, just like Carbon's CLIP. 3D Systems touts Figure 4 as being more than 50 times faster than conventional SLA systems, and says it enables an immense array of materials possibilities. Moreover, Figure 4 is modular and fully automatable. Stratasys does not have a super-fast 3D printing technology.

Desktop Metal looks like it has the potential to be just as disruptive in the metals 3D printing space. This company presents a potential threat to 3D Systems, which makes laser-based metal 3D printers, though its metal business is small. Based upon exchanges on the company's quarterly conference calls, I think we safely surmise that its metals business accounts for less than 10% of its total revenue.

Based upon exchanges on the company's quarterly conference calls, I think we safely surmise that its metals business accounts for less than 10% of its total revenue.

Stratasys' recent strategic partnership with Desktop Metal will give it an ideal opportunity to strengthen its knowledge of metal 3D printing in general and intimately get to know the start-up. It seems likely to me that Stratasys would be interested in acquiring Desktop Metal if things go decently with the start-up's initial products. Whether it could afford to do so and whether Desktop Metal would be interested in being acquired are different matters.

Investors in 3D Systems and Stratasys should focus on the companies' revenue and gross margins in their quarterly financial reports. Increased competition that's causing pricing pressure will negatively impact these numbers.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Beth McKenna has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Ford, and Johnson & Johnson. The Motley Fool owns shares of General Electric. The Motley Fool recommends 3D Systems, BMW, Lowe's, and Stratasys. The Motley Fool has a disclosure policy.

The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Ford, and Johnson & Johnson. The Motley Fool owns shares of General Electric. The Motley Fool recommends 3D Systems, BMW, Lowe's, and Stratasys. The Motley Fool has a disclosure policy.

3D printing studio. Winning development strategy in a competitive environment.

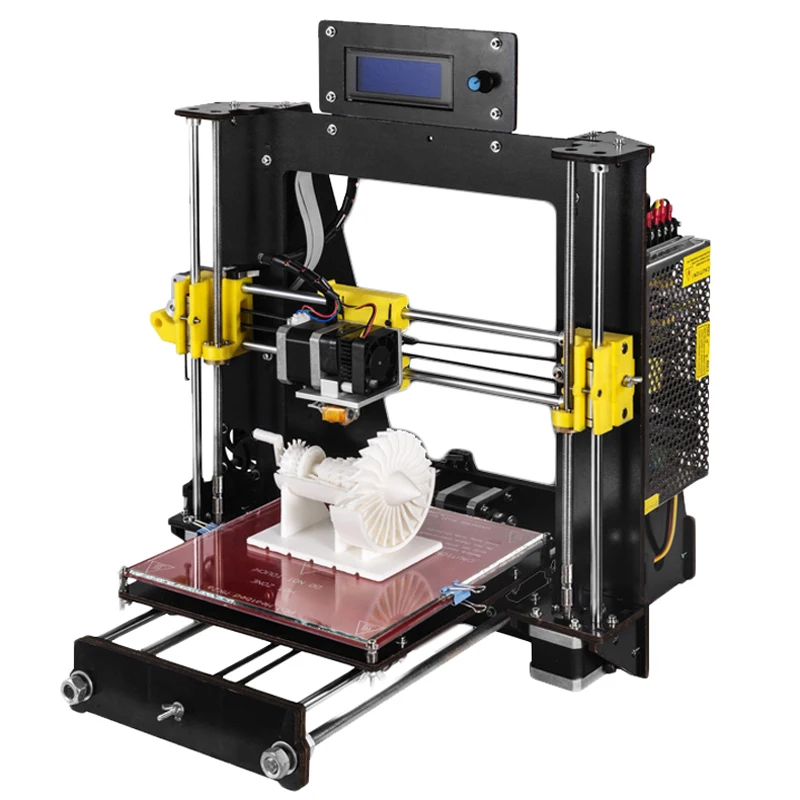

Now 3D technologies are becoming more and more accessible to the general public.

And, of course, the majority of people have a desire, if not to open their own printing business, then at least recoup the costs of purchased equipment or make 3D printing an additional source of income.

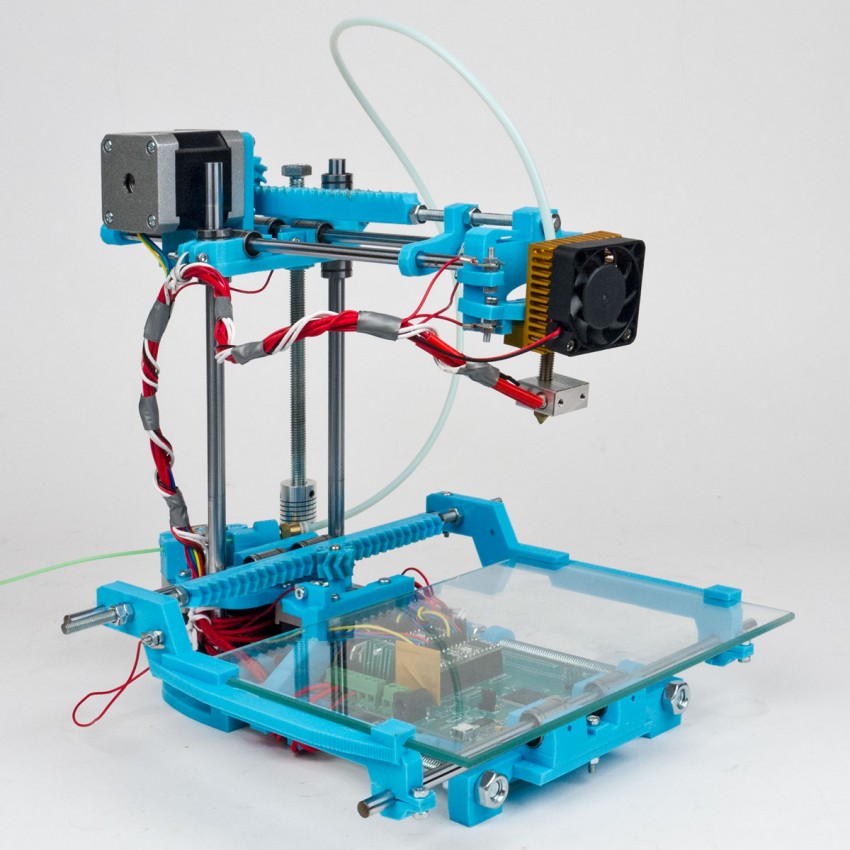

Some 10 years ago, 3D printing was just beginning its development, in principle, little was known about this technology.

European 3D printers, which were already on the market at that time, were quite expensive.

And only, approximately, since 2013. printers of Russian manufacturers began to appear, which were more affordable for our consumers.

The absence of competition made this field of activity attractive and profitable for start-up entrepreneurs .

With the development of Russian manufacturing companies and the availability of the most affordable Chinese-made 3D printers, such studios began to appear like mushrooms after the rain.

Most entrepreneurs in this area chose the most popular path - they leave an order for a single product, they fulfill it and wait (or, at best, look for) the next customer.

This approach, in most cases, ends in failure.

This was probably due to two factors:

- significantly increased competition

- and the lack of demand for services, since few of the inhabitants knew exactly how 3D printing can be applied.

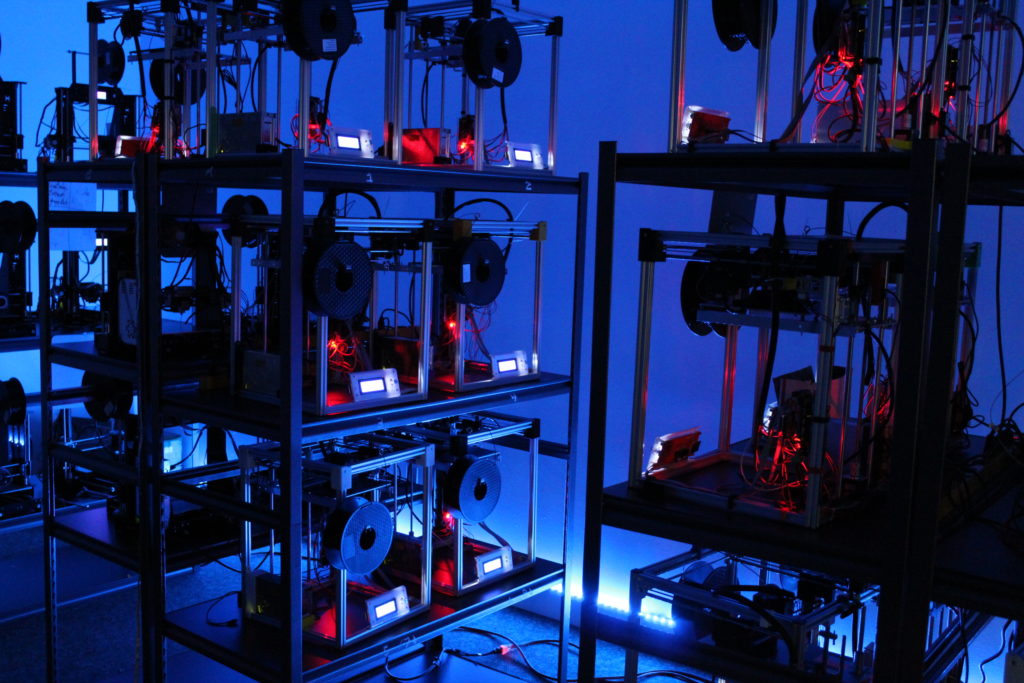

Large labor costs for finding orders, insufficient number of clients, in addition, it often turned out that it took much more time for one print than expected, in connection with this, the question arose of the advisability of purchasing additional 3D printers, since it was difficult to fulfill a large volume of orders.

Not all studios survived.

Hence, in our opinion, the widespread opinion that this type of activity cannot be profitable.

But, for some studios, on the contrary, things are going uphill, and from makers working at home, they are turning into a steadily growing company that brings a stable income.

Why does this happen?

This time we talked to the user of our Hercules Strong 3D printer, Alexander Bogomolov, the founder of the “MIR3D.RND” workshop.

Alexander opened his own workshop ,

, which combines the directions of milling and 3D printing, and it should be noted that he focuses on the second direction.

It all started with the fact that in 2019 Alexander completed the gubernatorial training program for small and medium-sized businesses. And, since the topic of additive technologies has long interested him, he presented his graduation project in the form of a business plan for creating a workshop that combines 3D printing and milling.

After the defense of the project, the workshop was opened.

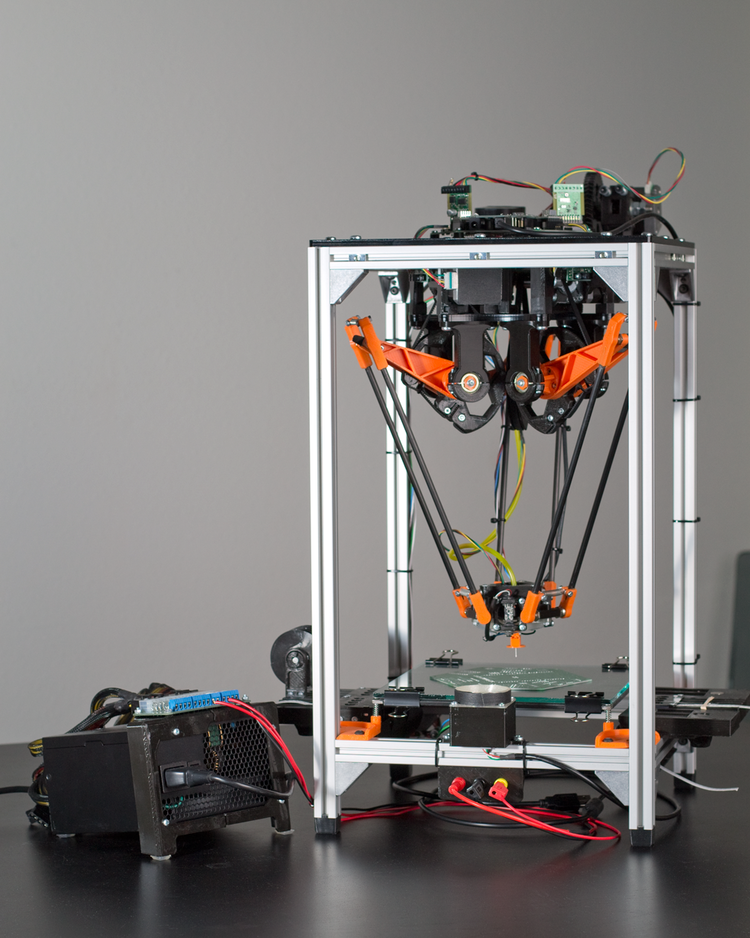

The 3D printer was selected based on the following requirements:

- it must have been professional equipment

- Russian assembly

- the ability to contact and get help from technical support if necessary

- the ability to quickly get printer spare parts in case of their breakdown.

- large working area that allows you to place a large number of parts.

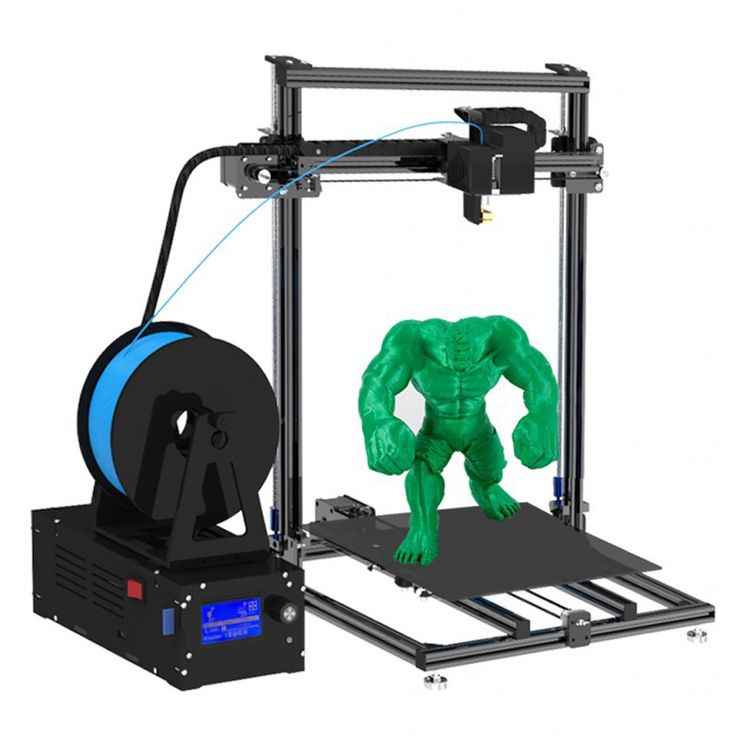

Our Hercules 3D printers met all these requirements, and the choice fell on the Hercules Strong model.

Of course, like most 3D printing studios, they print to order, for the most part

functional parts, for example, for household appliances that are out of order.

But, Alexander realized that in order to develop and stand out from the competition, you need to create a unique selling proposition.

He decided to find his own narrow target audience and focus on development in this direction.

And he managed to do it!

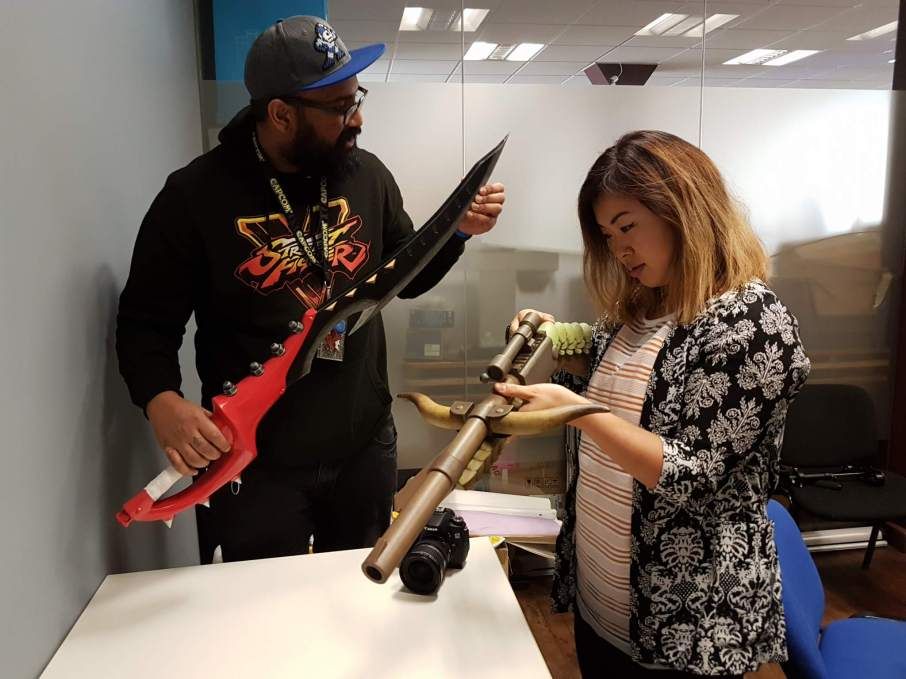

The focus is on the beauty industry, and more specifically on the masters involved in weaving dreadlocks.

Alexander has developed a special device for weaving, which is now very popular and helps craftsmen a lot in their work.

Thus, having managed to find his consumer and created the necessary product, Alexander ensured the demand for his unique products and received a source of stable income.

In addition, the studio specializes in printing brackets, crosses and corners for exhibition pavilions and awnings for recreation.

Previously, we have already told you the story of entrepreneur ,

, who also grew from a maker that prints at home to a company that entered Russian marketplaces with its products.

Evgeniy Rubtsov, the founder of the "3Dform" company, also took the path of developing a narrow niche

- they print molds and cutouts for confectioners on Hercules Original and Hercules Strong.

Also, the company "3Dpoint" - specializes in printing and selling rare auto parts,

work on Hercules G2.

By the way, the founder of this company, Victor, participated in streams on the YouTube channel "Additive Kitchen", where he shared his impressions about this printer in detail.

From this we can conclude that not always a wide profile of services in the field of 3D printing gives a stable result, but going into a narrow line of business and correctly identifying your potential audience, their needs and requests can lead a printing studio to larger volumes work, and as a result, a stable income.

Share your stories in the comments, if you also opened your own print studio, what results and conclusions did you come to in the process? What was the secret of your success?

>_____________________________________________________________________________

All detailed characteristics of 3D printers and interesting cases of our users on our website Our active life, 3D printing from us and users of our printers, announcements and news in social networks:

VK,

FB,

Instagram.

Choose a convenient one and subscribe.

3D Printing Market Research: 6 Important Trends

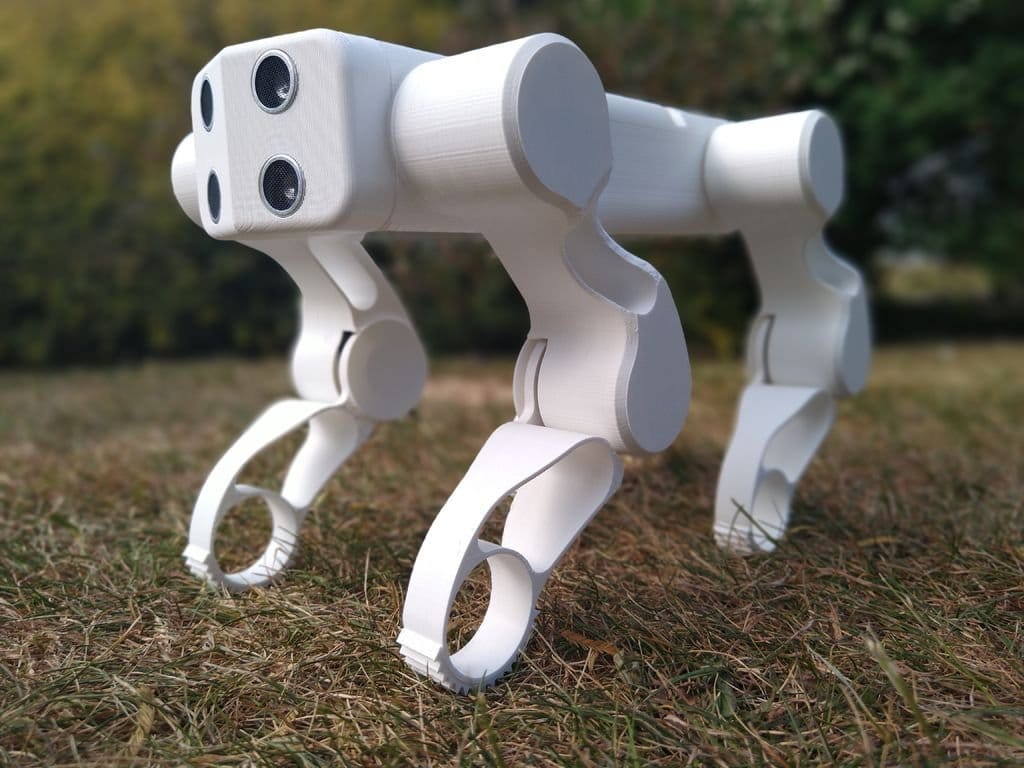

Time is the most valuable commodity today. High competition and the emergence of new business models require accelerated development cycles to quickly and flexibly implement innovative ideas. With new, more efficient equipment, high productivity, and a wide choice of materials, 3D printing technology saves time and money in the development and production of parts.

3D printing was originally designed to completely change the principles of production. The technology has a number of strategic advantages, such as design flexibility, reduced time to market, mass customization, distributed manufacturing, and many others. Despite some difficulties, 3D printing continues to show undeniable advantages.

Over the past few years, Jabil, an international manufacturing services company, has sponsored three 3D printing trend studies to set the direction for additive manufacturing and assess current realities. The 2021 survey surveyed more than 300 people responsible for making 3D printing decisions in manufacturing companies. The report allows you to get acquainted with the experience and opinion of professionals working "at the forefront". Respondents work in a wide range of industries, including electronics, plastics and packaging, industrial engineering, automotive, healthcare, and many others, giving us a comprehensive understanding of the 3D printing market and how additive technologies are being used.

The 2021 survey surveyed more than 300 people responsible for making 3D printing decisions in manufacturing companies. The report allows you to get acquainted with the experience and opinion of professionals working "at the forefront". Respondents work in a wide range of industries, including electronics, plastics and packaging, industrial engineering, automotive, healthcare, and many others, giving us a comprehensive understanding of the 3D printing market and how additive technologies are being used.

1. The scope of 3D printing is rapidly expanding

Thirty years is a very short time when it comes to traditional production methods. Additive technologies are revolutionizing a wide variety of industries.

The results of the last two surveys are in stark contrast to the information obtained in the first survey in 2017. Even in the past two years, the adoption of 3D printing has increased significantly. The rise in popularity and expansion of the scope of additive manufacturing is clearly seen in the present study.

In 2017, the most popular answer to the question “what is 3D printing used for in your company?” was the answer "for rapid prototyping". Seven out of ten respondents confirmed the use of 3D printing for this purpose. The remaining answer options lag far behind the first: only three out of ten respondents chose the second option (tooling production). Since then, the scope of 3D printing has expanded significantly.

R&D has become the most popular area for 3D printing, ahead of prototyping. At the same time, there is a sharp increase in application scenarios in other areas. Since 2017, the proportion of companies using additive manufacturing to manufacture parts and tooling has doubled, and the use of these methods for mass production of parts has tripled.

Nearly 100% of study participants reported that they use 3D printing to produce functional or end-of-life parts. Undoubtedly, the scale of their production varies. Nearly 80% of respondents report using additive manufacturing to make at least 25-50% of functional parts.

Improvements in 3D printers allow companies to experiment with additive technologies in areas where they were previously unavailable. As the price of 3D printers declines and their productivity rises, the technology will become more accessible and will change the manufacturing industry as a whole.

2. The growth of additive manufacturing: forecasts are more optimistic than ever

Prospects for the development of 3D printing are extremely positive. Market participants are confident in a significant increase in the popularity of technology in the future. 97% of respondents believe that the adoption of 3D printing in their companies will grow in the next five years.

The majority of study participants believe that the use of 3D printers in their organizations will at least double over this period of time. Nearly half of respondents expect usage to double, and 4 out of 10 expect much more significant increases (5x or more). In addition to the growing popularity of additive technologies, a significant role in expanding their use, as already mentioned, will be played by their availability.

Companies in general plan to increase their additive capacity, but the highest expectations are related to mass production of parts and goods. Slightly more than 80% of respondents expect that the use of additive technologies for mass production of products in their organizations will grow at least twice over the next five years.

H. 3D printing brings many benefits to companies

During the first study, many of the benefits were perceived as "intangible" concepts. However, over the past few years, use cases have increased, concepts have become reality, and two years later, respondents are even more inspired by the benefits of additive technologies. We have identified three main benefits of additive manufacturing according to reviews.

Perhaps the rise in popularity of 3D printing is not a coincidence, but is due to increased demand for additive manufacturing during the COVID-19 crisis. As the pandemic spread, companies with 3D printers began to produce personal protective equipment such as respirators and masks that suddenly became scarce. When developing new diagnostic equipment and analysis kits, the use of 3D printing has accelerated the process of prototyping and design.

When developing new diagnostic equipment and analysis kits, the use of 3D printing has accelerated the process of prototyping and design.

Respondents cited faster manufacturing of parts as the main benefit of additive manufacturing. Jabil saw this first hand: indeed, the desire to eliminate the labor-intensive iterative process was the driving force behind the introduction of additive manufacturing into the Auburn Hills facility. Not only did it speed up workflows, but it also helped reduce costs by being able to immediately recreate the exact geometry (no need to cut off excess material). In fact, savings amounted to 30-40% on tooling and 80% on lead times.

“With the power of 3D printing, every aspect of manufacturing has been greatly improved,” said John Wahl VI, Tooling Engineer at Jabil's Auburn Hills facility. “The first aspect is time, the second is a more creative approach, the third is costs, the fourth is materials.”

According to the distribution by job level, senior managers are more optimistic about the benefits of 3D printing than department heads. Since it is the leaders who shape the vision (and plan the budget) for the future of the company, everything points to the further spread of 3D printing.

Since it is the leaders who shape the vision (and plan the budget) for the future of the company, everything points to the further spread of 3D printing.

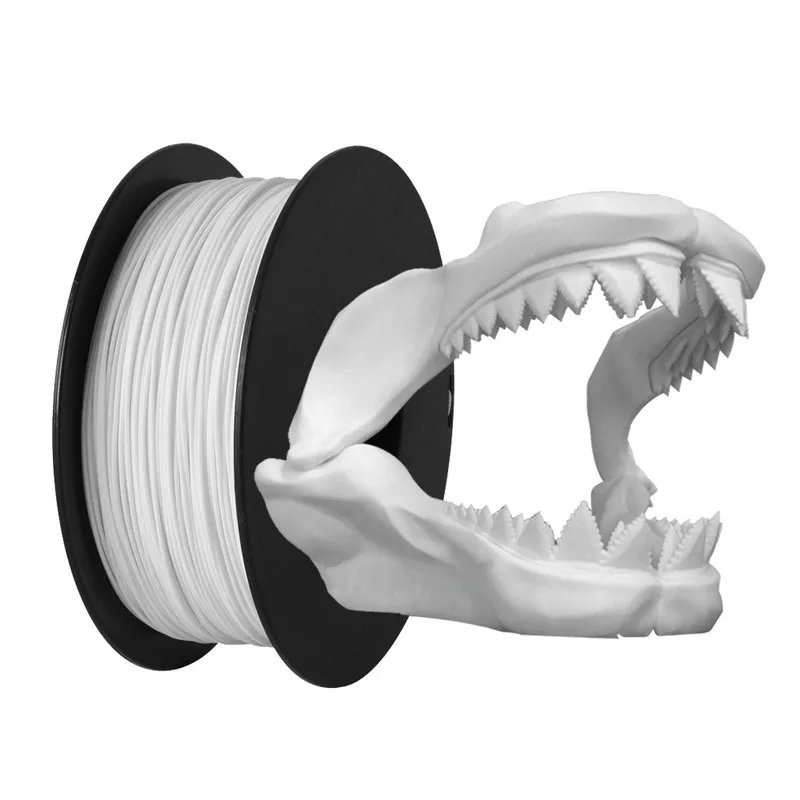

4. 3D printing materials become more affordable

Compared to 2019, companies are using many more types of 3D printing materials. Despite the fact that plastics/polymers are still leading the way, other materials are not losing ground and are catching up. This confirms our conclusion that the scope of 3D printing is expanding.

When it comes to primary material, the difference between plastic and metal in 3D printing is not as big as you might think. More than a third of respondents answered that they use plastic and metal equally, and those who choose only plastics are only 10% more.

Certainly some problems must be overcome in order to use some materials. More than half of the respondents (twice as many as in 2019) said that it takes too long to develop the necessary materials. Slightly more survey participants said that some materials are too expensive for large-scale use, and are not available or certified.

However, as these problems are overcome, interest in different materials increases. When you look at what materials companies actually use and what they would like to use, plastic still comes out on top. At the same time, the desire to use almost all materials exceeds the current use. It is noteworthy that the interest in printing with glass exceeds the actual use by 20%, ceramics - by 14%, metal - by 10%. It will be interesting to see the changes in the use of materials in the next two years.

5. Additive manufacturing still a source of problems

Despite the optimistic view of the development of additive manufacturing, companies still have to solve a number of problems associated with 3D printing. In 2019, half of respondents cited material costs as a problem, but this year only about two-fifths did so. All problems are located approximately on the same level: most of them fluctuate around 40%.

However, many of the current problems are related to costs, since 95% of respondents reported financial barriers to adopting additive manufacturing. Obtaining appropriate qualifications and certifications is the main challenge, followed by capital expenditures associated with equipment and the need for in-house specialists.

Obtaining appropriate qualifications and certifications is the main challenge, followed by capital expenditures associated with equipment and the need for in-house specialists.

In 2021, pre- and post-processing costs have become a major concern. Companies are using more and more pre- and post-processing methods. In 2019, just over half of respondents reported using mechanical finishing, now it is almost three-quarters, with no polishing being the most common option. Given that the use of all processing methods has increased significantly, it is possible that companies are experiencing growth difficulties. If these problems continue to be given priority attention, they can be overcome.

6. Training of specialists is a priority

Now about three-quarters of respondents are engaged in additive manufacturing on their own. Given that half of the time they chose “lack of in-house talent” as their problem, it can be assumed that companies are prioritizing educating their employees about additive manufacturing or attracting professionals with experience and knowledge in the field of 3D printing.

This does not mean that organizations are opposed to outsourcing additive manufacturing: in fact, almost 100% of respondents said they were considering this option. When looking at potential suppliers, companies take into account a variety of criteria. Design capability is key, and scalability, pricing, and experience continue the list.

We are seeing significant growth in 3D printing in some areas. In others, this growth is still small. Four years ago, companies used 3D printers primarily for fast, low-cost prototyping: Few businesses relied on additive manufacturing for full-scale production. However, in just four years, as the problems with materials for additive manufacturing were solved and the scope of its use increased, the situation has changed. We have seen how 3D printing has literally taken over many manufacturing industries, which is reflected in the growth of market performance. Slowly but surely, the adoption of additive manufacturing continues. Digital manufacturing is the future.