3D printing manufacturers in india

Popular Construction 3D Printing Companies In India

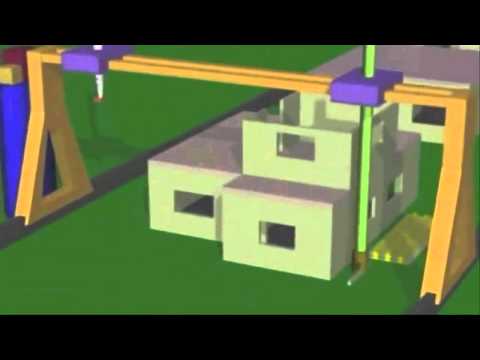

Above: Construction 3D Printing Ecosystem in India/Source: Manufactur3D3D printing is a novel method of constructing structures. It enables users to build objects from the ground up using a digital file. Lately, 3D printing in construction is gaining wide popularity and we are witnessing a rise in the number of construction 3d printing companies in India.

If you’re looking for a resource to know about India’s entire construction 3D printing ecosystem, look no further!

Contents

- 1 Top Construction 3D Printing Companies in India

- 1.1 3D Printer Manufacturers

- 1.1.1 Tvasta

- 1.1.2 DELTASYS E FORMING

- 1.1.3 Simpliforge Creations

- 1.2 Top Construction 3D Printing Materials Manufacturers

- 1.2.1 MYK Laticrete

- 1.2.2 Sika

- 1.3 Legacy Companies exploring Construction 3D Printing in India

- 1.3.1 L&T Construction

- 1.3.2 Godrej Construction

- 1.

3.3 India Cements

- 1.4 Construction 3D Printing Service Providers in India

- 1.4.1 Hamilton Labs

- 1.4.2 Ekaksha Robotic Abstracts Limited

- 1.1 3D Printer Manufacturers

- 2 Conclusion

Top Construction 3D Printing Companies in India

3D Printer Manufacturers

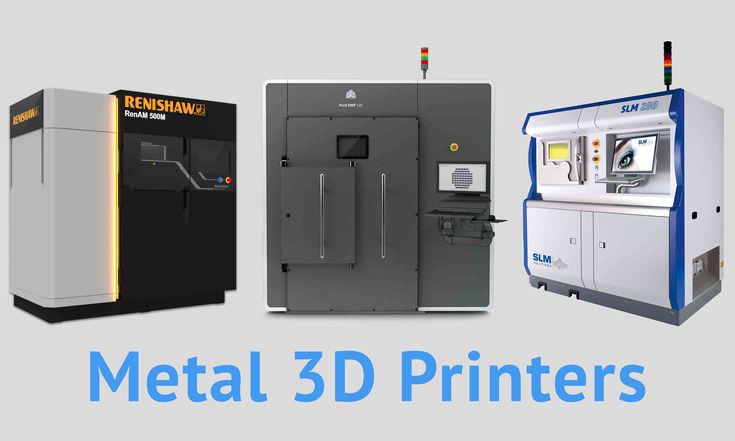

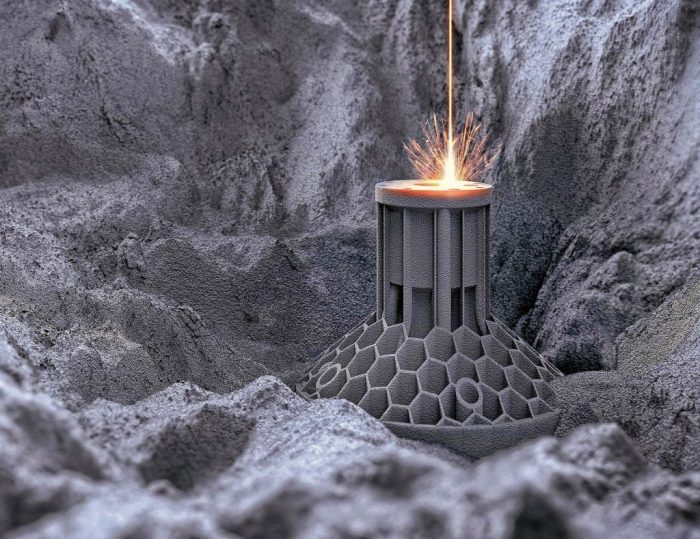

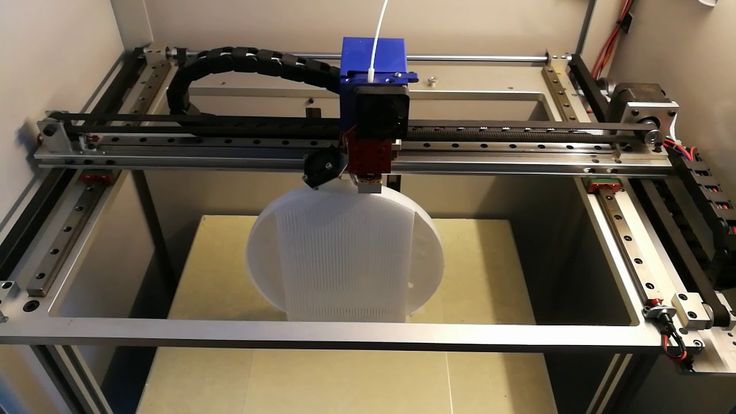

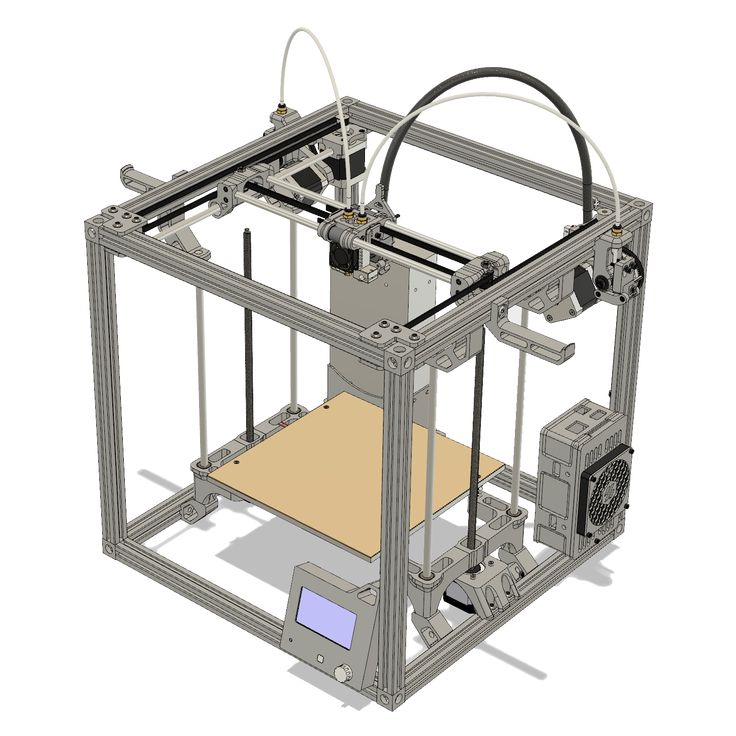

Above: DELTASYS E FORMING concrete 3D printer built for IIT Bombay/Image Source: DELTASYS E FORMINGAs of today, there are at least three construction 3D printer manufacturers in India. There are multiple kinds of 3D printers, namely, gantry-style, D-shape and Robotic-arm style. In India you will find the Gantry-style and Robotic Arm style being developed and sold commercially.

Below are the three Startups developing Construction 3D Printers in India.

TvastaTvasta, an IIT-Madras alumni startup, is the most popular construction 3d printing companies in India. It is a 3D printer manufacturer that has completed numerous projects for well-known clients. Despite the fact that the majority of these projects were for capability testing, they are quite remarkable.

Despite the fact that the majority of these projects were for capability testing, they are quite remarkable.

Some of its most popular projects have been the 3D printed house on the campus of IIT Madras, 3D printed houses for the Indian Army, and the recently completed 3D printed Bus Shelter developed in collaboration with Godrej Construction.

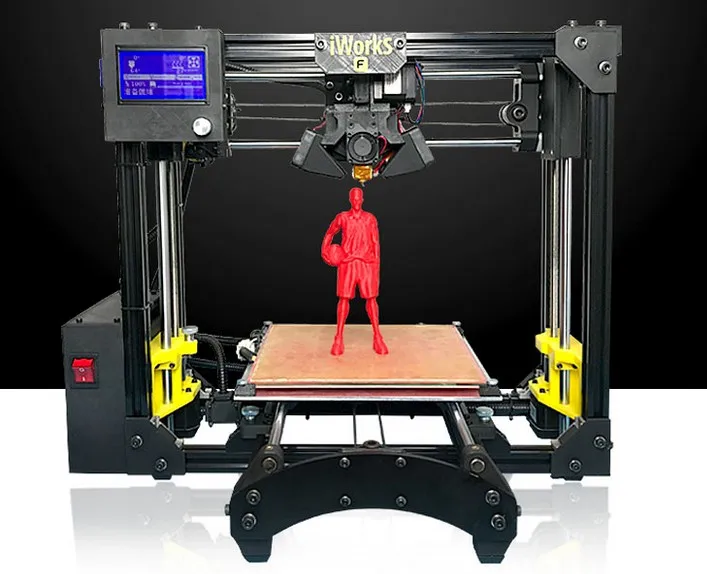

DELTASYS E FORMINGDELTASYS E FORMING, founded in 2018, is an emerging 3D printer manufacturer based in Belgaum, Karnataka. The company produces a wide range of 3D printers such as FDM, DLP, and Pellet-extrusion printers, as well as building and selling Construction 3D printers.

This rapidly growing company has already sold more than six concrete 3D printers in India, with multiple orders still pending fulfilment. IIIT Bombay, IIT Guwahati and IISc Bengaluru are among the notable customers of their concrete 3D printers.

Simpliforge Creations is another 3D printing startup that started as a service provider but has since expanded into the development of construction 3D printers. Simpliforge Creations is based in Hyderabad, India’s upcoming 3D printing hub, is developing a robotic arm 3D printer.

Their current 3D printer, claimed to be the largest robotic concrete 3D printer in India, can create structures up to 7m in size. Apsuja Infratech (Charvitha Meadows) and the company have collaborated to create a new-age gated community project in Telangana.

Top Construction 3D Printing Materials Manufacturers

Above: Construction 3D Printing/Image Source: Sika GroupConcrete 3D printers use a type of cement that differs from traditional concrete. To maintain control over the whole process and ensure ideal performance, companies usually develop their own materials, but not always. Sometimes they rely on material experts who can collaborate and develop a material that satisfies the printing hardware and suits the regional atmosphere where the material will be used. The material mostly is a complex mixture of Portland cement, fillers, plasticisers, additives, etc.

The material mostly is a complex mixture of Portland cement, fillers, plasticisers, additives, etc.

There aren’t many companies offering concrete 3D printing materials manufacturers in India but we list down the top two companies specialising in these materials.

MYK LaticreteMYK Laticrete, a collaboration between LATICRETE International in the United States and the MYK Group in India, creates 3D Mortar (concrete material for 3D printing). It has an advanced R&D centre that evaluates tile and stone installation materials against multiple industry standards in order to provide customers with technical solutions. This is the first of its kind in the building materials industry, developing products to meet the needs of the global market.

MYK Laticrete has already developed a 3D printing-specific material and is available in India.

SikaSika AG is a Swiss company that works in the construction industry. Sika has been researching 3D construction printing (3DCP) technology for quite some time. Along the way, it has obtained 7 patents on printing processes, developed novel materials, and additives for 3D printing. The patents demonstrate its expertise and scope of operations, which include not only materials but also the technology and process to ensure a successful outcome.

Along the way, it has obtained 7 patents on printing processes, developed novel materials, and additives for 3D printing. The patents demonstrate its expertise and scope of operations, which include not only materials but also the technology and process to ensure a successful outcome.

Its scope spans the entire 3D printing ecosystem, including the development of unique 3D mortar formulations, concrete technology and mixture design, on-demand coloration technology, the development of precise printheads, CAD and technical design support, automation, and much more.

Sika AG also has a subsidiary in India, Sika India.

Legacy Companies exploring Construction 3D Printing in India

Above: L&T Construction portfolio/Source: L&T ConstructionIn addition to Startups, several legacy companies are investigating construction 3D printing in India. These Indian companies are partnering with Startups to experiment with 3D printers and materials to test the technology’s capabilities. The goal is to assess the potential and develop a business case for the future.

The goal is to assess the potential and develop a business case for the future.

We take look at a few of these legacy construction firms that are interested in 3D printing.

L&T ConstructionL&T Construction is one of the largest construction companies in India and the construction arm of the Larsen & Toubro conglomerate. It has collaborated with COBOD International, a Danish innovator and manufacturer of 3D construction printers and bought their 3D printer – a first in India. L&T used COBOD’s BOD2 printer to construct a two-story building in Tamil Nadu as part of the collaboration. For the material, L&T created a special concrete mix for 3D printing out of locally available regular construction materials.

Godrej ConstructionGodrej Construction has been investigating 3D printing for some time, and it recently collaborated with Tvasta to build a concrete 3D printed bus shelter at its Mumbai plant. Godrej Construction and Tvasta together created a sustainable concrete mix for the bus shelter that included 30% recycled concrete aggregates (RCA) sourced from concrete waste debris and recycled at the Godrej Recycled Concrete Plant in Vikhroli, Mumbai.

Godrej Construction and Tvasta together created a sustainable concrete mix for the bus shelter that included 30% recycled concrete aggregates (RCA) sourced from concrete waste debris and recycled at the Godrej Recycled Concrete Plant in Vikhroli, Mumbai.

The pilot project assisted the company in better understanding the technology, which it is now optimising in order to develop a commercially viable technology.

It’s still too early to comment on how Godrej intends to leverage the technology but once a business case is established, it scale-up the use of the 3DCP technology.

India CementsTvasta and India Cements, a Chennai-based cement manufacturing company, signed a memorandum of understanding (MoU) for a technology partnership earlier this year. The partners will work together on dedicated research and development activities as well as the development of raw material formulations for 3D printing applications. They will also collaborate closely on key projects to develop and deliver affordable housing solutions. Both companies plan to use technology to create sustainable building solutions such as 3D printed houses or structures.

Both companies plan to use technology to create sustainable building solutions such as 3D printed houses or structures.

Construction 3D Printing Service Providers in India

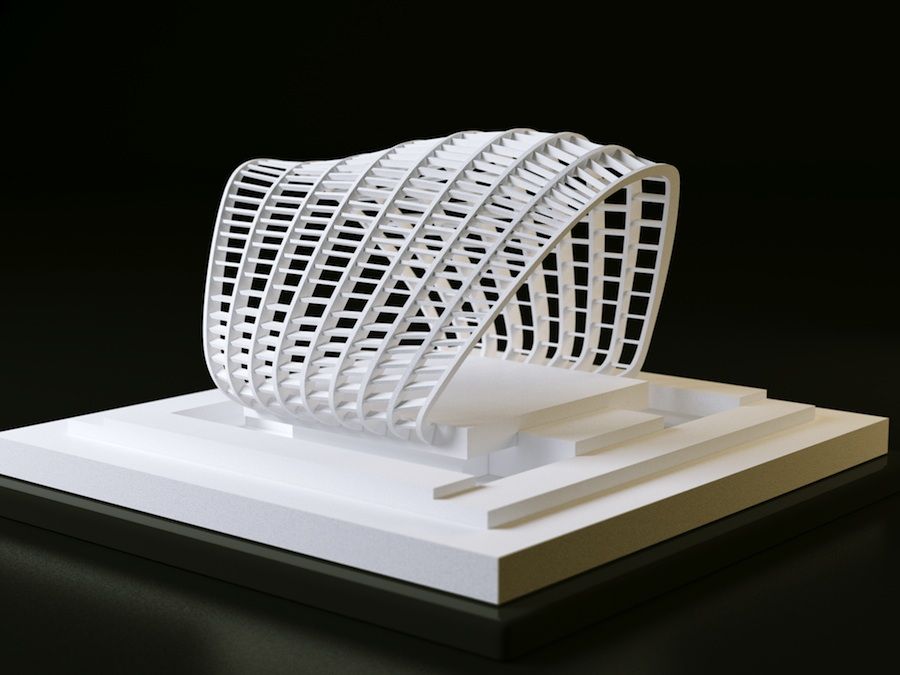

Above: Service providers help in building a clients construction projects/Source: COBODReal estate developers are constantly on the lookout for new building techniques that will not only save them money and time, but will also be an attractive selling proposition. And 3D printing fits seamlessly into the narrative. It is not only sustainable and one-of-a-kind, but also quite strong for ground-level structures like toilets, single room homes, bus shelters, etc.

As a result, these real estate companies can always collaborate with construction 3D printing service providers to build their designs to generate curiosity and buzz around their new residential or commercial project.

Unlike other technologies which are much more developed and comparatively easier to operate for service providers, the construction 3D printing technology is big and messy and thus a service provider ecosystem is nearly absent.

As a result, all technology manufacturers, including Tvasta, DELTASYS E FORMING, and Simpliforge Creations, offer such services. Besides these manufacturers, India has two more construction 3D printing service providers.

Hamilton LabsHamilton Labs, the Singapore-based complete construction 3D printing solutions provider, was among the first to enter the Indian market. It primarily serves as a service provider but has also developed its own gantry-style 3D printer. In 2017, a 3D printed toilet project was carried out in collaboration with NUS, NAMIC and Hamilton Labs to accelerate the production of toilet units in India under the ‘Swachh Bharat Mission’.

Hamilton Labs has formed a number of partnerships with key stakeholders. Laticrete, Saint-Gobain, G-Cast, Ekaksha Robotic Abstracts Limited (more on them below), and others are among their partners.

Ekaksha Robotic Abstracts LimitedEkaksha Robotic Abstracts is a public company based in Mumbai that provides complete 3D Construction Printing services. It is a new company, but they have partnered with Hamilton Labs.

It is a new company, but they have partnered with Hamilton Labs.

They provide three services: pre-construction planning, architectural models, and construction management.

Conclusion

With this comprehensive article, you should have a good understanding of the construction 3D printing ecosystem in India. Though small, the ecosystem is expanding and gaining popularity in India. It is currently difficult to estimate the size of this market in India because most companies are working on pilot projects, research institutions are experimenting and developing materials, and legacy companies are investigating the feasibility and future potential.

The sector is expected to see significant investments over the next five to ten years, followed by growth in adoption over the next decade or so. It will be interesting to see if the Government of India approves the use of this technology for its social welfare and infrastructure development schemes.

The global construction 3D printing market is also growing rapidly and you can check out the top construction 3D printing in the world to know more about them.

(In case you want to connect with any of these companies, mail us at [email protected])

About Manufactur3D: Manufactur3D is an online magazine on 3D Printing. Visit our Indian Scenario page for more updates on 3D Printing News from India. To stay up-to-date about the latest happenings in the 3D printing world, like us on Facebook or follow us on LinkedIn and Twitter.

Top 8 3D printing companies in India

As the industrial and academic ecosystem changes, the demand for 3D printers in India is rising too. With wide applications in academics, jewelry, industrial prototyping, medicinal implants and prosthetics, 3D printing is quickly becoming both widely available and widely used.

What is 3D printing

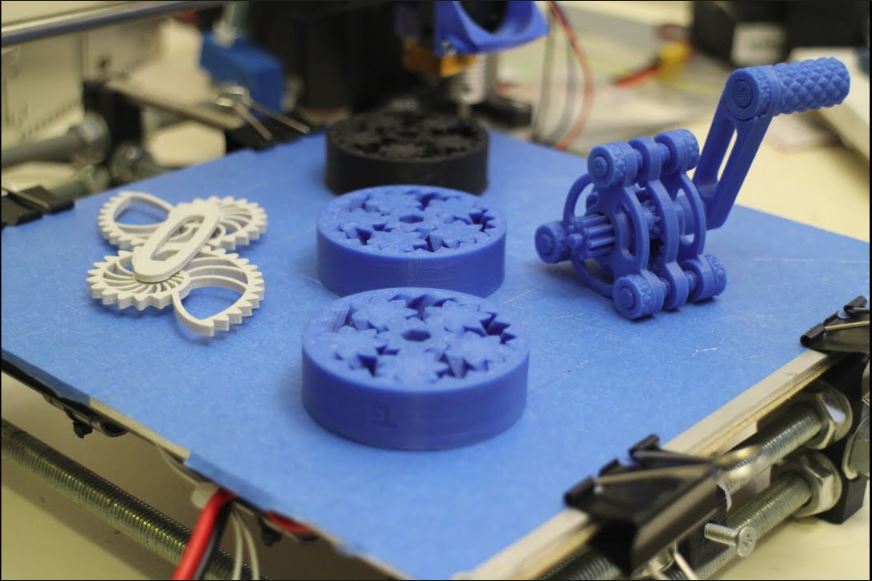

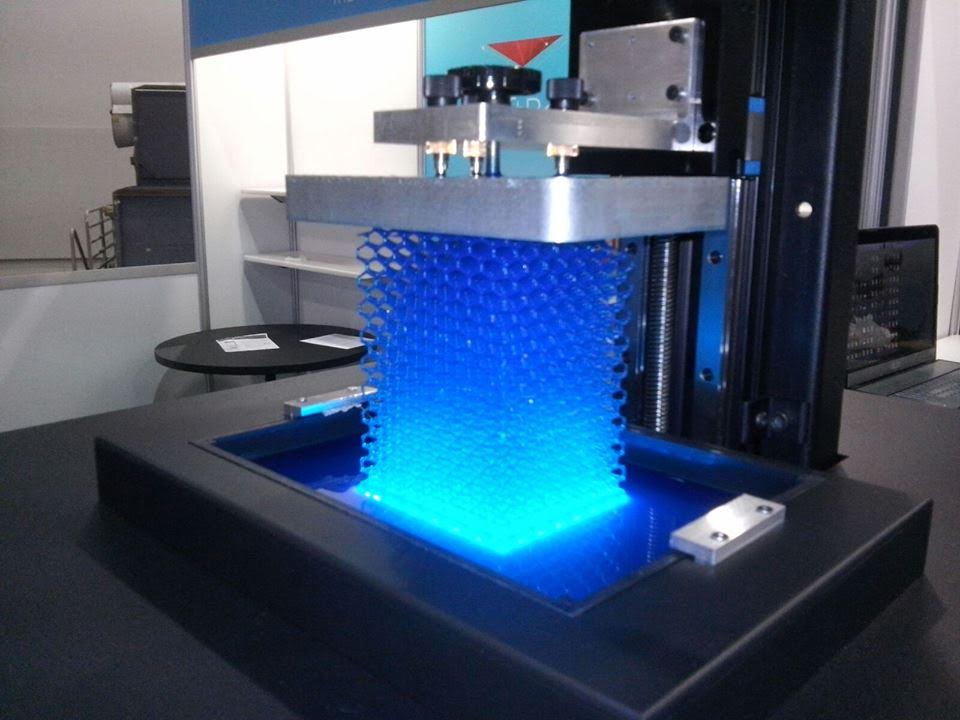

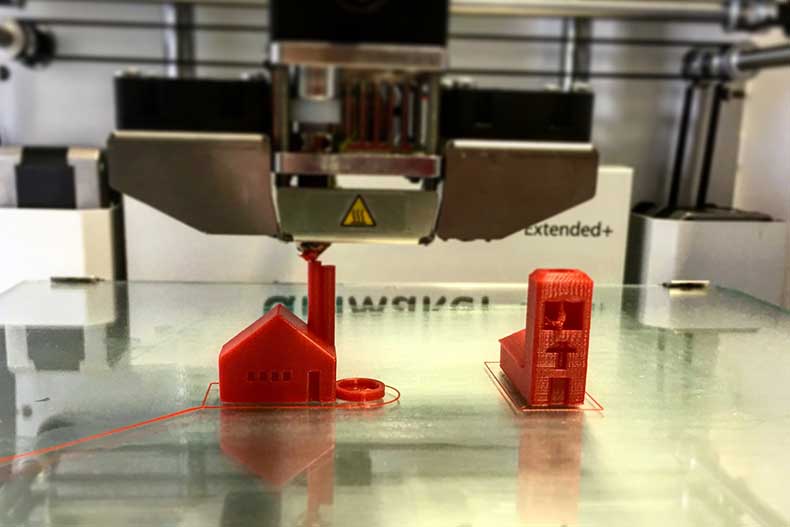

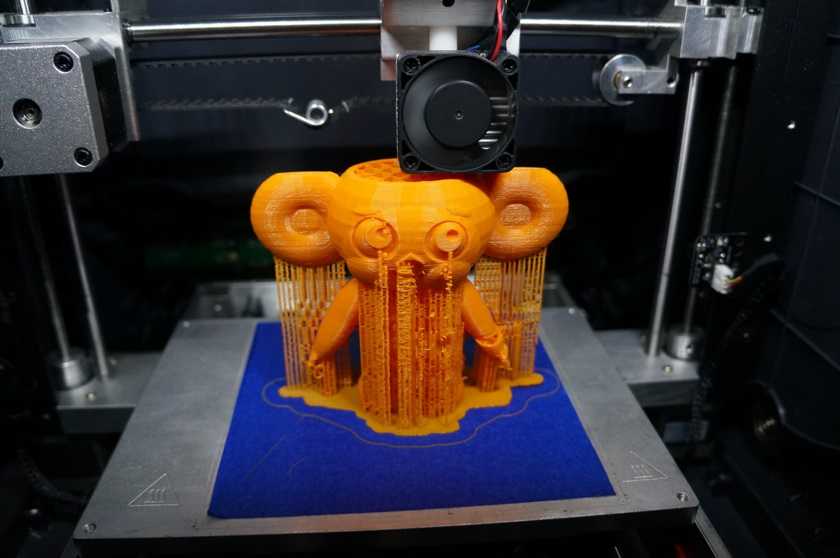

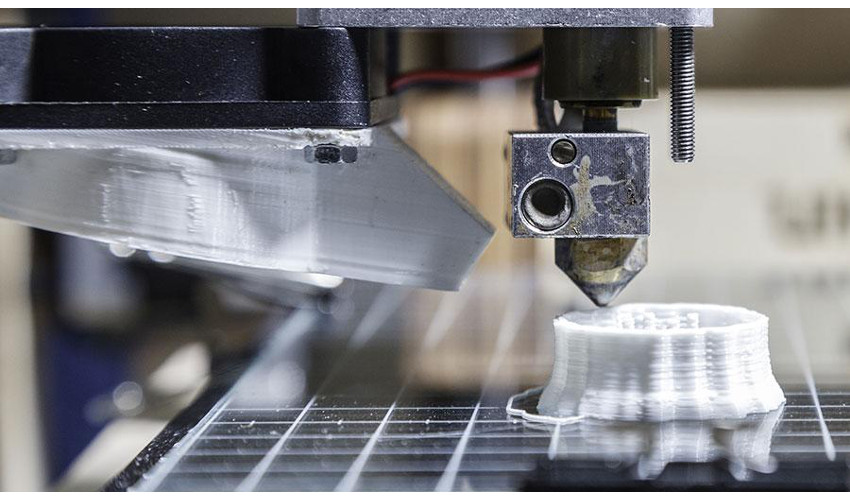

3D Printing is the process where liquid molecules, powder or granulated material is solidified and joined to achieve the desired shape and size in three-dimensions. Normally it’s done one layer at a time to make sure the proportions of 3D are maintained.

Normally it’s done one layer at a time to make sure the proportions of 3D are maintained.

Wikipedia notes that earlier, the term “3D printing” originally referred to a process that deposits a binder material onto a powder bed with inkjet printer heads layer by layer….. (today it) encompass(es) a wider variety of additive manufacturing techniques. United States and global technical standards use the official term additive manufacturing for this broader sense.”

While, the material and equipment were developed through the eighties, Hideo Kodama of Nagoya Municipal Industrial Research Institute is credited with the invention of fabricating a true 3D plastic model.

One of the most popular applications is Rapid Prototyping, where either a small part of a machine or a scale model is created using 3D Printers.

You might want to watch this video below:

Indian 3D printing companies

The following list of the top 3D printing companies includes those companies that manufacture and or distribute 3D printers. Most also offer 3-D printing services and some even conduct training programs for 3D printing.

Here is the list of the top 3D printing companies in India:

1. Brahma3

About: Their recently launched Brahma 3 Anvil is a versatile beast for 3D printing. It has a high resolution – upto 100 microns per layer – and works on LCD as well as with a computer. It supports a large variety of material including ABS (Acrylonitrile Butadiene Styrene) and PLA (Polylactic acid, which is biodegradable). In case you forgot, PLA is a popular bio-plastic used in medical implants as well as for cups.

Brahma3 Anvil can print objects as large as 240mm x 240mm x 240mm. That’s about the size of a football!

That’s about the size of a football!

Website: Brahma3

Website review: The website is tiny when it comes to images and content. Without additional content, it’s difficult to understand more about them.

2. JGroup Robotics

About: JGroup offers 3d printers, on-demand services, 3d printing material and 3d printed products. This means they offer the entire range of products and services that you can expect from one of the top 3d printing companies in India.

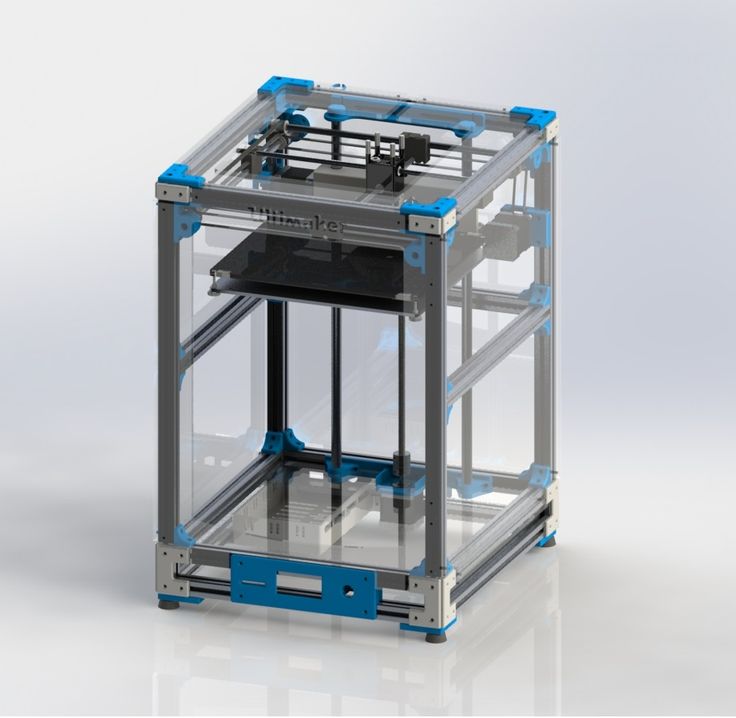

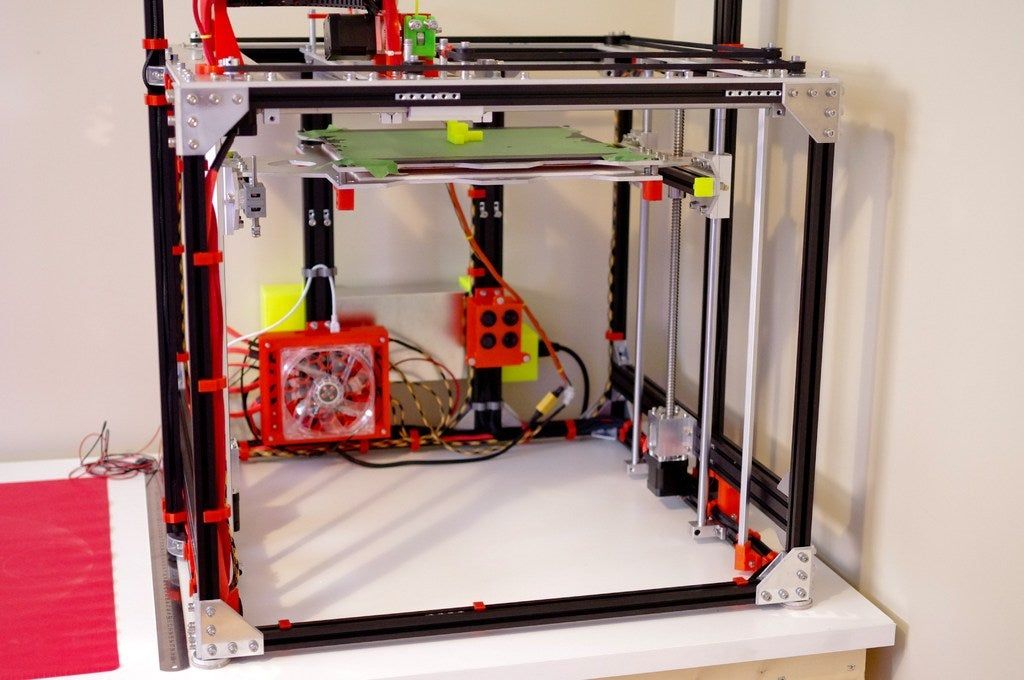

Apart from offering 3D printers, JGgroup Robotics also offers printing services, 3D printing material and 3D printed products. Of the many printing methods available, its printers rely on Fused Deposition Modeling (popularly called FDM).

This technology uses thermoplastic filament that are heated and extruded. Each of these ultimately create a three dimensional object.

They used to offer online courses, but currently there are no details available on the website.

Website: JGroup Robotics

3. Stratasys India

About: Launched in April 2015, Stratasys 3D Printing Experience center is the the Indian arm of Stratasys global. It features both FDM and Polyjet technologies.

According to the company websites, the Centre “exhibits Stratasys’ comprehensive range of 3D printing materials – PolyJet photopolymers and FDM thermoplastics.” Their objective is to help test new products and design finished products.

They have listed Honda, Siemens, Airbus, Volvo, Lockheed Martin and Audi as their customers.

4. Altem

About: Altem Technologies Pvt Ltd, head-quartered in Bangalore, uses Dassault Systems’ 3D Experience Platform to provide cutting edge solutions, mainly ENOVIA, CATIO, and DELMIA.

Recipients of the Frost & Sullivan 2017 Award for innovation in 3D printing, Altem boasts of clientele in sectors as diverse as ng automobile, architecture, aerospace, defense, medical, consumer durable, electronics and so on.

Founded in 2010, Altem recently joined hands with ARTEC3D to sell 3D Scanners. They are also distributors of Stratasys printers since 2010.

5. Think3D

About: Since the company is headquartered in Singapore, in this list Think3D will classify as a multinational with Indian presence. Founded by BITS graduates, Think3D also sells 3D Scanners and 3D Filaments in addition to 3D Printers, both desktop and industrial. It also offers customized training programs for schools selected for Atal Innovation Mission (AIM). Its client list appears to be the largest among all companies in this list, from Microsoft, Shell and Pepsico to Indian Navy and ISRO.

6. Novabeans

About: Founded in 2014, Novabeans today has offices in Gurgaon, Delhi and Paris, in addition to over 10 resellers and franchisees across India. They are currently authorized resellers of brands like Littlebits, Ultimaker, LeapFrog, ColorFabb and so on. Novabeans runs a special program to provide 3D printers for schools, under its Novabeans 3D Printing for Education Program.

It runs e-Studios that caters to professionals and creative people who’d like to build models for courses, workshops etc.

7. Divide By Zero Technologies

About: They developed their first 3D printer for internal use in May 2013 – and by August the same year, they received their first order for print service. Today, their client list has impressive names: Eicher, Saint Gobain, Hawkins, Mahindra, TVS… Their printers are classified as Desktop, Professional and Industrial, based on capacity, size, specifications and so on. They develop their printers based on their in-house developed and patented AFPM (Advanced Fusion Plastic Modeling) technology.

Awards:

1. World Association of Small and Medium Enterprises (WASME) SME Excellence Award 2017

2. India Design Mark Award 2017 by India Design Council

3. 3D Printing World Award

4. IPF Industrial Excellence Award

8. Imaginarium

About: Imaginarium India Pvt Ltd dubs itself India’s largest 3D printing company. And that doesn’t sound like an exaggeration, given that it has 20 Industrial 3D printers you can choose from. They pride themselves in the fact that product impacts medicine, engineering, jewelery and what not.

With facility that includes SLA, SLS, VC, CNC, Injection Molding and Scanning, they just need a CAD design to convert an idea into a prototype reality.

They offer 140 different materials to work with. Currently, they churn out about 1,600 3D printed items and use up an approximate 150 kg (about 330 lb) metal cast every month.

They have added Imaginarium Precious, an arm that serves the jewellery segment. It accepts your designs online and once the order is ready, the items are shipped to you. Currently, Imaginarium Precious offers product runs in the range of 10-1,000.

Currently, Imaginarium offers shipping only within India.

Website review: The design is close to minimalist and the color combination of the website is light, but that also makes it slightly difficult to read.

Case studies and pages showing details of quality would have further helped them instill more confidence if they are serious about getting orders online.

Their FAQ section is pretty detailed and also covers the basics of Intellectual Property Rights.

Use of 3D printing technology worldwide

Globally, one of the best ways this technology is used is when companies require certain parts or items in very small numbers. Besides that, bespoke manufacturing is fast becoming popular. A good example of bespoke manufacturing would be printing a box with a commercial logo.

Read how 3D Printing is helping fight the Coronavirus.

Forbes reported 7 real-life examples of how 3D priting is actually used. The two most significant uses were printing for prosthetic purpose (human body parts) and low-cost, small houses, though the latter is rather in an testing stage. It also said you could actually print musical instruments of your choice if you had the right design.

It also said you could actually print musical instruments of your choice if you had the right design.

In terms of business opportunity, freelancers are creating and selling designs. online If you’re looking to get, say, a figuring based on your pet dog, you hire a freelancer online. She’ll design the model and email the design to you. You print out the model!

One can safely say there is a wide range of business applications for 3D printing and what we’re seeing today may only be a fraction.

A few lines on how 3D printers work

There are different types of 3D printing technologies out there. However, a few things are common across their working.

First you create a 3D model in your computer, using a 3D modeling software. Alternatively, you can use a 3D scanner to create that model. As of now, 3D scanners that really produce results are expensive.

After that, the printer can take over and produce the object you wanted.

One important thing to note is the 3D modeling software is popularly made to suit a particular industry. Consequently, we have seen a rise in software as well that focus on specific segments and industries.

Consequently, we have seen a rise in software as well that focus on specific segments and industries.

TRUMPF partners with Indian family company Magod Laser to promote 3D printing

Photo courtesy of TRUMPF

Indian family company Magod Laser has joined forces with TRUMPF, one of the world's largest machine tool suppliers and manufacturers of metal 3D printing systems, to promote 3D printing technology in the Indian continent. nine0005

Inspiration from the USA

The story began in 1991 in the USA, where Swami Magod, the current Managing Director of Magod Laser, received his Master's degree in Industrial Engineering. After graduating from university, he continued to work in the USA for several years, and it was here that he first became acquainted with laser technology and heard the name TRUMPF. After gaining extensive experience in the field of laser cutting, he returned to India with the clear goal of saving clients time and cost in sheet metal cutting. nine0005

After gaining extensive experience in the field of laser cutting, he returned to India with the clear goal of saving clients time and cost in sheet metal cutting. nine0005

Magoda Laser

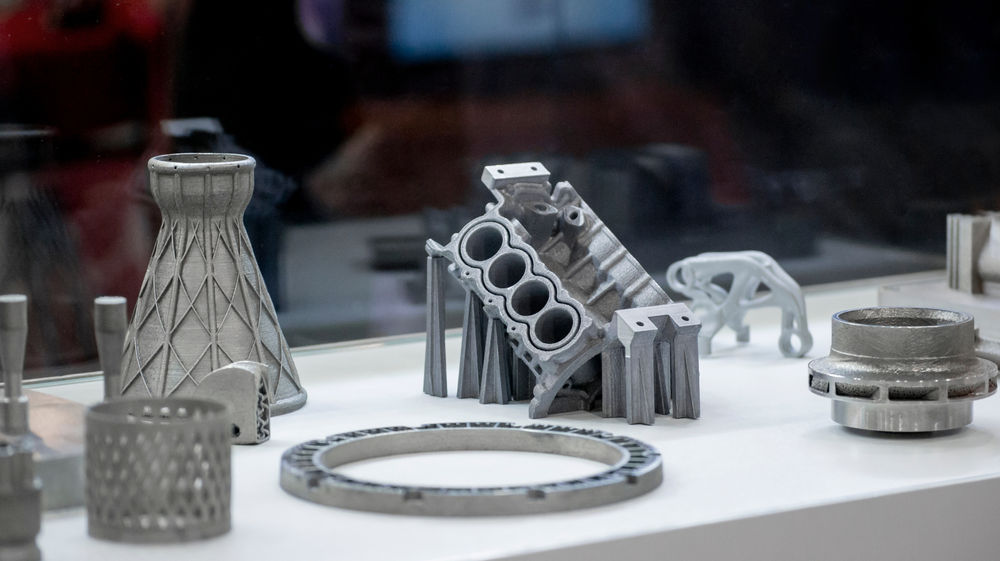

Magod Laser headquarters in Bangalore / Image provided: Trumpf Magod Laser, founded in 1997 in Bangalore, is a synonym for the use of Laser Power technology for industrial . It was the first company in South India to use lasers for sheet metal cutting. With the ultimate goal of making sheet metal cutting faster and more affordable for customers, the company has managed to capture a huge share of the Indian market. nine0005 Today Magod Laser has a total of 25 TRUMPF machines - and is a leader in the development of additive manufacturing in India. Magod Lasers now uses TRMPF additive production systems, such as TruPrint 1000 / Image Credit: Trumpf with the existing preference towards TRUMPF and with positive experience with this computers , Magod Laser purchased the necessary equipment and decided to plunge into additive manufacturing. Swamy came up with the idea when one of her clients asked the team to weld parts with a laser. Swami explained, “Two of our clients have already used 3D printing and they asked us to laser weld parts together. I realized it was time to print the metal parts myself.” TRUMPF supplied the necessary equipment in the form of a TruPrint 1000 and Swamy introduced a combined process that took full advantage of the company's expertise. According to Swamy, “There is a limit to the size of parts in 3D printing, so we offer a combination of additive manufacturing and laser welding. To make larger parts, we just weld a few small parts.” nine0005 A major problem in the Indian AM market is a lack of technology awareness, but Magod Laser is confident of success. Many companies have reportedly already expressed interest in testing technologies spanning industries from aviation to medical devices. Above: Swami Magod and his brother Rajendra at their factory in Bangalore / Image Credit: TRUMPF Of course, there are many good reasons to adopt additive manufacturing. Magod's customers share Magod Laser's enthusiasm for experimenting with different geometries and materials in developing new parts. Magod engineers also make prototypes for companies considering 3D printing their own parts. Magod Lasers invests in the development of its employees / Image credit: TRUMPF Educating potential customers and promoting 3D printing in India is an important step and Magod Laser believes it will take the lead. Magod benefits from having a workforce that is open and willing to learn and this inherent team trait will surely help Magod Laser play a vital role in the Indian additive manufacturing market in the future. Author MANUFACTUR3D Source 1 Source 2 Attention! Need a report that reflects how COVID-19 has impacted this market and its growth? The aerospace and defense 3D printing market was valued at $1,915. The COVID-19 pandemic has affected the aviation industry since 2020, prompting airlines to accelerate the retirement of older aircraft as a cost-cutting measure and are now planning to replace them with new generation aircraft that are relatively lighter and have more fuel. -effective. Several aerospace OEMs are investing in large-scale research projects to expand the use of 3D printed parts and components in next-generation aircraft. In addition, the use of 3D printed parts is also on the rise in the secondary market, as the use of such parts can reduce the burden on traditional supply chains. nine0005 The benefits offered by 3D printing have popularized its adoption in the aerospace sector. 3D printing enables parts to be produced at lower cost, faster lead times, and more digitally agile design and development methods. The use of 3D printing also results in significant cost savings for users and manufacturers. While the adoption of 3D printing in the A&D sector is growing, there are significant challenges that are currently holding back its progress towards mainstream adoption. However, advances in 3D printing technology and materials science are likely to remove most of these limitations, thus spurring the adoption of 3D printing in the aviation industry in the coming years. nine0005 3D printing or additive manufacturing refers to a process in which a material is applied, bonded, or solidified under computer control to create a three-dimensional solid object from a digital file. The report considers the use of 3D printing only in the aviation (civil and military) and space industries. Land and sea vehicles are excluded from the scope of the study. The market was segmented by aircraft, unmanned aerial vehicles and spacecraft applications, and by materials for alloys, specialty metals and other materials. The report also examines the market sizes and market forecasts in major countries in different regions. Report scope can be customized per your requirements. The aviation industry, as well as production and logistics hubs, suffered significant losses in 2019-2020 due to the sudden outbreak of the pandemic. However, the industry is expected to recover during the forecast period. According to the International Air Transport Association (IATA), by 2023, passenger traffic will recover to pre-crisis levels. This is expected to lead to new aircraft purchases as well as demand for aircraft spare parts. Opportunities for aggressive growth and increased work-in-progress due to slow manufacturing capacity due to a lack of technology integration have forced aircraft OEMs to focus on new 3D printing technologies that are expected to save time and money through automation and increased operational efficiency. production. Several aircraft OEMs are incorporating 3D printed parts into their aircraft models. For example, in March 2021, Stratasys received an extension from Airbus to produce 3D printed resin components for aircraft cabin interiors. To understand key trends, Download Sample Report The Asia-Pacific region is expected to record the highest growth in the market during the forecast period. Countries such as China, India, Japan, South Korea and others are investing in research and development of 3D printing technologies aimed at expanding their adoption in the aerospace sector. To understand geography trends, Download Sample Report The aerospace and defense 3D printing market is fragmented due to the presence of aircraft and spacecraft OEMs and Tier 1 and Tier 2 manufacturers that support the aerospace and defense industry in the market. Some of the prominent players in the market are GE Aviation, Airbus SE (Airbus), Safran SA (Safran), Raytheon Technologies Corporation and The Boeing Company. Airbus SE The Boeing Company GE Aviation Safran SA Raytheon Technologies Corporation 1. 1.1 Study Assumptions 1.2 Scope of the Study 1.3 Currency Conversion Rates for USD 2. RESEARCH METHODOLOGY 3. EXECUTIVE SUMMARY 3.1 Market Size and Forecast, Global, 2018 - 2027 3.2 Market Share by Application, 2021 3.3 Market Share by Material, 2021 3.4 Market Share by Geography, 2021 3.5 Structure of the Market and Key Participants 0005 4.1 Market Overview 4.2 Market Drivers 4.3 Market Restraints 4.4 Industry Attractiveness - Porter's Five Forces Analysis 4.4.1 Threat of New Entrants 4.4. 2 Bargaining Power of Buyers/Consumers 4.4.3 Bargaining Power of Suppliers 0002 4. 5. MARKET SEGMENTATION (Market Size and Forecast by Value - USD million, 2018 - 2027) 5.1 Application 5.1.1 Aircraft 5.1.2 Unmanned Aerial Vehicles 5.1.3 Spacecraft 5.2 Material 5.2.1 Alloys 5.2.2 Special Metals 5.2.3 Other Materials 5.3 Geography 5.3.1 North America 5.3.1.1 United States 5.3.1.2 Canada 5.3 .2 Europe 5.3.2.1 United Kingdom 5.3.2.2 France 5.3.2.3 Germany 5.3.2.4 REOUROPE 20408 5.3.3 Asia-Pacific 5.3.3.1 China 5.3.3.2 India 5. 5.3.3.4 Rest of Asia-Pacific 5.3.4 Latin America 5.3.4.1 Mexico 5.3.4.2 Brazil 5.3.4.3 Rest of Latin America 5.3.5 Middle-East and Africa 5.3.5.1 South Africa 5.3.5.2 Saudi Arabia 5.3.5.3 United Arab Emirates 5.3.5.4 Rest of Middle-East and Africa 6. COMPETITIVE LANDSCAPE 6.1 Vendor Market Share 6.2 Company Profiles 6.2.1 Aerojet Rocketdyne Holdings Inc 6.2.2 MTU Aero Engines AG 6.2.3 Moog Inc. 6.2.4 Safran SA 6.2.5 GE Aviation 6.2.6 The Boeing Company 6.2.7 Airbus SE 6. 6.2.9 Raytheon Technologies Corporation 6.2.10 Honeywell International Inc. 6.2.11 American Additive Manufacturing LLC 6.2.12 Lockheed Martin Corporation 7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Poppage into additive production  nine0005

nine0005  The technology opens up previously impossible geometries, paving the way for users to refine and improve their parts. The production of implants for medical purposes is just one example: 3D printed implants are more durable and more successfully fuse with healthy bone tissue. Another advantage of additive manufacturing is that it only applies material where it is really needed, so 3D printed parts are lighter. What's more, any excess powder can be recycled and reused - a much more cost-effective and sustainable approach than traditional processes where up to 80 percent of the material ends up wasted. nine0005

The technology opens up previously impossible geometries, paving the way for users to refine and improve their parts. The production of implants for medical purposes is just one example: 3D printed implants are more durable and more successfully fuse with healthy bone tissue. Another advantage of additive manufacturing is that it only applies material where it is really needed, so 3D printed parts are lighter. What's more, any excess powder can be recycled and reused - a much more cost-effective and sustainable approach than traditional processes where up to 80 percent of the material ends up wasted. nine0005

Hands-on experimentation is key

Seizing the Initiative  Magod Laser is always happy when potential customers and long-term partners can visit their manufacturing facilities to see 3D printing technology in action. He continues: “We are always on the lookout for new technologies to add to our portfolio because learning new things is a key part of our corporate ethos. We take the professional development of our employees seriously. By giving them the opportunity to gain skills in new processes such as 3D printing, we are paving the way for them to move into more responsible roles. Every new technology has a learning curve. After all, we are better off developing our own team rather than bringing in experts from outside, and our employees feel more valued if we invest in their development and gradually give them more responsibility.” nine0005

Magod Laser is always happy when potential customers and long-term partners can visit their manufacturing facilities to see 3D printing technology in action. He continues: “We are always on the lookout for new technologies to add to our portfolio because learning new things is a key part of our corporate ethos. We take the professional development of our employees seriously. By giving them the opportunity to gain skills in new processes such as 3D printing, we are paving the way for them to move into more responsible roles. Every new technology has a learning curve. After all, we are better off developing our own team rather than bringing in experts from outside, and our employees feel more valued if we invest in their development and gradually give them more responsibility.” nine0005

We accept news, articles or press releases

with links and images. [email protected] 3D Printing in Aerospace and Defense Market | 2022-27 | Industry Share, Size, Growth

3D Printing in Aerospace and Defense Market | 2022-27 | Industry Share, Size, Growth - Mordor Intelligence Market Review

Study Period: 2018-2027 Base Year: 2021 Fastest Growing Market: Asia-Pacific Largest Market: Europe CAGR: >24% Market Review

51 million in 2021 and is expected to grow at a CAGR of more than 24% over the forecast period (2022-2027). nine0005

51 million in 2021 and is expected to grow at a CAGR of more than 24% over the forecast period (2022-2027). nine0005

Report scope

Market size and forecasts were presented in value terms (US$ million). nine0005

Market size and forecasts were presented in value terms (US$ million). nine0005

Application Aircraft Unmanned Aerial Vehicles Spacecraft

Material Alloys Special Metals Other Materials

Geography0198

North America United States Canada

Europe United Kingdom France Rest of Europe

Asia-Pacific China India Japan Rest of Asia-Pacific

Latin America Mexico Rest of Latin America 9013 7

Middle-East and Africa South Africa Saudi Arabia United Arab Emirates Rest of Middle-East and Africa  click here.

click here. Key Market Trends

The aircraft segment is forecast to dominate the market during the forecast period

While the previous contract was only for the A350 aircraft, the extension includes the production of parts for several more aircraft platforms, as well as the production of spare parts. In addition to the A350, the company will now supply parts for installation on the A300, A330, A340 and A320 air platforms. In addition, the aging aircraft fleet in the military segment and the formation of demand for the replacement of military aircraft with a modern fleet have overcome the years and created significant market potential. nine0005

While the previous contract was only for the A350 aircraft, the extension includes the production of parts for several more aircraft platforms, as well as the production of spare parts. In addition to the A350, the company will now supply parts for installation on the A300, A330, A340 and A320 air platforms. In addition, the aging aircraft fleet in the military segment and the formation of demand for the replacement of military aircraft with a modern fleet have overcome the years and created significant market potential. nine0005 The Asia-Pacific region is expected to witness the highest growth

Under China's "Made in China 2025" master plan, the Chinese government has highlighted the development of aerospace hardware and 3D printing as key growth drivers for China's manufacturing industry. The last C9 commercial airliner in the country19 is built using several 3D printed components, paving the way for greater adoption of 3D printing technologies in the country. The C919 uses 3D printed titanium parts, 28 cockpit door parts and two air intake structural parts to reduce the weight of the airliner and increase its safety. In the space industry, in 2020, China successfully launched its own-designed space 3D printer aboard the Long March 5B rocket. The 3D printer was developed by the China Academy of Space Technology (CAST) and completed the first microgravity 3D printing tests in space. On the other hand, India is gradually focusing more and more on the use of 3D printing technology, and in cities such as Bangalore, Chennai, Mumbai, Visakhapatnam, etc., start-ups for the production of basic parts for the aerospace and defense industries are emerging.

Under China's "Made in China 2025" master plan, the Chinese government has highlighted the development of aerospace hardware and 3D printing as key growth drivers for China's manufacturing industry. The last C9 commercial airliner in the country19 is built using several 3D printed components, paving the way for greater adoption of 3D printing technologies in the country. The C919 uses 3D printed titanium parts, 28 cockpit door parts and two air intake structural parts to reduce the weight of the airliner and increase its safety. In the space industry, in 2020, China successfully launched its own-designed space 3D printer aboard the Long March 5B rocket. The 3D printer was developed by the China Academy of Space Technology (CAST) and completed the first microgravity 3D printing tests in space. On the other hand, India is gradually focusing more and more on the use of 3D printing technology, and in cities such as Bangalore, Chennai, Mumbai, Visakhapatnam, etc., start-ups for the production of basic parts for the aerospace and defense industries are emerging. Clientele includes the Indian Navy, Air Force, Indian Space Research Organization (ISRO) and Hindustan Aeronautics Limited (HAL). Japanese aerospace companies are also strongly advocating the use of 3D printing technologies as they result in minimal wastage of materials and therefore are in line with their lean manufacturing principles. Japanese firms including IHI and MHI are actively adopting 3D printing technologies to expand their design and manufacturing capabilities for the A&D sector. Such developments are expected to drive market growth in the region during the forecast period. nine0005

Clientele includes the Indian Navy, Air Force, Indian Space Research Organization (ISRO) and Hindustan Aeronautics Limited (HAL). Japanese aerospace companies are also strongly advocating the use of 3D printing technologies as they result in minimal wastage of materials and therefore are in line with their lean manufacturing principles. Japanese firms including IHI and MHI are actively adopting 3D printing technologies to expand their design and manufacturing capabilities for the A&D sector. Such developments are expected to drive market growth in the region during the forecast period. nine0005 Competitive environment

With the growing demand for lightweight components and more cost-effective onboard platforms, companies are actively investing in expanding existing additive manufacturing facilities to take advantage of the growing opportunities. On that note, in July 2021, Burloak Technologies announced the opening of its second additive manufacturing center in Camarillo, California. The new facility is expected to strengthen Ontario's cutting-edge additive manufacturing center. Aircraft OEMs are also increasing their presence in the additive manufacturing market due to the growing demand for 3D printed components. In addition, due to the economic advantages of 3D printing components in the space sector compared to traditional subtractive manufacturing methods, space agencies such as NASA and ESA are currently looking into the possibility of manufacturing spacecraft parts using 3D printing components. It is expected that in the coming years this will allow new companies to enter the market, thereby increasing competition in the market.

With the growing demand for lightweight components and more cost-effective onboard platforms, companies are actively investing in expanding existing additive manufacturing facilities to take advantage of the growing opportunities. On that note, in July 2021, Burloak Technologies announced the opening of its second additive manufacturing center in Camarillo, California. The new facility is expected to strengthen Ontario's cutting-edge additive manufacturing center. Aircraft OEMs are also increasing their presence in the additive manufacturing market due to the growing demand for 3D printed components. In addition, due to the economic advantages of 3D printing components in the space sector compared to traditional subtractive manufacturing methods, space agencies such as NASA and ESA are currently looking into the possibility of manufacturing spacecraft parts using 3D printing components. It is expected that in the coming years this will allow new companies to enter the market, thereby increasing competition in the market. Due to the economic advantages of 3D printed components in the space sector over traditional subtractive manufacturing methods, space agencies such as NASA and ESA are currently looking into the possibility of manufacturing spacecraft parts using 3D printed components. It is expected that in the coming years this will allow new companies to enter the market, thereby increasing competition in the market. Due to the economic advantages of 3D printed components in the space sector over traditional subtractive manufacturing methods, space agencies such as NASA and ESA are currently looking into the possibility of manufacturing spacecraft parts using 3D printed components. It is expected that in the coming years this will allow new companies to enter the market, thereby increasing competition in the market. nine0005

Due to the economic advantages of 3D printed components in the space sector over traditional subtractive manufacturing methods, space agencies such as NASA and ESA are currently looking into the possibility of manufacturing spacecraft parts using 3D printed components. It is expected that in the coming years this will allow new companies to enter the market, thereby increasing competition in the market. Due to the economic advantages of 3D printed components in the space sector over traditional subtractive manufacturing methods, space agencies such as NASA and ESA are currently looking into the possibility of manufacturing spacecraft parts using 3D printed components. It is expected that in the coming years this will allow new companies to enter the market, thereby increasing competition in the market. nine0005 Major Players

Table of Contents

INTRODUCTION

INTRODUCTION

4.5 Intensity of Competitive Rivalry

4.5 Intensity of Competitive Rivalry

You can also purchase parts of this report. Do you want to check out a section wise price list?

3.3.3 Japan

3.3.3 Japan

2.8 Samuel, Son & Co.

2.8 Samuel, Son & Co. Frequently Asked Questions

What is the study period of this market?

The 3D Printing In Aerospace and Defense Market market is studied from 2018 - 2027.

What is the growth rate of 3D Printing In Aerospace and Defense Market? nine0387

The 3D Printing In Aerospace and Defense Market is growing at a CAGR of >24% over the next 5 years.

Which region has the highest growth rate in 3D Printing In Aerospace and Defense Market?

Asia-Pacific is growing at the highest CAGR over 2021- 2026.

Which region has the largest share in 3D Printing In Aerospace and Defense Market?

Europe holds highest share in 2021.

Who are the key players in 3D Printing In Aerospace and Defense Market? nine0387

Airbus SE, The Boeing Company, GE Aviation, Safran SA, Raytheon Technologies Corporation are the major companies operating in 3D Printing In Aerospace and Defense Market.

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

Please enter a valid email id!

Please enter a valid message!

Download Free Sample Now

First Name

Mr/MsMr.Mrs.Dr.Ms.

Last Name

Your Email

By submitting, you confirm that you agree to our privacy policy

Download Free Sample Now

Your Email

By submitting, you confirm that you agree to our privacy policy

Message

By submitting, you confirm that you agree to our privacy policy

thank you!

Thank you for your purchase.