Harvard business review 3d printing

The 3-D Printing Revolution

Idea in Brief

The Breakthrough

Additive manufacturing, or 3-D printing, is poised to transform the industrial economy. Its extreme flexibility not only allows for easy customization of goods but also eliminates assembly and inventories and enables products to be redesigned for higher performance.

The Challenge

Management teams should be reconsidering their strategies along three dimensions: (1) How might our offerings be enhanced, either by us or by competitors? (2) How should we reconfigure our operations, given the myriad new options for fabricating products and parts? (3) How will our commercial ecosystem evolve?

The Big Play

Inevitably, powerful platforms will arise to establish standards and facilitate exchanges among the designers, makers, and movers of 3-D-printed goods. The most successful of these will prosper mightily.

Leer en español

Ler em português

Industrial 3-D printing is at a tipping point, about to go mainstream in a big way. Most executives and many engineers don’t realize it, but this technology has moved well beyond prototyping, rapid tooling, trinkets, and toys. “Additive manufacturing” is creating durable and safe products for sale to real customers in moderate to large quantities.

The beginnings of the revolution show up in a 2014 PwC survey of more than 100 manufacturing companies. At the time of the survey, 11% had already switched to volume production of 3-D-printed parts or products. According to Gartner analysts, a technology is “mainstream” when it reaches an adoption level of 20%.

Among the numerous companies using 3-D printing to ramp up production are GE (jet engines, medical devices, and home appliance parts), Lockheed Martin and Boeing (aerospace and defense), Aurora Flight Sciences (unmanned aerial vehicles), Invisalign (dental devices), Google (consumer electronics), and the Dutch company LUXeXcel (lenses for light-emitting diodes, or LEDs). Watching these developments, McKinsey recently reported that 3-D printing is “ready to emerge from its niche status and become a viable alternative to conventional manufacturing processes in an increasing number of applications. ” In 2014 sales of industrial-grade 3-D printers in the United States were already one-third the volume of industrial automation and robotic sales. Some projections have that figure rising to 42% by 2020.

” In 2014 sales of industrial-grade 3-D printers in the United States were already one-third the volume of industrial automation and robotic sales. Some projections have that figure rising to 42% by 2020.

Further Reading

More companies will follow as the range of printable materials continues to expand. In addition to basic plastics and photosensitive resins, these already include ceramics, cement, glass, numerous metals and metal alloys, and new thermoplastic composites infused with carbon nanotubes and fibers. Superior economics will eventually convince the laggards. Although the direct costs of producing goods with these new methods and materials are often higher, the greater flexibility afforded by additive manufacturing means that total costs can be substantially lower.

With this revolutionary shift already under way, managers should now be engaging with strategic questions on three levels:

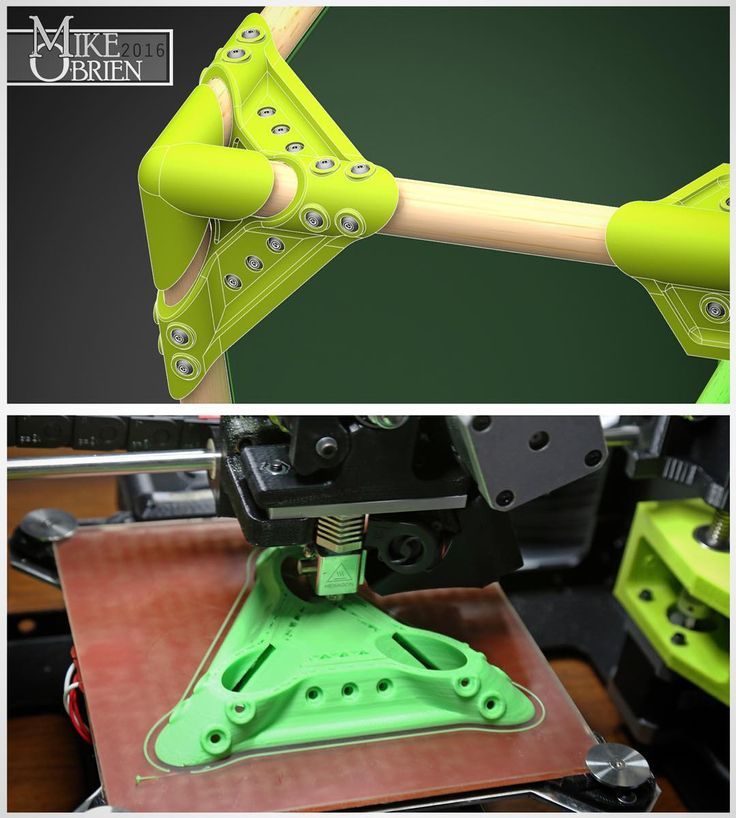

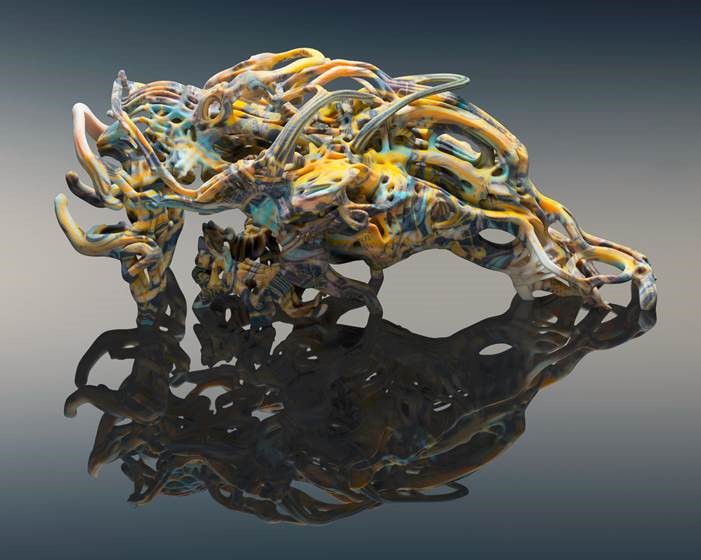

First, sellers of tangible products should ask how their offerings could be improved, whether by themselves or by competitors. Fabricating an object layer by layer, according to a digital “blueprint” downloaded to a printer, allows not only for limitless customization but also for designs of greater intricacy.

Fabricating an object layer by layer, according to a digital “blueprint” downloaded to a printer, allows not only for limitless customization but also for designs of greater intricacy.

Second, industrial enterprises must revisit their operations. As additive manufacturing creates myriad new options for how, when, and where products and parts are fabricated, what network of supply chain assets and what mix of old and new processes will be optimal?

Third, leaders must consider the strategic implications as whole commercial ecosystems begin to form around the new realities of 3-D printing. Much has been made of the potential for large swaths of the manufacturing sector to atomize into an untold number of small “makers.” But that vision tends to obscure a surer and more important development: To permit the integration of activities across designers, makers, and movers of goods, digital platforms will have to be established. At first these platforms will enable design-to-print activities and design sharing and fast downloading. Soon they will orchestrate printer operations, quality control, real-time optimization of printer networks, and capacity exchanges, among other needed functions. The most successful platform providers will prosper mightily by establishing standards and providing the settings in which a complex ecosystem can coordinate responses to market demands. But every company will be affected by the rise of these platforms. There will be much jockeying among incumbents and upstarts to capture shares of the enormous value this new technology will create.

Soon they will orchestrate printer operations, quality control, real-time optimization of printer networks, and capacity exchanges, among other needed functions. The most successful platform providers will prosper mightily by establishing standards and providing the settings in which a complex ecosystem can coordinate responses to market demands. But every company will be affected by the rise of these platforms. There will be much jockeying among incumbents and upstarts to capture shares of the enormous value this new technology will create.

These questions add up to a substantial amount of strategic thinking, and still another remains: How fast will all this happen? For a given business, here’s how fast it can happen: The U.S. hearing aid industry converted to 100% additive manufacturing in less than 500 days, according to one industry CEO, and not one company that stuck to traditional manufacturing methods survived. Managers will need to determine whether it’s wise to wait for this fast-evolving technology to mature before making certain investments or whether the risk of waiting is too great. Their answers will differ, but for all of them it seems safe to say that the time for strategic thinking is now.

Their answers will differ, but for all of them it seems safe to say that the time for strategic thinking is now.

Additive’s Advantages

It may be hard to imagine that this technology will displace today’s standard ways of making things in large quantities. Traditional injection-molding presses, for example, can spit out thousands of widgets an hour. By contrast, people who have watched 3-D printers in action in the hobbyist market often find the layer-by-layer accretion of objects comically slow. But recent advances in the technology are changing that dramatically in industrial settings.

Some may forget why standard manufacturing occurs with such impressive speed. Those widgets pour out quickly because heavy investments have been made up front to establish the complex array of machine tools and equipment required to produce them. The first unit is extremely expensive to make, but as identical units follow, their marginal cost plummets.

Additive manufacturing doesn’t offer anything like that economy of scale. However, it avoids the downside of standard manufacturing—a lack of flexibility. Because each unit is built independently, it can easily be modified to suit unique needs or, more broadly, to accommodate improvements or changing fashion. And setting up the production system in the first place is much simpler, because it involves far fewer stages. That’s why 3-D printing has been so valuable for producing one-offs such as prototypes and rare replacement parts. But additive manufacturing increasingly makes sense even at higher scale. Buyers can choose from endless combinations of shapes, sizes, and colors, and this customization adds little to a manufacturer’s cost even as orders reach mass-production levels.

However, it avoids the downside of standard manufacturing—a lack of flexibility. Because each unit is built independently, it can easily be modified to suit unique needs or, more broadly, to accommodate improvements or changing fashion. And setting up the production system in the first place is much simpler, because it involves far fewer stages. That’s why 3-D printing has been so valuable for producing one-offs such as prototypes and rare replacement parts. But additive manufacturing increasingly makes sense even at higher scale. Buyers can choose from endless combinations of shapes, sizes, and colors, and this customization adds little to a manufacturer’s cost even as orders reach mass-production levels.

A big part of the additive advantage is that pieces that used to be molded separately and then assembled can now be produced as one piece in a single run. A simple example is sunglasses: The 3-D process allows the porosity and mixture of plastics to vary in different areas of the frame. The earpieces come out soft and flexible, while the rims holding the lenses are hard. No assembly required.

The earpieces come out soft and flexible, while the rims holding the lenses are hard. No assembly required.

Printing parts and products also allows them to be designed with more-complex architectures, such as honeycombing within steel panels or geometries previously too fine to mill. Complex mechanical parts—an encased set of gears, for example—can be made without assembly. Additive methods can be used to combine parts and generate far more interior detailing. That’s why GE Aviation has switched to printing the fuel nozzles of certain jet engines. It expects to churn out more than 45,000 of the same design a year, so one might assume that conventional manufacturing methods would be more suitable. But printing technology allows a nozzle that used to be assembled from 20 separately cast parts to be fabricated in one piece. GE says this will cut the cost of manufacturing by 75%.

U.S. hearing aid companies converted to 100% 3-D printing in less than 500 days.

Additive manufacturing can also use multiple printer jets to lay down different materials simultaneously. Thus Optomec and other companies are developing conductive materials and methods of printing microbatteries and electronic circuits directly into or onto the surfaces of consumer electronic devices. Additional applications include medical equipment, transportation assets, aerospace components, measurement devices, telecom infrastructure, and many other “smart” things.

Thus Optomec and other companies are developing conductive materials and methods of printing microbatteries and electronic circuits directly into or onto the surfaces of consumer electronic devices. Additional applications include medical equipment, transportation assets, aerospace components, measurement devices, telecom infrastructure, and many other “smart” things.

The enormous appeal of limiting assembly work is pushing additive manufacturing equipment to grow ever larger. At the current extreme, the U.S. Department of Defense, Lockheed Martin, Cincinnati Tool Steel, and Oak Ridge National Laboratory are partnering to develop a capability for printing most of the endo- and exoskeletons of jet fighters, including the body, wings, internal structural panels, embedded wiring and antennas, and soon the central load-bearing structure. So-called big area additive manufacturing makes such large-object fabrication possible by using a huge gantry with computerized controls to move the printers into position. When this process has been certified for use, the only assembly required will be the installation of plug-and-play electronics modules for navigation, communications, weaponry, and electronic countermeasure systems in bays created during the printing process. In Iraq and Afghanistan the U.S. military has been using drones from Aurora Flight Sciences, which prints the entire body of these unmanned aerial vehicles—some with wingspans of 132 feet—in one build.

When this process has been certified for use, the only assembly required will be the installation of plug-and-play electronics modules for navigation, communications, weaponry, and electronic countermeasure systems in bays created during the printing process. In Iraq and Afghanistan the U.S. military has been using drones from Aurora Flight Sciences, which prints the entire body of these unmanned aerial vehicles—some with wingspans of 132 feet—in one build.

Three-Dimensional Strategy

This brief discussion of additive manufacturing’s advantages suggests how readily companies will embrace the technology—and additional savings in inventory, shipping, and facility costs will make the case even stronger. The clear implication is that managers in companies of all kinds should be working to anticipate how their businesses will adapt on the three strategic levels mentioned above.

Offerings, redesigned.

Product strategy is the answer to that most basic question in business, What will we sell? Companies will need to imagine how their customers could be better served in an era of additive manufacturing. What designs and features will now be possible that were not before? What aspects can be improved because restrictions or delivery delays have been eliminated?

What designs and features will now be possible that were not before? What aspects can be improved because restrictions or delivery delays have been eliminated?

For example, in the aerospace and automotive industries, 3-D printing will most often be used in the pursuit of performance gains. Previously, the fuel efficiency of jet fighters and vehicles could be enhanced by reducing their weight, but this frequently made them less structurally sound. The new technology allows manufacturers to hollow out a part to make it lighter and more fuel-efficient and incorporate internal structures that provide greater tensile strength, durability, and resistance to impact. And new materials that have greater heat and chemical resistance can be used in various spots in a product, as needed.

Want to know how fast the 3-D future is coming? Don’t look only at adoption rates among manufacturers. Look at the innovation rates of inventors. In 2005 only 80 patents relating to additive manufacturing materials, software, and equipment were granted worldwide, not counting duplicates filed in multiple countries. By 2013 that number had gone into orbit, with approximately 600 new nonduplicative patents issued around the globe.

By 2013 that number had gone into orbit, with approximately 600 new nonduplicative patents issued around the globe.

What are some of the companies behind these patents? Not surprisingly, the two leaders are Stratasys and 3D Systems, rivals that have staked out positions in additive manufacturing. They hold 57 and 49 nonduplicative patents respectively. As befits its printing heritage, Xerox, too, has invested heavily in additive technologies for making electronics and has developed a strong alliance with 3D Systems. Panasonic, Hewlett-Packard, 3M, and Siemens likewise hold numerous patents.

But surprisingly, the largest users of 3-D printing have also been active innovators. Fourth on the list, with 35 patents, is Therics, a manufacturer of medical devices. These commercial companies understand additive manufacturing’s potential to give them important advantages over competitors.

Also noteworthy among patent holders are companies that straddle both worlds. GE and IBM are important manufacturers but are increasingly invested in platforms that optimize value chains run by other companies. GE (11 patents) is developing the industrial internet, and IBM (19) has worked out what it is calling the “software-defined supply chain” and optimization software for smart manufacturing systems. Both are well positioned to take on similar roles with regard to additive manufacturing—and both bear watching as models for how incumbents can capture disproportionate value from a highly disruptive technology.

GE (11 patents) is developing the industrial internet, and IBM (19) has worked out what it is calling the “software-defined supply chain” and optimization software for smart manufacturing systems. Both are well positioned to take on similar roles with regard to additive manufacturing—and both bear watching as models for how incumbents can capture disproportionate value from a highly disruptive technology.

In other industries, the use of additive manufacturing for more-tailored and fast-evolving products will have ramifications for how offerings are marketed. What happens to the concept of product generations—let alone the hoopla around a launch—when things can be upgraded continually during successive printings rather than in the quantum leaps required by the higher tooling costs and setup times of conventional manufacturing? Imagine a near future in which cloud-based artificial intelligence augments additive manufacturing’s ability to change or add products instantly without retooling. Real-time changes in product strategy, such as product mix and design decisions, would become possible. With such rapid adaptation, what new advantages should be core to brand promises? And how could marketing departments prevent brand drift without losing sales?

Real-time changes in product strategy, such as product mix and design decisions, would become possible. With such rapid adaptation, what new advantages should be core to brand promises? And how could marketing departments prevent brand drift without losing sales?

Operations, reoptimized.

Operations strategy encompasses all the questions of how a company will buy, make, move, and sell goods. The answers will be very different with additive manufacturing. Greater operational efficiency is always a goal, but it can be achieved in many ways. Today most companies contemplating the use of the technology do piecemeal financial analysis of targeted opportunities to swap in 3-D equipment and designs where those can reduce direct costs. Much bigger gains will come when they broaden their analyses to consider the total cost of manufacturing and overhead.

How much could be saved by cutting out assembly steps? Or by slashing inventories through production only in response to actual demand? Or by selling in different ways—for example, direct to consumers via interfaces that allow them to specify any configuration? In a hybrid world of old and new manufacturing methods, producers will have many more options; they will have to decide which components or products to transition over to additive manufacturing, and in what order.

Additional questions will arise around facilities locations. How proximate should they be to which customers? How can highly customized orders be delivered as efficiently as they are produced? Should printing be centralized in plants or dispersed in a network of printers at distributors, at retailers, on trucks, or even in customers’ facilities? Perhaps all of the above. The answers will change in real time, adjusting to shifts in foreign exchange, labor costs, printer efficiency and capabilities, material costs, energy costs, and shipping costs.

This article also appears in:

A shorter traveling distance for products or parts not only saves money; it saves time. If you’ve ever been forced to leave your vehicle at a repair shop while the mechanic waits for a part, you’ll appreciate that. BMW and Honda, among other automakers, are moving toward the additive manufacturing of many industrial tools and end-use car parts in their factories and dealerships—especially as new metal, composite plastic, and carbon-fiber materials become available for use in 3-D printers. Distributors in many industries are taking note, eager to help their business customers capitalize on the new efficiencies. UPS, for example, is building on its existing third-party logistics business to turn its airport hub warehouses into mini-factories. The idea is to produce and deliver customized parts to customers as needed, instead of devoting acres of shelving to vast inventories. If we already live in a world of just-in-time inventory management, we now see how JIT things can get. Welcome to instantaneous inventory management.

Distributors in many industries are taking note, eager to help their business customers capitalize on the new efficiencies. UPS, for example, is building on its existing third-party logistics business to turn its airport hub warehouses into mini-factories. The idea is to produce and deliver customized parts to customers as needed, instead of devoting acres of shelving to vast inventories. If we already live in a world of just-in-time inventory management, we now see how JIT things can get. Welcome to instantaneous inventory management.

Indeed, given all the potential efficiencies of highly integrated additive manufacturing, business process management may become the most important capability around. Some companies that excel in this area will build out proprietary coordination systems to secure competitive advantage. Others will adopt and help to shape standard packages created by big software companies.

Ecosystems, reconfigured.

Finally comes the question of where and how the enterprise fits into its broader business environment. Here managers address the puzzles of Who are we? and What do we need to own to be who we are? As additive manufacturing allows companies to acquire printers that can make many products, and as idle capacity is traded with others in the business of offering different products, the answers to those questions will become far less clear. Suppose you have rows of printers in your facility that build auto parts one day, military equipment the next day, and toys the next. What industry are you part of? Traditional boundaries will blur. Yet managers need a strong sense of the company’s role in the world to make decisions about which assets they will invest in—or divest themselves of.

Here managers address the puzzles of Who are we? and What do we need to own to be who we are? As additive manufacturing allows companies to acquire printers that can make many products, and as idle capacity is traded with others in the business of offering different products, the answers to those questions will become far less clear. Suppose you have rows of printers in your facility that build auto parts one day, military equipment the next day, and toys the next. What industry are you part of? Traditional boundaries will blur. Yet managers need a strong sense of the company’s role in the world to make decisions about which assets they will invest in—or divest themselves of.

Aurora Flight Sciences can print the entire body of a drone in one build.

They may find their organizations evolving into something very different from what they have been. As companies are freed from many of the logistical requirements of standard manufacturing, they will have to look anew at the value of their capabilities and other assets and how those complement or compete with the capabilities of others.

The Platform Opportunity

One position in the ecosystem will prove to be the most central and powerful—and this fact is not lost on the management teams of the biggest players already in the business of additive manufacturing, such as eBay, IBM, Autodesk, PTC, Materialise, Stratasys, and 3D Systems. Many are vying to develop the platforms on which other companies will build and connect. They know that the role of platform provider is the biggest strategic objective they could pursue and that it’s still very much up for grabs.

Platforms are a prominent feature in highly digitized 21st-century markets, and additive manufacturing will be no exception. Here platform owners will be powerful because production itself is likely to matter less over time. Already some companies are setting up contract “printer farms” that will effectively commoditize the making of products on demand. Even the valuable designs for printable products, being purely digital and easily shared, will be hard to hold tight. (For that matter, 3-D scanning devices will make it possible to reverse-engineer products by capturing their geometric design information.)

(For that matter, 3-D scanning devices will make it possible to reverse-engineer products by capturing their geometric design information.)

Everyone in the system will have a stake in sustaining the platforms on which production is dynamically orchestrated, blueprints are stored and continually enhanced, raw materials supplies are monitored and purchased, and customer orders are received. Those that control the digital ecosystem will sit in the middle of a tremendous volume of industrial transactions, collecting and selling valuable information. They will engage in arbitrage and divide the work up among trusted parties or assign it in-house when appropriate. They will trade printer capacity and designs all around the world, influencing prices by controlling or redirecting the “deal flow” for both. Like commodities arbitrageurs, they will finance trades or buy low and sell high with the asymmetric information they gain from overseeing millions of transactions.

Any manufacturer whose strategy for the future includes additive techniques has to lay out a road map for getting there. Companies already on the journey are taking things step-by-step, but in three different ways.

Companies already on the journey are taking things step-by-step, but in three different ways.

Trickle Down

Some start with their high-end products, knowing that their most sophisticated (and price-insensitive) customers will appreciate the innovation and flexibility. The luxury will trickle down in the time-honored way as the technology matures and becomes more affordable. Automotive manufacturers, for example, tend to engineer one-off parts specially for Formula One racing cars and then find ways to introduce versions of those innovations to high-end sports and luxury cars. As engineers’ familiarity with the technology grows, they spot opportunities to bring it to parts for mass-market car segments.

Swap Out

Other pioneers proceed in a less splashy way, focusing first on the components of a given product that are easiest to migrate to additive manufacturing. The objective is to develop the organization’s know-how by advancing to more-challenging components of the same product. This is common in aerospace, where companies have selected a specific product, such as an F-35 fighter jet, and started with mundane brackets and braces before moving to, say, internal panels and partitions. As the manufacturers learn more, they begin printing the fighter’s exterior skin. Experiments with printing its load-bearing structures are now under way.

This is common in aerospace, where companies have selected a specific product, such as an F-35 fighter jet, and started with mundane brackets and braces before moving to, say, internal panels and partitions. As the manufacturers learn more, they begin printing the fighter’s exterior skin. Experiments with printing its load-bearing structures are now under way.

Cut Across

A third approach is to find components that show up in multiple products and use them to establish a 3-D foothold. For example, a design improvement for a fighter jet could be transferred to drones, missiles, or satellites. Such cross-product improvement builds knowledge and awareness throughout the company of how additive manufacturing can enhance performance on key dimensions such as weight, energy use, and flexibility.

The common theme here is small, incremental steps. In all three approaches, engineers are being given fascinating new puzzles to solve without having their world upended by still-evolving methods and materials, thus minimizing risk and resistance to change. It is up to more-senior managers to maintain the appropriate level of pressure for taking each successive step. As they push for further adoption, they should allow naysayers to explain why 3-D printing isn’t right for a given part or process, but then challenge them to overcome that roadblock. Traditionalists will always be quick to tell you what 3-D printing can’t do. Don’t let them blind you to what it can.

It is up to more-senior managers to maintain the appropriate level of pressure for taking each successive step. As they push for further adoption, they should allow naysayers to explain why 3-D printing isn’t right for a given part or process, but then challenge them to overcome that roadblock. Traditionalists will always be quick to tell you what 3-D printing can’t do. Don’t let them blind you to what it can.

Responsibility for aligning dispersed capacity with growing market demand will fall to a small number of companies—and if the whole system is to work efficiently, some will have to step up to it. Look for analogs to Google, eBay, Match.com, and Amazon to emerge as search engines, exchange platforms, branded marketplaces, and matchmakers among additive manufacturing printers, designers, and design repositories. Perhaps even automated trading will come into existence, along with markets for trading derivatives or futures on printer capacity and designs.

In essence, then, the owners of printer-based manufacturing assets will compete with the owners of information for the profits generated by the ecosystem. And in fairly short order, power will migrate from producers to large systems integrators, which will set up branded platforms with common standards to coordinate and support the system. They’ll foster innovation through open sourcing and acquiring or partnering with smaller companies that meet high standards of quality. Small companies may indeed continue to try out interesting new approaches on the margins—but we’ll need big organizations to oversee the experiments and then push them to be practical and scalable.

And in fairly short order, power will migrate from producers to large systems integrators, which will set up branded platforms with common standards to coordinate and support the system. They’ll foster innovation through open sourcing and acquiring or partnering with smaller companies that meet high standards of quality. Small companies may indeed continue to try out interesting new approaches on the margins—but we’ll need big organizations to oversee the experiments and then push them to be practical and scalable.

Digital History Replicated

Thinking about the unfolding revolution in additive manufacturing, it’s hard not to reflect on that great transformative technology, the internet. In terms of the latter’s history, it might be fair to say that additive manufacturing is only in 1995. Hype levels were high that year, yet no one imagined how commerce and life would change in the coming decade, with the arrival of Wi-Fi, smartphones, and cloud computing. Few foresaw the day that internet-based artificial intelligence and software systems could run factories—and even city infrastructures—better than people could.

The future of additive manufacturing will bring similar surprises that might look strictly logical in hindsight but are hard to picture today. Imagine how new, highly capable printers might replace highly skilled workers, shifting entire companies and even manufacturing-based countries into people-less production. In “machine organizations,” humans might work only to service the printers.

And that future will arrive quickly. Once companies put a toe in the water and experience the advantages of greater manufacturing flexibility, they tend to dive in deep. As materials science creates more printable substances, more manufacturers and products will follow. Local Motors recently demonstrated that it can print a good-looking roadster, including wheels, chassis, body, roof, interior seats, and dashboard but not yet drivetrain, from bottom to top in 48 hours. When it goes into production, the roadster, including drivetrain, will be priced at approximately $20,000. As the cost of 3-D equipment and materials falls, traditional methods’ remaining advantages in economies of scale are becoming a minor factor.

Local Motors can print a good-looking roadster from bottom to top in 48 hours.

Here’s what we can confidently expect: Within the next five years we will have fully automated, high-speed, large-quantity additive manufacturing systems that are economical even for standardized parts. Owing to the flexibility of those systems, customization or fragmentation in many product categories will then take off, further reducing conventional mass production’s market share.

Smart business leaders aren’t waiting for all the details and eventualities to reveal themselves. They can see clearly enough that additive manufacturing developments will change the way products are designed, made, bought, and delivered. They are taking the first steps in the redesign of manufacturing systems. They are envisioning the claims they will stake in the emerging ecosystem. They are making the many layers of decisions that will add up to advantage in a new world of 3-D printing.

A version of this article appeared in the May 2015 issue (pp. 40–48) of Harvard Business Review.

40–48) of Harvard Business Review.

3-D Printing Will Change the World

Leer en español

Ler em português

To anyone who hasn’t seen it demonstrated, 3-D printing sounds futuristic—like the meals that materialized in the Jetsons’ oven at the touch of a keypad. But the technology is quite straightforward: It is a small evolutionary step from spraying toner on paper to putting down layers of something more substantial (such as plastic resin) until the layers add up to an object. And yet, by enabling a machine to produce objects of any shape, on the spot and as needed, 3-D printing really is ushering in a new era.

As applications of the technology expand and prices drop, the first big implication is that more goods will be manufactured at or close to their point of purchase or consumption. This might even mean household-level production of some things. (You’ll pay for raw materials and the IP—the software files for any designs you can’t find free on the web. ) Short of that, many goods that have relied on the scale efficiencies of large, centralized plants will be produced locally. Even if the per-unit production cost is higher, it will be more than offset by the elimination of shipping and of buffer inventories. Whereas cars today are made by just a few hundred factories around the world, they might one day be made in every metropolitan area. Parts could be made at dealerships and repair shops, and assembly plants could eliminate the need for supply chain management by making components as needed.

) Short of that, many goods that have relied on the scale efficiencies of large, centralized plants will be produced locally. Even if the per-unit production cost is higher, it will be more than offset by the elimination of shipping and of buffer inventories. Whereas cars today are made by just a few hundred factories around the world, they might one day be made in every metropolitan area. Parts could be made at dealerships and repair shops, and assembly plants could eliminate the need for supply chain management by making components as needed.

Another implication is that goods will be infinitely more customized, because altering them won’t require retooling, only tweaking the instructions in the software. Creativity in meeting individuals’ needs will come to the fore, just as quality control did in the age of rolling out sameness.

These first-order implications will cause businesses all along the supply, manufacturing, and retailing chains to rethink their strategies and operations. And a second-order implication will have even greater impact. As 3-D printing takes hold, the factors that have made China the workshop of the world will lose much of their force.

And a second-order implication will have even greater impact. As 3-D printing takes hold, the factors that have made China the workshop of the world will lose much of their force.

China won’t be a loser in the new era, but it will have to give up on being the world’s manufacturing powerhouse.

China has grabbed outsourced-manufacturing contracts from every mature economy by pushing the mass-manufacturing model to its limit. It not only aggregates enough demand to create unprecedented efficiencies of scale but also minimizes a key cost: labor. Chinese government interventions have been pro-producer at every turn, favoring the growth of the country’s manufacturers over the purchasing power and living standards of its consumers.

Under a model of widely distributed, highly flexible, small-scale manufacturing, these daunting advantages become liabilities. No workforce can be paid little enough to make up for the cost of shipping across oceans. And few managers raised in a pro-producer climate have the consumer instincts to compete on customization.

It seems that the United States and other Western countries, almost in spite of themselves, will pull off the old judo technique of exploiting a competitor’s lack of balance and making its own massive weight instrumental in its fall.

China won’t be a loser in the new era; like every nation, it will have a domestic market to serve on a local basis, and its domestic market is huge. And not all products lend themselves to 3-D printing. But China will have to give up on being the mass-manufacturing powerhouse of the world. The strategy that has given it such political heft won’t serve it in the future.

The great transfer of wealth and jobs to the East over the past two decades may have seemed a decisive tipping point. But this new technology will change again how the world leans.

A version of this article appeared in the March 2013 issue of Harvard Business Review.

Harvard engineers develop true 3D printing technology

News April 23, 2022

Further

Alexander Sheremetiev news editor

Alexander Sheremetiev news editor

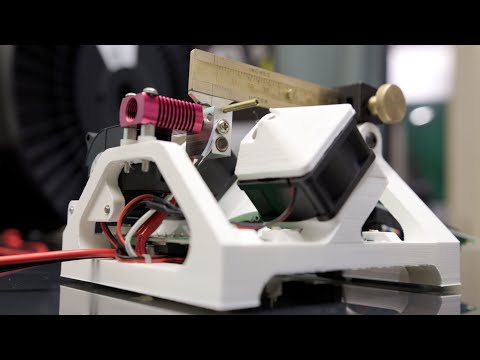

Researchers have developed a 3D printing technique that goes beyond the traditional layered bottom-up approach and eliminates the need for support structures. Description published in the journal Nature.

Description published in the journal Nature.

Read Hi-Tech in

A team of researchers led by scientists from the Rowland Institute at Harvard University has developed a new 3D printing technology. The engineers used a method of converting red light to blue and adding a photosensitive liquid to a resin used in 3D printers.

In traditional 3D printing, resin solidifies in a flat and straight line along the path of light. In their work, the researchers add nanocapsules containing special chemicals to the resin so that the resin reacts only to a certain type of light - blue light at the focus of the laser. Such a beam is formed in the process of frequency upconversion. The beam travels in three dimensions, so it doesn't need layering. As the researchers note, the resulting resin has a higher viscosity than the traditional method, so after printing it can stand without support.

“We designed the resin, we designed the system so that the red light does nothing,” says Daniel Congreve, co-author of the study. “But a small dot of blue light triggers a chemical reaction that causes the resin to harden and turn into plastic. What this basically means is that you have a laser going through the whole system and only in that little blue do you get polymerization, [and only there] do you get printing. We just scan that blue dot in three dimensions, and wherever that blue dot hits, it polymerizes and you get 3D printing.”

“But a small dot of blue light triggers a chemical reaction that causes the resin to harden and turn into plastic. What this basically means is that you have a laser going through the whole system and only in that little blue do you get polymerization, [and only there] do you get printing. We just scan that blue dot in three dimensions, and wherever that blue dot hits, it polymerizes and you get 3D printing.”

The researchers demonstrated their printer and created 3D Harvard and Stanford logos and a small boat. This is a standard test for 3D printers: the small size of the boat and many small details, such as overhanging windows and open spaces in the cabin, create a challenge.

The authors of the development believe that the technology can seriously change 3D printing. Traditional layering requires the use of props for overhanging elements to keep the resin from sinking and dripping down. Refusal of such structures will significantly speed up the process.

Engineers plan to continue developing the system to increase speed and print even finer details.

Photo: Dan Congreve, Stanford UniversityCover photo: An industrial 3D printer does not show the development described in the article.

Read more:

It has been hunted for centuries: what do we know about the planet Vulcan next to the Sun

Astronomers have found a planet near the Earth: it has a very strange orbit

Physicists figured out how to design and print the most delicious chocolate in the world

Read more

How I got my dental crown printed on a 3D printer

How I got my dental crown printed on a 3D printer | Big Ideas Innovation ManagementArticle published in Harvard Business Review Russia Saul Kaplan

Since I'm a tech freak and trying to keep up with all the new stuff, I've been following the development of 3D printing and the burgeoning movement of "makers" - creating everything and everything with the help of such devices. That is, I read about it, watched how innovators and other enthusiasts create their products, and also wondered if this technology is capable of anything more than bright plastic souvenirs that are lined with my desktop. 3D printing hasn't affected my life in any way yet. Well, at least until something bad happened to me recently - a piece of a tooth broke off. Nothing to do, had to go to our family dentist. And it was dentistry, not articles or videos, that convinced me of the enormous potential of 3D printers. Sometimes it takes a kick in the teeth to finally take notice of disruptive innovation.

That is, I read about it, watched how innovators and other enthusiasts create their products, and also wondered if this technology is capable of anything more than bright plastic souvenirs that are lined with my desktop. 3D printing hasn't affected my life in any way yet. Well, at least until something bad happened to me recently - a piece of a tooth broke off. Nothing to do, had to go to our family dentist. And it was dentistry, not articles or videos, that convinced me of the enormous potential of 3D printers. Sometimes it takes a kick in the teeth to finally take notice of disruptive innovation.

I must say that I am not new to restorative dentistry. Somewhere about seven years ago, a piece of another tooth broke off, I needed a crown, and this whole epic did not evoke pleasant memories for me. I had to make several long (and certainly expensive) visits to the dentist. First, I had to make a cast of my decayed tooth. The impression was sent to a dental laboratory to make a permanent crown. In the meantime, I was sent home with an uncomfortable cement-on-hard composite temporary crown. A few weeks later the permanent crown was ready and I went back to the dentist who took a long time to install it.

In the meantime, I was sent home with an uncomfortable cement-on-hard composite temporary crown. A few weeks later the permanent crown was ready and I went back to the dentist who took a long time to install it.

The prospect of repeating this procedure seven years later did not please me at all. However, this time, instead of an impression mix, my dentist placed a digital camera in my mouth, and before I could blink, a virtual image of my damaged tooth appeared on the computer screen to the right of the chair. My dentist knows that I'm a tech freak, so he went out of his way to show me his cutting-edge technical capabilities. I watched my decayed tooth twirl this way and that in 3D as the design software quickly and deftly put the virtual crown on my virtual tooth. Voila! The doctor even made a few manual changes to it using the special functions of the program: he sharpened it a little on one side and polished it on the other.

Read the related article: Will 3D printers change traditional manufacturing patterns?

And then something happened that really shook me to the core and convinced me of the huge potential of 3D printing.