3D printer trend

What Were the 3D Printing Trends in 2022?

Published on December 29, 2022 by Madeleine P.

As 2022 comes to an end, it’s time once again to reflect upon the state of the 3D printing market this year. Or more specifically, it is the moment to look back at the trends that dominated the additive manufacturing industry. And what was certainly clear this year is that the AM sector is continuing the progress that it has already made in previous years. For example, it has continued to recover from the pandemic as well as continue to industrialize, moving especially towards both large-format 3D printing and larger-scale operations. Additionally, actors in the field continue to focus on sustainability.

The connection between sustainability and 3D printing especially is certainly not a secret. AM is often lauded as a much more environmentally friendly process thanks to its ability to reduce waste. And though it is not perfect, with plastic use in particular courting controversy, the focus on developing the technologies more and encouraging environmental responsibility with 3D printing has only grown. In particular, we can point to the fact that the Additive Manufacturing Green Trade Association (AMGTA) continues to expand, counting many leaders in additive manufacturing among its members. Currently, the association has 50 member companies, a sharp increase from the beginning of 2021.

Sherri Monroe is the Executive Director of the AMGTA, an association which has grown rapidly as interest in 3D printing’s role in more sustainable manufacturing is explored (photo credits: 3Dnatives)

That being said, we also saw a number of new trends dominating the sector. But what exactly are these trends? How have we changed from previous years? Where do we see AM in the near future? To close out the year, we took a step back to reflect on the key takeaways from the 3D printing sector in 2022.

Consolidation Takes the Center Stage for 3D Printing in 2022

At the beginning of the year, we took a look at a report that suggested that the 3D printing industry was not likely to consolidate in the near future. However, that was quickly proven wrong. Despite great expansion in the industry in 2022, we also saw many signs of consolidation in the 3D printing sector, through acquisitions and mergers of course but also through partnerships.

However, that was quickly proven wrong. Despite great expansion in the industry in 2022, we also saw many signs of consolidation in the 3D printing sector, through acquisitions and mergers of course but also through partnerships.

Perhaps one of the biggest consolidation shocks of the year was the merger between Ultimaker and Makerbot back in May 2022. For those who have been acquainted with 3D printing for quite some time, you might remember that MakerBot was one of the first desktop 3D printer companies to emerge from the RepRap movement and was actually acquired first by Stratasys in 2013. Meanwhile, Ultimaker is well known on the market not just for its desktop solutions but also its Cura software, one of the most well-known slicers among 3D printing enthusiasts.

Nadav Goshen (left) and Juergen von Hollen (right) shaking hands on the closing of the merger (photo credits: Ultimaker)

The merger was closed in September of this year, launching a new brand under the name UltiMaker. The companies have both stressed that for them the merger was key to “fueling global 3D printing innovation”, namely by combining their current strengths and solutions as well as investing in new R&D for more products. Nadav Goshen, the former CEO at Makerbot and now CEO of the new combined company, commented in a press release, “As we begin the next chapter together as UltiMaker, we will continue to focus on developing 3D printing innovations to advance the availability of accessible and easy-to-use 3D printing solutions. By combining our teams and technical expertise, we can work towards developing and delivering a comprehensive portfolio of products to support professional, educational and light-industrial applications.”

The companies have both stressed that for them the merger was key to “fueling global 3D printing innovation”, namely by combining their current strengths and solutions as well as investing in new R&D for more products. Nadav Goshen, the former CEO at Makerbot and now CEO of the new combined company, commented in a press release, “As we begin the next chapter together as UltiMaker, we will continue to focus on developing 3D printing innovations to advance the availability of accessible and easy-to-use 3D printing solutions. By combining our teams and technical expertise, we can work towards developing and delivering a comprehensive portfolio of products to support professional, educational and light-industrial applications.”

But that is not the only example. The year started off strong in February when 3D Systems announced that after a year of selling various parts of the company in 2021, it would be acquiring Titan Robotics and Kumovis, thus returning to the FDM market after a lengthy absence. In August, the company also sought to acquire dp polar GmbH, a German designer and manufacturing of an AM system that has been optimized for high-speed mass production of customized components.

In August, the company also sought to acquire dp polar GmbH, a German designer and manufacturing of an AM system that has been optimized for high-speed mass production of customized components.

Similarly in August, Stratasys, one of the leading and first 3D printing manufacturers, announced its acquisition of Covestro’s 3D printing material business. Carbon also made its first acquisition of ParaMatters, a software company known for its generative design software capabilities. And at this point, you may be sensing a pattern within many of these acquisitions and mergers throughout the years. Namely that we saw that AM companies are seeming to seek to create full end-to-end solutions for additive manufacturing by targeting companies that may have different strengths, for example materials or software.

With its acquisition of Digital Metal, Markforged will move into the metal binder jetting market (photo credits: Digital Metal)

This can also been seen as more companies sought to gain access to other AM technologies to extend their own reach. A notable example is Markforged which is seeking to enter the metal binder jetting market with its acquisition of Digital Metal. Markforged, which is best-known for its carbon-fiber and metal 3D printing processes, has been growing rapidly. And the move into metal binder jetting shows its continued intent to grow as well as placing it as a direct competitor on the American market to powerhouse Desktop Metal.

A notable example is Markforged which is seeking to enter the metal binder jetting market with its acquisition of Digital Metal. Markforged, which is best-known for its carbon-fiber and metal 3D printing processes, has been growing rapidly. And the move into metal binder jetting shows its continued intent to grow as well as placing it as a direct competitor on the American market to powerhouse Desktop Metal.

Furthermore, it is not just AM companies that are moving forward with acquisitions and mergers. This year we have also seen large tech companies who were not as active in the sector acquiring 3D printing companies. For example, globally-known camera-manufacturer Nikon moved to acquire SLM solutions through a Public Takeover Offer, announced in September. As of the expiry of the acceptance period for the offer, Nikon has officially acquired about 92.38% of SLM. In a similar vein, the struggling Fast Radius, which went public this year but then quickly saw a decrease in performance, was acquired by SyBridge Technologies in a $15. 9 million sale process under the US bankruptcy code.

9 million sale process under the US bankruptcy code.

However, consolidation does not just refer to acquisitions, though those were also clearly abundant in 2022. As part of this trend, we also want to highlight the increasing role of partnerships in additive manufacturing. Notably between software, post-processing and 3D printer manufacturers as a way to provide customers with a “one stop shop” for their 3D printing needs, helping in the continued industrialization of AM.

The importance of software is clear when you look at many of the acquisitions of partnerships in the AM sector over the course of 2022 (photo credits: 3Dnatives)

Discussing for example the cooperation between AMT and HP, wherein automation and software partnerships are keys to developing a fully comprehensive solution for customers, Wayne Davey, Global Head of Sales and Go To Market for HP’s Personalization and 3D printing business, commented, “We are excited to take our partnership to the next level with AMT given their shared vision, shared customer, and proven portfolio of post processing post processing technology. At HP we believe leveraging partnerships that bring unique expertise to the end-to-end Multi Jet Fusion workflow are key to accelerating the scale of additive manufacturing to production.”

At HP we believe leveraging partnerships that bring unique expertise to the end-to-end Multi Jet Fusion workflow are key to accelerating the scale of additive manufacturing to production.”

Moreover, DyeMansion, an established provider of post-processing solutions, and Nexa3D have entered a partnership for the same reason. Kevin McAlea, Chief Operating Officer, Nexa3D, explained “It’s only natural that we would partner with DyeMansion, a leading provider of automated post-processing solutions for powder bed fusion, to ensure that our industrial customers can leverage high-throughput manufacturing capabilities from end-to-end as well as reduce their total cost of operation.” In any case, it seems that many in the 3D printing industry are seeing that we are stronger together, making consolidation a growing reality.

Disruption on the Market Despite Growth

Still, where you see consolidation and growth, disruption is often not far behind. From the very beginning of 2022, disruption was a key trend in the market for a variety of reasons. One of the very first was of course the war in Ukraine. The Russian Invasion officially started on February 24th, 2022 after months of increasing aggression by the Russian government. The move built upon years of tensions between the nations since the annexation of Crimea in 2014.

One of the very first was of course the war in Ukraine. The Russian Invasion officially started on February 24th, 2022 after months of increasing aggression by the Russian government. The move built upon years of tensions between the nations since the annexation of Crimea in 2014.

And though this may seem far from 3D printing, the additive manufacturing community as a whole certainly reacted to the news. In the immediate aftermath of the invasion, many well-known faces in the industry moved to denounce the attack. Beyond that, a number of 3D printing companies including EOS, decided to stop business with Russian customers while others organized donations.

Though we heard about this crisis mostly at the beginning of the year, support continued throughout. We can point notably to silent auctions launched by the Together We Are Strong initiative which was founded by companies such as Nexa3D, EOS, BigRep, Wohlers Associates powered by ASTM International, SYGNIS, Digital University, and 3YOURMIND. These took place at major 3D printing events including Rapid + TCT 2022 and Formnext.

These took place at major 3D printing events including Rapid + TCT 2022 and Formnext.

Companies like Poland-based Sygnis (whose 3D printing farm is pictured here) used 3D printing to help the war effort (photo credits: Sygnis)

There were other ways that the 3D printing community supported the Ukrainian people as well. Users from across the globe as well as companies worked to make 3D printed parts that could help Ukrainians. One notable example is the creation of open-source tourniquet files that could be used on injured civilians. Additionally, companies like Unlimited Tomorrow and Oxford Performance Materials are seeking to send 3D printed prosthetics to the war-torn country. Ukrainian organizations devoted to using additive manufacturing to help their country also rose up including 3D Printing for Ukraine. In this case, the disruption happened outside of the AM community which then rose to meet it. But this was not always the case.

For example, supply chain disruptions were also a source of concern over 2022. And though of course 3D printing is often one of the solutions to this issues, best exemplified during the beginning of the COVID crisis, plastic and microchip shortages the world over managed to affect nearly every industry. This was also exacerbated by the Ukrainian War itself as trade routes were rewritten almost overnight and crucial materials were not able to get where they needed.

And though of course 3D printing is often one of the solutions to this issues, best exemplified during the beginning of the COVID crisis, plastic and microchip shortages the world over managed to affect nearly every industry. This was also exacerbated by the Ukrainian War itself as trade routes were rewritten almost overnight and crucial materials were not able to get where they needed.

Last but not least, though we have seen significant growth in the AM sector over the past few years or so, not all the signs have been so rosy. One of the most worrying signs of course has been a number of layoffs over the course of the year. Though this is likely at least partially a result of the ongoing consolidation of the market as mentioned earlier, it is also clearly a sign of an ongoing trend in the tech sector in general due to the current global recession. And it affected many of the largest companies in the industry. Desktop Metal, Nexa3D, Xerox and Carbon all announced that they were letting go of significant portions of their workforce, with DM alone reducing its global workforce by 12%.

Discussing the reduction, which was named a cost optimization measure, Ric Fulop, CEO of Desktop Metal, noted, “As outlined on prior financial results calls, we have been focused on identifying opportunities to optimize our expense structure while maintaining our growth opportunities. We believe this initiative, which builds on steps we began to take in the second half of 2021 to integrate our teams, positions Desktop Metal to meet our near- and long-term financial commitments and supports our path to profitability.” Showing that for many in the industry, profits may have been less desirable than expected.

Automation and Software Gain in Importance for 3D Printing in 2022

It may come as no surprise that on this list of 3D printing trends from 2022, we are including automation. As 3D printing continues to industrialize, the need to automate the different steps is becoming increasingly important to allow for the type of large-scale printing that is desired in a number of industries. As such, over the course of this year we saw a number of different technologies and software that arose to meet that need.

As such, over the course of this year we saw a number of different technologies and software that arose to meet that need.

We already touched upon it when we discussed consolidation, but one sign of the increased importance of this was in partnerships between 3D printing solution manufacturers and software providers. Indeed, one of the places where it was most evident was in post-processing. Though perhaps less discussed than other additive manufacturing steps, post-processing, or the treatment of a part after printing, is critical for the production of high-quality parts. However the step remains time-consuming and difficult, as also shown in PostProcess’s latest report on trends in post-processing. Automation could help solve that and that is where the industry seems to be moving, as can be seen with the recent partnerships between AMT and HP, as well as DyeMansion and Nexa3D.

But post-processing is not the only area where we have seen a focus on automation in AM. Software is increasingly important in the field as monitoring becomes a key requirement for the creation of end-use parts. As a result, many have been investing more in either creating their own proprietary software solutions to allow for a complete end-to-end AM workflow or through partnerships with software providers allowing for greater automation overall.

Software is increasingly important in the field as monitoring becomes a key requirement for the creation of end-use parts. As a result, many have been investing more in either creating their own proprietary software solutions to allow for a complete end-to-end AM workflow or through partnerships with software providers allowing for greater automation overall.

Once again we must mention Markforged as the company has steadily developed The Digital Forge Platform, a smart platform designed for their solutions. This year Markforged enabled the integration of simulation software in The Digital Forge. Shai Terem, president and CEO of Markforged especially understands the need for the further integration into 3D printing operations, stating: “Simulation enables our customers to adopt The Digital Forge deeper into their manufacturing operations by replacing more mission-critical tooling and end-use metal parts with validated and optimized 3D printed advanced composite parts with Continuous Fiber Reinforcement. Cloud-based software innovation like Simulation is core to our mission to bring industrial part production to the point of need.” This shows especially the importance that automation and software has when it comes to scaling production.

Cloud-based software innovation like Simulation is core to our mission to bring industrial part production to the point of need.” This shows especially the importance that automation and software has when it comes to scaling production.

AI has also continued to solidify its foothold within the 3D printing as a whole especially when it comes to automation. More and more companies are adopting machine learning or AI-based software to help improve processes like monitoring. But it is also being used by researchers as a way of improving productivity in AM.

One notable example is a recent collaboration between Fraunhofer Research Institution for Additive Manufacturing Technologies (IAPT), the Fraunhofer Institute for Ceramic Technologies and Systems (IKTS), the Fraunhofer Institute for Toxicology and Experimental Medicine (ITEM), the Fraunhofer Institute for Mechanics of Materials (IWM) and the Fraunhofer Institute for Digital Medicine (MEVIS). These institutions turned to AI and 3D printing to create customized finger implants. And though this project is just in the beginning, it shows the immense possibilities that open up when 3D printing is combined with software, AI and of course automation.

And though this project is just in the beginning, it shows the immense possibilities that open up when 3D printing is combined with software, AI and of course automation.

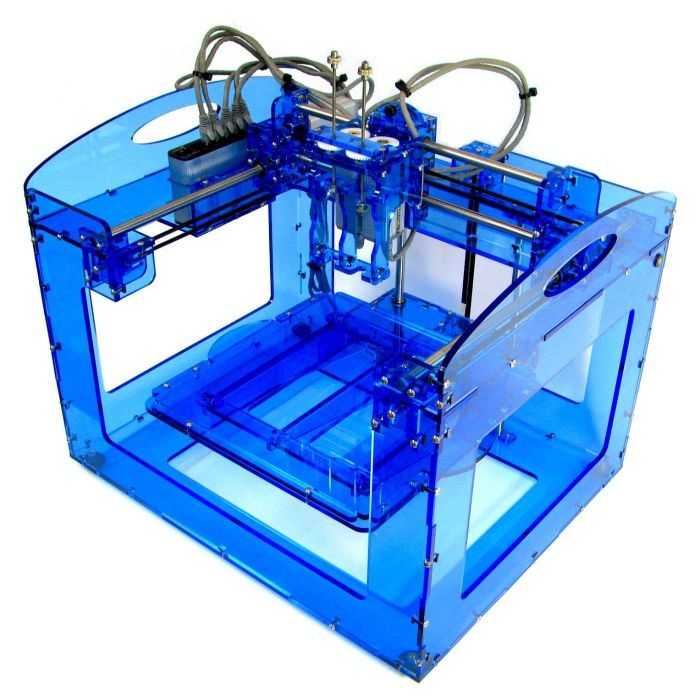

The Rise of Binder Jetting

And last, but certainly not least, we would be remiss if we did not mention one particular 3D printing technology that came up time and again in 2022: binder jetting. Though not always the most discussed out of the 3D printing technologies, binder jetting seemed to start to find its footing this year. Through new compatible materials and new actors on the field, it has earned its spot in our 3D printing trends for 2022.

Photo credits: Digital Metal

First, material development was important for binder jetting in 2022. We can point to Desktop Metal in particular for its increasingly wide range of available materials. Though of course the company continued to invest heavily in both metal and sand, two of the most common binder jetting materials, with the launch of ExOne’s S-Max Flex Sand 3D printer especially, it also branched out. The company has invested in less conventional materials including wood binder jetting, rubber and even foam. This has allowed it to branch into even more industries and applications, firmly cementing the role of binder jetting for end-use parts as well as cores and molds.

The company has invested in less conventional materials including wood binder jetting, rubber and even foam. This has allowed it to branch into even more industries and applications, firmly cementing the role of binder jetting for end-use parts as well as cores and molds.

Next, the binder jetting market was the one that seemed to change the most this year. After the acquisition of ExOne by Desktop Metal last year, the binder jetting market shrunk considerably as two of the biggest competitors joined together. However, as we mentioned earlier, now there are new players. One is of course Markforged.

The American manufacturer’s acquisition of Digital Metal has placed it firmly in the metal binder jetting market as well as positioned it as a direct competitor to DM in a number of fields. However that is not all! This year also marks the official launch of HP’s long-awaited metal 3D printing solution. Though HP uses its Multi Jet Fusion (MJF) process for its polymer solutions, its new metal 3D printer has turned to metal binder jetting. The Metal Jet S100 machine was first unveiled at IMTS 2022 this year and further showcased at Formnext.

The Metal Jet S100 machine was first unveiled at IMTS 2022 this year and further showcased at Formnext.

The decision of both HP and Markforged to delve into metal binder jetting seems centered on the act that through the technology it is possible to achieve mass production of end-use metal parts. Ramon Pastor, global head and general manager of 3D Metals, HP Inc explained it thusly: “Since announcing the breakthrough Metal Jet technology in 2018, we have been working to develop the industry’s most advanced commercial solution for 3D metals mass production. 3D printed metal parts are a key driving force behind digital transformation and the new Metal Jet S100 Solution provides a world class metals offering for our customers, from the first designs right through to production, but more importantly helps them to realize the unlimited potential for digital manufacturing.”

And there you have it. Though of course we have seen continued examples of ongoing trends within the additive manufacturing sector, this year we had a few notable new ones. Between increasing consolidation, disruption in the sector, automation’s increasing role and of course the advancements in binder jetting, 2022 was certainly not a dull one. And we cannot wait to see what else awaits us in the 3D printing world in 2023.

Between increasing consolidation, disruption in the sector, automation’s increasing role and of course the advancements in binder jetting, 2022 was certainly not a dull one. And we cannot wait to see what else awaits us in the 3D printing world in 2023.

What do you think of the 3D printing trends we identified for 2022? Can you think of any others? What do you think we can expect for additive manufacturing in 2023? Let us know in a comment below or on our Linkedin, Facebook, and Twitter pages! Don’t forget to sign up for our free weekly Newsletter here, the latest 3D printing news straight to your inbox! You can also find all our videos on our YouTube channel.

*Cover Photo Credits: 3Dnatives

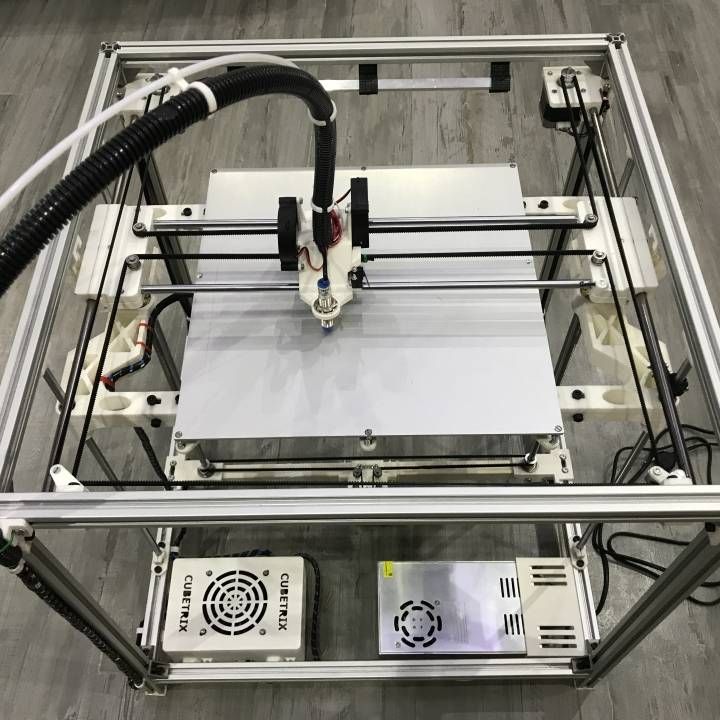

The most important 3D printing trends

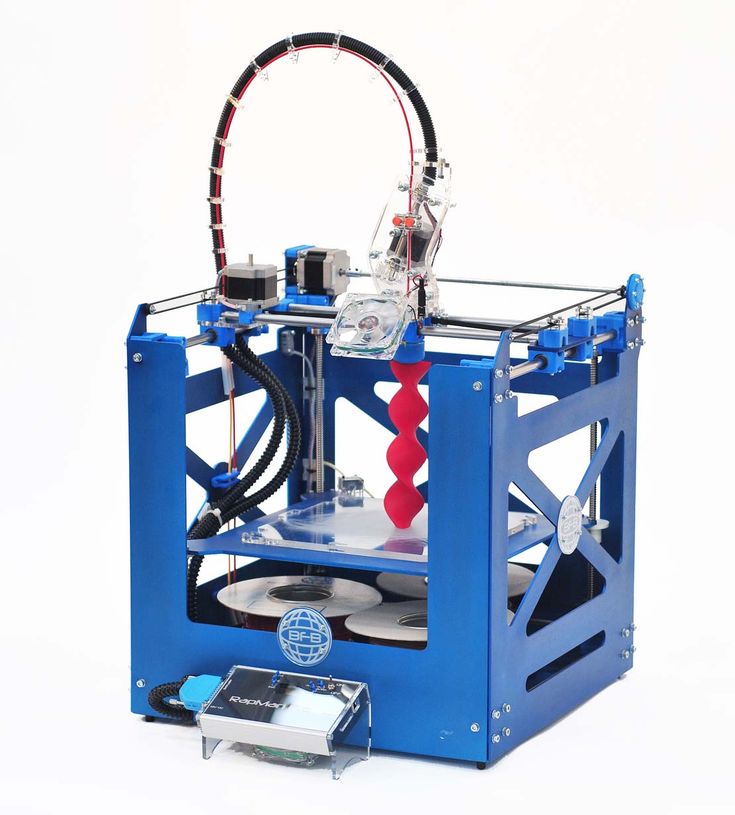

About ten years ago, many leading analyst firms predicted that 3D printers would be standing in virtually every household by 2020. Now we know that these predictions have little to do with the reality around us, and 3D printing has remained an industrial technology. However, this does not mean that its development has stopped. On the contrary, according to a 3D Printing Market Size, Share & Trends Analysis Report, "The global 3D printing market size was valued at USD 13.78 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 21.0% from 2021 to 2028." Let's take a closer look at the most interesting 3D printing trends and applications of this technology in different sectors.

However, this does not mean that its development has stopped. On the contrary, according to a 3D Printing Market Size, Share & Trends Analysis Report, "The global 3D printing market size was valued at USD 13.78 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 21.0% from 2021 to 2028." Let's take a closer look at the most interesting 3D printing trends and applications of this technology in different sectors.

The most interesting 3D printing market trends

3D printing technology is becoming increasingly popular. It is therefore worth taking a look at the most interesting trends to better understand what the future of 3D printing is.

3D printing trends: Printed skin

For over 20 years, scientists have been working to develop technology that would help them grow human skin or tissue that could replace it. One of the primary applications of such skin would, of course, be transplants for victims of burns, accidents, people with badly healing wounds or dermatological problems. It turns out that 3D technology, which has made it possible to print human skin, comes to the rescue. Already, skin manufactured this way is revolutionising the cosmetics industry and reducing the amount of cosmetics tested on animals. This trend is expected to grow significantly in the coming years.

It turns out that 3D technology, which has made it possible to print human skin, comes to the rescue. Already, skin manufactured this way is revolutionising the cosmetics industry and reducing the amount of cosmetics tested on animals. This trend is expected to grow significantly in the coming years.

3D-printed houses

3D Printing applications have become a strong trend in the building industry, designing the „house of the future”. 3D printed houses are fully functional buildings, featuring electricity, water, telecommunications and air-conditioning systems. This could be one way to satisfy the ever-increasing demand for small, individual apartments and houses. A 3D printer for concrete prints walls and the entire house layer by layer in a 24/7 operation. All it needs is the support of a few construction workers. This reduces labor costs by 50 % to 80 % and construction waste by 30 % to 60 %. It is flexible, it can be easily modified or adjusted to customer needs and it only takes 20 % of the time of a building a comparable conventional house!

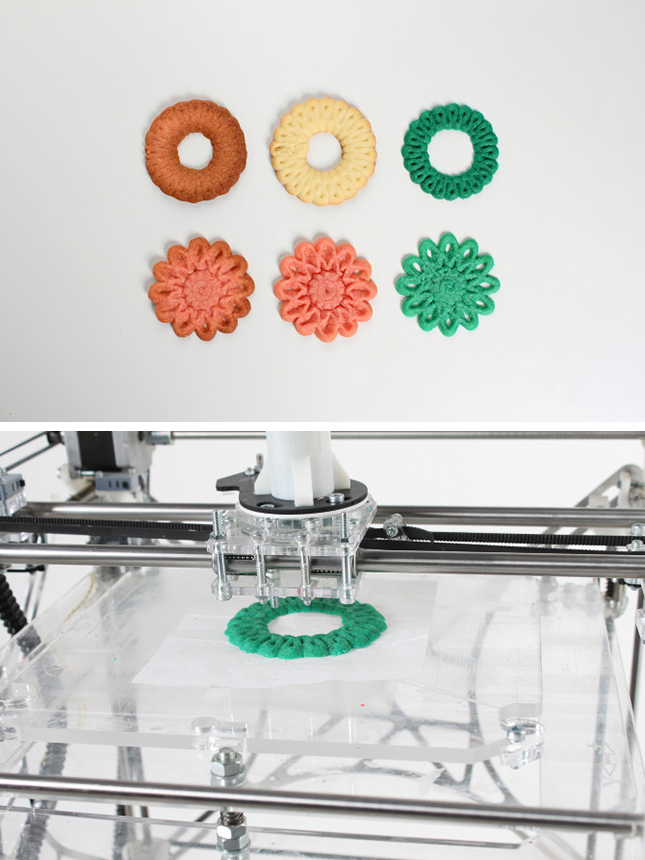

Repurposing plastic

It turns out that 3D printing also strongly supports the zero waste attitude. After all, its very idea is based on zero-waste production – whatever is made is made to measure, there is no waste and not even matrices are needed. But how sustainable are the materials used for 3D printing? Today it is possible to transform plastic waste into filament suitable for 3D printers, so a circular production can be established with the help of 3D printing.

After all, its very idea is based on zero-waste production – whatever is made is made to measure, there is no waste and not even matrices are needed. But how sustainable are the materials used for 3D printing? Today it is possible to transform plastic waste into filament suitable for 3D printers, so a circular production can be established with the help of 3D printing.

4D Printing

It is worth explaining what 4D printing actually is, as its name can be somewhat misleading. This technology involves the use of materials for printing, which after printing and the application of an appropriate stimulus (e.g. temperature) can change shape. Currently, 4D printing is mainly used for visual purposes, but it is easy to imagine its future use, for example in medicine (transplantation), construction (to build pipelines), or robotics.

3D printing trends and the COVID-19 pandemic

3D printing has helped us in dealing with the pandemic. Thanks to 3D printers, we were able to meet the needs of hospitals and medical staff at critical moments. Among other things, the technology helped to speed up the production of face shields or complex ventilator components. In the UK and Israel, for example, protective masks were 3D printed. We all remember the situation when a hospital was built in Wuhan, China, in only 2 weeks with the help of 3D printed materials. Shortly afterward, fifteen isolation rooms for medical staff and people infected with COVID-19 were built in the city of Xianning.

Among other things, the technology helped to speed up the production of face shields or complex ventilator components. In the UK and Israel, for example, protective masks were 3D printed. We all remember the situation when a hospital was built in Wuhan, China, in only 2 weeks with the help of 3D printed materials. Shortly afterward, fifteen isolation rooms for medical staff and people infected with COVID-19 were built in the city of Xianning.

Last but not least, the pandemic has made many companies realise how important it is to not depend on a complex and long supply chain. 3D printing is an obvious ally in this case.

Find out more about the ALSO 3D Printing Solution.

TRENDS IN 3D PRINTING

Paul Benning, Chief Technologist 3D Print HP Inc., spoke about the current technology trends in the manufacturing industry regarding 3D printing.

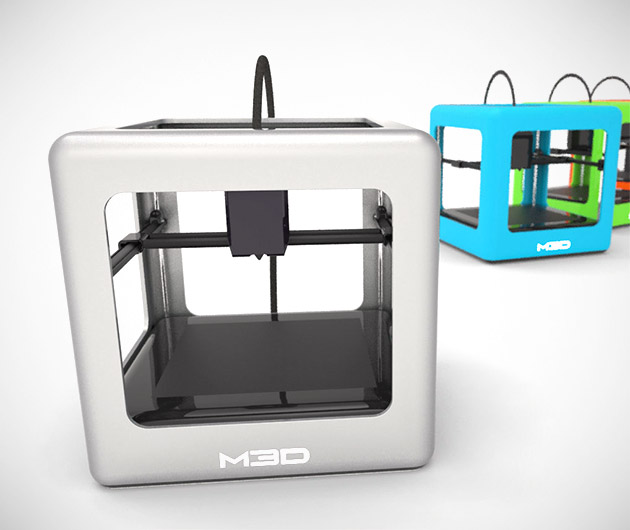

What is 3D printing?

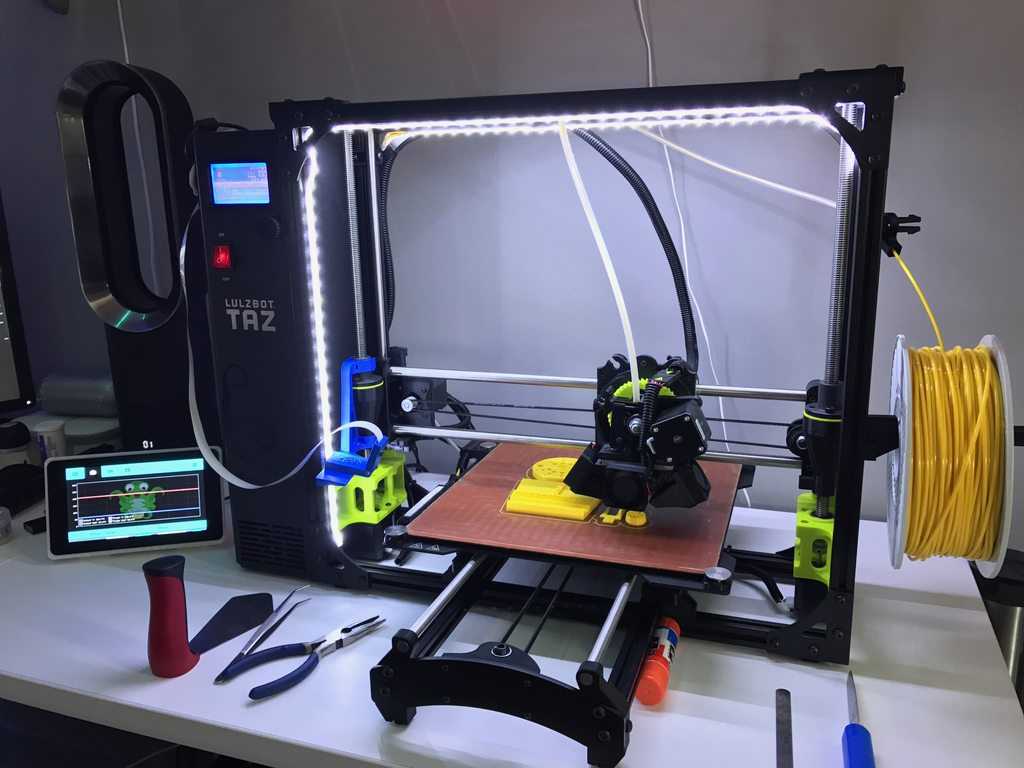

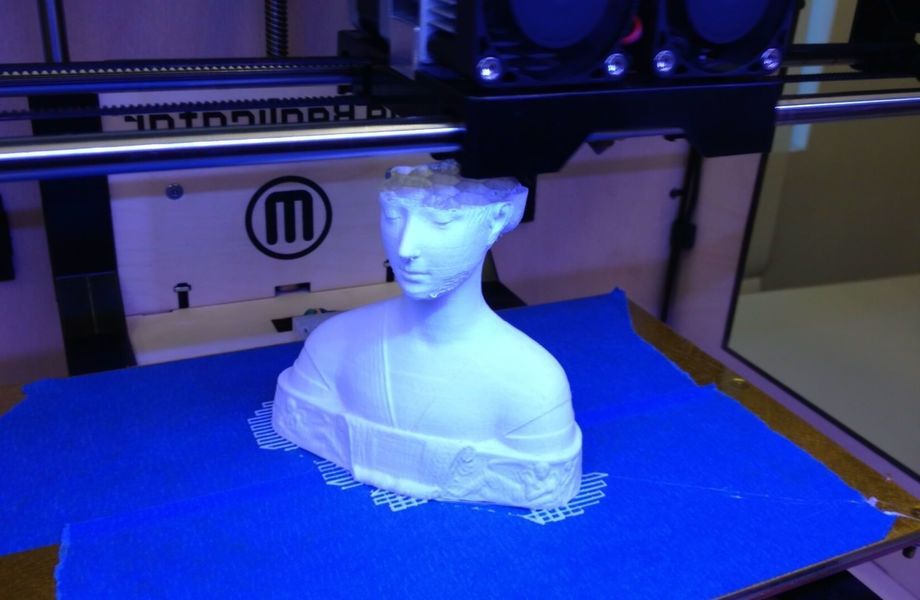

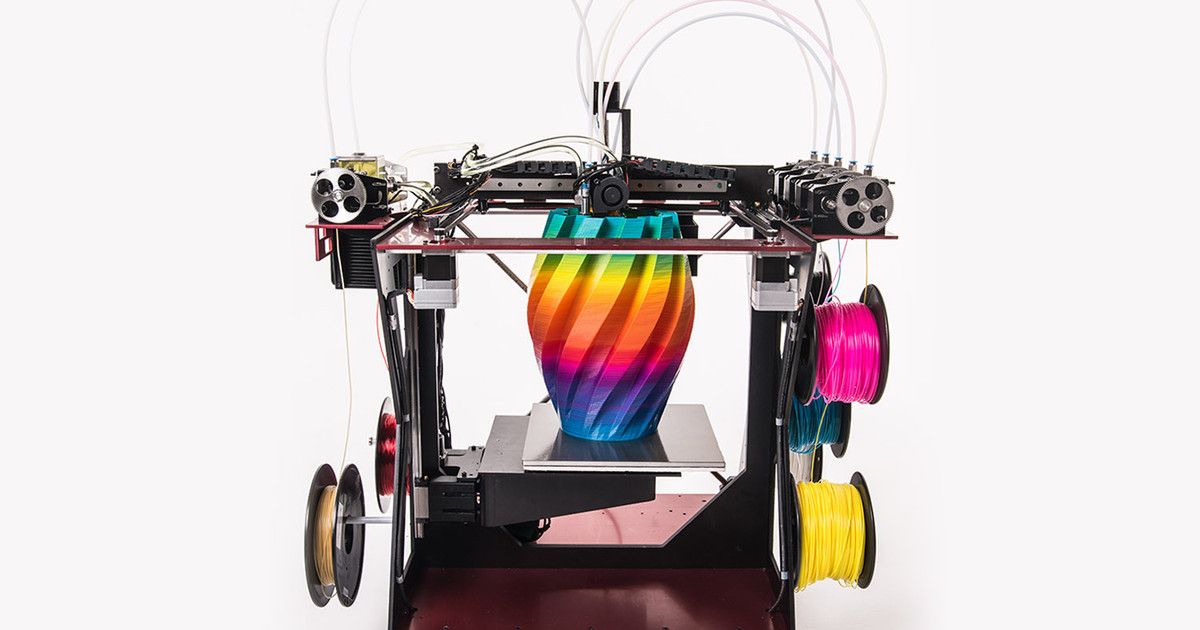

3D printing is a manufacturing process that produces objects according to a 3D digital model. Using a 3D printer and adding material layer by layer, such as plastics and metals, complex objects can be produced quickly and at a low cost, in a short time and in the form of unique parts. HP Multi Jet Fusion 3D technology enables customers to create complex parts with controlled physical and functional properties at every point and deliver speed, quality and strength throughout the manufacturing process for a variety of industries and applications.

Using a 3D printer and adding material layer by layer, such as plastics and metals, complex objects can be produced quickly and at a low cost, in a short time and in the form of unique parts. HP Multi Jet Fusion 3D technology enables customers to create complex parts with controlled physical and functional properties at every point and deliver speed, quality and strength throughout the manufacturing process for a variety of industries and applications.

How has 3D printing evolved over the years?

We are on the threshold of the 4th Industrial Revolution, where physical and digital technologies will radically change almost everything that companies design, design, manufacture, distribute and repair. Growing global demand for sustainable solutions and customized products has led to an increase in demand for 3D printed parts and products. Technological innovations in this area have cut costs in half and doubled productivity. As the 3D printing sector expands beyond prototyping, the use of this technology, especially in supply chains, is becoming more common.

In 2018, HP launched Metal Jet Technology, the world's most advanced 3D printing technology for mass production of mass-produced metal parts. It enables the production of mechanically functional end parts at up to 50 times the throughput of other 3D printing methods at a significantly lower cost than other inkjet printing systems.

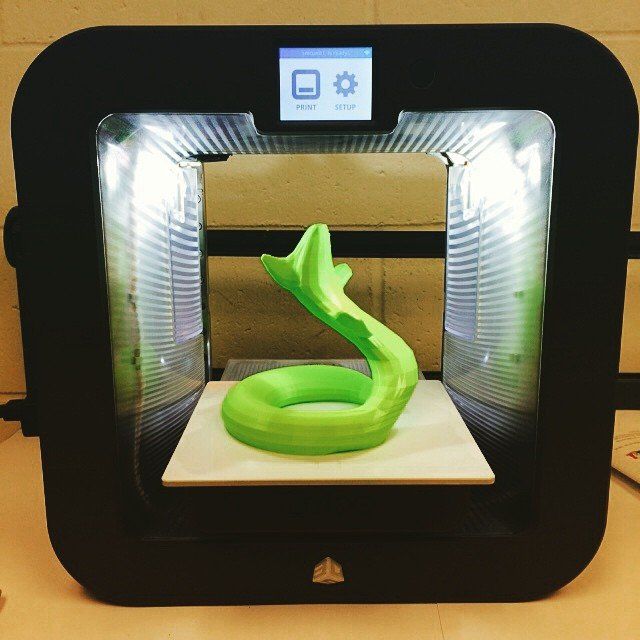

What are the current trends in 3D printing?

The trend we see is the impact of digital manufacturing on manufacturing applications in the automotive, industrial and medical sectors. In the automotive sector, we have become increasingly focused on the development of manufacturing materials, as 3D printing tends to move from prototyping to the production of final parts and products. As new platforms such as electric vehicles move into mass production, the HP Metal Jet is expected to be used for applications such as making fully safety-certified metal parts. Industrial 3D manufacturing also allows the automotive industry to create applications in new ways that were not previously possible, as well as design parts for specific systems or models.

What innovative technology have you seen in 3D printing?

One really powerful example of 3D printing we've seen in the past few weeks is how 3D technology providers and digital solution developers are coming together to help build life-saving applications to combat COVID-19. HP and its global network of partners and customers print critical parts such as vent valves, face mask adjusters and hands-free doorknobs for local hospitals and healthcare providers around the world.

Beyond that, we've seen many uses for this technology, from custom dentures and invisible braces to help people achieve the smile they want, to parts used in cars.

How can 3D printing promote customer orientation?

One of the main advantages of 3D printing is the ability to customize products and parts for the end user. This may be in the form of a design preference, or serve a more practical purpose such as improving the fit or usability of a product. For example, 3D printing allows for easy customization of prosthetic limbs and reduces production time from weeks to days, and can deliver custom-fitted and customized shoes, including insoles made using innovative 3D scanning, dynamic gait analysis, and manufacturing techniques.

For example, 3D printing allows for easy customization of prosthetic limbs and reduces production time from weeks to days, and can deliver custom-fitted and customized shoes, including insoles made using innovative 3D scanning, dynamic gait analysis, and manufacturing techniques.

How can 3D printing make manufacturing more flexible?

Companies no longer need to predict consumer demand by gambling on how much product they will sell; 3D printing provides endless flexibility as it allows you to print what you really need.

3D printing also allows manufacturers to create more successful prototypes as they can print a new model/part every time a design is improved or changed with a simple software tweak that is instantaneous. Thus, there is a saving in time and money compared to if they had to produce new molds every time.

3D printing also allows you to create incredible volumes in a short time. Customer HP SmileDirectClub uses Mult Jet Fusion 3D printing solutions to produce over 50,000 personalized molds per day and expects orders to print nearly 20 million mouth molds over the next 12 months.

More than 10 million parts were produced worldwide in 2018 using HP Multi Jet Fusion technology.

How can 3D printing benefit the manufacturing industry?

3D printing completely rethinks the way things are conceived, designed, produced and distributed, dramatically reducing development and manufacturing costs, greatly simplifying logistics and reducing your carbon footprint. It has huge potential to revolutionize supply chains, and we're starting to see a rise in companies turning to this form of manufacturing to stay competitive and create products faster.

3D printing will be the catalyst for significant shifts in the global manufacturing sector, and leaders will be determined by their ability to exploit their full potential. In a fully digital future, the production of goods will be closer to the consumer, democratizing production on a global scale and allowing mass customization of products. With traditional processes, designers will be able to create entirely new categories of products as the line between ideas and physical reality blurs. And manufacturers no longer tied to overseas factories will shorten supply chains with the newfound ability to make anything, anywhere.

And manufacturers no longer tied to overseas factories will shorten supply chains with the newfound ability to make anything, anywhere.

What are the challenges of 3D printing?

The most significant obstacle is the change of mind. It is critical to think about design for 3D from the early stages of product development, to think about the broader implications of how to get development ready for full-scale production, and how supply chains can be optimized. For those who have worked in traditional manufacturing for decades, there is a deep, ingrained sense of limitations and barriers. In 3D production, a process of re-learning is practically necessary - the vast majority of these restrictions no longer apply. The design possibilities are endless. And, of course, there are new skills that need to be developed to take full advantage of these opportunities.

What applications of 3D printing have you seen in the industry?

3D printing is used in a variety of industries, including automotive, manufacturing, healthcare, and consumer goods. Along with the incredible efforts to support the COVID-19 pandemic, I have also seen some fantastic applications in the commercial sector. 3D printing is used by major car manufacturers to make gears and protective gloves, fashion designers produce 3D printed bags and shoes, and companies print custom foot insoles simply by scanning a patient's foot. The possibilities are truly endless and I look forward to seeing what comes out of the industry in the next few years.

Along with the incredible efforts to support the COVID-19 pandemic, I have also seen some fantastic applications in the commercial sector. 3D printing is used by major car manufacturers to make gears and protective gloves, fashion designers produce 3D printed bags and shoes, and companies print custom foot insoles simply by scanning a patient's foot. The possibilities are truly endless and I look forward to seeing what comes out of the industry in the next few years.

The work done by Jaguar Land Rover to develop electric vehicles or Vestas VBIC, the world's largest supplier of wind turbines, is an important example of how 3D printing allows industries to seamlessly transition from prototyping to manufacturing with incredible flexibility, enabling real-time improvements.

Author Georgia Wilson

Source

Tags:

Paul Benning Main PRINT HP InC., Technological Trends in the manufacturing industry, 3D packet, 3D print development trends, 3D printer, technology HP Multi Jet Fusion 3D

Attention!

We accept news, articles or press releases

with links and images. [email protected]

[email protected]

main trends and expert forecasts

Analytics and business

Experts recommend

Author: Semyon Popadyuk

Author: Semyon Popadyuk

What 3D printing trends do additive manufacturing experts think will be especially relevant in 2022?

3D Printing Industry, one of the leading online publications in the 3D industry, asked researchers, senior executives, technical experts and investors to share their vision for 3D printing this year.

The message is clear: the potential of 3D printing in various industries, including aerospace, automotive and medical, is still growing.

The pandemic has boosted the industry as weak links in the supply chain have been identified, advanced additive technologies have once again topped the agenda. Increasing demands on materials, as well as an increase in demand for higher performance materials, are evidence of manufacturers' confidence in 3D printing. At the same time, attention to the problems of sustainable development suggests that the industry keeps pace with the times.

At the same time, attention to the problems of sustainable development suggests that the industry keeps pace with the times.

The discussion touched upon trends such as consolidation, manufacturing, automation, the expansion of the manufacturing ecosystem (including post-processing), as well as advances in software such as digital threads, simulation, and the growing use of artificial intelligence.

Become a 3D Expert! The iQB Technologies training center offers courses on working with hardware and software products for preparing models for 3D printing and processing 3D scanning data

Bart Van der Schueren, CTO Materialize

Additive manufacturing has proven its worth for many different applications and business models. Over the past two years, due to supply problems, it has received special attention. This has accelerated the adoption of the technology, but at the same time poses challenges for users and the entire 3D industry as a whole..jpg) As the boundaries between traditional manufacturing and 3D printing disappear, the two ecosystems are beginning to merge and form a more integrated manufacturing environment.

As the boundaries between traditional manufacturing and 3D printing disappear, the two ecosystems are beginning to merge and form a more integrated manufacturing environment.

© Materialize

This digitized unified manufacturing environment allows for greater efficiency and repeatability, greater scale and control, but requires a common resource, namely data. Data will play an increasingly important role in 3D printing. It's not just about access to data, it's also about how organizations and users can collect, use and protect their own data.

Smart manufacturing is based on the ability to analyze data to form actionable strategies. They allow to improve and expand production and, as a result, create better products. Combining data from different processes and levels makes it possible to optimize and automate production. This requires an AM software platform that can connect to all systems and datasets in and out of the production environment.

At the same time, organizations must be able to protect their intellectual property. In the case of additive processes, this is relevant both from the point of view of the design of parts and the process itself. With 3D printing, the material and product are created at the same time. Given this side of the issue, data obviously plays a more important role in 3D printing than in traditional manufacturing.

In the case of additive processes, this is relevant both from the point of view of the design of parts and the process itself. With 3D printing, the material and product are created at the same time. Given this side of the issue, data obviously plays a more important role in 3D printing than in traditional manufacturing.

But even in the presence of large amounts of data, optimization first requires knowledge of people in specific areas of specialization, and only then does it make sense to automate the process. In other words, if you're using a lot of data to automate and scale inefficient production, you still won't get good results. The main thing is to combine the right technology with the right experience.

Read more in the article Trend 2022: smart data is increasingly relevant for additive manufacturing

Brian Thompson, VP CAD & General Manager, PTC

Design for Additive Manufacturing (DfAM) will continue to evolve and software will become a critical enabler for industrial additive manufacturing. We will continue to overcome the fragmentation associated with point solutions and strive to create an interconnected ecosystem that combines hardware, software products and materials.

We expect an increase in activity and interest in the field of post-processing products printed on metal 3D printers. Now technologies are being actively developed that complement the printing process itself. This means that metal 3D printing technologies are becoming more mature, at least in a few niche markets.

Hybrid manufacturing (where the same machine performs both additive and subtractive processes) remains a hot topic, especially among manufacturers interested in combining a 3- and 5-axis milling machine with a 3D printer, which would eliminate the need for separate post-processing equipment.

We are already seeing great strides in predicting deformations in metal printing. However, there is also expected to be an increase in interest in modeling tools to address the strain problems inherent in polymer 3D printing. We are also looking forward to products that increase the predictability of resin printing.

Download the free brochure 3D Plastic Printing: Technology and Applications

Finally, we anticipate an increasing focus on digital filament technology across the entire value chain, from concept to post-processing and quality control. In our practice, there was a demonstration project: it included not only an innovative heat exchanger (an achievement in itself) created using flagship CAD technologies, product lifecycle management and industrial Internet of things (order fulfillment and monitoring), but also augmented reality capabilities that allow “send” the part to a specialist anywhere in the world! By September 2022, it is unlikely that there will be manufacturers able to fully implement this practice, but this is what we are aiming for.

Avi Reichental, co-founder and CEO of Nexa3D

This year, the pandemic will continue to largely determine development trends. Over the past two years, weaknesses in a complex and fragile supply chain have been identified, which is a priority issue for most manufacturers. This forces them to accelerate the digitalization and localization of supplies. This is where 3D printing plays a key role, particularly in terms of speed, throughput, cost and sustainability.

As the number of companies moving towards mass additive manufacturing increases, there will be an increased demand for scalable solutions for post-processing and full production automation. The basis for these solutions will be advanced adaptive machine learning and vision technologies to improve the stability and efficiency of production.

© Nexa3D

We will undoubtedly see an expansion of open ecosystems of innovation and collaboration, from which everyone will benefit. With greater and more flexible participation from around the world, this collaborative approach will help accelerate the adoption and development of technology.

Mohsen Seifi, Director, International AM Programs, Martin White, Program Manager, AM Europe, UK Alexander Liu, Program Manager, AM Asia, Singapore, and Terry Wohlers, Head of Advisory Services and Market Intelligence, ASTM International 9 Center of Excellence for Additive Manufacturing0143

In 2022, development is expected in two key areas:

In critical applications, site inspections can help ensure risk-adjusted structural integrity and certify large parts that are difficult to scan with CT. For example, ASTM is currently working with NASA on a three-year project to use site inspections to determine the effect of defects on structural integrity.

With regard to post-processing, it is obvious that in order to develop durable and reliable parts and products, it is necessary to optimize the surface treatment and internal structure (microstructures, porosity level). In some cases, more than 60% of the cost of the final product is in post-processing. Thus, we see that the industry is really striving to improve the quality of products. We believe that post-processing will have a significant impact on the success of additive manufacturing, as was already evident at Formnext 2021.

iQB Technologies experts recommend article: 3D printing as a full-fledged manufacturing technology in the context of the COVID-19 pandemic

Daeho Hong, Production Manager nTopology

In 2022, many enterprises will develop core additive technologies, from prototyping and R&D to manufacturing. We expect more items in the aerospace, automotive, heavy industry, and medical device industries to be approved and put into production than in recent years.

More integrated and automated additive manufacturing will streamline product development and manufacturing by integrating enterprise systems, 3D printing software and hardware. This year we will see a transition from prototyping to manufacturing, with the main challenges being the stabilization of selected additive technologies, scaling up to reduce costs, and quality control.

Gil Lavi, Founder & CEO, 3D Alliances

In the short term, I see more synergy between the following four areas:

-

3D printing software,

-

3D printers,

-

post-processing,

-

materials for 3D printing.

With increasing awareness and demand from industrial users to introduce additive technologies into manufacturing processes, solution providers are realizing the importance of building a single end-to-end workflow. Therefore, in 2022, I look forward to greater collaboration between 3D printing hardware, software, and material suppliers to help users integrate 3D into manufacturing.

Another challenge, in my opinion, is to ensure that publicly traded 3D printing companies are valued on the stock exchange. Only a few of them will be able to achieve this only through high financial performance. Simply put, in the longer term, this industry will continue to evolve and push the boundaries, discovering new ways to transform analog and manual processes into digital ones.

Rush LaSelle, Senior Director, Additive Manufacturing, Jabil

We look forward to further development of initiatives aimed at reducing production costs through 3D printing. The results obtained will help to prove that additive processes have significant advantages over traditional ones in relation to the manufacture of medium-sized batches and industries that are sensitive to price fluctuations. The main costs will be aimed at increasing the productivity of industrial 3D printers relative to capital investments. In addition, you need to focus on reducing labor and material costs, as well as reducing the time from design to delivery.

Reducing the cost of acquiring and operating 3D printers remains a critical factor for mass-produced businesses. As users seek to realize the benefits of additive manufacturing to increase production volumes, it is essential to be able to increase the productivity of printers. The use of more lasers in powder melting/sintering plants or higher layering speeds while improving print resolution will increase cost efficiency and investment attractiveness.