Top 3d printing stocks 2015

The Top 10 3D Printing Stocks for 2015

0Shares

Although the stock market has not been kind to 3D printing companies as of late, the financial economy is one thing and the real economy is oftentimes something entirely different. That means that stocks may be tanking and, yet, 3D printing companies are growing and setting new revenue records. Most are also quite profitable and, even those that are not have invested heavily on future growth. So, here is 3DPI’s list of the top 10 public pure-play 3D printing companies for yearly turnover, with Stratasys taking the market’s lead.

Stratasys: $750mDriven in part by demand of the new Object500 Connex3, by continued demand for PolyJet and industrial FDM 3D printing, and by new acquisitions such as Solid Concepts and Harvest Technologies (now part of Stratasys Direct Manufacturing) Stratasys (NASDAQ:SSYS) grew by 54% and topped $750 million in sales. At the same time, the US-Israeli company (which includes MakerBot Industries and SolidScape, among others) registered a GAAP net loss of $119 million, more than quadrupled from last year (also due to intensive acquisitions and investments). The outlook for 2015 is bright, with forecasted revenues for $940 million: if it outperforms its expectations by 6%, Stratasys could become the first billion dollar pure-play 3D printing company.

Even though it grew by 27% to record revenues, 3D Systems (NYSE:DDD) lost the lead to Stratasys with FY 2014 revenues set at $653 million. Avi Reichental, the company’s CEO, said that he was disappointed that the company was not able to better capitalize on its technology portfolio, which includes some of the most advanced 3D printing capabilities in the industry, and the will to reach out to the mass market. However, 3D Systems remained on the black side of the profit/loss board with GAAP net income at $1.6 million. The outlook for 2015 is bright, although, with a revenue forecast of between $850 and $900 million, 3DS is set on trailing Stratasys for at least one more year.

Materialise: $81mMaterialise (NASDAQ:MTLS), one of Europe’s leading 3D printing service providers and a developer of cutting edge 3D printing software, recorded revenues for $81 million in fiscal year 2014, growing by 18. 4%. It also recorded profits of $1.8 million, which were about half as much as the year before, but still significant. Materialise bases its business on 3D software development and distribution, which accounted for 22% of all sales, with medical 3D printing services accounting for 37%. The industrial segment – which included the i.materialise 3D printing service – accounted for 40% of revenues. Next year Materialise expects to grow by 20% and reach €100m in yearly turnover.

4%. It also recorded profits of $1.8 million, which were about half as much as the year before, but still significant. Materialise bases its business on 3D software development and distribution, which accounted for 22% of all sales, with medical 3D printing services accounting for 37%. The industrial segment – which included the i.materialise 3D printing service – accounted for 40% of revenues. Next year Materialise expects to grow by 20% and reach €100m in yearly turnover.

ExOne‘s (NASDAQ:XONE) 2014 revenue was approximately $43.9 million with growth at about 10%, driven by a strong fourth quarter that saw sales increase by 50%. While this led to gross profits for $10 million, ExOne recorded $21 million in operating losses, due mostly to investments in the expansion of operations (new facilities opened in Russia and Italy) and more than $8 million in R&D. ExOne also announced a new, huge 3D printer, the Exerial.

Arcam: $39m (340 Swedish Krona)Arcam (STO:ARCM), the Swedish-based producer of EBM (electron beam melting) systems recorded sales for the equivalent, in Swedish Krona, of about $39 million. This means the company grew by 70% in just one year, with profits of over $6 million. Perhaps, though, it seemed too good to be true to the financial markets (it is listed on the Swedish NASDAQ), since Arcam’s stock has lost over 70%, since its all time peak in late 2013, and is now worth about $17.

This means the company grew by 70% in just one year, with profits of over $6 million. Perhaps, though, it seemed too good to be true to the financial markets (it is listed on the Swedish NASDAQ), since Arcam’s stock has lost over 70%, since its all time peak in late 2013, and is now worth about $17.

The performance of Germany’s SLM Soutions (XETRA: AM3D) was very similar to Arcam’s: it achieved record revenues of €33.6 million after growing by 56% in fiscal year 2014. At the same time, though, the company’s stock, has lost some ground from the high of €21 to today’s €18, though remaining more stable than most other 3D printing manufacturers. In the current year (to date), SLM is reporting 100% YoY growth in the number of orders.

Alphaform $30m (€29m)Alphaform (ETR:ATF) is a large German rapid prototyping service that has been making its first steps into the consumer sector through the Artshapes 3D printed art project. The company registered record revenues of €29 million in fiscal year 2014, after growing by 11.6%. However, its losses during the same period amounted to €3 million, which is still a significant improvement from the €6 million in FY 2013.

The company registered record revenues of €29 million in fiscal year 2014, after growing by 11.6%. However, its losses during the same period amounted to €3 million, which is still a significant improvement from the €6 million in FY 2013.

The German company, voxeljet (NYSE:VJET), has been criticized by analysts for selling too few machines and giving favorable conditions to its customers in order to increment orders. However, it must be considered that voxeljet‘s 3D printers are huge machines, with printing volumes as large as 8 cubic meters, and, thus, cater to very specific needs. Full year revenues guidance for FY 2014 (to be confirmed on March 26th) is between €16 and €17 in revenue and the company stated that it expects to grow by close to 50% in 2015.

Organovo $0Organovo (NYSEMKT: ONVO) is the only publicly trade company working on bioprinting. It is still mostly focused on the research phase and has only just released its first commercial product, the exVive3D human liver tissue. Organovo built its own bioprinter and uses it to develop 3D printed organic tissue to sell to large pharmaceutical companies mainly for research purposes. The company is spending approximately $20 million a year for operations, but it is certain that itss products will generate revenues of more than $100 million in the short to medium term.

Organovo built its own bioprinter and uses it to develop 3D printed organic tissue to sell to large pharmaceutical companies mainly for research purposes. The company is spending approximately $20 million a year for operations, but it is certain that itss products will generate revenues of more than $100 million in the short to medium term.

One last company we are going to consider in this top 10 list of 3D printing stocks is UK-based Renishaw (LON: RSW), which registered revenues for £355 million, with slightly decreasing profits set at about £70 million. Currently the company has not disclosed revenues from its additive manufacturing business other than stating it has “experienced strong demand”. So strong, in fact, that after entering the market with the AM250 SLM machine, it has presented the new EVO system in 2014.

Davide Sher

Davide was born in Milan, Italy and moved to New York at age 14, which is where he received his education, all the way to a BA. He moved back to Italy at 26 and began working as an editor for a trade magazine in the videogame industry. As the market shifted toward new business models Davide started working for YouTech, the first iPad native technology magazine in Italy, where he discovered the world of additive manufacturing and became extremely fascinated by its incredible potential. Davide has since started to work as a freelance journalist and collaborate with many of Italy’s main generalist publications such as Corriere della Sera, Panorama, Focus Italy and Wired Italy: many of his articles have revolved around the different applications of 3D printing.

He moved back to Italy at 26 and began working as an editor for a trade magazine in the videogame industry. As the market shifted toward new business models Davide started working for YouTech, the first iPad native technology magazine in Italy, where he discovered the world of additive manufacturing and became extremely fascinated by its incredible potential. Davide has since started to work as a freelance journalist and collaborate with many of Italy’s main generalist publications such as Corriere della Sera, Panorama, Focus Italy and Wired Italy: many of his articles have revolved around the different applications of 3D printing.

Top 3D Printing Stocks for 2015

This article was updated on June 19, 2015.

Since the onset of 2014, 3D printing stocks have essentially been in freefall, which has the positive effect of bringing their valuations down to much more palatable levels. Consequently, investors who can stomach high volatility could potentially find long-term opportunity from these price dips.

After all, according to Wohlers Report 2015, the 3D printing industry is expected to grow by more than 31% per year through the year 2020, and eventually generate more than $21 billion in revenue. In other words, the longer-term prospects of the industry appear to be promising.

Without further ado, here are my top 3D printing stocks for the remainder of 2015 and beyond.

Top diversified 3D printing stockSource: Author.

Over two years ago, I argued that 3D Systems (DDD -2.66%) is the best bet for investors who wanted to own a broad-based, diversified 3D printing company. My reasoning was based on the fact that 3D Systems offers the broadest 3D printing technology portfolio in the industry, which in theory should allow it to cater to a bigger market opportunity than its competitors.

Unfortunately, in practice, 3D Systems' jack-of-all trades approach has been plagued with execution issues and a lack of focus, and has missed Wall Street expectations on numerous occasions over the last two years. For these reasons, I believe investors may be better served with Stratasys (SSYS 3.23%) as the top diversified 3D printing stock for 2015 and beyond.

For these reasons, I believe investors may be better served with Stratasys (SSYS 3.23%) as the top diversified 3D printing stock for 2015 and beyond.

Through the first quarter of 2015, Stratasys has sold more than 129,000 3D printers since the respective inceptions of its Stratasys, Objet, and MakerBot brands -- the most of any 3D printing company. As these 3D printers are put to use, they consume materials, which Stratasys tends to sell at a higher markup than its 3D printing hardware. This razor-and-blade model, driven by its large installed base, effectively sets the company up to generate long-term recurring revenue streams from the sale of consumables.

However, to be clear, Stratasys isn't free from its faults. The company has experienced ongoing performance issues with its MakerBot unit to the point that management was forced to write down more than 73% of the $403 million it paid for the company in mid-2013. This misstep has raised questions about management's ability to create shareholder value from acquisitions, and has instilled worries that the company has overpaid for other acquisitions.

Source: ExOne.

Although ExOne's (XONE) stock decline of more than 80% since the beginning of 2014 suggests that the underlying business suffered a catastrophic blow, there are still plenty of reasons for investors to get excited for this specialty industrial 3D printing company to turn things around in 2015 and beyond.

A major source of ExOne's disappointment in 2014 and 2015 was related to numerous product shipment delays, largely at the request of customers, which dragged on revenues and forced the company to consistently miss earnings expectations. ExOne also began a transition from targeting metal foundries -- which proved to be reluctant to adopt ExOne's binder jetting 3D printers -- to directly targeting metal foundry customers. While it's currently slow going, the hope is that this transition will eventually expand ExOne's addressable market by a wide margin, as there are more foundry customers than there are metal foundries.

To get involved with ExOne, investors will need to have faith in management's long-term vision that its binder jetting technology is uniquely suited for a variety of 3D printing applications, and that its transition from focusing on metal foundries to their customers begins to bear fruit.

Top alternative 3D printing stockSource: Proto Labs.

Rapid manufacturer Proto Labs (PRLB 3.87%) officially became a 3D printing stock when it acquired FineLine Prototyping in April 2014, a leading 3D printing service bureau based in Raleigh, North Carolina. Consequently, Proto Labs' manufacturing services can now fluidly take a product developer's idea through the majority of the product design process -- from a conceptual 3D-printed model to a larger-scale manufacturing run in the tens of thousands, using real manufacturing processes like CNC machining and injection molding.

Where I think Proto Labs really stands out from the crowd is in the breadth of quick-turn manufacturing services it offers, and its ability to scale by leveraging cutting-edge automation technology. Together, these factors raise the barrier of entry for competitors to replicate Proto Labs' business model in its entirety, because the capital, technology, and expertise required are intensive.

Together, these factors raise the barrier of entry for competitors to replicate Proto Labs' business model in its entirety, because the capital, technology, and expertise required are intensive.

In terms of disruption, Proto Labs remains better insulated from the threat of technological disruption than its 3D printing peers because it's technology-agnostic. Should a breakthrough 3D printing or manufacturing technology enter the market, Proto Labs can simply acquire said technology, integrate it into its existing operations, and offer it to its customers without skipping much of a beat. Ultimately, this adaptability gives Proto Labs an enduring characteristic.

Taking a stakeWhile no one can be certain how the rest of 2015 will treat 3D printing stocks, the most important factor to consider when investing in any 3D printing stock is whether or not the underlying business is operating as expected, and continues to hold the potential to deliver on its promise of earnings growth over a long time horizon. As long as the underlying fundamentals remain intact, enjoy what's sure to be a wild ride.

As long as the underlying fundamentals remain intact, enjoy what's sure to be a wild ride.

Steve Heller owns shares of 3D Systems, ExOne, and Proto Labs. The Motley Fool recommends and owns shares of 3D Systems, ExOne, Proto Labs, and Stratasys. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Largest listed companies in the 3D printing sector

3D printing dates back to the late 1980s. At the end of 2018, the size of the 3D printing market, according to various estimates, reached from $9 trillion to $10 trillion. Calculations were made based on the cost of producing printers, components and 3D printing.

In the coming years, expert agencies (IMARC, Inkwood Reasearch, Marketwatch, etc.) predict a steady growth of at least 20% per year. In this scenario, by the end of 2025, the scale of the entire 3D printing segment will reach at least $ 32 trillion - 3. 5 times higher than the current values.

5 times higher than the current values.

The outlook for the sector makes it attractive to investors. Consider the largest and most stable companies in this segment, whose shares can be considered for purchase and take their rightful place in your portfolio.

1. HP Inc Capitalization: $29.3 billion

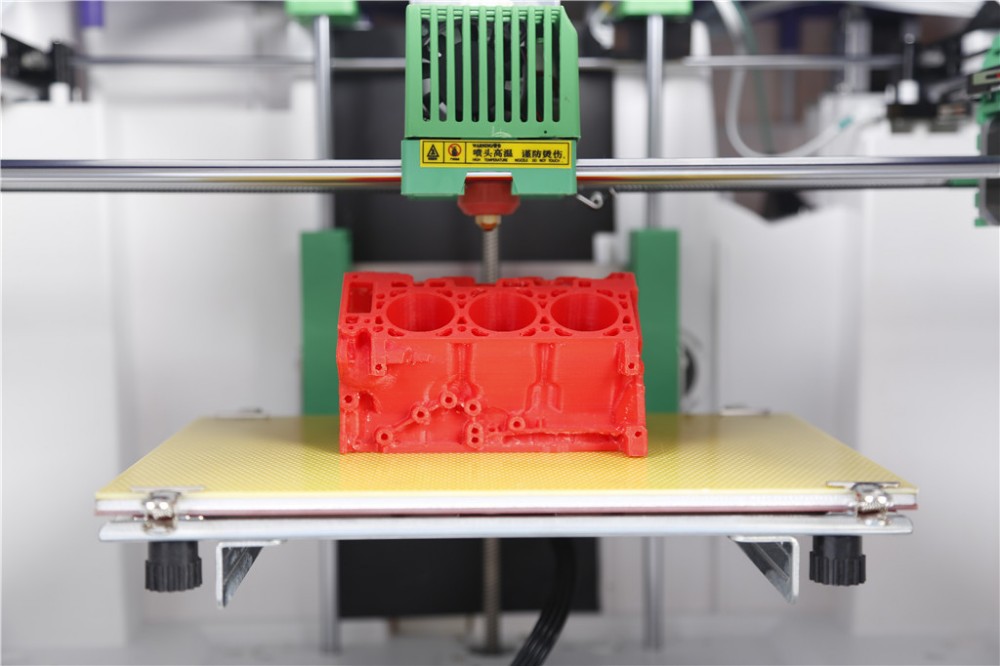

HP manufactures computers, printers, tablets and a number of other devices. The release of 3D printers is not the main specialization of the company, but HP occupies one of the leading positions in the 3D printing segment. In 2014, the company developed the Multi Jet Fusion technology, which allowed to increase productivity and reduce the cost of professional (industrial) 3D printers. The technology has been successfully applied in mass production of printers since 2016.

In 2017, HP opens the world's first 3D lab, equipped with printers in various build states and essential tools for device experimentation. The company has opened up the first opportunities to test new materials in 3D printers to increase efficiency.

The company has opened up the first opportunities to test new materials in 3D printers to increase efficiency.

In 2018, HP will open a joint manufacturing center with China's Guangdong in Guangdong, China, which is the largest such 3D printing project in Asia Pacific and Japan. The facility is equipped with ten high-tech next-generation HP Metal Jet printers to produce parts and prototypes for industrial customers.

2. Proto L abs (NYSE: PRLB). Capitalization: $2.56 billion

The company was founded in 1999 and has more than 10 production sites in seven countries. The head office is located in Minnesota. The company specializes in the production of parts for other manufacturing companies. The corporation positions itself as the fastest in the world in the production of custom prototypes and finished parts for industrial customers. In 2014, Proto Labs launched 3D printed parts.

In addition to 3D printing, the company produces CNC (Computer Numerical Control) parts, injection molding and sheet metal parts. In 2015, Proto Labs bought Alphaform (specializing in innovative 3D printing) with divisions in Germany, Finland and the UK. This allowed the company to expand its 3D printing business in Europe. To diversify its business and introduce sheet metal manufacturing, the company acquired Rapid Manufacturing in 2017 for $120 million. 9 Systems ( NYSE: DDD). Capitalization: $1.01 billion

In 2015, Proto Labs bought Alphaform (specializing in innovative 3D printing) with divisions in Germany, Finland and the UK. This allowed the company to expand its 3D printing business in Europe. To diversify its business and introduce sheet metal manufacturing, the company acquired Rapid Manufacturing in 2017 for $120 million. 9 Systems ( NYSE: DDD). Capitalization: $1.01 billion

3D Systems was founded by inventor Chuck Hull in 1986 as the world's first 3D printing company. It produces 3D printers and components, including software, and also designs them. The company provides services at various stages of design, development and production of products for many large industries, including aerospace, automotive, medical, entertainment and other areas. It should be noted that the corporation also works with retail consumers. Business diversification within the 3D segment makes the company financially stable.

3D Systems is headquartered in Rock Hill, South Carolina, USA. The number of employees of the company exceeds 2600 (as of the end of 2018), which is twice as high as five years ago.

4. Stratasys ( NASDAQ: SSYS). Capitalization: $0.98 billion

The company was founded in 1989 by Scott Crump. The technology was based on the idea of creating the shape of a figure by layering after Scott decided in 1988 to make a toy for his daughter using a gun filled with glue. At 1992 Stratasys released its first 3D Modeler product.

Today, Stratasys manufactures industrial and desktop 3D printers and related accessories. The range of services includes installation, maintenance and training in working with printers. The company serves various industries by developing technologies for the production of prototypes and parts. The first public offering of Stratasys shares took place in 1994 at $5 per share and a total volume of $5. 7 million. The head office is located in Minnesota.

7 million. The head office is located in Minnesota.

5. Materialize Capitalization: $0.88 billion

Incorporated in 1990 in Leuven, Belgium, Materialise specializes in 3D printing services and 3D printer software. Like other leaders in this sector, Materialize works with various major manufacturers around the world (Adidas, HP), but a significant share of the business is in cooperation with medical centers and institutions. The company's portfolio includes more than 150 medical patents. Materialize offices are located in 18 countries, including one office located in the CIS in Ukraine.

Issuer Comparison

The most valuable company among the leaders is HP, which is due to the scale and diversification of the company's business in the entire technology segment. 3D Systems, Stratasys and Materialize specialize exclusively in the 3D printing segment, while their capitalization is on the same level. Proto Labs has three businesses besides 3D printing and is in the middle of our list in terms of capitalization.

The most undervalued company in terms of EV/EBITDA is HP, but it is not correct to compare it with other issuers by this multiplier due to the differentiation of the company's products and services. 3D Systems has the highest EV/EBITDA, and from this point of view, the paper is not so attractive to buy. Moreover, over the past four years, 3D Systems shares have been in a stable sideways trend without technical prerequisites for growth.

The remaining three companies, in our opinion, may be of interest. At the same time, if your long-term goal is to get the maximum increase from the growth of the 3D printing sector, then investing in HP shares is less preferable compared to other securities. After all, the reaction of the shares of companies with a direct specialization is more sensitive to changes in the sector. Below are the consensus forecasts of investment houses according to Reuters, according to which Stratasys (14.9%) and Materialize (13.6%) shares have the greatest potential now.

HP Inc (NYSE: HPQ): $20.5 (+3.4%)

Proto Labs (NYSE: PRLB): $98.7 (+3.0%)

3D Systems (NYSE: DDD): $8 .6 (+0.6%)

Stratasys (NASDAQ: SSYS): $20.8 (+14.9%)

Materialize (NASDAQ: MLTS): $19.2 (+13.6%)

OPEN ACCOUNT

BCS Broker

Top 10 companies in the field of 3D printing listed on the stock exchange

So, we present to your attention the rating of companies in the field of 3D printing in terms of annual turnover.

Stratasys: $750 million

Industry leader Stratasys grew 54% over the past year with sales exceeding $750 million. This is partly driven by demand for the new Object500 Connex3 model, as well as the traditionally popular PolyJet and industrial FDM 3D printers. Another growth driver was the acquisition of other companies such as Solid Concepts and Harvest Technologies (now part of Stratasys Direct Manufacturing). At the same time, the American-Israeli company (which includes, among other things, MakerBot Industries and SolidScape) recorded a net loss of $119 in its financial statements.million. This figure is more than four times higher than last year, which is also due to active acquisitions and investments. The forecast for 2015 is positive, it is expected that the revenue will be $940 million. If Stratasys manages to beat expectations by 6%, it could become the first pure 3D printing company to reach $1 billion in revenue.

At the same time, the American-Israeli company (which includes, among other things, MakerBot Industries and SolidScape) recorded a net loss of $119 in its financial statements.million. This figure is more than four times higher than last year, which is also due to active acquisitions and investments. The forecast for 2015 is positive, it is expected that the revenue will be $940 million. If Stratasys manages to beat expectations by 6%, it could become the first pure 3D printing company to reach $1 billion in revenue.

3D Systems: $650 million

Although 3D Systems' revenue rose 27% to a record high, the company still lost the top spot to Stratasys last year. The head of the company, Avi Reichental, said he was not entirely satisfied with how the company realized the potential of its technology portfolio. 3D Systems has some of the most advanced 3D printing technology in the industry, but hasn't shown enough willingness to go mainstream. However, according to 3D Systems financial statements, the company turned out to be in positive territory with a net profit of $1. 6 million at the end of the year. Although the forecast for 2015 is generally positive, it is likely that 3D Systems will again be behind Stratasys, with revenues of $850-900 million.

6 million at the end of the year. Although the forecast for 2015 is generally positive, it is likely that 3D Systems will again be behind Stratasys, with revenues of $850-900 million.

Materialize: $81 million

Materialize is one of Europe's leading 3D printing service providers and a developer of innovative 3D printing software. In 2014, the company's revenue amounted to $81 million, which is 18.4% more than last year. The company's net profit reached $1.8 million, half of what it was in 2013, but still significant. Materialize's core business is the development and sale of 3D printing software (22% of sales) and medical 3D printing services (37%). The industrial segment, including the i.materialise 3D printing service, generated 40% of the company's total revenue. Materialize is expected to grow by 20% next year and reach €100 million in annual turnover.

ExOne: $43.9 million

Last year, ExOne grew by 10% with revenues of approximately $43. 9 million. The main contribution to this result was made by the fourth quarter, during which sales increased by 50%. This state of affairs resulted in a gross profit of $10 million, but ExOne's operating costs were $21 million. This was mainly due to investments in the expansion of the company (new production facilities in Russia and Italy), as well as research and development (more than $8 million). In addition, ExOne announced the creation of a new large-scale 3D printer, Exerial.

Arcam: $39 million

Arcam, a Swedish manufacturer of electron beam melting (EBM) systems, recorded revenues of approximately $39 million. Thus, sales grew by 70% in a year, and profits exceeded $6 million. However, it is likely that in the financial markets such results were considered too good to be true. Compared to a record high at the end of 2013, Arcam shares are down more than 70% and are now trading for around $17.

SLM Solutions: $36 million

Germany's SLM Solutions posted similar results to Arcam, with record earnings of approximately $36 million and 56% growth in 2014. At the same time, the company's shares fell from a record high of €21 to €18. However, SLM Solutions boasts a more stable stock price than most other members of the 3D printing industry. At the moment, for the past period of 2015, SLM Solutions reports an increase in the number of orders twice year-on-year.

At the same time, the company's shares fell from a record high of €21 to €18. However, SLM Solutions boasts a more stable stock price than most other members of the 3D printing industry. At the moment, for the past period of 2015, SLM Solutions reports an increase in the number of orders twice year-on-year.

Alphaform: $30 million

German company Alphaform offers rapid prototyping services. Alphaform made its first steps in the consumer market as part of the Artshapes project to apply 3D printing to the arts. The company reported record revenue of $30 million in 2014, up 11.6%. While Alphaform lost more than $3 million in the same period, this is a significant improvement from $6.5 million in 2013.

voxeljet: $17-18 million

Analysts have criticized the German company voxeljet for not selling enough devices while offering special deals to customers to increase orders. However, it should be taken into account that voxeljet manufactures large industrial equipment, the print volume of which reaches 8 cubic meters - in other words, the company occupies a very specific niche. Estimated revenue for 2014 (updated data will be available at the end of March) is $17-18 million. In addition, according to voxeljet forecasts, the company expects to grow by almost 50% this year.

Estimated revenue for 2014 (updated data will be available at the end of March) is $17-18 million. In addition, according to voxeljet forecasts, the company expects to grow by almost 50% this year.

Organovo: $0

Organovo is the only listed biomaterials 3D printing company. However, most of Organovo's activities are still research and the first commercial product, exVive3D human liver tissue, was released just recently. The company has created its own bioprinter and uses it to 3D print organic tissues, which it then sells to major pharmaceutical companies for research purposes. The company's annual operating costs are approximately $20 million. At the same time, Organovo is confident that its products can bring more than $100 million in profit in the foreseeable future.

Renishaw: data not available

Rounding out the top ten was British company Renishaw, which recorded revenue of $520 million and a slightly lower profit of $100 million.