Mckinsey 3d printing

Future now: 3D printing moves from prototyping to production

Article (6 pages)

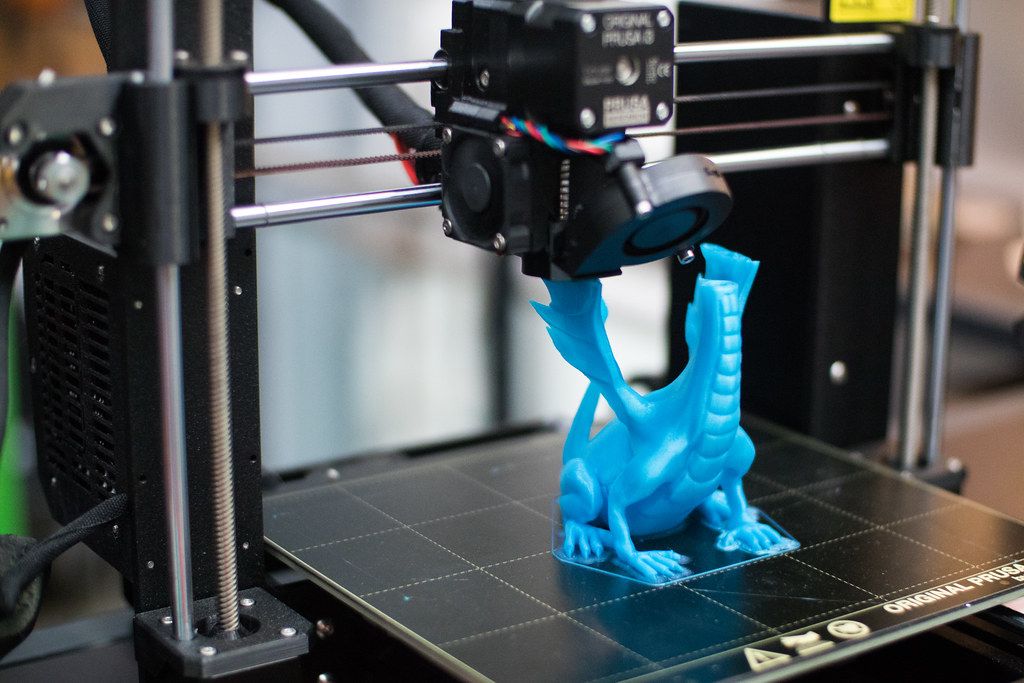

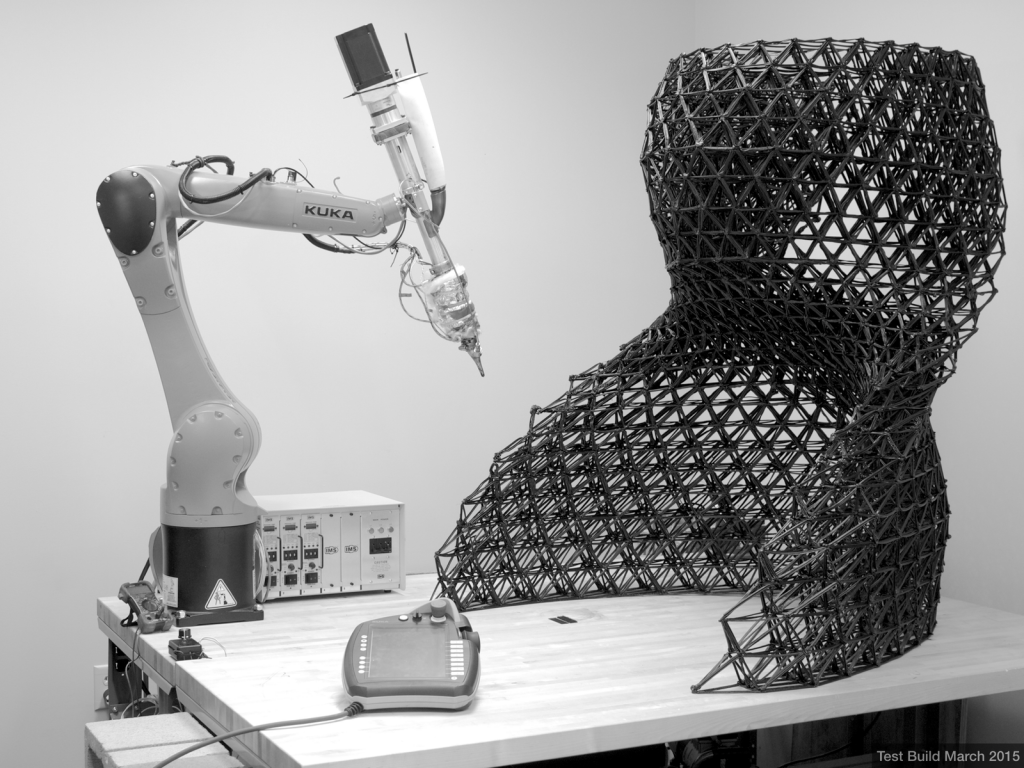

The heist at the center of the 2018 ensemble comedy movie Ocean’s 8 required the protagonists to switch valuable jewels for 3-D-printed copies. “Replicators,” which generate food or tools from basic raw materials, have been a staple of science fiction in film and TV for generations. Yet while Hollywood has been quick to seize on the potential of additive manufacturing (AM), these technologies have been slow to find their blockbuster applications in real-world manufacturing.

- 2022: The year in charts

- 2022: The year in images

- The state of AI in 2022—and a half decade in review

- Pixels of Progress: A granular look at human development around the world

- What matters most? Six priorities for CEOs in turbulent times

Compared with traditional production approaches, AM technologies offer four potential sources of value. First, their ability to generate almost any 3-D shape allows designers the freedom to create parts that perform better or cost less than conventional alternatives. For example, an additively manufactured titanium bracket produced by Airbus is 30 percent lighter than its predecessor without compromising performance or durability.

Second, with no need for molds or fixed tooling, every part produced by a machine can be unique, paving the way for mass-scale customization. Test equipment maker Vectoflow uses AM to produce bespoke probes for fluid flow–measurement applications. Its microlaser sintering process enables compact and complex designs with streamlined shapes to minimize impact on the flows being measured. Probes are manufactured in a range of materials to suit the required operating environment, including stainless steel, titanium, and various superalloys.

Third, eliminating time-consuming toolmaking and fabrication operations accelerates both product development and production, reducing time to market. The complex fuel injector head used in the latest Ariane 6 rocket is additively manufactured as a single piece of nickel-based alloy. Previous iterations of this part were welded together from 248 individually machined components.

The complex fuel injector head used in the latest Ariane 6 rocket is additively manufactured as a single piece of nickel-based alloy. Previous iterations of this part were welded together from 248 individually machined components.

Finally, AM can simplify the maintenance and support of products in the field, reducing the need for spare-parts inventories by enabling on-demand production of items from digital files. Carmaker Mercedes-Benz, for example, now uses AM to produce spare parts for its classic vehicles.

The race is on

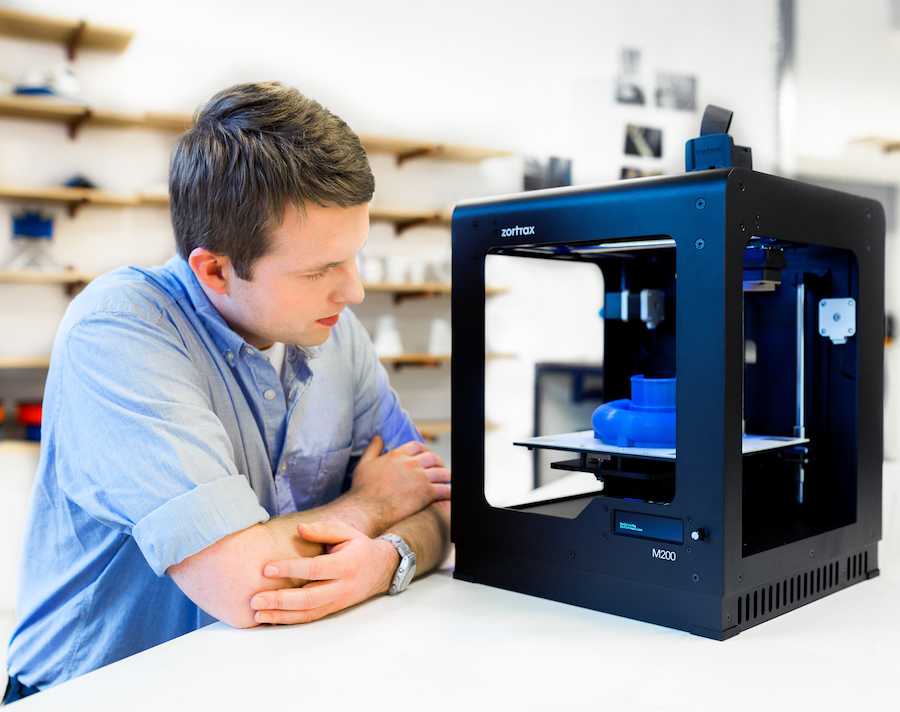

By 2020, 40 years after the development of the first commercial machines, analysis of the AM sector showed it had grown to a €13.4 billion industry with a 22 percent annual growth rate. The sector remains extremely dynamic, with more than 200 players competing to develop new hardware, software, and materials.

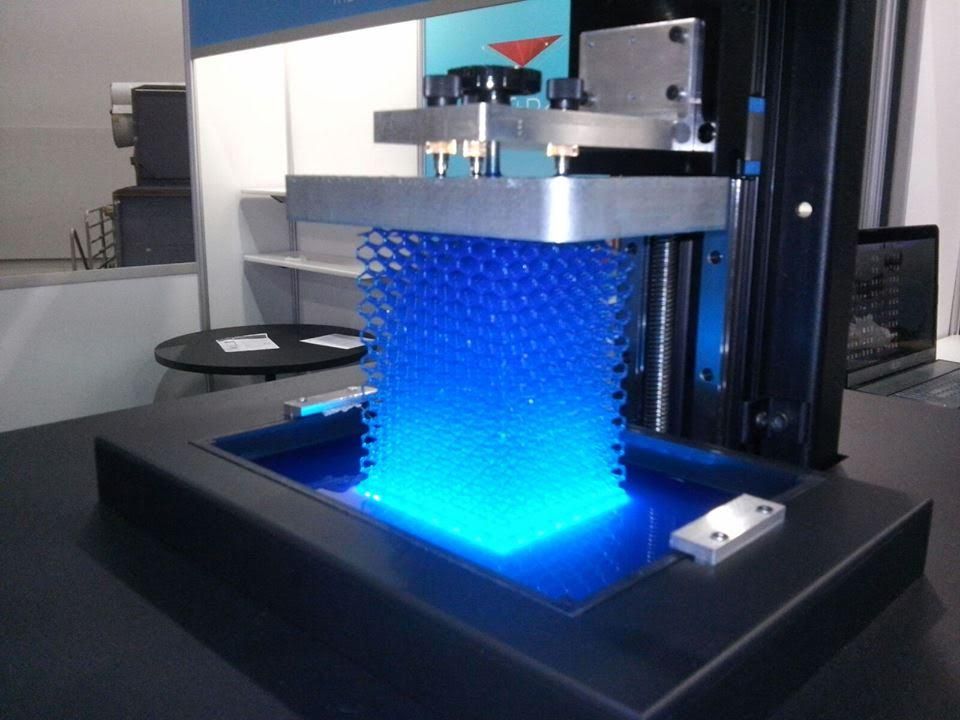

Rapid innovation is driving major improvements in the performance of AM technologies. The newest generations of machines are overcoming many of the perceived limitations of their predecessors, such as by allowing the production of overhanging parts without the need for elaborate printed support structures, or creating stronger parts by controlling the alignment of fiber reinforcements using magnetic fields. The range of materials available for AM systems continues to expand, including high-strength aluminum alloys and medical-grade polymers.

The range of materials available for AM systems continues to expand, including high-strength aluminum alloys and medical-grade polymers.

AM systems are getting faster, too. Recent systems based on selective laser sintering (SLS), for example, use as many as one million laser diodes to accelerate the production of parts. And improvements to software and postprocessing technologies are further streamlining the end-to-end journey from concept to finished component. AM technologies pair very well with generative-design systems, which use AI techniques to define and optimize the geometry of parts.

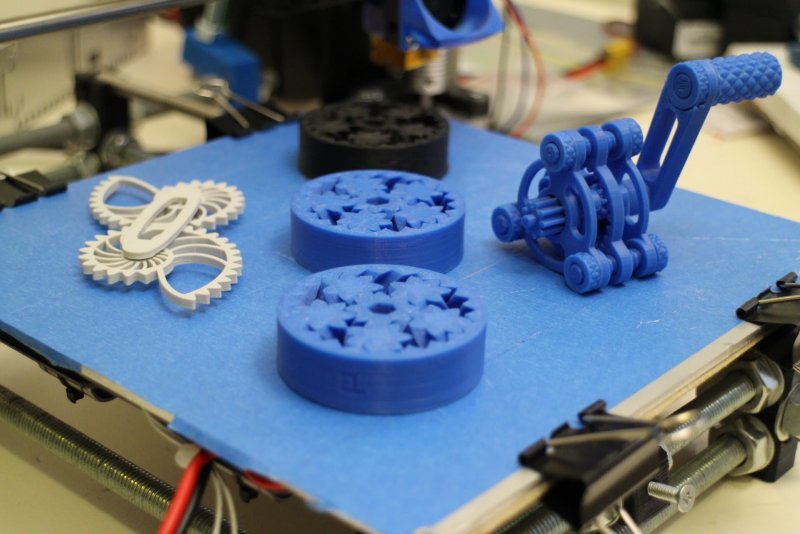

In many sectors, AM has become widely accepted as the fastest and most cost-effective way to produce functional prototypes during product development and testing. AM technologies are also being applied in a growing range of “indirect” applications, including tooling, spare parts, and fixtures for conventional manufacturing machines.

Not ready for prime time?

Yet while companies have dabbled in using AM for the direct manufacture of final products, large-scale adoption of the approach remains limited. Manufacturers have cited four significant barriers to their use of AM:

Manufacturers have cited four significant barriers to their use of AM:

- Hardware. The slow speed and limited build volume available in most AM machines restrict the range of possible applications. Such machines have also proven tricky to integrate into production workflows. An industrial AM production cell may require the user to combine manufacturing, postprocessing, and material-handling equipment from different vendors.

- Software. AM equipment often relies on vendor-specific control software, with limited integration between different machines or with the equipment and production-control systems used in the wider plant. The technology and know-how necessary to achieve consistent quality and stable productivity is hard to come by.

- Materials. Today, even common engineering materials are much more expensive when supplied in a form suitable for processing with AM equipment. Polymers must be specially developed for AM machines, a time-consuming and complex process.

And the additional processing required to convert metal alloys into a powder form suitable for AM machines adds significantly to their cost. Moreover, not enough of the available AM materials, especially polymers, have been fully certified for critical end-use applications.

And the additional processing required to convert metal alloys into a powder form suitable for AM machines adds significantly to their cost. Moreover, not enough of the available AM materials, especially polymers, have been fully certified for critical end-use applications. - Services. Industrial users complain that equipment vendors do not currently provide a high level of technical support beyond that necessary to install and commission the equipment. Users would like more help refining component designs to suit specific manufacturing processes, for example, or finding ways to improve the quality, reliability, and productivity of machines once production commences.

While companies have dabbled in using additive manufacturing for the direct manufacture of final products, large-scale adoption of the approach remains limited.

Finally, manufacturers struggle to work out how AM will benefit them. Design engineers typically have limited knowledge of the capabilities of AM systems or of how to design for AM. Simply switching an existing component from a conventional manufacturing to an AM process is rarely advantageous. Instead, the benefits emerge when the unique capabilities of AM are exploited, such as by combining multiple features into a single component to reduce the overall number of parts in an assembly or to eliminate the need for subsequent fabrication or process steps.

Design engineers typically have limited knowledge of the capabilities of AM systems or of how to design for AM. Simply switching an existing component from a conventional manufacturing to an AM process is rarely advantageous. Instead, the benefits emerge when the unique capabilities of AM are exploited, such as by combining multiple features into a single component to reduce the overall number of parts in an assembly or to eliminate the need for subsequent fabrication or process steps.

Today, the risks of an industrial-scale AM installation are all carried by the end user. And these barriers can make it extremely difficult to build a business case for direct manufacture using AM technologies. Overcoming them is a challenge for the whole sector. Equipment makers could make further improvements in speed, end-to-end automation, and integration with existing manufacturing systems, for example, while materials providers could address issues around certification, availability, and cost.

Yet ambitious manufacturers need not wait for the AM industry to do all the work. Despite the limitations, some industrial users have made significant progress in direct production using AM, developing knowledge and capabilities along the way that will serve them well as the industry evolves.

A medical miracle

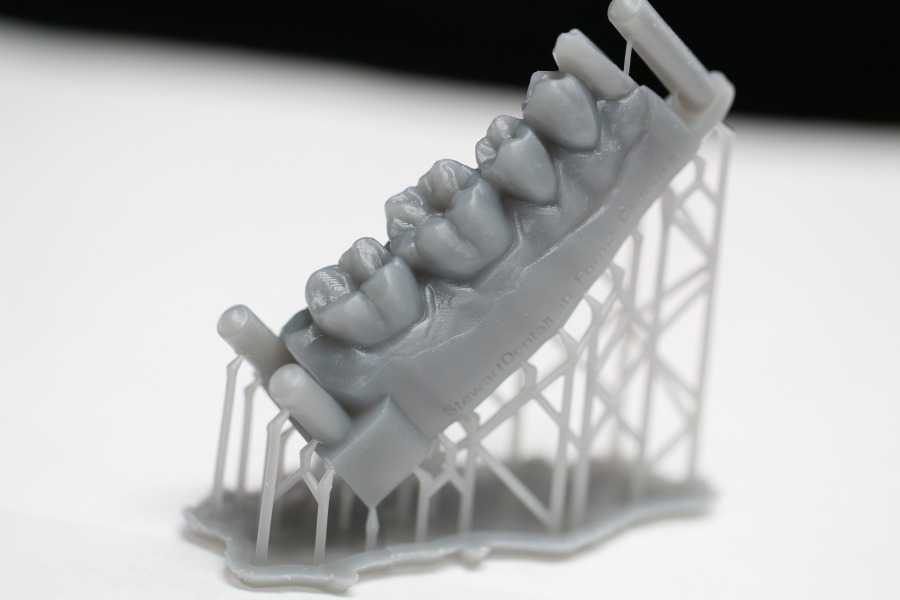

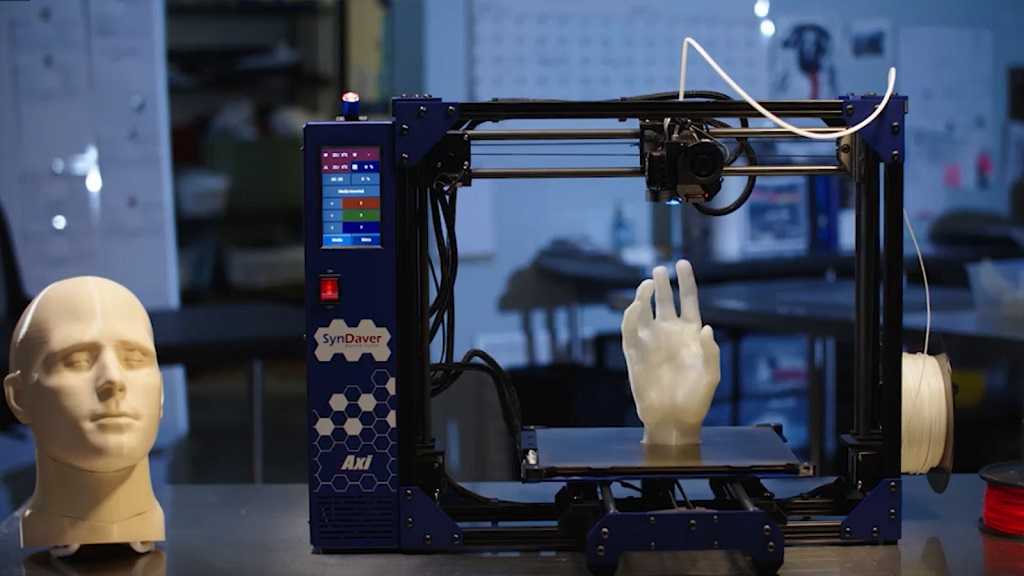

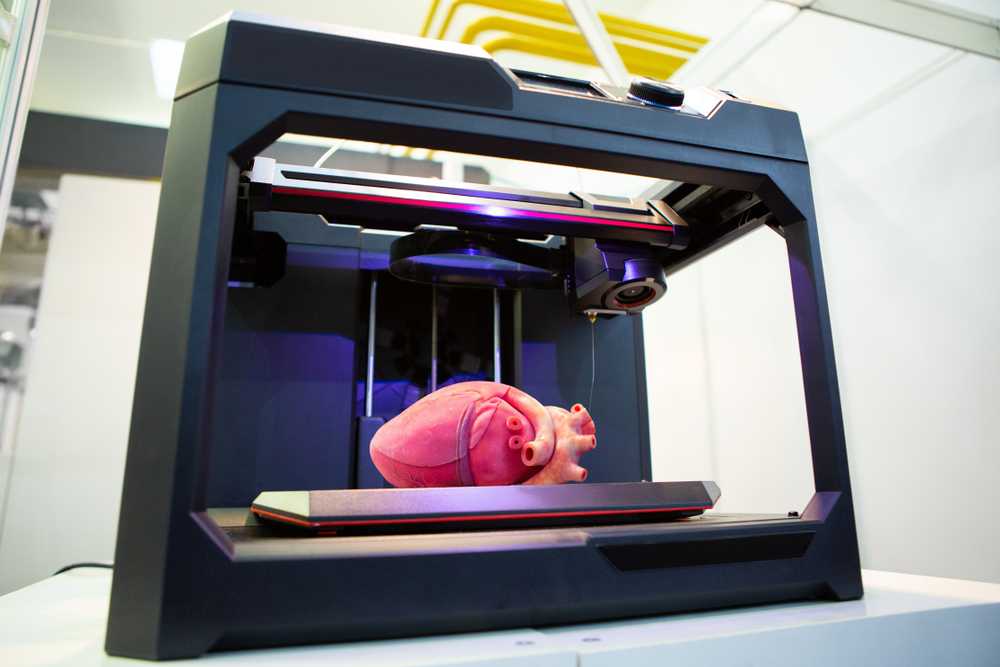

One standout sector that has managed to move beyond these perceived limitations is the medical-devices industry. AM technologies are now applied routinely and at scale to produce a wide range of products, including prosthetics and implants, surgical guides, and anatomical models for preoperative planning or patient education (Exhibit 1).

Exhibit 1

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: [email protected]

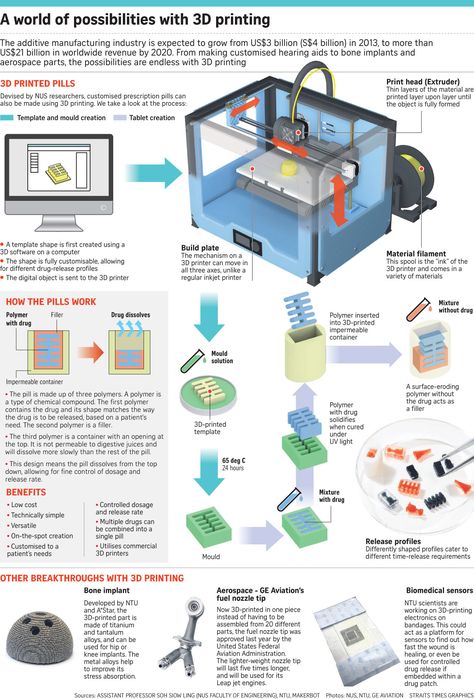

These applications have succeeded because they are highly customized, high-value applications that offer benefits to patients and clinicians that conventional manufacturing technologies cannot match. Instead of spending time shaving bone or shaping a standard orthopedic implant, for example, a surgeon can simply install a custom device manufactured to match the individual patient’s morphology. AM is even being explored in the pharmaceutical sector, using 3-D printing techniques to produce pills with customized drug doses and release characteristics.

Instead of spending time shaving bone or shaping a standard orthopedic implant, for example, a surgeon can simply install a custom device manufactured to match the individual patient’s morphology. AM is even being explored in the pharmaceutical sector, using 3-D printing techniques to produce pills with customized drug doses and release characteristics.

A blueprint for AM excellence

Manufacturers in other sectors, meanwhile, will not be able to exploit the benefits of AM until they take a more holistic approach to AM technologies. That will typically require them to develop novel product designs, manufacturing flows, and business models. The experience of the medical-device sector shows that this can be done.

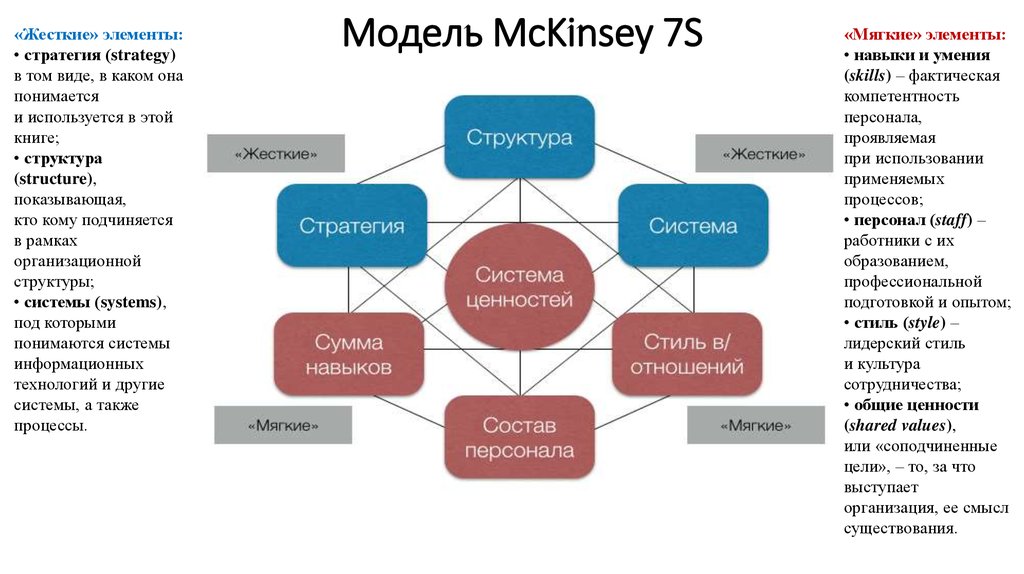

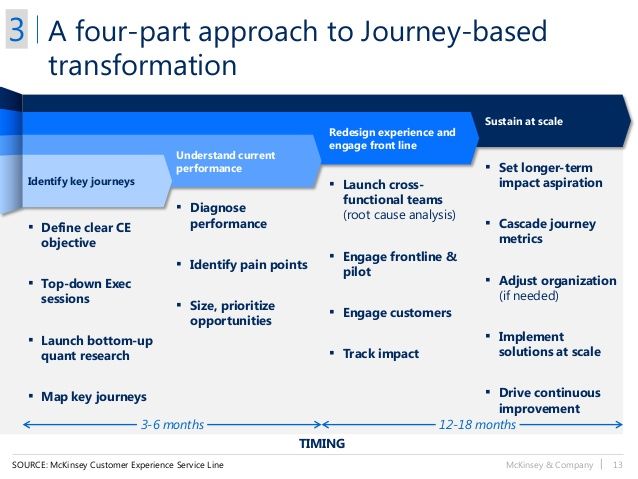

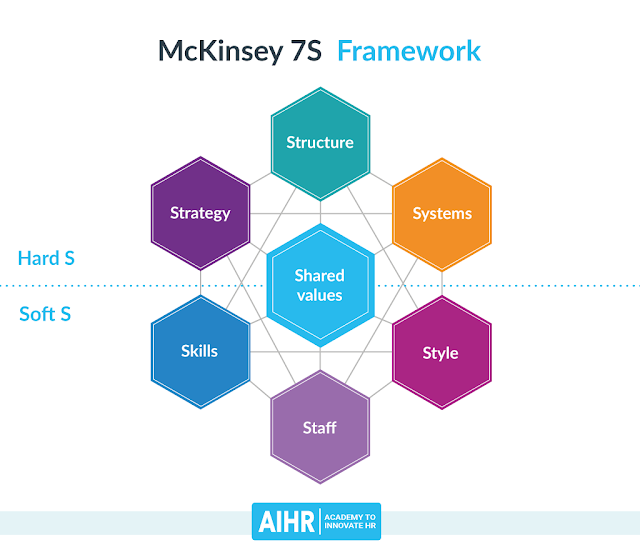

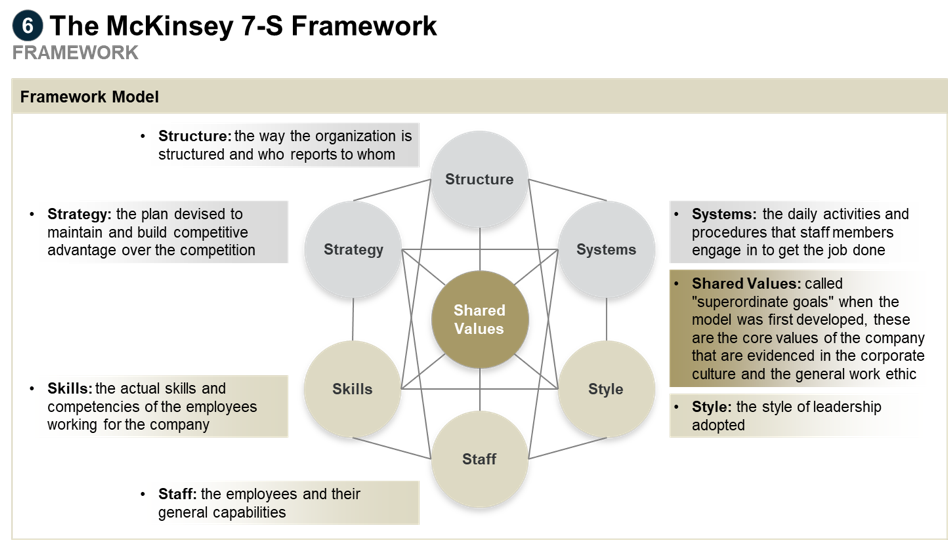

Exhibit 2 describes a framework that can help a company develop AM capabilities from a cleansheet. It aims to minimize risks and keep the requirement for up-front investment low, while still carrying the organization all the way from initial investigations to large-scale applications.

Exhibit 2

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: [email protected]

At the heart of this approach is an “AM center of competence,” which consolidates the organization’s AM efforts in one place and serves as a repository for capabilities, knowledge, and best practices. At the outset, this center of competence can be a small, dedicated team, but it should ideally be outward facing, engaging with external partners to develop knowledge and relationships and sharing what it learns with engineers and other stakeholders across the organization.

Led by the center of competence, the organization’s first forays into AM can be quick and low risk, designed to develop understanding of the available technologies and engender excitement for their potential. The production of prototype parts is the most common AM starting point, while the manufacture of tooling for assembly can help to create excitement among production engineers and shop floor personnel.

The production of prototype parts is the most common AM starting point, while the manufacture of tooling for assembly can help to create excitement among production engineers and shop floor personnel.

While it is experimenting with these simple applications, the center of competence can also begin identifying opportunities for the more systematic application of the AM technologies. This could be done by identifying critical points along the value chain where AM could help, such as by eliminating scrap, simplifying assembly, reducing inventory, or improving the next generation of products.

To explore these opportunities while keeping investment levels manageable, companies can adopt a collaborative approach. By building a small ecosystem of partners, such as AM service providers or design consultancies, companies can gain access to the capacity and expertise needed to experiment with different approaches and technologies. At the same time, leaders can keep one eye on opportunities for future applications to reach real scale. In regulated industries, for example, early certification of promising materials, design approaches, and technologies can provide a competitive advantage by eliminating potential bottlenecks to adoption.

In regulated industries, for example, early certification of promising materials, design approaches, and technologies can provide a competitive advantage by eliminating potential bottlenecks to adoption.

As it moves the most promising AM applications into production, the organization enters a build-and-transfer phase. To identify further potential applications more quickly, companies can codify their growing AM knowledge into design tools, for example. These might include total cost of ownership (TCO) models that make it easy to quantify the costs and benefits of shifting to AM for common applications within the business. In parallel, organizations can intensify their work with ecosystem partners to transfer knowledge as needed and begin to acquire the necessary hardware for in-house production of AM parts.

Once it has gained some experience in direct production using AM, an organization can move into the scale-and-sustain phase, incorporating AM fully into its portfolio of manufacturing technologies. This phase typically involves investment in additional production capacity, the development of standard processes for design and production control, and further skill building for engineers and operators.

This phase typically involves investment in additional production capacity, the development of standard processes for design and production control, and further skill building for engineers and operators.

An organization with AM capabilities can also start to rethink its business model and identify additional sources of competitive advantage. Can it apply AM technologies to enable the late-stage customization of products, for example, or create limited-run series for certain user groups? Could it use AM as a bridge between prototypes and full-scale production, allowing new products to be beta tested by a select group of customers?

After decades as a bit player, additive manufacturing is on the cusp of stardom. Faster machines, better materials, and smarter software are helping to make AM a realistic solution for many real-world production applications. As the technical barriers fall, the onus is on manufacturers to improve their understanding of these rapidly evolving technologies, building the skills, processes, and business models needed to make additive manufacturing shine in the industrial world.

How 3-D printing will transform the metals industry

Article (PDF-2MB)

Today, 3-D printing is a very small part of the metals industry, but it is growing rapidly and this market is expected to be worth as much as $10 billion by 2030 to 2035.1 1.Wohlers Associates; Euler Hermes; LulzBot. Already, a number of healthcare and aerospace companies have adopted the technology. Some are running pilots to see how 3-D metal printing can contribute to their operations while others are using 3-D printers to produce metal prototypes in-house.

Stay current on your favorite topics

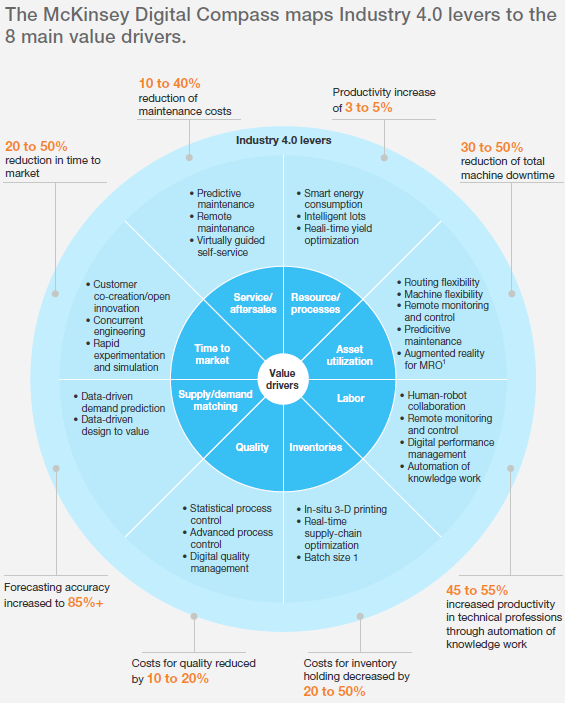

We expect the current low-scale experiments to shift to broader industrial adoption within the next five to ten years, especially at the high end of the metals market. By significantly lowering production costs and lead times for a variety of metal parts, 3-D printing has the potential to reshape the industry structure.

By significantly lowering production costs and lead times for a variety of metal parts, 3-D printing has the potential to reshape the industry structure.

The main benefits of 3-D printing are a shorter value chain, cost and time reductions through elimination of assembly steps, greater customization and design freedom, and minimal waste. But the technology still has significant challenges to overcome. These include the high costs of metal powder and 3-D printers for large-scale production, as well as significant constraints on the dimensions of printed parts. Additionally, most printers cannot mix materials within one item. However, R&D activities by corporations and academics are rapidly addressing these limitations.

Industry players can enter this promising market in several ways: powder production, 3-D printing end products, servicing 3-D printer operations, and manufacturing 3-D printers. For the metals value chain, perhaps the biggest opportunity lies in producing high-performing metal powders or innovative products with enhanced properties. As the technology increasingly takes hold, we expect powder producers and creators of the product designs to hold the greatest power in the value chain, with those in the middle increasingly squeezed.

As the technology increasingly takes hold, we expect powder producers and creators of the product designs to hold the greatest power in the value chain, with those in the middle increasingly squeezed.

At a time of high volatility in the cost of raw materials, metal manufacturers are eyeing 3-D printing with intense interest—and for good reason. By significantly lowering production costs and lead times for a variety of metal parts, 3-D printing has the potential to transform the value chain in metal production and reshape the industry’s power dynamics.

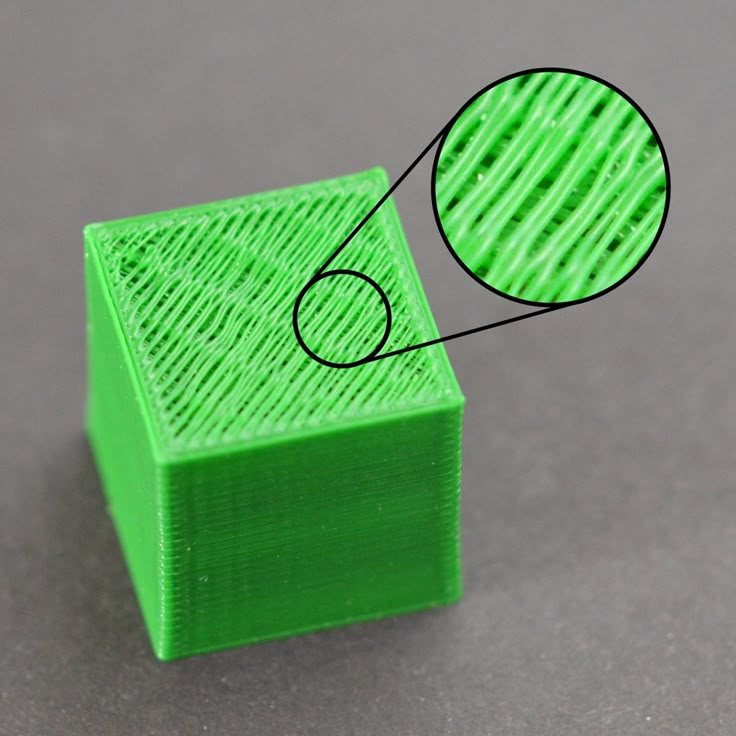

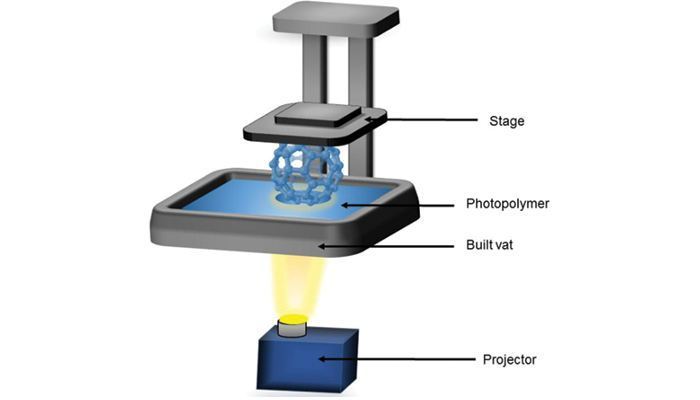

The technology, which works by layering rather than eliminating material to create a shape (hence it is also known as additive manufacturing), has several important selling points. First, it requires only three major steps: metal production, powder production, and product printing (with some finishing). Additionally, 3-D printing largely eliminates waste and expands the available design options, allowing manufacturers to adapt products to use less material, incorporate improved mechanical properties, avoid assembly steps, and create new geometries.

The process also makes small production batches more cost-effective, broadening the range of manufacturing options and enabling better customization to end-user needs. For example, a company can locate a 3-D printer at the product’s final destination, such as the maintenance department for the production of spare parts, lowering both logistical challenges and the high cost of ordering complex one-off parts from suppliers.

While plastics have garnered most of the attention to date, it is metals that have been the fastest-growing 3-D–printing category since 2012.2 2.Wohlers Associates; SmarTech Publishing. Given the increasing need for metal producers to differentiate themselves through their cost structures, supply chain performance, or products, we believe it is only a matter of time before the technology becomes a transformative force in the industry. It has the potential not only to revolutionize product manufacturing but to create new ecosystems of innovation and entrepreneurship.

Fully realizing this promise will take time, however. In speed of high-volume production, cost of raw materials, quality consistency, and breadth of end-product sizes, 3-D printers still lag behind conventional methods. Nevertheless, 3-D printing is rapidly advancing on all those fronts.

Currently, 3-D printing comprises only a few basis points of the metals market, but analysts expect that its growth trajectory—currently akin to rates usually associated with tech markets rather than metals—will take annual revenues to the region of $10 billion by 2030 to 2035.3 3.Wohlers Associates; Euler Hermes; LulzBot. Already, the technology is being used to produce nickel, nickel alloys, and other high-value metals. Industries such as healthcare and aerospace are at the forefront of embracing 3-D printing to gain the precision, low weight, and fast turn-around their customers require—and for which those customers are willing to pay extra. As the technology matures and costs drop, we expect adoption to spread.

Key advantages of 3-D printing for metals players

There are four core benefits of 3-D printers over traditional metal production.

Shorter value chain. 3-D printing generally requires only three steps. The first is producing the metal itself using conventional smelting and casting processes. The second step is the production of the raw material for the printer, which takes the form of either powder or wire (see “3-D metal printing today—a technology overview”). The 3-D printer then prints the metal component by melting the powder or wire to create the desired shape, with some finishing steps often required afterwards.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: [email protected]

Conventional production stages such as hot rolling, cold rolling, cutting, bending, welding, and assembly become, to a large degree, obsolete (exhibit). Consequently, there is little need for standard inventory methods, complex logistics, and lengthy supply chains. Provided there is a printer available, production can start immediately.

Consequently, there is little need for standard inventory methods, complex logistics, and lengthy supply chains. Provided there is a printer available, production can start immediately.

Exhibit

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: [email protected]

Low waste. The conventional process of milling, stamping, and otherwise processing large sheets of metal causes extensive waste of material. In contrast, 3-D printers melt only the powder or wire required to build the component’s skeleton and structure layer by layer. Manufacturers can then remove any excess powder from the printer and reuse it. Consequently, scrap rates for 3-D printing are only 1 percent to 3 percent, and are expected to eventually approach zero. 4 4.MIT Technology Review; Wohlers Associates; expert interviews. The process is also less labor-intensive and has a much lower environmental impact thanks to its elimination of the emissions attendant with traditional manufacturing and transport through the supply chain.

4 4.MIT Technology Review; Wohlers Associates; expert interviews. The process is also less labor-intensive and has a much lower environmental impact thanks to its elimination of the emissions attendant with traditional manufacturing and transport through the supply chain.

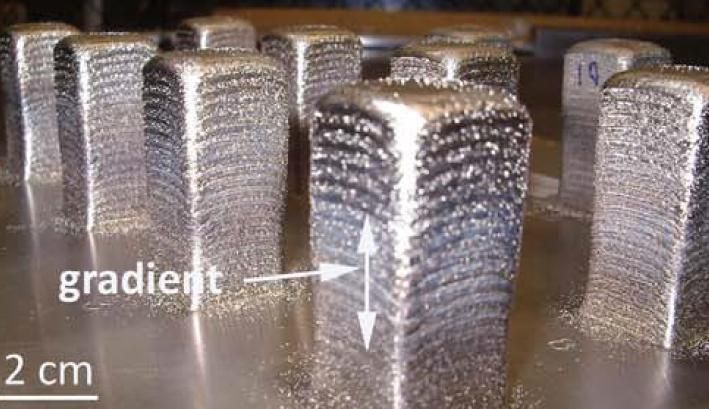

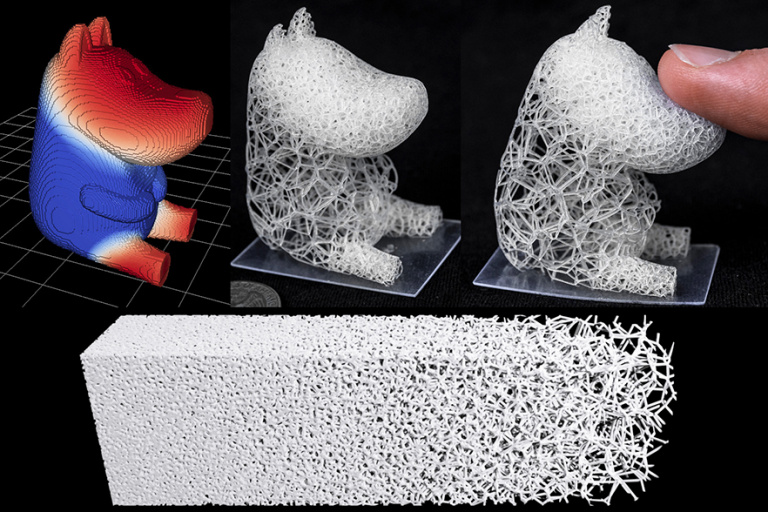

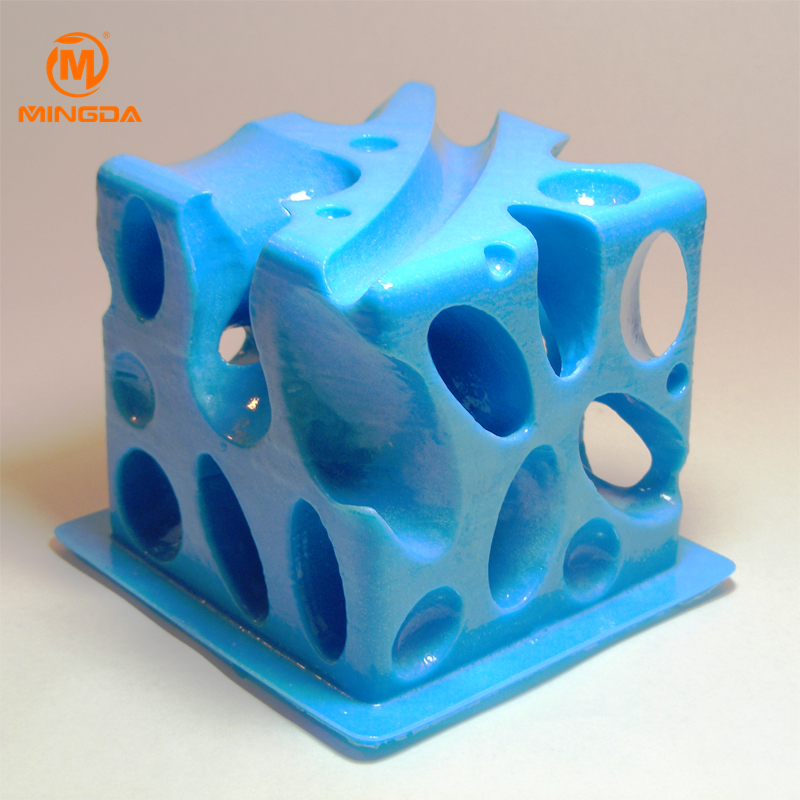

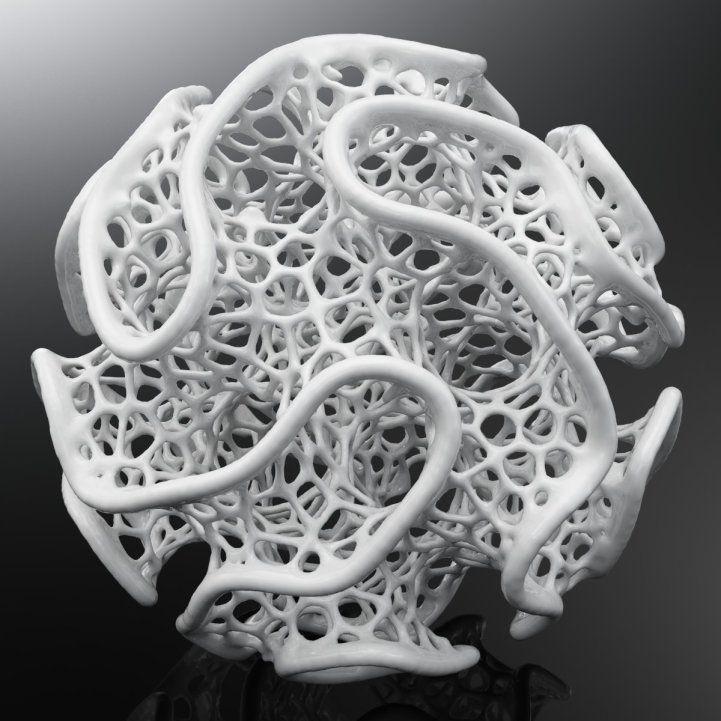

Greater design freedom. The ability to sidestep many design and manufacturing constraints is one of the biggest advantages of 3-D printers. They can circumvent assembly steps and create previously impossible structures, such as a metal rib cage that was custom-printed for a cancer patient. The printers can also reduce the amount of material required for a part by, for example, printing part interiors as nonsolid, bone-like structures that nevertheless deliver the same functional specifications as conventional parts. Manufacturers can 3-D–print complex shapes with often improved properties, as they have started to do with lightweight car seats and airplane belt buckles.

The quality of most 3-D–printed parts is fast approaching that of their conventionally made counterparts. For wrought items, the quality is already comparable to products manufactured through traditional methods. On milled objects, 3-D printing is getting close but sometimes still requires additional processing, such as heat treatment or hardening, to achieve the necessary physical properties. For highly heat-resistant superalloys such as the ones used in jet engine manufacturing, 3-D printing is gaining acceptance due to savings in time and cost over conventional machining.

For wrought items, the quality is already comparable to products manufactured through traditional methods. On milled objects, 3-D printing is getting close but sometimes still requires additional processing, such as heat treatment or hardening, to achieve the necessary physical properties. For highly heat-resistant superalloys such as the ones used in jet engine manufacturing, 3-D printing is gaining acceptance due to savings in time and cost over conventional machining.

Would you like to learn more about our Metals & Mining Practice?

Aside from opening up new design possibilities, 3-D printing also enables fast production and iteration of prototypes. If testing identifies the need for design improvements, implementing such changes requires nothing more than uploading a new design to the printer.

Cost effectiveness at small scale. Today, most metal-manufacturing facilities are set up for large-scale production, and few efficient solutions exist for small batches or products. Consider a spring, only a few centimeters in size, that triggers air-bag inflation during crashes. The typical production batch for the metal in conventional manufacturing exceeds 200 tons—vastly more than the annual demand for this tiny part in any type of airbag. For such small production lots, 3-D printing is generally much more affordable.

Consider a spring, only a few centimeters in size, that triggers air-bag inflation during crashes. The typical production batch for the metal in conventional manufacturing exceeds 200 tons—vastly more than the annual demand for this tiny part in any type of airbag. For such small production lots, 3-D printing is generally much more affordable.

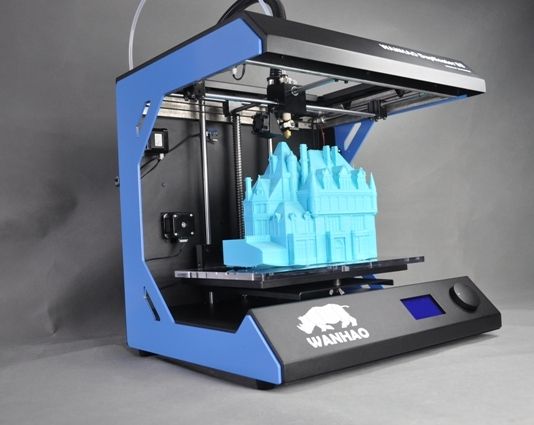

In addition, a 3-D–printing site can be set up quickly and often with less investment than a conventional metal-production facility, which might require building power plants, roads, and bridges. For 3-D printing, the main investment is the printer itself, prices for which start at a few thousand dollars (though they can go up to $2 million). There is no need to build expensive milling and refining capabilities, and the 3-D printers can be located at or near the products’ final destination or be transported to a new location when needed. The ability to rapidly establish just-in-time production makes 3-D printing particularly appealing to those manufacturing small batches of highly customized parts who want to scale that production as needed. In theory, every part produced can be fully customized at little additional cost aside from that incurred during postprocessing.

In theory, every part produced can be fully customized at little additional cost aside from that incurred during postprocessing.

Technological obstacles to broader adoption

Today, conventional manufacturing is still the preferred choice for most mass-produced metal products because it is more cost-efficient and better adapted to high-volume production. Current 3-D printing technology also has some important limitations. Parts larger than 30 cm² are difficult to produce using existing 3-D printers, and most printers cannot mix materials within one item. Some makers of 3-D printers have announced successful experiments in mixing materials during printing, but no such printer is yet commercially available. Naturally, all these shortcomings are the focus of intense research at all levels of the value chain.

However, the biggest hurdle to 3-D printing becoming a viable, large-scale production alternative is the high cost of printers and of metal powder. Powder production today is inefficient, partly because of its small scale and partly because as little as 50 percent of the atomized powder is of sufficient quality. 5 5.MIT Technology Review; Wohlers Associates; expert interviews. The main reason for this low yield rate is irregular and inconsistent particle size. Most existing powder atomizers produce powders too coarse for many applications. The industry is working to improve the yield rate, which will help drive down the total cost and increase output of 3-D printing processes. Some tests by precious metals manufacturers indicate that yield rates above 90 percent are achievable,6 6.MIT Technology Review; Wohlers Associates report 2016; expert interviews. and we expect metal powder costs to come down in the near future. Printer prices are also dropping, a trend that the technology’s broader adoption will support.

5 5.MIT Technology Review; Wohlers Associates; expert interviews. The main reason for this low yield rate is irregular and inconsistent particle size. Most existing powder atomizers produce powders too coarse for many applications. The industry is working to improve the yield rate, which will help drive down the total cost and increase output of 3-D printing processes. Some tests by precious metals manufacturers indicate that yield rates above 90 percent are achievable,6 6.MIT Technology Review; Wohlers Associates report 2016; expert interviews. and we expect metal powder costs to come down in the near future. Printer prices are also dropping, a trend that the technology’s broader adoption will support.

Currently, aerospace, medicine, and other industries whose products demand high precision and entail high cost, are leading the way in embracing 3-D printing. These industries require rigorous customization (in artificial hip joints, for example) or short lead times (as with jet engine turbine blades), which makes 3-D printing particularly suitable to their needs.

The fact that 3-D printers can use less material than conventional manufacturing is also a major selling point in applications such as turbine blades, which are made from expensive metals and benefit from low weight. But as the technology improves and costs drop, we believe adoption of 3-D printing will spread to sectors such as oil and gas, automotive, robotics, and consumer products.

We strive to provide individuals with disabilities equal access to our website. If you would like information about this content we will be happy to work with you. Please email us at: [email protected]

How 3-D printing may transform the value chain

The shift over the coming few years will be gradual. Within the next five to ten years, we expect 3-D printing to penetrate into the high end of the market, particularly in the manufacturing of material-heavy components out of expensive metals. For the time being, 3-D printing is unlikely to push aside traditional production methods in commodity metals products.

For the time being, 3-D printing is unlikely to push aside traditional production methods in commodity metals products.

However, as the technology matures and adoption spreads, 3-D printing promises to transform the power dynamics in the metal-manufacturing value chain. The key growth enablers will be the availability of material, material science know-how, and production performance. The players near the front of the value chain (such as powder producers) and the end (design creators, likely within or affiliated with end customers) will hold the greatest influence as they will define the properties and production costs of the components. Powder producers that differentiate themselves by developing unique metal powders and dominate particular metal-printing segments will be in a position to set the costs of production, exerting considerable power over the market and the value chain. Design owners may be able to counter the resulting price pressure to some degree by pooling their business.

The growing importance of steel scrap in China

We expect the industry to make rapid improvements in the cost and quality of metal powder. Base metal producers of steel, nickel, copper, and aluminum with pyrometallurgical processes are in the best position to enter the powder production market. By raising the quality of current atomizer technology, they can develop proprietary platforms that they then scale globally, and in time set up direct distribution to end customers, eliminating much of the current value chain. They could even recycle or exchange material between production sites or their customers if required. In addition, these players will be the natural partners for end customers on material science questions, because both the performance of specific metal powders and the “printability” of high-performance materials will be fundamental to the competitiveness of the end products. In short, such companies will be able to create end-to-end ecosystems, from the raw materials to end-customer relationships.

As happens in many disruptions, it is the middlemen who will suffer most as the distance between producer and user shrinks. With 3-D printing eliminating most of the supply- chain steps from the process, the players in the middle are at risk of becoming either obsolete or being left to handle the least profitable steps in the process.

Assessing 3-D printing’s potential for your business

The following questions can help every company in the metal value chain determine the impact 3-D printing is likely to have on its business.

How soon will 3-D printing affect my market? The answer depends largely on your business model, your position in the value chain, and the end markets that your products target. The technology will first penetrate markets where short timelines are critical (such as jet engine turbine blades). Next, the technology will infiltrate the production of small parts (less than 30 cm² in size) made out of expensive material because it can significantly reduce the amount of material needed. Beyond those niches, adoption will depend on the speed with which 3-D printing becomes cost-competitive with existing alternatives, but we expect low-value, mass-market products to be among the last affected.

Beyond those niches, adoption will depend on the speed with which 3-D printing becomes cost-competitive with existing alternatives, but we expect low-value, mass-market products to be among the last affected.

While 3-D printing has been embraced already by the aerospace and medical-device industries, within three years we expect the technology to penetrate all industries where speed of delivery is critical, such as oil and gas or mining. Use on a larger scale in machinery or transportation sectors is at least five years away.

What is the best entry point for my business? There are four clear opportunities in the value chain to capitalize on 3-D printing. Companies can focus on powder production, printing end products, servicing printer setups, or developing and selling 3-D printers. The development of high-performance printing powders is a particularly promising niche for metal producers, though 3-D printer manufacturers are already active in this arena. We will likely see specialized players emerge in all these areas.

We will likely see specialized players emerge in all these areas.

If we want to use 3-D–print products, should we “make” or “buy”? Various factors should guide the decision whether to develop 3-D printing capability in-house or use services offered by others. For example, do you want to deploy your limited resources to build a new capability? Will either choice give you an important edge in time to market? How critical is protection of your IP and pipeline information? Companies should also take into account the technology curve of 3-D printing. Right now, the technology is near the steepest point of its development curve, when much is still changing. In some cases, it may be wise to wait until the technological evolution plateaus at the phase of incremental improvements before making a significant investment.

How deeply should we jump in? There is wide diversity in how companies are choosing to address this question. Some are running pilots to see how 3-D printing can contribute to their operations. By experimenting with the 3-D printing of prototypes and spare parts, they can test the technology with little risk, while cutting back on the storage costs and time lags of ordering spare parts externally.

By experimenting with the 3-D printing of prototypes and spare parts, they can test the technology with little risk, while cutting back on the storage costs and time lags of ordering spare parts externally.

Others are already making big bets on additive manufacturing in hopes of emerging as leaders in this nascent arena. Alcoa recently invested $60 million in advanced 3-D–printing materials and processes, and opened a metal powder plant in Pittsburgh that will produce industrial volumes of aluminum, nickel, and titanium powders for 3-D–printing customers, particularly in aerospace.7 7.Alcoa press release, 2016. The company is also investing in R&D to develop new powders and to improve printing speeds and reduce costs.

Building up capacity and developing pricing for a new market presents challenges for new entrants. We recommend starting with one market segment in which you holistically explore all opportunities 3-D printing offers to reshape the value chain.

Will we need to adapt our processes? In additive manufacturing, getting the initial design right is critical to fully leveraging the technology’s advantage. Parts specifically designed for this new process tend to be more successful than ones where traditional manufacturing is simply switched to 3-D printing—especially since redesigning parts to use less material can bring additional functional benefits and cost savings. But adopting 3-D printing on a significant scale requires some organizational changes and a more agile supply chain to cater to faster innovation cycles.

As 3-D printing of metals matures, it is likely to significantly disrupt many parts of the current value chain. We expect the change to be binary: either 3-D printing will prove to be the better alternative and, as a result, will sweep through the industry, as smartphones swept aside most other telecommunications devices; or it will fail to meet its promise and remain a narrow niche. However, if the technology overcomes the remaining challenges confronting it today and the supply chain adapts to 3-D–printing processes, we expect the structural advantages of this production method to make it the uncontested choice for most metals manufacturers.

However, if the technology overcomes the remaining challenges confronting it today and the supply chain adapts to 3-D–printing processes, we expect the structural advantages of this production method to make it the uncontested choice for most metals manufacturers.

Stay current on your favorite topics

Five factors impacting 3D printing on the global economy

02/25/2014

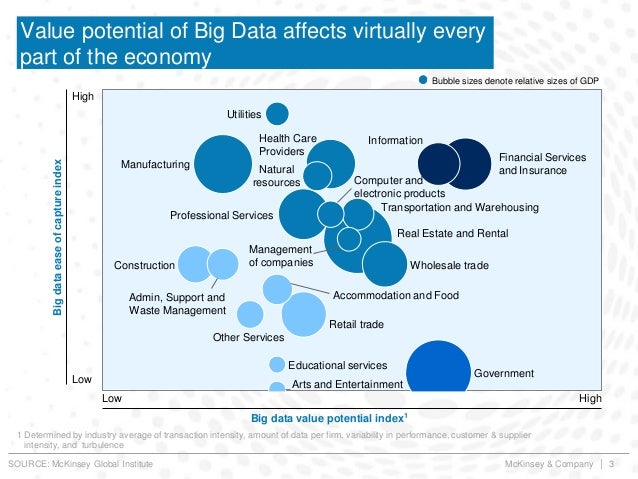

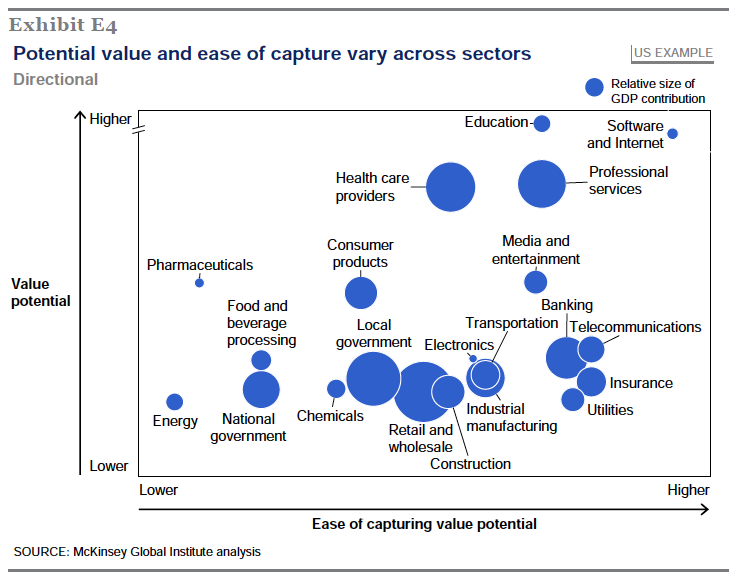

The rapid development of 3D printing technologies will be accompanied by five trends in the current balance of the global economy, the consulting firm McKinsey & Co. recently concluded.

Last year, the company listed 3D printing as one of the 12 technologies that could impact the global economy and predicted the 3D printing market would grow to $550 billion by 2025. Now, McKinsey is putting 3D printing at the forefront and is advising property managers to prepare for five changes in the global economy that will accompany the development of 3D technologies. nine0003

nine0003

1. Accelerate Product Development Processes

Since 3D printing devices have become widely available, 3D printers have been used for rapid prototyping, reducing the development time for new designs. The declining cost of 3D printers is leading to increased adoption of the technology. 3D printed prototypes enable companies to improve customer experience by quickly providing customers with prototypes for feedback and recommendations. McKinsey predicts that the use of 3D printing - both for prototyping and for creating intermediate products needed to develop final products - will increase, speeding up production cycles. nine0003

2. New production facilities

In 2011, only about 25% of the 3D printing market's production capacity was used directly for the production of final products. This segment of the market shows the highest rate of annual growth - about 60%. Lower prices and improvements in 3D printing technology mean that 3D printing can become an efficient method for producing custom products with high component complexity but low production volumes. nine0003

nine0003

3. Changing demand and revenue streams

The sheer potential of 3D printing, including order customization, modular design and one-to-one production of spare parts, means that companies and customers will have to adapt to new opportunities. New manufacturing processes require re-evaluation of manufacturing models, and in the case of 3D printing, the changes will affect both suppliers and consumers, who can in turn become manufacturers.

4. New features

3D printing offers ever-increasing possibilities that many managers are simply unaware of, and this ultimately leads to their limited use. Companies already considering the market implications of 3D printing will benefit from timely development of technical expertise and efficiency gains ahead of the competition.

5. New Competition

3D printing lowers the cost of small batch production by eliminating the cost of special production equipment. This means that new companies specializing in the creation and rapid delivery of complex designs will enter the small-scale production market. Over time, 3D printing technologies may allow such companies to become serious competitors. In the meantime, the domestic use of 3D printing itself will have an impact on the general principles of competition. nine0003

Over time, 3D printing technologies may allow such companies to become serious competitors. In the meantime, the domestic use of 3D printing itself will have an impact on the general principles of competition. nine0003

More information on McKinsey's forecasts can be found here.

Source

what areas of life will change 3D printing - T & P

The possibilities of 3D printing are almost endless. 3D printing technology makes it possible to speed up inventive activity by an order of magnitude, solving production preparation problems, and in some cases it is already actively used for the production of finished products. According to McKinsey estimates, the direct economic impact of using 3D printing as a technology by 2020-2035 could reach $500 billion. T&P has compiled a list of areas that will be most affected by the development of 3D printing. nine0011

Mechanical engineering and electronics

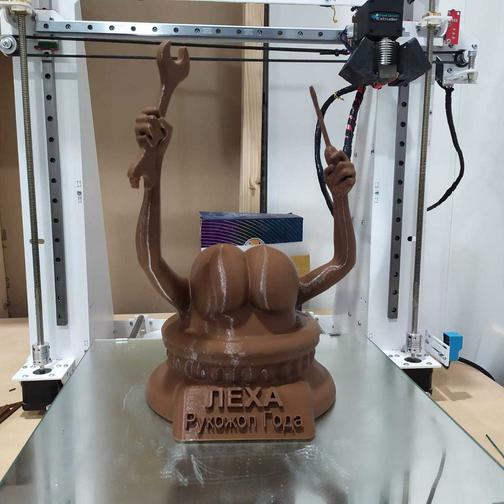

3D printers are widely used in prototyping - creating a mockup of a device in order to understand how well it will work in practice. This is most relevant for the production of machines and electronics. For example, 3D printers were successfully used by Porsche brand engineers to study the flow of engine oil in a car transmission, and by Lockheed when creating the Polecat unmanned aircraft, where many parts were obtained through 3D printing. In addition, 3D printers are used to make molds and models for foundries or to solve small-scale production problems; in the production of various kinds of small things for domestic needs. nine0003

This is most relevant for the production of machines and electronics. For example, 3D printers were successfully used by Porsche brand engineers to study the flow of engine oil in a car transmission, and by Lockheed when creating the Polecat unmanned aircraft, where many parts were obtained through 3D printing. In addition, 3D printers are used to make molds and models for foundries or to solve small-scale production problems; in the production of various kinds of small things for domestic needs. nine0003

Textile and footwear industry

3D printing will revolutionize the textile and footwear industry. Recently, designer Joshua Harris developed a project for a 3D printer that can create clothes in minutes and recycle old items without leaving home. According to the designer, the need to maintain boutiques with goods will disappear over time, and people will order wardrobe items on special media in digital format to print them at home, and clothes will be produced not by textile factories, but by designers and programmers in offices. The reduction in the number of stores is due to the need to build new housing on the vacant site, since according to various forecasts, by 2050, 75% of the world's population will live in cities. The project also has its drawbacks - the rejection of traditional methods of clothing production will leave millions of people without work, and enormous resources will be required to retrain them. However, as Harris himself claims, his idea is still in development, since a way has not yet been found to produce a compact and efficient model of a clothing printer. nine0003

The reduction in the number of stores is due to the need to build new housing on the vacant site, since according to various forecasts, by 2050, 75% of the world's population will live in cities. The project also has its drawbacks - the rejection of traditional methods of clothing production will leave millions of people without work, and enormous resources will be required to retrain them. However, as Harris himself claims, his idea is still in development, since a way has not yet been found to produce a compact and efficient model of a clothing printer. nine0003

Architecture

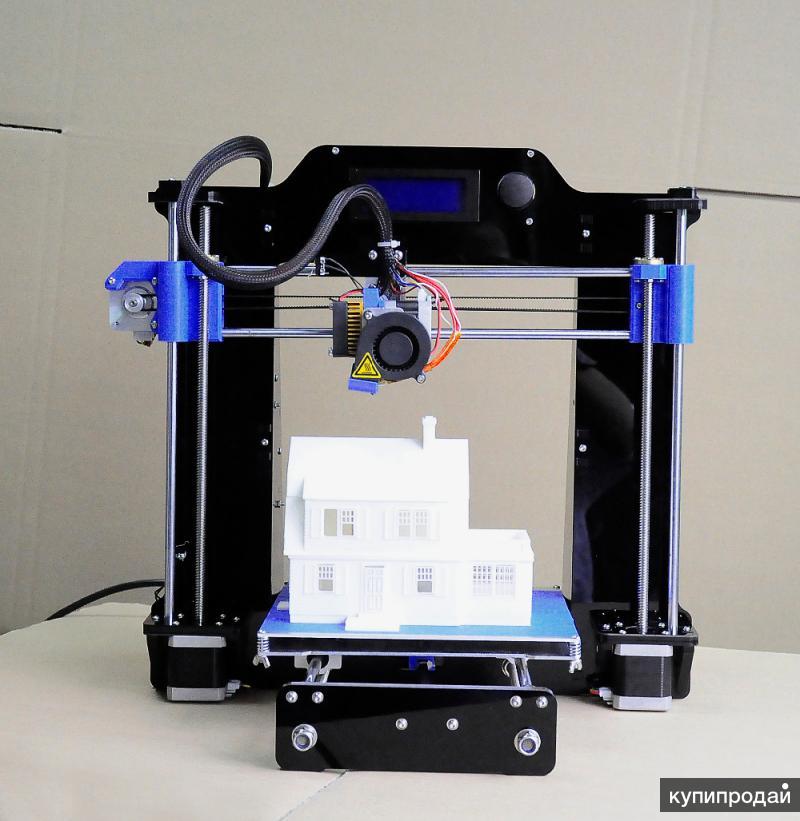

When it comes to architecture, 3D printing really pushes the envelope. So, with the help of a 3D printer, an architect can model the facade of a building or even an entire city and print it in an exact reduced copy to show to the customer. Printed models of houses can be placed on the layout to demonstrate the city's development plan. New technologies give rise to bold experiments in this industry. For example, Swiss architects Michael Hansmeyer and Benjamin Dillenburger, as part of their Digital Grotesque project, printed a 16-square-meter room on a huge 3D printer, providing it with unusual reliefs and patterns. nine0003

For example, Swiss architects Michael Hansmeyer and Benjamin Dillenburger, as part of their Digital Grotesque project, printed a 16-square-meter room on a huge 3D printer, providing it with unusual reliefs and patterns. nine0003

Construction

As practice shows, 3D printers can be used to print concrete houses. In the future, this technology may well be used in the construction of bases on the Moon and on Mars, but in the event that the problem with weak gravity is solved. In conventional construction, 3D printing is already widely used, in particular in China, where each customer can choose the configuration of rooms without changing the cost and simply print their dream home in a few days. This area already has its record holders. Chinese company Yingchuang New Materials spent 20 million yuan and 12 years developing a machine that can now print houses at a rate of 10 structures per day, based on a mixture of building waste and cement. nine0003

Medicine

3D printing will not only provide people with housing and clothing, but also save their lives in case of emergency. 3D printers are actively used to print humanoid tissues, elements of human organs (kidneys, liver, lungs), blood vessels, cartilage, bones, teeth, and various kinds of prostheses. An example is Oxford Performance Materials, which in 2011 performed the first successful operation to implant a piece of a 3D-printed skull into a patient. nine0003

3D printers are actively used to print humanoid tissues, elements of human organs (kidneys, liver, lungs), blood vessels, cartilage, bones, teeth, and various kinds of prostheses. An example is Oxford Performance Materials, which in 2011 performed the first successful operation to implant a piece of a 3D-printed skull into a patient. nine0003

Food

Food-printing has long gone beyond science fiction. Successful companies are already operating in Moscow that, using custom-made 3D printers, print any figures from chocolate, for example, cars, faces and figurines of people, complex patterns for cakes. Food-printing is actively developing, and subsequently almost any dish can be printed on a 3D printer. At the moment, there are many prototype food printers in development, such as Foodini or Atomium from Electrolux Design Lab. nine0003

Jewelry

3D printing technology has expanded the possibilities for the production of decorative jewelry, as the traditional plastic molding method has its limits, and with the help of 3D printing, products of very complex and unusual shapes can be made.

There are many online stores where you can choose 3D printed jewelry for every taste. Nevertheless, according to some experts, it is unlikely that 3D printing will seriously compete with traditional jewelry, which involves working with precious metals and stones - such production is unprofitable from an economic point of view, so these two areas will most likely always go hand in hand. nine0003

Military

Perhaps there is a hidden threat in 3D printing, as it can be used to quickly and cheaply produce not only product prototypes and decorative ornaments, but also weapons. So, in May 2013, the network organization Defense Distributed developed a real plastic pistol that anyone could download and print on a 3D printer. Shortly after the announcement of the invention, the US State Department demanded that the instructions be removed from the website. Currently, in some countries of the world, the production, sale, purchase and possession of weapons printed on a 3D printer is illegal.