Buying 3d printer stock

Top 3D Printing Stocks for Q4 2022

Table of Contents

Table of Contents

-

Best Value 3D Printing Stocks

-

Fastest Growing 3D Printing Stocks

-

3D Printing Stocks With the Best Performance

SSYS is top for value and performance and NNDM is top for growth

By

Noah Bolton

Full Bio

Noah has about a year of freelance writing experience. He's worked on his investing website dealing with topics such as the stock market and financial advice for beginners.

Learn about our editorial policies

Updated October 06, 2022

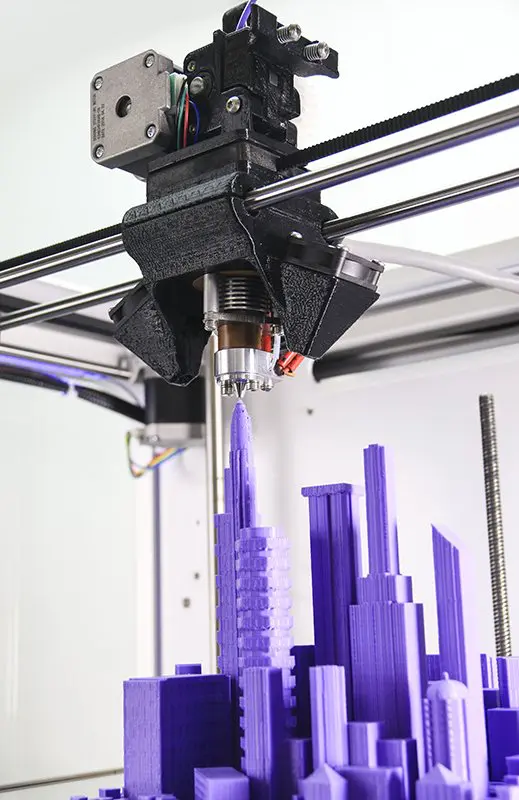

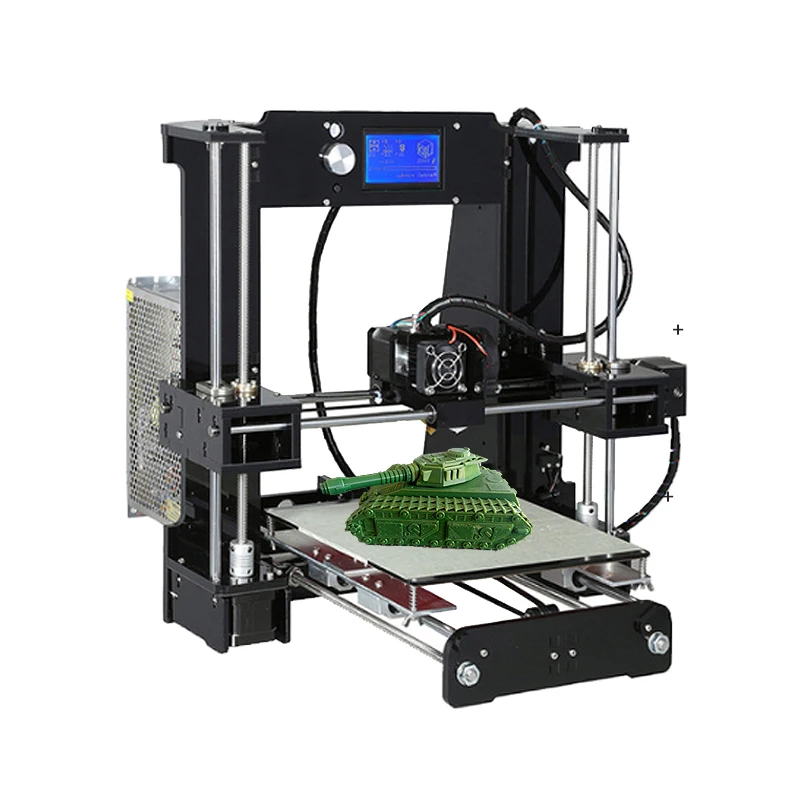

The 3D printing industry is made up of companies that provide products and services capable of manufacturing a range of products. 3D printing, also known as additive manufacturing, creates physical objects from digital designs. The printing process works by laying down thin layers of material in the form of liquid or powdered plastic, metal, or cement, and then fusing the layers together. Though still too slow for mass production, it is a revolutionary technology that has the potential to disrupt the manufacturing logistics and inventory management industries. The 3D printing industry is comprised of only a handful of companies, including players such as Proto Labs Inc., Faro Technologies Inc., and Desktop Metal Inc.

The industry is so young that it has no meaningful benchmark index. But the performance of these stocks can be compared to the broader market as represented by the Russell 1000 Index. These stocks have not performed well. Stratasys Ltd. (SSYS), the best performing 3D printing stock, has dramatically underperformed the Russell 1000, which has provided a total return of -12.5% over the past 12 months. This market performance number and all statistics in the tables below are as of Sept. 20, 2022.

Here are the top three 3D printing stocks with the best value, fastest sales growth, and the best performance.

These are the 3D printing stocks with the lowest 12-month trailing price-to-sales (P/S) ratio. For companies in early stages of development or industries suffering from major shocks, this metric can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

For companies in early stages of development or industries suffering from major shocks, this metric can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

| Best Value 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing P/S Ratio | |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 1.6 |

| 3D Systems Corp. (DDD) | 9.00 | 1.2 | 2.0 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | 2.1 |

Source: YCharts

- Stratasys Ltd.: Stratasys offers 3D printing solutions, such as 3D printers, polymer materials, a software ecosystem, and related parts.

It serves a variety of industries, including aerospace, automotive, consumer products, and healthcare. On Sept. 13, Stratasys completed the merger of its MakerBot subsidiary with Ultimaker, which offers platforms used to make 3-D printers. Ultimaker is backed by NPM Capital. The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%.

It serves a variety of industries, including aerospace, automotive, consumer products, and healthcare. On Sept. 13, Stratasys completed the merger of its MakerBot subsidiary with Ultimaker, which offers platforms used to make 3-D printers. Ultimaker is backed by NPM Capital. The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%. - 3D Systems Corp.: 3D Systems provides 3D printing solutions. The company offers a range of hardware, software, and materials designed for additive manufacturing. Its products and services are used in a variety of industries and sectors, including aerospace, automotive, semiconductor, healthcare, and more.

- Proto Labs Inc.: Proto Labs is an e-commerce-based company that provides digital manufacturing services. It offers 3D printing, injection molding, CNC machining, and sheet metal fabrication.

On Aug. 5, Proto Labs announced financial results for Q2 2022, the three-month period ending on June 30, 2022. Net income fell more than 80% to $2.6 million from the prior-year quarter while revenue rose 3.1%.

On Aug. 5, Proto Labs announced financial results for Q2 2022, the three-month period ending on June 30, 2022. Net income fell more than 80% to $2.6 million from the prior-year quarter while revenue rose 3.1%.

These are the 3D printing stocks with the highest YOY sales growth for the most recent quarter. Rising sales can help investors identify companies that are able to grow revenue organically or through other means and find growing companies that have not yet reached profitability. In addition, accounting factors that may not reflect the overall strength of the business can significantly influence earnings per share. However, sales growth can also be potentially misleading about the strength of a business, because growing sales on money-losing businesses can be harmful if the company has no plan to reach profitability.

| Fastest Growing 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | Revenue Growth (%) | |

Nano Dimension Ltd. (NNDM) (NNDM) | 2.45 | 0.6 | 1,270 |

| Desktop Metal Inc. (DM) | 3.07 | 1.0 | 203.9 |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 13.3 |

Source: YCharts

- Nano Dimension Ltd.: Nano Dimension is an Israel-based 3D printing company focused on developing equipment and software for 3D-printed electronics. It develops printers for multilayer printed circuit boards and nanotechnology-based inks. The company serves a range of industries, including consumer electronics, healthcare, aerospace, and automotive. On Sept. 1, Nano Dimension released Q2 2022 results. The company's net loss widened sharply to $40.0 million from a loss of $13.6 million in the same quarter a year earlier even as revenue soared more than 13-fold. The larger second-quarter loss was fueled partly by $10.9 million in non-cash adjustments for depreciation and amortization expenses, and share-based payments.

- Desktop Metal Inc.: Desktop Metal manufactures 3D printers and related equipment used to build complex parts from metal. It also offers 3D printing software. The company serves a range of industries, including automotive, consumer products, education, and heavy industry. On Aug. 08, the company reported Q2 2022 results. Desktop Metals' net loss increase nearly seven-fold to $297.3 million compared to the same quarter a year earlier even as revenue tripled.

- Stratasys Ltd.: See above for company description.

These are the 3D printing stocks that had the smallest declines in total return over the past 12 months out of the companies we looked at.

| 3D Printing Stocks With the Best Performance | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing Total Return (%) | |

Stratasys Ltd. (SSYS) (SSYS) | 15.49 | 1.0 | -34.5 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | -50.6 |

| Materialise NV (MTLS) | 10.95 | 0.6 | -53.9 |

| Russell 1000 | N/A | N/A | -12.5 |

Source: YCharts

- Stratasys Ltd.: See above for company description.

- Proto Labs Inc.: See above for company description.

- Materialise NV: Materialise is a Belgium-based provider of additive manufacturing software and 3D printing services. It serves a range of industries, including healthcare, aerospace, and automotive. On Sept. 7, Materialise completed its acquisition of Identity3D, which makes products that encrypt, distribute, and track digital parts as they move through supply-chains. The value of the deal was not specified in the announcement.

The comments, opinions, and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

YCharts. "Financial Data.

"

"Stratasys Ltd. "Stratasys Completes Merger of MakerBot with Ultimaker."

Proto Labs Inc. "Proto Labs Q2 2022 Earnings Release."

Nano Dimension Ltd. "Earnings Press Release for Q2 2022."

Desktop Metals Inc. " Desktop Metals Second Quarter 2022 Earnings."

Materialise NV. "Materialise Acquires Indenity3D."

5 3D Printing Stocks to Consider in 2022

An in-depth look at the leading 3D printing stocks in the U.S stock market this year. Here’s what you need to know.

By Nicholas Rossolillo – Updated Jul 11, 2022 at 2:42PM

Back in the early 2010s, stocks were booming for 3D printing -- also known as additive manufacturing, a computer-controlled process in which three-dimensional objects are made. But the boom was followed by a bust as many pure-play 3D printing companies didn't immediately deliver on lofty expectations.

Rumors of the manufacturing technology's demise are clearly premature. These days, 3D printing is a high-growth niche that is steadily reshaping the manufacturing and industrial sectors. Some estimates point to a doubling in annual revenue from additive manufacturing between 2022 and 2026. Even growth investor Cathie Wood has launched a fund focused on manufacturing tech, The 3D Printing ETF (NYSEMKT:PRNT), via her company ARK Invest.

These days, 3D printing is a high-growth niche that is steadily reshaping the manufacturing and industrial sectors. Some estimates point to a doubling in annual revenue from additive manufacturing between 2022 and 2026. Even growth investor Cathie Wood has launched a fund focused on manufacturing tech, The 3D Printing ETF (NYSEMKT:PRNT), via her company ARK Invest.

Here's what you need to know about 3D printing and additive manufacturing stocks for 2022:

Image source: Getty Images.

Investing in 3D printing stocks

The manufacturing of products in all corners of the economy is being revolutionized by 3D printing, from healthcare equipment to metal fabrication to housing construction. It's invading so many sectors that tech giants such as Microsoft (NASDAQ:MSFT), Autodesk (NASDAQ:ADSK), and HP (NYSE:HPQ) have launched products aimed at 3D printing and additive manufacturing. Other engineering and software outfits such as Dassault Systemes (OTC:DASTY), ANSYS (NASDAQ:ANSS), and Trimble (NASDAQ:TRMB) have also gotten involved in 3D printing technology.

Other engineering and software outfits such as Dassault Systemes (OTC:DASTY), ANSYS (NASDAQ:ANSS), and Trimble (NASDAQ:TRMB) have also gotten involved in 3D printing technology.

Here are five key players to consider for 2022 that are a more focused bet on 3D printing:

| Company | Market Cap | Description |

|---|---|---|

| Desktop Metal (NYSE:DM) | $1.3 billion | Recent IPO that focuses on metal fabrication technology. |

| Stratasys (NASDAQ:SSYS) | $1.5 billion | One of the original 3D printing pioneers, with a wide array of printers and supporting design software. |

| Xometry (NASDAQ:XMTR) | $1.9 billion | A manufacturing marketplace, including access to on-demand 3D printing services. |

| 3D Systems (NYSE:DDD) | $1.9 billion | Another original 3D printing pioneer and the largest pure-play stock on 3D printing technology. |

| PTC (NASDAQ:PTC) | $11.7 billion | A manufacturing technology provider with a suite of software and related services for industrial businesses. |

1. Desktop Metal

This company is a recent entry into the 3D printing space after going public via a SPAC at the end of 2020. The stock has been a terrible market underperformer since then, losing three-quarters of its value as of spring 2022. However, Desktop Metal could still be a promising investment for the long term.

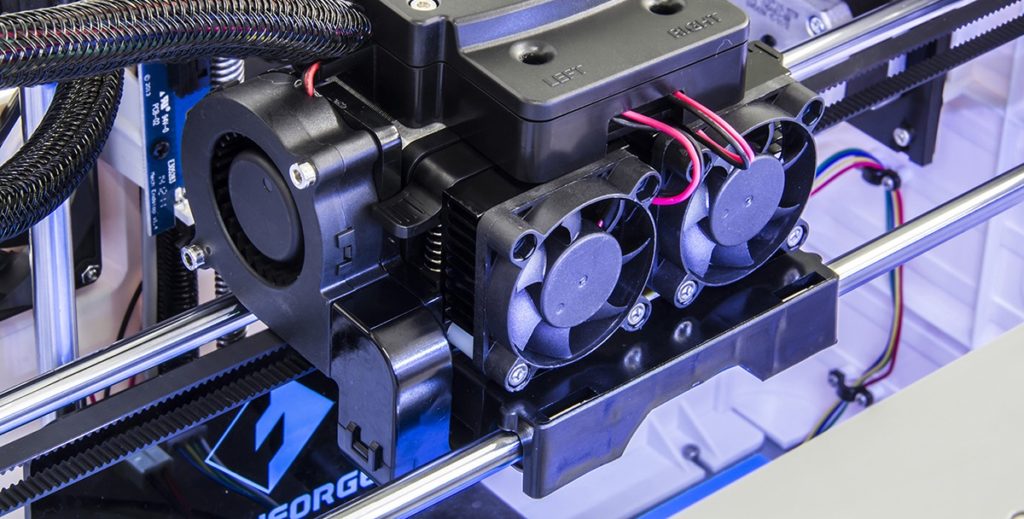

As its name implies, Desktop Metal develops 3D printing hardware and accompanying design software for metal and carbon fiber parts. The company's smaller systems can handle prototyping and one-off parts, and larger printers are production grade-designed for manufacturing facilities. Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

Despite a tenuous start as a public company, Desktop Metal was actually increasing revenue at a torrid triple-digit pace in 2021. Gross profit margins are thin, and the company generated a steep net loss, but that should improve over time as the business scales its operation. Desktop Metal also has several hundred million dollars in cash and investments to fund its expansion. It used some of these funds to acquire additive manufacturing peer ExOne at the end of 2021.

2. Stratasys

Stratasys was part of the early 2010s 3D printing stock boom and bust, but its business has endured. Sales took a dip early in the COVID-19 pandemic but are rebounding as the Israel-based company picks up new manufacturing contracts.

Stratasys serves a diverse set of customers, including aerospace and automotive parts manufacturers, medical and dental companies, and makers of basic consumer products. In addition to a wide array of 3D printer models, Stratasys develops software to help users accelerate the time between design and final printing.

In addition to a wide array of 3D printer models, Stratasys develops software to help users accelerate the time between design and final printing.

It isn't the highest-growth name on this list, but Stratasys is profitable (on a free cash flow basis) and has more than $500 million in cash and investments on its balance sheet, as well as no debt. Management thinks its payoff from years of research and development into additive manufacturing will accelerate in 2022.

3. Xometry

This is another newcomer to public markets. Xometry completed its initial public offering (IPO) over the summer of 2021, raising almost $350 million in cash in the process. As is often the case with new IPOs, the stock has underperformed since then. It has lost over half of its value from the time it started trading on public markets, but the business itself is rapidly growing.

Xometry is a marketplace for on-demand manufacturing of prototyping and mass production. It has a network of more than 5,000 suppliers that companies can call on to meet their fabrication needs. Among the suppliers on the Xometry platform are 3D printing companies, injection molding, and automated machining. The company reported having more than 28,000 active buyers utilizing its platform at the end of 2021.

It has a network of more than 5,000 suppliers that companies can call on to meet their fabrication needs. Among the suppliers on the Xometry platform are 3D printing companies, injection molding, and automated machining. The company reported having more than 28,000 active buyers utilizing its platform at the end of 2021.

Although it isn't profitable yet, Xometry's unique approach to the 3D printing and additive manufacturing industry is growing fast. Like other names on this list, it has a sizable war chest of cash and short-term investments that it can spend on research and marketing as it tries to attract more suppliers and buyers to its marketplace.

4. 3D Systems

3D Systems was another early player in the 3D printing industry, and while it suffered through the boom-and-bust period of the early 2010s, its business has held steady for much of the past decade. After a brief dip during the early days of the pandemic, 3D Systems is back in growth mode.

The company develops printers and design software for all sorts of materials and industries (medical device makers, dental labs, semiconductor designers, aerospace, and automotive manufacturers). It claims leadership among independent 3D printing companies (as measured by sales). As the 3D printing industry expands in the coming years, 3D Systems thinks it will be able to attract lots of new business with its extensive experience and global reach.

As an established tech outfit in the manufacturing sector, 3D Systems offers investors the prospect of more stable growth, along with profitability. It also has a large net cash position from which it can consolidate its lead in 3D printers and software technology.

5. PTC

By far the largest company on this list, PTC is a longtime technology partner of manufacturing and industrial enterprises. Fast approaching $2 billion in annualized sales and highly profitable, PTC has all the tools needed to digitally transform industrial businesses.

Besides 3D printing computer-aided design software (ANSYS is a peer and software partner that also operates in this space), PTC specializes in augmented reality, industrial IoT (Internet of Things), and product life-cycle management software. Most of its revenue is subscription-based (including its Creo software that enables 3D printing), making for a stable and steadily growing business model that generates ample cash flow. PTC puts spare cash to work developing new products for its partners and makes bolt-on acquisitions of other software companies that enhance its overall portfolio.

As a larger company, PTC won't be the fastest-growing stock in the additive manufacturing and 3D printing space. However, the company has established itself as a leader in industrial technology and should be a primary beneficiary as the production of manufactured goods gets more efficient.

The future of 3D printing

Manufacturing technology is making inroads throughout the global economy by reducing the cost of production and localizing and speeding up the time it takes to deliver customer orders. This is far from mere hype. Nevertheless, as is the case with all technology investments, progress won't go straight up. Expect twists and turns in these stocks as they develop new methods to design and make products.

This is far from mere hype. Nevertheless, as is the case with all technology investments, progress won't go straight up. Expect twists and turns in these stocks as they develop new methods to design and make products.

If you decide to invest, do so in a measured way. Maintain a diversified portfolio, be wary of stocks benefiting from investor over-optimism, and always leave spare cash to invest more when there are inevitable dips. Given enough time -- years and decades -- investing in 3D printing could eventually provide a big payoff.

Related communication stocks topics

Investing in 5G Stocks

As the 5G technology rollout continues, these companies look like winners.

Investing in Top Telecommunications Stocks

Our world is increasingly interconnected, and these companies make it happen.

Investing in Communication Stocks

Communications has a broad definition. These companies are the leaders in the space.

Investing in Top Consumer Discretionary Stocks

When people have a little extra cash, they indulge in offerings from these companies.

Nicholas Rossolillo has positions in Autodesk and PTC. The Motley Fool has positions in and recommends Autodesk, HP, and Microsoft. The Motley Fool recommends 3D Systems, ANSYS, Dassault Systemes, PTC, and Trimble Inc. The Motley Fool has a disclosure policy.

Motley Fool Investing Philosophy

- #1 Buy 25+ Companies

- #2 Hold Stocks for 5+ Years

- #3 Add New Savings Regularly

- #4 Hold Through Market Volatility

- #5 Let Winners Run

- #6 Target Long-Term Returns

Why do we invest this way? Learn More

Related Articles

3 Dividend-Paying Tech Stocks to Buy in November

3 Robinhood Stocks to Buy Right Now

Better Buy: Microsoft vs. Alphabet

2 Growth Stocks to Buy and Hold Forever

PTC (PTC) Q4 2022 Earnings Call Transcript

Why Is Everyone Talking About Microsoft?

3 Things About Microsoft That Smart Investors Know

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

View Premium Services

Largest listed companies in the 3D printing sector

3D printing dates back to the late 1980s. At the end of 2018, the size of the 3D printing market, according to various estimates, reached from $9 trillion to $10 trillion. Calculations were made based on the cost of producing printers, components and 3D printing.

In the coming years, expert agencies (IMARC, Inkwood Reasearch, Marketwatch, etc.) predict a steady growth of at least 20% per year. In this scenario, by the end of 2025, the scale of the entire 3D printing segment will reach at least $ 32 trillion - 3.5 times higher than the current values.

The outlook for the sector makes it attractive to investors. Consider the largest and most stable companies in this segment, whose shares can be considered for purchase and take their rightful place in your portfolio.

1. HP Inc Capitalization: $29.3 billion

HP Inc Capitalization: $29.3 billion

HP manufactures computers, printers, tablets and a number of other devices. The release of 3D printers is not the main specialization of the company, but HP occupies one of the leading positions in the 3D printing segment. In 2014, the company developed the Multi Jet Fusion technology, which allowed to increase productivity and reduce the cost of professional (industrial) 3D printers. The technology has been successfully applied in mass production of printers since 2016.

In 2017, HP opens the world's first 3D lab, equipped with printers in various build states and essential tools for device experimentation. The company has opened up the first opportunities to test new materials in 3D printers to increase efficiency.

In 2018, HP will open a joint manufacturing center with China's Guangdong in Guangdong, China, which is the largest such 3D printing project in Asia Pacific and Japan. The facility is equipped with ten high-tech next-generation HP Metal Jet printers to produce parts and prototypes for industrial customers.

The facility is equipped with ten high-tech next-generation HP Metal Jet printers to produce parts and prototypes for industrial customers.

2. Proto L abs (NYSE: PRLB). Capitalization: $2.56 billion

The company was founded in 1999 and has more than 10 production sites in seven countries. The head office is located in Minnesota. The company specializes in the production of parts for other manufacturing companies. The corporation positions itself as the fastest in the world in the production of custom prototypes and finished parts for industrial customers. In 2014, Proto Labs launched 3D printed parts.

In addition to 3D printing, the company produces CNC (Computer Numerical Control) parts, injection molding and sheet metal parts. In 2015, Proto Labs bought Alphaform (specializing in innovative 3D printing) with divisions in Germany, Finland and the UK. This allowed the company to expand its 3D printing business in Europe. To diversify its business and introduce sheet metal manufacturing, the company acquired Rapid Manufacturing in 2017 for $120 million. 9 Systems ( NYSE: DDD). Capitalization: $1.01 billion

To diversify its business and introduce sheet metal manufacturing, the company acquired Rapid Manufacturing in 2017 for $120 million. 9 Systems ( NYSE: DDD). Capitalization: $1.01 billion

3D Systems was founded by inventor Chuck Hull in 1986 as the world's first 3D printing company. It produces 3D printers and components, including software, and also designs them. The company provides services at various stages of design, development and production of products for many large industries, including aerospace, automotive, medical, entertainment and other areas. It should be noted that the corporation also works with retail consumers. Business diversification within the 3D segment makes the company financially stable.

3D Systems is headquartered in Rock Hill, South Carolina, USA. The number of employees of the company exceeds 2600 (as of the end of 2018), which is twice as high as five years ago.

4. Stratasys ( NASDAQ: SSYS). Capitalization: $0.98 billion

The company was founded in 1989 by Scott Crump. The technology was based on the idea of creating the shape of a figure by layering after Scott decided in 1988 to make a toy for his daughter using a gun filled with glue. At 1992 Stratasys released its first 3D Modeler product.

Today, Stratasys manufactures industrial and desktop 3D printers and related accessories. The range of services includes installation, maintenance and training in working with printers. The company serves various industries by developing technologies for the production of prototypes and parts. The first public offering of Stratasys shares took place in 1994 at $5 per share and a total volume of $5.7 million. The head office is located in Minnesota.

5. Materialize Capitalization: $0.88 billion

Incorporated in 1990 in Leuven, Belgium, Materialise specializes in 3D printing services and 3D printer software. Like other leaders in this sector, Materialize works with various major manufacturers around the world (Adidas, HP), but a significant share of the business is in cooperation with medical centers and institutions. The company's portfolio includes more than 150 medical patents. Materialize offices are located in 18 countries, including one office located in the CIS in Ukraine.

Like other leaders in this sector, Materialize works with various major manufacturers around the world (Adidas, HP), but a significant share of the business is in cooperation with medical centers and institutions. The company's portfolio includes more than 150 medical patents. Materialize offices are located in 18 countries, including one office located in the CIS in Ukraine.

Issuer Comparison

The most valuable company among the leaders is HP, which is due to the scale and diversification of the company's business in the entire technology segment. 3D Systems, Stratasys and Materialize specialize exclusively in the 3D printing segment, while their capitalization is on the same level. Proto Labs has three businesses besides 3D printing and is in the middle of our list in terms of capitalization.

The most undervalued company in terms of EV/EBITDA is HP, but it is not correct to compare it with other issuers by this multiplier due to the differentiation of the company's products and services. 3D Systems has the highest EV/EBITDA, and from this point of view, the paper is not so attractive to buy. Moreover, over the past four years, 3D Systems shares have been in a stable sideways trend without technical prerequisites for growth.

3D Systems has the highest EV/EBITDA, and from this point of view, the paper is not so attractive to buy. Moreover, over the past four years, 3D Systems shares have been in a stable sideways trend without technical prerequisites for growth.

The remaining three companies, in our opinion, may be of interest. At the same time, if your long-term goal is to get the maximum increase from the growth of the 3D printing sector, then investing in HP shares is less preferable compared to other securities. After all, the reaction of the shares of companies with a direct specialization is more sensitive to changes in the sector. Below are the consensus forecasts of investment houses according to Reuters, according to which Stratasys (14.9%) and Materialize (13.6%) shares have the greatest potential now.

HP Inc (NYSE: HPQ): $20.5 (+3.4%)

Proto Labs (NYSE: PRLB): $98.7 (+3.0%)

3D Systems (NYSE: DDD): $8 .6 (+0.6%)

Stratasys (NASDAQ: SSYS): $20.8 (+14.9%)

Materialize (NASDAQ: MLTS): $19. 2 (+13.6%)

2 (+13.6%)

OPEN ACCOUNT

BCS Broker

Problems when buying a 3D printer on the marketplace

Main marketplaces for buying a 3D printer in Russia

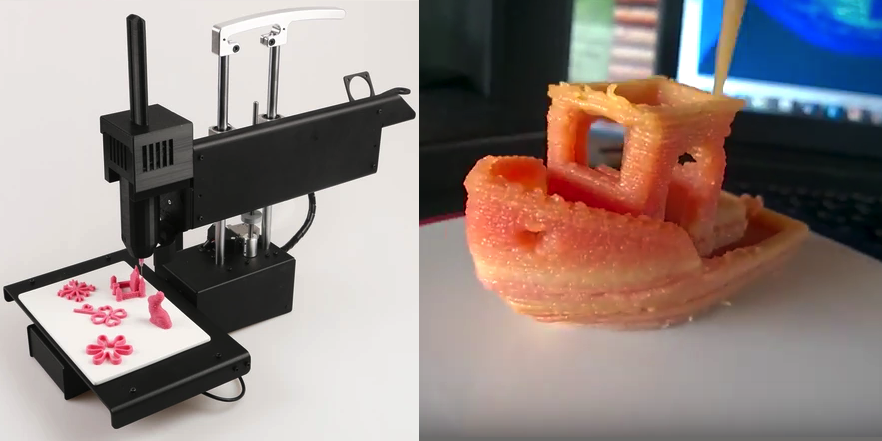

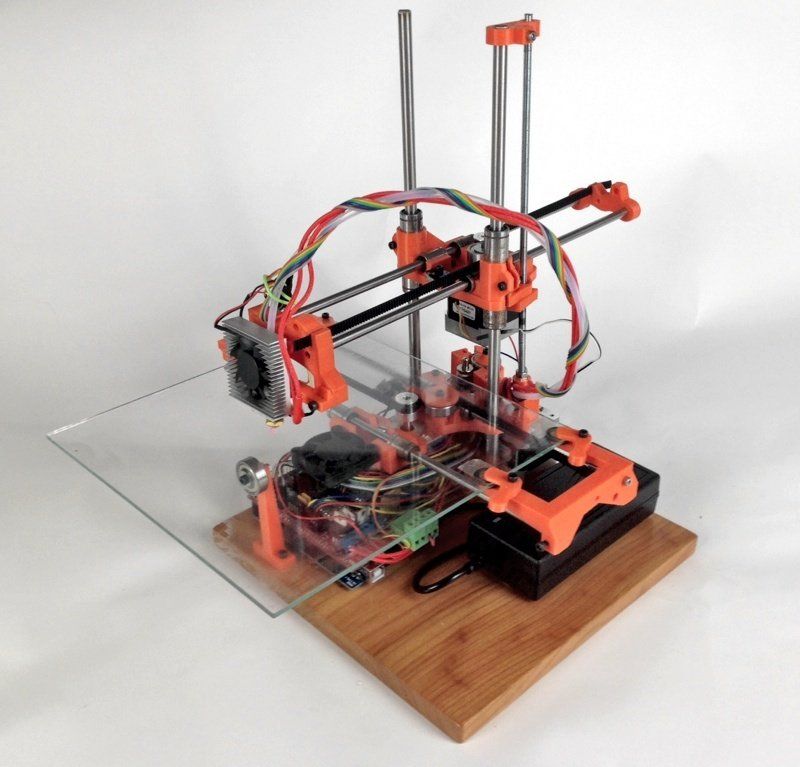

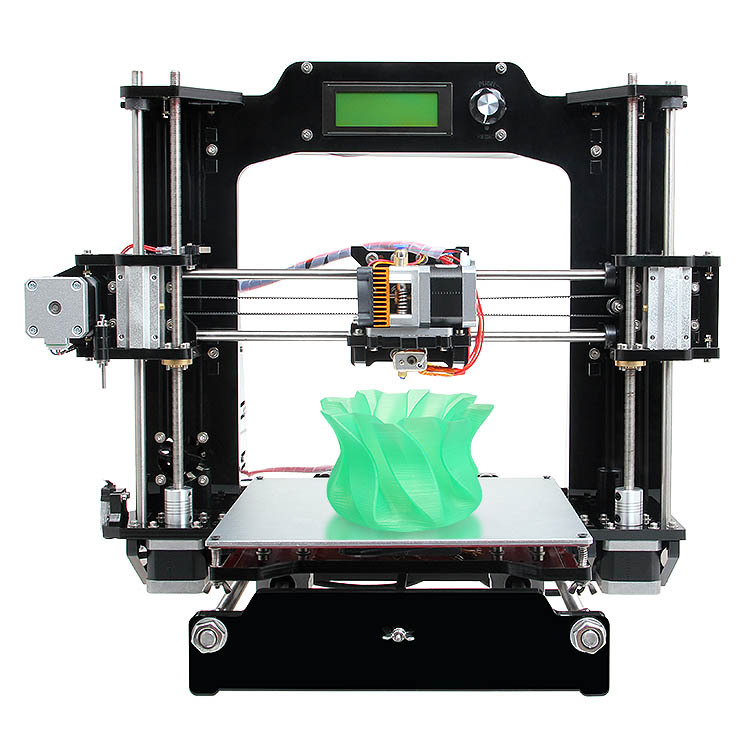

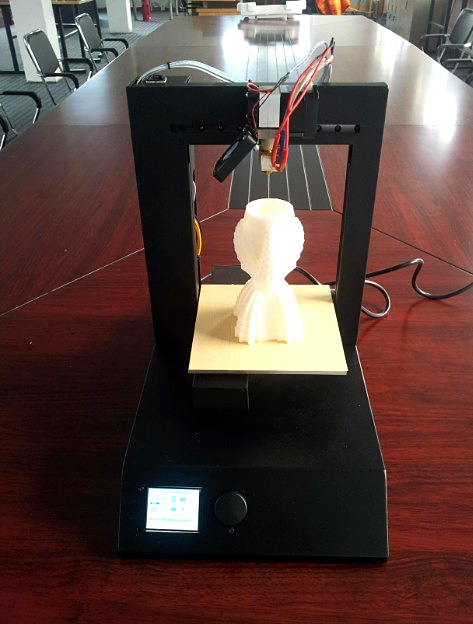

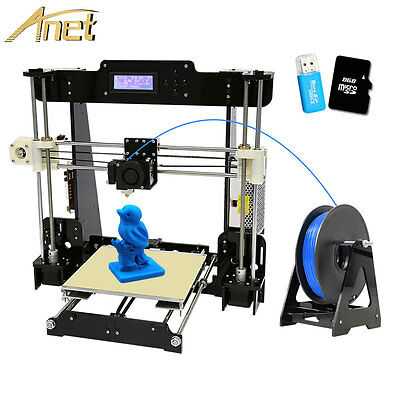

We are living in an amazing time! Our lives are changing more and more under the influence of technology. Even 5 years ago, reading articles about 3D printing, I imagined that it was either insanely expensive or completely crooked and terrible. And now, you can join the world of 3D printing even cheaper than buying a computer! All you have to do is choose a 3D printer model, add a filament spool to your order, click the pay button, and the printer will make you and your family happy!

You can buy a 3D printer at a large number of sites and stores. The first impulse is to look for where it is cheaper. But there are no free breakfasts, and let's figure out what pitfalls we can meet after we have pressed the coveted “pay” button on the page of the marketplace that suits us.

What is a marketplace

This principle works Aliexpress

In order not to spread the thought along the tree, let's set the framework for the discussion.

Marketplaces are sites on the Internet where many different sellers sell their goods. The marketplace or exposes on its website pages with a description of the goods, while payment goes through the marketplace system, and both the site itself and a separate seller can deliver the goods to you.

The largest companies that trade in this way are Amazon, eBay and Aliexpress, which are based abroad, while OZON and Yandex.Market already trade mainly in Russia.

Let's deal with them in order!

What is not immediately clear when buying a printer on a foreign site

Data on customs duties at the beginning of 2021

In Russia, if what you buy crosses the border, you may be charged customs duty. And the question is not so much in money, but in the time spent on visits to the customs post, and payment of receipts. Most likely for this reason, eBay and Amazon are not popular with us. They are used when you need a product from Europe or the USA, but it is simply not available on other sites.

And the question is not so much in money, but in the time spent on visits to the customs post, and payment of receipts. Most likely for this reason, eBay and Amazon are not popular with us. They are used when you need a product from Europe or the USA, but it is simply not available on other sites.

On the other hand, Aliexpress have their own warehouses in Russia, where 3D printers are already cleared by customs.

The main reason to buy a 3D printer on Aliexpress

Looks like that's what we're looking for

And here everything is extremely simple - the declared price. If we compare the cost of 3D printers across all sites, it turns out that the declared price here is the lowest. On average, a 3D printer can be bought at a 10-15% discount from the price in some specialized 3D printer store in Russia. That's all it is an advantage. And you have to fight for it.

Communication - the first difficulty in buying on these sites

An example of a “literary” translation of a description

On Aliexpress, goods are grouped by sellers into “shops” within the site. You can chat with the manager of each store. You can even in Russian, there is an auto-translation. The problem is that a 3D printer is a technique, and even Chinese managers of specialized stores do not understand anything about it. So it is very difficult to get an intelligible answer from them if something is not clear to you. Even after their sworn assurance that they would "contact the engineers and explain." Well, the auto-translator translates badly different technical terms.

You can chat with the manager of each store. You can even in Russian, there is an auto-translation. The problem is that a 3D printer is a technique, and even Chinese managers of specialized stores do not understand anything about it. So it is very difficult to get an intelligible answer from them if something is not clear to you. Even after their sworn assurance that they would "contact the engineers and explain." Well, the auto-translator translates badly different technical terms.

You will not be able to look around and feel the 3D printer you like - sellers simply do not have showrooms! Chinese managers will not even tell you about which printer is suitable for your tasks.

The feedback system does not work well - the most frequent feedback reports that everything has arrived, but I have not tried it in work. Only experienced marketplace users will understand which feedback should be taken into account when choosing.

But suppose you went through the communication stage, chose, and paid for the goods.

Even this printer came whole. They pack well!

Packed, your 3D printer was handed over to the transport company. The printers are packaged well, so she got them to you safe and sound.

It is normal practice to record the unpacking process on video - it is not uncommon, some large parts are missing from the 3D printer kit - you never know, the hardworking Chinese did not check what he put in the box. And so you have proof that there was no detail.

If everything is fine, then you are lucky - you bought a printer with a lot of savings.

Virtually no after sales service

Real correspondence with the seller. How much you pay, how much you get

But they are Chinese! Sometimes the rollers are overtightened and damaged, sometimes the nozzle is screwed in crookedly, and the thread is broken, sometimes the metal parts are bent in the wrong way, or holes are drilled in them in the wrong place. We have to contact the managers of the Middle Kingdom again. And here the task is already more complicated - not only do they not understand, what you wrote about the problems with your printer, they also pretend to be a felt boots - “it shouldn’t be like that, everything should work like that”. Or I also like - “you disassemble what came to you assembled, and then assemble it again.”

We have to contact the managers of the Middle Kingdom again. And here the task is already more complicated - not only do they not understand, what you wrote about the problems with your printer, they also pretend to be a felt boots - “it shouldn’t be like that, everything should work like that”. Or I also like - “you disassemble what came to you assembled, and then assemble it again.”

Often, for the same reason, even involving the administration of Aliexpress, it is not possible to solve the problem or return the money!

Danger of losing your money altogether

I regularly read reviews about 3D printers on Ali's pages - “They didn’t deliver on time”, “I had to pay customs”, “I received a shortage, they didn’t return the money and the Aliexpress administration didn’t help.”

At the same time, 3D printers purchased this way are often not covered by the Consumer Rights Protection Law - you paid abroad, and sort it out there!

All this can be avoided only if you buy a lot on Aliexpress and at the same time understand how you can check the components of a 3D printer.

Well, how are our Russian sites?

3D printer can be bought on OZON and Yandex.Market

You have probably bought something on these marketplaces, and the principles of their work do not differ much from foreign ones, so I will not dwell on this.

It's nice to read the description of goods in literary Russian. Support also speaks Russian, it is more realistic to communicate with them.

A tangible discount can only be obtained by waiting for promotions and spending a lot of points ov

The main advantage of buying here can be created by the loyalty program of these sites. The very points with which you can pay for part of the purchase. If you often use, or make the first order, then the cost of the printer can be decently reduced.

Discounts in Russian: before 120 now 140

Comparing prices on the pages of Russian aggregators, it turns out that you have to spend a lot of discount points, or wait for some kind of promotion for a very long time. Otherwise, the cost of a 3D printer can be almost 50% higher than on Aliexpress.

Otherwise, the cost of a 3D printer can be almost 50% higher than on Aliexpress.

As for the Russian-language description, it is short, not very informative. Often technical terms are used incorrectly.

Just like with colleagues from abroad, there are no showrooms, which means that you won’t be able to come to the store and touch an expensive purchase.

One of the complaints on the well-known resource

There is also an original problem. Our marketplaces attract new customers with a free return system. It seems to be good, but no one keeps track of what the dissatisfied buyer brought back to the point of issue of orders. But this box will return to the warehouse of the marketplace, and then it can leave for you! Therefore, your printer may arrive scratched, with missing parts, a burnt motherboard, or frankly used. With enviable regularity, I read complaints from buyers and, oddly enough, from sellers that our marketplaces do not track returns. Salvation from this can only be a video recording of how you open the received package, but this will not be a guarantee. OZON or Yandex.Market managers are sometimes reluctant to respond to such cases, but even if you return the printer and return the money, time and nerves cannot be returned! Well, the last hope for the ZoPP and the court, checks and all papers must be kept.

Salvation from this can only be a video recording of how you open the received package, but this will not be a guarantee. OZON or Yandex.Market managers are sometimes reluctant to respond to such cases, but even if you return the printer and return the money, time and nerves cannot be returned! Well, the last hope for the ZoPP and the court, checks and all papers must be kept.

In fairness, it should be said that I observed such cases less often than with printers from foreign sellers. So, it is likely that you have successfully received your printer some time after payment.

What to do, the 3D printer is broken and it's too late to return it

This has happened before. Now this is a meme

It happens, yes. We are all human and every 3D printer broke something in his printer. That's when you will find out that no one understands such a technique on native marketplaces. They will send you to sellers who are more likely to simply arrange delivery from China, but do not assemble and service 3D printers themselves.

Most often, you have to communicate with the support of the sites for a long time. It seems to be in Russian, but Russian marketplace support managers understand 3D printing just as little as their Chinese counterparts. As a result of long negotiations, you were lucky if you were sent to a company that specializes in the sale of 3D printers specifically in Russia. How to define good?

Carry out government orders - companies that can be entrusted with repairs

Clean service and plenty of equipment

The logic is simple - under the terms of state contracts, they are required to have conditions for the maintenance and repair of equipment that they sell. So you can give them a printer bought on the marketplace, and receive, in addition to the service, all the necessary documents. And the fact that the flow of printers in the service departments of such companies is large, allows us to expect high-quality repairs.

Sorry, I digress, but it just hurts to see how people abandon 3D printing simply because they could not find a normal after-sales and service!

What is the alternative

It turns out that the main disadvantages of buying 3D printers on marketplaces are:

-

Bad communication

-

There is no way to feel the printer live

-

Lack of after-sales service

-

Problems with the organization of repair work

Is there an alternative to marketplaces that can close these gaps? Among all the options, the only thing that comes to my mind is buying a 3D printer in one of the large stores that are legally located in Russia, which have a showroom and a service center that specialize in the sale of 3D printing equipment, and which carry out government orders.