Number of 3d printers in the world

10 million 3D Printers to Sold by 2030

Global 3D printing market was valued at USD 13.84 billion in 2021, and it is expected to reach a value of USD 51.95 billion by 2028, at a CAGR of 20.80% over the forecast period (2022-2028).

| Source: SkyQuest Technology Consulting Pvt. Ltd. SkyQuest Technology Consulting Pvt. Ltd.

Westford, USA, Aug. 08, 2022 (GLOBE NEWSWIRE) -- 3D printing is quickly becoming one of the most popular technologies in the world. It has been used to create everything from prosthetic body parts and surgical implants to customized eyeglasses and airplane parts. The applications of 3D printing are only going to continue to increase in the future. This is because 3D printing is able to create complex objects very quickly and with high accuracy.

One of the biggest benefits of 3D printing market is that it can be used to create custom objects quickly and relatively cheaply. This means that it can be used in a variety of different industries, including manufacturing, construction, and medical research.

10 million 3D Printers to be Sold by 2030

Although the exact number of 3D printers to be sold by 2030 is impossible to predict with complete accuracy, SkyQuest analysis expect that the sales of 3D printers will continue to grow at a healthy CAGR of 20.38%. In 2015, global sales of 3D printers reached an estimated 0.8 million, and by 2019 this figure increased 1.5 million, and is projected to surpass a 10 million mark by 2030.

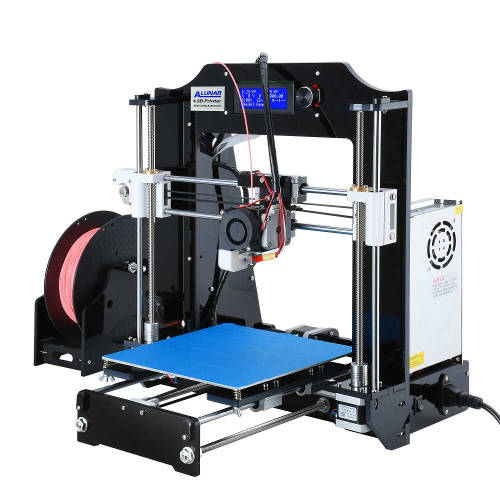

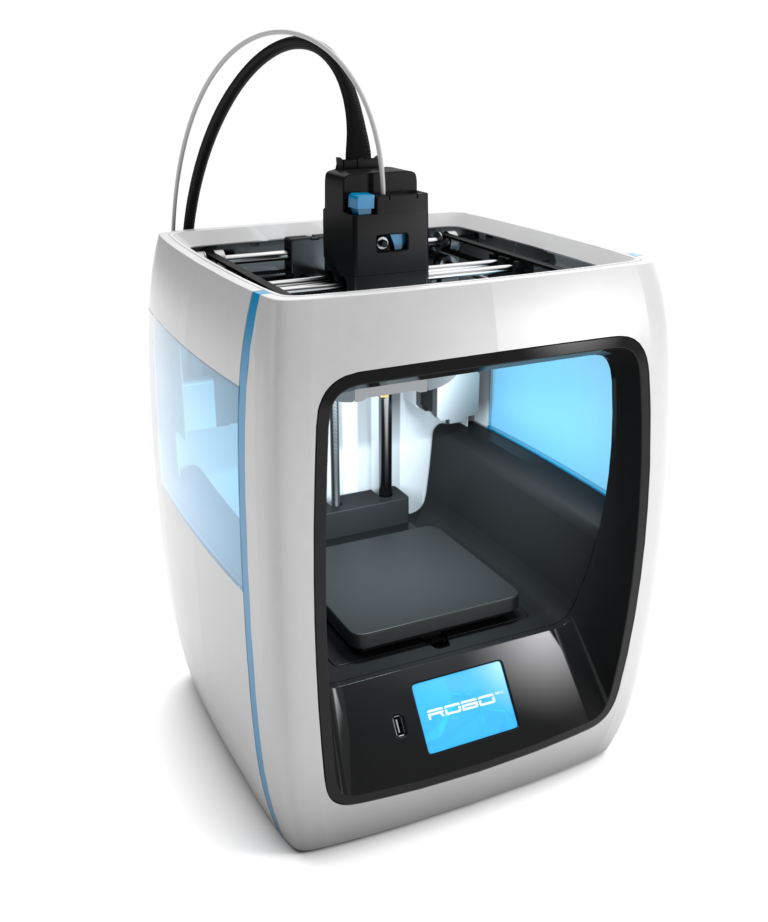

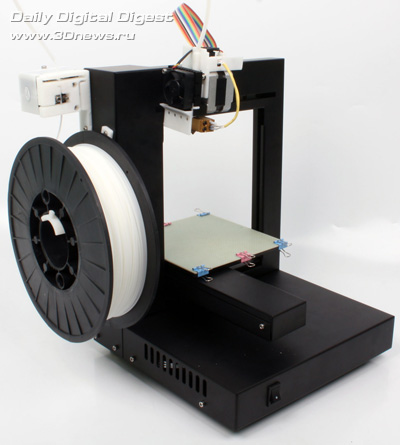

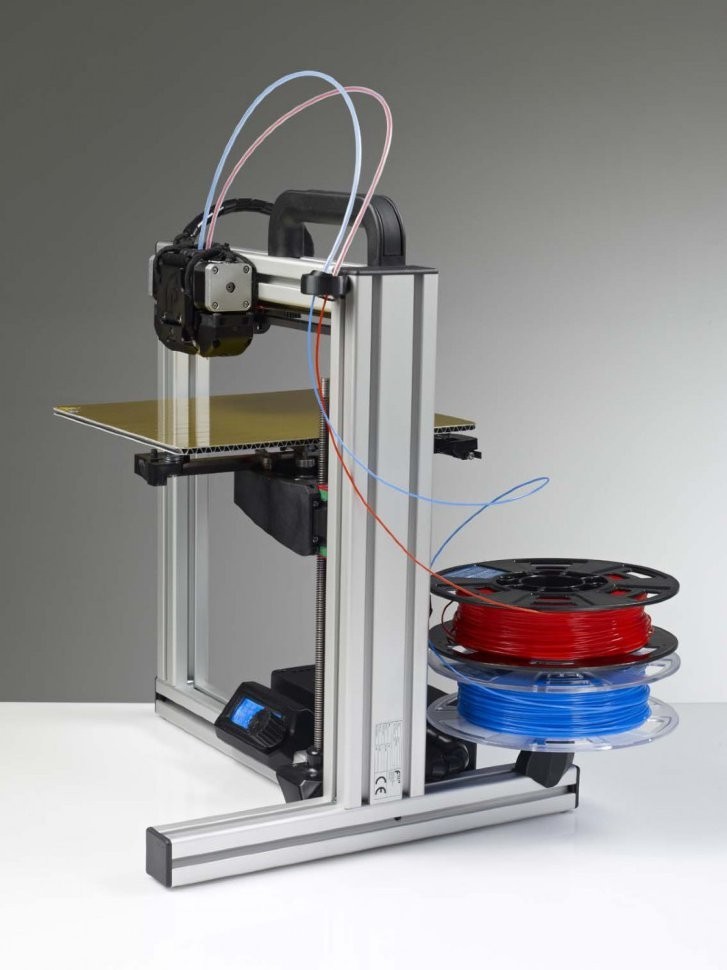

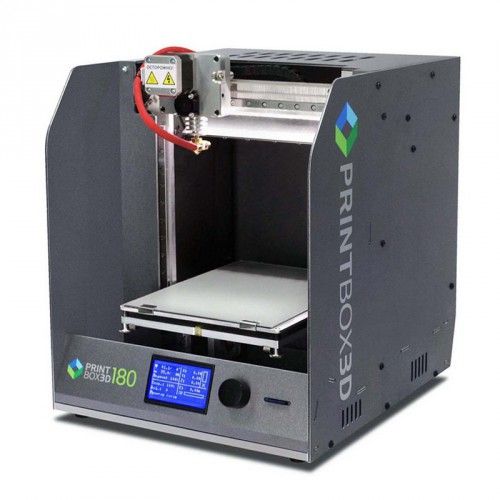

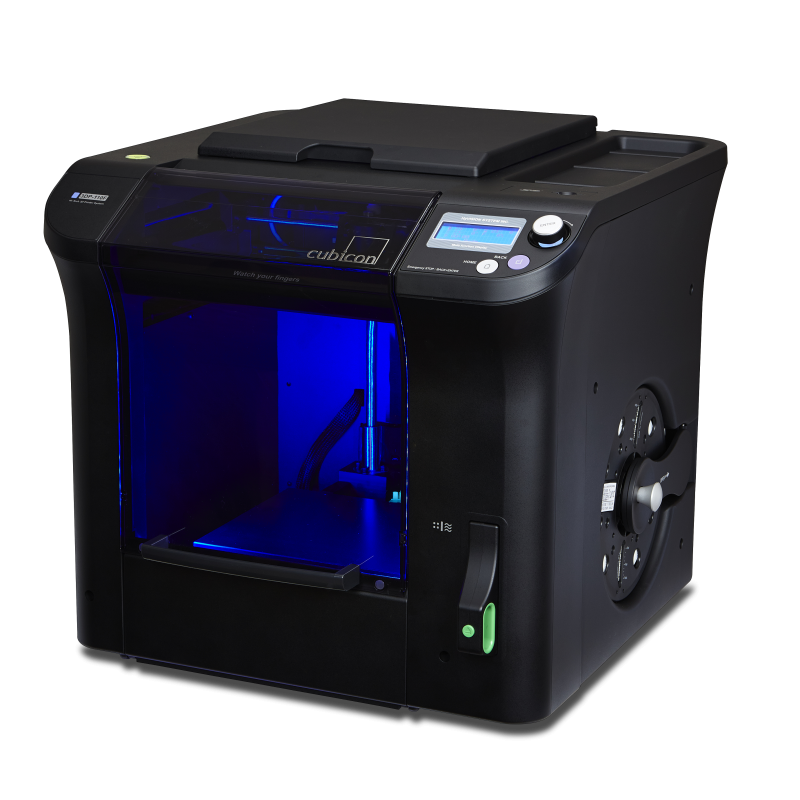

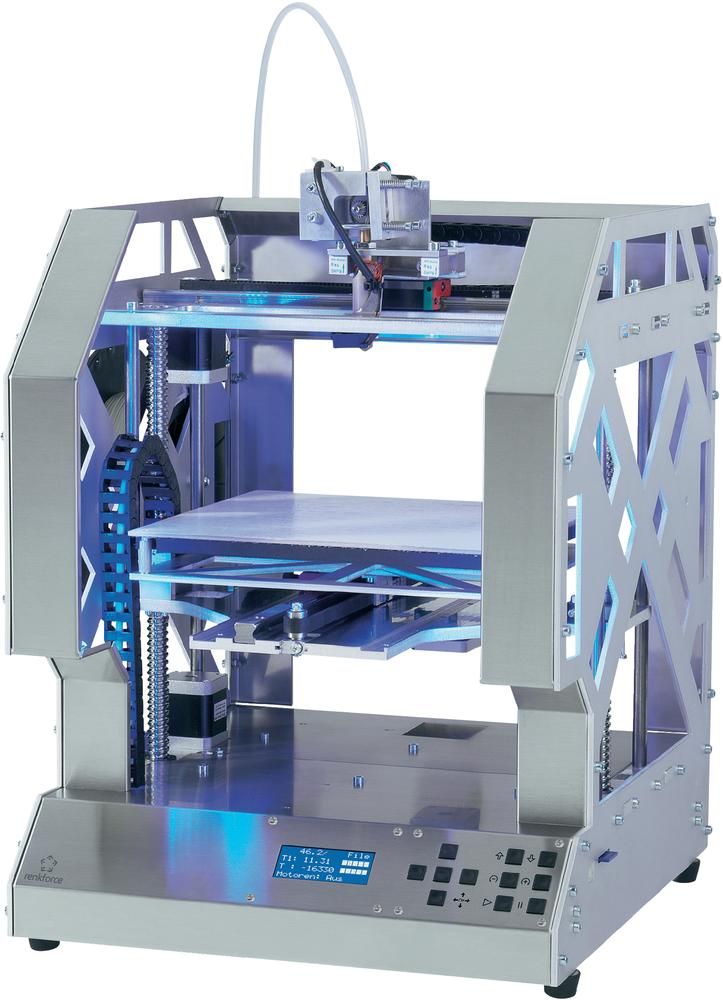

One key factor driving the growth of 3D printing market sales is the decreasing cost of these devices. In 2014, the average price of a consumer-grade 3D printer was approximately $1,000. Just two years later, in 2016, the average price of low-cost 3D printers has dropped to less $400. This decrease in prices is making 3D printers more affordable for a wider range of consumers and businesses, which is helping to drive growth in sales. On the other hand, industrial and professional 3D printer cost has come down to around $10,000 and $5,000 respectively, which used to more than $20,000 in 2015.

In 2014, the average price of a consumer-grade 3D printer was approximately $1,000. Just two years later, in 2016, the average price of low-cost 3D printers has dropped to less $400. This decrease in prices is making 3D printers more affordable for a wider range of consumers and businesses, which is helping to drive growth in sales. On the other hand, industrial and professional 3D printer cost has come down to around $10,000 and $5,000 respectively, which used to more than $20,000 in 2015.

The demand for 3D printing is expected to grow in the coming years, as the costs and technological developments for the technology decline. This is especially true for medical applications, which are expected to account for a large share of future growth.

3D printing has already revolutionized manufacturing processes, and it is expected to do even more in the future. The technology can be used to produce customized products, which is why it is often used to create medical devices.

Advantages of 3D printing over other manufacturing processes include the ability to produce multiple copies of a product with minimal mistakes. Additionally, 3D printing is faster than other methods and it does not require specialized equipment. This makes it suitable for small businesses and Manufacturing Enterprises who need quick turnaround times on products.

SkyQuest has published a report 3D printing market that primarily focuses on demand and sales of 3D printers by application and end-use industry. The report also provides a detailed insights into number of units sold in each sector and their major buyers by region. This would help the market participant to identify market opportunities and target their potential consumers in the global 3D printing market. To get a detailed market analysis, pricing analysis, value chain and supply chain optimization, and forecast,

Get sample copy of this report:

https://skyquestt. com/sample-request/3d-printing-market

com/sample-request/3d-printing-market

Automotive Industry Generates 27% of Sales in Global 3D Printing Market

The automotive industry generates a significant chunk of the global 3D printing market. As per SkyQuest Technology, the automotive industry generated 27% of sales in the global 3D printing market in 2021 and is projected to continue expanding their market share at a CAGR of around 22.3% in the years to come as the application area expands. As of 2021, the automotive industry generated market revenue of $2.3 billion and is projected attain a market value of $11.87 billion by 2028.

A number of factors are contributing to the growth in the automotive industry and 3D printing is one of them. Automotive companies are increasingly turning to 3D printing technology for various reasons. Some of the reasons include replacing parts with customized parts, manufacturing prototypes faster and more cost-effectively, and creating models for Toyota's Arcturus concept cars.

3D printing has also revolutionized the design process for carmakers. Instead of creating a model using 2D drawings, carmakers now use 3D prints to create accurate models that can be used for engineering and manufacturing purposes.

This report by SkyQuest on global 3D printing market provides a snapshot of the market trends and projections for 3D printing in the automotive industry. It provides insights on how this technology is changing the way carmakers work and helps to identify future opportunities.

Healthcare Holds 20% of Global 3D Printing Market

As per SkyQuest analysis, healthcare to generate a revenue of $5.8 billion by 2030. With rapidly changing market dynamics in the global healthcare market and advancing applications of 3D printing in healthcare domain, the market is projected to grow at a CAGR of around 20.9% until 2030.

While the healthcare industry only holds a 20% share of the global 3D printing market, it is clear that this technology is having a profound impact on how medical care is delivered. In particular, 3D printing is being used to create custom prosthetics and implants, as well as to produce models of organs and body parts for surgical planning. Additionally, 3D-printed pharmaceuticals are beginning to enter the market, offering patients personalized medication dosing based on their specific needs.

In particular, 3D printing is being used to create custom prosthetics and implants, as well as to produce models of organs and body parts for surgical planning. Additionally, 3D-printed pharmaceuticals are beginning to enter the market, offering patients personalized medication dosing based on their specific needs.

Medical implants and tissue engineering are booming industries that are seeing growing demand from patients all around the world. One reason for this increased demand is the advancement in 3D printing technology.

3D printing has revolutionized the manufacturing process for medical devices, and it is now more common than ever to find devices being printed using 3D printers. This is in part due to the fact that 3D printing is both cost-effective and accurate. Globally more than 30 million medical implants are done. Wherein, the US is the largest country and is holding higher market share. For instance, every year, the country witnesses over 1 million implants are being done for hip and knee replacement. On other hand more than 3 million dental implants taken place annually. This represents a huge opportunity and potential for 3D printing market for production of medical implants. As per SkyQuest analysis, the global market is flooded with at least 2 million types of medical devices, which is significantly huge.

On other hand more than 3 million dental implants taken place annually. This represents a huge opportunity and potential for 3D printing market for production of medical implants. As per SkyQuest analysis, the global market is flooded with at least 2 million types of medical devices, which is significantly huge.

In addition to medical devices, 3D printing is also being used to create tissues and organs for medical use. These tissues and organs can help to improve the quality of life for patients who have lost their own tissue or organ due to injury or disease. From the last few years, the global 3D printing market has been witnessing a significant surge in the demand for cosmetic and plastic surgeries. For instance, in 2021, more than 1.4 million surgical and non-surgical procedures were performed and this number is expected to grow at a CAGR of over 15.8% in the years come. As the number of procedures increases, it offers lucrative opportunity for the market participants since the demand for customized tissue is getting huge attention.

SkyQuest Technology has identified underlying market opportunities in the global 3D printing market by application and prepared report that answers how the market is advancing, where the demand is coming from, what are the market trends, which country and region has the most potential consumers, what are the government policies, and how end-users are responding in the market. The report also focuses on number of players active in the market, their market share, competitive landscape, and growth strategies. This comprehensive report would help you in identifying the most potential growth opportunities that the competitors have missed and provide deeper insights on how the market is performing across the globe. To get a detailed market analysis,

Browse summary of the report and Complete Table of Contents (ToC):

https://skyquestt.com/report/3d-printing-market

Recent Developments in 3D Printing Market

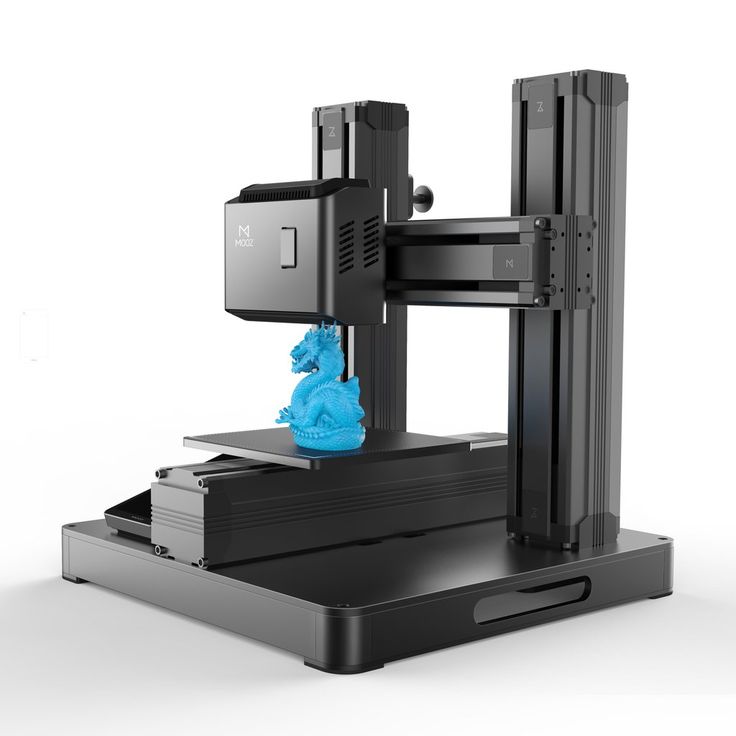

- Researchers at Rutgers University and the University of Louisville have developed a Fused Filament Fabrication (FFF) system that’s capable of using multiple nozzles to rapidly 3D print different areas of the same part on a single gantry.

The 3D printer is double the speed of standard FFF

The 3D printer is double the speed of standard FFF - In July 2022, a state of art 3D printing facilities is opened at Bengaluru, India

- In March 2022, The Department of Science and Innovation (DSI) of South Africa started a pilot project to use 3D printing technology to construct about 25 homes in an effort to address the housing shortage there.

- In March 2022, The INDUSTRY F421 industrial FFF machine was introduced by 3DGence, a European company, and is suitable for high performance materials. The company has also released AS9100, a brand-new high-temperature filament that is approved for use in the aerospace and defense industries and produced using polyether ether ketone (PEEK).

- In February 2022, Imaginarium partnered with Ultimaker to introduce desktop & industrial 3D printer range in the India market. In India, where additive manufacturing is anticipated to make significant strides in the following years, this alliance will aid Ultimaker in growing its operations there.

- In May 2021, GE Additive partnered with Protolabs and fashion designer Zac Posen to construct four gowns and a headdress for showing at the Met Gala. Electron-beam melting (EBM), Multi Jet Fusion (MJF), and stereolithography (SLA) technology were used across the items to fulfil the design requirements of wearable clothes.

Top Players in Global 3D Printing Market

- 3D Systems Corporation (US)

- The ExOne Company (Germany)

- voxeljet AG (Germany)

- Materialise NV (Belgium)

- Made in Space, Inc. (US)

- Envisiontec, Inc. (Germany)

- Stratasys Ltd. (US)

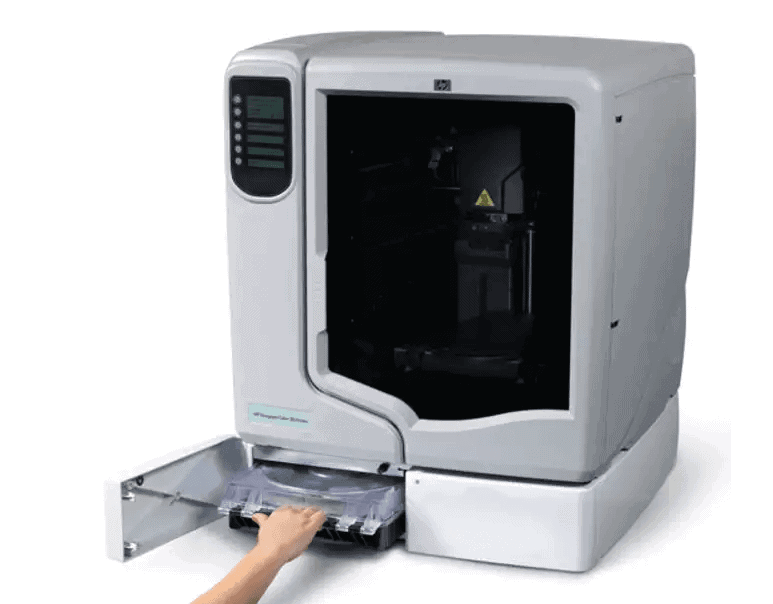

- HP, Inc. (US)

- General Electric Company (GE Additive) (US)

- Autodesk Inc. (US)

Speak to Analyst for your custom requirements:

https://skyquestt.com/speak-with-analyst/3d-printing-market

Related Reports in SkyQuest’s Library:

Global Smart Water Metering Market

Global IOT Connected Machines Market

Global Volumetric Video Market

Global Network Attached Storage Market

Global Crypto Wallet Market

About Us:

SkyQuest Technology is leading growth consulting firm providing market intelligence, commercialization and technology services. It has 450+ happy clients globally.

It has 450+ happy clients globally.

Address:

1 Apache Way, Westford, Massachusetts 01886

Phone:

USA (+1) 617-230-0741

Email: [email protected]

LinkedIn Facebook Twitter

Tags

Global 3D printing Market Global 3D printing Industry 3D printing Market size 3D printing Market growth 3D printing40+ 3D Printing Industry Stats You Should Know [2021]

A collection of 40+ relevant 3D printing statistics and facts looking at the current state of the industry

The 3D printing industry is evolving and developing rapidly, making it difficult to keep up to date with the trends in this space. A great way to stay up to speed is to keep an eye on 3D printing statistics.

A great way to stay up to speed is to keep an eye on 3D printing statistics.

To ensure that you keep up with the latest in the industry, we’ve compiled a list of relevant 3D printing statistics, highlighting the recent growth and evolution of the industry, alongside a succinct analysis of the key industry segments.

Contents

The current state of the industry

The 3D printing industry has been on a stable growth path over the last decade. Although 3D printing is still less than 1 per cent of the global manufacturing market, the technology is set to become an invaluable tool for production workflows.

It means that the perception of 3D printing, as a solely prototyping technology, is changing, and not it’s perceived as a rapidly maturing manufacturing solution.

1. In 2019, the global additive manufacturing market grew to over $10.4 billion, crossing the pivotal double-digit billion threshold for the first time in its nearly 40 year history. (SmarTech Analysis, 2020 Additive Manufacturing Market Outlook and Summary of Opportunities Report)

(SmarTech Analysis, 2020 Additive Manufacturing Market Outlook and Summary of Opportunities Report)

2. In 2018, VC funding exceeded $300 million in start-ups related to 3D printing. The common thread of all investment: industrial solutions and applications. (Hubs, The 3D Printing Trends Report 2019)

3. The 3D printing market is set to double in size every 3 years with the annual growth forecasted by analysts varying between 18.2 and 27.2 per cent. (Hubs, The 3D Printing Trends Report 2019)

4. 71 per cent of companies say that a lack of knowledge is the greatest factor on project-by-project choices to use 3D printing or traditional methods, while 29 per cent insist that it’s a lack of confidence in 3D printing as being reliable. (Jabil, A Survey of 3D Printing Stakeholders in Manufacturing 2019)

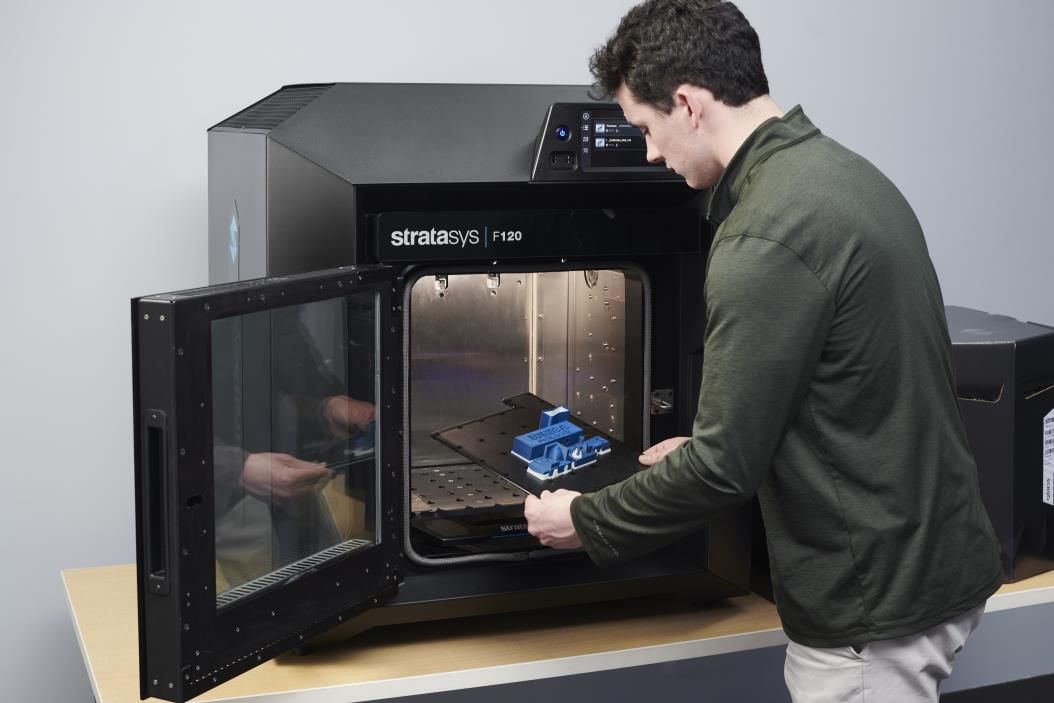

5. Based on the number of industry players, systems manufacturers make up the biggest group in the AM market (38 per cent), although the number of service providers has risen dramatically, reaching 34 per cent. (Ernst & Young, 3D printing: hype or game changer? A Global EY Report 2019)

(Ernst & Young, 3D printing: hype or game changer? A Global EY Report 2019)

Many industries are embracing 3D printing to make better products faster and to optimise their operations. However, adoption rates vary across sectors. Companies within the aerospace, medical, automotive and industrial goods industries are among the most mature adopters of the technology and also key contributors to the industrialisation of 3D printing.

In the meantime, the adoption of 3D printing is also uneven across geographical regions. Currently, North America and Europe lead the charge. However, the two regions are at risk of losing their seats at the head of the global 3D printing industry, with Asia fast becoming a strong 3D printing competitor.

6. In 2019, footwear 3D printing revenues made up approximately 0.3 per cent of global footwear market revenues, according to SmarTech Analysis. (SmarTech Analysis, Markets for 3D Printed Footwear 2019 Report)

7. The orthopaedics 3D printing market was valued at $691 million in 2018 and is predicted by SmarTech Analysis to grow into a $3.7 billion market by 2027.

The orthopaedics 3D printing market was valued at $691 million in 2018 and is predicted by SmarTech Analysis to grow into a $3.7 billion market by 2027.

8. The market for medical 3D printing, including materials, services, software and hardware, is currently estimated to be worth $1.25 billion, according to SmarTech Analysis.

9. A report by SmarTech Analysis suggests that revenues for 3D-printed dentistry will grow to $3.7 billion by 2021, and the technology will become the leading production method for dental restorations and devices worldwide by 2027.

10. The USA, UK, Germany, France and China are the top 5 countries with the highest 3D printing adoption and investment rates. (Ultimaker, 3D Printing Sentiment Index)

11. Germany generated around €1 billion in AM-related revenues during 2019.

12. The US has the largest installed base of 3D printers of 422,000 units in the world. (Ultimaker, 3D Printing Sentiment Index)

13. The number of surveyed organisations with AM systems in-house more than quadrupled in the past 3 years, leaping from 9 per cent in 2016 to 40 per cent in 2019. (Ernst & Young, 3D printing: hype or game changer? A Global EY Report 2019)

(Ernst & Young, 3D printing: hype or game changer? A Global EY Report 2019)

14. AM adoption is growing across shop floors globally, evidenced by more than 70 per cent of enterprises finding new applications for 3D printing in 2019 and 60 per cent using CAD, simulation and reverse engineering internally. (Sculpteo, The State of 3D Printing Report 2019)

Applications

The primary use of 3D printing remains in the realm of product development. Yet, the stats below show that increasingly the technology is maturing into a fully-fledged production solution.

In addition to offering greater flexibility in production, 3D printing also enables businesses to create new business models that were previously either not feasible or not economically viable.

Ultimately, the scope of applications and opportunities possible with 3D printing will be increasing in line with the growing capabilities of the technology.

15. Proof of concept and prototyping dominated 3D printing applications in 2019. (Sculpteo, The State of 3D Printing Report 2019)

(Sculpteo, The State of 3D Printing Report 2019)

16. The number of manufacturers using 3D printing for full-scale production has doubled between 2018 and 2019: 21 per cent and 40 per cent respectively. (Essentium, A survey of manufacturers)

17. 79 per cent of surveyed companies expect their use of 3D printing for production parts or goods to at least double in the next 3 to 5 years. (Jabil, A Survey of 3D Printing Stakeholders in Manufacturing 2019)

18. In the aerospace and defence industry, the most popular application of 3D printing is prototyping (72 per cent), followed by repair (44 per cent), research and development (43 per cent) and production parts (39 per cent). (Jabil, A Survey of Aerospace and Defense OEMs MAY 2019)

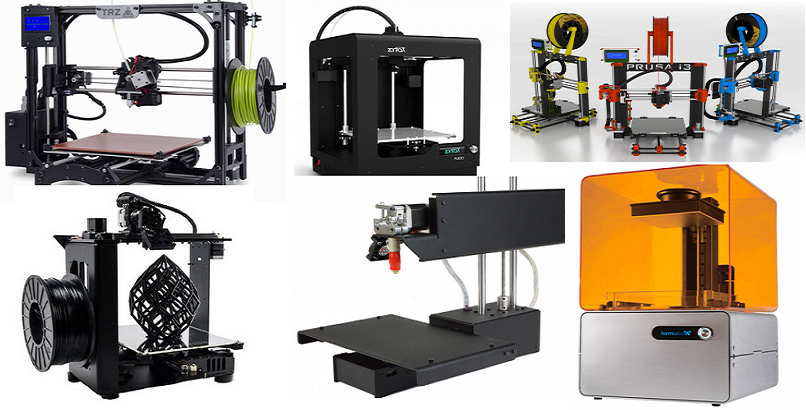

HardwareThe hardware segment of the 3D printing industry is evolving rapidly, with 3D printers becoming faster, more reliable and production capable.

In terms of technology, the metal 3D printing segment is growing fast, particularly binder jetting and compact metal machines, which tend to be cheaper than Powder Bed Fusion (PBF) systems.

At the same time, polymer 3D printing hardware remains the biggest segment in terms of systems in use. Technologies like Selective Laser Sintering, Multi Jet Fusion and Stereolithography have evolved to the point where they are used in the production of thousands of parts.

Finally, the markets for ceramic and electronic 3D printers remain relatively young. That said, the development of new technologies – for example, XJet’s Nanoparticle Jetting Technology for ceramics and DragonFly Lights-Out Digital Manufacturing (LDM) for electronics – sets the foundation for these markets to reach maturity in the near future.

19. Research firm, CONTEXT, estimates that metal 3D printer shipments will see year-on-year unit-volume growth rates of over 49 per cent.

20. The metal AM hardware segment is set to create an almost $4 billion revenue opportunity by 2024.

21. 62 per cent of the globally installed PBF metal AM systems come from German suppliers. (AMPOWER, Metal Additive Manufacturing Report 2019)

22. In metal PBF processes, 20 per cent to 40 per cent of the raw part costs are associated with material costs. In powder-based DED processes, the material can make up 70 per cent of the raw part cost, in Wire Arc Deposition even up to 80 per cent. (AMPOWER, Metal Additive Manufacturing Report 2019)

In metal PBF processes, 20 per cent to 40 per cent of the raw part costs are associated with material costs. In powder-based DED processes, the material can make up 70 per cent of the raw part cost, in Wire Arc Deposition even up to 80 per cent. (AMPOWER, Metal Additive Manufacturing Report 2019)

23. The global metal AM market was worth EUR 1.51 billion in 2018 and is set to grow at a 25 per cent CAGR. (AMPOWER, Metal Additive Manufacturing Report 2019)

24. The Powder Bed Fusion family plays the largest role in metal AM, comprising 80 per cent of all metal AM system installations worldwide.

25. The sales of compact industrial metal printers will top $1 billion by 2027.

26. 72 per cent of companies, surveyed for EY’s Global 3D Printing Report 2019, are using polymer AM systems, compared to 49 per cent that use metal ones.

27. HP’s Multi Jet Fusion has become one of the fastest-growing polymer 3D printing processes. More than 10 million parts are said to have been produced using MJF 3D printers in 2018.

Materials

The materials market remains a vital part of the 3D printing industry. One of the key trends shaping the market is the increased activity within materials development. In many ways, this trend is being driven by market demand, with customers demanding functional materials, particularly for production applications.

Both large materials companies and niche start-ups are actively developing high-performing materials, be it composites, metals or ceramics. Material prices are also coming down slowly but surely.

These trends taken together indicate a healthy maturation of the materials industry, which is predicted to grow into a whopping $4.5 billion opportunity in the next 5 years.

28. In 2019, the AM materials market was valued at $1.5 billion.

29. 99 per cent of manufacturing executives believe an open ecosystem is important to advance 3D printing at scale.

30. The most commonly used material for 3D printing continues to be plastics, at 82 per cent. Companies using 3D printing are also working with carbon fibre (24 per cent) and composites (20 per cent). (Ultimaker, 3D Printing Sentiment Index)

Companies using 3D printing are also working with carbon fibre (24 per cent) and composites (20 per cent). (Ultimaker, 3D Printing Sentiment Index)

31. The polymer AM segment grew to an estimated nearly $5.5 billion in 2018. (SmarTech Analysis, A 2019 Additive Manufacturing Market Outlook and Summary of Opportunities Report)

32. Sales of materials for polymer Powder Bed Fusion were at an all-time high in 2018, exceeding $400 million. (The Wohlers Report 2019)

33. The 3D printing ceramic materials market is expected to grow from a $20 million revenue opportunity in 2020 to over $450 million by 2029, according to a report by SmarTech Analysis.

34. 94 per cent of surveyed companies say designers choose traditional manufacturing due to the lack of additive materials. (Jabil, A Survey of 3D Printing Stakeholders in Manufacturing 2019)

SoftwareThe 3D printing software segment is smaller than the hardware and materials segments. However, in recent years it’s been on a steady growth path, driven by the need to overcome multiple challenges within the 3D printing workflow.

Today’s 3D printing software solutions are unlocking the possibility to create complex designs faster and increase print success rates. In addition to that, ensuring part quality and managing workflows more efficiently have also become possible with the development of a new generation of software products.

As seen on the graph below, the software segment was relatively small in 2018, but it holds huge potential to grow into almost a billion worth of opportunity within the next decade.

Post-processing

As 3D printing moves to production, there’s a great push to overcome post-processing challenges, such as manual operations, which tend to increase lead-time and cost of 3D printing. According to a whitepaper by RIZE (3D Printing: The Impact Of Post-processing), post-processing can add between 17 per cent and 100 per cent to 3D printing time on a batch-by-batch basis.

A number of companies have appeared on the market in order to tackle post-processing challenges by developing automated solutions for part cleaning, depowdering, surface finishing and dyeing.

35. 66 per cent of companies report experiencing 2 or more challenges with their current Post-Printing. (PostProcess Technologies, 3D Printing Trends Report: Additive Post-Printing Survey 2019)

36. 75 per cent of companies indicate Length of Time to Finish Parts as a key challenge in their Post-Printing, while for 51 per cent of respondents, the challenge lies in a lack of consistency. (PostProcess Technologies, 3D Printing Trends Report: Additive Post-Printing Survey 2019)

Service bureaus

Service bureaus represent a big part of the AM market. According to the EY Report 2019, service providers make up 34 per cent of the global AM landscape. And the percentage is set to grow. By 2022, nearly one-third (32 per cent) of 900 surveyed companies expect to design and produce their AM parts via service providers.

The key reasons for companies to use service providers are the reluctance to invest in their own equipment, lack of experience and skills, as well as the opportunity to produce parts on-demand and closer to the point of use. The latter, in particular, could be the driver behind the rise of online 3D printing services, like Hubs and Sculpteo.

The latter, in particular, could be the driver behind the rise of online 3D printing services, like Hubs and Sculpteo.

37. Small and medium-sized enterprises (SMEs) are the power users of online 3D printing services, representing more than 75 per cent of the global customer base. (Hubs, The 3D Printing Trends Report 2019)

38. The industry most commonly served by 3D printing service bureaus is consumer goods (with 77 per cent of respondents choosing this option). In second and third place are automotive (75 per cent) and industrial goods (73 per cent). (AMFG, AM Service Provider Report 2019)

39. FFF/FDM, SLA and SLS are the technologies most commonly offered by AM service providers. (AMFG, AM Service Provider Report 2019)

40. 37 per cent of 3D printing service providers reported producing between 1,001 and 10,000 parts annually. This was followed by a quarter who reported producing between 10,001 and 50,000. (AMFG, AM Service Provider Report 2019)

41. The number of companies using service providers has more than tripled from 8 per cent in 2016 to 26 per cent in 2019. (Ernst & Young, 3D printing: hype or game changer? A Global EY Report 2019)

The number of companies using service providers has more than tripled from 8 per cent in 2016 to 26 per cent in 2019. (Ernst & Young, 3D printing: hype or game changer? A Global EY Report 2019)

42. Around 81 per cent of companies cite a reluctance to invest in their own systems as their reason for working with service providers in the future. 48 per cent cite their unfamiliarity with AM processes and standards, while 38 percent cite their uncertainty around AM design. (Ernst & Young, 3D printing: hype or game changer? A Global EY Report 2019)

3D printing statistics: A tale of the burgeoning industryThe 3D printing industry is becoming bigger and more mature year on year. And the statistics above make this trend especially evident.

Of course, the industry, as it penetrates more markets and verticals, still needs to overcome a number of challenges. Spreading the knowledge about the true capabilities and limitations of the technology, as well as making it more accessible to small and medium-sized companies, will be decisive factors in accelerating 3D printing’s adoption.

Ultimately, with the current effort from the industry players and the tremendous pace of progress in this field, we’re excited about the impact 3D printing will have on manufacturing in the years to come.

70% of companies plan to increase investment in 3D printing

You are here

Home

The State of 3D Printing is the largest survey of the additive manufacturing industry conducted by the French company Sculpteo. The annual report provides all the information you need to understand the current state of the additive technology industry. In 2019, 1,300 people took part in the survey, a record number in five years. The questions were answered by users of 3D printers from all over the world, from different countries and industries, which allows you to evaluate 3D printing and its development on a global scale.

Additive technologies have a great future - now 51% of respondents use them in production, while before 3D printing was considered only a prototyping method. 3D printers are being used more and more every year, and enterprises are beginning to apply this technology in a wide variety of industries. We know that additive manufacturing can take your company to a whole new level.

3D printers are being used more and more every year, and enterprises are beginning to apply this technology in a wide variety of industries. We know that additive manufacturing can take your company to a whole new level.

3D Printing Applications

The possibilities of 3D printing are expanding day by day. Together with them, the scope of application of additive technologies is also expanding. It is safe to say that enterprises are gaining more confidence in 3D technologies. They are beginning to realize the full benefits of 3D printing and are using it more actively than before.

- The percentage of people using 3D printing for manufacturing has grown from 38% to 48% over the past year.

- More than 70% of respondents use 3D printers at least several times a month.

3D printing is helping companies overcome emerging new challenges in applications ranging from research and prototyping to modeling and manufacturing. See how individuals and companies use 3D printing, what technologies and materials they use, and what challenges they face. What are the most popular 3D printing technologies? Is the use of additive metal printing plants still on the rise? Let's see.

What are the most popular 3D printing technologies? Is the use of additive metal printing plants still on the rise? Let's see.

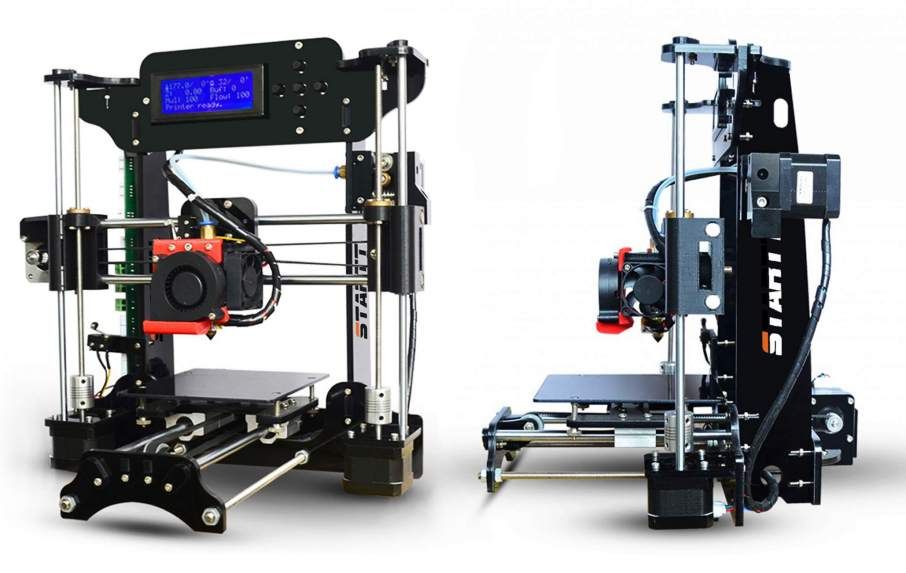

- The technology is dominated by FDM, although the use of SLS, MJF and Polyjet is expanding through outsourcing.

- 3D printing is mainly used in the context of CAD modeling, prototyping and testing, and research.

- About 50% of respondents consider quality control to be the main difficulty in using 3D printers.

- Laser cutting and CNC milling are the most common manufacturing methods used in conjunction with 3D printing.

- More than 70% of respondents do not resort to post-processing of printed products.

Advantages and Limitations of Additive Technologies

What do the participants of the study think about 3D printing technologies? In this section, you'll learn what 3D printing companies see as the main benefits of 3D printing, as well as how additive manufacturing helps them improve the quality of their manufacturing processes and products.

3D technologies are developing very fast. However, respondents also spoke about the shortcomings of the industry, the elimination of which could accelerate the adoption of technologies.

- About 70% of respondents consider the ability to produce parts with complex geometry (for example, with cellular structures) a serious advantage of 3D printing.

- More than 40% cite rapid iteration and reduced production time as benefits.

- The entry threshold was a factor preventing the adoption of 3D printing for 64% of those surveyed.

- 52% believe that a lack of knowledge about 3D printing is limiting its growth.

- 64% of respondents believe that more reliable technologies are needed for the growth of the 3D printing industry.

Understanding demand, training, and supply and cost of materials will be important factors for the adoption of 3D printing in the coming year. 53% of survey participants believe that 3D printing will play an important role in manufacturing, business and individual lives.

Business strategies

Additive manufacturing plays a major role in business strategies and in most cases becomes a significant competitive advantage. Sculpteo respondents spoke about how they assess the success of the implementation and impact on their business of 3D printing technologies. Most of them report significant improvements, and we see interest in applying additive manufacturing in a wide variety of areas.

We also touch on finances - investments in 3D printing are growing every year. Comparing the data with previous years, you can see that companies are using additive technologies much more confidently and spending more money on them.

You can also see that the vast majority of those surveyed have been using 3D printing for several years and plan to invest more in this technology in the near future. The numbers show that 3D printers are helping companies achieve significant improvements at all stages of the manufacturing process.

- 13% cannot rate the success of using 3D printing.

- Over 80% say 3D printing has had at least a significant impact on the rate of innovation.

- 70% rate the reduction in production time as significant or drastic.

- About 50% of companies consider 3D printing a competitive advantage in their industry.

- 55% say that 3D printing is one of their strengths and they are mastering it faster than their competitors.

- 25% have invested more than $100k in 3D printing in the last year.

- For more than 40%, 3D printing is their core business, and another 36% use it extensively across multiple departments or have a division dedicated to 3D printing.

- Accelerating product development is the main goal for which companies use 3D printers.

- About 60% report that the budget prevents more active use of additive technologies.

- About 70% of companies plan to increase investment in 3D printing next year, while 20% are going to increase investment by more than 2 times.

Power Users

Who are Power Users? This is a special group of 3D printer users who have been using additive manufacturing professionally for more than two years. They have considerable experience in 3D printing and have invested at least $10,000 in it over the past year.

Competent users see the potential of additive manufacturing in all aspects and use all technical innovations. This technology becomes key to their companies and is often integrated at many different levels. What do knowledgeable users think about the potential of 3D printing? Will they continue to invest in it? Let's see.

- 47% of knowledgeable users will increase their investment by at least 50%.

- Competent users use metals, photopolymers, ceramics and composites more than anyone else.

- More than 75% of key users see 3D printing as an advantage for their companies over competitors.

- They are less constrained by budget and more by physical space and staffing.

Summary

- 51% of respondents use 3D printing technologies in production.

- 80% report that 3D printing has had a significant impact in accelerating innovation.

- 63% believe that 3D printing will play an important role in the context of manufacturing and business.

Translation from English. The material is abbreviated. Original on the Sculpteo website

Author: Olga Gorobets

Source

Tags:

State of 3D Printing, additive technologies industries, 3D printers, 3D printing, FDM, S , MJF, Polyjet, Laser cutting and CNC milling, 3D technologies, Business strategies, Additive manufacturing, metals, photopolymers, composites

Other materials:

- Forget assembly: how to optimize a part with SLM technology

- Best 3D scanners of 2019

- The story of the cyborg N. How I lost my arms and became a tester of bionic prostheses in extreme conditions

Attention!

We accept news, articles or press releases

with links and images. [email protected]

[email protected]

Overview of the 3D printing market in 2020

Analytics and business

Experts recommend

Author: Andrey Kombarov

Author: Andrey Kombarov

Additive Manufacturing Trends | Application of 3D printing | A look at additive technologies | Business Strategies for 3D Printing | Overview of the 3D printing industry over the past 6 years | Key Findings

The future of additive manufacturing starts with understanding the goals and expectations of 3D printing users around the world. This was the reason for the launch of an ambitious research project by the French company Sculpteo - the annual State of 3D Printing report. Today it is one of the most authoritative and comprehensive sources of information about the real situation and prospects of the industry.

This year, 1,600 respondents from 71 countries took part in the Sculpteo survey. According to the report, a growing number of companies are realizing the possibilities of additive manufacturing, increasing investments and demonstrating undeniable confidence in the future of professional use of 3D printing.

According to the report, a growing number of companies are realizing the possibilities of additive manufacturing, increasing investments and demonstrating undeniable confidence in the future of professional use of 3D printing.

This material offers a complete overview of the world of additive manufacturing and will help you develop the right business strategy.

In the blog , the 2020 State of the 3D Printing Market research is published in abbreviated form. You can download the full version for free in our virtual library:

Additive Manufacturing Trends

Materials

- New and available materials.

- Improving the quality and stability of budget additive technologies.

- Improving post-processing technologies to obtain parts with the highest quality surface.

- 3D printing from multiple materials at once.

Environmental sustainability

- Biodegradable materials and materials of biological origin.

- Manufactured on demand and on site to reduce transport and environmental costs.

- Application of 3D printing to meet the challenges of renewable energy and energy efficiency.

Technology Development

- Improved usability of software and printers

- Mass Production: Printing and 3D Scanning Speed

- Generative Design

Availability

- Reducing the cost of 3D printers and materials (metals, photopolymers).

- Low post-processing costs.

- Sharing projects and tools.

iQB Technologies experts recommend articles:

3D printing as a full-fledged manufacturing technology in the context of the COVID-19 pandemic

2020 results and forecasts: the 3D printing market will grow by 25% annually

Application of 3D printing

The possibilities of 3D printing are growing every day, and with them the scope of its application is expanding. Gradually, companies begin to feel more confident in relation to 3D technologies. 68% of respondents are looking to use additive manufacturing to solve more problems, and 44% of are going to introduce new 3D printing technologies. Most professionals outsource SLS and Jet Fusion printing, as well as metal 3D printing, so they do not need to maintain their own equipment, and this will encourage them to test new technologies.

Gradually, companies begin to feel more confident in relation to 3D technologies. 68% of respondents are looking to use additive manufacturing to solve more problems, and 44% of are going to introduce new 3D printing technologies. Most professionals outsource SLS and Jet Fusion printing, as well as metal 3D printing, so they do not need to maintain their own equipment, and this will encourage them to test new technologies.

So what are the most popular 3D printing and post-processing technologies? Let's find out!

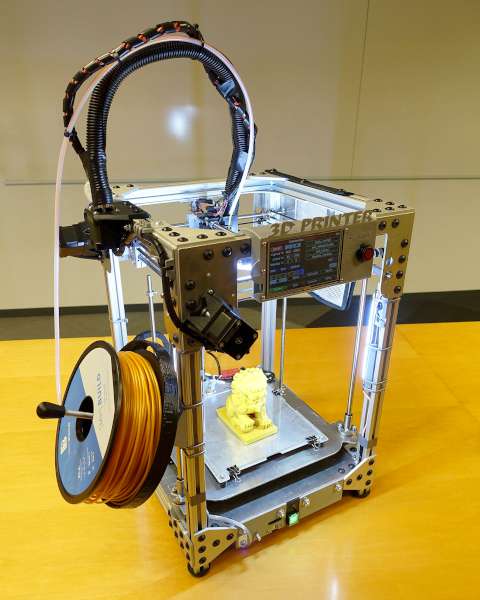

We emphasize once again that production volumes using 3D printing continue to grow. We are seeing this growth in research and development and education, which is in line with the increased demand for new materials and technologies in the market.

Click image to enlarge

The use of photopolymers is increasing through both internal and external services, while for metal 3D printing, most users outsource.

Design, testing and prototyping remain the main tasks solved with the help of 3D printing.

Stability and quality control remain a major concern for users seeking to scale up the use of 3D printing.

Most users use SLS, Jet Fusion and metal 3D printing technologies through outsourcing without purchasing equipment.

3D printing users are interested in exploring new applications, technologies and materials.

Typically, 3D printing is used in conjunction with traditional manufacturing methods such as laser cutting, CNC machining, and injection molding.

A look at additive technologies

What do respondents think about 3D printing technologies? In this section, we will look at the main benefits of 3D printing for users and their companies. How exactly does it optimize production processes?

66% of respondents use 3D printing to create parts with complex geometries. Survey participants cite the reduction in iterations, lead times and costs as the most important benefits of this technology.

In this section, we will also look at the future of the additive industry and the factors driving its growth and business adoption. What needs to be done to accelerate the adoption of 3D technologies? Now we'll find out.

As technology and materials become more accessible, the cost savings of 3D printing become clear to more and more users. Many also cite time savings due to reduced iterations and lead times as a benefit.

Set-up costs and lack of knowledge are seen as the main limiting factors for the adoption of 3D printing.

The role of 3D printing in business and manufacturing continues to grow.

New materials and reliable technologies are in demand for more than 55% industries.

Business Strategies for 3D Printing

Additive manufacturing is a huge competitive advantage. With some significant benefits of 3D printing, such as reduced lead times and speed of innovation, the vast majority of respondents view 3D printing as a significant improvement for their business.

As far as money is concerned, investments in additive technologies are growing every year. Most of these users will increase their investments in 2020! It can also be seen that the vast majority of those surveyed have been using 3D printing for several years and plan to invest more in this technology in the near future. The business world believes in the promise of additive manufacturing.

Let's watch how 3D printing becomes a real asset for companies, helping them develop their business strategy!

63% of see a significant or dramatic impact on sales. Reduced lead times and speed of innovation are the most important success metrics for 3D printing.

Nearly 60% of consider 3D printing one of their strengths compared to the competition.

65% of companies plan to increase their investment in 3D printing in 2020.

The integration of 3D printing into manufacturing processes continues to increase: 74% of actively use 3D printing in their companies.

Overview of the 3D printing industry over the past 6 years

The Sculpteo report offers a look at the analysis of the state of the 3D printing industry for each year since 2015. How has the use of 3D printing evolved over the period 2015-2020? Let's look at the answers of the latest polls.

Large-scale production using 3D printing continues to spread, becoming as commonplace as prototyping and testing.

Accelerating development and offering customized products and limited editions remains a major challenge for companies using 3D printing.

The market share of photopolymers continues to increase, showing significant growth over the past two years.

Key Findings

1. Lack of stability is the Achilles' heel of 3D printing

In order for additive technologies to become an integral part of any production, it is necessary to develop equipment and materials that ensure high stability.

- 51% claims to use 3D printing mostly for quality control purposes.

- 62% believe the 3D printing industry needs more robust technology to grow.

2. 3D printing is gaining ground in certain industries

Many industries are beginning to increase their use of 3D printing as its role in their manufacturing processes becomes more significant. Users are constantly deepening their knowledge and experience in the application of additive technologies.

- 80% of have been using 3D printing in their companies for over 2 years.

- 33% expect up to 50% increase in investment this year, which is a more conservative estimate than in previous years.

3. 3D printing may not be profitable

For wider use of additive technologies, the cost of manufactured parts must be reduced - this will attract more industries and sectors.

- More than 50% of s outsource SLS, Jet Fusion, SLM/DMLS and Binder Jetting to offset equipment and service costs.

Learn more