Best 3d printer company to invest in

Top 3D Printing Stocks

Table of Contents

Table of Contents

-

Best Value 3D Printing Stocks

-

Fastest Growing 3D Printing Stocks

-

3D Printing Stocks With the Best Performance

-

Trends in 3D Printing Sector

-

Advantages of 3D Printing Stocks

SSYS is top for value and performance and NNDM is top for growth

By

Noah Bolton

Full Bio

Noah has about a year of freelance writing experience. He's worked on his investing website dealing with topics such as the stock market and financial advice for beginners.

Learn about our editorial policies

Updated October 06, 2022

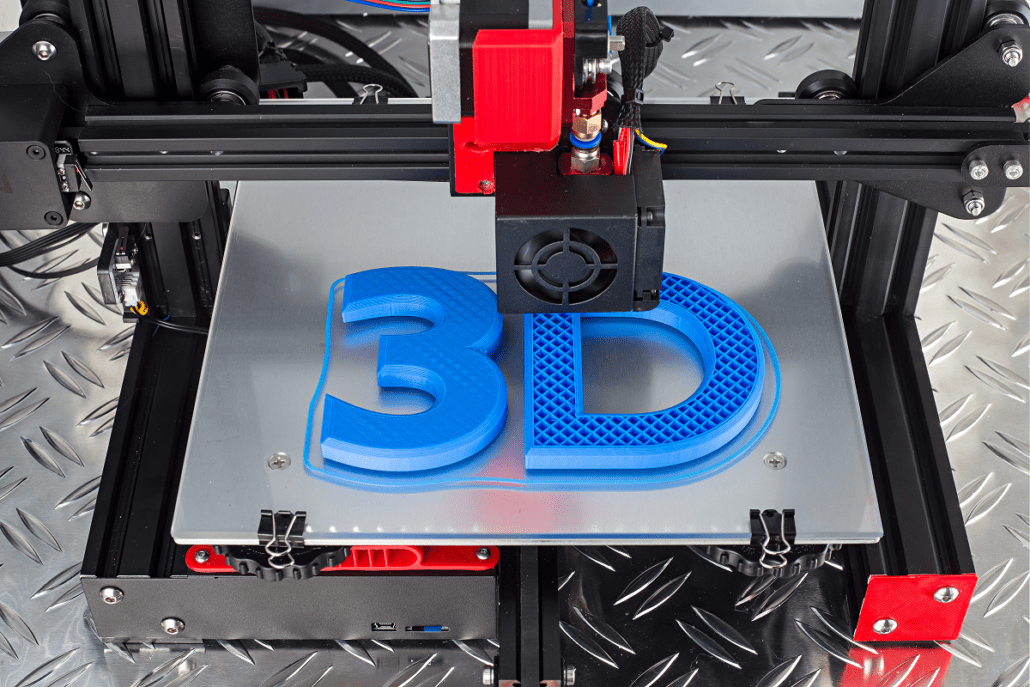

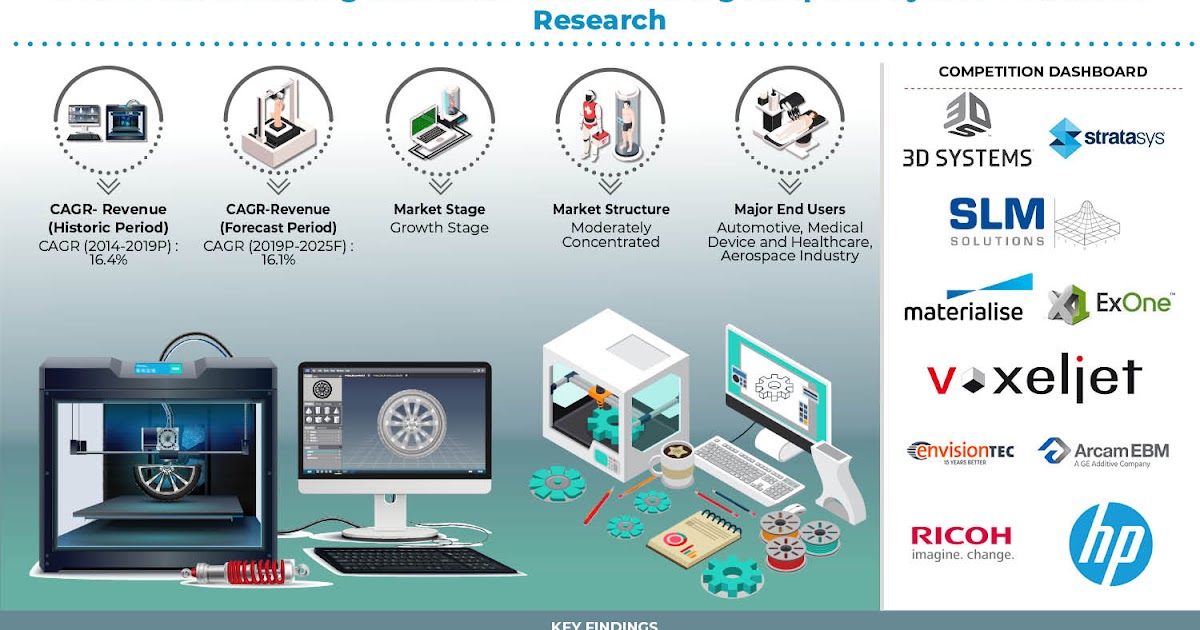

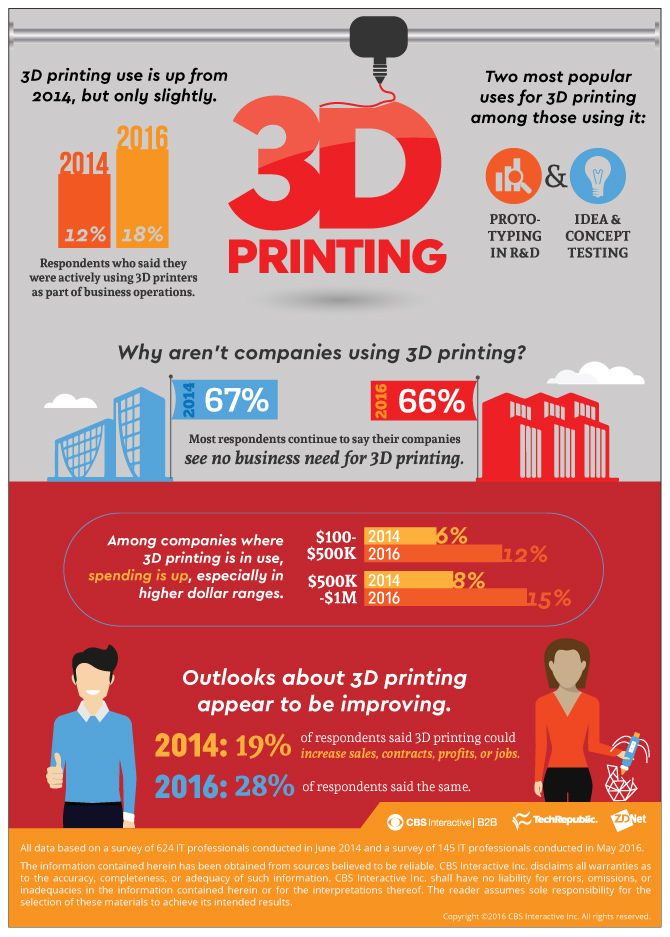

The 3D printing industry is made up of companies that provide products and services capable of manufacturing a range of products. 3D printing, also known as additive manufacturing, creates physical objects from digital designs. The printing process works by laying down thin layers of material in the form of liquid or powdered plastic, metal, or cement, and then fusing the layers together. Though still too slow for mass production, it is a revolutionary technology that has the potential to disrupt the manufacturing logistics and inventory management industries. The 3D printing industry is comprised of only a handful of companies, including players such as Proto Labs Inc., Faro Technologies Inc., and Desktop Metal Inc.

The industry is so young that it has no meaningful benchmark index. But the performance of these stocks can be compared to the broader market as represented by the Russell 1000 Index. These stocks have not performed well. Stratasys Ltd. (SSYS), the best performing 3D printing stock, has dramatically underperformed the Russell 1000, which has provided a total return of -12.5% over the past 12 months. This market performance number and all statistics in the tables below are as of Sept. 20, 2022.

Here are the top three 3D printing stocks with the best value, fastest sales growth, and the best performance.

These are the 3D printing stocks with the lowest 12-month trailing price-to-sales (P/S) ratio. For companies in early stages of development or industries suffering from major shocks, this metric can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated.

| Best Value 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing P/S Ratio | |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 1.6 |

| 3D Systems Corp. (DDD) | 9. 00 00 | 1.2 | 2.0 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | 2.1 |

Source: YCharts

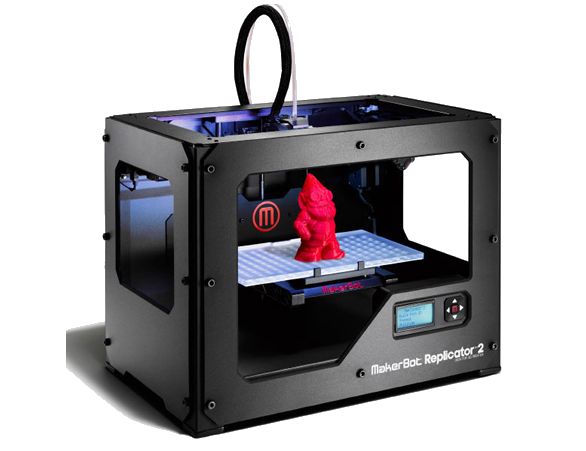

- Stratasys Ltd.: Stratasys offers 3D printing solutions, such as 3D printers, polymer materials, a software ecosystem, and related parts. It serves a variety of industries, including aerospace, automotive, consumer products, and healthcare. On Sept. 13, Stratasys completed the merger of its MakerBot subsidiary with Ultimaker, which offers platforms used to make 3-D printers. Ultimaker is backed by NPM Capital. The merged company will keep the Ultimaker name and focus on providing solutions, hardware, software and materials to the industry. NPM Capital will have majority ownership of the new company at 53.5%, and Stratasys will own 46.5%.

- 3D Systems Corp.: 3D Systems provides 3D printing solutions. The company offers a range of hardware, software, and materials designed for additive manufacturing.

Its products and services are used in a variety of industries and sectors, including aerospace, automotive, semiconductor, healthcare, and more.

Its products and services are used in a variety of industries and sectors, including aerospace, automotive, semiconductor, healthcare, and more. - Proto Labs Inc.: Proto Labs is an e-commerce-based company that provides digital manufacturing services. It offers 3D printing, injection molding, CNC machining, and sheet metal fabrication. On Aug. 5, Proto Labs announced financial results for Q2 2022, the three-month period ending on June 30, 2022. Net income fell more than 80% to $2.6 million from the prior-year quarter while revenue rose 3.1%.

These are the 3D printing stocks with the highest YOY sales growth for the most recent quarter. Rising sales can help investors identify companies that are able to grow revenue organically or through other means and find growing companies that have not yet reached profitability. In addition, accounting factors that may not reflect the overall strength of the business can significantly influence earnings per share. However, sales growth can also be potentially misleading about the strength of a business, because growing sales on money-losing businesses can be harmful if the company has no plan to reach profitability.

However, sales growth can also be potentially misleading about the strength of a business, because growing sales on money-losing businesses can be harmful if the company has no plan to reach profitability.

| Fastest Growing 3D Printing Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | Revenue Growth (%) | |

| Nano Dimension Ltd. (NNDM) | 2.45 | 0.6 | 1,270 |

| Desktop Metal Inc. (DM) | 3.07 | 1.0 | 203.9 |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | 13.3 |

Source: YCharts

- Nano Dimension Ltd.: Nano Dimension is an Israel-based 3D printing company focused on developing equipment and software for 3D-printed electronics. It develops printers for multilayer printed circuit boards and nanotechnology-based inks.

The company serves a range of industries, including consumer electronics, healthcare, aerospace, and automotive. On Sept. 1, Nano Dimension released Q2 2022 results. The company's net loss widened sharply to $40.0 million from a loss of $13.6 million in the same quarter a year earlier even as revenue soared more than 13-fold. The larger second-quarter loss was fueled partly by $10.9 million in non-cash adjustments for depreciation and amortization expenses, and share-based payments.

The company serves a range of industries, including consumer electronics, healthcare, aerospace, and automotive. On Sept. 1, Nano Dimension released Q2 2022 results. The company's net loss widened sharply to $40.0 million from a loss of $13.6 million in the same quarter a year earlier even as revenue soared more than 13-fold. The larger second-quarter loss was fueled partly by $10.9 million in non-cash adjustments for depreciation and amortization expenses, and share-based payments. - Desktop Metal Inc.: Desktop Metal manufactures 3D printers and related equipment used to build complex parts from metal. It also offers 3D printing software. The company serves a range of industries, including automotive, consumer products, education, and heavy industry. On Aug. 08, the company reported Q2 2022 results. Desktop Metals' net loss increase nearly seven-fold to $297.3 million compared to the same quarter a year earlier even as revenue tripled.

- Stratasys Ltd.

: See above for company description.

: See above for company description.

These are the 3D printing stocks that had the smallest declines in total return over the past 12 months out of the companies we looked at.

| 3D Printing Stocks With the Best Performance | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing Total Return (%) | |

| Stratasys Ltd. (SSYS) | 15.49 | 1.0 | -34.5 |

| Proto Labs Inc. (PRLB) | 37.49 | 1.0 | -50.6 |

| Materialise NV (MTLS) | 10.95 | 0.6 | -53.9 |

| Russell 1000 | N/A | N/A | -12.5 |

Source: YCharts

- Stratasys Ltd.: See above for company description.

- Proto Labs Inc.: See above for company description.

- Materialise NV: Materialise is a Belgium-based provider of additive manufacturing software and 3D printing services. It serves a range of industries, including healthcare, aerospace, and automotive. On Sept. 7, Materialise completed its acquisition of Identity3D, which makes products that encrypt, distribute, and track digital parts as they move through supply-chains. The value of the deal was not specified in the announcement.

Trends in 3D Printing Sector

The 3D printing industry is a young one, and companies are still jockeying for market share or facing consolidation risks. Nonetheless, 3D printing has significant potential to impact a host of other industries. 3D printing businesses may be crucial in helping other companies maximize production efficiencies in an effort to reduce environmental impact out of a concern for climate change, for example. 3D printing can be used to create personalized products in the healthcare or therapeutics spaces. This technology can also be used to facilitate a faster turnaround for the creation of new models of existing products in industries such as the automotive space.

This technology can also be used to facilitate a faster turnaround for the creation of new models of existing products in industries such as the automotive space.

Advantages of 3D Printing Stocks

3D printing technology has the benefit of being a relatively new technology which has potential applications across a range of fields. This is one reason why the 3D printing market is expected to roughly triple in size to $44.5 billion by 2026. This versatility provides a significant benefit to 3D printing stocks within an investment portfolio. Another advantage of 3D printing technology is that it may have the potential to alleviate some of the impact of supply chain constraints. Given the ongoing supply chain crisis which has impacted a host of industries, there is an opportunity for 3D printing companies to provide a critical service.

The comments, opinions, and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

YCharts. "Financial Data.

"

"Stratasys Ltd. "Stratasys Completes Merger of MakerBot with Ultimaker."

Proto Labs Inc. "Proto Labs Q2 2022 Earnings Release."

Nano Dimension Ltd. "Earnings Press Release for Q2 2022."

Desktop Metals Inc. " Desktop Metals Second Quarter 2022 Earnings."

Materialise NV. "Materialise Acquires Indenity3D."

3D Natives. "What Were the 3D Printing Trends in 2021?"

Fast Company. "Four 3D printing trends to look for in 2022."

Hubs. "3D printing trend report 2022."

Five 3D Printing Stocks to Consider in 2023

Image source: Getty Images.

Back in the early 2010s, stocks were booming for 3D printing -- also known as additive manufacturing, a computer-controlled process in which three-dimensional objects are made. But the boom was followed by a bust as many pure-play 3D printing companies didn't immediately deliver on lofty expectations.

Rumors of the manufacturing technology's demise are clearly premature. These days, 3D printing is a high-growth niche that is steadily reshaping the manufacturing and industrial sectors. Some estimates point to a doubling in annual revenue from additive manufacturing between 2022 and 2026. Even growth investor Cathie Wood has launched a fund focused on manufacturing tech, The 3D Printing ETF (PRNT -2.04%), via her company ARK Invest.

Here's what you need to know about 3D printing and additive manufacturing stocks for 2023:

Investing in 3D printing stocks in 2023

The manufacturing of products in all corners of the economy is being revolutionized by 3D printing, from healthcare equipment to metal fabrication to housing construction. It's invading so many sectors that tech giants such as Microsoft (MSFT -0.54%), Autodesk (ADSK -4.23%), and HP (HPQ -2. 66%) have launched products aimed at 3D printing and additive manufacturing. Other engineering and software outfits such as Dassault Systemes (DASTY -1.06%), ANSYS (ANSS -1.68%), and Trimble (TRMB -2.75%) have also gotten involved in 3D printing technology.

66%) have launched products aimed at 3D printing and additive manufacturing. Other engineering and software outfits such as Dassault Systemes (DASTY -1.06%), ANSYS (ANSS -1.68%), and Trimble (TRMB -2.75%) have also gotten involved in 3D printing technology.

Here are five key players to consider for 2023 that are a more focused bet on 3D printing:

| Company | Market Cap | Description |

|---|---|---|

| Desktop Metal (NYSE:DM) | $584.3 million | Recent IPO that focuses on metal fabrication technology. |

| Stratasys (NASDAQ:SSYS) | $924.3 million | One of the original 3D printing pioneers, with a wide array of printers and supporting design software. |

| Xometry (NASDAQ:XMTR) | $1.3 billion | A manufacturing marketplace, including access to on-demand 3D printing services. |

| 3D Systems (NYSE:DDD) | $1.2 billion | Another original 3D printing pioneer and the largest pure-play stock on 3D printing technology. |

| PTC (NASDAQ:PTC) | $15.4 billion | A manufacturing technology provider with a suite of software and related services for industrial businesses. |

1. Desktop Metal

This company is a recent entry into the 3D printing space after going public via a SPAC at the end of 2020. The stock has been a terrible market underperformer since then, losing three-quarters of its value as of spring 2022. However, Desktop Metal could still be a promising investment for the long term.

As its name implies, Desktop Metal develops 3D printing hardware and accompanying design software for metal and carbon fiber parts. The company's smaller systems can handle prototyping and one-off parts, and larger printers are production grade-designed for manufacturing facilities. Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

Desktop Metal serves companies operating in automotive, consumer goods, and heavy industrial equipment businesses.

Despite a tenuous start as a public company, Desktop Metal was actually increasing revenue at a torrid triple-digit pace in 2021. Gross profit margins are thin, and the company generated a steep net loss, but that should improve over time as the business scales its operation. Desktop Metal also has several hundred million dollars in cash and investments to fund its expansion. It used some of these funds to acquire additive manufacturing peer ExOne at the end of 2021.

2. Stratasys

Stratasys was part of the early 2010s 3D printing stock boom and bust, but its business has endured. Sales took a dip early in the COVID-19 pandemic but are rebounding as the Israel-based company picks up new manufacturing contracts.

Stratasys serves a diverse set of customers, including aerospace and automotive parts manufacturers, medical and dental companies, and makers of basic consumer products. In addition to a wide array of 3D printer models, Stratasys develops software to help users accelerate the time between design and final printing.

In addition to a wide array of 3D printer models, Stratasys develops software to help users accelerate the time between design and final printing.

It isn't the highest-growth name on this list, but Stratasys is profitable (on a free cash flow basis) and has more than $500 million in cash and investments on its balance sheet, as well as no debt. Management thinks its payoff from years of research and development into additive manufacturing will accelerate in 2022.

3. Xometry

This is another newcomer to public markets. Xometry completed its initial public offering (IPO) over the summer of 2021, raising almost $350 million in cash in the process. As is often the case with new IPOs, the stock has underperformed since then. It has lost over half of its value from the time it started trading on public markets, but the business itself is rapidly growing.

Xometry is a marketplace for on-demand manufacturing of prototyping and mass production. It has a network of more than 5,000 suppliers that companies can call on to meet their fabrication needs. Among the suppliers on the Xometry platform are 3D printing companies, injection molding, and automated machining. The company reported having more than 28,000 active buyers utilizing its platform at the end of 2021.

It has a network of more than 5,000 suppliers that companies can call on to meet their fabrication needs. Among the suppliers on the Xometry platform are 3D printing companies, injection molding, and automated machining. The company reported having more than 28,000 active buyers utilizing its platform at the end of 2021.

Although it isn't profitable yet, Xometry's unique approach to the 3D printing and additive manufacturing industry is growing fast. Like other names on this list, it has a sizable war chest of cash and short-term investments that it can spend on research and marketing as it tries to attract more suppliers and buyers to its marketplace.

4. 3D Systems

3D Systems was another early player in the 3D printing industry, and while it suffered through the boom-and-bust period of the early 2010s, its business has held steady for much of the past decade. After a brief dip during the early days of the pandemic, 3D Systems is back in growth mode.

The company develops printers and design software for all sorts of materials and industries (medical device makers, dental labs, semiconductor designers, aerospace, and automotive manufacturers). It claims leadership among independent 3D printing companies (as measured by sales). As the 3D printing industry expands in the coming years, 3D Systems thinks it will be able to attract lots of new business with its extensive experience and global reach.

As an established tech outfit in the manufacturing sector, 3D Systems offers investors the prospect of more stable growth, along with profitability. It also has a large net cash position from which it can consolidate its lead in 3D printers and software technology.

5. PTC

By far the largest company on this list, PTC is a longtime technology partner of manufacturing and industrial enterprises. Fast approaching $2 billion in annualized sales and highly profitable, PTC has all the tools needed to digitally transform industrial businesses.

Besides 3D printing computer-aided design software (ANSYS is a peer and software partner that also operates in this space), PTC specializes in augmented reality, industrial IoT (Internet of Things), and product life-cycle management software. Most of its revenue is subscription-based (including its Creo software that enables 3D printing), making for a stable and steadily growing business model that generates ample cash flow. PTC puts spare cash to work developing new products for its partners and makes bolt-on acquisitions of other software companies that enhance its overall portfolio.

As a larger company, PTC won't be the fastest-growing stock in the additive manufacturing and 3D printing space. However, the company has established itself as a leader in industrial technology and should be a primary beneficiary as the production of manufactured goods gets more efficient.

The future of 3D printing

Manufacturing technology is making inroads throughout the global economy by reducing the cost of production and localizing and speeding up the time it takes to deliver customer orders. This is far from mere hype. Nevertheless, as is the case with all technology investments, progress won't go straight up. Expect twists and turns in these stocks as they develop new methods to design and make products.

This is far from mere hype. Nevertheless, as is the case with all technology investments, progress won't go straight up. Expect twists and turns in these stocks as they develop new methods to design and make products.

If you decide to invest, do so in a measured way. Maintain a diversified portfolio, be wary of stocks benefiting from investor over-optimism, and always leave spare cash to invest more when there are inevitable dips. Given enough time -- years and decades -- investing in 3D printing could eventually provide a big payoff.

Related communication stocks topics

Investing in 5G Stocks

As the 5G technology rollout continues, these companies look like winners.

Investing in Top Telecommunications Stocks

Our world is increasingly interconnected, and these companies make it happen.

Investing in Communication Stocks

Communications has a broad definition. These companies are the leaders in the space.

Investing in Top Consumer Discretionary Stocks

When people have a little extra cash, they indulge in offerings from these companies.

Nicholas Rossolillo has positions in Autodesk. The Motley Fool has positions in and recommends Autodesk, HP, and Microsoft. The Motley Fool recommends 3d Systems, Ansys, Dassault Systèmes Se, PTC, and Trimble. The Motley Fool has a disclosure policy.

Overview of 3D printer manufacturers

3D printing appeared in the late 1980s, but 2020 became a breakthrough year for the technology. The pandemic disrupted supply chains, and it was 3D printing that made it possible to quickly obtain the necessary items and spare parts, ranging from consumables for hospitals and clinics to parts for medical, industrial and other equipment.

The prospects and pace of development of the sector in recent years have significantly increased its investment attractiveness, however, there are certain risks that should not be discounted.

Vadim Kizimov

private investor

Author profile

Buy

Buy

Buy

Buy

Service in partnership with Investment mi.koff Quotes are updated every 15 minutes

Brief overview of technology

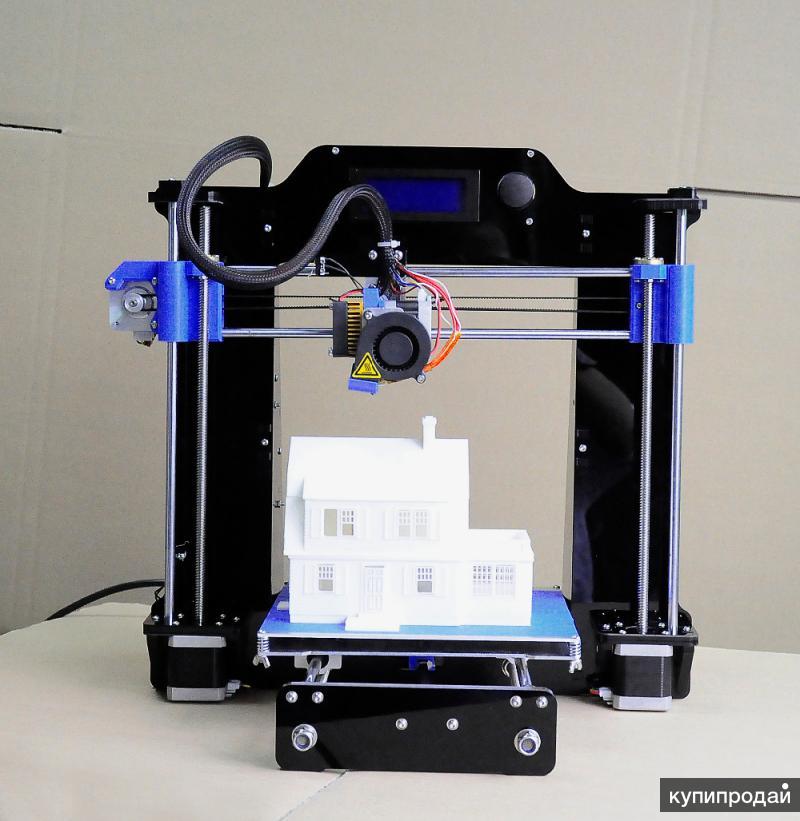

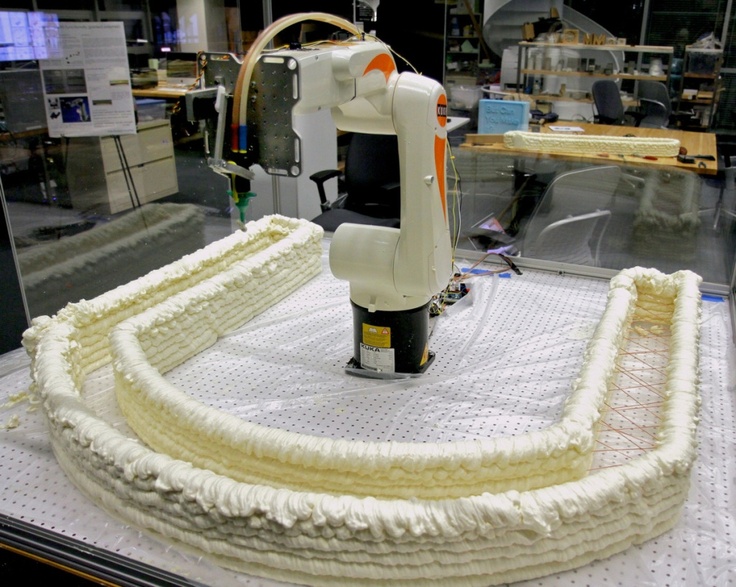

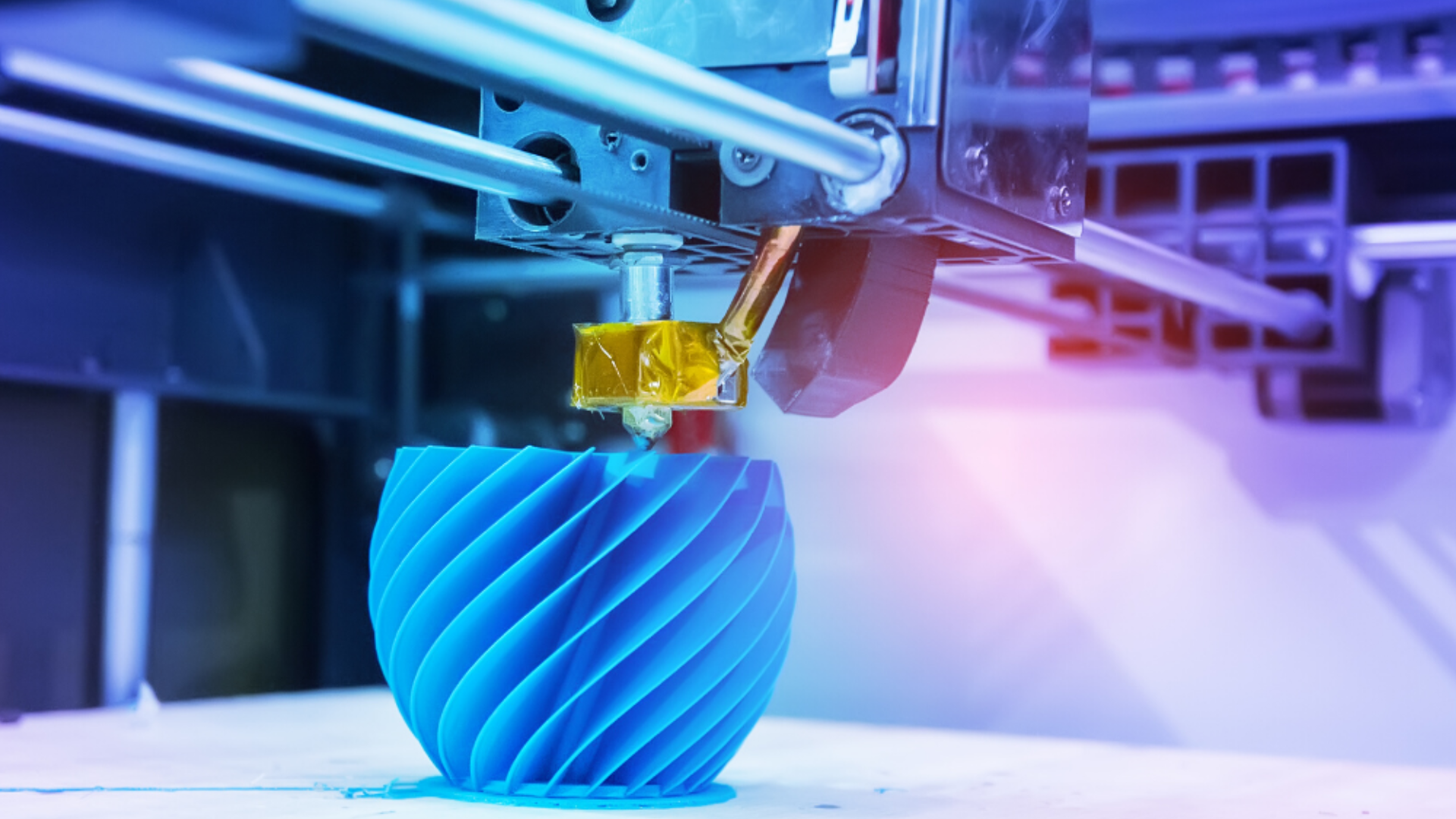

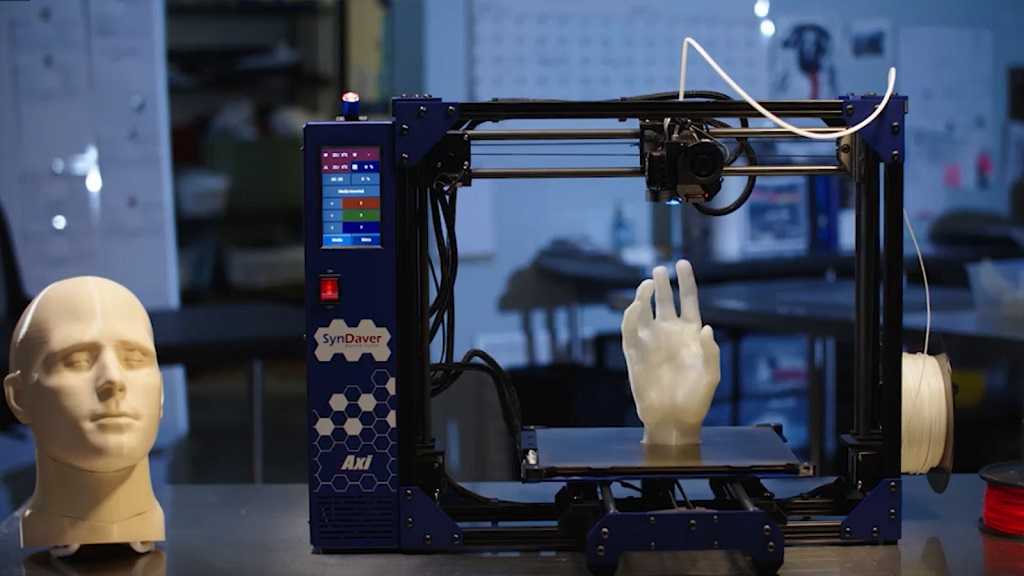

3D printing is the process of converting a model developed on a computer into a real three-dimensional object. Printing occurs due to the successive layering of thin layers of material. These are mainly thermoplastics of various types, but ceramic, biocompatible and other composite mixtures can also be used. That is why this technology is called additive.

3D printing technologies differ depending on the materials and equipment used, but the general scheme of the process is always the same:

- A virtual model of the object is created on the computer, and in order to make a model, you do not need to have 3D modeling skills. A special scanner photographs a real object from different angles, creating a digital copy of it.

- The program is slicing - splitting the model into many thin horizontal layers.

- The template is loaded onto the 3D printer, the device reads the diagram and prints it layer by layer in volumetric form.

Applications

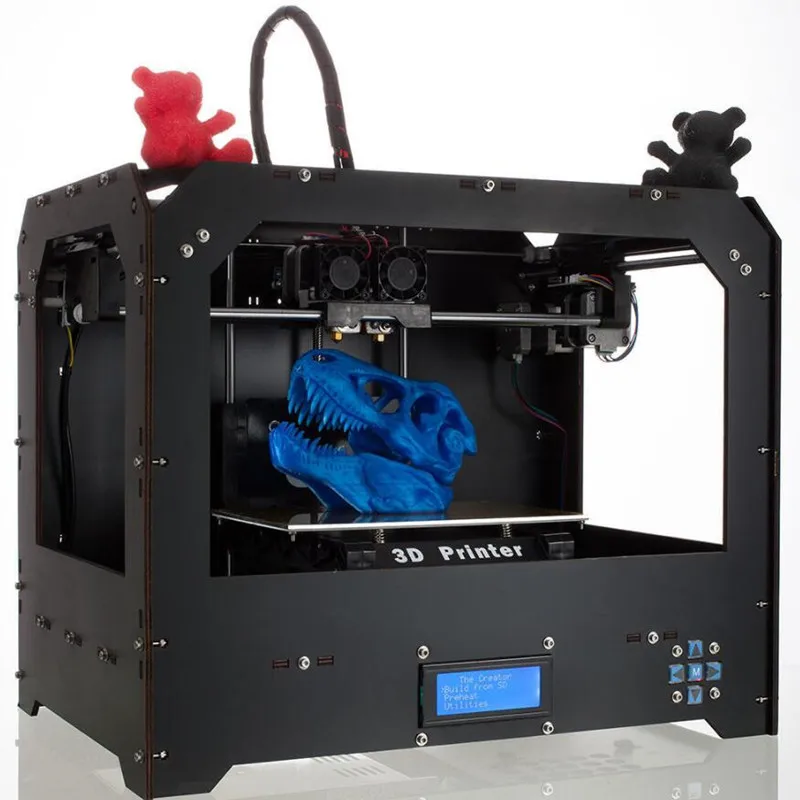

Using a 3D printer, you can copy any object or create your own. The possibilities for additive printing are almost limitless. Now the technology has already found application in various industries:

- health care: the creation of orthopedic orthoses, dentistry, transplantology, the manufacture of prostheses;

- industrial production: parts of machine tools and equipment;

- space, aviation and automotive industry;

- robotics;

- construction: models of buildings or individual structural elements;

- food production: figured chocolate, jellies and other desserts;

- household items: from smartphone cases and collectible figurines to shoes and interior items;

- jewelry.

At the moment, additive technologies are most in demand in medicine — 3D printing makes it possible to create consumables, prostheses, orthoses, mouth guards, and even absolutely accurate models of human organs — and in industrial production when creating parts and equipment elements.

But the scope of 3D printing is constantly expanding, opening up new opportunities for both large companies and small start-ups.

Industry Prospects

At the moment, 3D printing does not yet allow you to get fast and large-scale results, but the technology has proven itself in areas that require precision and uniqueness.

The increased availability of equipment and the absence of the need for long training of personnel to work with 3D printers also played a role. Over the past six years, the number of global and specific industries that use 3D printing technology has increased, and this market is truly limitless:

- large companies or organizations may refuse to purchase the necessary consumables or parts, producing them on their own in the volumes they need;

- The role of additive printing in medicine has already been discussed above, and there are also broad development prospects here;

- 3D solutions lower the barrier to entry for new players.

Now, to launch your own production, there is no need to rent a room and purchase sophisticated equipment. For example, niches for creating custom car tuning parts, collectible figurines for computer game fans or unique gifts have just begun to open and have already begun to gain popularity.

Now, to launch your own production, there is no need to rent a room and purchase sophisticated equipment. For example, niches for creating custom car tuning parts, collectible figurines for computer game fans or unique gifts have just begun to open and have already begun to gain popularity.

At the end of 2021, the additive printing market was worth $15 billion, calculations were based on the cost of 3D printing and the production of printers and components. In the coming years, the expert agency Business Insights predicts an annual growth of the segment by more than 24%. At this pace, by the beginning of 2029, the size of the 3D printing market will grow at least five and a half times.

Technology deficiencies and risks of companies

Despite the prospects for the development of 3D technologies, 3D printing cannot yet be unequivocally called a profitable industry. There are a number of difficulties that do not allow you to fully rely on additive technologies.

Still high cost of equipment. Cheap 3D printers can print small objects. To create parts of large dimensions, it is necessary to purchase expensive equipment, which may turn out to be unprofitable.

Poor performance. This drawback should be considered in conjunction with the previous one: now the speed and cost of 3D printers do not allow them to be used in mass production, making a tangible profit.

Insufficient strength of manufactured parts. The layered structure is more brittle in the direction of the layers than the monolith and cannot withstand heavy loads.

Lack of stability. The use of additive technologies on an industrial scale requires equipment and materials that can provide higher production reliability. At the moment, 3D printing is most often used for prototyping, quality control, or for the production of single parts.

The need for post-processing , which increases the cost and time of production of each unit.

Unpredictability. Additive manufacturing is constantly evolving, new materials and printer models are emerging, and there is always a risk that equipment that has been heavily invested in will suddenly become obsolete.

3D printing companies on the St. Petersburg Stock Exchange

There are quite a few companies associated with 3D printing on the St. Petersburg Stock Exchange, and it is not their main activity. This industry is so young that at the moment it does not even have a benchmark significant index.

But the global trend of increasing demand for additive technologies in various areas of life can open up new prospects for industry pioneers.

Proto Labs (NYSE: PRLB). Capitalization - 2.56 billion Proto Labs was founded in 1999 in Minnesota, and by 2022 it already has more than ten branches in seven countries of the world. The company specializes in the creation of prototypes and finished parts for individual orders. In this niche, Proto Labs is one of the largest and fastest manufacturers: it takes only a few days to create a part of any complexity.

In this niche, Proto Labs is one of the largest and fastest manufacturers: it takes only a few days to create a part of any complexity.

Since 2014, Proto Labs has been using additive technology for manufacturing parts. In total, the company operates in four areas:

- Injection molding, revenue growth +4% year-on-year.

- CNC machining, +41%.

- 3D printing, +17%.

- Sheet metal production, +24%.

While 3D printing still only accounted for 14.8% of the company's revenue as of the end of 2021, the technology's growth trends could bring more tangible profits in the future.

Source: Tinkoff Investments Source: Tinkoff Investments3D Systems Corp (NYSE: DDD). Capitalization - 1.88 billion. The company was founded in 1986, headquarters - in Rock Hill, South Carolina.

3D Systems manufactures and sells equipment, software and materials for additive manufacturing. Most often, the company's products are used in the aerospace, automotive, semiconductor and healthcare industries.

In 2021, 3D Systems announced two separate acquisitions. The company has agreed to acquire Titan Additive LLC, a developer and manufacturer of large-format industrial 3D printers, and Kumovis, a German provider of additive manufacturing solutions for personalized medical applications.

After the announcement of the results for the fourth quarter of 2021, the company's quotes increased by 15%. This positive reaction was driven by double-digit revenue growth of 13.1% yoy, excluding sales of part of the business. In addition, 3D Systems reduced its net loss by almost three times, and the revenue forecast for 2022 was increased by 10%.

Source: Tinkoff Investments Source: Tinkoff Investments Align Technology (NYSE: ALGN). Capitalization - 32.4 billion American company Align Technology is a manufacturer of medical equipment for dentistry and orthodontics. The patented Invisalign bite treatment system is based on the use of transparent removable orthodontic caps, which are printed on a 3D printer individually for each client.

The company is headquartered in Silicon Valley and has a rapidly growing branch network covering Russia, Mexico, Costa Rica, the Netherlands, Australia and Japan.

Digital orthodontics is rapidly evolving, and Align Technology is not going to give up just yet. The percentage structure of revenue for 2021 is distributed as follows: 80% - sales of Invisalign products, 20% - sales of intraoral scanners and other dental equipment.

Source: Tinkoff Investments Source: Tinkoff InvestmentsHP Inc. (NYSE: HPQ). Capitalization - 39.7 billion. The company does not specialize in the production of 3D printers, but is still one of the leaders in the additive printing market.

In 2014, HP developed Multi Jet Fusion 3D powder printing technology to lower the price and speed of industrial 3D printers, and two years later, the first HP Multi Jet Fusion models went on sale.

In 2017, Hewlett Packard introduced the world's first 3D lab for testing various types of additive printing raw materials. And in 2018, it announced Metal Jet technology for 3D printing of industrial quality metal products.

And in 2018, it announced Metal Jet technology for 3D printing of industrial quality metal products.

HP Metal Jet Printer delivers 50 times the performance and significantly lower cost of finished parts than other technologies.

On April 7, 2022, investors were shocked by the news that Warren Buffett had bought $4.2 billion worth of shares in the company. Immediately after the announcement of the deal, HP shares grew by 14.75%.

Compare companies by multiples, growth rates, and R&D spending.

Source: Tinkoff Investments Source: Tinkoff InvestmentsCompany multiples

| Capitalization, billion dollars | P/E | Forecast P/E | P/S | Debt to equity | |

|---|---|---|---|---|---|

| PRLB | 2.56 | 38.00 | 28.00 | 2.81 | 0.01 |

| ALGN | 32.40 | 41.00 | 32.00 | 8.18 | 0.04 |

| DDD | 1. 88 88 | 5.30 | 5.00 | 2.88 | 0.60 |

| HPQ | 39.70 | 6.80 | 8.70 | 0.69 | −3.58 |

Capitalization, billion dollars

PRLB

2.56

ALGN

32.4

DDD 9008

0002 HPQ

39,7,000

Algn

32

HPQ

8.7

PRLB

2.81

Algn

8,18

DDD

2.88

HPQ

0.69

equity

PRLB

0.01

Algn

0.04

DDD

3%)

3%) 2019

458 (+2.69%)

2020

434 (−5.24%)

200003

488 (+12.44%)

2019

2406 (+22 %)

2020

2471 (+3%)

2021

3952 (+60%)

2019

636 (−8%)

2020

557 (−12%)

2021

615 (+10.4%)

2019

58 760 (+1.3%)

2020

56 630 (−3.62%)

2021

63 000 (+11.25%)

Help growth, million dollars

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| PRLB | 63 | 50 | 35 |

| ALGN | 442 | 1775 | 772 |

| DDD | −69 | −149 | 322 |

| HPQ | 3152 | 2884 | 6503 |

2019

63

2020

50

2021

35

2019

442

2020

1775

2021

772

2019

−69

2020

−149

2021

322

2019

3152

2020

2884

2021

6503

R&D costs, as a percentage of revenue

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| PRLB | 7. 2% 2% | 8.5% | 9.0% |

| ALGN | 6.5% | 7.1% | 6.3% |

| DDD | 13.1% | 13.3% | 11.2% |

| HPQ | 2.6% | 2.6% | 3.0% |

2019

7.2

2020

8.5

2019

6.5

20200003

7.1

2021

6.3

2019

13.1

2020

13.3

2021

11,2,2

2019

9000

2020 9000 9000

2.6

Summarizing the data, several conclusions can be drawn:

- All companies are profitable, with the exception of DDD, which received a one-time profit in 2021 through the sale of non-core assets.

- ALGN and PRLB have the lowest leverage.

- All companies are growing.

- DDD has the highest R&D spending and the lowest revenue growth rate. Investors should pay attention to this.

What's the bottom line

Modern 3D printers can significantly reduce time and costs when solving geometry control and reverse engineering problems in the automotive, aviation, mechanical engineering, shipbuilding, jewelry and medicine industries.

However, in any industry, especially in a start-up one, it is necessary to carefully select companies for investment, since you can always get on a promising, at first glance, start-up, whose management, carried away by development costs, will not be able to turn a profit.

Review of leading companies in the field of 3D printing services / Sudo Null IT News

I got the impression that in Russia there is a stereotype that there are only two ways to make money on 3D printers:

1) Become a dealer of an international company / set up the production of your own 3d printers

2) buy several 3d printers and take orders from architects/doctors/military

0660 designer people are lower than it seems, and the future, which is unevenly distributed / distributed not quite in Russia, is already here.

Under the cut you will find a brief overview of the three giants of the European and American 3d printing industry, which do not specialize in the production of their own 3d printers, but develop communities, create a "marketplace", act as platforms for startups, designers, etc. After the review of the "big three" follows a review of the most interesting projects created around these giants.

After the review of the "big three" follows a review of the most interesting projects created around these giants.

Some projects are commented by Konstantin Ivanov (consst), who attended European (3DPrintShow) and American (Inside 3D Printing) conferences.

Three giants in 3D printing marketplaces from USA and Europe

www.shapeways.com

en.wikipedia.org/wiki/Shapeways

The company, organized in 2007 in the Netherlands (originates from the Philips business incubator), but is headquartered in New York. The company employs 90 people. At the moment, it has attracted about $40 million in investments. It has two full-fledged productions in the Netherlands and in New York. The number of ordered products has exceeded one million.

Konstantin: “World and US market leader Shapeways. Successfully located its head office in Queens, NY, becoming a Mecca among the creative people. For a pretty decent history of its existence, Shapeways has gathered a huge community of designers, at the end of 2013 - 300,000 people.Of course, the number of active and prolific designers is much smaller, but the total number and products on the marketplace cannot fail to impress.

With each of the active designers, Shapeways community managers (they are usually called community managers, which is rather rare in Russia so far) work a lot, communicate, and help resolve any issues: high-quality photography of products, placement on the marketplace, correction of 3d models. In general, the community is the heart of Shapeways.

The huge knowledge base they have collected on the forum and in the Tutorials sections on the site allows you to find the answer to almost any question that arises when working with 3d models for printing. Storehouse of knowledge.

Some of the people from Shapeways (former community managers, production managers) are already creating their own separate businesses in the field of 3d printing. Shapeways encourages and develops an entrepreneurial culture.

However, competitors really, really dislike Shapeways for dumping the market.

Indeed, their prices for 3d printing from many different materials are almost always lower than competitors from Europe. They can afford it, with so many investments involved)

Shapeways have created and are developing an excellent powerful API for developers of various online 3d model customizers, which can also be made through them. As a result, in addition to the marketplace, they work as a production and API, which is very convenient.

They have completely stopped delivering to Russia since last year, citing problems at customs. By the way, I must say that the experience of ordering 3D printing from them in NY is also not ideal: they missed the delivery time for samples, I had to write to support, but the issue was quickly resolved.”

Some videos and articles in English for a deeper understanding

Video about the company. Keanu Reeves is there too.

Number of unique pieces made from 2008 to 2013

Founder Peter Weijmarshausen

Forbes article (10/10/2011)

Wired article by Bruce Sterling (10/3/2011)

BusinessInsider article (12/19/2012)

Petermarijhausen speech on TechCrunch

Another performance by Peter Weijmarshausen

www. sculpteo.com

sculpteo.com

en.wikipedia.org/wiki/Sculpteo

French startup launched in 2009. Raised several million investments, has a small fleet of its equipment

Strengths: a very interesting online service, with the ability to not only analyze your model, but also prepare it online for printing. There is a mobile application 3DPcase

Konstantin: “French guys who started after Shapeways was on the market. Small team, own small production (industrial 3d printers) in Paris.Like many other players in the market, part of their production capacity is outsourced. This is quite logical, since to control a huge production, including from metals, ceramics, etc. - Pretty messy story.

Quite often you can meet them at exhibitions. The last time, while talking with them at 3DPrintShow in London and Inside3DPrinting in New York, the guys shared their opinion on the pace of market development in Europe and the USA and a little more about competition in Europe, where Shapeways is also actively going.

The main focus of Sculpteo's development is applications, their own online software for calculating, correcting and even preparing 3d models for printing. This is very impressive, none of the competitors do this. For comparison, Shapeways uses only half of its software, the second part is Netfabb's software.

Sculpteo is great for those who are already quite proficient with 3d models and use 3d printing for prototyping.

The team is also developing its API. Delivery to Russia, according to the director of the company Clement, they do, but in fact this is not possible.”

Once they kept their blog on Habré, with some quite useful articles, for example, a translation of an article about the “Industrial Revolution” 1, 2, 3, 4, 5.

Konstantin: has an office both in Belgium and, for example, in Ukraine. The main activity is prototyping of industrial, engineering, medical, aviation, etc. products.However, the company also has its own consumer direction, which was named i.

Materialise. The marketplace and community are also being developed. If you look closely, they very much follow the example of their American colleagues, up to copying interface elements, which is quite logical - the usability in Shapeways is really very good.

Recently launched the so-called Boutiques, separate shops for selected designers. Continue their movement to the consumer segment.

A number of important advantages: its large production with the most experienced staff and a large number of different technologies, printers and post-processing. Completely own software that works well with models (but no better than Sculpteo does). And, of course, the API, which they are actively developing and connecting more and more partners to it.

I also offer a white label option for companies that don't want their customers to know exactly where their products are made.”

A little video about projects Materialise

Videos with TED (in English)

How the largest stereolithographic machine

9000Print clothing

How to earn 3D-printer.

Aggregators:

3DHubs.com - allow owners to register their 3d printer in the database. Thus, it becomes possible for any person to find either the nearest 3d printer, or exactly the printer that is needed (all over the world).

Plus, they can collect useful statistics and publish monthly trend reports. They take a commission of 15-20%

Konstantin: “I was introduced to the founders of a fairly recent startup 3dhubs by one of the investors from the London fund, who also invested in the company. Brian and Bram came up with and are making a great international story that actually makes life easier for those who need to print something “close to home”.The service works all over the world and even a little in Russia. The guys are attentive to the customer service inside, help each client if one of the hub owners has problems with printing. Very comfortably.

Coming to each new city or exhibition, they do the so-called unlock of the city and open new hubs with printers there.

This was also the case at the exhibition in London last year.”

makeXYZ.com

Texas Entrepreneurs Project. Allows you to search for 3d printers and 3d designers. Received investment from Intel.

Standing on the shoulders of giants

www.sols.co

Allows you to create personalized insoles.

Konstantin: “A great example of how, growing inside a small start-up company, Sols founder Kegan Schouwenburg caught the entrepreneurial spirit and started her own project for the production of custom orthopedic insoles made using 3d printing!Kegan was one of the people who did the entire Shapeways production from scratch, which is a really big job.

Her company has now raised about $8 million in funding from the same investors who invested in Shapeways and is actively building its business. At the same time, he uses polyamide (nylon) for the manufacture of the base for the insoles and makes all samples using Shapeways.

Proper collaboration and collaboration.”

mixeelabs.com

An online application that allows you to create figurines ($25), molecules, key chains for dogs, cufflinks and wallets for cards.

Konstantin: “Second success story in the 3d printing business, also from a former Shapeways employee. Nancy Yi Liang is the founder of product customizer Mixeelabs, who makes money from his brainchild and lives in New York.At our last meeting with her, she told how well things are going with the sale of her products from the site (80% of sales), a little worse from the Shapeaways marketplace (20% of sales), but at the same time, the very first viral effect gave her the same Sad Keanu, which she invented and distributed perfectly everywhere.

Her project is a great example of how, having come up with an interesting and rather viral thing, you can earn money on it in the long run.”

joshharker.

com

Joshua Harker — Artist, sculptor, musician, digital adventurer, imagination architect, troublemaker

Konstantin: later he went into business, opened his own company, developed his own unique and recognizable style (which was later copied by many others) and showed how to effectively apply new design approaches to 3d printing.I could not resist and decided that the worse we are, we will make one for ourselves. Here is the result:

www.minetoys.com

For all Minecraft fans. Prints your character from the game.

www.twikit.com

The service allows you to customize gifts and jewelry made of plastic and metal.

n-e-r-v-o-u-s.com

Konstantin: “Nervous are practically gods in 3D printing design, they come up with new shapes and structures and constantly amaze.

In addition to the beautiful futuristic design, they came up with an incredible online thing that creates amazing kinetic structures right in the browser, right in front of you.All this is flexible and allows you to actually make wearable objects made using 3D printing.

Photos of works from Nervous System

Octopussy which I myself printed a year ago (report on Habré)

Blokify.com

A mobile application that makes it very easy to create a 3d model and send it to print. Convenient for working with children.

Video and a couple of photos

draw

materialize

WhiteClouds.com

»Submit your ideas (even on a napkin). We will bring them to life."

The company does not require its customers to be able to handle a computer: you can send a simple sketch made by hand, and the company's specialists will turn it into a digital three-dimensional model, print it on a 3D printer and send the finished product to the customer.Once, they even sent a cardboard model to the company, asking them to print a copy on a 3d printer, and the order was completed.

Portfolio under the spoiler

A little zombie:

Russian projects

8

The following picture speaks eloquently about the state of affairs in Russia:

3D Printing Map of the Worldparable on the topic

One company once sent a shoe salesman to an African city.

Shortly after arriving in Africa, he wrote to the office:

“You can take me back. Here everyone walks barefoot.

They returned him to his homeland.Then they sent another shoe seller.

Almost immediately upon arrival, he sends an urgent telegram to the office:

“Send all the shoes you have.Here everyone walks barefoot!

zdravprint.ru

A service for the creation of individual fixators, which are printed on a 3D printer and are designed to replace plaster at certain stages of recovery.

Konstantin: “My good friend Fedor Aptekarev at the last Yandex Startup Camp launched a project to create plaster using 3d printing. With such a cast, the fracture can be endured a little easier.”What awaits us in the future

Me : Konstantin, while collecting materials for this post, I came across some skeptical statements by highly respected people (for example, the director of Epson) about the future of 3d printing, but you, in turn, You have been actively developing this industry in Russia for a year already, holding training seminars, developing a community, holding competitions for designers, planning to launch an API for your project, what is the basis for your confidence that this is worth doing?

Konstantin: Glad you asked.Let's clarify what exactly the head of Epson said. Something like this: “There is no big future for plastic 3D printing at home. We will only make commercial 3D printers.” He talks about building an industrial design printer. Epson itself is going to develop industrial printers. And I completely agree with them.

In my opinion, industrial 3d printing technologies, which we also use, can really bring 3d printing to a new consumer level. Here you need to immediately make a reservation that the head of Epson is talking about home printing, but he only means FDM technology (plastic filament melting), as the most popular home 3d printing technology. At the same time, do not forget that after the end of the patent for SLA technology (stereolithography), for example, a completely “home” Formlabs 1 printer appeared, which gives a very acceptable quality. Yes, of course, it can not be compared with the industrial one.

I'm talking about the fact that rather than home 3d printing, there is no future, but FDM technology.

She will live herself. It is suitable for too narrow an application and the quality is very, very low.

I am sure that what we are doing now will create (and is already creating it abroad) a new market and new opportunities for consumers and designers, will speed up the solution of many problems and, of course, will become more accessible. Confidence is fully confirmed by the facts, the results of communication with colleagues from abroad and in Russia, and, of course, by the numbers, which are constantly growing.

Me: Konstantin, having talked to the CEO of the world's leading companies and "having been in the future for a bit", what will the world expect in the coming years?

Konstantin: In the very near future, I can say with complete confidence, the following awaits us:

- the widespread integration of the "print on a 3d printer" button into all conceivable and unthinkable applications, programs, games, and so on. We will print both in 3d printing services and for enthusiasts on home 3d printers- the end of patents for the main industrial 3d printing technologies (SLA (already), SLS, 3DP, DMLS) will lead to a more serious development of smaller and less expensive printers, respectively, the growth of both industrial technologies and quality will also skyrocket

- Google , actively introducing 3D scanners into their phones, will also contribute to the growth of the market, since many people will have the most important thing for the market - a model for printing.

Learn more