How many 3d printers were sold in 2023

10 million 3D Printers to Sold by 2030

Global 3D printing market was valued at USD 13.84 billion in 2021, and it is expected to reach a value of USD 51.95 billion by 2028, at a CAGR of 20.80% over the forecast period (2022-2028).

| Source: SkyQuest Technology Consulting Pvt. Ltd. SkyQuest Technology Consulting Pvt. Ltd.

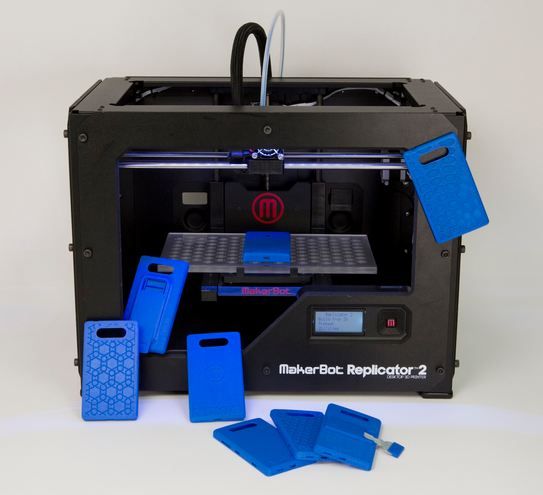

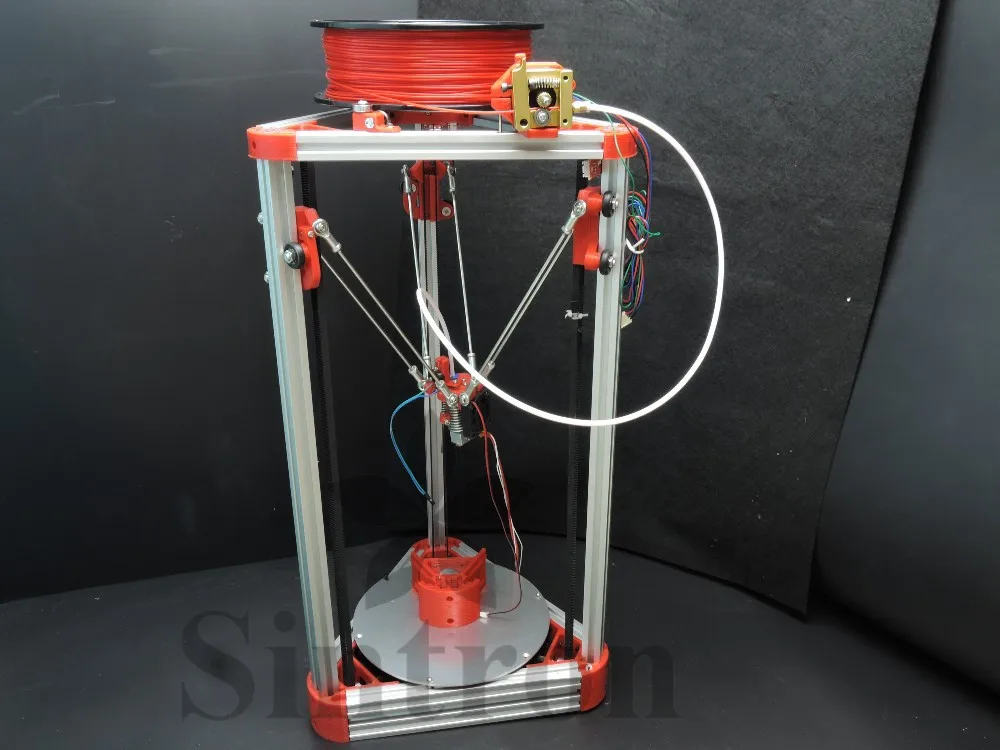

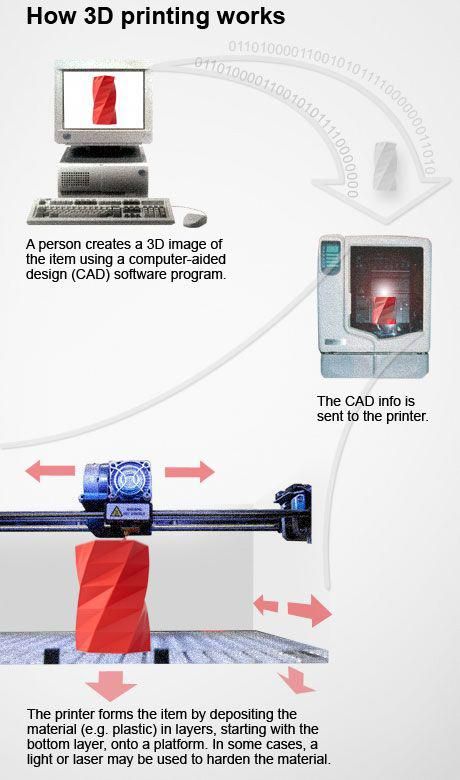

Westford, USA, Aug. 08, 2022 (GLOBE NEWSWIRE) -- 3D printing is quickly becoming one of the most popular technologies in the world. It has been used to create everything from prosthetic body parts and surgical implants to customized eyeglasses and airplane parts. The applications of 3D printing are only going to continue to increase in the future. This is because 3D printing is able to create complex objects very quickly and with high accuracy.

One of the biggest benefits of 3D printing market is that it can be used to create custom objects quickly and relatively cheaply. This means that it can be used in a variety of different industries, including manufacturing, construction, and medical research.

10 million 3D Printers to be Sold by 2030

Although the exact number of 3D printers to be sold by 2030 is impossible to predict with complete accuracy, SkyQuest analysis expect that the sales of 3D printers will continue to grow at a healthy CAGR of 20.38%. In 2015, global sales of 3D printers reached an estimated 0.8 million, and by 2019 this figure increased 1.5 million, and is projected to surpass a 10 million mark by 2030.

One key factor driving the growth of 3D printing market sales is the decreasing cost of these devices. In 2014, the average price of a consumer-grade 3D printer was approximately $1,000. Just two years later, in 2016, the average price of low-cost 3D printers has dropped to less $400. This decrease in prices is making 3D printers more affordable for a wider range of consumers and businesses, which is helping to drive growth in sales. On the other hand, industrial and professional 3D printer cost has come down to around $10,000 and $5,000 respectively, which used to more than $20,000 in 2015.

In 2014, the average price of a consumer-grade 3D printer was approximately $1,000. Just two years later, in 2016, the average price of low-cost 3D printers has dropped to less $400. This decrease in prices is making 3D printers more affordable for a wider range of consumers and businesses, which is helping to drive growth in sales. On the other hand, industrial and professional 3D printer cost has come down to around $10,000 and $5,000 respectively, which used to more than $20,000 in 2015.

The demand for 3D printing is expected to grow in the coming years, as the costs and technological developments for the technology decline. This is especially true for medical applications, which are expected to account for a large share of future growth.

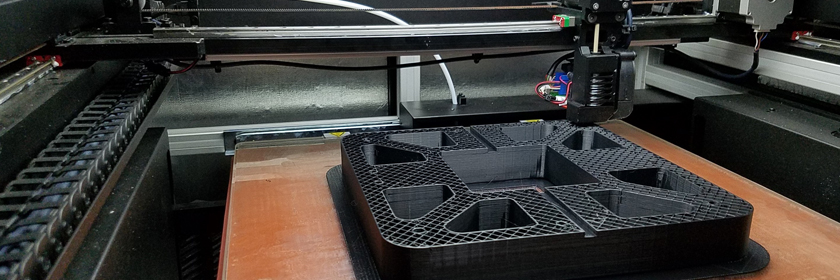

3D printing has already revolutionized manufacturing processes, and it is expected to do even more in the future. The technology can be used to produce customized products, which is why it is often used to create medical devices.

Advantages of 3D printing over other manufacturing processes include the ability to produce multiple copies of a product with minimal mistakes. Additionally, 3D printing is faster than other methods and it does not require specialized equipment. This makes it suitable for small businesses and Manufacturing Enterprises who need quick turnaround times on products.

SkyQuest has published a report 3D printing market that primarily focuses on demand and sales of 3D printers by application and end-use industry. The report also provides a detailed insights into number of units sold in each sector and their major buyers by region. This would help the market participant to identify market opportunities and target their potential consumers in the global 3D printing market. To get a detailed market analysis, pricing analysis, value chain and supply chain optimization, and forecast,

Get sample copy of this report:

https://skyquestt. com/sample-request/3d-printing-market

com/sample-request/3d-printing-market

Automotive Industry Generates 27% of Sales in Global 3D Printing Market

The automotive industry generates a significant chunk of the global 3D printing market. As per SkyQuest Technology, the automotive industry generated 27% of sales in the global 3D printing market in 2021 and is projected to continue expanding their market share at a CAGR of around 22.3% in the years to come as the application area expands. As of 2021, the automotive industry generated market revenue of $2.3 billion and is projected attain a market value of $11.87 billion by 2028.

A number of factors are contributing to the growth in the automotive industry and 3D printing is one of them. Automotive companies are increasingly turning to 3D printing technology for various reasons. Some of the reasons include replacing parts with customized parts, manufacturing prototypes faster and more cost-effectively, and creating models for Toyota's Arcturus concept cars.

3D printing has also revolutionized the design process for carmakers. Instead of creating a model using 2D drawings, carmakers now use 3D prints to create accurate models that can be used for engineering and manufacturing purposes.

This report by SkyQuest on global 3D printing market provides a snapshot of the market trends and projections for 3D printing in the automotive industry. It provides insights on how this technology is changing the way carmakers work and helps to identify future opportunities.

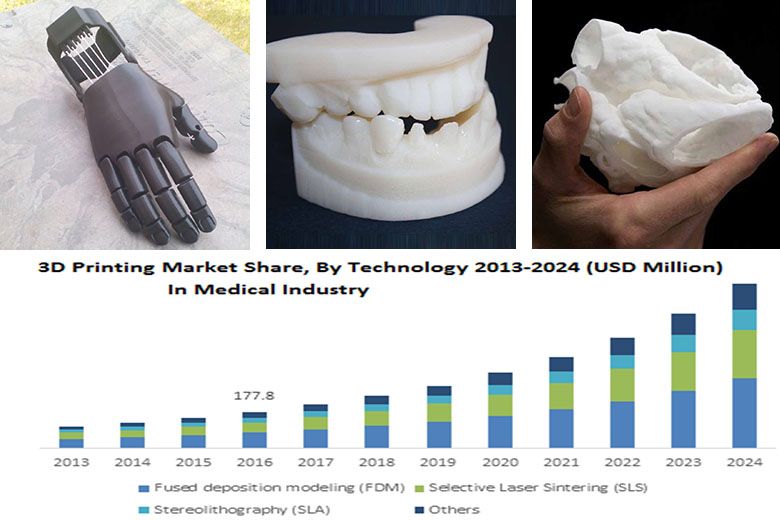

Healthcare Holds 20% of Global 3D Printing Market

As per SkyQuest analysis, healthcare to generate a revenue of $5.8 billion by 2030. With rapidly changing market dynamics in the global healthcare market and advancing applications of 3D printing in healthcare domain, the market is projected to grow at a CAGR of around 20.9% until 2030.

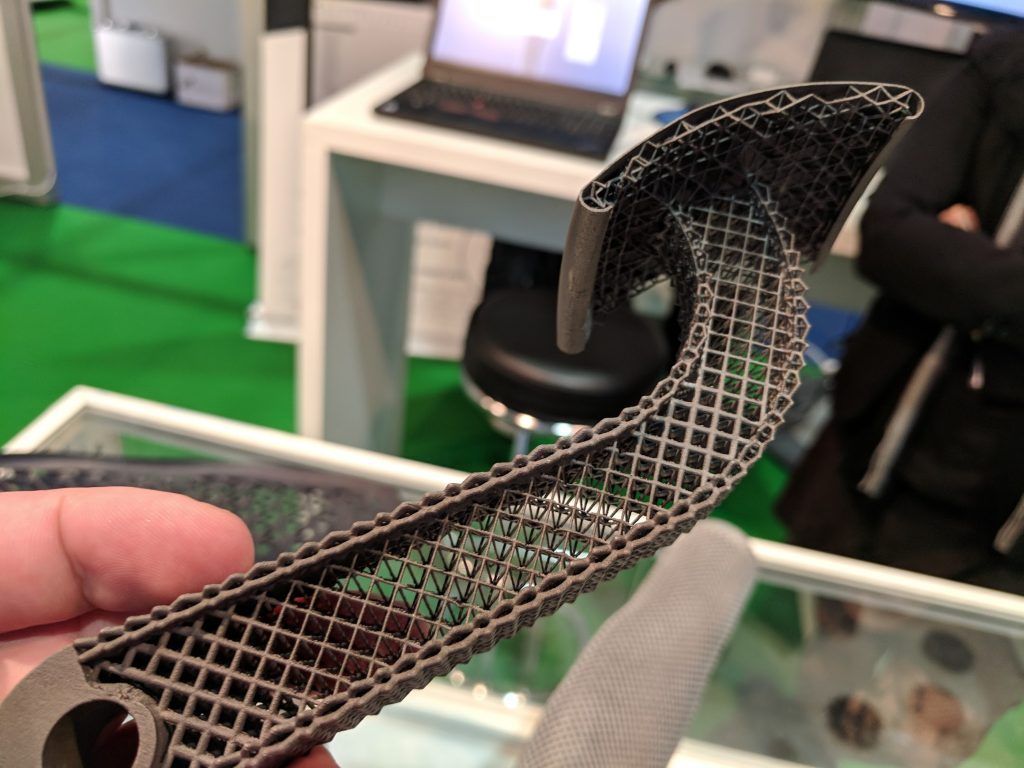

While the healthcare industry only holds a 20% share of the global 3D printing market, it is clear that this technology is having a profound impact on how medical care is delivered. In particular, 3D printing is being used to create custom prosthetics and implants, as well as to produce models of organs and body parts for surgical planning. Additionally, 3D-printed pharmaceuticals are beginning to enter the market, offering patients personalized medication dosing based on their specific needs.

In particular, 3D printing is being used to create custom prosthetics and implants, as well as to produce models of organs and body parts for surgical planning. Additionally, 3D-printed pharmaceuticals are beginning to enter the market, offering patients personalized medication dosing based on their specific needs.

Medical implants and tissue engineering are booming industries that are seeing growing demand from patients all around the world. One reason for this increased demand is the advancement in 3D printing technology.

3D printing has revolutionized the manufacturing process for medical devices, and it is now more common than ever to find devices being printed using 3D printers. This is in part due to the fact that 3D printing is both cost-effective and accurate. Globally more than 30 million medical implants are done. Wherein, the US is the largest country and is holding higher market share. For instance, every year, the country witnesses over 1 million implants are being done for hip and knee replacement. On other hand more than 3 million dental implants taken place annually. This represents a huge opportunity and potential for 3D printing market for production of medical implants. As per SkyQuest analysis, the global market is flooded with at least 2 million types of medical devices, which is significantly huge.

On other hand more than 3 million dental implants taken place annually. This represents a huge opportunity and potential for 3D printing market for production of medical implants. As per SkyQuest analysis, the global market is flooded with at least 2 million types of medical devices, which is significantly huge.

In addition to medical devices, 3D printing is also being used to create tissues and organs for medical use. These tissues and organs can help to improve the quality of life for patients who have lost their own tissue or organ due to injury or disease. From the last few years, the global 3D printing market has been witnessing a significant surge in the demand for cosmetic and plastic surgeries. For instance, in 2021, more than 1.4 million surgical and non-surgical procedures were performed and this number is expected to grow at a CAGR of over 15.8% in the years come. As the number of procedures increases, it offers lucrative opportunity for the market participants since the demand for customized tissue is getting huge attention.

SkyQuest Technology has identified underlying market opportunities in the global 3D printing market by application and prepared report that answers how the market is advancing, where the demand is coming from, what are the market trends, which country and region has the most potential consumers, what are the government policies, and how end-users are responding in the market. The report also focuses on number of players active in the market, their market share, competitive landscape, and growth strategies. This comprehensive report would help you in identifying the most potential growth opportunities that the competitors have missed and provide deeper insights on how the market is performing across the globe. To get a detailed market analysis,

Browse summary of the report and Complete Table of Contents (ToC):

https://skyquestt.com/report/3d-printing-market

Recent Developments in 3D Printing Market

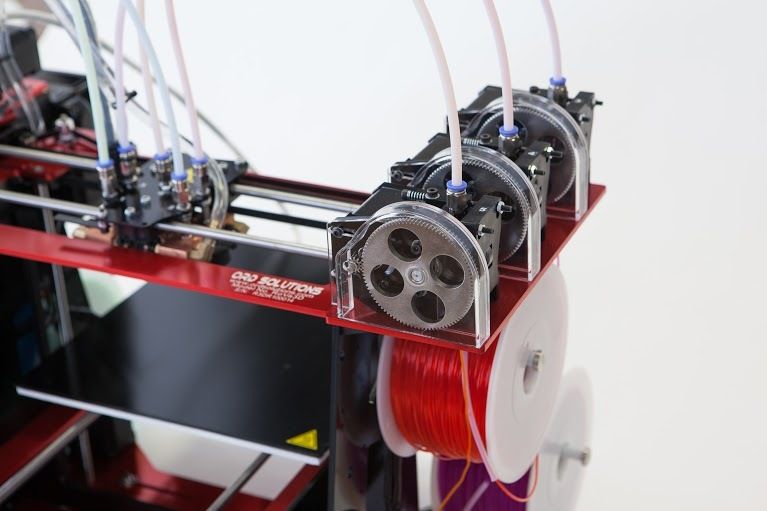

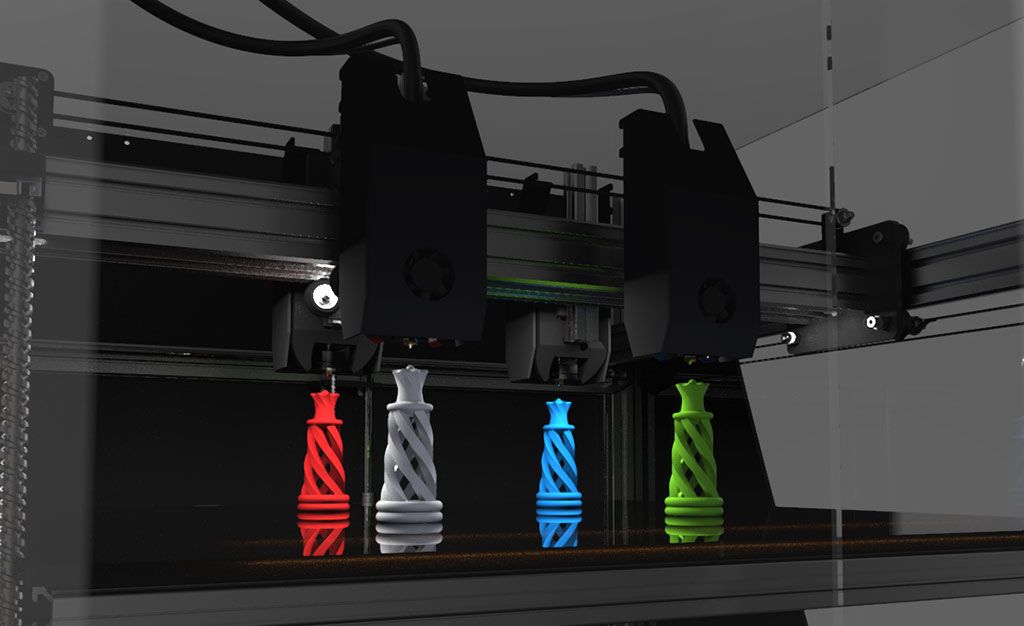

- Researchers at Rutgers University and the University of Louisville have developed a Fused Filament Fabrication (FFF) system that’s capable of using multiple nozzles to rapidly 3D print different areas of the same part on a single gantry.

The 3D printer is double the speed of standard FFF

The 3D printer is double the speed of standard FFF - In July 2022, a state of art 3D printing facilities is opened at Bengaluru, India

- In March 2022, The Department of Science and Innovation (DSI) of South Africa started a pilot project to use 3D printing technology to construct about 25 homes in an effort to address the housing shortage there.

- In March 2022, The INDUSTRY F421 industrial FFF machine was introduced by 3DGence, a European company, and is suitable for high performance materials. The company has also released AS9100, a brand-new high-temperature filament that is approved for use in the aerospace and defense industries and produced using polyether ether ketone (PEEK).

- In February 2022, Imaginarium partnered with Ultimaker to introduce desktop & industrial 3D printer range in the India market. In India, where additive manufacturing is anticipated to make significant strides in the following years, this alliance will aid Ultimaker in growing its operations there.

- In May 2021, GE Additive partnered with Protolabs and fashion designer Zac Posen to construct four gowns and a headdress for showing at the Met Gala. Electron-beam melting (EBM), Multi Jet Fusion (MJF), and stereolithography (SLA) technology were used across the items to fulfil the design requirements of wearable clothes.

Top Players in Global 3D Printing Market

- 3D Systems Corporation (US)

- The ExOne Company (Germany)

- voxeljet AG (Germany)

- Materialise NV (Belgium)

- Made in Space, Inc. (US)

- Envisiontec, Inc. (Germany)

- Stratasys Ltd. (US)

- HP, Inc. (US)

- General Electric Company (GE Additive) (US)

- Autodesk Inc. (US)

Speak to Analyst for your custom requirements:

https://skyquestt.com/speak-with-analyst/3d-printing-market

Related Reports in SkyQuest’s Library:

Global Smart Water Metering Market

Global IOT Connected Machines Market

Global Volumetric Video Market

Global Network Attached Storage Market

Global Crypto Wallet Market

About Us:

SkyQuest Technology is leading growth consulting firm providing market intelligence, commercialization and technology services. It has 450+ happy clients globally.

It has 450+ happy clients globally.

Address:

1 Apache Way, Westford, Massachusetts 01886

Phone:

USA (+1) 617-230-0741

Email: [email protected]

LinkedIn Facebook Twitter

Tags

Global 3D printing Market Global 3D printing Industry 3D printing Market size 3D printing Market growth 3D printingAmazon to Ban the Sale of 3D Printers by 2023

Published on April 1, 2022 by Madeleine P.

At 3Dnatives, we like April Fools’ Day! So this article was just a little joke for the occasion, Amazon remains supportive of 3D printing development!

You have almost certainly heard of Amazon. The American online retailer currently makes more than 12 million products available for purchase at lower prices. On this platform, you can find video games, clothing, household appliances, and of course 3D printing solutions – until now! That’s because Amazon is planning to make non-company 3D printers disappear from the platform very soon. Amazon has announced plans to ban all 3D printers by 2023. A slap in the face for major 3D printing companies offering their technologies on the popular online portal. Considering that Amazon receives more than 2 billion website visits per month, it’s easy to see why so many 3D printing companies sell their printers there.

Thankfully, Amazon did not keep its customers in the dark for long regarding their decision to ban 3D printers on the website. In fact, apparently the company is working internally to launch production and soon the sale of its own 3D printer line, including software, expected to be on the market starting in 2024. This is a large step from the conglomerate, as it dares to take in an industry that has proven to enjoy increasing popularity and acceptance.

In fact, apparently the company is working internally to launch production and soon the sale of its own 3D printer line, including software, expected to be on the market starting in 2024. This is a large step from the conglomerate, as it dares to take in an industry that has proven to enjoy increasing popularity and acceptance.

The company’s own 3D printer should be available for sale on the website from 2024 (photo credits: Amazon)

Amazon: A New Top 3D Printer Manufacturer in the Future?

Though of course the plan to ban 3D printers from Amazon is shocking, the first questions that spring to mind are probably: What can we expect from Amazon’s 3D printer? What innovative and ingenious features will this technology come with? Fortunately, Andy Jassy, CEO of Amazon and successor to the famous Jeff Bezos, cleared some doubts in a recent press release, making it clear that the plan is to take Amazon to the next level. In order to realize Amazon’s vision, the company has decided to put itself forward in the 3D printing sector. Internally, the board is already convinced that Amazon will have made a name for itself in the additive manufacturing market in just a few years. Already it seems that the board of the U.S. company expects the company to become one of the big players among 3D printing manufacturers in the future.

Internally, the board is already convinced that Amazon will have made a name for itself in the additive manufacturing market in just a few years. Already it seems that the board of the U.S. company expects the company to become one of the big players among 3D printing manufacturers in the future.

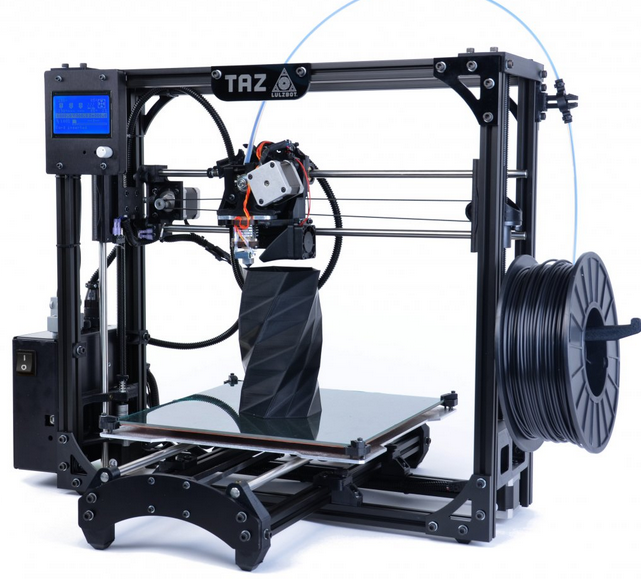

In usual and unsurprising Amazon fashion, the first concrete plans are already in place from the R&D team to ensure that the company’s entry into the 3D printing industry is guaranteed. David Stafford, as head of the R&D department at Amazon Lab126, is playing a key role in the design and manufacture of the Amazon 3D printer. They plan to offer an affordable 3D printer based on FDM technology that is not only aimed at individuals, but also businesses; priced at under $100, this 3D printer will be found in Amazon Basics’ own product line and reinforces the idea of making 3D printing accessible to everyone.

Features and characteristics of the 3D printer

To ensure that the entry into the field of 3D printing with the future FDM printer is also a complete success for the US company, the printer will have important and practical features: for example, the device, which is to be supplied with a closed power supply unit, is to have an build volume of 1200 x 600 x 450 mm and will be able to offer its users many interesting . The incredible thing is that it does not plan to just stick to using FDM as a printing technology, but they will be launching an all-in-one FDM/SLA combined machine! As unrealistic as this may sound, Amazon has said that they are very confident in their idea. If it is done successfully, it will also give Amazon even more of an edge as often those looking for cheap printers must choose between SLA and FDM for their needs. With this machine, they could get everything at an incredibly affordable price, even if they are very tight-lipped about the specific details of how the printer will work. What is also known is that with a total weight of 19.4 kg, the printing speed is expected to be 320 mm per second, though whether that is just for FDM or for both is still unknown.

The incredible thing is that it does not plan to just stick to using FDM as a printing technology, but they will be launching an all-in-one FDM/SLA combined machine! As unrealistic as this may sound, Amazon has said that they are very confident in their idea. If it is done successfully, it will also give Amazon even more of an edge as often those looking for cheap printers must choose between SLA and FDM for their needs. With this machine, they could get everything at an incredibly affordable price, even if they are very tight-lipped about the specific details of how the printer will work. What is also known is that with a total weight of 19.4 kg, the printing speed is expected to be 320 mm per second, though whether that is just for FDM or for both is still unknown.

It is still unclear which software the Amazon printer will be compatible with. However, Stafford gave some small insights, setting his team and himself up for great expectations from the public. They want to use this type of software that will combine user-friendliness, efficiency and cost savings in one cheap package. Great words, which will hopefully be followed by great deeds. However, what exactly this project means for the banning of the current 3D printers and the companies behind them, is still not clear. But we will be watching the news closely and inform you of any new developments. If you want to learn more about the new Amazon technology, you can find more information from the US company HERE.

Great words, which will hopefully be followed by great deeds. However, what exactly this project means for the banning of the current 3D printers and the companies behind them, is still not clear. But we will be watching the news closely and inform you of any new developments. If you want to learn more about the new Amazon technology, you can find more information from the US company HERE.

David Stafford gives great reason to be excited about the advancement of 3D printing

Did you fall for the prank? Let us know if you believed our April Fool’s Day article in a comment below or on our Facebook, Twitter and LinkedIn pages! Sign up for our free weekly Newsletter here, the latest 3D printing news straight to your inbox!

*Cover Photo Credits: Amazon

90,000 The printer market will grow to over $6.5 billion by 2023. May 07, 2021 - Analyst firm IDC has released a report for the first quarter of 2021, which includes sales data for "hard copy devices", i. e. printers, MFPs and copiers, in Western Europe. IDC estimates that 5.15 million devices in these categories were shipped during the quarter. This is 18.9% more than in the first quarter of last year. Report and Forecast Wizards note that the growth in annual terms is observed for the third quarter in a row. Moreover, sales were the highest in the last six years (if we compare the figures of the first quarters). Growth was driven by inkjet devices, while laser device sales continued to decline in most countries in the region. More specifically, sales of inkjet devices increased by 29.6%, and laser decreased by 2.1% . If we move to monetary terms, the market grew by only 0.9% and reached 2.07 billion euros. https://www.ixbt.com/news/2021/05/07/zapadnoevropejskij-rynok-printerov-...

e. printers, MFPs and copiers, in Western Europe. IDC estimates that 5.15 million devices in these categories were shipped during the quarter. This is 18.9% more than in the first quarter of last year. Report and Forecast Wizards note that the growth in annual terms is observed for the third quarter in a row. Moreover, sales were the highest in the last six years (if we compare the figures of the first quarters). Growth was driven by inkjet devices, while laser device sales continued to decline in most countries in the region. More specifically, sales of inkjet devices increased by 29.6%, and laser decreased by 2.1% . If we move to monetary terms, the market grew by only 0.9% and reached 2.07 billion euros. https://www.ixbt.com/news/2021/05/07/zapadnoevropejskij-rynok-printerov-...

August 28, 2020 - Global shipments of paper printing peripherals in Q2 2020 decreased by 10.2% year-on-year to 20 million units. This is reported by the analytical company IDC in its study Worldwide Quarterly Hardcopy Peripherals Tracker. The impact of the COVID-19 pandemic continues to create challenges for most suppliers with manufacturing sites in China, Indonesia, the Philippines and neighboring countries. Statistics presented include shipments of printers, copiers and multifunctional devices (MFPs). The analytics are given in relation to the technique for printing in A2-A4 format. Despite the reduction of the market as a whole around the world, a number of regions in the II quarter of 2020 showed an increase in the supply of printing devices. The leader in the dynamics of deliveries was China, where in the II quarter it was sold 19.1% more devices compared to the results of the same period last year. Demand has been boosted by remote work and distance learning over this period, analysts said. https://www.cnews.ru/news/top/2020-08-28_mirovoj_rynok_printerov

This is reported by the analytical company IDC in its study Worldwide Quarterly Hardcopy Peripherals Tracker. The impact of the COVID-19 pandemic continues to create challenges for most suppliers with manufacturing sites in China, Indonesia, the Philippines and neighboring countries. Statistics presented include shipments of printers, copiers and multifunctional devices (MFPs). The analytics are given in relation to the technique for printing in A2-A4 format. Despite the reduction of the market as a whole around the world, a number of regions in the II quarter of 2020 showed an increase in the supply of printing devices. The leader in the dynamics of deliveries was China, where in the II quarter it was sold 19.1% more devices compared to the results of the same period last year. Demand has been boosted by remote work and distance learning over this period, analysts said. https://www.cnews.ru/news/top/2020-08-28_mirovoj_rynok_printerov

February 22, 2020 - Research conducted by International Data Corporation (IDC) shows that the global device market printing in the last quarter of last year showed mixed results. Delivery of traditional printers of various types (laser, inkjet), multifunctional devices, and copiers is taken into account. The data covers vehicles in A2-A4 formats. It is reported that , approximately 25.3 million print devices were sold globally between October and December inclusive. This is 5.4% less than the result for the last quarter of 2018, when the market volume was 26.8 million pieces of . At the same time, a 0.9% growth was recorded in monetary terms: the total revenue of printing equipment suppliers reached approximately $11.9 billion. The largest player in the market is HP with 9.8 million devices sold and a share of 38.6%. In second place is the Canon Group, which delivered 5.4 million devices and occupied 21.4% of the industry. Closes the top three Epson with 4.8 million units sold and 19.0% of the industry. https://3dnews.ru/1004288

Delivery of traditional printers of various types (laser, inkjet), multifunctional devices, and copiers is taken into account. The data covers vehicles in A2-A4 formats. It is reported that , approximately 25.3 million print devices were sold globally between October and December inclusive. This is 5.4% less than the result for the last quarter of 2018, when the market volume was 26.8 million pieces of . At the same time, a 0.9% growth was recorded in monetary terms: the total revenue of printing equipment suppliers reached approximately $11.9 billion. The largest player in the market is HP with 9.8 million devices sold and a share of 38.6%. In second place is the Canon Group, which delivered 5.4 million devices and occupied 21.4% of the industry. Closes the top three Epson with 4.8 million units sold and 19.0% of the industry. https://3dnews.ru/1004288

October 18, 2019 - 3D printer sales growth in 2019 is double-digit percent. Shipments of 3D printers in the industrial, design and professional price segments will grow in 2019 by 14%, 13% and 15%, respectively , against the background of stagnation in the segment of printers for home use. Chris Connery, vice president of global research at CONTEXT says: But key markets will grow differently. This makes Q4 the key to industry success in 2019.year." https://www.it-world.ru/it-news/analytics/149281.html

Shipments of 3D printers in the industrial, design and professional price segments will grow in 2019 by 14%, 13% and 15%, respectively , against the background of stagnation in the segment of printers for home use. Chris Connery, vice president of global research at CONTEXT says: But key markets will grow differently. This makes Q4 the key to industry success in 2019.year." https://www.it-world.ru/it-news/analytics/149281.html

June 11, 2019 - Analytical company Research and Markets has released a report on the achievements and prospects of the printing device market from 2013 to 2023 of the year. According to experts, the market size should grow to 6.6 billion dollars, and high-performance printers for business will serve as the main growth factor. The business printer market includes several categories: publishing, promotional products, food packaging and labels, document management, as well as the production of signs, posters and decorative panels. As of 2017, publishing remained the largest direction, the profitability of which was 35% of the market as a whole. However, experts are confident that the segment of devices for the production of packaging and labels will definitely show rapid growth. The reason for this is the continued growth of the e-commerce market. An increasing percentage of people are connecting to the global network, which involves more and more new customers and gives rise to an avalanche-like growth in the number of online stores and other sales platforms. Such growth seriously increases the demand for packaging products and, as a result, equipment for their production. Another important trend tied to the growth of the e-commerce market is the increased interest in the offer of "print on demand" (print on demand), the essence of which is the production of specific products in small runs for individual orders. This refers to pamphlets and manuals, advertising booklets and highly specialized books that are paid for by small owners, and not by large agencies or publishers.

As of 2017, publishing remained the largest direction, the profitability of which was 35% of the market as a whole. However, experts are confident that the segment of devices for the production of packaging and labels will definitely show rapid growth. The reason for this is the continued growth of the e-commerce market. An increasing percentage of people are connecting to the global network, which involves more and more new customers and gives rise to an avalanche-like growth in the number of online stores and other sales platforms. Such growth seriously increases the demand for packaging products and, as a result, equipment for their production. Another important trend tied to the growth of the e-commerce market is the increased interest in the offer of "print on demand" (print on demand), the essence of which is the production of specific products in small runs for individual orders. This refers to pamphlets and manuals, advertising booklets and highly specialized books that are paid for by small owners, and not by large agencies or publishers. This, in turn, generates demand not for large production chains, usually using offset printing technology, but for low-volume digital printing devices. 9RBC Chinese, Japanese and domestic brands have increased in the Russian market. New players from South Korea are also appearing

This, in turn, generates demand not for large production chains, usually using offset printing technology, but for low-volume digital printing devices. 9RBC Chinese, Japanese and domestic brands have increased in the Russian market. New players from South Korea are also appearing

Photo: Vladimir Smirnov / TASS

The shares of the main players in the market of printing devices in Russia have changed dramatically since the beginning of the year, follows from the data provided by RBC by the analytical company ITResearch. By the end of the third quarter, the largest printers sold were Chinese Pantum (53%), American HP (21%), Japanese Epson, Canon and Brother (4-5% each). At the same time, at the end of last year, HP was the market leader with a 36% share, Pantum had 16%, Canon and another Japanese vendor Kyocera had 10% each, Brother had 9%.

RBC's source in the distribution market said that, according to his data, the leading brands in the Russian market until February 2022 were HP, Pantum and the American Xerox with shares of 27, 21 and 13%, respectively. The top ten also included Kyocera, Brother, Epson, Canon, Ricoh, Lexmark. In February, the share of HP increased to 38%, but then the position of all foreign vendors worsened: for example, the share of HP decreased to 12% by September, Xerox - to 4%. The only exception was Pantum, whose share rose to 67%.

The top ten also included Kyocera, Brother, Epson, Canon, Ricoh, Lexmark. In February, the share of HP increased to 38%, but then the position of all foreign vendors worsened: for example, the share of HP decreased to 12% by September, Xerox - to 4%. The only exception was Pantum, whose share rose to 67%.

adv.rbc.ru

According to ITResearch, in the first three months of this year, the market sank in terms of the number of devices sold by almost a quarter, but its volume in money increased slightly due to rising prices. In the second quarter, the decline was 45% due to growing food shortages, problems with logistics and exchange rate instability. In total, 613,000 printers and desktop multifunctional devices (MFPs) were sold in Russia in the first half of the year, which is 36% less than a year earlier. In the third quarter, in absolute terms, the market began to grow (almost 300 thousand units), although it showed a double-digit drop year-on-year. ITResearch experts attribute this to the fact that the contribution of deliveries under the parallel import scheme began to be felt with the simultaneous growth of the role of Pantum and import substitution. In 2021, according to ITResearch, 2.17 million printers were sold in Russia, which is 13.1% less than a year earlier. The volume of this year remained almost at the level of the previous one — $567 million. The dynamics was associated with a reduction in pandemic demand, when, due to the transition to a hybrid mode of work from home and office, consumers retrofitted their workplaces.

In 2021, according to ITResearch, 2.17 million printers were sold in Russia, which is 13.1% less than a year earlier. The volume of this year remained almost at the level of the previous one — $567 million. The dynamics was associated with a reduction in pandemic demand, when, due to the transition to a hybrid mode of work from home and office, consumers retrofitted their workplaces.

adv.rbc.ru

In March, HP suspended deliveries of products to Russia due to the military conflict in Ukraine. The suspension of work in Russia was also announced by the American Xerox and the division of Canon in Europe, Africa and the Middle East. In August, Lexmark sold its Russian division to F-Plus Equipment and Development (a subsidiary of one of the largest Russian distributors, Marvel Distribution). The terms of the deal were not disclosed, only it was reported that F+ imaging brand equipment will continue to be manufactured under contract at the same factories as Lexmark equipment.

In mid-March, the Japanese Ricoh Group and Epson also announced the suspension of shipments of devices to Russia due to the situation in Ukraine. But, as three sources in the real estate market and one in the distribution market told RBC, Ricoh recently rented more than 100 permanent places in a coworking space on Leningradsky Prospekt. The company itself declined to comment. According to the CEO of the consulting company Remain, Dmitry Klapsha, this year the demand for coworking and service offices has increased from international companies that do not want to completely close their Russian representative offices and leave the market: companies simply move to optimize rental costs and gain greater flexibility.

Leading ITResearch expert Vladimir Mironos named Taiwanese Avision, which also has production facilities in China and until recently was known in Russia only for its scanners, and Huawei, which made its debut in the segment of laser multifunctional devices, among new suppliers. A source in the distribution market also mentioned the Chinese Deli Group as a new player in the printer market. In addition, printers from the South Korean brand Sindoh began to be delivered to Russia, two sources told RBC in the distribution market. The equipment of this manufacturer is offered on its website, in particular, by the Russian vendor and distributor of printing equipment Katyusha, the RBC correspondent was convinced. RBC sent a request to Sindoh headquarters.

A source in the distribution market also mentioned the Chinese Deli Group as a new player in the printer market. In addition, printers from the South Korean brand Sindoh began to be delivered to Russia, two sources told RBC in the distribution market. The equipment of this manufacturer is offered on its website, in particular, by the Russian vendor and distributor of printing equipment Katyusha, the RBC correspondent was convinced. RBC sent a request to Sindoh headquarters.

All listed new brands are not included in the global top. According to the analytical platform Statista, as of March 2021, the largest players in the global printer market were HP (with a 24.5% share), Canon (17.7%), Brother (10.7%), Epson (9.9% ), Kyocera (7.8%), NEC (5.6%) and Ricoh (3.6%).

According to Mironos, Russian manufacturers of F+ imaging and Katyusha are also increasing deliveries.

F+ imaging manufacturing facilities are located in Russia and Asia. The company can produce more than 50,000 printers a year and intends to sell them in the CIS countries. F+ imaging expects to take up to 20% of the print market in Russia in the coming years. According to Dmitry Kuptsov, CEO of F+ imaging, the shortage of chips is decreasing, which, together with the decline in business activity around the world, should significantly reduce the shortage of printing equipment in the next six months. He expects that in 2023 the situation in the Russian print market will improve: players optimize supply chains, excess profits will decrease, and the most serious participants will remain. In addition, Russian manufacturers will increase their output.

F+ imaging expects to take up to 20% of the print market in Russia in the coming years. According to Dmitry Kuptsov, CEO of F+ imaging, the shortage of chips is decreasing, which, together with the decline in business activity around the world, should significantly reduce the shortage of printing equipment in the next six months. He expects that in 2023 the situation in the Russian print market will improve: players optimize supply chains, excess profits will decrease, and the most serious participants will remain. In addition, Russian manufacturers will increase their output.

Katyusha has its own production of printers and multifunction devices in Zelenograd. Now the company is expanding its network of sales offices in Russia, it is already present on the market of the CIS countries, in particular, in Kazakhstan, Belarus and other countries, said Maxim Vinogradov, managing partner of the company.

According to Anna Budakova, Deputy Commercial Director of Arti Group (developer of monitoring and print management software), there were no restrictions on the use of foreign printing equipment in Russia, and the equipment of manufacturers who left Russia was included in the list for parallel imports. But for government customers, there is a requirement that built-in applications for printing equipment for working with monitoring and print management systems should be included in the register of domestic software, Budakova noted. She also pointed out that private customers have recently become interested in Russian products, who are afraid of being left without the support of foreign manufacturers and developers. Now, according to Budakova, there are no acute problems with the support of foreign office printing equipment, but in the future the issue of compatibility of printer and MFP drivers with Russian server operating systems will have to be resolved. This problem will be especially relevant for equipment older than three years. “When a company switches from a Microsoft Windows server operating system to a Linux operating system, there may be difficulties with drivers when connecting printing equipment, since the drivers currently used were written for Windows operating systems, Western versions of Linux, Mac OS.

But for government customers, there is a requirement that built-in applications for printing equipment for working with monitoring and print management systems should be included in the register of domestic software, Budakova noted. She also pointed out that private customers have recently become interested in Russian products, who are afraid of being left without the support of foreign manufacturers and developers. Now, according to Budakova, there are no acute problems with the support of foreign office printing equipment, but in the future the issue of compatibility of printer and MFP drivers with Russian server operating systems will have to be resolved. This problem will be especially relevant for equipment older than three years. “When a company switches from a Microsoft Windows server operating system to a Linux operating system, there may be difficulties with drivers when connecting printing equipment, since the drivers currently used were written for Windows operating systems, Western versions of Linux, Mac OS.